CMS Broker Review 2025: Trusted Gateway to China Markets

CMS

Hong Kong

Hong Kong

-

Minimum Deposit $1270

-

Withdrawal Fee $varies

-

Leverage 30:1

-

Minimum Order 0.01

-

Forex Unavailable

-

Crypto Unavailable

-

Stock Available

-

Indices Available

Licenses

Hong Kong Securities and Futures License

Hong Kong Securities and Futures License

Softwares & Platforms

Customer Support

Supported language: Chinese (Simplified), Chinese (Traditional), English, Korean

Social Media

Summary

China Merchants Securities (CMS) is a well-established, investment-grade brokerage with over 25 years of experience and deep China market insights. Backed by the Fortune 500 China Merchants Group, CMSI offers a comprehensive range of multi-asset trading services regulated by Hong Kong, UK, and South Korea authorities. Its professional-grade platforms, institutional focus, and strong financial foundation make it ideal for sophisticated investors prioritizing stability and China exposure. However, CMSI’s premium pricing, limited retail features, and geographic restrictions may not suit beginners or cost-sensitive traders.

- Triple regulatory oversight (SFC, FCA, FSS) ensuring comprehensive protection

- Investment-grade Moody's Baa2 rating validating financial strength

- Unique China market expertise through parent company connections

- Six SFC license types enabling full financial services spectrum

- Professional platforms like CQG for institutional trading

- 24/7 futures trading support across global markets

- State-owned enterprise backing providing stability

- Multi-currency capabilities with competitive FX rates

- 25-year operational track record without major incidents

- Comprehensive product range from equities to OTC derivatives

- Website accessibility issues affecting online services

- No demo accounts for platform testing

- High minimum commissions (HK$100) for small traders

- Absence of popular MT4/MT5 platforms

- No promotional offers or bonuses

- Geographic restrictions limiting global reach

- Limited digital innovation features

- Premium fee structure across services

- Complex account opening process

- Traditional model may not suit self-directed traders

Overview

China Merchants Securities International (CMS) stands as a distinguished pillar in Asian financial services, representing the international investment banking arm of China Merchants Securities Co., Ltd. Established in July 1999 in Hong Kong, this institution has evolved over nearly 25 years from a regional subsidiary into a sophisticated global financial platform operating across three continents.

The firm's journey mirrors China's broader economic integration with global markets. As a wholly owned subsidiary of China Merchants Securities (dual-listed on HKEX: 6099.HK and SSE: 600999.SH), CMS benefits from the substantial backing of China Merchants Group, a Fortune 500 conglomerate with roots dating to 1872. This heritage provides not only financial strength but also deep institutional knowledge across China's corporate landscape.

A pivotal moment came in 2021 when CMS successfully completed a HK$2.35 billion capital increase, significantly strengthening its operational capabilities. This coincided with their inaugural USD bond issuance in overseas markets and Moody's Investors Service assigning a Baa2 long-term issuer rating with a stable outlook – placing the firm firmly in investment-grade territory.

Operating through strategically positioned subsidiaries in Hong Kong, London, and Seoul, CMS serves as a critical bridge between Eastern and Western financial markets. Their corporate vision, "To Become A Leading Chinese Investment Bank", drives strategic initiatives focused on institutional-grade services rather than retail promotional tactics.

For More Information, Visit CMS website at cmschina.com .

Overview Table

| Attribute | Details |

|---|---|

| Company Name | China Merchants Securities International Company Limited (CMS) |

| Established | July 1999 |

| Headquarters | Hong Kong (Central and Kwun Tong offices) |

| Parent Company | China Merchants Securities Co., Ltd. (6099.HK / 600999.SH) |

| Ultimate Parent | China Merchants Group |

| Credit Rating | Moody's Baa2/P-2 (Investment Grade) with Stable Outlook |

| Capital Base | HK$2.35 billion capital increase (2021) |

| Global Presence | Hong Kong, London (UK), Seoul (South Korea) |

| Primary Regulator | Securities and Futures Commission (SFC) – Hong Kong |

| Business Segments | Securities Brokerage, Futures Trading, Corporate Finance, Asset Management |

| Corporate Vision | "To Become A Leading Chinese Investment Bank" |

| Website Status | Currently experiencing accessibility issues |

10 Facts List

- Quarter-Century Heritage: Established in 1999, operating for 25+ years as China Merchants Securities' international platform

- Investment-Grade Rating: Holds Moody's Baa2/P-2 rating since 2021, consistently reaffirmed with stable outlook

- Triple Regulatory Oversight: Licensed by SFC (Hong Kong), FCA (UK), and FSS (South Korea)

- Comprehensive SFC Licensing: Possesses six different license types enabling full financial services

- State-Owned Enterprise Backing: Part of Fortune 500 China Merchants Group

- HK$2.35 Billion Capital Strengthening: Major capital increase completed in 2021

- International Debt Market Access: Successfully issued USD bonds in 2021

- Multi-Market Trading Access: Provides access to Hong Kong plus 12 overseas markets

- Six Trading Platform Options: Professional-grade platforms including CQG and SPTrader

- Corporate Social Responsibility: Consecutively awarded "Caring Company" designation

CMS Licenses and Regulatory

CMS operates under one of the most comprehensive regulatory frameworks in Asian financial services, with oversight from three major international regulators. This multi-layered structure provides exceptional client protection and positions CMS among the most rigorously supervised Chinese financial institutions internationally.

The Securities and Futures Commission (SFC) of Hong Kong serves as primary regulator, overseeing main operations through the Hong Kong subsidiary. Under SFC regulation, CMS holds six different license types:

Type 1 (Dealing in Securities): Enables execution of securities transactions with minimum liquid capital requirements of HK$3 million.

Type 2 (Dealing in Futures Contracts): Permits trading futures and options on recognised exchanges with specialised risk management requirements.

Type 4 (Advising on Securities): Allows provision of investment advice, research reports, and portfolio advisory services.

Type 5 (Advising on Futures Contracts): Complements Type 2 license for derivatives advisory services.

Type 6 (Advising on Corporate Finance): One of the most prestigious licenses, enabling advice on M&A, IPOs, and restructuring.

Type 9 (Asset Management): Authorises discretionary portfolio management with strict client asset segregation requirements.

The UK subsidiary operates under Financial Conduct Authority (FCA) oversight, enabling European market access. The Seoul subsidiary, regulated by the Financial Supervisory Service (FSS), facilitates Korea-China investment flows. This regulatory diversity reduces dependence on any single market while ensuring best practice adoption across operations.

Regulatory Licenses List

Hong Kong - Securities and Futures Commission (SFC)

- Type 1: Dealing in Securities

- Type 2: Dealing in Futures Contracts

- Type 4: Advising on Securities

- Type 5: Advising on Futures Contracts

- Type 6: Advising on Corporate Finance

- Type 9: Asset Management

United Kingdom – Financial Conduct Authority (FCA)

- Entity: China Merchants Securities (UK) Limited

- Investment Advisory License (No. 610534)

- Status: Exceeded

South Korea - Financial Supervisory Service (FSS)

- Multi-Securities Business License

- Comprehensive securities-related activities authorization

Trading Instruments

CMS has developed one of the most comprehensive multi-asset trading platforms among Chinese securities firms operating internationally. Their extensive product offering enables diversified portfolio construction across asset classes while accessing unique Chinese market opportunities.

| Asset Class | Key Features |

|---|---|

| Equities | - Full access to Hong Kong Stock Exchange listings: H-shares, red chips, blue chips - Stock Connect access to mainland China A-shares - Trading in 12+ global markets for international diversification |

| Fixed Income | - Offerings include government bonds, corporate debt (focus on Chinese issuers), and Dim Sum bonds (CNH-denominated) - Fee Structure: 0.04% custody, $30 transaction, $80 early redemption |

| Derivatives | - Range of products: Index futures (HSI, Mini-HSI), commodity futures (precious metals, energy), currency futures, and interest rate derivatives - Institutional-grade platforms like CQG Trader and SPTrader |

| Investment Funds | - Access to equity, bond, balanced, and money market funds - Likely focus on Greater China strategies - Includes ETFs for transparent, low-cost market access |

| OTC Derivatives | - Licensed dealer offering structured notes, OTC options, and swaps - Tailored strategies for sophisticated investors |

| Private Equity | - Leverages CMS's corporate finance expertise - Access to pre-IPO i |

Trading Platforms

CMS's technology infrastructure reflects a pragmatic balance between proprietary development and established third-party solutions, ensuring stable, proven platforms while maintaining customisation flexibility.

Mobile Platforms

include the CMS Hong Kong App serving as primary retail interface with real-time quotes, order placement, portfolio monitoring, and multi-language support. The CQ Key App provides complementary functionality with advanced charting optimised for mobile.

Professional Software

caters to active traders through CQG Trader – globally recognised for derivatives with ultra-low latency, advanced charting, and API access. CQG Web offers browser-based access maintaining professional features. SPTrader represents Hong Kong's indigenous solution optimised for local market microstructure with direct market access. Sharp Point Futures Trading Software specialises in derivatives with automated strategy support.

This multi-platform strategy reveals market specialisation focus, clear client segmentation between retail and professional solutions, and vendor diversification reducing operational risk. Operating multiple platforms requires sophisticated backend integration, including centralised order management, high-performance data feeds, and unified risk controls.

Trading Platforms Comparison Table

| Feature | CMS HK App | CQ Key App | CQG Trader | SPTrader Pro | Sharp Point |

|---|---|---|---|---|---|

| Type | Mobile | Mobile | Desktop | Mobile/Desktop | Desktop |

| Asset Classes | All | Stocks/Options | Futures/Options | All | Futures |

| Charting | Basic | Enhanced | Professional | Professional | Professional |

| Order Types | Basic | Standard | Advanced | Advanced | Advanced |

| Multi-Account | No | No | Yes | Yes | Yes |

| API Access | No | No | Yes | Yes | Yes |

| Target Users | Retail | Active Retail | Professional | Professional | Professional |

CMS How to Open an Account: A Step-by-Step Guide

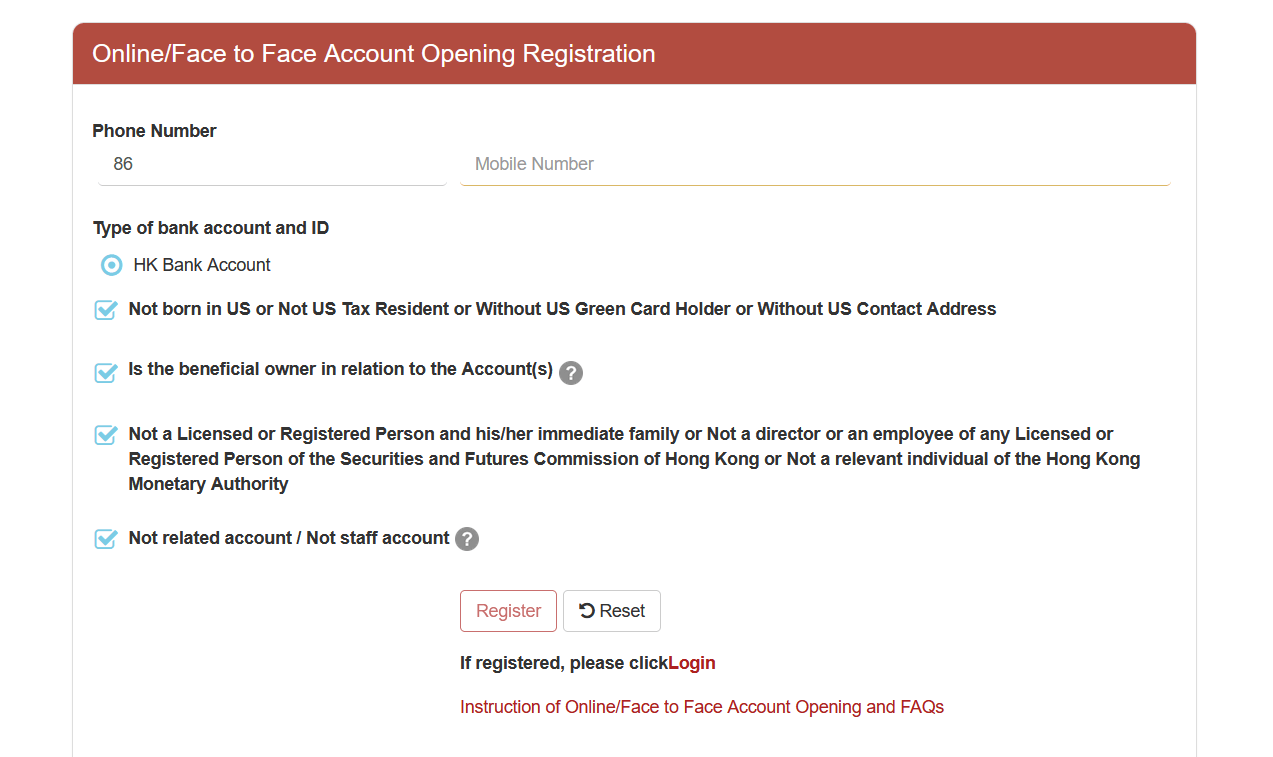

Opening an account with CMS involves navigating comprehensive requirements reflecting their multi-jurisdictional compliance obligations. The process ensures thorough due diligence while determining client suitability.

Pre-Application Requirements include a minimum age of 18 years, appropriate residency status, and financial suitability varying by account type. Documentation needs encompass a valid passport/ID, proof of address within 3 months, financial statements, tax identification, employment information, and investment experience questionnaire.

The Application Process begins with form submission via online portal (when accessible), physical offices, or authorised intermediaries. Applications capture personal details, financial background, investment objectives, trading experience, and source of funds declaration.

KYC Verification involves identity confirmation, address verification, sanctions screening, PEP checks, and adverse media screening. Risk assessment determines appropriate account type, permitted instruments, leverage limits, and product access levels.

Account Approval requires compliance review, credit assessment for margin facilities, and senior management approval for large accounts. Following approval, clients receive funding instructions and platform access credentials with two-factor authentication setup.

Processing typically requires 2-5 business days for standard accounts, 5-10 days for corporate/trust accounts, with additional time for international clients requiring enhanced due diligence.

Account Opening Steps List

- Documentation Preparation: Gather passport/ID, address proof, financial documents, investment experience details

- Choose Application Method: Online (if available), physical office visit, or authorized intermediary

- Complete Application Form: Personal details, financial information, investment objectives, risk tolerance

- Submit for KYC Review: Identity verification, sanctions screening, risk assessment

- Await Account Approval: 2-5 business days standard processing

- Receive Account Details: Account number, login credentials, funding instructions

- Fund Your Account: Bank wire, check deposit, or securities transfer

- Platform Setup: Download platforms, configure settings, complete authentication

- Schedule Training: Arrange platform training for professional software

- Begin Trading: Start with appropriate products based on approved permissions

Charts and Analysis

CMS's analytical resources reflect their philosophy that informed clients make better investment decisions. Professional-grade charting capabilities distributed across platforms provide varying sophistication levels from basic mobile charts to institutional-grade analysis.

| Category | Key Features |

|---|---|

| Technical Analysis Tools | - Multiple chart types: candlestick, bar, line, specialized - Timeframes from tick-level to monthly - 20–200+ technical indicators (platform-dependent) - Custom indicator programming - Pattern recognition and charting tools |

| Fundamental Research | - In-depth coverage of Hong Kong-listed companies - Sector analysis focused on China growth themes - Financial modeling and credit risk analysis - Macroeconomic insights from Chinese markets |

| Market Intelligence | - Economic calendars with a China-centric focus - Real-time news from major global providers - Access to Chinese-language sources for local context - AI-powered sentiment analysis tools on professional platforms |

| Educational Programs | - Live webinar series on market trends and platform tutorials - Downloadable guides on investment basics and trading tools - Structured learning paths (beginner to advanced) - Support for professional certifications and exams |

| Research Strengths | - Exclusive access to mainland China insights via parent company - Multi-jurisdictional research perspective - Regulatory-ensured independence - Multilingual delivery for international clients |

CMS Account Types

CMS's tiered account structure serves diverse client needs while maintaining regulatory compliance across jurisdictions. Each type is calibrated to match experience, resources, and risk tolerance.

Cash Securities Account

represents the entry-level offering for conservative investors. Features include no leverage, T+2 settlement, access to equities/bonds/funds/ETFs, lower minimum deposits (typically HK$10,000-50,000), simplified risk management, and suitability for long-term strategies.

Margin Trading Account

provides leveraged opportunities for experienced investors with maximum ratios varying by security (blue chips up to 70%, mid-caps 50%), interest charged on borrowed amounts, enhanced capabilities including short selling and intraday trading, but requiring higher minimums and sophisticated risk understanding.

Futures Trading Account

enables derivatives access with products including HSI futures and global commodities, leveraging up to 20:1, daily variation margin settlements, and requiring specialised knowledge with position limits based on experience.

Corporate/Institutional Accounts

offer enterprise solutions with multi-user access, straight-through processing, FIX connectivity, customised reporting, and potential prime brokerage services for qualifying institutions.

Account Types Comparison Table

| Feature | Cash Securities | Margin Trading | Futures Trading | Institutional |

|---|---|---|---|---|

| Minimum Deposit | HK$10,000-50,000 | HK$100,000+ | HK$50,000+ | HK$1,000,000+ |

| Leverage | None (1:1) | Up to 3.33:1 | Up to 20:1 | Negotiated |

| Products | Stocks, Bonds, ETFs | All securities | Futures/Options | All products |

| Short Selling | No | Yes | Yes | Yes |

| Risk Level | Low | Medium-High | High | Variable |

| Platform Access | All | All | Specialized | All + APIs |

| Suitable For | Beginners | Active traders | Derivatives traders | Institutions |

Negative Balance Protection

Negative balance protection prevents traders from losing more than deposited funds, crucial in leveraged trading environments. Negative balances can occur through market gaps, extreme volatility events, black swan incidents, flash crashes, or technical factors like slippage. While specific CMS policy details aren't provided, analysis suggests a framework based on regulatory requirements. Hong Kong SFC has no mandatory retail protection but requires clear procedures. The UK FCA mandates protection for retail CFD clients. Korean FSS implements strict leverage limits reducing risks. Protection typically varies by client classification, with retail clients receiving the highest protection, including automatic forgiveness, while professional clients may waive protection for higher leverage access. Institutional clients operate under bilateral agreements. Risk mitigation involves pre-trade controls with position limits, real-time monitoring with automated alerts, graduated liquidation procedures, and margin call cascades from warnings at 50% to automatic closure at 0%. Costs include capital allocation for loss absorption, wider spreads for funding protection, stricter requirements, and potential competitive disadvantages. Exclusions typically cover professional client waivers, fraud losses, and managed account arrangements.

CMS Deposits and Withdrawals

CMS's payment infrastructure accommodates international clients while maintaining strict AML compliance across jurisdictions. Multiple currency options and transfer methods ensure smooth fund flows.

Deposit Methods

| Method | Processing Time | Notes / Features |

|---|---|---|

| Domestic HK Transfers (CHATS/RTGS) | Same day (before 3:30 PM) | Fast local processing |

| International SWIFT Transfers | 1–3 business days | Subject to international banking networks |

| Mainland China Remittances | Varies (under regulatory limits) | Special arrangements for mainland clients |

| China Merchants Bank (CMB) | Real-time (until 11:00 PM) | Preferential fees, seamless integration |

| Check Deposits | ~2 business days (local clearing) | Traditional method, slower |

| Securities Transfers | Varies | Allows consolidation without liquidation |

Withdrawal Methods

| Method | Processing Time | Notes / Features |

|---|---|---|

| Domestic HK Withdrawals | Same day (if requested before noon) | Fast turnaround within Hong Kong banking hours |

| International SWIFT Transfers | 1–3 business days | Requires pre-registered beneficiary info |

| Internal Transfers (Between Accounts) | Instant | No fees, seamless between CMS accounts |

| Check Issuance | Standard postal delivery | Physical instrument, useful for certain clients |

| Security Measures | N/A | Two-factor authentication and beneficiary whitelisting required |

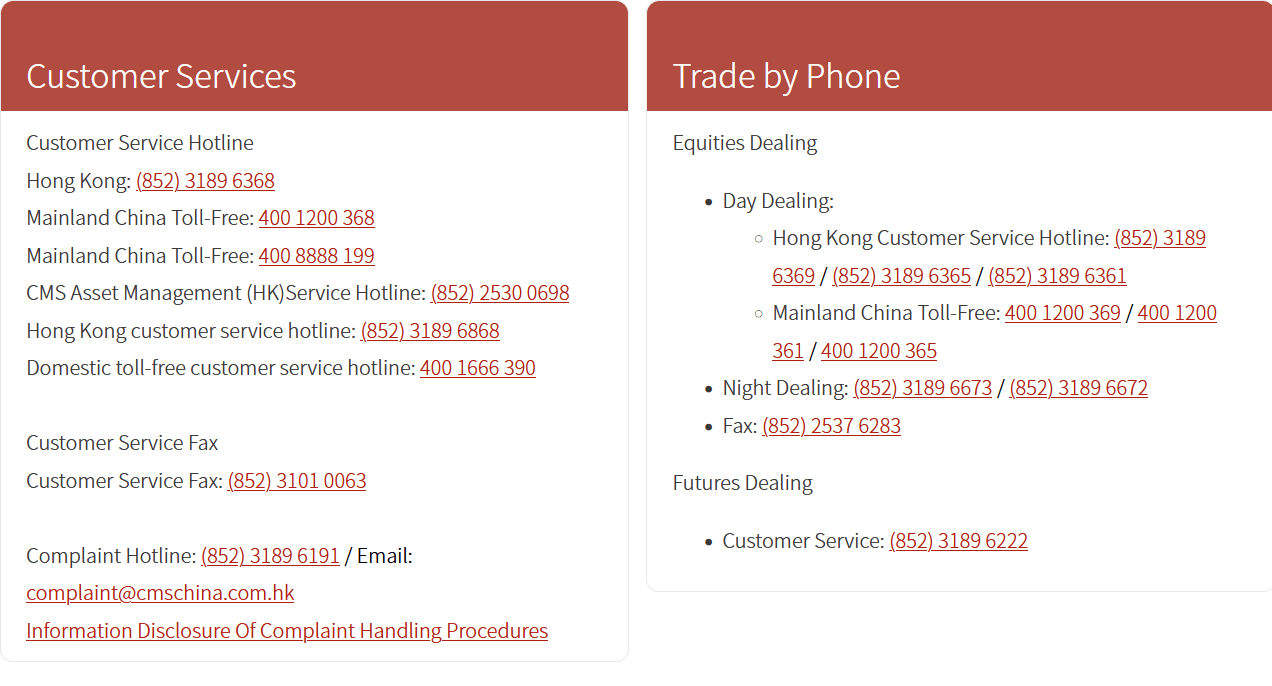

Support Service for Customer

CMS's comprehensive support framework combines traditional high-touch service with modern communication channels, reflecting diverse client preferences across time zones.

- Telephone Support includes general enquiries at (852) 3189 6368 operating Monday-Friday 9 AM-6 PM HKT with multilingual service. Mainland China toll-free 400 1200 368 provides dedicated Mandarin support. The Korea service line 400 8888 199 offers Korean language assistance. The 24-hour trading desk (852) 3189 6191 ensures round-the-clock futures support.

- Email Channels provide 24-hour response times for general enquiries to online@cmschina.com.hk, the UK office at cmsuk@cmschina.co.uk for European coverage, and the Korea office at cmskorea@cmschina.co.kr for local expertise.

- Physical Offices in Central Hong Kong and Kwun Tong Kowloon offer walk-in services, document submission, face-to-face consultations, and full-service capabilities.

- Service Differentiation provides standard channels for retail clients, dedicated relationship managers for premium accounts, and 24/7 coverage teams for institutions. Specialised support includes platform-specific technical assistance, direct analyst access for qualified clients, and compliance guidance.

Customer Support Comparison Table

| Feature | CMS Offering | Industry Standard | Evaluation |

|---|---|---|---|

| Phone Hours | Business + 24/7 trading | 24/7 major brokers | Adequate |

| Languages | 4 (Cantonese/Mandarin/English/Korean) | 2-3 typical | Above average |

| Email Response | 24 hours | 24-48 hours | Competitive |

| Physical Offices | 2 in Hong Kong | 1-3 typical | Standard |

| Live Chat | Not available | Common | Behind trend |

| 24/7 Trading Support | Yes | Essential | Good |

| Dedicated RMs | Premium clients | Standard | Meets expectations |

Prohibited Countries

CMS, like all regulated institutions, maintains geographic restrictions based on international sanctions, regulatory requirements, and risk policies. These stem from UN sanctions, US Treasury OFAC programs, EU restrictive measures, Hong Kong implementations, and FATF high-risk jurisdictions.

Comprehensively Restricted countries typically include North Korea (UN/US/EU sanctions), Iran (complex regime), Syria (broad sanctions), Cuba (US dollar restrictions), and the Crimea region (territorial sanctions).

High-Risk Jurisdictions facing practical restrictions include Afghanistan, Yemen, Libya, Somalia, and South Sudan due to conflict zones and weak infrastructure.

Enhanced Due Diligence requirements apply to Pakistan, Myanmar, Belarus, Venezuela, and Zimbabwe, while the United States may face restrictions due to FATCA complexity.

Restrictions apply based on nationality and residence, affecting documentation acceptance, processing times, and ongoing monitoring requirements. Changes in sanctions status may trigger account reviews or closures with grace periods for position unwinding.

Special Offers for Customers

Based on available information, CMS does not actively promote special offers, bonuses, or promotional campaigns. This absence reflects a traditional institutional approach common among established Chinese financial institutions with SOE backgrounds.

While competitors offer aggressive cash bonuses (HK$500-10,000), commission-free periods, and gift promotions, CMS focuses on relationship-based benefits potentially including negotiated commission rates, preferential margin rates, waived custody fees, and priority IPO allocations for substantial clients.

China Merchants Group synergies may provide integrated benefits for existing bank customers, employee programs, and cross-product bundling. Educational value-adds likely include complimentary seminars, platform training, research access, and networking opportunities.

This approach targets serious long-term investors over promotional seekers, emphasising service excellence over price competition and building trust through expertise rather than marketing incentives.

Conclusion

Throughout this comprehensive analysis of China Merchants Securities International, I've examined an institution representing both Chinese finance evolution and enduring relationship-based business traditions. Their position as a bridge between Eastern and Western markets offers unique value for specific investor segments.

The safety question receives strong affirmation through triple-regulatory oversight, Moody's Baa2 investment-grade rating maintained since 2021, substantial HK$2.35 billion capitalisation, and 25-year operational history without major incidents. This foundation provides confidence for those entrusting funds to CMS.

Their institutional DNA manifests through professional-grade platforms over retail solutions, absence of promotional gimmicks, comprehensive licensing for complex transactions, and education focus over marketing incentives. This positioning serves sophisticated investors well but may frustrate beginners seeking hand-holding.

Strengths include unparalleled Chinese market expertise, multi-jurisdictional capabilities, platform diversity, and exceptional financial stability. However, limitations exist in website accessibility issues, limited retail focus, premium pricing structure, and geographic restrictions.

I find CMS most suitable for institutional investors, high-net-worth individuals with a China focus, professional derivatives traders, and those prioritising stability over cost. They may disappoint beginners, cost-sensitive traders, or those seeking cutting-edge digital features.

Trust verdict: Yes, CMS is trustworthy for appropriate clients. Their regulatory compliance, financial strength, and institutional backing provide strong trust foundations. However, suitability depends on aligning needs with their institutional-grade, China-focused positioning.

Read our latest broker reviews before making decisions.

Looking for a broker with minimum withdrawal fees? Take a look at IC Markets review.