Exness Review 2025: Is This Global Forex & CFD Broker Safe and Reliable?

Exness

Cyprus

Cyprus

-

Minimum Deposit $1

-

Withdrawal Fee $0

-

Leverage 500:1

-

Spread From 0.3

-

Minimum Order 0.1

-

Forex Available

-

Crypto Unavailable

-

Stock Available

-

Indices Available

Licenses

United Kingdom Market Making (MM)

United Kingdom Market Making (MM)

Cyprus Market Making (MM)

Cyprus Market Making (MM)

South Africa Retail Forex License

South Africa Retail Forex License

Japan Forex Trading License

Japan Forex Trading License

Softwares & Platforms

Customer Support

+35725030959

(English)

+35725030959

(English)

Supported language: Arabic, Chinese (Simplified), English, French, German, Hindi, Indonesian, Italian, Japanese, Korean, Malay, Polish, Tamil, Thai, Urdu

Social Media

Summary

Exness is a well-established forex and CFD broker founded in 2008, serving over 190 countries with more than $4 trillion in monthly trading volume. While the broker holds prestigious FCA and CySEC licenses, these entities don't provide retail trading services as of 2025, meaning most clients trade through offshore entities in Seychelles or Mauritius. The platform offers competitive trading conditions with 120+ forex pairs, 35+ cryptocurrencies, spreads from 0.1 pips, and no deposit/withdrawal fees. However, the lack of regular bonuses, limited stock selection, and prohibition in major markets like the US, UK, and EU are notable limitations. The broker best suits experienced forex traders who understand leverage risks and prioritize competitive spreads over regulatory protection.

- Multiple regulatory licenses including FCA and CySEC

- Extensive forex offering with 120+ pairs

- Competitive spreads from 0.1 pips

- No deposit or withdrawal fees

- Negative balance protection for all

- 24/7 multilingual support

- Low minimum deposits (as low as $1 in some regions)

- Multiple platform options

- Fast execution speeds

- 35+ cryptocurrency pairs available

- FCA/CySEC licenses don't cover retail traders

- Most clients served through offshore entities

- Limited stock selection (93 instruments)

- No regular bonuses or loyalty programs

- High leverage risks (up to 1:2000)

- Prohibited in major markets (US, UK, EU)

- Phone support limited to weekdays

- Educational resources less comprehensive than leaders

- Overnight fees on some positions

- Potential inactivity fees may apply

Overview

Established in 2008 and headquartered in Limassol, Cyprus, Exness has evolved into a significant player in the global forex and CFD trading landscape. With operations spanning over 190 countries and processing over $4 trillion in monthly trading volume, the broker has built a substantial market presence. However, a critical consideration for potential clients is that while Exness holds prestigious licenses from the FCA (UK) and CySEC (Cyprus), these entities no longer provide retail trading services as of 2025, meaning most retail traders are serviced through offshore entities in Seychelles and Mauritius.

For more detailed information about Exness's services, account types, trading conditions, and regulatory compliance, visit their official website at exness.com.

Overview Table

| Category | Information |

|---|---|

| Headquarters | Limassol, Cyprus |

| Established | 2008 |

| Countries Served | 190+ |

| Monthly Volume | Over $4 trillion |

| Regulated By | FCA, CySEC, FSA, FSC, FSCA |

| Minimum Deposit | As low as $1 (region-dependent) |

| Maximum Leverage | Up to 1:2000 |

| Total Instruments | 200+ |

| Platforms | MT4, MT5, Exness Terminal, Mobile Apps |

| Customer Support | 24/7 Chat/Email, Weekday Phone |

| Languages | 18+ |

Facts List

- Founded in 2008 with 16+ years of market experience

- Processes over $4 trillion in monthly trading volume

- Serves hundreds of thousands of active clients globally

- Offers 120+ forex pairs and 35+ cryptocurrency pairs

- Provides negative balance protection for all clients

- No deposit or withdrawal fees charged by the broker

- Supports multiple base currencies for trading accounts

- 24/7 multilingual customer support available

- Competitive spreads starting from 0.1 pips

- Four primary account types to suit various trading styles

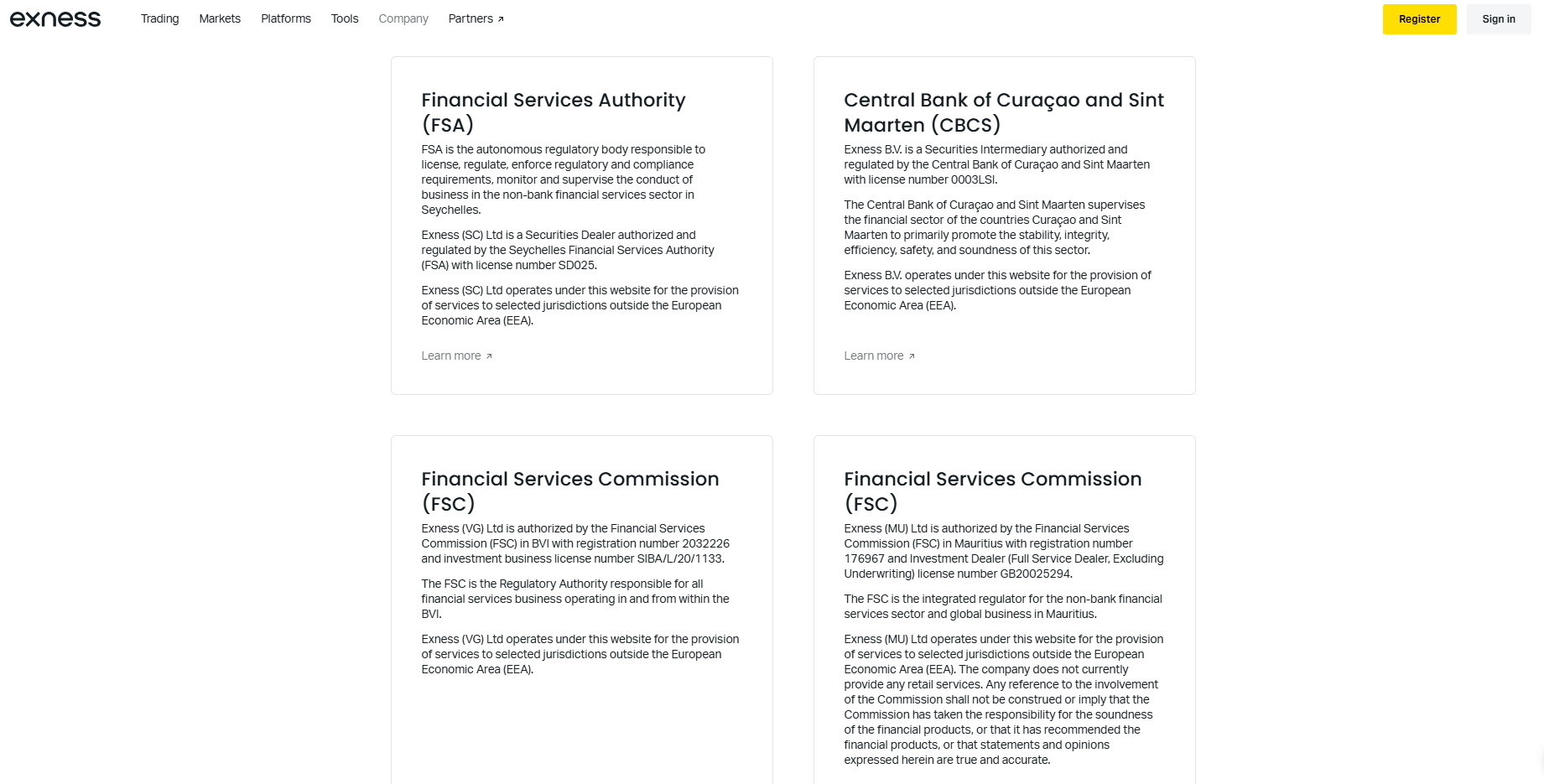

Exness Licenses and Regulatory

The regulatory landscape for Exness presents a nuanced picture that traders must carefully consider. While the broker maintains licenses from respected authorities, the practical application of these licenses varies significantly.

Regulatory Licenses

| Authority | Location | License Number | Retail Services | Protection Level |

|---|---|---|---|---|

| FCA | United Kingdom | 730729 | No | High (but unavailable) |

| CySEC | Cyprus | 178/12 | No | High (but unavailable) |

| FSCA | South Africa | 51024 | Yes | Medium |

| FSC | Mauritius | C113012295 | Yes | Low-Medium |

| FSA | Seychelles | SD025 | Yes | Low |

Trading Instruments

Exness provides access to a diverse range of financial instruments, enabling traders to build well-diversified portfolios across multiple asset classes.

| Asset Class | Number | Popular Examples | Min Spreads | Leverage |

|---|---|---|---|---|

| Forex Pairs | 120+ | EUR/USD, GBP/USD, USD/JPY | 0.1 pips | Up to 1:2000 |

| Cryptocurrencies | 35+ | BTC/USD, ETH/USD, XRP/USD | Variable | Up to 1:400 |

| Stock Indices | 10+ | S&P 500, NASDAQ, FTSE 100 | 0.3 points | Up to 1:200 |

| Commodities | 18 | Gold, Silver, Oil, Gas | 0.3 points | Up to 1:200 |

| Individual Stocks | 93 | Apple, Amazon, Google | Variable | Up to 1:20 |

Trading Platforms

Exness offers multiple trading platforms to accommodate different trading styles and technical requirements.

Trading Methods:

- MetaTrader 4 (Desktop/Mobile)

- MetaTrader 5 (Desktop/Mobile)

- Exness Terminal (Web-based)

- Exness Trader Mobile App (iOS/Android)

- API Trading for institutional clients

Platform Comparison

| Feature | MT4 | MT5 | Exness Terminal | Mobile App |

|---|---|---|---|---|

| Charting Tools | Advanced | Advanced | Basic | Basic |

| Technical Indicators | 30+ | 38+ | 15+ | 20+ |

| Expert Advisors | Yes | Yes | No | No |

| Web Access | No | No | Yes | N/A |

| One-Click Trading | Yes | Yes | Yes | Yes |

| Custom Indicators | Yes | Yes | No | No |

| Market Depth | No | Yes | No | No |

| Hedging Allowed | Yes | Yes | Yes | Yes |

Exness How to Open an Account: A Step-by-Step Guide

Opening an account with Exness follows a streamlined digital process designed for quick onboarding.

Step-by-Step Process

- Visit exness.com and click "Sign Up"

- Complete registration with email and phone

- Verify email through confirmation link

- Select preferred account type

- Submit KYC documents (ID and proof of address)

- Wait for verification (usually within 24 hours)

- Fund account using preferred payment method

- Download trading platform

- Begin trading

Charts and Analysis

Educational resources at Exness provide traders with tools for market analysis and skill development.

| Resource Type | Availability | Quality | Languages |

|---|---|---|---|

| Economic Calendar | Yes | Good | Multiple |

| Market Analysis | Daily Updates | Professional | 18+ |

| Webinars | Weekly | Intermediate | English, Spanish, Arabic |

| Video Tutorials | 50+ Videos | Basic-Advanced | Multiple |

| Trading Guides | Extensive Library | Comprehensive | 18+ |

| Demo Account | Unlimited | Full Features | All |

Exness Account Types

Exness offers four primary account types, with the Standard Cent account being regionally available, each tailored to different trading needs and experience levels.

Account Comparison

| Feature | Standard | Standard Cent* | Pro | Zero | Raw Spread |

|---|---|---|---|---|---|

| Min Deposit | $1-$10** | $1-$10** | $500 | $500 | $500 |

| Spreads From | 0.3 pips | 0.3 pips | 0.1 pips | 0 pips | 0 pips |

| Commission | None | None | None | $0.05 /lot | $3.5 /lot |

| Max Leverage | 1:2000 | 1:2000 | 1:2000 | 1:2000 | 1:2000 |

| Min Lot Size | 0.01 | 0.0001 | 0.01 | 0.01 | 0.01 |

| Execution | Instant/Market | Instant | Instant/Market | Market | Market |

*Regionally available **Varies by region and payment method

Negative Balance Protection

Exness provides negative balance protection to all clients regardless of account type or jurisdiction. This policy ensures traders cannot lose more than their deposited funds, with the broker absorbing any negative balance and resetting accounts to zero. However, this protection applies only to trading losses and doesn't cover account fees or instances of market abuse.

Exness Deposits and Withdrawals

Exness offers multiple payment methods with no fees charged by the broker for deposits or withdrawals.

Payment Methods

| Method | Deposit Time | Withdrawal Time | Min Amount | Fees |

|---|---|---|---|---|

| Bank Wire | 3-5 days | 3-7 days | $50 | None* |

| Credit/Debit | Instant | 1-3 days | $10 | None |

| Skrill | Instant | Up to 24 hours | $10 | None |

| Neteller | Instant | Up to 24 hours | $10 | None |

| Cryptocurrency | Instant | Up to 24 hours | Varies | None |

| Perfect Money | Instant | Up to 24 hours | $10 | None |

Support Service for Customer

Support services are available through multiple channels with varying response times.

Support Comparison

| Channel | Availability | Languages | Response Time | Quality |

|---|---|---|---|---|

| Live Chat | 24/7 | 18+ | <5 minutes | Excellent |

| 24/7 | 18+ | <24 hours | Good | |

| Phone | Weekdays only | 10+ | <5 minutes | Good |

| Social Media | Variable | English mainly | Variable | Fair |

Prohibited Countries

Exness is not allowed to provide its services to residents of the following regions:

- Europe

- United Kingdom

- United States

- Canada

- Japan

- Australia

- Russian Federation

- North Korea

- Iran

- Syria

- Sudan

- Cuba

- Region of Crimea

- Sevastopol

- Afghanistan

Special Offers for Customers

Unlike many competitors, Exness generally does NOT offer regular deposit bonuses or ongoing loyalty programs. The broker may occasionally run limited promotional campaigns or rebate programs, but these are not consistent features of their service offering.

| Offer Type | Availability | Requirements | Benefits |

|---|---|---|---|

| Welcome Bonus | Not offered | N/A | N/A |

| Loyalty Program | Not regular | N/A | N/A |

| Rebates | Occasional | Varies | Variable |

| VPS Hosting | Available | $5,000 balance + 5 lots/month | Free VPS |

Conclusion

After comprehensive analysis, Exness presents a complex picture for potential traders. While the broker boasts impressive credentials including 16 years of operation and over $4 trillion in monthly volume, the reality of their regulatory coverage requires careful consideration. The fact that their prestigious FCA and CySEC licenses don't extend to retail traders means most clients trade through offshore entities with different protection levels.

For traders in permitted jurisdictions who prioritize competitive spreads, diverse forex offerings, and low minimum deposits, Exness offers compelling value. The absence of deposit/withdrawal fees and provision of negative balance protection demonstrate client-focused policies. However, the lack of regular promotional offers and limited educational resources compared to industry leaders may disappoint some traders.

The broker appears most suitable for experienced forex traders who understand leverage risks and don't require extensive educational support. Those seeking the security of top-tier regulatory protection or comprehensive stock trading options should explore alternatives. Ultimately, while Exness operates legitimately with substantial market presence, traders must weigh the offshore entity reality against the competitive trading conditions offered.