EBSI 2025 Review: SFC-Regulated China & HK Broker

EBSI

Hong Kong

Hong Kong

-

Minimum Deposit $1200

-

Withdrawal Fee $varies

-

Leverage 100:1

-

Minimum Order 0.01

-

Forex Unavailable

-

Crypto Unavailable

-

Stock Available

-

Indices Unavailable

Licenses

Hong Kong Securities and Futures License

Hong Kong Securities and Futures License

Softwares & Platforms

Customer Support

Supported language: Chinese (Simplified), English

Social Media

Summary

Everbright Securities International (EBSI) is a Hong Kong broker that acquired Sun Hung Kai Financial in 2015, gaining 55+ years of local presence while backed by China's state-owned Everbright Group. The firm targets retail investors with its EBSI Direct platform and new EBSI GO! app, offering Stock Connect access to mainland markets but lacking negative balance protection and charging higher fees than discount competitors. EBSI operates under multiple SFC licenses across subsidiary entities, with limited international reach beyond Hong Kong, China, and US markets. Best suited for conservative investors prioritizing Chinese market access and stability over innovation, low costs, or global diversification.

- State-owned backing ensures financial stability

- 55+ year Hong Kong market presence via Sun Hung Kai legacy

- Direct Stock Connect access to China A-shares

- Multiple SFC regulatory licenses

- IPO financing opportunities

- Physical office for in-person consultation

- Recent platform modernization with EBSI GO!

- Comprehensive Chinese market research

- Multi-language support (English, Chinese)

- Participates in Investor Compensation Fund

- No negative balance protection

- Higher fees than discount brokers

- No 24/7 live chat support

- Limited European market access

- No cryptocurrency trading

- Complex multi-entity structure

- US client acceptance uncertain

- Traditional platform lacking modern features

- Slower account opening process

- Limited educational resources compared to competitors

Overview

Everbright Securities International represents a unique convergence of Hong Kong's established financial infrastructure and mainland China's expanding capital markets. Through its 2015 acquisition of Sun Hung Kai Financial's business operations, EBSI inherited over 55 years of Hong Kong market presence while bringing the backing of China Everbright Group, a Fortune Global 500 state-owned enterprise. This dual heritage positions EBSI as a bridge between traditional Hong Kong brokerage services and modern Chinese financial power.

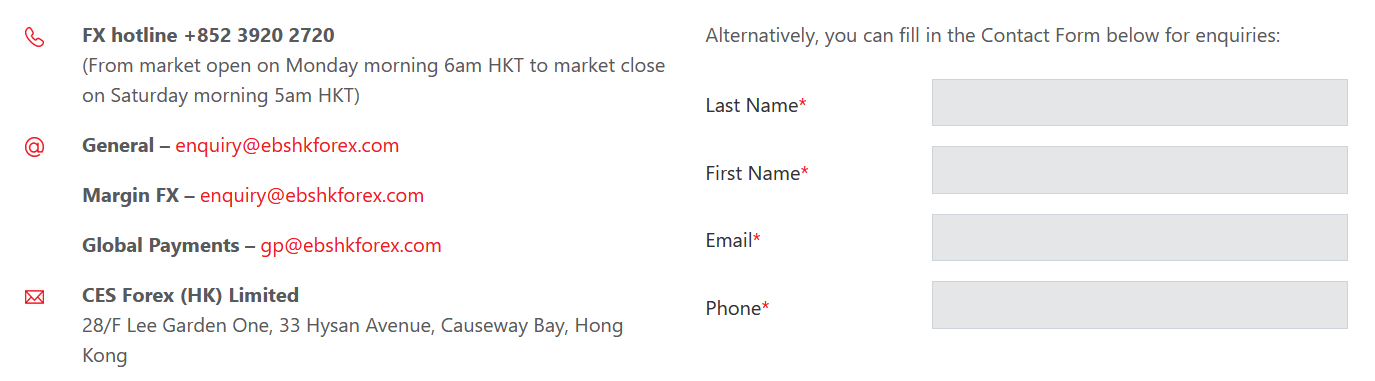

The firm operates from its headquarters at 28/F, Lee Garden One in Causeway Bay, maintaining full regulatory compliance under Hong Kong's Securities and Futures Commission. EBSI's recently launched EBSI GO! app alongside the rebranded EBSI Direct platform demonstrates active modernization efforts addressing previous technology gaps. While positioning itself as a comprehensive financial services provider, EBSI primarily serves retail investors seeking exposure to Hong Kong and mainland Chinese markets through Stock Connect programs.

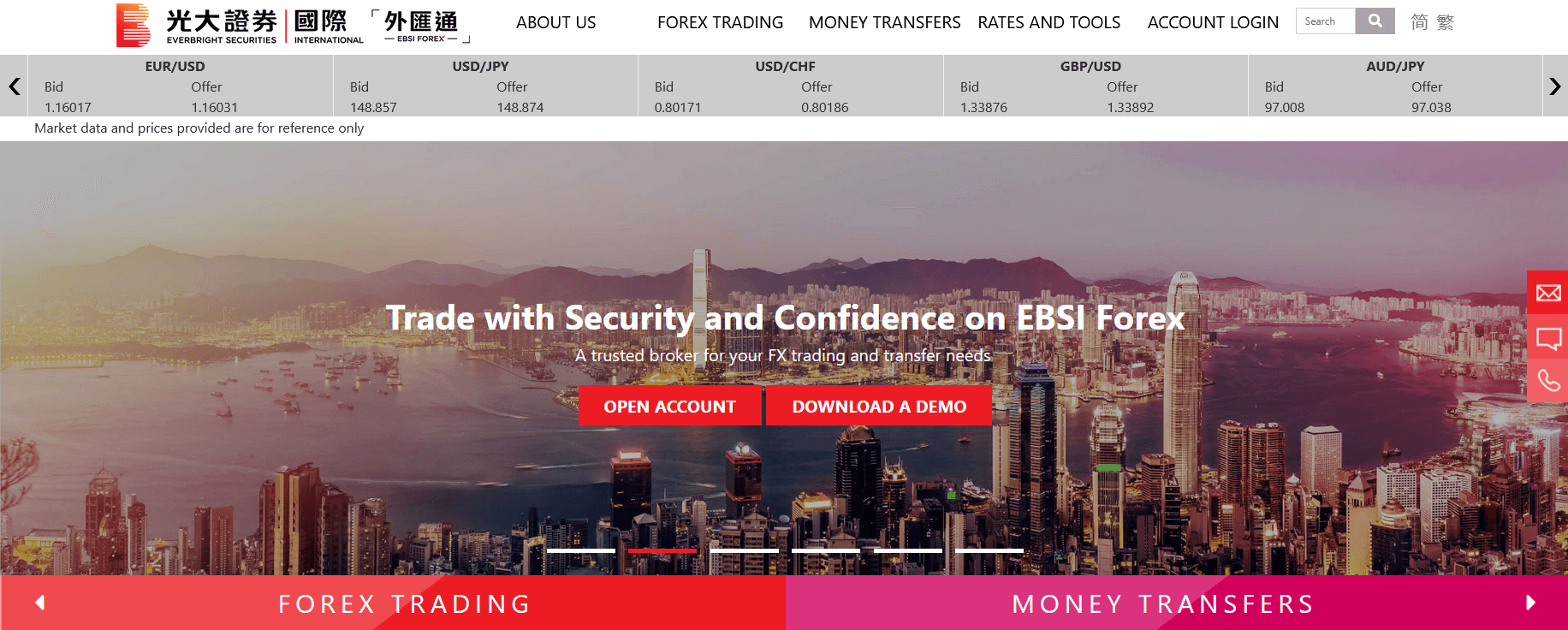

For More Information, Visit BOCOM’s Official Website ebshkforex.com

Overview Table

| Feature | Details |

|---|---|

| Company Name | Everbright Securities International (EBSI) |

| Established | 2015 (via Sun Hung Kai acquisition); Parent founded 1996 |

| Headquarters | 28/F, Lee Garden One, 33 Hysan Avenue, Causeway Bay, Hong Kong |

| Parent Company | China Everbright Group Ltd. (Fortune Global 500) |

| Regulation | Securities and Futures Commission (SFC) Hong Kong |

| Trading Platforms | EBSI Direct, EBSI GO! (2025 launch) |

| Key Markets | Hong Kong, Mainland China (Stock Connect), United States |

| Minimum Deposit | HKD 10,000 (varies by account type) |

| Customer Support | Phone, Email, Physical Office |

| Languages | English, Traditional Chinese, Simplified Chinese |

Facts List

- Acquired Sun Hung Kai Financial's Hong Kong operations in 2015, inheriting 55+ years of local market presence

- Backed by China Everbright Group, a Fortune Global 500 state-owned enterprise providing financial stability

- Multiple SFC licenses held across various subsidiary entities for comprehensive service offerings

- Stock Connect participant enabling direct access to Shanghai and Shenzhen A-shares markets

- EBSI GO! app launched in 2025 addressing previous technology modernization concerns

- No negative balance protection - clients remain liable for account deficits per Hong Kong regulations

- Limited international market access beyond Hong Kong, China, and US markets

- US client acceptance subject to case-by-case compliance review due to FATCA restrictions

- IPO financing available for qualified clients seeking participation in new listings

- Physical presence in Causeway Bay providing face-to-face consultation options

EBSI Licenses and Regulatory

EBSI operates under comprehensive regulatory oversight from the Securities and Futures Commission of Hong Kong, though licenses are distributed across multiple subsidiary entities rather than consolidated under a single corporation. This structure, while complex, ensures specialized compliance for different service areas.

The regulatory framework provides critical client protections including mandatory asset segregation, where client funds remain separate from firm assets. EBSI participates in Hong Kong's Investor Compensation Fund, offering additional protection for qualifying clients. However, unlike some international jurisdictions, Hong Kong regulations do not mandate negative balance protection, leaving clients potentially liable for deficits exceeding their account equity.

Regulatory Licenses:

- Type 1: Dealing in Securities

- Type 2: Dealing in Futures Contracts

- Type 4: Advising on Securities

- Type 5: Advising on Futures Contracts

- Type 6: Advising on Corporate Finance

- Type 9: Asset Management

- Stock Connect Participant Status

- Investor Compensation Fund Member

Trading Instruments

EBSI's asset offerings concentrate heavily on Greater China markets, reflecting both its strategic positioning and operational expertise. While the platform provides access to major global markets, the depth of offerings varies significantly by region.

| Asset Class | Coverage | Key Features |

|---|---|---|

| Hong Kong Equities | Comprehensive | HSI, GEM, H-shares, REITs |

| China A-Shares | Via Stock Connect | Shanghai & Shenzhen markets |

| US Equities | Major exchanges | NYSE, NASDAQ listings |

| Bonds | Selected offerings | Government & corporate debt |

| Mutual Funds | Diverse selection | Focus on Greater China funds |

| Structured Products | Limited | Equity-linked notes available |

| Forex | Major pairs | Limited exotic currencies |

| Commodities | Not available | - |

| Cryptocurrencies | Not available | - |

Trading Platforms

EBSI operates two primary platforms following recent modernization efforts. The established EBSI Direct platform serves as the comprehensive web-based solution, while the newly launched EBSI GO! app addresses mobile trading demands.

The platforms prioritize stability and regulatory compliance over cutting-edge features. While lacking advanced algorithmic trading tools or social trading elements found in fintech competitors, they provide reliable execution and essential analytical tools sufficient for most retail trading strategies.

| Feature | EBSI Direct | EBSI GO! | Phone Trading |

|---|---|---|---|

| Platform Type | Web-based | Mobile App | Broker-assisted |

| Real-time Quotes | Yes | Yes | Via broker |

| Advanced Charts | Full package | Basic | Not applicable |

| Order Types | All available | Limited | All available |

| Research Integration | Full access | Limited | Via broker |

| Market Coverage | All markets | All markets | All markets |

| Languages | EN/TC/SC | EN/TC/SC | EN/TC/SC |

| Cost | Standard fees | Standard fees | Higher commissions |

| Availability | 24/7 | 24/7 | Business hours |

EBSI How to Open an Account: A Step-by-Step Guide

- Select Account Type: Choose between cash (HKD 10,000 minimum), margin (HKD 50,000), or wealth management (HKD 1,000,000) accounts

- Begin Application: Complete online forms at EBSI website or visit Causeway Bay office

- Submit Identification: Provide HKID (residents) or passport (international clients)

- Verify Address: Submit recent utility bills or bank statements

- Declare Financial Information: Complete suitability assessment including income and experience

- Fund Account: Transfer initial deposit via wire transfer or local Hong Kong bank transfer

- Await Verification: Processing typically takes 2-5 business days

- Receive Credentials: Access EBSI Direct and EBSI GO! platforms upon approval

- Complete Setup: Configure trading preferences and security settings

- Begin Trading: Start investing once account activation confirmed

Charts and Analysis

EBSI's commitment to trader education and market analysis manifests through a comprehensive suite of research tools and educational resources. The integration of these resources within the trading platform creates a holistic environment supporting informed investment decisions.

| Category | Details |

|---|---|

| Research Division Output | - Daily market previews, intraday updates, and closing summaries- Stock analysis and thematic reports- Focus: HK & Mainland China markets |

| - Sector deep dives: Technology, Healthcare, Consumer, Financials- Unique insights from local expertise and company management access | |

| Technical Analysis Tools | - Chart types: Candlestick, Bar, Line- Timeframes: 1-minute to monthly- Indicators: MA, MACD, RSI, Bollinger Bands, Elliott Wave, Fibonacci |

| - Drawing tools: Trendlines, Channels, Pattern recognition- Save custom templates- Multi-chart layouts for comparisons | |

| Economic Calendar | - Tracks key data releases, earnings, and central bank events- Filters by region and importance- Real-time actual vs expected updates |

| Market Data & Screeners | - Pre-built screens: New highs, unusual volume, earnings surprises- Custom screeners for technical & fundamental criteria |

EBSI Account Types

EBSI structures accounts across three primary tiers designed to serve different client segments with varying service levels and minimum requirements.

Account Types Comparison Table

| Feature | Cash Account | Margin Account | Premier Wealth |

|---|---|---|---|

| Minimum Deposit | HKD 10,000 | HKD 50,000 | HKD 1,000,000 |

| Leverage | None | Up to 5x | Up to 10x |

| Short Selling | No | Yes | Yes |

| IPO Financing | No | Yes | Priority access |

| Dedicated Manager | No | No | Yes |

| Advisory Services | None | Limited | Comprehensive |

| Research Access | Basic | Standard | Premium |

| Fee Structure | Standard | Standard | Preferential |

| Platform Access | All platforms | All platforms | All + exclusive tools |

Negative Balance Protection

Critical Disclosure: EBSI does not offer formal negative balance protection. Clients remain legally liable for any account deficits resulting from adverse market movements, even when using leverage. This represents significant risk for margin traders during volatile market conditions. While EBSI implements margin monitoring systems and provides warnings before forced liquidations, these measures do not eliminate the possibility of owing money beyond deposited funds. The firm's communication-focused approach provides grace periods for margin calls, but ultimate liability rests with clients per Hong Kong regulations.

EBSI Deposits and Withdrawals

EBSI's funding operations accommodate standard banking methods with processing times typical for Hong Kong financial institutions. All withdrawals require pre-registered bank accounts for security.

Payment Methods Comparison Table

| Method | Deposit Time | Withdrawal Time | Fees | Notes |

|---|---|---|---|---|

| Wire Transfer | 1-2 days | 1-3 days | Bank charges | International supported |

| Local Transfer | Same day | Next day | None | HK banks only |

| Check Deposit | 2-3 days | Not applicable | Possible fees | HK checks preferred |

| Credit Card | Not available | Not available | - | - |

| E-wallets | Not available | Not available | - | - |

Support Service for Customer

Customer support reflects EBSI's traditional service model, prioritizing phone and in-person assistance over digital channels. The absence of 24/7 live chat distinguishes EBSI from fintech competitors.

- Trading Hotline: +852 3920 2888

- General Support: +852 2106 8101

- Email: cs@ebshk.com

- Physical Office: Causeway Bay location

- Social Media: Facebook and LinkedIn (non-primary support)

Customer Support Availability Table

| Channel | Hours | Languages | Response Time |

|---|---|---|---|

| Phone Trading | Market hours | EN/TC/SC | Immediate |

| Phone Support | 9am-6pm HKT | EN/TC/SC | Minutes |

| 24/7 submission | EN/TC/SC | Within 24 hours | |

| Branch Visit | Business hours | EN/TC/SC | By appointment |

| Live Chat | Not available | - | - |

Prohibited Countries

EBSI cannot serve residents from comprehensively sanctioned jurisdictions including North Korea, Iran, and Syria. US resident acceptance undergoes case-by-case review due to FATCA compliance requirements. The firm operates primarily in Asia-Pacific regions where local regulations permit international brokerage relationships.

Special Offers for Customers

EBSI's promotional strategy emphasizes service value over cash incentives. Current offers include:

- Account opening fee waivers for initial periods

- Reduced commission rates for new clients (first 3 months)

- IPO financing at preferential rates for qualified accounts

- Referral rewards through service upgrades rather than cash bonuses

- Seasonal promotions during Chinese New Year

Conclusion

EBSI represents a calculated choice for investors prioritizing institutional backing and China market access over cutting-edge technology or competitive pricing. The 2015 acquisition of Sun Hung Kai Financial created a hybrid entity combining Hong Kong market heritage with Chinese state-owned stability. While the recent EBSI GO! launch shows responsiveness to modernization needs, the platform remains fundamentally traditional in approach.

The absence of negative balance protection poses significant risk for leveraged traders, while limited international market access restricts global diversification options. However, for investors specifically focused on Greater China opportunities and valuing security over cost savings, EBSI provides a credible platform backed by substantial financial resources.

You can find out more about brokers in our broker review page.

Are you looking for a broker that supports MT5? I suggest BDSwiss.