CPT Markets Review 2025: Legit Broker for Forex Trading or a Scam?

CPT Markets

United Kingdom

United Kingdom

-

Minimum Deposit $20

-

Withdrawal Fee $varies

-

Leverage 1000:1

-

Spread From 0.1

-

Minimum Order 0.01

-

Forex Available

-

Crypto Available

-

Stock Unavailable

-

Indices Available

Licenses

United Kingdom Market Making (MM)

United Kingdom Market Making (MM)

South Africa Retail Forex License

South Africa Retail Forex License

Softwares & Platforms

Customer Support

Supported language: Arabic, Spanish, Chinese (Simplified), English

Social Media

Summary

Founded in 2010, CPT Markets offers global forex and CFD trading, regulated by the FCA (UK) and FSCA (South Africa). It provides access to over 2,200 instruments across forex, indices, commodities, shares, and cryptocurrencies. Clients can trade via MT4, MT5, and cTrader, with flexible account options starting from a $20 minimum deposit. The broker also offers educational resources, competitive spreads, negative balance protection, and 24/5 customer support.

- Trusted regulators (FCA, FSCA)

- Large, diverse range of markets

- MT4, MT5 plus cTrader platforms

- Competitive spreads and commissions

- Fast, fee-free funding

- 24/5 client support

- Useful research tools

- Negative balance protection

- Limited crypto selection

- Educational content varies by region

- Cannot accept clients from USA and several other countries

Overview

CPT Markets is a global online broker that has been providing forex and CFD trading services since 2010. With offices in London, UK, and Johannesburg, South Africa, the company serves clients worldwide, offering access to over 2,200 financial instruments across multiple asset classes, such as forex, indices, shares, commodities, and cryptocurrencies.

The broker operates under the regulatory oversight of the Financial Conduct Authority (FCA) in the UK and the Financial Sector Conduct Authority (FSCA) in South Africa, ensuring a secure and transparent trading environment for its clients. CPT Markets provides a choice of popular trading platforms, including MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader, which are available on desktop, web, and mobile devices.

Traders can select from three main account types—Classic, Prime, and ECN—catering to different trading preferences and budgets. The broker also offers educational resources, such as webinars, tutorials, and market analysis, to help traders enhance their skills and knowledge.

For more comprehensive information, visit CPT Markets' official website.

Overview Table

| Key Aspects | Details |

|---|---|

| Foundation | 2010 |

| Headquarters | London, United Kingdom |

| Regulation | FCA (UK), FSCA (South Africa) |

| Trading Platforms | MT4, MT5, cTrader |

| Account Types | Classic, Prime, ECN |

| Minimum Deposit | $20 (Classic), $1,000 (Prime), $1,000 (ECN) |

| Tradable Assets | Forex, Indices, Shares, Commodities, Cryptocurrencies |

| Customer Support | 24/5 via live chat, email, and phone |

| Educational Resources | Webinars, tutorials, market analysis |

| Unique Features | Competitive spreads, low minimum deposits, negative balance protection |

Facts List

- CPT Markets was founded in 2010 and has offices in London, UK, and Johannesburg, South Africa.

- The broker is regulated by the Financial Conduct Authority (FCA) in the UK and the Financial Sector Conduct Authority (FSCA) in South Africa.

- CPT Markets offers over 2,200 tradable instruments, including forex, indices, shares, commodities, and cryptocurrencies.

- Traders can choose from three account types: Classic (minimum deposit $20), Prime (minimum deposit $1,000), and ECN (minimum deposit $1,000).

- The broker provides access to popular trading platforms such as MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader.

- Trading platforms are available on desktop, web, and mobile devices (iOS and Android).

- CPT Markets offers competitive spreads, with the EUR/USD spread starting from 0.1 pips on the ECN account.

- The broker provides educational resources, including webinars, tutorials, and market analysis, to support traders' growth.

- CPT Markets offers negative balance protection to ensure that clients cannot lose more than their account balance.

- Customer support is available 24/5 via live chat, email, and local phone numbers in the UK and South Africa.

CPT Markets Licenses and Regulatory

CPT Markets is a well-regulated broker, operating under the oversight of two respected financial authorities:

Financial Conduct Authority (FCA), United Kingdom:

- CPT Markets UK Ltd is authorized and regulated by the FCA, with firm reference number 606110.

- The FCA is known for its stringent regulations and investor protection measures, ensuring that brokers adhere to high standards of transparency, fairness, and financial stability.

Financial Sector Conduct Authority (FSCA), South Africa:

- CPT Markets (PTY) Ltd is licensed by the FSCA, with license number 45954.

- The FSCA is responsible for regulating the conduct of financial institutions in South Africa, promoting fair treatment of clients, and maintaining the integrity of the financial markets.

These regulatory licenses demonstrate CPT Markets' commitment to operating in compliance with strict financial regulations and industry best practices. The oversight provided by the FCA and FSCA helps ensure client protection, segregation of client funds, and fair dealing practices.

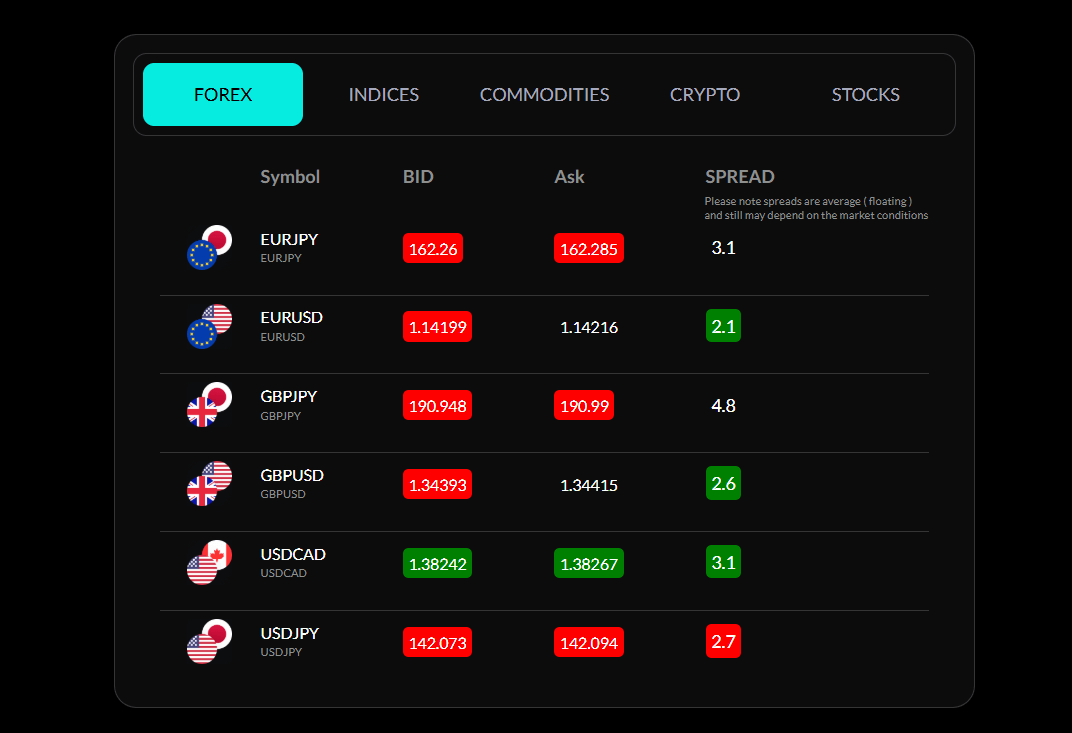

Trading Instruments

CPT Markets provides access to 2,200+ financial instruments across multiple asset classes:

| Asset Class | Examples |

|---|---|

| Forex Pairs | Major, Minor, and Exotic pairs (e.g., EUR/USD, AUD/JPY, USD/TRY) |

| Indices | US30, UK100, AUS200 |

| Shares | 1000+ international stocks (e.g., US, UK, Europe) |

| Commodities | Metals, energies, and agricultural prices (e.g., Gold, Silver, Oil, Coffee) |

| Cryptocurrencies | Bitcoin, Ethereum, Litecoin, etc. against USD or EUR |

| Options and Futures | Available for trading |

Spreads are variable depending on instrument and account type. EUR/USD averages 1.4 pips on Classic, 0.7 pips on Prime, and 0.1 pip + commission on ECN. Complete asset lists and real-time prices are available on CPT Markets' official website.

Trading Platforms

CPT Markets provides traders with access to three popular trading platforms, ensuring a seamless and powerful trading experience across different devices:

MetaTrader 4 (MT4)

- A widely-used, advanced trading platform known for its user-friendly interface and extensive features

- Offers a wide range of technical analysis tools, including 30+ built-in indicators and the ability to create custom indicators

- Supports automated trading through Expert Advisors (EAs) and the MetaQuotes Language 4 (MQL4) for custom trading strategies

- Available on desktop, web, and mobile (iOS and Android) platforms

MetaTrader 5 (MT5)

- The successor to MT4, offering enhanced features and a more advanced trading environment

- Provides access to a broader range of markets, including stocks, futures, and options, in addition to forex and CFDs

- Includes 38+ built-in indicators, 44 graphical objects, and 21 timeframes for in-depth technical analysis

- Supports automated trading through Expert Advisors (EAs) and the MetaQuotes Language 5 (MQL5)

- Available on desktop, web, and mobile (iOS and Android) platforms

cTrader

- An intuitive and feature-rich trading platform designed for both beginners and advanced traders

- Offers a user-friendly interface with advanced charting tools, 70+ pre-built indicators, and the ability to create custom indicators

- Supports algorithmic trading through cAlgo, a powerful tool for developing and backtesting custom trading robots

- Provides a comprehensive range of order types, including Market, Limit, Stop, and Trailing Stop orders

- Available on desktop, web, and mobile (iOS and Android) platforms

trading platforms comparison table

| Feature | MT4 | MT5 | cTrader |

|---|---|---|---|

| Charting Tools | 30+ indicators | 38+ indicators | 70+ indicators |

| Timeframes | 9 | 21 | 9 |

| Automated Trading | Expert Advisors (EAs) | Expert Advisors (EAs) | cAlgo (cBots) |

| Customization | MQL4 | MQL5 | cTrader Automate |

| Order Types | Market, Pending | Market, Pending, Stop, Trailing Stop | Market, Limit, Stop, Trailing Stop |

| Desktop Platform | Yes | Yes | Yes |

| Web Platform | Yes | Yes | Yes |

| Mobile Apps (iOS/Android) | Yes | Yes | Yes |

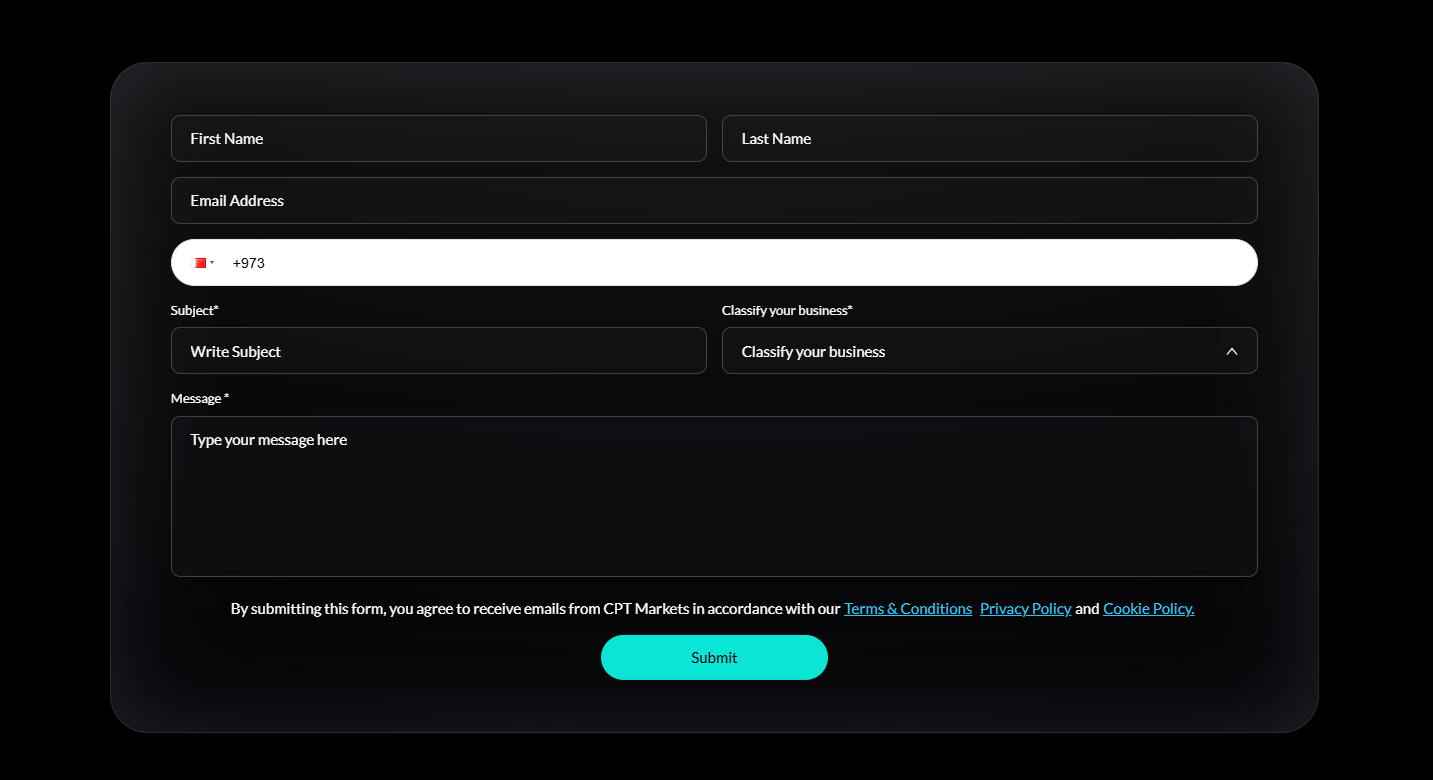

CPT Markets How to Open an Account: A Step-by-Step Guide

- Visit the CPT Markets official website and click on the "Open an Account" or "Sign Up" button, usually located in the top right corner of the homepage.

- Choose the type of account you wish to open (e.g., Classic, Prime, or ECN) and click on the corresponding "Open Account" button.

- Fill in your personal details, including your first and last name, email address, phone number, country of residence, and date of birth. Ensure that all information provided is accurate and up-to-date.

- Create a strong and secure password for your account, and select your preferred account currency (e.g., USD, EUR, or GBP).

- Provide additional information, such as your address, city, postal code, and employment details, as required by the broker's account opening form.

- Answer questions related to your trading experience, financial knowledge, and risk tolerance. This information helps the broker assess the suitability of their products and services for your needs.

- Read and agree to the broker's terms and conditions, privacy policy, and risk disclosure statement.

- Submit your account application and wait for the broker to review and approve your request. This process usually takes a few business days.

- Once your account is approved, you will receive a confirmation email with your account details and login credentials.

- Log in to your account and submit the required documents for identity and address verification, such as a copy of your passport or ID card and a recent utility bill or bank statement. This step is necessary to comply with anti-money laundering (AML) and know-your-customer (KYC) regulations.

- After your documents are verified, fund your account using one of the available payment methods, such as bank transfer, credit/debit card, or e-wallet.

- Once your account is funded, you can start trading on the CPT Markets platform.

Charts and Analysis

CPT Markets provides a comprehensive suite of educational resources and trading tools to support its clients in enhancing their market knowledge and making informed trading decisions. These resources include:

| Feature Category | Details |

|---|---|

| Charts and Technical Analysis Tools | - Advanced charting (line, bar, candlestick) - 50+ technical indicators (MA, MACD, RSI, Bollinger Bands) - Custom timeframes (1 min to monthly) - Drawing tools (trend lines, Fibonacci, support/resistance) - Real-time price updates and historical data |

| Economic Calendar | - Comprehensive global calendar (US, UK, Eurozone, Japan, Australia) - Customizable event filters - Event descriptions, expectations, alerts/reminders |

| Market Analysis and Insights | - Daily market reviews and analysis - Technical and fundamental research across asset classes - Trading ideas by experts - Weekly outlook videos - Quarterly forecasts and guides |

| Educational Webinars and Tutorials | - Live and recorded webinars on trading topics - Beginner tutorials on platform use and basic concepts - Advanced trading strategy series - Guest webinars with experts - Interactive Q&A sessions |

| Trading Guides and E-books | - Downloadable guides and e-books on forex, CFDs, technical analysis - Step-by-step platform guides - Risk management and psychology handbooks - Market-specific trading guides - Regularly updated e-book library |

| Trading Glossary and FAQ | - Comprehensive, searchable trading glossary - FAQ section covering accounts, funding, platform use, and trading basics |

CPT Markets Account Types

CPT Markets offers three main live account types tailored to suit different trading styles, preferences, and budgets:

Classic Account

- Minimum deposit: $20

- Spreads starting from 1.4 pips

- No commission charges

- Ideal for novice traders or those looking to start with a low initial investment

Prime Account

- Minimum deposit: $1,000

- Spreads starting from 0.7 pips

- No commission charges

- Suitable for more experienced traders seeking tighter spreads

ECN Account

- Minimum deposit: $1,000

- Raw spreads starting from 0.1 pips

- Commission of $4 per round turn lot traded

- Designed for advanced traders who prefer raw spreads and faster execution speeds

In addition to these live account options, CPT Markets also provides demo accounts, allowing traders to practice their strategies and familiarize themselves with the trading platforms using virtual funds, without any risk to their capital.

CPT Markets Account Comparison

| Account Type | Classic | Prime | ECN |

|---|---|---|---|

| Min Deposit | $0 | $1000 | $1000 |

| Commission | $0 | $0 | $4 per lot RT |

| EUR/USD Spread | 1.4 pips | 0.7 pips | 0.1 pips |

| Max Leverage | Up to 1:30 (UK), 1:1000 (Int'l) | Up to 1:30 (UK), 1:1000 (Int'l) | Up to 1:30 (UK), 1:1000 (Int'l) |

Negative Balance Protection

NBP is a risk management feature offered by some brokers, including CPT Markets, to ensure that traders cannot lose more than the funds available in their trading account. In other words, it prevents a trader's account balance from going negative, even in highly volatile market conditions or unexpected events. Here's how negative balance protection works:

- When a trader opens a position, they are essentially borrowing money from the broker to control a larger position size through leverage.

- If the market moves against the trader's position and their account balance is insufficient to cover the losses, the broker will automatically close the position to prevent the account balance from turning negative.

- Without negative balance protection, a trader could potentially lose more than their initial deposit, leaving them in debt to the broker.

CPT Markets Deposits and Withdrawals

CPT Markets supports a variety of payment methods, with the exact options varying by region and account entity:

Deposit Methods

| Payment Method | Options |

|---|---|

| Bank Transfer | Yes |

| Credit/Debit Cards | Visa, Mastercard, Maestro |

| E-Wallets | Neteller, Skrill |

| Local Payment Processors | Yes |

Withdrawal Methods

| Payment Method | Options |

|---|---|

| Bank Transfer | Yes |

| Credit/Debit Cards | Visa, Mastercard, Maestro |

| E-Wallets | Neteller, Skrill |

| Local Payment Processors | Yes |

- No deposit or withdrawal fees

- Inactivity fee of $50/mo after 90 days without trading

- Overnight/swap fees for positions held past 5pm EST

- ECN accounts: $4 per round turn lot commission, in addition to raw spreads. Classic and Prime remain commission-free

- No other account maintenance fees

Support Service for Customer

CPT Markets customer support is available 24/5 via:

- Live Chat

- Email: support.za@cptmarkets.com

- Phone: +27129914400 (South Africa), +44(0)2039882277 (UK)

- Social media: Facebook, Twitter

- Online contact form

CPT Markets Support Comparison

| Channel | Availability | Languages |

|---|---|---|

| Live Chat | 24/5 | English, Chinese, Arabic |

| 24/5 | English, Chinese, Spanish, Arabic | |

| Phone | 24/5 | English, Chinese, Spanish, Arabic |

| Social Media | Weekly | English |

Prohibited Countries

CPT Markets serves an international audience but due to local regulations can not onboard residents of:

- USA

- Canada

- Israel

- Iran

- North Korea

- Belgium

- Australia

- New Zealand

This list is not exhaustive and subject to change so always check with CPT Markets directly for the most up-to-date country restrictions.

Special Offers for Customers

CPT Markets occasionally runs limited-time promotions such as:

- New client bonus for eligible account funding

- Loyalty programs with volume-based rebates

- Contests and prizes for most profitable investors

- Service trials and platform discounts

- Refer-a-friend bonuses

Availability and terms vary by region and entity. Check the official CPT Markets website for current deals.

Conclusion

As we approach the end of this comprehensive review of CPT Markets, I want to consolidate the findings and insights gathered throughout the article to provide a cohesive summary that addresses their safety, reliability, and overall reputation.

Drawing upon the analysis conducted across various aspects of CPT Markets' operations, such as regulatory compliance, geographical jurisdictions, customer support, and special offers, I can distill these observations into a focused evaluation of their trustworthiness and dependability as a broker.

CPT Markets' regulatory oversight from the Financial Conduct Authority (FCA) in the UK and the Financial Sector Conduct Authority (FSCA) in South Africa lends significant credibility to their legitimacy and commitment to upholding industry standards. These licenses, combined with their strict client fund segregation practices and negative balance protection, demonstrate a solid foundation of safety and security for traders.

The broker's wide range of tradable assets, spanning over 2,200 instruments across forex, indices, shares, commodities, and cryptocurrencies, caters to diverse trading preferences and allows for ample portfolio diversification. The availability of the popular MT4, MT5, and cTrader platforms across desktop, web, and mobile devices ensures a seamless and flexible trading experience for users.

CPT Markets' competitive pricing structure, with tight spreads and low commissions, makes them an attractive choice for cost-conscious traders. The broker's educational resources, including webinars, tutorial videos, and articles, provide a supportive environment for traders to enhance their skills and knowledge.

Furthermore, the broker's 24/5 customer support, available through multiple channels and languages, ensures that clients can access assistance whenever needed. The fast and fee-free deposit and withdrawal processes add to the broker's user-friendly approach.

While CPT Markets does have some limitations, such as restricted access for residents of certain countries and variations in educational content across regions, these drawbacks are relatively minor when weighed against the broker's numerous strengths.

In conclusion, I believe that CPT Markets is indeed a trustworthy and reliable broker that prioritizes the safety and satisfaction of its clients. Their strong regulatory standing, comprehensive offering of assets and platforms, competitive pricing, and dedication to customer support make them a compelling choice for traders seeking a secure and user-focused trading environment.

As with any financial decision, it is always advisable to conduct thorough due diligence and consider individual trading needs and risk tolerance before choosing a broker. However, based on the extensive analysis conducted in this review, I can confidently recommend CPT Markets as a legitimate and reputable option for those interested in forex and CFD trading.

Find fastest execution under the broker reviews speed index.

UK FSCS cover explored in the ActivTrades review.