Fortrade Review: Trading Platforms & Currency Services

Fortrade

United Kingdom

United Kingdom

-

Minimum Deposit $100

-

Withdrawal Fee $varies

-

Leverage 30:1

-

Spread From 2

-

Minimum Order 0.01

-

Forex Available

-

Crypto Available

-

Stock Available

-

Indices Available

Licenses

United Kingdom Market Making (MM)

United Kingdom Market Making (MM)

Cyprus Market Making (MM)

Cyprus Market Making (MM)

Australia Retail Forex License

Australia Retail Forex License

Forex & CFD Brokerage License

Forex & CFD Brokerage License

Softwares & Platforms

Customer Support

+442045717564

(English)

+442045717564

(English)

Supported language: Arabic, Dutch, English, French, German, Italian, Polish, Portuguese, Russian, Spanish

Social Media

Summary

Fortrade is a regulated online broker offering CFD and forex trading across a wide range of instruments including currencies, indices, stocks, commodities, ETFs, and cryptocurrencies. Founded in 2013 and headquartered in the UK, it is regulated by several authorities including the FCA, CySEC, and ASIC. Fortrade provides user-friendly platforms like MetaTrader 4 and its proprietary Fortrader platform. It supports both beginners and advanced traders with educational resources, market analysis, and a free demo account. With no deposit fees and a minimum deposit of $100, Fortrade aims to make trading accessible and secure.

- Strong regulatory oversight from FCA, ASIC, CySEC, and others

- Wide range of tradable assets including forex, stocks, indices, and commodities

- Competitive spreads and leverage up to 1:30

- Choice of user-friendly trading platforms: MT4 and Fortrader

- Negative balance protection for added security

- Low minimum deposit of $100 and accessible account types

- Comprehensive educational resources and market analysis

- Responsive customer support in multiple languages

- Segregation of client funds for enhanced protection

- Commitment to fair and transparent trading practices

- No promotional bonuses or special offers due to regulatory restrictions

- Limited cryptocurrency offerings compared to some competitors

- No 24/7 customer support available

- Educational resources could be expanded to include more advanced topics

- Wire transfer withdrawals may incur fees up to $40

- Withdrawal processing times can take up to 15 business days for credit/debit cards

- Inactivity fee of $10 per month after 180 days of no trading activity

- Not available to residents of the United States and some other countries

- Slower withdrawal times compared to some other brokers

Overview

Fortrade is an international online broker offering trading in contracts for difference (CFDs) and foreign exchange (forex) markets. Established in 2013 in London, United Kingdom, Fortrade has expanded its operations to serve clients in over 150 countries worldwide. The company is regulated by top-tier financial authorities such as the Financial Conduct Authority (FCA) in the UK, the Australian Securities and Investments Commission (ASIC), and the Cyprus Securities and Exchange Commission (CySEC).

Fortrade provides access to a wide range of tradable assets including forex currency pairs, stocks, indices, commodities, and exchange-traded funds (ETFs). Clients can trade through the popular MetaTrader 4 (MT4) platform as well as Fortrade's proprietary Fortrader web terminal. The broker offers competitive spreads, leverage up to 1:30, and educational resources to support both beginner and experienced traders.

With a strong focus on trust and transparency, Fortrade keeps client funds segregated and protected through regulatory oversight and compensation schemes like the Financial Services Compensation Scheme (FSCS). The company has built a reputation for reliable trade execution, helpful customer support, and a commitment to responsible trading practices. Visit Fortrade's official website for more details on their products, platforms and how to open an account.

Overview Table

| Category | Information |

|---|---|

| Established | 2013 in London, United Kingdom |

| Regulations | FCA (UK), ASIC (Australia), CySEC (Cyprus), NBRB (Belarus), FSC (Mauritius), CIRO (Canada) |

| Instruments | Forex, CFDs on indices, shares, commodities, ETFs, bonds |

| Platforms | MetaTrader 4 (MT4), Fortrader web & mobile |

| Minimum Deposit | $100 (£/€); $500 recommended |

| Account Currencies | USD, EUR, GBP |

| Leverage | Up to 1:30 |

| Educational Resources | Trading guides, webinars, video tutorials, Trading Central |

Facts List

- Fortrade was founded in 2013 and is headquartered in London, United Kingdom.

- The company is authorised and regulated by 6 financial regulators across different jurisdictions.

- Fortrade offers trading on over 300 instruments including forex, indices, stocks, commodities and ETFs.

- Clients can trade on the MetaTrader 4 platform as well as Fortrade's own Fortrader web and mobile platform.

- The minimum deposit to open an account is $100 in USD, EUR or GBP currencies. A deposit of $500 is recommended.

- Maximum leverage offered is 1:30 in compliance with regulatory restrictions in Europe and Australia.

- Fortrade provides negative balance protection to ensure clients cannot lose more than their account balance.

- The broker offers an unlimited demo account with $10,000 in virtual funds to practise risk-free.

- Fortrade's educational resources include e-books, webinars, courses, video tutorials and Trading Central analysis.

- Customer support is available via phone, email, live chat and contact form from 9am to 9pm GMT on weekdays.

Fortrade Licenses and Regulatory

Fortrade operates under a strong regulatory framework, holding licenses from multiple top-tier financial authorities across different jurisdictions. This extensive oversight provides a high level of client protection and ensures the broker adheres to strict industry standards.

The most notable regulators overseeing Fortrade's operations include:

- The Financial Conduct Authority (FCA) in the United Kingdom

- The Australian Securities and Investments Commission (ASIC)

- The Cyprus Securities and Exchange Commission (CySEC)

Fortrade's FCA license (FRN 609970) allows the company to offer its services to clients in the UK, while the CySEC license (CIF 385/20) enables operations across Europe under MiFID regulations. The ASIC license (AFSL 493520) covers Fortrade's activities in Australia.

Having multiple licenses from respected regulators is a strong indicator of Fortrade's commitment to compliance and client security. These watchdogs enforce strict rules around segregation and protection of client funds, fair trading practices, and transparency in operations. For example, Fortrade keeps client deposits separate from its own operating funds and offers negative balance protection to ensure traders cannot lose more than their account balance.

In addition to the main licenses, Fortrade holds further authorisations in Belarus from the National Bank of the Republic of Belarus (NBRB), in Mauritius from the Financial Services Commission (FSC), and in Canada from the Canadian Investment Regulatory Organisation (CIRO). This broad regulatory coverage allows Fortrade to serve clients in over 150 countries worldwide.

Compared to the industry standard, Fortrade's regulatory profile is comprehensive and robust. Many brokers operate with just one or two licenses, so Fortrade's six authorisations across key financial markets demonstrate a higher level of scrutiny and compliance. Traders can have confidence that Fortrade is held to high standards of client protection and ethical practices.

It's important for any trader considering Fortrade to understand how these regulations safeguard their interests and provide recourse. For example, Fortrade's FCA license means UK clients have access to the Financial Services Compensation Scheme which can pay up to £85,000 in compensation if the broker faces liquidation. Regulatory oversight also gives clients official channels to pursue complaints if they feel the broker has acted unfairly.

While strong regulation doesn't eliminate the risks inherent in trading forex and CFDs, it does provide vital protections and peace of mind when choosing a broker. Fortrade's multi-jurisdictional licensing and solid track record affirm its status as a secure and reputable trading provider. Prospective clients should still conduct their own due diligence, but Fortrade's regulatory standing is a green flag for its credibility and reliability.

List of Fortrade's regulatory licenses

- Financial Conduct Authority (FCA) in the UK – FRN 609970

- Australian Securities and Investments Commission (ASIC) - AFSL 493520

- Cyprus Securities and Exchange Commission (CySEC) – CIF 385/20

- National Bank of the Republic of Belarus (NBRB) - FRN 193075810

- Financial Services Commission (FSC) in Mauritius – Investment dealer number GB21026472

- Canadian Investment Regulatory Organization (CIRO) – Member of the Canadian Investor Protection Fund (CIPF)

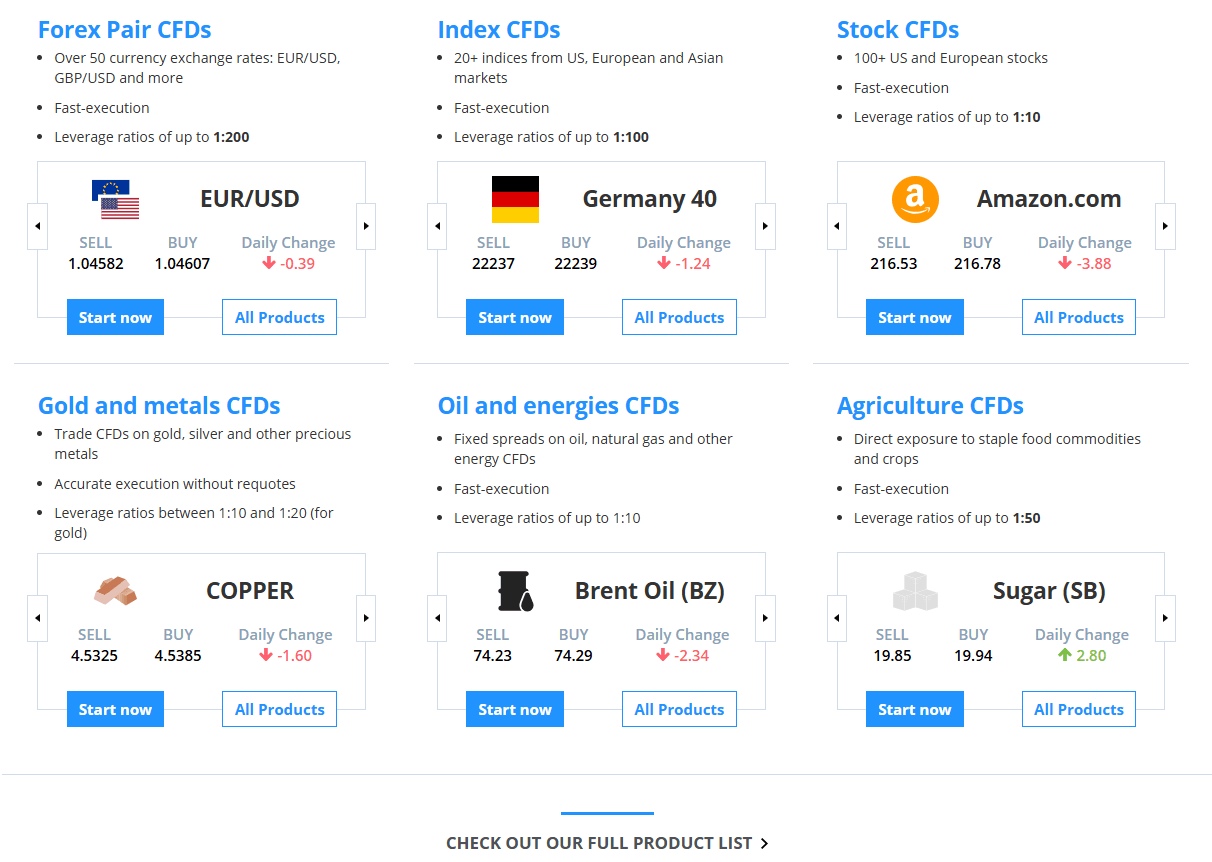

Trading Instruments

Fortrade offers a wide range of tradable assets, providing clients with diverse opportunities to invest in global financial markets. The broker's extensive offering spans multiple asset classes, allowing traders to build well-balanced portfolios and adapt to changing market conditions.

| Asset Class | Description | Examples | Additional Info |

|---|---|---|---|

| Forex | Access to over 60 currency pairs, including major, minor, and exotic pairs. | EUR/USD, GBP/USD | Spreads from 2 pips, high liquidity, 24/5 trading. |

| CFDs on Stocks | Trading CFDs on global company stocks. | Apple, Amazon, Tesla, Facebook | Speculate on rising and falling prices, leverage options, no need to own the underlying shares. |

| Indices | CFDs on 18 major stock indices. | S&P 500, FTSE 100, DAX 40, Nikkei 225 | Competitive spreads, diversified exposure with single instruments. |

| Commodities | CFD trading on metals, energies, and agricultural products. | Gold, silver, crude oil, wheat, soybeans | Spreads from 0.04 pips (gold), 0.75 pips (wheat), 0.07 pips (Brent Crude). |

| ETFs | CFD trading on sector-specific, geographically focused, and leveraged ETFs. | Sector ETFs, inverse ETFs, leveraged ETFs | Trade on margin, diversify trading strategies with ETFs. |

| Bonds | CFD trading on US Treasury notes and bonds with varying maturities. | US Treasury notes, 5/10/30-year bonds | Hedge stock market exposure or benefit from interest rate fluctuations. |

| Cryptocurrencies | CFD trading on leading cryptocurrencies. | Bitcoin, Ethereum, Litecoin, Ripple | Available 24/7, high volatility for potential trading opportunities. |

Overall, Fortrade's extensive range of tradable assets caters to a wide spectrum of trading styles and risk appetites. The broker's diverse offering is on par with or exceeds many of its industry peers, reflecting Fortrade's commitment to providing clients with ample opportunities in the financial markets.

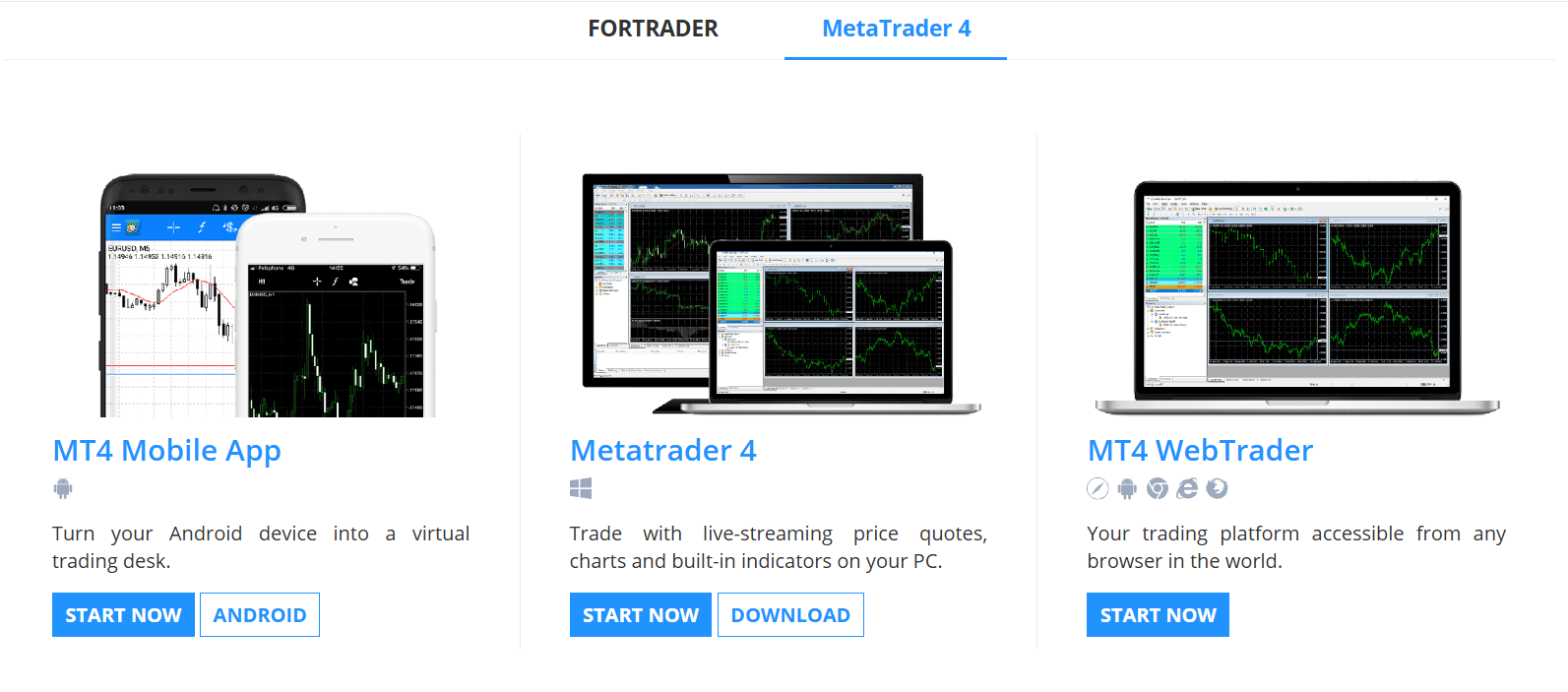

Trading Platforms

Fortrade offers clients a choice of robust trading platforms to suit different preferences and needs. As an industry standard, the broker provides access to the popular MetaTrader 4 (MT4) platform, known for its reliability, advanced charting tools, and algorithmic trading capabilities. MT4 is available as a desktop application for Windows and Mac, a web-based version for browser-based trading, and mobile apps for iOS and Android devices.

MetaTrader 4 (MT4)

MT4 is a powerful platform that caters to both novice and experienced traders. It offers a user-friendly interface with customisable charts, a wide range of technical indicators, and the ability to place trades directly from the charts. MT4 also supports automated trading through Expert Advisors (EAs), allowing clients to implement algorithmic strategies and take advantage of market opportunities 24/5.

Fortrade's MT4 platform comes equipped with 30 built-in indicators and 24 graphical objects for in-depth market analysis. The platform supports multiple order types, including Market Orders, Limit and Stop Orders, and One-Click Trading for rapid trade execution. MT4's CodeBase feature also allows traders to create and share custom indicators and EAs with the MQL4 developer community.

Fortrader Web Platform

In addition to MT4, Fortrade offers its proprietary Fortrader platform as a web-based trading solution. Fortrader is a sleek, intuitive platform that focuses on simplicity and ease of use. It provides a streamlined trading experience with real-time quotes, interactive charts, and a user-friendly order management system.

The Fortrader platform is accessible from any web browser without requiring any downloads or installations. It offers a customisable layout with detachable windows, allowing traders to create a workspace that suits their needs. The platform includes essential tools for analysis and trade execution, including multiple timeframes, drawing tools, and a range of order types.

Mobile Trading Apps

For traders who value flexibility and the ability to manage their positions on the go, Fortrade offers mobile trading apps for both MT4 and Fortrader. The MT4 mobile app is available for iOS and Android devices, providing full account management capabilities and advanced trading features. Traders can access real-time quotes, interactive charts, and a full range of order types directly from their smartphones or tablets.

The Fortrader mobile app, also available for iOS and Android, offers a seamless trading experience optimised for mobile devices. It includes key features such as real-time pricing, multiple chart types, technical analysis tools, and one-tap order execution. The app's user-friendly interface and intuitive navigation make it easy for traders to stay connected to the markets wherever they are.

Overall, Fortrade's range of trading platforms caters to the diverse needs of modern traders. MT4 remains a top choice for those seeking advanced tools and automated trading capabilities, while the Fortrader web platform offers a streamlined, browser-based solution. With mobile apps for both platforms, Fortrade ensures that clients can access their accounts and trade the markets with ease, whether at home, in the office, or on the move.

By offering stable, feature-rich platforms across multiple devices, Fortrade empowers clients to take control of their trading and implement their strategies effectively. The broker's commitment to technological excellence and user experience is evident in the quality of its trading platforms, positioning Fortrade as a competitive choice in the dynamic world of online trading.

Comparison table of Fortrade's trading platforms

| Feature | MT4 Desktop | MT4 WebTrader | MT4 Mobile | Fortrader Web | Fortrader Mobile |

|---|---|---|---|---|---|

| Customizable layout | Yes | Limited | Limited | Yes | Limited |

| Technical indicators | 30+ built-in | 30+ built-in | 30+ built-in | Basic set | Basic set |

| Drawing tools | 24 graphical objects | 24 graphical objects | Touch-screen tools | Basic set | Touch-screen tools |

| Automated trading | Yes (EAs) | No | No | No | No |

| Order types | Market, Limit, Stop, OCO | Market, Limit, Stop, OCO | Market, Limit, Stop, OCO | Market, Limit, Stop | Market, Limit, Stop |

| One-click trading | Yes | Yes | Yes | No | Yes |

| Alerts | Yes | Yes | Push notifications | No | Push notifications |

| Multi-language support | Yes | Yes | Yes | No | No |

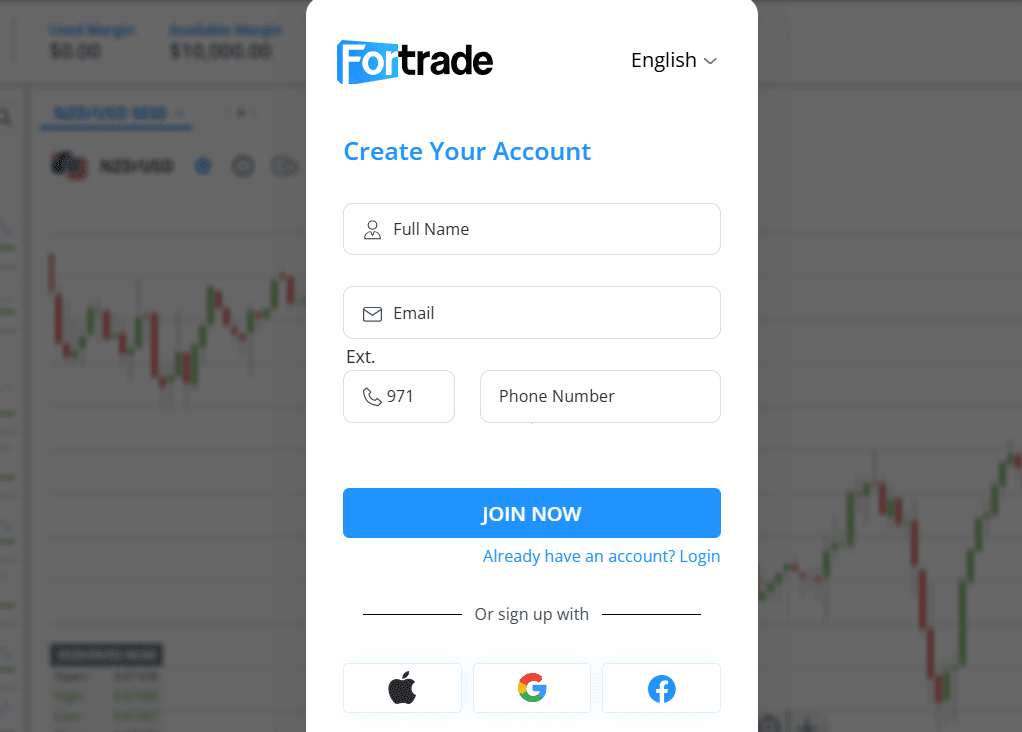

Fortrade How to Open an Account: A Step-by-Step Guide

Opening an account with Fortrade is a straightforward process that can be completed online in just a few steps.

Here's a detailed guide on how to get started:

Step 1: Visit the Fortrade website Go to the official Fortrade website at www.fortrade.com. Click on the "Open an Account" button located at the top right corner of the homepage.

Step 2: Choose your account type Select whether you want to open a live trading account or a demo account. A demo account allows you to practise trading with virtual funds, while a live account requires a real money deposit.

Step 3: Provide your personal information Fill in the registration form with your personal details, including your full name, date of birth, country of residence, phone number, and email address. Make sure all information is accurate and up-to-date.

Step 4: Complete the questionnaire Answer a few questions about your trading experience, financial knowledge, and risk tolerance. This helps Fortrade assess the suitability of their products and services for your needs.

Step 5: Choose your account preferences Select your account base currency (USD, EUR, or GBP), leverage, and platform choice (MetaTrader 4 or Fortrader). Read and agree to Fortrade's terms and conditions.

Step 6: Verify your identity and address To comply with anti-money laundering regulations, Fortrade requires new clients to submit proof of identity and address. Upload a clear copy of your government-issued ID (passport, driver's license, or national ID card) and a recent utility bill or bank statement showing your name and address.

Step 7: Fund your account Once your account is approved, log in to the client portal and navigate to the deposit section. Choose your preferred payment method (credit/debit card, bank wire transfer, Skrill, or Neteller) and follow the instructions to transfer funds. Fortrade's minimum deposit is $100, but they recommend starting with at least $500 to ensure sufficient trading capital.

Step 8: Download and install the trading platform If you chose MetaTrader 4, download the MT4 platform from Fortrade's website and install it on your device. For Fortrader, no download is required as it's a web-based platform accessible from any browser.

Step 9: Start trading Once your account is funded and the platform is set up, you can start trading Fortrade's wide range of instruments, including forex, stocks, indices, commodities, and more. Be sure to familiarise yourself with the platform's features and tools before placing real trades.

Fortrade aims to make the account opening process as quick and efficient as possible. Most accounts are approved within 24 hours, subject to successful identity verification. The broker's multilingual support team is available to assist with any questions or issues during the registration process.

By following these simple steps, you can open an account with Fortrade and start exploring the opportunities in the global financial markets. As with any trading decision, it's crucial to consider your investment goals, risk tolerance, and financial situation before committing funds.

Charts and Analysis

Fortrade offers a comprehensive suite of educational resources and analytical tools to support clients in their trading journey. By providing access to high-quality charting, market analysis, and learning materials, Fortrade empowers traders to make informed decisions and continuously develop their skills.

| Feature | Description | Key Highlights |

|---|---|---|

| Advanced Charting | Powerful charting tools are available on MetaTrader 4 and Fortrader platforms to help with technical analysis. | - Multiple chart types (line, bar, candlestick) - 30+ technical indicators - Customizable timeframes |

| Market Analysis and Insights | Regular market analysis and commentary are provided to keep traders informed. | - Daily market overviews - Weekly forecasts - In-depth reports on currency pairs, indices, and commodities |

| Economic Calendar | An economic calendar to track key market events and their potential impact. | - Filter by date, currency, event type - Includes historical data and market consensus forecasts |

| Educational Resources | Fortrade Trading Academy offers resources for all skill levels, from beginners to advanced traders. | - Beginner's guides - Video tutorials - Webinars and interactive quizzes - eBooks and trading guides |

Comparison to Industry Standards Fortrade's educational resources and analytical tools are well-rounded in their offerings and are of similar quality when compared to what's available from other leading online brokers. The advanced charting features and range of technical indicators are on par with industry standards.

Furthermore, Fortrade's commitment to providing regular market analysis and insights demonstrates a strong focus on supporting clients' ongoing learning and development, which is crucial in the fast-paced world of online trading.

Fortrade Account Types

Fortrade offers a streamlined selection of account types designed to cater to the needs of both novice and experienced traders. By providing a focused range of options, Fortrade ensures that clients can easily select the account that best suits their trading style, experience level, and financial goals.

Standard Account

The Standard Account is Fortrade's flagship offering and is suitable for the majority of traders. Key features include:

- Minimum deposit of $100, with a recommended starting balance of $500

- Leverage up to 1:30 for retail clients, in line with regulatory requirements

- Competitive spreads starting from 2 pips on major currency pairs

- Access to a wide range of markets, including forex, stocks, indices, commodities, and more

- Available on both the MetaTrader 4 and Fortrader platforms

- Negative balance protection to ensure clients cannot lose more than their account balance

The Standard Account provides a balanced mix of accessibility and flexibility, making it an ideal choice for traders of all levels.

Demo Account

For those new to trading or looking to test Fortrade's platforms risk-free, the broker offers a Demo Account with the following features:

- No minimum deposit required

- Virtual starting balance of $10,000

- Access to live market prices and real-time execution

- Ability to practice trading strategies without risking real money

- Unlimited demo period, allowing traders to switch to a live account when ready

- Available on both the MetaTrader 4 and Fortrader platforms

The Demo Account is an invaluable tool for beginner traders to familiarise themselves with the markets and platform features before committing real funds.

Islamic Account

To cater to the specific needs of Muslim traders, Fortrade offers an Islamic Account that adheres to the principles of Sharia law. Key features include:

- Swap-free trading, with no interest charged or paid on overnight positions

- Minimum deposit of $100

- Leverage up to 1:30 for retail clients, in line with regulatory requirements

- Access to the same wide range of markets as the Standard Account

- Available on both the MetaTrader 4 and Fortrader platforms

The Islamic Account provides an ethical and compliant trading solution for Muslim clients, allowing them to participate in the financial markets while observing their religious beliefs.

Comparison to Industry Standards Fortrade's account types are in line with industry standards, offering a mix of accessibility and specialisation. The minimum deposit requirement of $100 for the Standard Account is competitive and makes trading accessible to a wide range of clients.

The availability of a Demo Account with no time limit is a strong offering, as some brokers restrict demo access to a fixed period. This commitment to client education and risk-free practice sets Fortrade apart.

The inclusion of an Islamic Account demonstrates Fortrade's dedication to catering to diverse client needs and promoting financial inclusion. While not all brokers offer swap-free accounts, it is becoming increasingly common in the industry.

However, some brokers offer a more extensive range of account types, such as ECN or VIP accounts with tighter spreads and additional benefits for high-volume traders. Fortrade's streamlined offering may not cater to the most advanced or institutional traders.

Comparison table of Fortrade's account types

| Feature | Standard Account | Demo Account | Islamic Account |

|---|---|---|---|

| Minimum deposit | $100 (recommended $500) | No minimum deposit | $100 |

| Leverage | Up to 1:30 | Up to 1:30 | Up to 1:30 |

| Spreads | From 2 pips | From 2 pips | From 2 pips |

| Markets | Forex, stocks, indices, commodities, etc. | Forex, stocks, indices, commodities, etc. | Forex, stocks, indices, commodities, etc. |

| Platforms | MetaTrader 4, Fortrader | MetaTrader 4, Fortrader | MetaTrader 4, Fortrader |

| Swap-free | No | No | Yes |

| Virtual funds | No | $10,000 | No |

| Negative balance protection | Yes | Yes | Yes |

Negative Balance Protection

Fortrade offers negative balance protection to all retail clients as part of its commitment to responsible trading and client fund protection. Under this policy, Fortrade guarantees that clients cannot lose more than the total funds in their trading account, ensuring that their maximum loss is limited to their deposit. If a client's position is closed out at a negative balance due to extreme market volatility or unexpected events, Fortrade will absorb the loss and reset the account balance to zero. This protection applies to all trading accounts and instruments offered by Fortrade, including forex, stocks, indices, commodities, and more. It is important to note that negative balance protection does not prevent clients from losing money up to the amount deposited in their account. Traders should still exercise caution and employ sound risk management strategies, such as setting appropriate stop-loss orders and managing their leverage responsibly. Fortrade's negative balance protection is automatically applied to all retail client accounts and does not require any additional action from the trader. However, professional clients may not be eligible for this protection, as they are considered to have higher levels of financial knowledge and risk tolerance. In addition to negative balance protection, Fortrade segregates client funds from its operating capital in secure, Tier-1 bank accounts. This segregation ensures that clients' money is protected in the event of the broker's insolvency or bankruptcy. By offering negative balance protection and implementing robust client fund segregation, Fortrade demonstrates its commitment to creating a safe and secure trading environment for its clients. These measures provide traders with peace of mind, knowing that their potential losses are limited and their funds are protected.

Fortrade Deposits and Withdrawals

Fortrade offers a range of convenient deposit and withdrawal options to cater to the diverse needs of its global client base. By providing multiple payment methods and efficient processing times, Fortrade ensures that clients can manage their funds easily and securely.

Deposit Method

| Deposit Method | Processing Time | Fees | Minimum Deposit |

|---|---|---|---|

| Credit/Debit Cards (Visa, Mastercard) | Instant | No fees | $100 (or equivalent) |

| Bank Wire Transfer | 1-7 business days | Fees may apply (depending on bank) | $100 (or equivalent) |

| Skrill | Instant | No fees | $100 (or equivalent) |

| Neteller | Instant | No fees | $100 (or equivalent) |

Withdrawal Method

| Withdrawal Method | Processing Time (After Approval) | Fortrade Fees | Additional Notes |

|---|---|---|---|

| Credit/Debit Cards (Visa, Mastercard) | 1–15 business days | No fees | May be delayed depending on card issuer |

| Bank Wire Transfer | 1–7 business days | No fees by Fortrade | Bank may charge ~$40 per withdrawal |

| Skrill | 1–2 business days | No fees | Fast processing |

| Neteller | 1–2 business days | No fees | Fast processing |

Support Service for Customer

In the fast-paced world of online trading, reliable customer support is crucial for a positive and seamless trading experience. Traders need to know that they can quickly reach out for assistance, whether they have questions about account management, technical issues, or trading strategies. Fortrade understands the importance of responsive and knowledgeable customer support, and offers multiple channels for traders to get the help they need.

Support Channels

Fortrade provides the following support channels for clients:- Live chat: Available on the Fortrade website, live chat allows traders to instantly connect with a support representative for real-time assistance.

- Email: Traders can send their enquiries to support@fortrade.com for a response within 24 hours.

- Phone: Fortrade offers local phone support numbers for several countries, including the UK, Australia, Canada, and more.

- Contact form: Clients can submit a support ticket through the contact form on the Fortrade website, providing details about their inquiry or issue.

- Live chat: Average wait time of 1-2 minutes

- Phone: Average wait time of 2-3 minutes

- Email: Response within 1-2 hours

- Contact form: Response within 24 hours

Fortrade's customer support comparison table

| Support Channel | Availability | Languages | Response Time |

|---|---|---|---|

| Live Chat | Monday to Friday, 9:00 am to 9:00 pm GMT | Multiple, including English, German, Spanish, French, Italian, Dutch, Portuguese, Polish, Russian, Arabic | Average wait time of 1-2 minutes |

| Monday to Friday, 9:00 am to 9:00 pm GMT | Multiple, including English, German, Spanish, French, Italian, Dutch, Portuguese, Polish, Russian, Arabic | Response within 1-2 hours | |

| Phone | Monday to Friday, 9:00 am to 9:00 pm GMT | Multiple, including English, German, Spanish, French, Italian, Dutch, Portuguese, Polish, Russian, Arabic | Average wait time of 2-3 minutes |

| Contact Form | Monday to Friday, 9:00 am to 9:00 pm GMT | Multiple, including English, German, Spanish, French, Italian, Dutch, Portuguese, Polish, Russian, Arabic | Response within 24 hours |

Prohibited Countries

Fortrade is committed to complying with international regulations and operating within the legal frameworks of the countries it serves. As a result, there are certain jurisdictions where Fortrade is not allowed to provide its services due to regulatory restrictions, licensing requirements, or geopolitical factors.

Reasons for Restrictions The primary reasons behind Fortrade's country restrictions include:

- Local regulations: Some countries have strict regulations governing the provision of online trading services. These regulations may require brokers to obtain specific licenses or meet certain capital requirements to operate legally. In such cases, Fortrade may choose not to offer its services to avoid non-compliance with local laws.

- Licensing requirements: Fortrade holds licenses from reputable regulatory bodies such as the FCA, ASIC, and CySEC. However, these licenses may not cover all jurisdictions globally. In countries where Fortrade does not have the necessary licenses to operate, it refrains from offering its services to avoid legal complications.

- Geopolitical factors: Political instability, economic sanctions, or other geopolitical tensions can make it difficult or impossible for Fortrade to provide services in certain regions. In such cases, the broker may choose to restrict access to its platform to protect itself and its clients from potential risks.

Prohibited Countries List

Fortrade does not offer its services to residents of the following countries:

- Afghanistan

- Algeria

- Angola

- Burundi

- Cambodia

- Central African Republic

- Congo Republic

- Cuba

- Democratic Republic of the Congo

- Eritrea

- Ethiopia

- Guinea-Bissau

- Guyana

- Haiti

- Hong Kong

- Iran

- Iraq

- Israel

- Japan

- Korea (North)

- Laos

- Liberia

- Libya

- Myanmar

- Panama

- Papua New Guinea

- Puerto Rico

- Singapore

- Somalia

- South Sudan

- Sudan

- Syria

- Tajikistan

- Turkmenistan

- Uganda

- United States

- Virgin Islands/Micronesia/Palau

- Uzbekistan

- Vanuatu

- Venezuela

- Yemen

- Zimbabwe

It's important to note that this list is subject to change based on evolving regulations and geopolitical circumstances. Traders should always check with Fortrade's support team for the most up-to-date information on country restrictions.

Consequences of Trading from Prohibited Countries Attempting to trade with Fortrade from a prohibited country can result in serious consequences. If Fortrade detects that a client is accessing its platform from a restricted jurisdiction, the broker may immediately suspend or terminate the client's account without prior notice.

Furthermore, trading from a prohibited country may violate local laws, which could lead to legal repercussions for the individual trader. It is the responsibility of each trader to ensure that they are complying with their local regulations when engaging in online trading activities.

To avoid any potential issues, traders should always check whether their country of residence is on Fortrade's prohibited list before attempting to open an account or access the trading platform.

List of regions where Fortrade is allowed to operate

- Europe (excluding restricted countries), Asia (excluding restricted countries), Africa (excluding restricted countries), South America (excluding restricted countries), Australia, New Zealand, Canada (excluding Quebec, Alberta, British Columbia, Manitoba, New Brunswick, Newfoundland and Labrador, Nova Scotia, Ontario, Prince Edward Island, Saskatchewan)

Special Offers for Customers

As a fully regulated broker, Fortrade does not currently offer any promotional bonuses, sign-up incentives, or trading competitions. This is in line with the restrictions imposed by the regulatory bodies that oversee Fortrade's operations, such as the Financial Conduct Authority (FCA) and the Cyprus Securities and Exchange Commission (CySEC).

These regulators have implemented strict rules regarding the use of promotional offers by brokers to protect traders from potential manipulation or misleading incentives. The aim is to ensure that traders make informed decisions based on the merits of the broker's services, rather than being unduly influenced by short-term promotional offers.

Conclusion

Throughout this comprehensive review of Fortrade, I have examined various aspects of their operations, from regulatory compliance and geographical coverage to trading platforms, account types, and customer support. By consolidating these findings, I aim to provide a cohesive assessment of Fortrade's safety, reliability, and overall reputation as an online broker.

One of the key strengths I discovered about Fortrade is their commitment to regulatory compliance. They hold licenses from multiple top-tier regulatory bodies, including the FCA, ASIC, and CySEC, which ensures a high level of oversight and protection for their clients. This regulatory coverage spans several jurisdictions, allowing Fortrade to serve traders in over 150 countries worldwide.

In terms of trading offerings, Fortrade provides a diverse range of tradable assets, including forex, stocks, indices, commodities, and more. They offer competitive spreads and leverage, along with a choice of trading platforms to suit different preferences. The MetaTrader 4 platform and Fortrade's proprietary Fortrader platform both offer advanced charting tools, technical analysis features, and automated trading capabilities.

Fortrade's account types cater to a variety of traders, from beginners to more experienced investors. The low minimum deposit requirement and demo account option make it accessible for those starting out, while the Islamic account and professional client classification demonstrate their adaptability to specific trader needs.

Customer support is another area where Fortrade excels, offering multiple channels for reaching out, including live chat, email, phone, and a contact form. Their support team is knowledgeable and responsive, providing assistance in several languages to cater to their global client base.

While Fortrade may not offer traditional promotional bonuses, their partnership with Trading Central provides added value to clients by offering expert analysis, trading ideas, and market insights. This focus on education and informed decision-making aligns with their commitment to responsible trading practices.

Fortrade's dedication to transparency and fair treatment of clients is evident in their handling of client funds, which are segregated from company assets and protected by compensation schemes in various jurisdictions. Their negative balance protection policy also ensures that clients cannot lose more than their account balance, providing an extra layer of security.

However, no broker is perfect, and there are a few areas where Fortrade could improve. For example, their educational resources, while comprehensive, could be expanded to include more advanced topics and in-depth courses. Additionally, while their customer support hours are extensive, they do not offer 24/7 assistance, which may be inconvenient for some traders.

Find niche specialists inside our broker review directory.

Multi-reg brand overview in the HF Markets review.