Dukascopy Review 2025: Pros and Cons, Trading Conditions and More

Dukascopy

Switzerland

Switzerland

-

Minimum Deposit $100

-

Withdrawal Fee $varies

-

Leverage 200:1

-

Spread From 0.1

-

Minimum Order 0.01

-

Forex Available

-

Crypto Unavailable

-

Stock Unavailable

-

Indices Unavailable

Licenses

Switzerland Financial Services License

Switzerland Financial Services License

Softwares & Platforms

Customer Support

+41227994888

(English)

+41227994888

(English)

Supported language: Arabic, Chinese (Simplified), English, French, German, Italian, Japanese, Russian

Social Media

Summary

Dukascopy is a Swiss-based brokerage known for its strong regulatory framework, competitive trading conditions, and advanced trading technology. It offers forex, CFDs, and binary options trading with access to deep liquidity and low spreads. The broker provides the JForex trading platform, which is equipped with advanced charting tools and automated trading capabilities. With a high level of security, transparent pricing, and banking services through Dukascopy Bank, it is a preferred choice for professional traders seeking a reliable and well-regulated trading environment.

- Highly regulated by top-tier authorities (FINMA, FCMC, JFSA)

- Competitive spreads starting from 0.1 pips

- Advanced proprietary trading platform (JForex)

- Negative balance protection for Dukascopy Europe clients

- 24/7 multilingual customer support

- Wide range of tradable assets (forex, CFDs, crypto, etc.)

- Extensive educational resources (webinars, tutorials, analysis)

- Low minimum deposit requirement ($100)

- Segregated client funds for added security

- Long-standing reputation as a Swiss bank

- Limited global presence compared to some larger brokers

- Higher fees for deposits/withdrawals via certain methods

- Inactivity fees after 6 months of no trading

- Limited forex pairs compared to some competitors

- No negative balance protection for Swiss & Japan entities

- Potentially complex platform for complete beginners

- Lacks strong emphasis on copy/social trading

- No US clients accepted

- CFD cryptocurrency spreads wider than industry average

- No notable promotions/bonuses mentioned

Overview

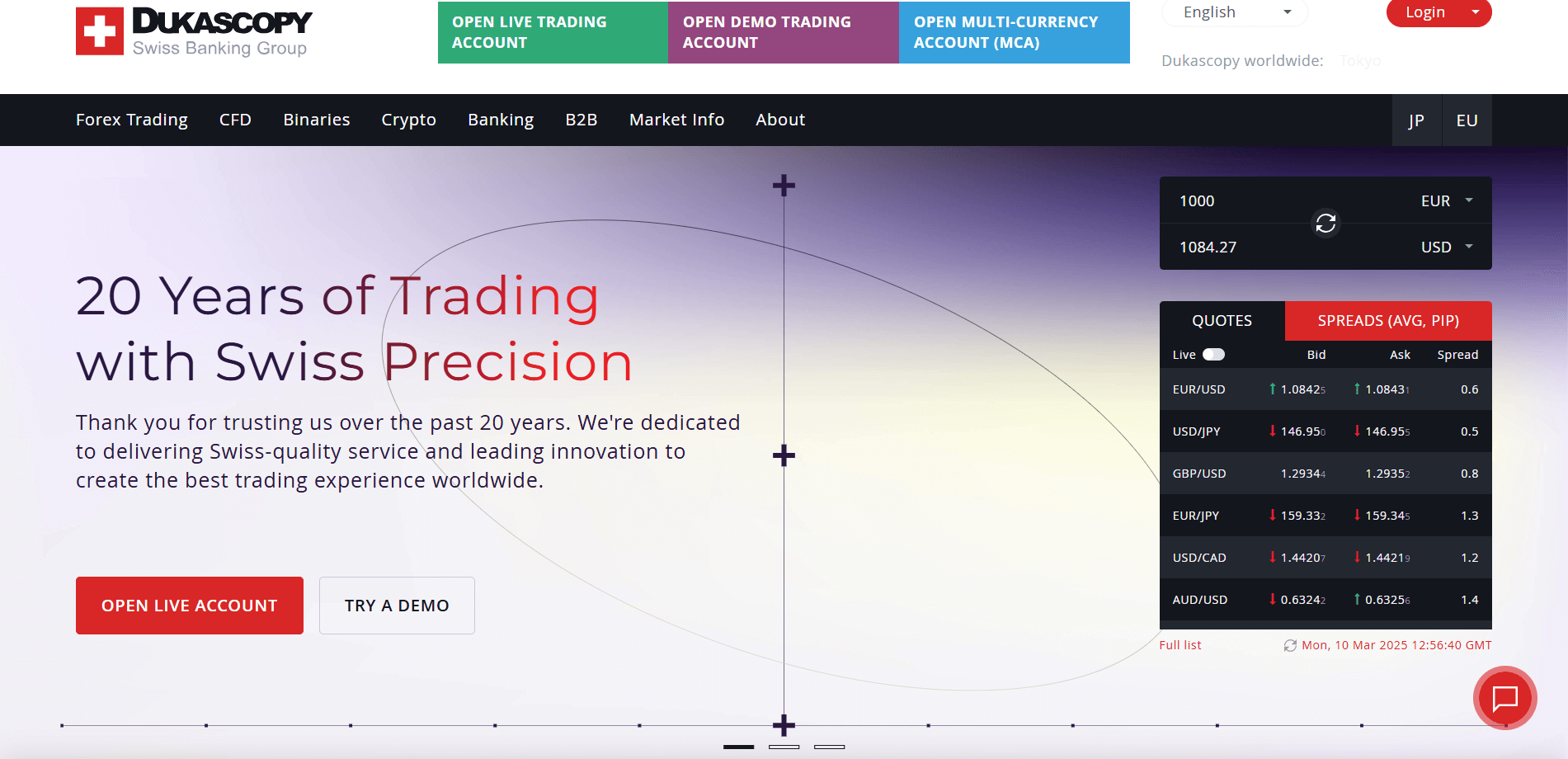

Dukascopy Bank SA, founded in 2004 and headquartered in Geneva, Switzerland, is an online bank and broker offering trading services in forex, CFDs, cryptocurrencies, commodities, ETFs, and binary options. Regulated by the Swiss Financial Market Supervisory Authority (FINMA) and the Japan Financial Services Agency (JFSA), Dukascopy provides a secure trading environment with deposit protection up to CHF 100,000 for Swiss entity clients. The broker has a global presence, with additional entities regulated in Latvia and Japan.

Known for its advanced proprietary trading platform, JForex, Dukascopy offers competitive spreads starting from 0.1 pips and leverage up to 1:200. With a wide range of over 1,200 tradable instruments across 8 asset classes and a low minimum deposit of just $100, the broker caters to both novice and experienced traders. Dukascopy provides 24/7 customer support via live chat, email, and phone in 11 languages, ensuring clients can access assistance whenever needed.

To further support traders, Dukascopy offers high-quality research, including market analysis, trading ideas, and an economic calendar, as well as educational resources such as articles, webinars, and tutorials. The broker has received numerous awards for its services, including "Best Bank Broker 2023" by Traders Union Awards and "JForex4 - Most User-Friendly Trading Experience" at Rimini IT Forum 2023. For more details on Dukascopy's offerings, visit their official website at dukascopy.com.

Overview Table

| Key Aspects | Details |

|---|---|

| Regulation | FINMA (Switzerland), JFSA (Japan), FCMC (Latvia) |

| Founded | 2004 |

| Headquarters | Geneva, Switzerland |

| Instruments | Forex, CFDs, Crypto, Commodities, Stocks, Indices, ETFs, Bonds |

| Platforms | JForex, MT4, MT5 |

| Min. Deposit | $100 |

| Spreads | From 0.1 pips |

| Leverage | Up to 1:200 |

| Deposit Protect | Up to CHF 100,000 (Swiss entity) |

| Support | 24/7 via live chat, email, phone in 11 languages |

Facts List

- Dukascopy Bank SA is regulated by top-tier financial authorities, including FINMA, JFSA, and FCMC.

- The broker offers over 1,200 tradable instruments across forex, CFDs, crypto, stocks, commodities, and more.

- Clients can trade on the proprietary JForex platform, as well as MT4 and MT5.

- Dukascopy provides competitive spreads starting from 0.1 pips and leverage up to 1:200.

- The minimum deposit requirement is just $100, making it accessible for beginner traders.

- Swiss entity clients enjoy deposit protection up to CHF 100,000, ensuring fund security.

- The broker offers 24/7 multilingual customer support via live chat, email, and phone.

- Dukascopy provides high-quality research, including market analysis, trading ideas, and an economic calendar.

- Educational resources such as articles, webinars, and tutorials are available to support traders.

- The broker has received numerous industry awards recognizing its platforms and services.

Dukascopy Licenses and Regulatory

Dukascopy Bank SA operates under a robust regulatory framework, holding licenses from top-tier financial authorities in multiple jurisdictions. The broker's primary regulator is the Swiss Financial Market Supervisory Authority (FINMA), which oversees its operations as a bank and securities dealer. FINMA is known for its stringent regulatory standards, ensuring that regulated entities maintain high levels of financial stability, risk management, and client protection.

In addition to FINMA, Dukascopy is regulated by the Japan Financial Services Agency (JFSA) and the Financial and Capital Market Commission (FCMC) in Latvia. This multi-jurisdictional regulation demonstrates Dukascopy's commitment to compliance and its ability to meet the strict requirements of various regulatory bodies.

The significance of being regulated by multiple top-tier authorities cannot be overstated. It provides clients with a high level of trust and confidence in the broker's operations, as these regulators enforce strict rules related to capital adequacy, segregation of client funds, transparency, and fair business practices. For example, FINMA requires regulated entities to maintain a minimum capital ratio and to segregate client funds from the broker's operating capital, ensuring that client assets are protected even in the event of the broker's insolvency.

Moreover, Dukascopy's Swiss banking license adds an extra layer of security for clients. As a licensed bank, Dukascopy must adhere to even stricter capital requirements and risk management standards compared to non-bank brokers. Swiss entity clients also benefit from deposit protection up to CHF 100,000 through the country's deposit insurance scheme, esisuisse.

Compared to the industry standard, Dukascopy's regulatory status is exceptional. While many brokers are regulated by a single authority, Dukascopy's multi-jurisdictional regulation demonstrates a higher level of commitment to compliance and client protection. The broker's Swiss banking license further sets it apart from most competitors, providing clients with additional peace of mind.

| Regulatory Body | Jurisdiction | Regulatory Details |

|---|---|---|

| Swiss Financial Market Supervisory Authority (FINMA) | Switzerland | Regulated as a bank and securities dealer. |

| Japan Financial Services Agency (JFSA) | Japan | Regulated through Dukascopy Japan K.K. subsidiary. |

| Financial and Capital Market Commission (FCMC) | Latvia | Regulated through Dukascopy Europe IBS AS subsidiary. |

| Swiss Bankers Association (SBA) | Switzerland | Member of the association, adhering to its code of conduct and professional ethics standards. |

| esisuisse | Switzerland | Member of the deposit insurance scheme, providing up to CHF 100,000 protection for Swiss clients. |

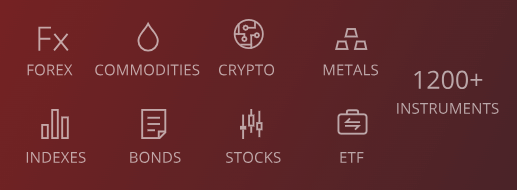

Trading Instruments

Dukascopy Bank SA offers an extensive range of tradable assets, catering to the diverse needs and preferences of traders worldwide. With over 1,200 instruments available across 8 asset classes, the broker provides a comprehensive trading environment that allows clients to diversify their portfolios and capitalize on various market opportunities.

Forex

- As a leading forex broker, Dukascopy offers a wide selection of currency pairs, including majors, minors, and exotics. Traders can access competitive spreads starting from 0.1 pips on popular pairs like EUR/USD. With leverage up to 1:200 and deep liquidity provided by the Swiss FX Marketplace (SWFX), Dukascopy enables clients to implement their forex trading strategies effectively.

CFDs

- Dukascopy's CFD offering covers a broad spectrum of underlying assets, such as stocks, indices, commodities, and cryptocurrencies. Clients can trade CFDs on over 1,000 global stocks from major exchanges in the US, Europe, and Asia. The broker also provides access to popular stock indices like the S&P 500, NASDAQ 100, and FTSE 100, as well as commodities such as gold, silver, oil, and natural gas. Moreover, Dukascopy offers CFDs on major cryptocurrencies, including Bitcoin, Ethereum, Litecoin, and Ripple.

Binary Options

- For traders seeking a simplified trading experience, Dukascopy provides binary options trading on 18 forex currency pairs. Binary options allow clients to speculate on the direction of an asset's price movement within a specific timeframe, with predefined potential profits and losses.

Precious Metals

- Dukascopy enables clients to trade gold and silver as spot contracts or CFDs. With competitive spreads and flexible contract sizes, the broker caters to both retail and institutional investors interested in precious metals trading.

Bonds

- Traders can access a selection of government bonds from major economies like the US, UK, and Germany. Dukascopy's bond offering provides clients with opportunities to diversify their portfolios and hedge against market volatility.

The breadth and depth of Dukascopy's tradable assets demonstrate the broker's commitment to meeting the evolving needs of its clients. By providing a diverse range of instruments, Dukascopy empowers traders to explore various market opportunities and implement their trading strategies across multiple asset classes.

Compared to the industry standard, Dukascopy's asset offerings are extensive and competitive. While some brokers may specialize in specific asset classes, Dukascopy's comprehensive approach ensures that clients have access to a wide range of trading opportunities.

Trading Platforms

Dukascopy Bank SA offers a range of trading platforms to cater to the diverse needs and preferences of its clients. The broker's flagship platform is the proprietary JForex, which is available as a desktop application, web-based platform, and mobile app for both iOS and Android devices.

JForex Platform

The JForex platform is a powerful and user-friendly trading software that provides clients with a comprehensive suite of tools and features. It offers advanced charting capabilities with over 250 technical indicators and drawing tools, as well as customizable layouts and workspaces. JForex supports automated trading through its built-in strategy builder and allows traders to back-test their strategies using historical data.

One of the standout features of JForex is its integrated market depth tool, which displays real-time order book information and allows traders to assess market liquidity and potential support and resistance levels. Additionally, JForex offers unique functionalities such as the ability to reverse or double positions with a single click, as well as the "Trailing Reverse" order type, which helps traders manage risk and maximize potential profits.

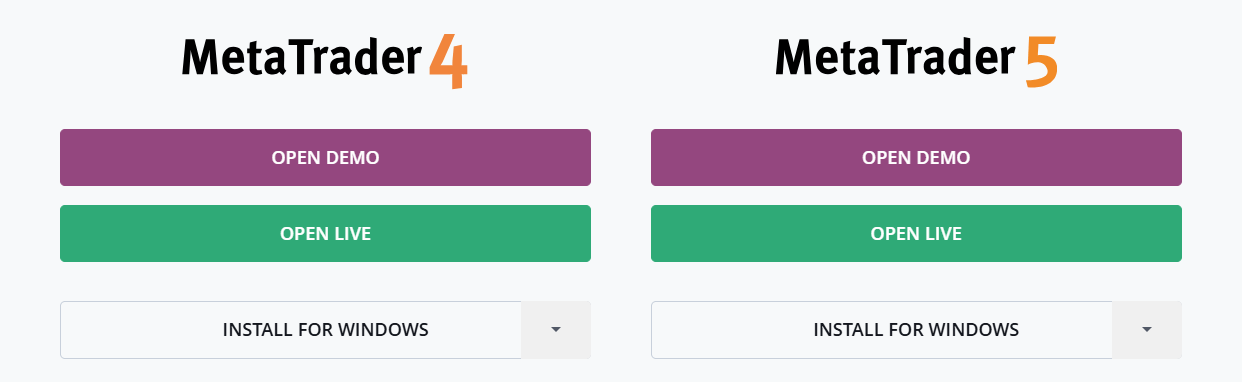

MetaTrader 4 and 5

For traders who prefer the familiarity and versatility of the MetaTrader platforms, Dukascopy offers both MT4 and MT5. These popular platforms provide a wide range of built-in technical indicators, charting tools, and automated trading capabilities through Expert Advisors (EAs). Traders can access MT4 and MT5 through desktop, web, and mobile applications.

While MT4 and MT5 offer a robust trading experience, it's worth noting that Dukascopy charges an additional commission of $0.50 per lot for trades executed on these platforms compared to JForex.

Web and Mobile Trading

Dukascopy's web-based trading platform, JForex Web 3, offers a streamlined and intuitive interface for trading directly through a web browser. The platform provides essential features such as real-time quotes, charts, and order management tools, making it a convenient option for traders who prefer not to install additional software.

For mobile trading, Dukascopy offers the JForex Mobile app for iOS and Android devices. The app provides a comprehensive range of features, including advanced charting, market depth, and the ability to place and manage trades on the go. The app's user-friendly interface and customizable layouts make it easy for traders to monitor their portfolios and take advantage of market opportunities wherever they are.

By offering a diverse range of trading platforms, Dukascopy ensures that clients can choose the software that best suits their needs and trading style. The broker's commitment to providing advanced tools, unique features, and a seamless trading experience across desktop, web, and mobile platforms sets it apart from many competitors in the industry.

Trading Platforms Comparison Table

| Feature | JForex | MT4 | MT5 |

|---|---|---|---|

| Desktop Platform | Yes | Yes | Yes |

| Web Platform | Yes | Yes | Yes |

| Mobile Apps (iOS/Android) | Yes | Yes | Yes |

| Automated Trading | Yes | Yes | Yes |

| Algorithmic Trading | Yes | Yes | Yes |

| Back-testing | Yes | Yes | Yes |

| Market Depth | Yes | No | Yes |

| Advanced Charting | Yes | Limited | Yes |

| Reverse/Double Position | Yes | No | No |

| Trailing Reverse Order | Yes | No | No |

| Additional Commission | No | $0.50/lot | $0.50/lot |

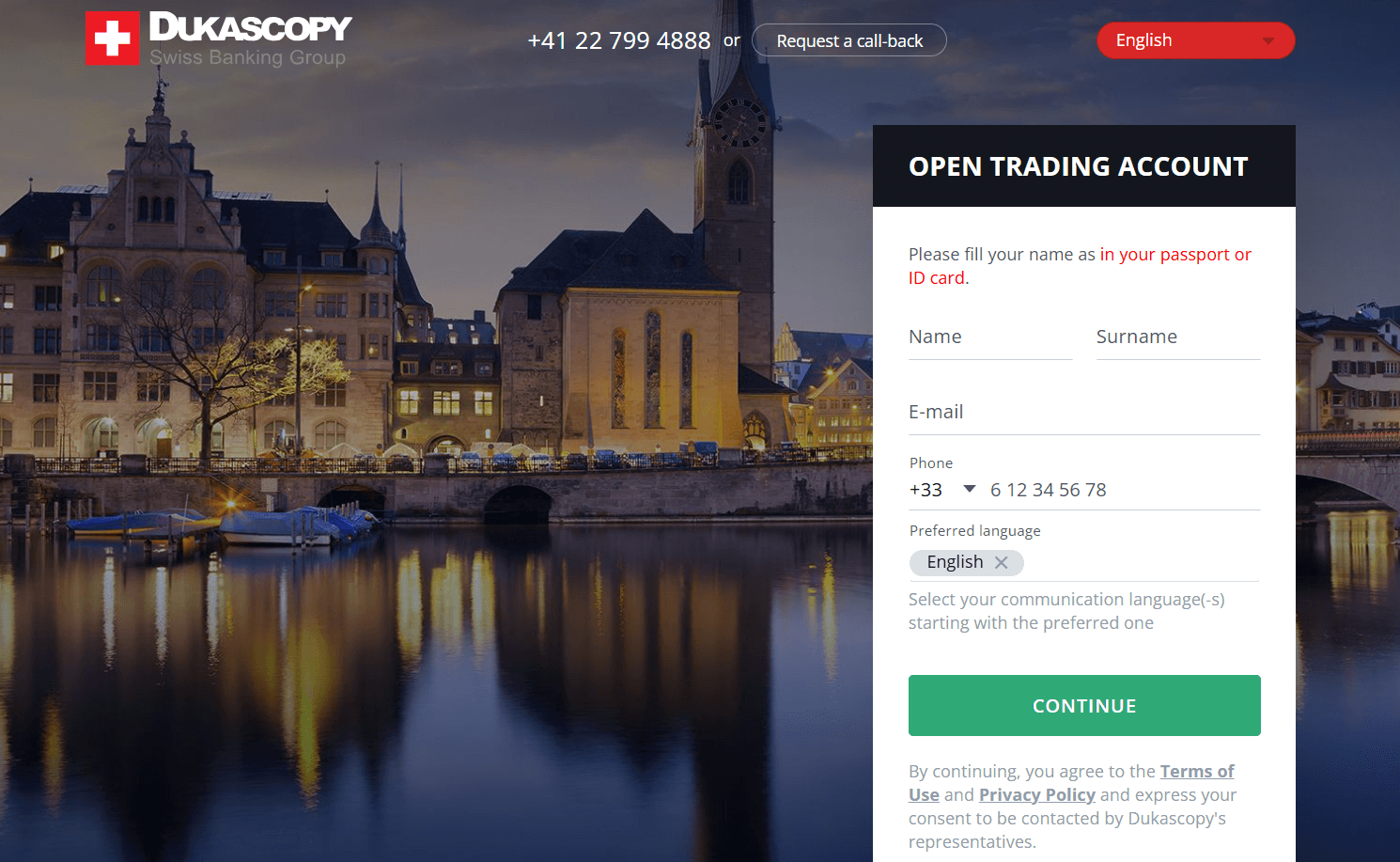

Dukascopy How to Open an Account: A Step-by-Step Guide

Opening an account with Dukascopy Bank SA is a straightforward process that can be completed entirely online. The broker has streamlined the application procedure to ensure a seamless experience for new clients. To get started, follow these simple steps:

Step 1: Visit the Dukascopy website dukascopy.com and click on the "Open an Account" button.

Step 2: Choose the type of account you wish to open (e.g., JForex, MT4, MT5, or demo account).

Step 3: Fill out the online application form with your personal information, including your name, address, date of birth, and contact details. You will also be required to provide information about your trading experience and financial knowledge.

Step 4: Select your preferred base currency for the account. Dukascopy offers a wide range of base currencies, including USD, EUR, GBP, CHF, and JPY.

Step 5: Choose your initial deposit amount. The minimum deposit requirement for live accounts is $100 or the equivalent in your chosen base currency.

Step 6: Upload the required identification documents, which typically include a valid government-issued ID (e.g., passport or driver's license) and proof of address (e.g., utility bill or bank statement). Dukascopy uses advanced encryption technology to ensure the security of your personal information.

Step 7: Complete the video identification process, which involves a short video call with a Dukascopy representative to verify your identity. This process is designed to comply with anti-money laundering (AML) and know-your-customer (KYC) regulations.

Step 8: Once your application is approved, fund your account using one of the available payment methods, such as bank wire transfer, credit/debit card, or e-wallet (e.g., Skrill or Neteller).

Dukascopy offers several benefits to new clients, including:

- A user-friendly account opening process that can be completed in a matter of minutes

- Multiple account types to suit different trading styles and preferences

- A wide range of base currencies to choose from

- Low minimum deposit requirements, making it accessible for both novice and experienced traders

- Advanced security measures to protect clients' personal and financial information

By following these simple steps and providing the required documentation, traders can quickly and easily open an account with Dukascopy and start exploring the broker's extensive range of tradable assets and advanced trading platforms.

Charts and Analysis

Dukascopy Bank SA provides a comprehensive suite of educational trading resources and tools to support its clients in enhancing their trading knowledge and skills. These resources cater to traders of all levels, from beginners to experienced professionals, and cover a wide range of topics related to forex, CFDs, and binary options trading.

| Category | Description |

|---|---|

| Charting Tools | The JForex platform offers advanced charting capabilities with over 250 built-in technical indicators and drawing tools. Traders can use multiple chart types (candlestick, bar, line) and customize charts with various time frames and layouts. The platform also allows for creating personalized indicators and saving chart templates for future use. |

| Market Analysis | Dukascopy provides daily market analysis and trading ideas from its in-house research team. These reports cover asset classes like forex, commodities, indices, and stocks, offering insights into current trends, potential trading opportunities, and risk management strategies. Analyses are accessible through the Dukascopy website or via email alerts. |

| Economic Calendar | Integrated into the JForex platform, the economic calendar lists global economic events and data releases. It offers details on expected market impacts for various currency pairs and tradable assets, helping traders stay informed about events that could affect financial markets. |

| Webinars and Video Tutorials | Dukascopy offers educational webinars and video tutorials covering platform usage, technical and fundamental analysis, and risk management. Webinars are hosted by experienced traders and financial experts, while video tutorials are available on the Dukascopy YouTube channel for step-by-step guidance on using the trading platforms and tools. |

| Downloadable PDFs and eBooks | A library of downloadable PDFs and eBooks is available on the Dukascopy website. These resources cover topics such as forex trading basics, technical analysis strategies, and money management techniques, providing traders with a solid foundation to develop their skills at their pace. |

| Market News and Analysis | Dukascopy offers real-time market news and analysis via its proprietary news service, Dukascopy TV, which streams live market updates, analysis, and expert interviews. Additionally, the broker’s blog features articles on trading topics, market trends, and economic events to keep traders informed about the latest market developments. |

Compared to the industry standard, Dukascopy's educational resources are comprehensive and well-developed. The broker's commitment to providing a diverse range of educational tools and content sets it apart from many competitors, who may offer more limited resources. By investing in high-quality educational materials, Dukascopy empowers its clients to make informed trading decisions and continually improve their skills.

Dukascopy Account Types

Dukascopy Bank SA offers a range of trading account types to cater to the diverse needs and preferences of its clients. Whether you're a novice trader just starting out or an experienced professional looking for advanced features and tools, Dukascopy has an account type that can suit your trading style and goals.

JForex Account

The JForex account is Dukascopy's flagship offering, designed for traders who prefer to use the broker's proprietary trading platform. This account type offers competitive spreads starting from 0.1 pips on major currency pairs and leverage up to 1:200. JForex accounts have a minimum deposit requirement of $100 and provide access to a wide range of tradable assets, including forex, CFDs, precious metals, and binary options.

MT4 Account

For traders who are more familiar with the MetaTrader 4 platform, Dukascopy offers the MT4 account type. This account features spreads starting from 0.2 pips and leverage up to 1:100. Like the JForex account, the MT4 account has a minimum deposit requirement of $100 and offers access to various tradable assets. However, it's important to note that Dukascopy charges an additional commission of $0.50 per lot traded on the MT4 platform.

MT5 Account

The MT5 account is similar to the MT4 account but utilizes the MetaTrader 5 platform. This account type offers spreads starting from 0.2 pips, leverage up to 1:100, and a minimum deposit requirement of $100. Traders can access a wide range of assets, including forex, CFDs, and precious metals. As with the MT4 account, an additional commission of $0.50 per lot traded applies to the MT5 account.

Demo Account

For traders who want to practice their strategies and familiarize themselves with Dukascopy's trading platforms without risking real money, the broker offers demo accounts. These accounts are available for the JForex, MT4, and MT5 platforms and provide access to live market data and virtual funds. Demo accounts are an excellent way for novice traders to gain experience and confidence before transitioning to a live trading account.

Islamic Account

Dukascopy offers Islamic accounts that comply with Sharia law, which prohibits the earning or paying of interest. These accounts are available for the JForex, MT4, and MT5 platforms and feature the same trading conditions as the standard accounts. However, Islamic accounts do not incur swap or rollover fees, making them suitable for Muslim traders who wish to adhere to their religious beliefs.

By providing a diverse range of account types, Dukascopy ensures that traders can select the option that best suits their individual needs and preferences. This flexibility is essential for creating a positive trading experience and accommodating traders with different levels of expertise, trading styles, and financial goals.

Account Types Comparison Table

| Feature | JForex | MT4 | MT5 |

|---|---|---|---|

| Minimum Deposit | $100 | $100 | $100 |

| Spreads (from) | 0.1 | 0.2 | 0.2 |

| Leverage (up to) | 1:200 | 1:100 | 1:100 |

| Commission (per lot) | $0 | $0.50 | $0.50 |

| Platform | JForex | MT4 | MT5 |

| Tradable Assets | Forex, CFDs, Metals, Binary Options | Forex, CFDs, Metals | Forex, CFDs, Metals |

| Demo Account | Yes | Yes | Yes |

| Islamic Account | Yes | Yes | Yes |

Negative Balance Protection

Negative balance protection is a crucial risk management feature that ensures traders cannot lose more money than they have deposited in their trading account. This protection is particularly important in the context of leveraged trading, where sudden market movements or unexpected events can cause positions to incur losses that exceed the account balance. Dukascopy Bank SA offers negative balance protection to its clients, but the extent of this protection varies depending on the specific entity with which the client has opened their account. For clients of Dukascopy Europe IBS AS, the broker provides full negative balance protection. This means that if a client's account balance falls below zero due to trading losses, Dukascopy Europe will absorb the negative balance and reset the account to zero. Clients of this entity cannot lose more than their account balance, even in extreme market conditions. However, for clients of Dukascopy Bank SA (Switzerland) and Dukascopy Japan K.K., negative balance protection is not offered. In these cases, clients are responsible for any negative balances that may occur in their accounts due to trading losses. It is crucial for traders to be aware of this distinction and to manage their risk accordingly. Potential scenarios that could lead to negative balances include:

- Sudden market movements: Unexpected economic events, geopolitical developments, or natural disasters can cause sharp price fluctuations, leading to significant losses.

- Gaps in market prices: When markets open after weekends or holidays, prices may gap up or down, causing stop-loss orders to be executed at unfavorable levels or not at all.

- High leverage: Trading with high leverage amplifies both potential profits and losses. A highly leveraged position can quickly deplete an account balance if the market moves against the trader.

- Inadequate risk management: Failing to implement proper risk management techniques, such as setting appropriate stop-loss orders or maintaining reasonable position sizes, can lead to excessive losses.

- Choose the appropriate Dukascopy entity based on their risk tolerance and the availability of negative balance protection.

- Use reasonable leverage levels and avoid overexposing their accounts to risk.

- Implement robust risk management strategies, including the use of stop-loss orders and proper position sizing.

- Stay informed about upcoming economic events and market-moving news to anticipate potential volatility.

Dukascopy Deposits and Withdrawals

Dukascopy Bank SA offers a range of convenient deposit and withdrawal options to facilitate the smooth transfer of funds for its clients. The broker understands the importance of efficient and secure payment processing, ensuring that traders can quickly fund their accounts and access their profits without undue delays or complications.

Deposit Methods

Dukascopy accepts the following deposit methods:| Payment Method | Accepted Instruments / Currencies | Minimum Deposit | Maximum Deposit | Processing Time | Fees |

|---|---|---|---|---|---|

| Bank Wire Transfer | Direct bank account funds | $100 or equivalent in base currency | No limit | Typically a few business days (exact time not specified) | No fees charged by Dukascopy; sending bank may impose its own charges |

| Credit/Debit Cards | Visa, Mastercard, Maestro | $100 | $5,000 per transaction | Instant | 1.5% fee for EEA cards; 2.5% fee for non-EEA cards |

| E-wallets | Skrill, Neteller | $100 | Not specified | Instant | Skrill: 2.5%; Neteller: either 1 EUR or 2.5% fee |

| Cryptocurrencies | Bitcoin (BTC), Ethereum (ETH), Tether (USDT) | No minimum deposit | No limit | Instant after required blockchain confirmations | No fees |

| Apple Pay | Apple Pay (mobile wallet) | $100 | Not specified | Likely instant | 2.5% fee per transaction |

Withdrawal Methods

Dukascopy offers the following withdrawal methods:| Payment Method | Minimum Withdrawal | Fees | Additional Details |

|---|---|---|---|

| Bank Wire Transfer | $100 | Flat fee of $19 for outgoing wire transfers | Funds are withdrawn directly to clients' bank accounts. |

| Credit/Debit Cards | $100 | Fee of EUR 1.5 (or equivalent) plus 2.5% of the withdrawn amount | Withdrawals are processed to Visa, Mastercard, or Maestro cards. |

| E-wallets | $100 | Skrill: 2.5% fee Neteller: 1 EUR or 2.5% fee (whichever applies) | Funds are withdrawn to Skrill or Neteller accounts. |

| Cryptocurrencies | No minimum | Flat fee of $30 per transaction | Supported cryptocurrencies include BTC, ETH, and USDT; funds are credited after required blockchain confirmations. |

Support Service for Customer

In the fast-paced world of online trading, reliable customer support is crucial for a positive trading experience. Traders need to know that they can quickly access assistance when they encounter issues or have questions about the platform, their accounts, or trading in general. Dukascopy Bank SA recognizes the importance of providing excellent customer support and offers several channels through which traders can reach out for help.

Live Chat

- Dukascopy's live chat support is available 24/7, allowing traders to connect with a support representative in real-time directly from the broker's website. This is often the quickest way to get answers to simple queries or to request assistance with more complex issues.

- For less urgent matters or more detailed inquiries, traders can send an email to Dukascopy's customer support team at support@dukascopy.com. The broker aims to respond to all email inquiries within 24 hours, ensuring that traders receive timely assistance.

Phone Support

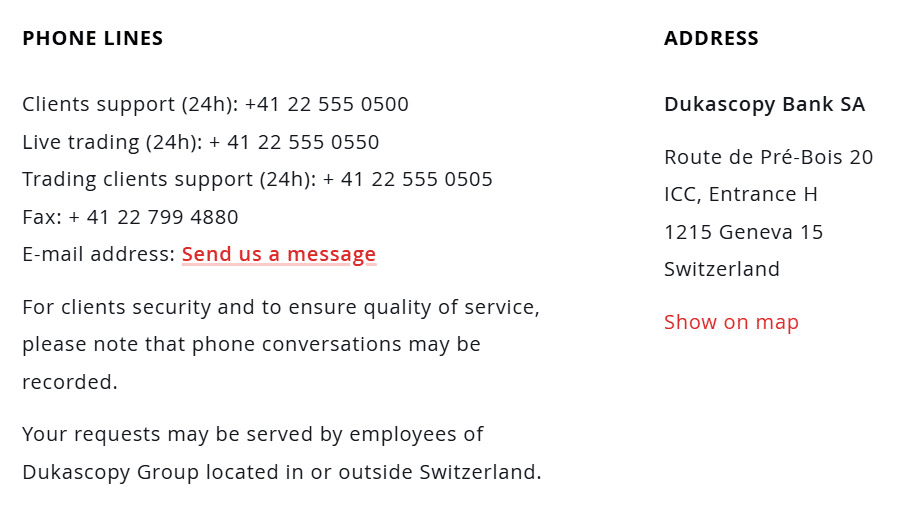

- Dukascopy offers phone support in multiple languages, catering to its international client base. Traders can call the broker's support hotline at +41 22 799 4888 during business hours (Monday to Friday, 7:30 AM - 10:30 PM CET). For country-specific contact details, traders can visit Dukascopy's "Contact Us" page on their official website.

Languages

- Dukascopy's customer support is available in several languages, including English, French, German, Italian, Spanish, Russian, Arabic, Chinese, and Japanese. This multilingual support ensures that traders from different regions can communicate effectively with the customer support team and receive assistance in their preferred language.

Social Media

- While not a primary support channel, Dukascopy maintains an active presence on social media platforms such as Facebook, Twitter, and LinkedIn. Traders can follow these accounts to stay updated on the latest news, promotions, and educational content from the broker.

On-Site Support

- For clients who prefer face-to-face interaction, Dukascopy offers on-site support at its headquarters in Geneva, Switzerland, as well as at its regional offices in Riga, Latvia, and Kyiv, Ukraine. Traders can schedule appointments to discuss their accounts, receive training on the trading platforms, or seek personalized advice from Dukascopy's expert staff.

Customer Support Comparison Table

| Support Channel | Availability | Languages | Response Time |

|---|---|---|---|

| Live Chat | 24/7 | English, French, German, Italian, Spanish, Russian, Arabic, Chinese, Japanese | Instant |

| 24/7 | English, French, German, Italian, Spanish, Russian, Arabic, Chinese, Japanese | Within 24 hours | |

| Phone | Monday to Friday, 7:30 AM - 10:30 PM CET | English, French, German, Italian, Spanish, Russian, Arabic, Chinese, Japanese | Immediate |

| Social Media | 24/7 | English | Varies |

| On-Site | By appointment | English, French, German, Italian, Spanish, Russian, Arabic, Chinese, Japanese | Immediate |

Prohibited Countries

Dukascopy Bank SA is committed to complying with international regulations and operating within the legal frameworks of the countries it serves. As a result, the broker is unable to provide services to clients residing in certain countries and regions due to local regulations, licensing requirements, or geopolitical factors.

Reasons for Restrictions:

- Local Regulations: Some countries have strict laws governing online trading and foreign financial service providers. These regulations may require brokers to obtain specific licenses or meet certain requirements before they can legally operate within the jurisdiction.

- Licensing Requirements: Dukascopy holds licenses from reputable regulatory bodies such as FINMA (Switzerland), FCMC (Latvia), and the JFSA (Japan). However, these licenses may not be sufficient to operate in all countries, as some jurisdictions have their own specific licensing requirements.

- Geopolitical Factors: Political instability, economic sanctions, or international trade agreements can also impact a broker's ability to provide services in certain regions. Dukascopy must adhere to these geopolitical restrictions to avoid potential legal or financial consequences.

Prohibited Countries List

Dukascopy does not accept clients from the following countries and regions:

- Afghanistan, Belarus, Belgium, Canada (including Quebec), Cuba, Iran, Israel, Japan, Myanmar, North Korea, Russian Federation, South Sudan, Sudan, Syria, Turkey, the United Kingdom, the United States

Consequences of Trading from a Prohibited Country: Attempting to trade with Dukascopy from a prohibited country can result in severe consequences, including:

- Account Termination: If Dukascopy discovers that a client is trading from a prohibited country, the broker reserves the right to immediately terminate the client's account and liquidate any open positions.

- Funds Seizure: In some cases, funds deposited from a prohibited country may be subject to seizure or frozen by international authorities, making it difficult or impossible for the client to recover their money.

- Legal Action: Clients who knowingly violate international trading restrictions may face legal action from regulatory bodies or government agencies, resulting in fines, penalties, or even criminal charges.

It is crucial for traders to carefully review the list of prohibited countries and ensure that they are not residing in a restricted jurisdiction before attempting to open an account with Dukascopy. By adhering to these regulations, traders can protect themselves from potential legal and financial risks and ensure a safe and compliant trading experience.

Special Offers for Customers

At the time of writing this review, Dukascopy does not offer any special offers. Traders can always check their websites for the latest updates.

Conclusion

As I conclude my comprehensive review of Dukascopy Bank, I find myself impressed by their commitment to providing a safe, reliable, and transparent trading environment for their clients. Throughout my analysis, I have examined various aspects of their operations, from regulatory compliance and geographical reach to customer support and trading platforms, and I can confidently say that Dukascopy stands out as a trustworthy and dependable broker.

One of the most striking aspects of Dukascopy is their strong regulatory framework. As a Swiss bank, they are regulated by the Swiss Financial Market Supervisory Authority (FINMA), ensuring a high level of oversight and protection for their clients. Additionally, their subsidiaries in Latvia and Japan are regulated by the Financial and Capital Market Commission (FCMC) and the Financial Services Agency (JFSA), respectively, further demonstrating their commitment to adhering to strict financial regulations globally.

Dukascopy's dedication to customer support is another area where they excel. With 24/7 availability through multiple channels, including live chat, email, and phone support in various languages, traders can rest assured that assistance is always within reach. The broker's extensive educational resources, including webinars, tutorials, and in-depth market analysis, provide clients with the tools and knowledge needed to make informed trading decisions.

When it comes to trading platforms, Dukascopy offers a powerful and versatile selection, catering to the needs of both novice and experienced traders. Their proprietary JForex platform stands out for its advanced charting capabilities, integrated market depth, and unique features like single-click position reversals. The availability of popular third-party platforms like MetaTrader 4 and 5 further enhances Dukascopy's appeal to a wide range of traders.

While Dukascopy does not appear to emphasize short-term promotional offers, their focus on providing competitive trading conditions, such as tight spreads and high leverage, demonstrates their commitment to long-term client satisfaction. The broker's wide range of tradable assets, including forex, CFDs, commodities, and cryptocurrencies, allows traders to diversify their portfolios and seize opportunities across multiple markets.

In conclusion, I believe that Dukascopy Bank is a strong choice for traders seeking a reliable, well-regulated, and technologically advanced broker. Their commitment to client security, coupled with their extensive educational resources and robust trading platforms, makes them well-suited for both beginner and experienced traders alike. While no broker is perfect, Dukascopy's transparency, regulatory compliance, and dedication to client support set them apart as a trustworthy and reputable player in the online trading industry.

Explore FCA-regulated names on the top-regulated broker list.

Check institutional spreads via the CPT Markets review.