Daman Markets Review 2025: UAE SCA MT5 Broker

Daman Markets

United Arab Emirates

United Arab Emirates

-

Minimum Deposit $250

-

Withdrawal Fee $varies

-

Leverage 500:1

-

Minimum Order 0.01

-

Forex Available

-

Crypto Unavailable

-

Stock Available

-

Indices Available

Licenses

Securities Brokerage License

Securities Brokerage License

Softwares & Platforms

Customer Support

+97144080400

(Arabic)

+97144080400

(Arabic)

Supported language: English, Arabic

Social Media

Summary

Daman Markets is the CFD/FX brand of Daman Securities LLC, licensed by the UAE SCA (License No. 604020). The broker offers MT5 on desktop, web, and mobile, with two account tiers: Classic ($250, spreads from 1.2 pips, no commission) and Pro ($20k, 0.0 pips + $35/million commission). Assets include forex, indices, commodities, stocks (global and UAE), and crypto, with “futures” referenced but best verified inside the portal. Funding supports cards, bank transfer, Skrill, and Neteller, while restricted countries (e.g., Russia, DPRK, Syria) are clearly listed. Strengths are its on-shore regulation and simple MT5 setup; gaps include unclear negative balance protection and inconsistent Pro commission disclosure ($17 vs $35) across pages. Overall, it’s a credible UAE-regulated option—but confirm fees and policies in writing before trading.

- On-shore UAE SCA regulation provides strong oversight

- 26+ years of market presence through parent company

- Access to unique UAE stock CFDs

- MetaTrader 5 with EA support

- Transparent contract specifications

- Two-tier account structure

- Swap-free option available

- Multi-asset CFD offering

- Clear entity structure and licensing

- Established Dubai headquarters

- Conflicting Pro account commission rates

- No explicit NBP advertisement

- High Pro account minimum ($20,000)

- Limited educational resources

- Support hours not specified

- Documentation still "portal-centric"

- High leverage risk (1:500)

- Restricted country list extensive

- No permanent bonuses advertised

- Website information inconsistencies

Overview

Daman Markets represents the CFD and Forex trading division of Daman Securities LLC, a Dubai-based financial institution established in 1998. Operating under the regulatory oversight of the UAE Securities & Commodities Authority (SCA) with a Category 1 license (#604020), this broker combines over two decades of market experience with on-shore regulatory compliance. The firm operates from the World Trade Center in Dubai, offering MetaTrader 5 access across multiple asset classes including forex, stocks, indices, commodities, and cryptocurrency CFDs.

The broker's positioning within the UAE regulatory framework sets it apart from many offshore competitors, providing enhanced oversight and client protection standards. With two distinct account tiers catering to different trader profiles and capital requirements, Daman Markets serves both retail and professional traders seeking exposure to global markets through a locally regulated entity.

Overview Table

| Item | Details |

|---|---|

| Legal Entity | Daman Securities LLC (trading as Daman Markets) |

| Founded | 1998 |

| Headquarters | World Trade Center, Dubai, UAE |

| Regulation | UAE SCA Category 1, License #604020 |

| Trading Platform | MetaTrader 5 (Desktop, Web, Mobile) |

| Account Types | DM Classic, DM Pro |

| Minimum Deposit | $250 (Classic), $20,000 (Pro) |

| Leverage | Up to 1:500 (Classic), 1:100 (Pro) |

| Spreads | From 1.2 pips (Classic), 0.0 pips (Pro) |

| Commission | None (Classic), From $35/million USD (Pro)* |

Facts List

- Established Heritage: Parent company Daman Securities founded in 1998, providing 26+ years of market presence

- On-shore Regulation: UAE SCA Category 1 license offers superior oversight compared to offshore alternatives

- Multi-Asset Trading: Access to forex, global stocks, UAE stocks, indices, commodities, and crypto CFDs

- Platform Stability: Exclusively uses MetaTrader 5 across all devices with EA support

- Dual Account Structure: Classic account for retail traders, Pro account for high-volume professionals

- Local Market Access: Unique offering of UAE stock CFDs including EMAAR and ADNOC

- High Leverage Available: Up to 1:500 leverage on Classic accounts (significant risk factor)

- Stop-Out Level: 50% margin level for both account types

- Islamic Accounts: Swap-free option available for Classic accounts only

- Documentation Issues: Pricing inconsistencies and missing NBP clarity on public pages

Daman Markets Licenses and Regulatory

Daman Markets operates under the regulatory umbrella of Daman Securities LLC, holding a UAE Securities & Commodities Authority Category 1 license (#604020). This license authorizes on-exchange trading and clearing, global markets brokerage, and OTC derivatives & FX spot dealing. The on-shore UAE regulation provides several advantages over typical offshore CFD licenses, including stricter capital requirements, enhanced conduct standards, and direct regulatory supervision.

The SCA oversight ensures compliance with UAE financial regulations, offering traders improved counterparty credibility and clearer dispute resolution pathways. However, regulatory protection does not eliminate market risks or leverage-related losses, making it crucial for traders to understand margin requirements and stop-out policies before trading.

Regulatory Licenses Held:

- United Arab Emirates - SCA Category 1, License No. 604020

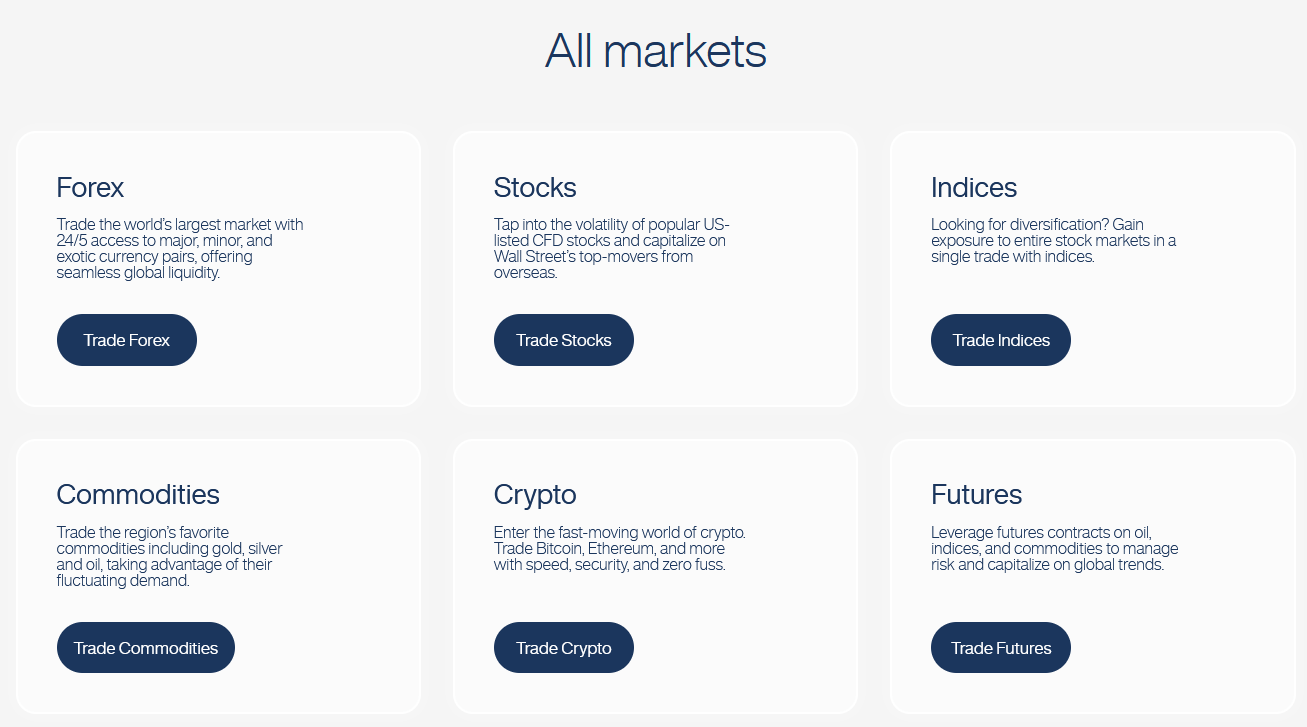

Trading Instruments

Daman Markets provides access to a diverse range of CFD instruments across multiple asset classes. The broker's unique positioning allows it to offer both international markets and local UAE securities, catering to regional investors seeking familiar domestic stocks alongside global opportunities.

Asset Categories Table

| Asset Class | Instruments Available | Trading Hours |

|---|---|---|

| Forex | Majors, Minors, Exotics | 24/5 |

| Stocks (Global) | US, UK, EU equities | Exchange hours |

| Stocks (UAE) | EMAAR, ADNOC, local listings | DFM/ADX hours |

| Indices | Cash indices, futures references | Market hours |

| Commodities | Gold, Oil, Natural Gas | Market hours |

| Cryptocurrencies | BTC, ETH, LTC, XRP, others | 24/7 |

| Futures | Referenced but requires verification | Various |

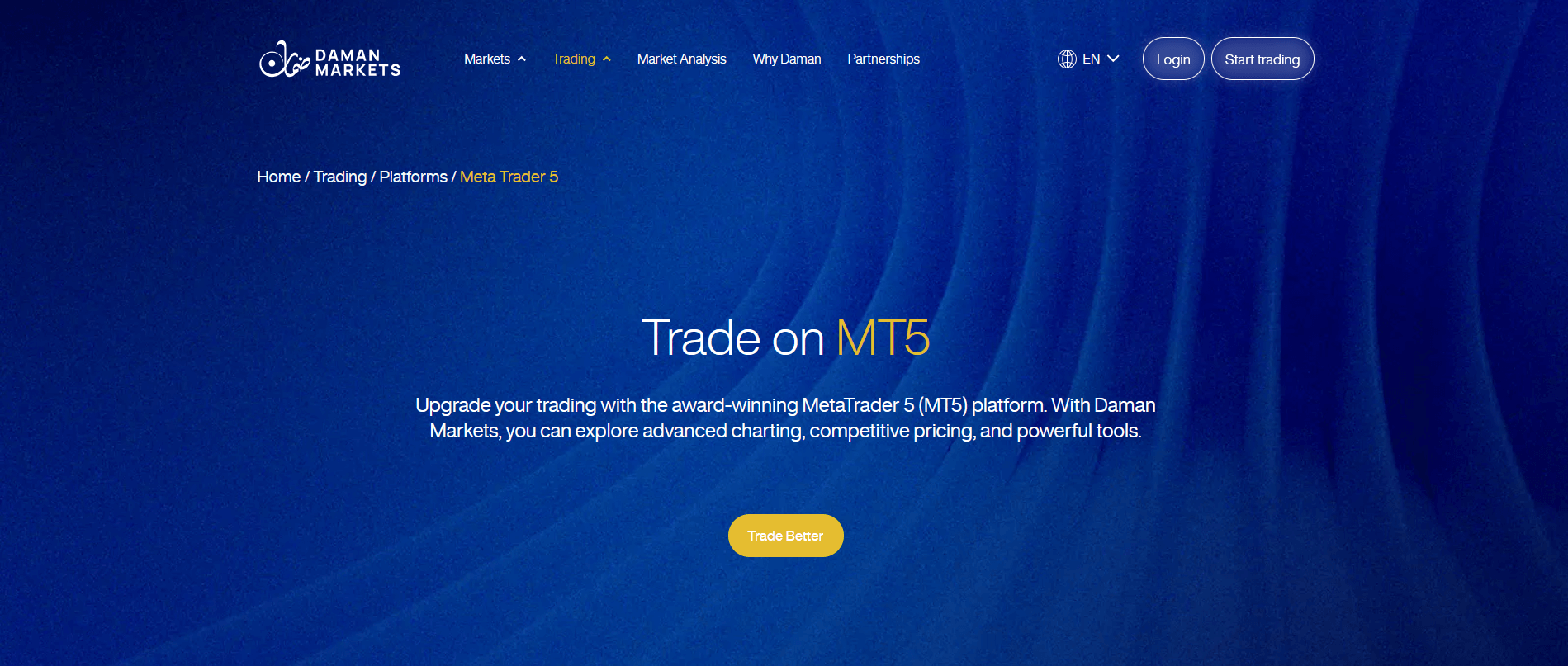

Trading Platforms

Daman Markets exclusively offers MetaTrader 5, providing consistency across all trading interfaces. The platform delivers advanced charting capabilities, automated trading support through Expert Advisors, and multi-asset functionality suitable for diverse trading strategies.

Trading Platform Comparison Table

| Feature | MT5 Desktop | MT5 Web | MT5 Mobile |

|---|---|---|---|

| Multi-asset CFDs | Yes | Yes | Yes |

| Custom Indicators | Full support | Limited | Limited |

| Expert Advisors | Yes | No | No |

| One-click Trading | Yes | Yes | Yes |

| Market Depth | Yes | Limited | Limited |

| Installation Required | Yes | No | Yes (App) |

| Charting Tools | Advanced | Standard | Basic |

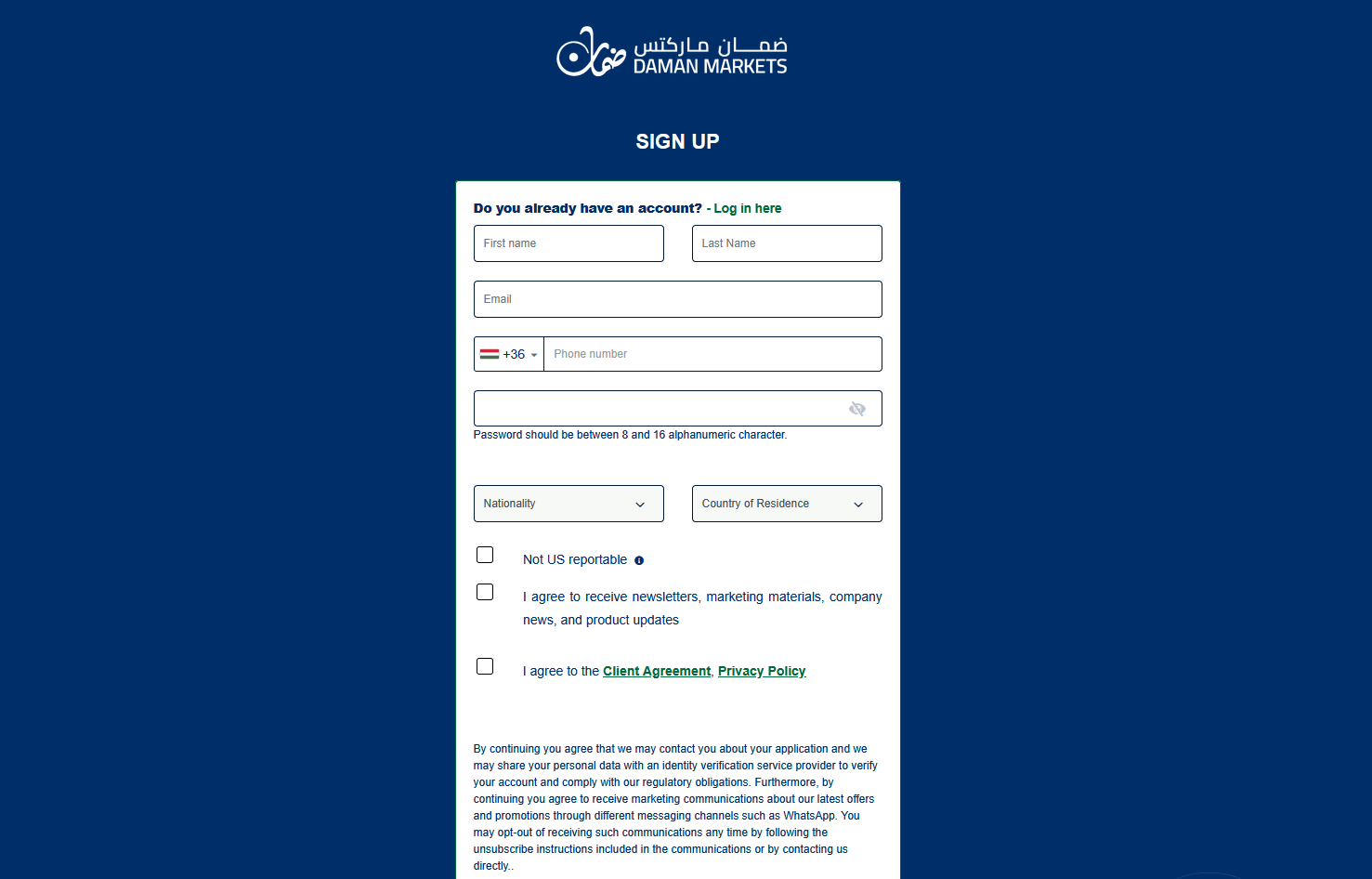

Daman Markets How to Open an Account: A Step-by-Step Guide

- Visit Website: Navigate to damanmarkets.com and click "Open Account"

- Complete Registration: Fill in personal details and create login credentials

- Submit KYC Documents: Upload government-issued ID and proof of address

- Review Agreements: Read and accept Client Agreement and trading terms

- Select Account Type: Choose between Classic ($250 minimum) or Pro ($20,000 minimum)

- Fund Account: Deposit using credit/debit cards, bank transfer, or e-wallets (Skrill/Neteller)

- Download MT5: Install platform on preferred device (desktop/mobile)

- Login and Trade: Access markets using provided MT5 credentials

Charts and Analysis

Daman Markets provides minimal analytical and educational resources, relying primarily on MT5's built-in capabilities and basic market news updates. The platform offers weekly outlooks and an economic calendar but lacks the comprehensive educational infrastructure expected from modern brokers.

| Resource Category | What's Offered | Quality Level | Industry Standard | Gap Assessment |

|---|---|---|---|---|

| Market News | Weekly outlooks, rate decisions | Basic (5/10) | Daily analysis, video updates | Below average - lacks depth and frequency |

| Economic Calendar | Standard calendar under Tools | Functional (6/10) | Advanced filters, impact alerts | Meets minimum requirements |

| Technical Analysis Tools | MT5 built-in only (30+ indicators) | Standard (6/10) | 50+ indicators, pattern recognition | Adequate for basic needs |

| Educational Content | Specification pages, basic guides | Minimal (3/10) | Full academy, courses, webinars | Significant gap - no structured learning |

| Research Reports | Not available | None (0/10) | Daily/weekly professional research | Major weakness |

| Video Tutorials | Not found | None (0/10) | Comprehensive video libraries | Missing entirely |

| Webinars/Live Sessions | Not advertised | None (0/10) | Weekly educational webinars | Missing entirely |

| Trading Calculators | Via MT5 only | Basic (5/10) | Web-based suite of calculators | Limited accessibility |

| Market Sentiment Tools | Not available | None (0/10) | Sentiment indicators, positioning | Missing feature |

| Strategy Resources | Not covered | None (0/10) | Strategy guides, backtesting help | No strategy education |

Daman Markets Account Types

Daman Markets offers two distinct account tiers designed for different trader profiles and capital levels.

DM Classic Account: Targeted at retail traders with a $250 minimum deposit, offering commission-free trading with spreads from 1.2 pips and leverage up to 1:500. Includes swap-free option for Islamic finance compliance.

DM Pro Account: Designed for professional traders with $20,000 minimum, featuring raw spreads from 0.0 pips plus commission. Limited to 1:100 leverage with no swap-free option available.

Account Types Comparison Table

| Feature | DM Classic | DM Pro |

|---|---|---|

| Minimum Deposit | $250 | $20,000 |

| Spreads (from) | 1.2 pips | 0.0 pips |

| Commission | None | $35 per million USD* |

| Maximum Leverage | 1:500 | 1:100 |

| Stop-out Level | 50% | 50% |

| Swap-free Option | Available | Not available |

| Target Audience | Retail traders | Professional/High-volume |

*Website shows conflicting information ($17 vs $35)

Negative Balance Protection

While negative balance protection prevents account balances from going below zero during extreme market volatility, Daman Markets does not explicitly advertise this feature on public pages. The Client Agreement contains risk management terms, but traders should request written confirmation of NBP status before funding accounts, particularly when using high leverage.

Daman Markets Deposits and Withdrawals

The broker supports multiple payment methods with varying processing times. USD transactions process without conversion fees, while other currencies incur bank FX rates. A Declaration of Deposit acknowledgment appears during the funding process, ensuring transparency in financial transactions.

Payment Methods Comparison Table

| Method | Deposit Min | Withdrawal Min | Processing Time | Fees |

|---|---|---|---|---|

| Visa/MasterCard | $250/$20,000* | Not specified | Instant | None listed |

| Bank Transfer | $250/$20,000* | Not specified | 1-3 days | Bank fees may apply |

| Skrill | $250/$20,000* | Not specified | Instant | None listed |

| Neteller | $250/$20,000* | Not specified | Instant | None listed |

Support Service for Customer

Customer support operates through website contact forms and help center resources, with additional contact details available through the parent company Daman Securities website. The Dubai-based support team likely offers English and Arabic assistance, though specific hours and response times aren't publicly detailed.

Customer Support Availability Table

| Channel | Availability | Languages | Response Time |

|---|---|---|---|

| Contact Form | 24/7 submission | Not specified | Not specified |

| Via Daman Securities | English/Arabic (assumed) | Not specified | |

| Phone | Dubai number available | English/Arabic (assumed) | Not specified |

| Help Center | 24/7 access | English | Immediate (self-service) |

Prohibited Countries

Daman Markets restricts services to residents of Afghanistan, DPRK, Myanmar, South Sudan, Syria, DRC, Mali, Yemen, Lebanon, Sudan, CAR, Iraq, Libya, Somalia, Haiti, Venezuela, Kenya, Russia, and other jurisdictions where local laws prohibit CFD trading. This list may change based on regulatory requirements.

Allowed Regions: UAE and eligible international jurisdictions excluding restricted countries

Special Offers for Customers

No permanent bonuses or promotions appear on the main website. The broker ran a time-boxed demo trading competition in 2025, suggesting occasional promotional events may occur. Traders should check the client portal for current offers and always review terms and conditions before participating.

Conclusion

Daman Markets presents a mixed proposition for CFD traders. The strong on-shore UAE regulation and established parent company provide credibility often lacking in offshore brokers. MetaTrader 5 exclusivity ensures platform stability, while access to UAE stocks offers unique regional opportunities.

However, several concerns require attention. The pricing conflict on Pro accounts ($17 vs $35 per million) needs clarification before committing substantial capital. The absence of explicit negative balance protection statements and incomplete public documentation suggest the platform is still refining its client-facing infrastructure.

For traders prioritizing regulatory security and local market access, Daman Markets warrants consideration after verifying key terms. The high leverage available (1:500) poses significant risk for inexperienced traders. I recommend obtaining written confirmation of commission rates, NBP status, and actual tradable symbols before funding any account.