CMB International 2025 Review: Leading HK Financial Firm

CMB International

Hong Kong

Hong Kong

-

Withdrawal Fee $varies

-

Minimum Order 0.01

-

Forex Unavailable

-

Crypto Unavailable

-

Stock Available

-

Indices Unavailable

Licenses

Hong Kong Securities and Futures License

Hong Kong Securities and Futures License

Softwares & Platforms

Customer Support

Supported language: English, Chinese (Simplified)

Social Media

Summary

CMB International (CMBI), a Hong Kong-based subsidiary of China Merchants Bank, excels as a top-tier investment bank with over 15 years of experience. It offers diverse services including investment banking, asset management, and brokerage to institutional and high-net-worth clients across Asia-Pacific. CMBI holds multiple SFC licenses, operates leading trading platforms, and is renowned for its strategic role linking international capital markets with Greater China investment opportunities.

- First Chinese bank-backed firm with SFC crypto license

- Multiple regulatory licenses ensuring exceptional protection

- Unmatched Greater China market access and expertise

- Preferential IPO allocations through underwriter status

- Institutional-grade trading platforms and research

- Seamless integration with China Merchants Bank

- 24/7 cryptocurrency trading for qualified investors

- Three floors of premium office space in Central Hong Kong

- Dedicated relationship managers for personalized service

- Strong parent company backing providing financial stability

- No publicly advertised minimum deposits

- Limited cryptocurrency selection (only 3 coins)

- No forex or CFD trading options

- Absence of 24/7 customer support (except crypto)

- Account opening less streamlined than online-only brokers

- No MT4/MT5 platform options

- Limited promotional offers compared to retail brokers

- Professional investor requirement for crypto trading

- Geographic restrictions for certain jurisdictions

- Higher barriers to entry for small retail traders

Overview

CMB International stands as a distinguished Hong Kong-based financial institution, established in 2010 as a subsidiary of China Merchants Bank. With 15 years of operational excellence, CMBI has evolved into a significant player in Asian financial markets, offering comprehensive services to corporate, institutional, and high-net-worth clients across the Asia-Pacific region.

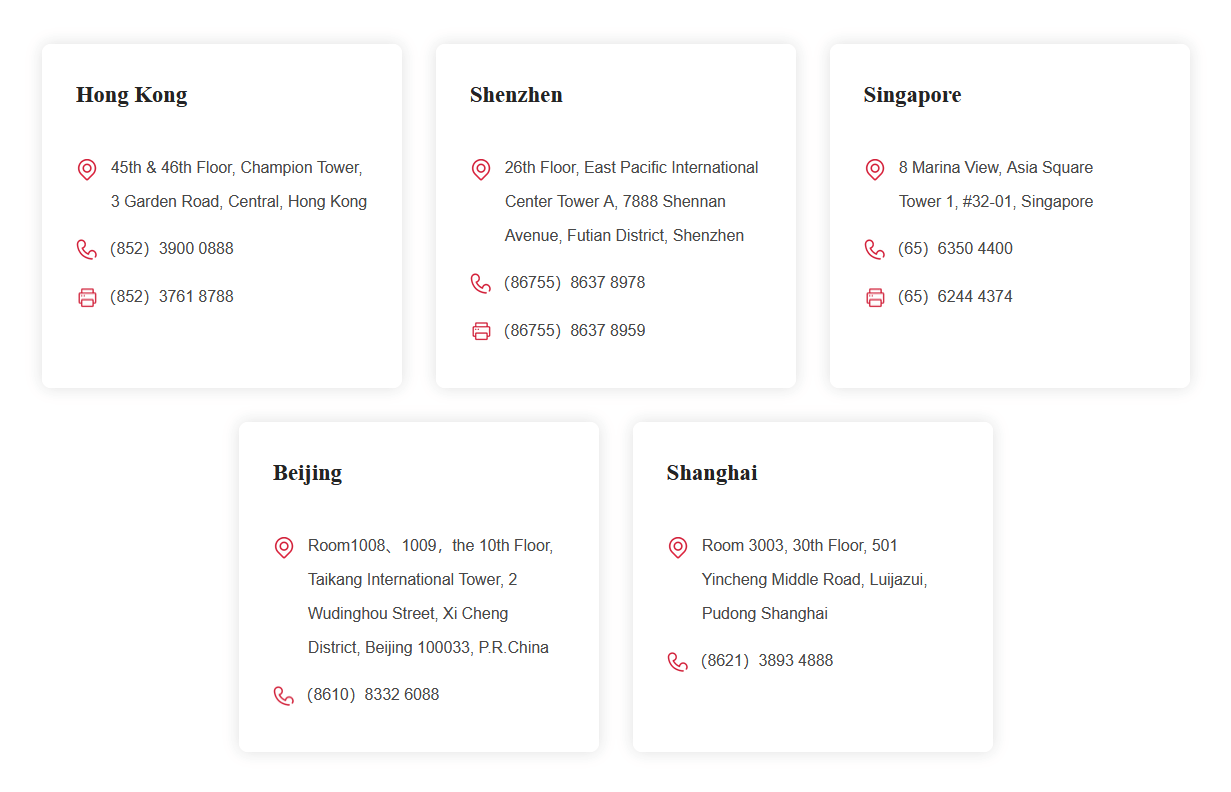

The firm operates from its prestigious headquarters at 39/F, 45/F & 46/F Champion Tower, 3 Garden Road, Central Hong Kong, leveraging its strategic position to bridge international capital markets with Greater China opportunities. CMBI regularly ranks among leading underwriters for Hong Kong IPOs and maintains significant market share in debt capital markets.

In July 2025, CMBI achieved a landmark milestone by becoming the first Chinese bank-backed firm in Hong Kong to receive SFC approval for virtual asset trading, launching 24/7 cryptocurrency services for professional investors. This positions them uniquely in the evolving digital asset landscape while maintaining their institutional-grade standards.

Additional details about their comprehensive service offerings, trading platforms, and investment solutions can be found on their official website at cmbi.com.hk.

Overview Table

| Feature | Details |

|---|---|

| Company Name | CMB International (CMBI) |

| Established | 2010 |

| Headquarters | 39/F, 45/F & 46/F, Champion Tower, 3 Garden Road, Central, Hong Kong |

| Parent Company | China Merchants Bank |

| Main Regulator | Securities and Futures Commission (SFC) of Hong Kong |

| Trading Products | Stocks, ETFs, Bonds, Futures, Options, Cryptocurrencies (BTC, ETH, USDT) |

| Trading Platforms | Yat Lung Global, SP Trader, Multicharts |

| Minimum Deposit | Relationship-driven (varies by account type) |

| Customer Support | Phone: (852) 3900 0888, Email: crm@cmbi.com.hk |

| Target Market | Institutional, Corporate, High-Net-Worth Individuals |

Facts List

- Founded in 2010 with 15 years of operational excellence in Asian financial markets

- First Chinese bank-backed firm with SFC virtual asset license (July 2025)

- Holds multiple SFC licenses including Types 1, 2, 4, 6, and 9 across subsidiaries

- Regularly ranks among leading underwriters for Hong Kong IPOs

- Offers 24/7 cryptocurrency trading (BTC, ETH, USDT) for professional investors

- Three distinct trading platforms serving different client segments

- Direct access to Hong Kong, US, and China A-shares through Stock Connect

- Occupies three floors in prestigious Champion Tower, Central Hong Kong

- Integrated with China Merchants Bank for seamless fund transfers

- Serves institutional, corporate, and high-net-worth clients exclusively

CMB International Licenses and Regulatory

CMBI operates under Hong Kong's stringent regulatory framework, maintaining multiple licenses with the Securities and Futures Commission. This comprehensive oversight provides exceptional security for clients. Each subsidiary holds specialized licenses: CMB International Capital Limited for corporate finance advisory, CMB International Securities Limited for securities dealing and now virtual assets, CMB International Futures Limited (License No: ACQ651) for derivatives, and CMB International Asset Management Limited for portfolio management.

The significance of this multi-license structure surpasses industry standards. While many brokers operate under single licenses, CMBI's specialized approach ensures focused expertise with appropriate oversight for each business line. Regular audits, dedicated compliance teams, and capital reserves well above regulatory minimums demonstrate their commitment to client protection.

- SFC Type 1: Dealing in Securities

- SFC Type 2: Dealing in Futures Contracts (License No: ACQ651)

- SFC Type 4: Advising on Securities

- SFC Type 6: Advising on Corporate Finance

- SFC Type 9: Asset Management

- SFC Virtual Asset License (July 2025)

- Money Lenders License

- HKMA Registration for banking-related services

- CSRC RQFII qualification

- Stock Connect program licenses

Trading Instruments

CMBI offers a carefully curated selection of tradable assets focusing on quality and institutional needs. The recent addition of cryptocurrencies marks a strategic expansion while maintaining their premium positioning.

| Category | Key Features | Market Coverage |

|---|---|---|

| Equities | Direct market access, extended hours for US stocks | Hong Kong, US, China A-shares |

| ETFs | Hong Kong-listed and international options | Global markets |

| Fixed Income | Primary and secondary market access | Asia-Pacific, Global |

| Derivatives | Index futures, commodity futures, options | CME, SGX, HKEX |

| Cryptocurrencies | BTC, ETH, USDT for professional investors | 24/7 trading |

Trading Platforms

CMBI's technology infrastructure reflects their commitment to serving diverse client needs through specialized platforms, each targeting specific user segments while maintaining institutional-grade reliability.

Yat Lung Global serves as the primary mobile application, now enhanced with crypto trading capabilities. Available for iOS and Android, it provides real-time market data, advanced charting, and seamless order execution across multiple markets including the new 24/7 cryptocurrency trading.

SP Trader caters to professional traders with desktop-based functionality, algorithmic trading capabilities, and multi-monitor support. It excels in futures and options trading with sophisticated analytics for derivatives strategies.

Multicharts provides quantitative traders with powerful strategy development and automated trading capabilities, supporting custom indicators, backtesting, and portfolio-level analysis across multiple markets simultaneously.

Trading Platform Comparison Table

| Feature | Yat Lung Global | SP Trader | Multicharts |

|---|---|---|---|

| Platform Type | Mobile App | Multi-device | Desktop |

| Target Users | General/Crypto | Professional | Algorithmic |

| Markets | All + Crypto | All Markets | All Markets |

| Real-time Data | Yes | Yes | Yes |

| Order Types | Standard | Advanced | All Types |

| Algo Trading | No | Limited | Yes |

| Languages | CN/EN | CN/EN | CN/EN |

| 24/7 Access | Yes (Crypto) | No | No |

CMB International How to Open an Account: A Step-by-Step Guide

- Initial Consultation - Contact CMBI to discuss investment objectives

- Choose Method - Select online (via app), in-person, or mail application

- Prepare Documents - Gather ID, address proof, and financial information

- Submit Application - Complete forms with supporting documents

- Identity Verification - Undergo verification including video call if online

- Compliance Review - Allow 2-3 business days for checking

- Account Approval - Receive confirmation and credentials

- Fund Account - Transfer initial deposit via bank transfer

- Platform Setup - Download and configure trading platforms

- Begin Trading - Start investing with full market access

Charts and Analysis

CMB International provides comprehensive educational resources and market analysis tools designed to enhance client knowledge and trading capabilities. The firm's approach emphasises quality over quantity, delivering institutional-grade research and insights typically reserved for professional investors.

| Category | Key Features |

|---|---|

| Research Reports and Market Analysis | - Daily market commentaries with timely insights - Sector-specific and macroeconomic reports - Company research combining fundamental and technical analysis - Focus on Hong Kong-listed and China-concept stocks - Proximity to local markets and management teams enables unique insights |

| Educational Webinars and Seminars | - Programs for all experience levels, from basic investment concepts to advanced derivatives strategies - Guest speakers include economists and fund managers - Specialised sessions on Stock Connect and Greater China market access - Coverage of regulatory updates and market structure changes |

| Trading Tools and Calculators | - Options calculators for strategy evaluation - Bond calculators for yield and duration analysis - Portfolio risk assessment and performance tools - Advanced technical analysis with institutional-grade charting and pattern recognition systems |

| Market Data and Economic Calendar | - Real-time quotes and historical data - Market statistics and corporate events tracking - Economic calendar covering data releases and central bank meetings - Seamless integration with trading platforms for analysis-to-execution workflow |

| Exclusive Client Resources | - Private research calls with senior analysts - Customised portfolio reviews with strategists - Invitations to investment forums and conferences - Tailored services for high-net-worth and institutional clients |

CMB International Account Types

CMBI's flexible account structure accommodates different client segments through customized solutions rather than rigid tiers. Individual accounts provide access to all trading products with features scaling based on relationship size. Joint and corporate accounts offer additional controls. Prime brokerage accounts serve institutional clients with securities lending and enhanced leverage. Wealth management accounts integrate comprehensive financial planning for high-net-worth individuals.

Account Types Comparison Table

| Feature | Individual | Corporate | Prime Brokerage | Wealth Management |

|---|---|---|---|---|

| Minimum Deposit | Relationship-based | Higher requirements | Institutional | High requirements |

| Trading Products | All available | All available | All + exclusive | All available |

| Leverage | Yes (qualified) | Yes | Enhanced | Yes |

| Platform Access | All platforms | All platforms | All + API | All + exclusive |

| Research Access | Standard | Enhanced | Full + direct | Premium |

| Relationship Manager | Available | Dedicated | Team coverage | Senior dedicated |

| Crypto Trading | Yes (qualified) | Yes (qualified) | Yes | Yes |

Negative Balance Protection

CMBI implements comprehensive risk management protocols through multiple protection layers. While not advertising blanket negative balance protection like retail brokers, their institutional-grade systems provide thorough client assessment, real-time position monitoring, automated alerts, and active risk management during volatile periods. The firm's substantial capital strength and preventive approach minimize situations where clients might face demands exceeding account equity.

CMB International Deposits and Withdrawals

CMBI provides multiple funding options leveraging their China Merchants Bank integration. Deposit methods include bank transfers, counter deposits, instant bank-securities transfers for linked accounts, and international wires. Withdrawal options feature online instructions processed within one business day, paper-based forms, and immediate transfers to linked bank accounts.

Payment Methods Comparison Table

| Method | Type | Processing Time | Requirements |

|---|---|---|---|

| Bank Transfer | Deposit | Same-day before 4PM | Client name match |

| Counter Deposit | Deposit | Immediate | Notification required |

| Bank-Securities Transfer | Both | Immediate | Linked accounts only |

| International Wire | Deposit | 1-3 days | SWIFT fees may apply |

| Online Withdrawal | Withdrawal | 1 business day | Platform verification |

Support Service for Customer

CMBI's multi-channel support infrastructure provides personalized service through phone support at (852) 3900 0888, email at crm@cmbi.com.hk, WeChat integration, and in-person consultations at Champion Tower. Support staff include experienced market professionals capable of addressing sophisticated queries, with dedicated relationship managers for qualified clients.

Customer Support Availability Table

| Channel | Availability | Languages | Response Time |

|---|---|---|---|

| Phone | Mon-Fri 8:30AM-6PM HKT | Cantonese, Mandarin, English | <3 minutes |

| Business hours | All languages | Within 1 day | |

| Business hours | Chinese, English | Same day | |

| In-Person | By appointment | All languages | Scheduled |

| Relationship Manager | Business hours | Client preference | Priority |

Prohibited Countries

CMBI maintains strict compliance with international regulations, resulting in service restrictions for certain jurisdictions. US persons face limitations requiring accredited investor status. EU residents may encounter MiFID II-related restrictions. Countries under UN sanctions or FATF blacklists face enhanced requirements or prohibitions. Mainland Chinese residents can access services within capital control regulations.

Special Offers for Customers

Rather than temporary promotions, CMBI focuses on sustained value through preferential IPO allocations for clients with significant relationships, exclusive access to private placements and structured products, premium research with early deal flow information, volume-based fee reductions for active traders, and integrated wealth management benefits through the China Merchants Bank ecosystem.

Conclusion

CMB International emerges as a sophisticated financial institution uniquely positioned in Asian capital markets. Their July 2025 cryptocurrency launch transforms them from a traditional institutional broker into a pioneering bridge between conventional and digital assets. With exceptional regulatory compliance, institutional-grade platforms, and unmatched Greater China expertise, CMBI excels at serving sophisticated investors seeking premium financial services. While not suitable for casual retail traders seeking low fees or extensive crypto options, they provide exceptional value for institutional, corporate, and high-net-worth clients requiring comprehensive financial solutions with strong Asian market connectivity.

Still looking for a broker? Read our in-depth reviews.

If you seek a more trusting broker, IG is the one for you.