Equiti Review 2025: Pros and Cons, Competitive Spreads, and Advanced Platforms

Equiti

United Kingdom

United Kingdom

-

Withdrawal Fee $varies

-

Leverage 2000:1

-

Minimum Order 0.1

-

Forex Available

-

Crypto Available

-

Stock Available

-

Indices Available

Licenses

Japan Forex Trading License

Japan Forex Trading License

Broker-Dealer License

Broker-Dealer License

Securities Brokerage License

Securities Brokerage License

Softwares & Platforms

Customer Support

+442039592397

(English)

+442039592397

(English)

+97145232000

(Arabic)

+97145232000

(Arabic)

+96265500404

(Arabic)

+96265500404

(Arabic)

+35722011708

(English)

+35722011708

(English)

Supported language: Arabic, English

Social Media

Summary

Equiti offers a variety of convenient deposit and withdrawal options, including bank wire transfers, credit/debit cards, and popular e-wallets like Neteller and Skrill. Deposits are processed quickly—instantly for cards and e-wallets—and carry no fees from Equiti. Withdrawals via e-wallets are also fast, though a small fee may apply. Bank transfers take longer and may involve additional costs. Overall, Equiti provides flexible and globally accessible funding methods that suit a wide range of traders.

- Well-regulated by FCA, JSC, SCA, and other top-tier authorities

- Competitive spreads starting from 0.0 pips and fast execution speeds

- 300+ tradable instruments including forex, shares, indices, commodities, crypto CFDs

- Offers MT4 and MT5 platforms for desktop, web, and mobile

- Multilingual 24/5 customer support via live chat, email, and phone

- Negative balance protection for all clients

- Segregated client funds for added security

- Flexible account types catering to various trading styles and needs

- Islamic swap-free account option available

- No dealing desk (NDD) execution model ensures fair trading

- No USA clients accepted due to regulatory restrictions

- High minimum deposit of $10,000 for Premier account

- No special offers or promotions (though this may be seen as a pro)

- Limited cryptocurrency CFD selection compared to some brokers

- Inactivity fees apply after 90 days of no trading activity

- No micro lot trading available (minimum 0.01 lots)

- Financing/overnight fees apply to positions held past market close

- Limited educational resources compared to some larger brokers

- No manage

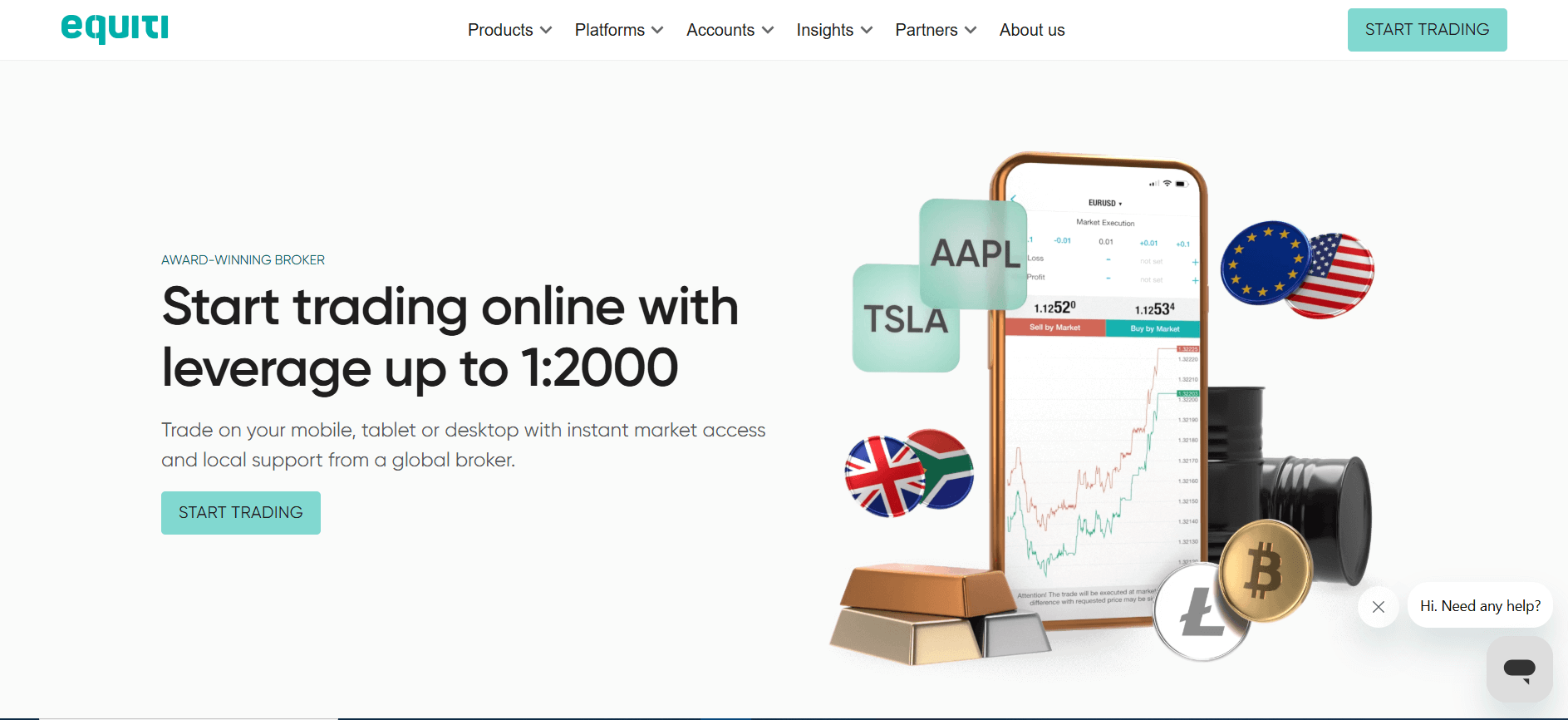

Overview

Equiti's journey began in 2008, and since then, the broker has established itself as a reputable name in the online trading industry. With a strong focus on providing a secure and transparent trading environment, Equiti has expanded its presence globally, serving clients across multiple continents. The broker's commitment to excellence has not gone unnoticed, as evidenced by the numerous awards and recognitions it has received over the years.

One of the standout features of Equiti is its robust regulatory framework, which includes licenses from top-tier authorities such as the Securities and Commodities Authority (SCA) in the UAE and the Jordan Securities Commission (JSC). Additionally, Equiti's global entity is regulated by the Financial Services Authority (FSA) in Seychelles, catering to traders seeking more flexible trading conditions and higher leverage.

For more detailed information about Equiti's offerings, visit their official website at equiti.com.

Overview Table

| Feature | Details |

|---|---|

| Established | 2008 |

| Headquarters | London, UK |

| Regulation | SCA (UAE), JSC (Jordan), FSA (Seychelles) |

| Trading Platforms | MetaTrader 4, MetaTrader 5 |

| Instruments | Forex, Indices, Shares, Commodities, Crypto CFDs |

| Minimum Deposit | No minimum (Standard), $100 (Premier) |

| Account Types | Standard, Premier |

| Customer Support | 24/5, Multi-language |

| Leverage | Up to 1:2000 |

Facts List

- Equiti was founded in 2008 and has its headquarters in London, UK.

- The broker is regulated by the SCA (UAE), JSC (Jordan), and FSA (Seychelles).

- Equiti offers the industry-standard MetaTrader 4, MetaTrader 5 platforms.

- Traders can access over 400 instruments, including Forex, Indices, Shares, Commodities, and Crypto CFDs.

- The Standard account has no minimum deposit requirement, while the Premier account requires a minimum deposit of $100.

- Equiti provides two main account types: Standard and Premier.

- The Standard account offers average spreads of 1.4 pips and no commissions.

- The Premier account features spreads from 0.0 pips and a commission of $3.5 per lot per side.

- Customer support is available 24/5 in multiple languages.

- Equiti offers leverage up to 1:2000 on both account types.

Equiti Licenses and Regulatory

Equiti's multi-faceted regulatory framework is a testament to the broker's commitment to providing a secure and compliant trading environment for its clients. By holding licenses from top-tier authorities in different regions, Equiti ensures that it adheres to strict financial regulations and maintains high standards of transparency and client protection.

In the Middle East and North Africa (MENA) region, Equiti's subsidiaries are regulated by two highly respected authorities. Equiti Group Limited Jordan is licensed by the Jordan Securities Commission (JSC), making it the first global brokerage to obtain this recognition. This license demonstrates Equiti's dedication to operating in accordance with local regulations and providing a trustworthy trading environment for clients in the region.

Similarly, EGM Futures DMCC, based in the United Arab Emirates (UAE), is regulated by the Securities and Commodities Authority (SCA). The SCA is known for its stringent regulatory standards, and Equiti's compliance with these requirements further reinforces the broker's commitment to maintaining the highest levels of integrity and client security.

For traders seeking more flexible trading conditions and higher leverage, Equiti's global entity, Equiti Brokerage (Seychelles) Ltd, is regulated by the Financial Services Authority (FSA) in Seychelles. While the FSA's regulatory oversight may not be as extensive as that of the JSC or SCA, it still provides a level of protection and ensures that Equiti operates in accordance with international financial standards.

Equiti's multi-regulatory approach allows traders to choose the entity that best aligns with their needs and preferences. Whether prioritizing the security and peace of mind that comes with strict regulation or seeking the potential for higher returns with increased leverage, Equiti offers a suitable solution.

Regulations List

- Securities and Commodities Authority (SCA) - United Arab Emirates

- Jordan Securities Commission (JSC) - Jordan

- Financial Services Authority (FSA) - Seychelles

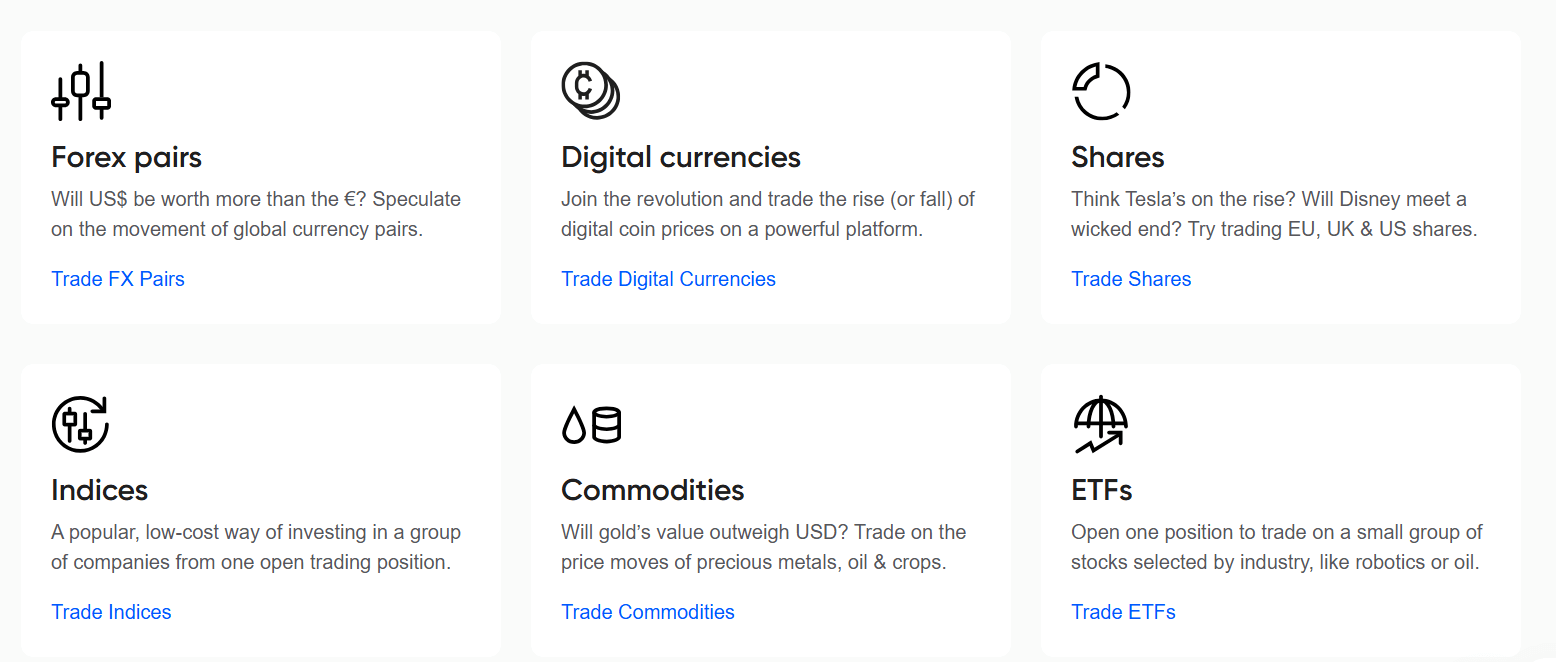

Trading Instruments

Equiti offers a diverse range of tradable assets, providing investors with ample opportunities to create well-balanced portfolios and capitalise on market trends. With over 300 financial instruments available, Equiti caters to the needs of both novice and experienced traders seeking exposure to various asset classes.

| Asset Class | Instruments Offered | Key Features |

|---|---|---|

| Forex | 60+ currency pairs (majors, minors, exotics) | Spreads from 1.4 pips (Executive), 0.0 pips + commission (Premier); high liquidity and volatility; strong diversification options |

| Indices | 15+ major global stock indices | Exposure to global markets; sector/geographic diversification; competitive pricing; suitable for broad market speculation |

| Shares | 180+ shares from UK, US, and Europe | Access to leading companies; opportunity to benefit from individual stock performance; supports portfolio diversification |

| Commodities | Precious metals (e.g., gold, silver), energies (e.g., oil, natural gas) | Safe-haven and hedging opportunities; responsive to economic shifts; useful for diversifying investment strategies |

| Cryptocurrency CFDs | Popular cryptos like Bitcoin, Ethereum (CFD trading only) | Trade crypto price movements without owning coins; leverage market volatility; flexible access to emerging digital asset class |

Trading Platforms

Equiti provides traders with a range of robust and user-friendly trading platforms, catering to the diverse needs of both novice and experienced traders. The broker offers the industry-standard MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, ensuring a seamless trading experience across multiple devices.

MetaTrader 4 (MT4)

MT4 is a widely-used trading platform known for its reliability, advanced charting tools, and extensive range of technical indicators. Equiti's MT4 platform is available for desktop, web, and mobile devices (iOS and Android), allowing traders to access their accounts and execute trades on the go. The platform supports automated trading through Expert Advisors (EAs), enabling traders to implement algorithmic strategies and optimise their trading efficiency.

MetaTrader 5 (MT5)

MT5 is the successor to MT4, offering enhanced features and functionality. Like MT4, Equiti's MT5 platform is available for desktop, web, and mobile devices (iOS and Android). MT5 provides a more advanced trading experience with a wider range of technical indicators, 21 timeframes, and depth of market (DOM) for more detailed market analysis. The platform also supports automated trading through Expert Advisors (EAs), allowing traders to implement sophisticated trading strategies.

Both MT4 and MT5 offer a wide range of technical indicators, drawing tools, and timeframes, empowering traders to conduct in-depth market analysis and make informed trading decisions. The platforms also provide a variety of order types, including market, limit, stop, and trailing stop orders, giving traders the flexibility to manage their positions effectively.

Equiti's commitment to offering stable, popular, and feature-rich trading platforms demonstrates the broker's dedication to providing a satisfactory trading experience for its clients. By staying up-to-date with market demands and client expectations, Equiti ensures that its technological offerings remain competitive and facilitate effective trading strategies.

Trading Platforms Comparison Table

| Feature | MetaTrader 4 (MT4) | MetaTrader 5 (MT5) |

|---|---|---|

| Device Compatibility | Desktop, Web, Mobile | Desktop, Web, Mobile |

| Operating Systems | Windows, macOS, iOS, Android | Windows, macOS, iOS, Android |

| Technical Indicators | 30+ | 38+ |

| Charting Timeframes | 9 | 21 |

| Automated Trading | Yes (EAs) | Yes (EAs) |

| Depth of Market (DOM) | No | Yes |

| Order Types | Market, Limit, Stop, Trailing Stop | Market, Limit, Stop, Trailing Stop |

| Customisable Interface | Yes | Yes |

| Equiti Asset Classes | Forex, Indices, Shares, Commodities, Crypto CFDs | Forex, Indices, Shares, Commodities, Crypto CFDs |

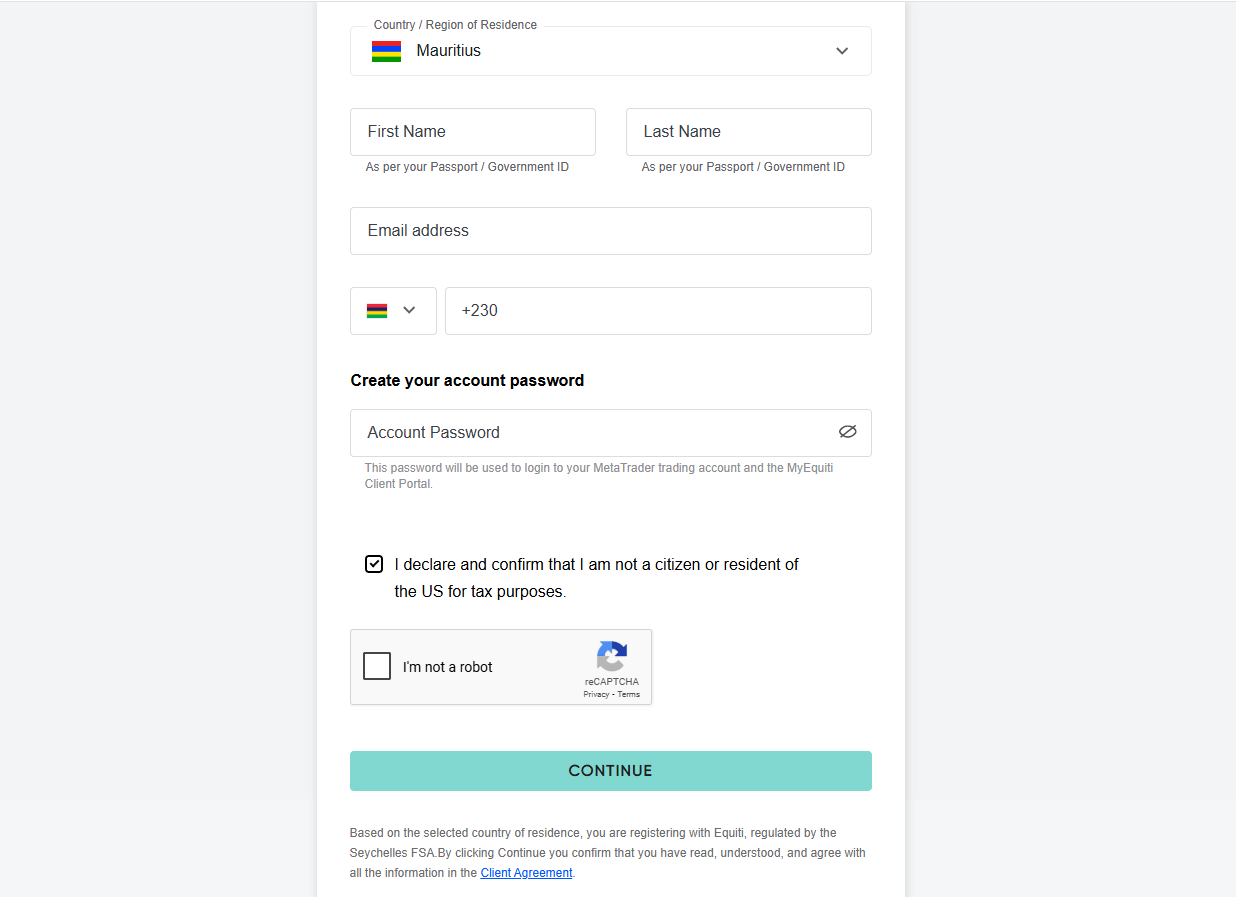

Equiti How to Open an Account: A Step-by-Step Guide

- Visit Equiti's official website at equiti.com and click "Open an Account".

- Select your preferred account type (Standard or Premier).

- Provide your personal information, including full name, email, phone number, and country of residence.

- Choose your base currency and leverage.

- Fill in your trading experience and financial information.

- Review and accept the terms and conditions, risk disclosure, and privacy policy.

- Submit your application and await account verification (usually within 1-2 business days).

- Fund your account using one of the available deposit methods and start trading.

Requirements and Funding Methods: To open an account with Equiti, you must:

- Be at least 18 years old

- Provide a valid government-issued ID and proof of residence

- Meet the minimum deposit requirement ($100 for Executive, $10,000 for Premier)

Charts and Analysis

Equiti offers a comprehensive suite of educational trading resources and tools, empowering clients to enhance their trading knowledge and skills. These resources cater to traders of all levels, from beginners to experienced professionals, and cover a wide range of topics to support informed decision-making.

| Feature | Description | Key Benefits |

|---|---|---|

| Charting Tools | Available on MetaTrader 4 (MT4) & MetaTrader 5 (MT5); includes various chart types, timeframes, and technical indicators. | Advanced price analysis, trend identification, customisable layouts, and saved templates |

| Market Analysis | In-house expert insights via blogs, webinars, and videos cover forex, indices, commodities, and shares. | Regular technical & fundamental analysis; helps identify opportunities and stay updated on market movements |

| Economic Calendar | Highlights key global economic events (e.g., GDP, interest rates, inflation reports) | Supports informed trading decisions; helps anticipate volatility and plan around major announcements |

| Educational Resources | Webinars, video tutorials, PDFs covering beginner to advanced topics like trading psychology and risk management | Suitable for all experience levels; promotes continuous learning and skill development |

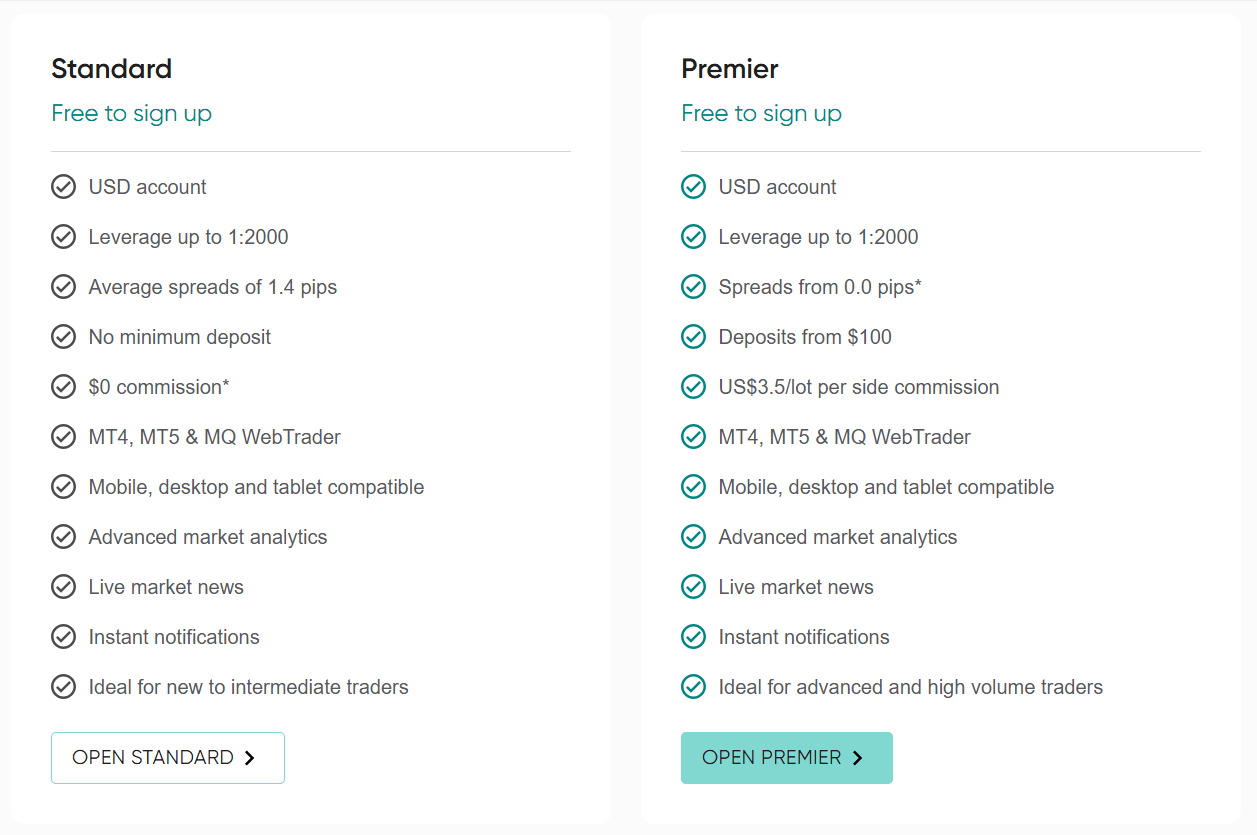

Equiti Account Types

Equiti offers two primary account types designed to cater to the needs of different traders based on their experience level and trading style. Both the Standard and Premier accounts are free to sign up and provide access to a USD trading account, advanced market analytics, live market news, and instant notifications. Traders can access these accounts through the MT4, MT5, and MQ WebTrader platforms, which are compatible with mobile, desktop, and tablet devices.

Standard Accoun

The Standard account is tailored for new to intermediate traders, offering competitive spreads and no commission fees. Key features of the Standard account include:

- Leverage up to 1:2000

- Average spreads of 1.4 pips

- No minimum deposit requirement

- $0 commission on trades

- Ideal for new to intermediate traders

Premier Account

The Premier account is designed for advanced and high-volume traders, providing tighter spreads and a commission-based pricing structure. Notable features of the Premier account include:

- Leverage up to 1:2000

- Spreads from 0.0 pips

- Minimum deposit of $100

- Commission of $3.5 per lot per side

- Ideal for advanced and high-volume traders

Both account types offer a range of benefits, including access to a USD trading account, high leverage, advanced market analytics, live market news, and instant notifications. Traders can choose the account type that best suits their trading experience, style, and volume.

Account Types Comparison Table

| Feature | Standard Account | Premier Account |

|---|---|---|

| Sign-up | Free | Free |

| Account Currency | USD | USD |

| Leverage | Up to 1:2000 | Up to 1:2000 |

| Spreads | Average 1.4 pips | From 0.0 pips |

| Minimum Deposit | No minimum | $100 |

| Commissions | $0 | $3.5 per lot per side |

| Platforms | MT4, MT5, MQ WebTrader | MT4, MT5, MQ WebTrader |

| Device Compatibility | Mobile, Desktop, Tablet | Mobile, Desktop, Tablet |

| Market Analytics | Advanced | Advanced |

| Market News | Live | Live |

| Notifications | Instant | Instant |

| Best Suited For | New to Intermediate Traders | Advanced and High-Volume Traders |

Negative Balance Protection

Equiti's Negative Balance Protection Policy: Equiti offers negative balance protection to all clients, regardless of their account type or trading platform. If a client's account balance falls into a negative value due to trading losses, Equiti will absorb the negative balance and reset the account to zero. Clients will not be required to pay back any negative balances, providing peace of mind and limiting their risk exposure. It is important to note that negative balance protection does not apply to accounts with open positions that have not been closed due to trading platform disruptions or malfunctions. In such cases, clients may still be responsible for any resulting negative balances. Equiti's commitment to negative balance protection demonstrates their dedication to managing risk effectively and prioritising the safety of their clients' funds. By offering this protection, Equiti enables traders to focus on their trading strategies without worrying about the potential for catastrophic losses.

Equiti Deposits and Withdrawals

Equiti offers a range of convenient deposit and withdrawal options to cater to the diverse needs of its global clientele. The broker strives to make funding and withdrawing from trading accounts as seamless and efficient as possible, ensuring that traders can focus on their trading activities without unnecessary distractions.

Deposit Methods

| Method | Supported Currencies | Minimum Deposit | Processing Time | Fees |

|---|---|---|---|---|

| Bank Wire Transfer | USD, EUR, GBP, AED, SAR, JOD, JPY | $50 (or equivalent) | 1–3 business days | No Equiti fees (bank fees may apply) |

| Credit/Debit Cards | USD, EUR, GBP, AED, SAR, JOD | $30 (or equivalent) | Instant | No fees charged by Equiti |

| E-wallets (Neteller, Skrill) | USD, EUR, GBP, AED | $30 (or equivalent) | Instant | No Equiti fees (e-wallet provider fees may apply) |

Withdrawal Methods

| Method | Supported Currencies | Minimum Withdrawal | Processing Time | Fees |

|---|---|---|---|---|

| Bank Wire Transfer | USD, EUR, GBP, AED, SAR, JOD, JPY | $50 (or equivalent) | 3–5 business days | $30 (or equivalent) |

| Credit/Debit Cards | USD, EUR, GBP, AED, SAR, JOD | $30 (or equivalent) | 5–14 business days | No fees charged by Equiti |

| E-wallets (Neteller, Skrill) | USD, EUR, GBP, AED | $30 (or equivalent) | 1 business day | 1% fee (max $30 or equivalent) |

Support Service for Customer

In the fast-paced world of online trading, reliable customer support plays a crucial role in ensuring a positive trading experience. Traders often require assistance with account-related queries, platform issues, or general guidance, and a responsive, knowledgeable support team can make all the difference. Equiti understands the importance of customer support and offers multiple channels through which traders can reach out for help.

Support Channels

- Live Chat: Equiti's website features a live chat option, allowing traders to connect with a support representative in real-time. This is often the quickest way to resolve minor queries or concerns.

- Email: Traders can send an email to Equiti's support team at support@equiti.com. This channel is suitable for less urgent matters or when a written record of the communication is preferred.

- Phone: Equiti provides dedicated phone support numbers for clients based on their region:

- UK: +44 203 959 2397

- UAE: +971 4 523 2000

- Jordan: +962 6 550 0404

- Cyprus: +357 22 011 708

- Social Media: While not a primary support channel, traders can reach out to Equiti via their official social media accounts on Facebook, Twitter, and LinkedIn for general enquiries or updates.

Customer Support Comparison Table

| Channel | Availability | Response Time | Languages |

|---|---|---|---|

| Live Chat | 24/5 | 1-2 minutes | English, Arabic |

| 24/5 | 24 hours | English, Arabic | |

| Phone | 24/5 | 1-2 minutes | English, Arabic |

| Social Media | Limited | Varies | English, Arabic |

Equiti Customer Support Comparison Table

| Feature | Equiti |

| Live Chat | ✓ |

| Email Support | ✓ (support@equiti.com) |

| Phone Support | ✓ (Regional numbers available) |

| Social Media Support | ✓ (Facebook, Twitter, LinkedIn) |

| Support Languages | English, Arabic |

| Support Hours | 24/5 (Sunday 22:05 GMT to Friday 21:50 GMT) |

| Live Chat Response Time | 1-2 minutes |

| Email Response Time | 24 hours |

| Phone Response Time | 1-2 minutes |

Prohibited Countries

Equiti, as a globally regulated broker, adheres to strict legal and regulatory requirements in the countries and regions where it operates. As a result, there are certain jurisdictions where Equiti is prohibited from offering its services due to local regulations, licensing restrictions, or geopolitical factors.

It is essential for traders to understand these restrictions to avoid any potential legal consequences or risks associated with attempting to trade with Equiti from a prohibited country. Trading from a restricted jurisdiction may result in the suspension or termination of the trading account, the freezing of funds, or other legal repercussions.

countries where Equiti is prohibited from operating include:

- Afghanistan

- Belgium

- Bosnia and Herzegovina

- Burundi

- Canada

- Central African Republic

- Congo (Democratic Republic)

- Eritrea

- Guinea-Bissau

- Iran

- Iraq

- Lebanon

- Libya

- Mali

- Netherlands

- North Korea

- Somalia

- South Sudan

- Sudan

- Syria

- Venezuela

- Yemen

Special Offers for Customers

At the time of writing, Equiti does not have any active special promotions or offers listed on its official website. This may be due to the regulatory restrictions imposed by the European Securities and Markets Authority (ESMA) and other financial authorities, which prohibit brokers from offering bonuses or other incentives that could encourage excessive trading or pose risks to clients' funds.

It is important to note that while special offers can be attractive, they should not be the sole deciding factor when choosing a broker. Traders should prioritise factors such as regulation, trading conditions, platform reliability, and customer support when evaluating a broker's overall quality and suitability for their needs.

Despite the current lack of special offers, Equiti has a history of providing competitive trading conditions, including tight spreads, fast execution speeds, and a wide range of tradable assets. The broker's commitment to innovation and technology is evident in its proprietary trading platforms and its partnerships with leading liquidity providers.

As always, traders should thoroughly research and compare multiple brokers before making a decision, taking into account their individual trading needs and risk tolerance.

- At the time of writing, Equiti does not have any active special offers or promotions listed on its official website.

Conclusion

Throughout this comprehensive review, I have thoroughly examined Equiti's operations, evaluating their regulatory compliance, trading conditions, platforms, customer support, and overall reputation in the online trading industry. By analysing these key aspects, I aim to provide a clear and unbiased assessment of Equiti's trustworthiness and reliability as a broker.

One of the standout features of Equiti is their strong regulatory framework, with licenses from top-tier authorities such as the FCA, JSC, SCA, and others. This commitment to compliance demonstrates Equiti's dedication to providing a safe and transparent trading environment for their clients. Additionally, their segregated client funds and negative balance protection further reinforce the security of trading with Equiti.

Equiti's trading conditions are competitive, with a wide range of tradable assets, including forex, metals, indices, shares, and crypto CFDs. They offer tight spreads and fast execution speeds, catering to the needs of both novice and experienced traders. The choice between the industry-standard MT4 and MT5 platforms ensures that traders have access to advanced tools and features to support their trading strategies.

In terms of customer support, Equiti provides a reliable and responsive service, with multiple channels for traders to seek assistance. The 24/5 availability and multilingual support team demonstrate Equiti's commitment to ensuring a positive trading experience for their global clientele.

While Equiti may not currently offer any special promotions or bonuses, I view this as a positive sign of their focus on providing a fair and transparent trading environment. The absence of such offers aligns with regulatory guidelines and suggests that Equiti prioritises the quality of their services over short-term incentives.

Based on my analysis, I believe that Equiti is a reputable and trustworthy broker that offers a solid trading experience for both beginners and seasoned traders. Their strong regulatory status, competitive trading conditions, and dedication to customer support make them a compelling choice in the online trading industry.

However, as with any financial decision, it is crucial for traders to conduct their own research and consider their individual trading goals and risk tolerance before choosing a broker. By thoroughly reviewing Equiti's offerings and comparing them with other reputable brokers, traders can make an informed decision that aligns with their specific needs.

| Aspect | Details |

|---|---|

| Regulatory Framework | Licensed by FCA, JSC, DMCC, and SCA; segregated client funds and negative balance protection. |

| Trading Conditions | Competitive with tight spreads, fast execution speeds, and a wide range of tradable assets (forex, metals, indices, shares). |

| Platforms | Offers MT4 (industry-standard) and proprietary EQTrader platform with advanced tools and features. |

| Customer Support | Reliable and responsive, available 24/5 with multilingual support. |

| Promotions/Bonuses | No current promotions or bonuses, aligning with regulatory guidelines for fairness and transparency. |

| Overall Reputation | Strong regulatory status, competitive conditions, and reliable customer service make Equiti a trustworthy choice. |

| Recommendation | Suitable for both beginners and experienced traders; encourages conducting individual research. |