Emperor Financial Services Group – Unregulated and Risky? Full Forex Broker Review

EFSG

Hong Kong

Hong Kong

-

Minimum Deposit $1280

-

Withdrawal Fee $varies

-

Leverage 200:1

-

Spread From 1

-

Minimum Order 0.01

-

Forex Available

-

Crypto Unavailable

-

Stock Unavailable

-

Indices Unavailable

Licenses

Softwares & Platforms

Customer Support

Supported language: English

Social Media

Summary

Emperor Financial Services Group (EFSG), founded in 2012 and registered in the Virgin Islands, offers forex and precious metals trading primarily to Hong Kong clients. While EFSG claims regulation by major authorities like the Hong Kong SFC and the UK FCA, its regulatory status is flagged as a "Suspicious Clone," suggesting possible false claims or identity copying. The broker provides MT4 platforms and requires a high minimum deposit of HK$10,000. However, the lack of verified regulation and offshore registration raise serious concerns about client safety and the legitimacy of its operations.

- Offers the popular MT4 trading platform

- Provides access to forex and precious metals markets

- Multiple customer support channels (phone, email, WhatsApp, social media)

- No dealing desk execution model

- Unregulated offshore broker with suspicious clone status

- Limited range of tradable assets

- High minimum deposit requirement of HK$10,000

- No clear information about customer support availability and quality

- Lack of transparency regarding account types, trading conditions, and deposit/withdrawal processes

- No web-based or proprietary mobile trading platforms

- No special offers or promotions for clients

- Questionable safety of clients' funds due to regulatory concerns

- Potential difficulties withdrawing money or resolving disputes

- Better-regulated alternatives available in the market

Overview

Emperor Financial Services Group (EFSG) is a forex and precious metals broker registered in the Virgin Islands. Founded in 2012, EFSG specialises in providing trading services to customers in Hong Kong. The broker offers demo accounts and the popular MT4 trading platform for Windows, Mac, and mobile devices.

While EFSG claims to be authorised and regulated by The Chinese Gold & Silver Exchange Society, the Securities and Futures Commission of Hong Kong, and the Financial Conduct Authority, its regulatory status is listed as a "Suspicious Clone". This is a major red flag indicating EFSG may be falsely claiming regulation or cloning a legitimate regulated broker.

More details are available on their website at [empfs.com], but the suspicious regulatory status is highly concerning.

Overview Table

| Aspect | Details |

|---|---|

| Founded | 2012 |

| Headquarters | Hong Kong |

| Regulation | Suspicious Clone |

| Instruments | Precious Metals, Forex |

| Platforms | MT4 (Windows, Mac, Mobile), EIEHK Unlocker |

| Min. Deposit | HK$10,000 |

| Customer Support | Phone, Email, WhatsApp, Social Media |

Key Facts

- Emperor Financial Services Group (EFSG) was founded on 2012-07-03.

- The company is registered in The Virgin Islands, an offshore jurisdiction.

- EFSG's regulatory status is listed as "Suspicious Clone", a major warning sign.

- They offer trading in precious metals and forex.

- Demo accounts are available for practising.

- MT4 is the primary trading platform, available for Windows, Mac, and mobile.

- A proprietary mobile app called EIEHK Unlocker is also offered.

- The minimum deposit required is a high HK$10,000.

- Customer support is provided via phone, email, WhatsApp, and social media.

- EFSG targets customers primarily in Hong Kong.

EFSG Licenses and Regulatory

While Emperor Financial Services Group claims to be authorised and regulated by The Chinese Gold & Silver Exchange Society, the Securities and Futures Commission of Hong Kong, and the Financial Conduct Authority, its regulatory status is officially listed as a "Suspicious Clone".

This means there are serious doubts about EFSG's regulatory claims, and they may be falsely stating licensing that they do not actually have. Cloning is a common tactic used by fraudulent brokers to mislead potential clients. A true "clone" copies the identity and details of an authorised, legitimate firm in order to scam traders.

There are no licenses or authorisations for EFSG listed with any major, reputable regulatory bodies like the FCA, ASIC, CySEC, etc. The offshore registration in the Virgin Islands, a jurisdiction known for lax regulations, is another major red flag.

Regulation is extremely important in the high-risk forex and CFD trading industry. Properly licensed brokers must follow strict rules regarding client funds, capital requirements, auditing, and more. Lack of regulation or suspicious regulatory status is highly concerning, as client funds and information may be at risk.

Trading Instruments

Emperor Financial Services Group offers trading in two main asset classes:

- Precious metals

- Forex (30+ currency pairs)

While more details on specific instruments are supposedly available on their website, the range of tradable assets seems limited compared to many other brokers. Most modern forex/CFD brokers offer access to a much wider variety including commodities, stock indices, cryptocurrencies, individual shares, bonds, and more.

The lack of asset diversity restricts opportunities for portfolio diversification. Traders looking for exposure to markets beyond forex and metals will need to look elsewhere.

Trading Platforms

Trading Platforms Emperor Financial Services Group (EFSG) provides clients with access to the popular MetaTrader 4 (MT4) platform for trading forex and precious metals. MT4 is a widely used third-party platform known for its user-friendly interface, advanced charting capabilities, and automated trading features.

MT4 Key Features

- Customizable charts with a wide range of technical indicators and drawing tools

- Multiple order types, including market, limit, stop, and trailing stop orders

- One-click trading directly from charts

- Expert Advisors (EAs) for algorithmic trading and backtesting

- Alerts and notifications for price levels and market events

- Mobile trading apps for iOS and Android devices

While MT4 is a reliable and feature-rich platform, EFSG does not appear to offer the newer MetaTrader 5 (MT5) version, which has additional features like an expanded scripting language and greater market depth. The lack of MT5 may be a drawback for some traders seeking more advanced functionality.

EFSG also offers a proprietary mobile trading app called EIEHK Unlocker. However, limited information is available about the specific features and capabilities of this app. It's unclear how it compares to the standard MT4 mobile app in terms of usability, stability, and tools.

Web-based Trading No information is provided about a web-based trading platform from EFSG. Many brokers offer a web version of MT4/MT5 or a proprietary web platform so clients can trade directly in their browser without needing to download software. The lack of a web-based option may inconvenience some traders.

Platform Comparison Table

| Platform | MT4 (Windows/Mac) | MT4 (Mobile) |

|---|---|---|

| Charting | Advanced | Basic |

| Indicators | 30+ | Limited |

| Order Types | Market, Pending | Market |

| One-Click Trading | Yes | No |

| Algorithmic Trading | Yes (EAs) | No |

| Alerts | Yes | Basic |

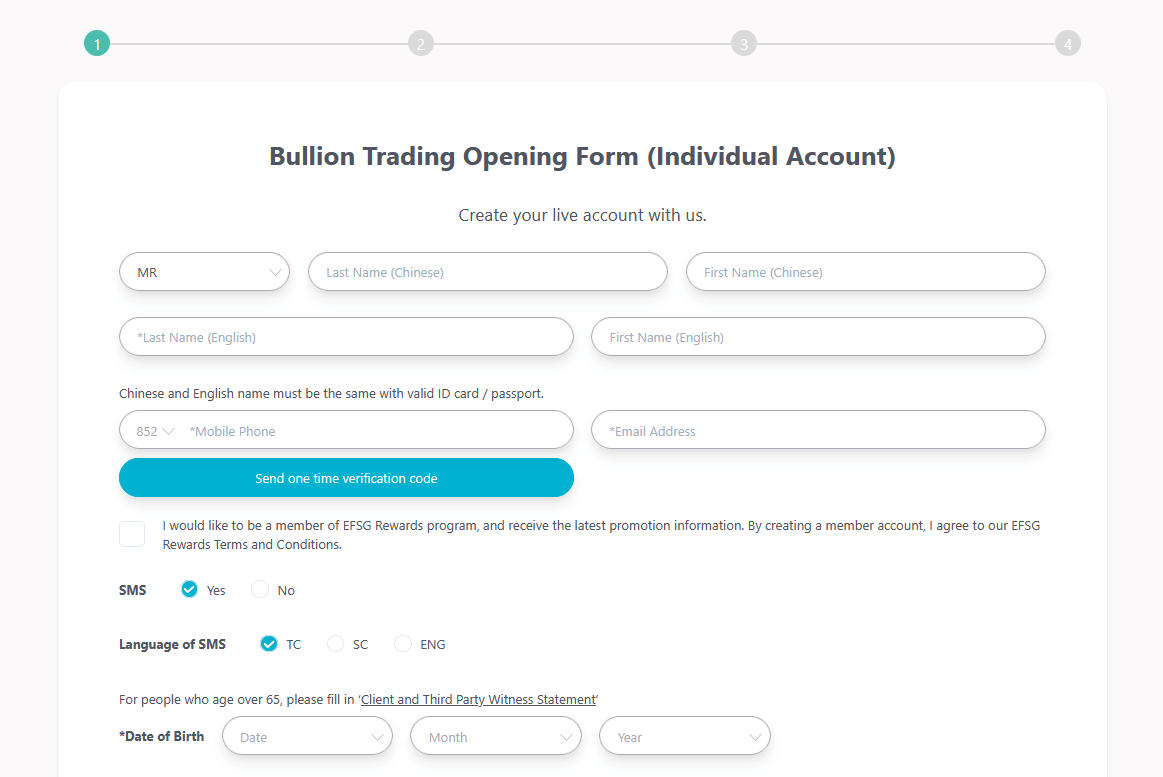

EFSG How to Open an Account: A Step-by-Step Guide

Opening an account with Emperor Financial Services Group (EFSG) allows you to start trading forex and precious metals. Follow these steps to begin your trading journey with EFSG:

Step 1: Meet the Requirements Before opening an account, ensure you meet the following requirements:

- Minimum age of 18 years old

- Valid government-issued ID (passport, driver's license, or national ID card)

- Proof of residence (utility bill, bank statement, or credit card statement)

- Minimum deposit of HK$10,000

Step 2: Choose an Account Type Select the account type that best suits your trading needs and experience level. EFSG offers several account options, including:

- Standard Account: Minimum deposit of HK$10,000 with access to all tradable assets

- Premium Account: Minimum deposit of HK$50,000 with lower spreads and additional benefits

- VIP Account: Minimum deposit of HK$100,000 with personalized support and exclusive perks

Step 3: Complete the Registration Form

Visit the EFSG website and click on the "Open an Account" button. Fill out the registration form with your personal information, including:

- Full name

- Date of birth

- Country of residence

- Email address

- Phone number

Step 4: Submit Required Documents Upload clear copies of your proof of identity and proof of residence documents. These must be valid and issued within the last three months.

Step 5: Verify Your Account EFSG will review your application and documents. You may be asked to provide additional information or complete further verification steps. This process typically takes 1-2 business days.

Step 6: Fund Your Account Once your account is approved, you can make your initial deposit using one of the following methods:

- Bank transfer (processing time: 2-5 business days)

- Credit/debit card (processing time: instant)

- E-wallet (processing time: instant)

The minimum deposit amount varies depending on your chosen account type. Funds will appear in your trading account once cleared.

Step 7: Start Trading After your account is funded, download the MT4 trading platform or mobile app. Log in using the credentials provided by EFSG. You can now start trading forex and precious metals!

EFSG strives to make the account opening process as smooth as possible. If you encounter any issues or have questions, their customer support team is available via phone, email, and live chat to assist you.

Charts and Analysis

Emperor Financial Services Group (EFSG) provides a limited selection of educational resources and trading tools compared to industry standards. The lack of comprehensive, high-quality materials is concerning, as education and analysis are crucial for informed trading decisions.

| Feature | EFSG Offering | Assessment |

|---|---|---|

| Charting Tools | Basic charting via the standard MT4 platform. Includes some indicators and drawing tools. | Limited functionality compared to advanced charting solutions offered by other brokers. No proprietary tools or enhancements. |

| Market Research & Insights | No economic calendar, market news, trading ideas, or research reports provided. | Indicates a lack of support for informed trading. Clients must rely on external sources for market analysis. |

| Educational Content | Minimal content available. No webinars, tutorials, guides, or structured learning programs mentioned. | Falls short compared to brokers that offer extensive educational resources for traders of all levels. |

EFSG Account Types

Standard Account

The Standard Account is EFSG's entry-level option, suitable for novice traders or those with limited funds. Key features include:

- Minimum deposit of HK$10,000

- Leverage up to 1:50

- Spreads from 2.0 pips

- Access to all tradable instruments (forex and precious metals)

- MT4 trading platform

Premium Account

The Premium Account is designed for more experienced traders seeking enhanced trading conditions. Benefits include:

- Minimum deposit of HK$50,000

- Leverage up to 1:100

- Spreads from 1.5 pips

- Access to all tradable instruments

- MT4 trading platform

- Dedicated account manager

- Priority withdrawal processing

VIP Account

The VIP Account caters to high-net-worth individuals and professional traders. Exclusive features include:

- Minimum deposit of HK$100,000

- Leverage up to 1:200

- Spreads from 1.0 pip

- Access to all tradable instruments

- MT4 trading platform

- Personal trading coach

- Invitation to exclusive events

- VIP customer support

Demo Account

In addition to the live trading accounts, EFSG also offers a demo account for practice trading. The demo account provides a risk-free environment to test strategies and familiarise oneself with the MT4 platform using virtual funds.

Account Types Comparison Table

| Feature | Standard | Premium | VIP |

|---|---|---|---|

| Min. Deposit | HK$10,000 | HK$50,000 | HK$100,000 |

| Max. Leverage | 1:50 | 1:100 | 1:200 |

| Min. Spread | 2.0 pips | 1.5 pips | 1.0 pip |

| Tradable Instruments | All | All | All |

| Platform | MT4 | MT4 | MT4 |

| Dedicated Manager | No | Yes | Yes |

| Priority Withdrawal | No | Yes | Yes |

| Trading Coach | No | No | Yes |

| VIP Events | No | No | Yes |

| VIP Support | No | No | Yes |

Negative Balance Protection

Emperor Financial Services Group (EFSG) does not provide any information about negative balance protection for their clients. This is a significant concern, as negative balance protection is a crucial risk management feature offered by many reputable brokers. Lack of Negative Balance Protection at EFSG The absence of information about negative balance protection at EFSG is worrisome. It suggests that traders may be exposed to the risk of losses exceeding their account balance, which could lead to significant financial hardship. Given the already questionable regulatory status and offshore registration of EFSG, the lack of negative balance protection is another red flag. It indicates that EFSG may not prioritise the safety and security of client funds to the same extent as well-regulated brokers.

EFSG Deposits and Withdrawals

Emperor Financial Services Group (EFSG) provides limited information about their deposit and withdrawal processes. Here's what we know based on the available information:

Deposits

- The minimum deposit for a Standard Account is HK$10,000.

- No details are provided about the specific deposit methods accepted (e.g., bank transfer, credit card, e-wallets).

- The processing times for deposits are not specified.

Withdrawals

- No information is provided about the withdrawal methods available.

- The processing times and any associated fees for withdrawals are not disclosed.

- It's unclear if there are any minimum or maximum withdrawal limits.

Verification Requirements

EFSG does not provide any details about their account verification process or the specific documents required to deposit or withdraw funds. Most brokers require proof of identity and proof of address to comply with anti-money laundering (AML) regulations, but EFSG does not confirm if this is part of their procedures.Lack of Transparency

The absence of clear information about deposit and withdrawal options, processing times, fees, and verification requirements is concerning. Transparency in these areas is essential for building trust with clients and ensuring a smooth trading experience. Traders need to know they can quickly and easily fund their accounts and access their funds when needed. Delays, hidden fees, or onerous verification processes can be significant barriers to trading and may indicate underlying issues with the broker's operations.Support Service for Customer

Emperor Financial Services Group (EFSG) offers several channels for customers to reach their support team:

Emperor Financial Services Group (EFSG) offers several channels for customers to reach their support team:

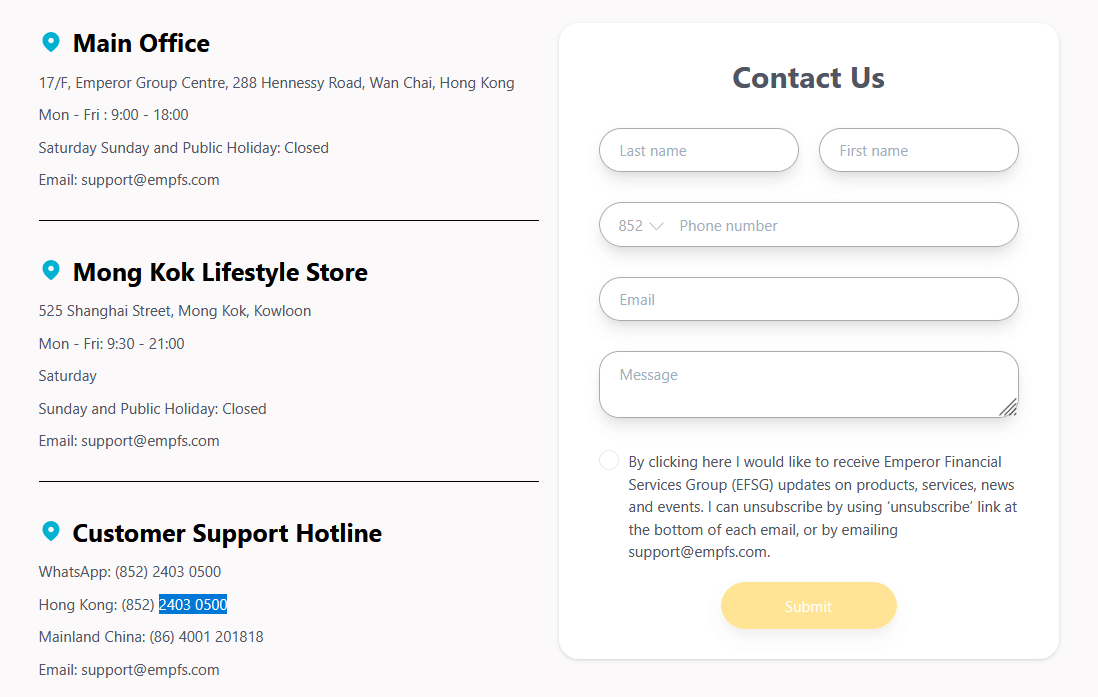

- Phone: Hong Kong: (852) 2403 0500, Mainland China: (86) 4001 201818

- Email: support@empfs.com

- WhatsApp: (852) 2403 0500

- Social Media: Facebook, Instagram, YouTube, LinkedIn

Customer Support Comparison Table

| Aspect | EFSG | Industry Standard |

|---|---|---|

| Channels | Phone, Email, WhatsApp, Social Media | Phone, Email, Live Chat, Social Media |

| Languages | English | Multiple (English, Chinese, Spanish, etc.) |

| Hours | Not specified | 24/7 |

| Response Times | Not specified | Clear targets (e.g., 1 min for phone, 1 hour for email) |

| Staff Expertise | Not specified | Knowledgeable, trained professionals |

Prohibited Countries

Emperor Financial Services Group (EFSG) is registered in the Virgin Islands and primarily targets clients in Hong Kong. However, there is no clear information available about the specific countries or regions where EFSG is prohibited from operating or providing services.

This lack of transparency is concerning, as traders need to know if they are eligible to open an account based on their country of residence. Restrictions on a broker's services can stem from various factors, such as:

- Local regulations and licensing requirements

- Sanctions or geopolitical factors

- The broker's internal policies and risk management decisions

Without a clear list of prohibited countries, traders may unknowingly attempt to register with EFSG only to have their application rejected. This can lead to frustration and wasted time.

Consequences of Trading from a Prohibited Country Trading with a broker from a prohibited country can have serious consequences. These may include:

- Account termination and funds confiscation

- Legal penalties and fines

- Difficulties with withdrawing funds

- Lack of regulatory protection and recourse in case of disputes

Special Offers for Customers

Emperor Financial Services Group (EFSG) does not provide any information about special offers, promotions, or bonuses for their clients. This lack of promotional incentives is unusual in the competitive world of online forex and CFD brokers.

Conclusion

Throughout this comprehensive review, I've taken an in-depth look at Emperor Financial Services Group (EFSG) to assess their suitability as a forex and precious metals broker. By examining various aspects of their operations, from regulatory compliance to trading platforms, I've aimed to provide an objective evaluation of their offerings.

However, the overarching theme that emerges is one of uncertainty and concern. EFSG's regulatory status is a major red flag, with their "suspicious clone" label indicating potential fraudulent activity. The lack of oversight from major regulatory bodies and the offshore registration in the Virgin Islands do little to instil confidence in the safety of clients' funds.

The limited range of tradable assets, with a focus solely on forex and precious metals, may not cater to the diverse needs of all traders. While the availability of the popular MT4 platform is a plus, the lack of alternative options like web-based trading or a proprietary mobile app is disappointing.

Customer support is another area where EFSG falls short, with no clear information on the availability, responsiveness, or expertise of their support team. For traders who may need assistance with technical issues or account queries, this lack of transparency is concerning.

The absence of any special offers or promotions, while not necessarily a deal-breaker, does make EFSG less competitive in an industry where such incentives are commonplace. More concerning is the lack of information about critical aspects like account types, trading conditions, and deposit/withdrawal processes.

When it comes to entrusting one's hard-earned money to a broker, transparency and trust are paramount. Unfortunately, EFSG's opaque practices and questionable regulatory standing do not inspire confidence.

As a trader, I would be hesitant to open an account with EFSG given the numerous red flags identified in this review. The potential risks, from difficulty withdrawing funds to outright fraud, simply outweigh any potential benefits.

There are many reputable, well-regulated brokers in the market who offer a wider range of assets, superior trading platforms, robust customer support, and greater transparency. I would strongly advise traders to consider these alternatives over EFSG.

It's important to remember that trading forex and other leveraged products is inherently risky. When choosing a broker, one should prioritise safety, security, and a proven track record of reliable service. Based on the findings of this review, EFSG does not meet these criteria.

As with any financial decision, I encourage readers to conduct their own due diligence and research before committing funds to any broker. Seek out regulated brokers with solid reputations, transparent practices, and a commitment to their clients' best interests.

While EFSG may promise attractive trading opportunities, the old adage holds: if something seems too good to be true, it probably is. Don't let the lure of easy profits blind you to the very real risks of trading with an untrustworthy broker.

In conclusion, based on the numerous concerning findings outlined in this review, I cannot in good conscience recommend Emperor Financial Services Group as a safe or suitable broker for forex and precious metals trading. Traders would be wise to steer clear and seek out more reputable, regulated alternatives.

Hungry for more data? Jump into the broker analytics reviews vault.

Spread-betting giant overview in the Plus500 review.