CMTrading Review 2025: Regulation, Trading Conditions, and More

CMTrading

South Africa

South Africa

-

Minimum Deposit $299

-

Withdrawal Fee $varies

-

Leverage 200:1

-

Spread From 0.7

-

Minimum Order 0.01

-

Forex Available

-

Crypto Available

-

Stock Available

-

Indices Available

Licenses

South Africa Retail Forex License

South Africa Retail Forex License

Japan Forex Trading License

Japan Forex Trading License

Softwares & Platforms

Customer Support

+441613883321

(English)

+441613883321

(English)

Supported language: Arabic, English, French

Social Media

Summary

CMTrading is a forex and CFD broker established in 2012, offering a range of trading instruments, including currencies, commodities, indices, and cryptocurrencies. It provides access to MT4 and the CMTrading WebTrader platform, catering to traders of all levels. The broker is regulated by the FSCA in South Africa and offers various account types with spreads starting from 0.7 pips to 1.2 pips. CMTrading provides copy trading, educational resources, and strong customer support. The minimum deposit starts at $299 for the Basic account, making it for traders looking to start with a moderate investment.

- Regulated by the FSCA (South Africa) and FSA (Seychelles)

- Comprehensive educational resources for traders of all levels

- User-friendly MetaTrader 4 and proprietary web-based platforms

- CopyKat platform for copy trading and learning from experienced traders

- Range of account types to suit different investment levels and needs

- Availability of Islamic accounts for traders following Sharia law

- Strong customer support with multiple channels and multilingual team

- Negative balance protection and segregated client funds for asset safety

- Competitive spreads starting from 0.7 pips on Premium accounts

- Regular market analysis and trading insights provided

- Limited selection of trading platforms compared to some competitors

- Relatively high minimum deposit of $299 for the Basic account

- Withdrawal fees of $30 per transaction

- Educational resources may not be as extensive as some larger brokers

- FSA regulation is from an offshore jurisdiction with less oversight than top-tier regulators

- No cryptocurrency funding options available

- Limited number of base currencies for account funding

- Inactivity fees applied after 60 days of no trading activity

- Maximum leverage of 1:200 may not be suitable for all trading styles

- No US clients accepted due to regulatory restrictions

Overview

CMTrading is a well-established online forex and CFD broker that has been operating since 2012. Headquartered in Johannesburg, South Africa, CMTrading has expanded its reach to serve clients globally, with a focus on the African and Middle Eastern markets. The broker is regulated by the Financial Sector Conduct Authority (FSCA) of South Africa under license number 38782 and the Financial Services Authority (FSA) of Seychelles under license number SD070, ensuring a secure and transparent trading environment.

Over the years, CMTrading has garnered recognition for its services, being named the "Best Performing Broker in Africa" and "Best Trade Execution Broker" at the Global Forex Awards in 2020. The broker offers a range of trading instruments, including forex, commodities, indices, stocks, and cryptocurrencies, catering to diverse trading preferences.

CMTrading provides access to the popular MetaTrader 4 platform as well as its proprietary CMTrading WebTrader, offering traders flexibility and advanced trading tools. The broker also supports social trading through its CopyKat platform, allowing users to learn from and copy the trades of successful traders.

For more detailed information about CMTrading's services, account types, and trading conditions, readers can visit the official website at cmtrading.com.

Overview Table

| Field | Details |

|---|---|

| Broker Name | CMTrading |

| Year Founded | 2012 |

| Headquarters | Johannesburg, South Africa |

| Regulation | FSCA (South Africa), FSA (Seychelles) |

| Trading Platforms | MetaTrader 4, CMTrading WebTrader |

| Minimum Deposit | $299 for basic account |

| Account Types | Basic, Trader, Gold, Premium, Islamic |

| Tradable Instruments | Forex, Commodities, Indices, Stocks, Cryptocurrencies |

| Educational Resources | Webinars, Videos, eBooks, Market Analysis |

| Customer Support | Email, Phone, WhatsApp, Live Chat |

| Unique Features | CopyKat Social Trading, Islamic Accounts |

Facts List

- CMTrading was founded in 2012 and is headquartered in Johannesburg, South Africa.

- The broker is regulated by the FSCA (South Africa) and FSA (Seychelles), providing a secure trading environment.

- CMTrading offers the MetaTrader 4 platform and its own CMTrading WebTrader.

- Minimum initial deposit from $299.

- Account types include Basic, Trader, Gold, Premium, and Islamic (swap-free) accounts.

- Traders can access forex, commodities, indices, stocks, and cryptocurrencies.

- CMTrading provides educational resources such as webinars, videos, eBooks, and market analysis.

- The broker supports social trading through its CopyKat platform, allowing users to learn from successful traders.

- Customer support is available via email, phone, WhatsApp, and live chat.

- CMTrading has won awards such as "Best Performing Broker in Africa" and "Best Trade Execution Broker" at the Global Forex Awards 2020.

CMTrading Licenses and Regulatory

CMTrading operates under a robust regulatory framework, holding licenses from multiple respected authorities. The broker is regulated by the Financial Sector Conduct Authority (FSCA) of South Africa with license number 38782 and the Financial Services Authority (FSA) of Seychelles with license number SD070.

The FSCA is the primary regulator for financial services in South Africa, responsible for overseeing the conduct of financial institutions and protecting consumers. By adhering to the FSCA's guidelines, CMTrading demonstrates its commitment to maintaining high standards of integrity, transparency, and customer protection.

The FSA is the regulatory body for non-bank financial services in Seychelles, ensuring that licensed entities operate in compliance with the country's laws and regulations. CMTrading's license from the FSA further solidifies its credibility and dedication to providing a secure trading environment for its clients.

Holding multiple regulatory licenses is a significant advantage for a brokerage as it indicates compliance with various jurisdictional requirements and a willingness to subject itself to oversight from different authorities. This multi-regulatory approach enhances client security and trust, as the broker must adhere to strict guidelines and maintain high operational standards to retain its licenses.

In comparison to industry standards, CMTrading's regulatory status is commendable. Many brokers opt for a single license, often from an offshore jurisdiction with less stringent regulations. By securing licenses from both the FSCA and FSA, CMTrading demonstrates a commitment to upholding a higher level of regulatory compliance and providing a more secure trading environment for its clients.

Regulations List

- Financial Sector Conduct Authority (FSCA) of South Africa - License number 38782

- Financial Services Authority (FSA) of Seychelles - License number SD070

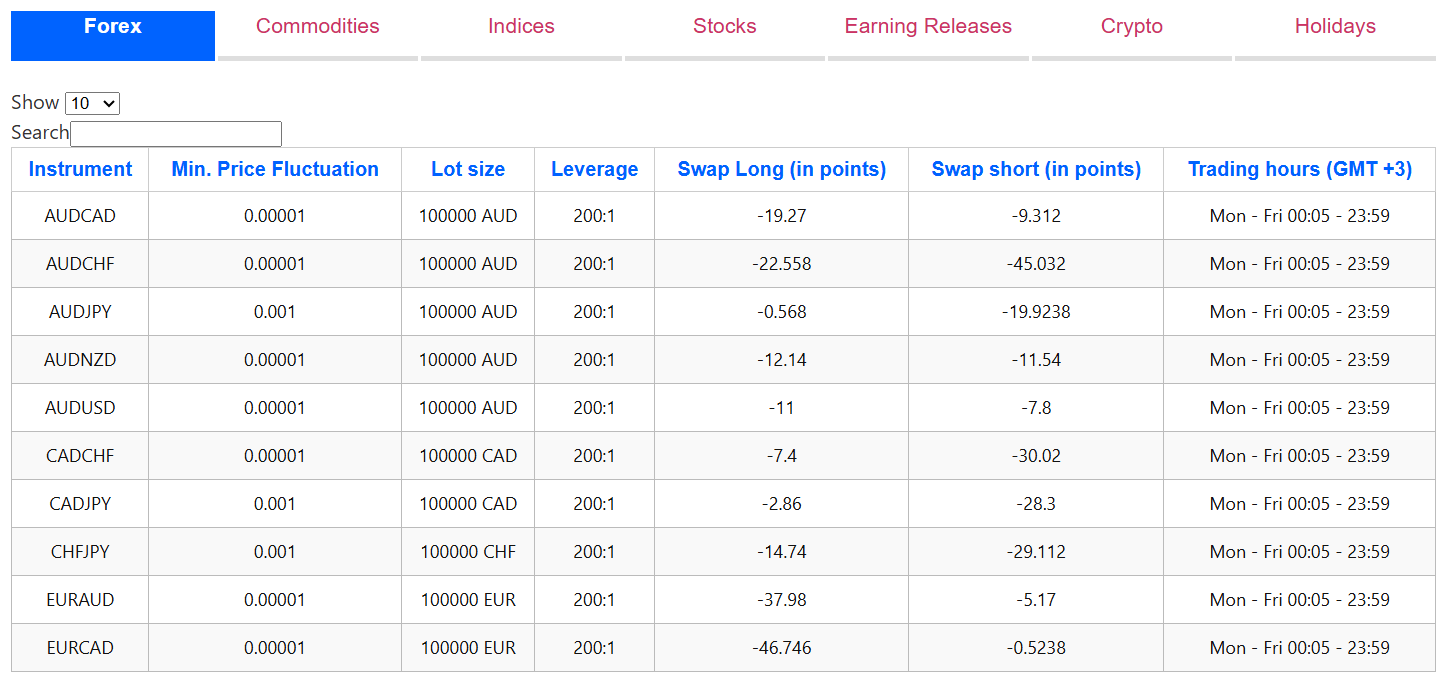

Trading Instruments

CMTrading offers a diverse range of tradable assets, providing traders with ample opportunities to diversify their portfolios and capitalize on various market trends. The broker's extensive offering spans multiple asset classes, including forex, commodities, indices, stocks, and cryptocurrencies.

| Instrument Category | Details |

|---|---|

| Forex | Provides access to a wide selection of currency pairs, including major, minor, and exotic pairs. Examples include EUR/USD, GBP/USD, USD/JPY, and USD/CHF. The broker offers competitive spreads to help traders maximize potential profits. |

| Commodities | Trade a variety of commodities, including precious metals like gold and silver, as well as energy products like oil and natural gas. This offering allows traders to hedge against market volatility and diversify their portfolios. |

| Indices | Offers trading on global stock indices such as the S&P 500, NASDAQ, FTSE 100, DAX 30, and Nikkei 225. This enables investors to gain exposure to entire markets or sectors without investing in individual stocks. |

| Stocks | Provides access to a selection of leading company stocks from various sectors, including technology, healthcare, energy, and financial sectors, allowing traders to capitalize on the performance of individual firms. |

| Cryptocurrencies | Offers trading on major cryptocurrencies such as Bitcoin, Ethereum, Litecoin, and Ripple. This enables traders to speculate on the price movements of these volatile digital assets, potentially achieving high returns. |

Having a diverse portfolio of tradable assets is crucial for both traders and brokers. For traders, a wide selection of assets allows for greater flexibility in implementing trading strategies, managing risk, and seizing opportunities across different markets. A broker's ability to offer a comprehensive range of assets demonstrates its adaptability to evolving market trends and its commitment to meeting the diverse needs of its clients.

Trading Platforms

CMTrading offers its clients a range of trading platforms to suit various trading styles and preferences. The broker provides access to the popular MetaTrader 4 (MT4) platform, as well as its proprietary CMTrading WebTrader. These platforms are accessible through desktop, web, and mobile devices, ensuring that traders can execute trades and manage their accounts from anywhere at any time.

MetaTrader 4 (MT4)

MT4 is a widely-used trading platform known for its user-friendly interface, advanced charting tools, and extensive customization options. CMTrading's MT4 platform comes equipped with a range of built-in indicators and analytical tools, allowing traders to perform in-depth market analysis and develop effective trading strategies.

The MT4 platform also supports the use of Expert Advisors (EAs), which are automated trading programs that can execute trades based on predetermined rules and algorithms. This feature is particularly useful for traders who prefer a more hands-off approach or those who wish to backtest their trading strategies.

CMTrading WebTrader

In addition to MT4, CMTrading offers its proprietary web-based trading platform, CMTrading WebTrader. This platform is accessible directly through web browsers, eliminating the need for any software installations. The WebTrader provides a streamlined and intuitive trading experience, with real-time quotes, interactive charts, and one-click trading functionality.

The CMTrading WebTrader also includes a range of risk management tools, such as stop-loss and take-profit orders, helping traders to control their exposure to market volatility. The platform's user-friendly interface makes it an excellent choice for beginner traders, while its advanced features cater to the needs of more experienced investors.

Mobile Trading Apps

For traders who value flexibility and the ability to trade on the go, CMTrading offers mobile trading apps for both iOS and Android devices. These apps provide full access to the broker's trading platforms, allowing users to monitor their accounts, analyze markets, and execute trades from their smartphones or tablets.

The mobile apps feature a responsive design and intuitive navigation, ensuring a seamless trading experience on smaller screens. Traders can access real-time market data, advanced charting tools, and account management features, all from the palm of their hand.

By offering a range of trading platforms and ensuring accessibility across multiple devices, CMTrading caters to the diverse needs of its clients. The broker's commitment to providing stable, reliable, and user-friendly platforms is crucial for ensuring a satisfactory trading experience and facilitating informed decision-making.

In comparison to industry standards, CMTrading's technological offerings are competitive, providing traders with the tools they need to succeed in today's fast-paced financial markets. However, some traders may prefer a broader range of platform options, such as the more advanced MetaTrader 5 (MT5) or cTrader platforms.

Trading Methods List

- MetaTrader 4 (MT4) platform

- CMTrading WebTrader (proprietary web-based platform)

- Mobile trading apps for iOS and Android devices

Trading Platforms Comparison Table

| Feature | MT4 | CMTrading WebTrader |

|---|---|---|

| Charting Tools | Advanced | Interactive |

| Indicators | Extensive | Built-in |

| Expert Advisors (EAs) | Supported | Not Available |

| Automated Trading | Yes | No |

| One-Click Trading | Yes | Yes |

| Risk Management Tools | Stop-Loss, Take-Profit | Stop-Loss, Take-Profit |

| Accessibility | Desktop, Web, Mobile | Web, Mobile |

| Customization | Extensive | Limited |

| Ease of Use | Moderate | User-Friendly |

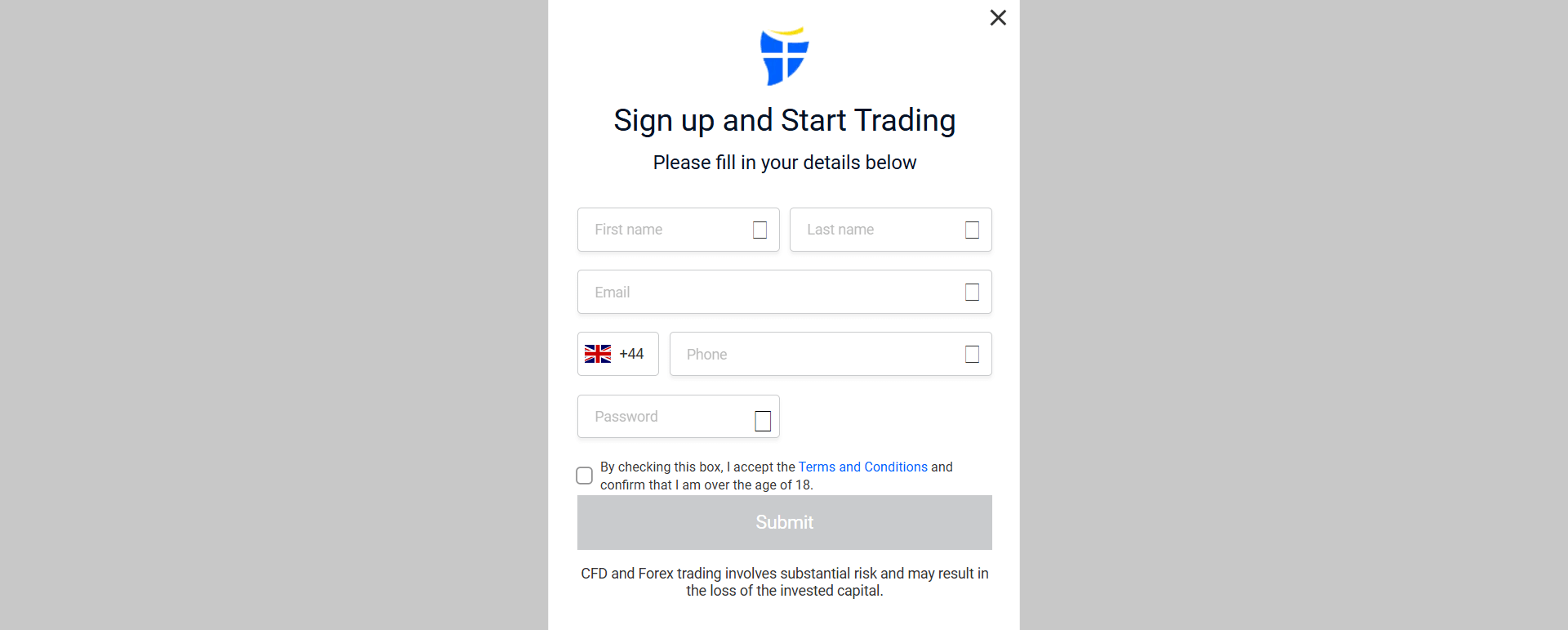

CMTrading How to Open an Account: A Step-by-Step Guide

Opening an account with CMTrading is a straightforward process that can be completed in just a few steps. Before getting started, ensure that you meet the broker's requirements and have the necessary documentation ready.

Account Opening Requirements

- Minimum deposit: $299 for the Basic account, with higher minimums for other account types

- Identification documents: Proof of identity (e.g., passport or driver's license) and proof of residence (e.g., utility bill or bank statement)

- Payment method: CMTrading accepts various payment methods, including credit/debit cards, bank wire transfers, and e-wallets like Skrill and Neteller

Account Opening Process

- Visit the CMTrading website: Navigate to cmtrading.com and click on the "Start Trading" or "Open an Account" button.

- Complete the registration form: Fill in your personal details, including your name, email address, phone number, country of residence, and desired account type (Basic, Trader, Gold, or Premium).

- Verify your email address: After submitting the registration form, you will receive an email from CMTrading with a verification link. Click on the link to verify your email address and proceed to the next step.

- Provide identification documents: Upload a copy of your proof of identity and proof of residence. CMTrading requires these documents to comply with anti-money laundering (AML) and know-your-customer (KYC) regulations.

- Fund your account: Once your account is verified, you can make your initial deposit using one of the accepted payment methods. The minimum deposit required depends on your chosen account type, starting from $299 for the Basic account.

- Start trading: After your deposit is processed, you can download the trading platform of your choice (MetaTrader 4 or CMTrading WebTrader) and start trading the available assets.

CMTrading aims to make the account opening process as smooth and efficient as possible. The broker's user-friendly interface and quick account verification process ensure that traders can start exploring the markets without unnecessary delays.

One of the unique benefits of opening an account with CMTrading is the access to a demo account. This feature allows traders to practice trading in a risk-free environment using virtual funds, helping them to familiarize themselves with the platform and test their strategies before investing real money.

By following these simple steps, traders can quickly and easily open an account with CMTrading and begin their trading journey with a reliable and user-friendly broker.

Charts and Analysis

CMTrading offers a comprehensive suite of educational trading resources and tools designed to enhance traders' knowledge and skills, empowering them to make informed decisions in the financial markets. These resources cater to traders of all experience levels, from beginners to seasoned professionals.

Charts & Technical Analysis Tools

- Available on MetaTrader 4 (MT4) and CMTrading WebTrader

- Features interactive charts with multiple timeframes, various chart types (candlestick, line, bar), drawing tools (trend lines, support/resistance, Fibonacci retracements), and built-in technical indicators (moving averages, RSI, MACD, Bollinger Bands)

- Offers customizable layouts and templates

Economic Calendar

- Keeps traders informed about market-moving events such as central bank announcements, economic data releases, and political developments

- Provides a detailed schedule and expected market impact to help adjust trading strategies

Educational Webinars and Seminars

- Regular live and recorded sessions led by industry experts and experienced traders

- Covers topics like market analysis, trading strategies, risk management, and platform tutorials

Trading Guides and E-books

- Offers downloadable resources that provide in-depth insights into technical and fundamental analysis, trading psychology, and money management

- Designed to be accessible for traders at all skill levels

Market News and Analysis

- Features timely updates on economic events, market trends, and expert opinions

- Combines in-house analysis with third-party research for diverse market perspectives

Trading Blog

- Regularly updated with trading commentary, tips, and educational articles

- Serves as an ongoing resource to keep traders informed about the latest market developments

In comparison to industry standards, CMTrading's educational offerings are competitive and well-rounded. The broker invests significantly in providing a diverse range of resources that cater to the needs of both beginner and experienced traders. By offering a mix of interactive tools, webinars, guides, and market analysis, CMTrading demonstrates its commitment to supporting its clients' growth and success in the financial markets.

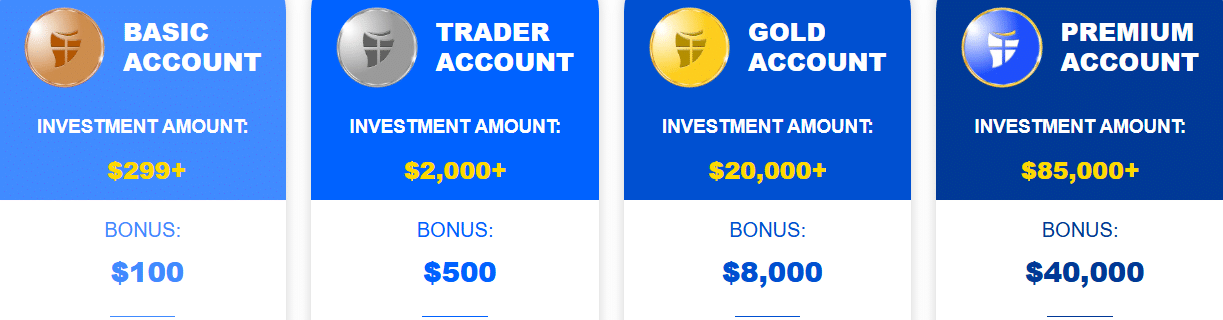

CMTrading Account Types

CMTrading offers a range of trading account options designed to cater to the diverse needs and preferences of traders at various stages of their trading journey. The broker provides four main account types: Basic, Trader, Gold, and Premium, each with its unique features and benefits.

Basic Account

The Basic account is an entry-level option suitable for novice traders who are just starting to explore the financial markets. Key features include:

- Minimum deposit: $299

- Spreads from 1.2 pips

- Leverage up to 1:200

- Access to a demo account

- Daily market reviews and trading e-books

Trader Account

The Trader account is designed for more experienced traders who require a higher level of support and resources. This account type offers:

- Minimum deposit: $2,000

- Spreads from 1.0 pips

- Leverage up to 1:200

- One risk-free trade

- Access to educational videos and webinars

- Dedicated account manager

Gold Account

The Gold account caters to advanced traders and investors who demand premium features and personalized support. Benefits include:

- Minimum deposit: $20,000

- Spreads from 0.9 pips

- Leverage up to 1:200

- Three risk-free trades

- Advanced educational resources and webinars

- Personal trading coach

- VIP events and exclusive promotions

Premium Account

The Premium account is tailored for high-net-worth individuals and institutional clients who require the highest level of service and customization. This account type provides:

- Minimum deposit: $85,000

- Spreads from 0.7 pips

- Leverage up to 1:200

- Five risk-free trades

- Customized educational resources and one-on-one training

- Dedicated personal account manager

- Priority withdrawal processing

- Exclusive invitations to VIP events and promotions

In addition to these standard account types, CMTrading also offers an Islamic account option, which is fully compliant with Sharia law. Islamic accounts are swap-free and do not incur interest charges, making them suitable for traders who adhere to Islamic financial principles.

Moreover, CMTrading provides a demo account facility for all account types, allowing traders to practice trading strategies and familiarize themselves with the trading platforms in a risk-free environment. The demo account mimics real market conditions and is an excellent tool for both beginner and experienced traders looking to refine their skills.

By offering a diverse range of account types, CMTrading demonstrates its commitment to accommodating the varying needs and goals of its clients. The broker's account structure enables traders to select an option that aligns with their trading style, experience level, and financial objectives, ultimately enhancing their overall trading experience.

Account Types Comparison Table

| Feature | Basic | Trader | Gold | Premium |

|---|---|---|---|---|

| Minimum Deposit | $299 | $2,000 | $20,000 | $85,000 |

| Spreads (from) | 1.2 pips | 1.0 pips | 0.9 pips | 0.7 pips |

| Leverage (up to) | 1:200 | 1:200 | 1:200 | 1:200 |

| Risk-Free Trades | - | 1 | 3 | 5 |

| Demo Account | ✓ | ✓ | ✓ | ✓ |

| Educational Resources | Basic | Standard | Advanced | Customized |

| Personal Support | - | Account Manager | Trading Coach | Dedicated Manager |

| Withdrawal Priority | Standard | Standard | High | Highest |

| VIP Events & Promotions | - | - | ✓ | ✓ |

Negative Balance Protection

CMTrading understands the importance of safeguarding its clients' funds and mitigating the risk of negative balances. As a result, the broker offers negative balance protection to all its clients, regardless of their account type or trading style. This means that if a trader's account balance falls below zero due to trading losses, CMTrading will absorb the negative balance, ensuring that the trader's liability is limited to the funds they have deposited. It is important to note that negative balance protection does not eliminate the risk of losing money in trading. Traders should still employ sound risk management strategies, such as setting appropriate stop-loss orders and managing their position sizes, to minimize potential losses. However, negative balance protection provides an additional layer of security, ensuring that traders cannot lose more than their initial investment. To benefit from CMTrading's negative balance protection, traders simply need to open an account with the broker and start trading. There are no additional terms and conditions or opt-in requirements for this feature. CMTrading automatically applies negative balance protection to all client accounts, demonstrating its commitment to responsible trading and client protection. In summary, negative balance protection is a vital risk management tool that shields traders from the possibility of losses exceeding their account balance. CMTrading's negative balance protection policy ensures that clients can trade with peace of mind, knowing that their potential losses are limited to the funds they have invested. By prioritizing client protection and risk management, CMTrading has established itself as a reliable and trustworthy broker in the online trading industry.

CMTrading Deposits and Withdrawals

CMTrading offers a range of convenient deposit and withdrawal options to ensure that traders can easily manage their funds and maintain financial flexibility. The broker understands the importance of efficient and secure transaction processing, and as such, it provides a variety of payment methods to cater to the diverse needs of its clients.

Deposit Options

Traders can fund their CMTrading accounts using the following methods:| Payment Method / Deposit Details | Details |

|---|---|

| Credit/Debit Cards | Visa, Mastercard, Maestro |

| Bank Wire Transfer | Bank Wire Transfer (may take 2-5 business days to clear) |

| E-wallets | Skrill, Neteller, WebMoney, FasaPay |

| Cryptocurrency | Bitcoin, Ethereum, Litecoin, Ripple |

| Minimum Deposit | $20 |

| Maximum Deposit | No maximum deposit limit |

| Deposit Processing Times | Deposits are typically processed instantly, except for bank wire transfers which may take 2-5 business days to clear |

Withdrawal Options

| Withdrawal Details | Information |

|---|---|

| Available Payment Options | Same as deposit options: Credit/Debit Cards (Visa, Mastercard, Maestro), Bank Wire Transfer, E-wallets (Skrill, Neteller, WebMoney, FasaPay), Cryptocurrency (Bitcoin, Ethereum, Litecoin, Ripple) |

| Initiation Process | Submit a withdrawal request through the client portal, specifying the desired amount and payment method |

| Minimum Withdrawal Amount | $50 |

| Maximum Withdrawal Amount | Depends on the chosen payment method and the trader's account balance |

| Withdrawal Processing Time | Processed within 1-5 business days, subject to the broker's verification procedures and the processing times of the selected payment provider |

Fees and Charges

CMTrading does not charge any fees for deposits, regardless of the payment method used. However, traders should be aware that their payment provider may impose transaction fees, which are beyond the broker's control. For withdrawals, CMTrading charges a flat fee of $30 per transaction. This fee is deducted from the withdrawn amount and covers the broker's administrative and processing costs. Traders should also consider any potential fees charged by their chosen payment provider when making a withdrawal.Verification Requirements

To comply with anti-money laundering (AML) and know-your-customer (KYC) regulations, CMTrading requires traders to complete a verification process before making a withdrawal. This involves submitting proof of identity and proof of address documents, such as a passport, driver's license, utility bill, or bank statement. The verification process is designed to protect traders' funds and prevent fraudulent activities. By offering a wide range of deposit and withdrawal options, competitive fees, and a straightforward verification process, CMTrading ensures that traders can manage their funds with ease and confidence. The broker's commitment to security and efficiency in financial transactions sets it apart from competitors and contributes to a seamless trading experience for its clients.Support Service for Customer

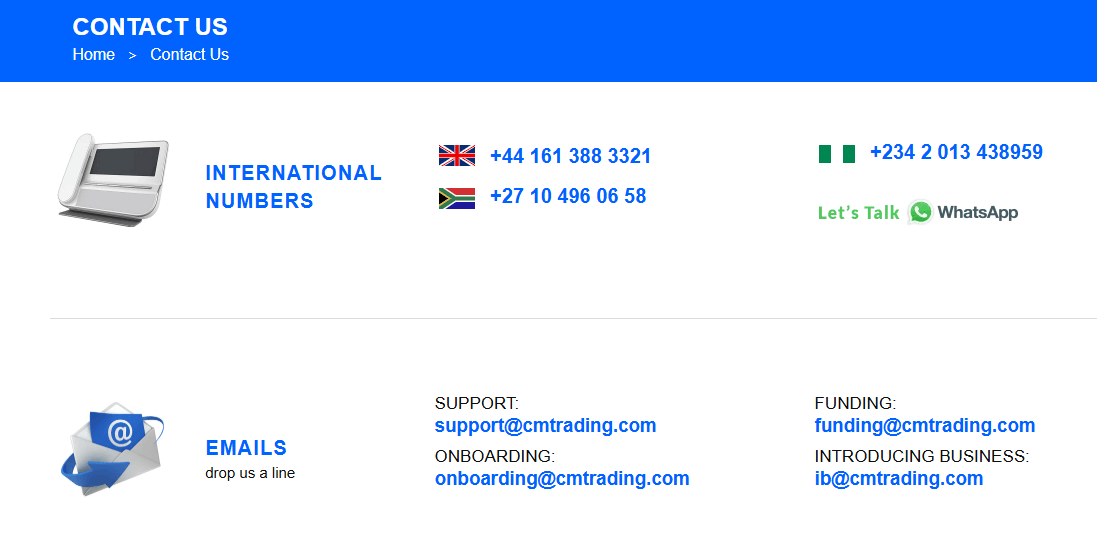

In the dynamic world of online trading, reliable customer support is a crucial factor that contributes to a positive trading experience. CMTrading understands the importance of providing prompt and efficient assistance to its clients, ensuring that they can navigate the trading landscape with confidence and ease. To cater to the diverse needs of its global client base, CMTrading offers multiple channels through which traders can reach out for support:

Live Chat

- CMTrading's website features a live chat option, allowing traders to connect with a support representative in real-time. This channel is ideal for quick queries and immediate assistance, with an average response time of less than 1 minute.

Email Support

- Traders can send their inquiries, concerns, or requests to CMTrading's dedicated support email address. The support team aims to respond to all emails within 24 hours, with most queries being resolved within this timeframe.

Phone Support

- For traders who prefer to discuss their concerns over the phone, CMTrading provides a range of local and international phone numbers. The multilingual support team is available to assist traders in various languages, including English, Arabic, Spanish, German, French, and Italian.

Social Media

- CMTrading maintains an active presence on popular social media platforms, such as Facebook, Twitter, and Instagram. Traders can reach out to the support team through these channels for general inquiries and updates on the latest market developments.

Customer Support Comparison Table

| Feature | CMTrading |

|---|---|

| Live Chat | ✓ |

| Email Support | ✓ |

| Phone Support | ✓ |

| Social Media Support | ✓ |

| Languages | English, Arabic, Spanish, German, French, Italian |

| Support Hours | 24/5 |

| Average Response Time | Live Chat: < 1 minute, Email: 24 hours |

Prohibited Countries

CMTrading is committed to complying with international regulations and operating within the legal framework of the countries it serves. Due to varying regulatory requirements, licensing restrictions, and geopolitical factors, the broker is prohibited from providing services in certain regions.

The primary reason behind these restrictions is the lack of appropriate licenses or authorizations required to offer financial services in specific jurisdictions. Additionally, some countries have strict regulations or bans on online trading, making it unlawful for CMTrading to operate within their borders.

It is crucial for traders to be aware of these restrictions, as attempting to access CMTrading's services from a prohibited country may result in legal consequences and the potential loss of funds. The broker implements strict measures to prevent clients from prohibited countries from opening an account or trading on its platform.

Prohibited Countries List

- CMTrading is allowed to operate in all regions except USA

Traders from permitted regions can freely access CMTrading's services, as the broker holds the necessary licenses and authorizations to operate in these jurisdictions. However, it is essential for traders to ensure that they comply with their local laws and regulations when engaging in online trading activities.

If you are unsure about the legal status of online trading in your country or have any questions regarding CMTrading's services, it is recommended to contact the broker's customer support team for further assistance. They will be able to provide you with up-to-date information and guidance on your eligibility to trade with CMTrading.

Special Offers for Customers

CMTrading offers a welcome bonus for new account registrations, providing traders with additional funds to start trading. Bonus availability and terms may vary, so it's important to check the latest promotions on their official website.

Conclusion

As I approach the end of this comprehensive review of CMTrading, I want to consolidate the findings and insights gathered throughout the article to provide a cohesive summary that addresses the broker's safety, reliability, and overall reputation.

Drawing upon the analysis conducted across various aspects of CMTrading's operations, I can confidently say that they have established themselves as a trustworthy and dependable broker. Their commitment to regulatory compliance, with licenses from the FSCA and FSA, demonstrates a strong focus on providing a secure trading environment for their clients.

While CMTrading's FSCA regulation is a positive aspect, it's important to note that their FSA license is from an offshore jurisdiction, which may not provide the same level of oversight as top-tier regulators like the FCA or ASIC. However, CMTrading mitigates this concern by implementing segregated client funds and negative balance protection, showcasing their dedication to safeguarding traders' assets.

One standout feature of CMTrading is their comprehensive educational resources. From webinars and video tutorials to eBooks and market analysis, they provide a wealth of materials to support traders at every level. This commitment to education not only benefits clients but also reflects positively on CMTrading's reputation as a broker that prioritizes trader success.

In terms of trading platforms, CMTrading offers the popular MetaTrader 4 alongside their proprietary web-based platform. While some traders may prefer a broader selection, such as MetaTrader 5 or cTrader, the provided options are user-friendly and suitable for most trading styles. The addition of copy trading functionality through their CopyKat platform is a valuable feature, particularly for novice traders looking to learn from more experienced professionals.

When it comes to account types and trading conditions, CMTrading caters to a wide range of traders. From the entry-level Basic account to the high-tier Premium option, there's a suitable choice for varying investment levels and trading strategies. The availability of Islamic accounts is another plus, demonstrating CMTrading's inclusivity and understanding of diverse trader needs.

Customer support is a crucial aspect of any brokerage, and CMTrading excels in this area. With multiple channels, including live chat, email, and phone support, clients can quickly access assistance whenever needed. The multilingual support team and extensive FAQ section further enhance the user experience.

While CMTrading provides a solid offering, there are a few areas where they could improve. The relatively high minimum deposit of $299 for the Basic account may be a barrier for some beginner traders. Additionally, the limited selection of funding methods and the presence of withdrawal fees may not be as competitive as some other brokers in the market.

Find fixed-spread brands via the fixed-spread broker line-up.

Compare low-deposit accounts in our LiteFinance review.