Fusion Markets Review: Forex Trading at Fusion Markets Explained

Fusion Markets

Australia

Australia

-

Withdrawal Fee $0

-

Leverage 500:1

-

Minimum Order 0.01

-

Forex Available

-

Crypto Available

-

Stock Available

-

Indices Available

Licenses

Australia Retail Forex License

Australia Retail Forex License

Forex Trading License

Forex Trading License

Softwares & Platforms

Customer Support

+678383762706

(English)

+678383762706

(English)

Supported language: English

Social Media

Summary

Fusion Markets, founded in 2017 in Melbourne, is a triple-regulated broker (ASIC, VFSC, FSA) known for ultra-low trading costs and efficient execution. It offers 250+ instruments including 90+ forex pairs, stocks, indices, commodities, and crypto, with spreads from 0.0 pips and no minimum deposit. Traders can choose from MT4, MT5, TradingView, and cTrader platforms, plus Islamic and Pro accounts. The broker charges no deposit/withdrawal fees, provides 24/7 support, and ensures negative balance protection for ASIC clients. While highly cost-effective and feature-rich, it has geographic restrictions, limited education, and English-only support.

- Triple regulation (ASIC, VFSC, FSA) ensuring robust oversight

- True ECN pricing with spreads from 0.0 pips

- No minimum deposit requirement

- Four platform options including TradingView and cTrader

- Islamic accounts available for Sharia-compliant trading

- Zero fees on deposits and withdrawals

- 90+ forex pairs exceeding many competitors

- 24/7 customer support via multiple channels

- Negative balance protection for ASIC clients

- Professional accounts with reduced commissions

- Geographic restrictions exclude US, EU, Canadian, and Japanese traders

- Limited educational resources compared to tier-1 brokers

- English-only customer support

- No proprietary trading platform

- Relatively new with shorter track record (2017)

- No promotional bonuses or loyalty programs

- Maximum 30:1 leverage under ASIC regulation

- Limited cryptocurrency selection versus crypto specialists

- No guaranteed stop losses

- Basic research tools and market analysis

Overview

Fusion Markets stands as a compelling force in the online trading landscape, establishing itself since 2017 as a technology-driven broker prioritizing ultra-low costs and efficient execution. Operating from Melbourne, Australia, this innovative brokerage has rapidly expanded its global footprint, now serving over 100,000 traders across multiple continents under the oversight of three reputable regulatory authorities.

Founded by industry veteran Phil Horner, Fusion Markets disrupts traditional brokerage models by leveraging proprietary price aggregation technology to deliver institutional-grade pricing to retail traders. The broker's commitment to transparency manifests through their straightforward fee structure—no deposit fees, no withdrawal charges, and no inactivity penalties. With access to 250+ trading instruments including 90+ forex pairs, global indices, commodities, stocks, and cryptocurrencies, Fusion Markets caters to diverse trading strategies while maintaining spreads as tight as 0.0 pips on major currency pairs.

Overview Table

| Category | Details |

|---|---|

| Established | 2017 |

| Headquarters | Melbourne, Australia |

| Regulation | ASIC (#385620), VFSC (#40256), FSA (#SD096) |

| Trading Instruments | 250+ (90+ Forex, Indices, Commodities, Stocks, Crypto) |

| Minimum Deposit | $0 (No minimum) |

| Account Types | Classic, Zero, Swap-Free, Pro |

| Trading Platforms | MT4, MT5, TradingView, cTrader |

| Maximum Leverage | 500:1 (VFSC/FSA), 30:1 (ASIC) |

| Spreads From | 0.0 pips (Zero Account) |

| Commission | $0 (Classic), $4.50/lot RT (Zero) |

Facts List

- Triple-regulated broker licensed by ASIC, VFSC, and FSA ensuring multi-jurisdictional compliance

- Zero minimum deposit requirement makes trading accessible to all experience levels

- 90+ forex pairs available, exceeding many established competitors

- Four platform options including MT4, MT5, TradingView, and cTrader integration

- Spreads from 0.0 pips on Zero accounts with competitive $4.50/lot commission

- Islamic accounts available upon request for Sharia-compliant trading

- 24/7 customer support via live chat, email, and phone in multiple languages

- No deposit/withdrawal fees charged by Fusion Markets

- Negative balance protection for ASIC-regulated clients

- Pro accounts available for qualified professionals and institutional traders

Fusion Markets Licenses and Regulatory

Fusion Markets operates under a robust triple-regulatory framework that significantly exceeds industry standards for mid-sized brokers. The Australian Securities and Investments Commission (ASIC) license #385620 represents their flagship regulatory credential, subjecting the broker to stringent capital adequacy requirements, mandatory segregated client funds, and comprehensive reporting obligations. ASIC's reputation as a tier-1 regulator provides Australian clients with maximum protection including negative balance guarantees and access to financial ombudsman services.

The Vanuatu Financial Services Commission (VFSC) license #40256 enables Fusion Markets to offer enhanced trading conditions to international clients, including leverage up to 500:1. While VFSC oversight is less stringent than ASIC, it still mandates proper capitalization and operational standards. The addition of Seychelles FSA regulation (license #SD096) further expands their international reach while demonstrating commitment to regulatory compliance across multiple jurisdictions.

This triple-regulatory approach positions Fusion Markets favorably against competitors who typically operate under one or two licenses. The geographical diversity of their regulatory oversight provides operational resilience and offers clients multiple options for account domiciliation based on their location and trading preferences.

Regulations List

- Australian Securities and Investments Commission (ASIC) - License #385620

- Vanuatu Financial Services Commission (VFSC) - Company #40256

- Financial Services Authority Seychelles (FSA) - License #SD096

Trading Instruments

Fusion Markets' expanded offering of 250+ instruments demonstrates significant growth from their initial focus on forex trading. The 90+ currency pairs available surpass many established brokers, providing exceptional coverage of majors, minors, and exotic pairs. This extensive forex selection caters to diverse trading strategies from scalping popular pairs to capturing volatility in emerging market currencies.

The addition of 120+ stock CFDs represents a substantial expansion into equity markets, allowing traders to access leading US companies without the complexity of direct share ownership. Cryptocurrency offerings include all major digital assets with leverage up to 10:1 (VFSC) or 2:1 (ASIC), striking a balance between opportunity and risk management.

| Asset Class | Number | Examples | Typical Spreads |

|---|---|---|---|

| Forex | 90+ pairs | EUR/USD, GBP/JPY, AUD/NZD | From 0.0 pips |

| Indices | 15+ | S&P 500, FTSE 100, DAX 40 | From 0.4 points |

| Commodities | 10+ | Gold, Silver, Oil, Gas | Competitive |

| Stocks | 120+ | Apple, Amazon, Tesla | Variable |

| Cryptocurrencies | 15+ | BTC, ETH, XRP | Market-based |

Trading Platforms

Fusion Markets embraces platform diversity by offering four distinct trading environments. MetaTrader 4 remains the cornerstone platform, beloved for its stability, extensive indicator library, and vast ecosystem of Expert Advisors. The broker's MT4 implementation includes all standard features plus optimized servers ensuring sub-30ms execution speeds for most trades.

MetaTrader 5 adds multi-asset capabilities, enhanced charting with 21 timeframes, and superior backtesting functionality. The platform's depth of market display and advanced pending order types appeal to sophisticated traders requiring granular control over entries and exits.

Trading Platforms Comparison Table

| Feature | MT4 | MT5 | TradingView | cTrader |

|---|---|---|---|---|

| Technical Indicators | 30+ | 38+ | 100+ | 65+ |

| Timeframes | 9 | 21 | 15 | 26 |

| Order Types | Basic | Advanced | Basic | Advanced |

| Copy Trading | Yes | Yes | Social | Yes |

| Mobile Apps | iOS/Android | iOS/Android | iOS/Android | iOS/Android |

| Automated Trading | EAs | EAs/Robots | Pine Script | cBots |

Fusion Markets How to Open an Account: A Step-by-Step Guide

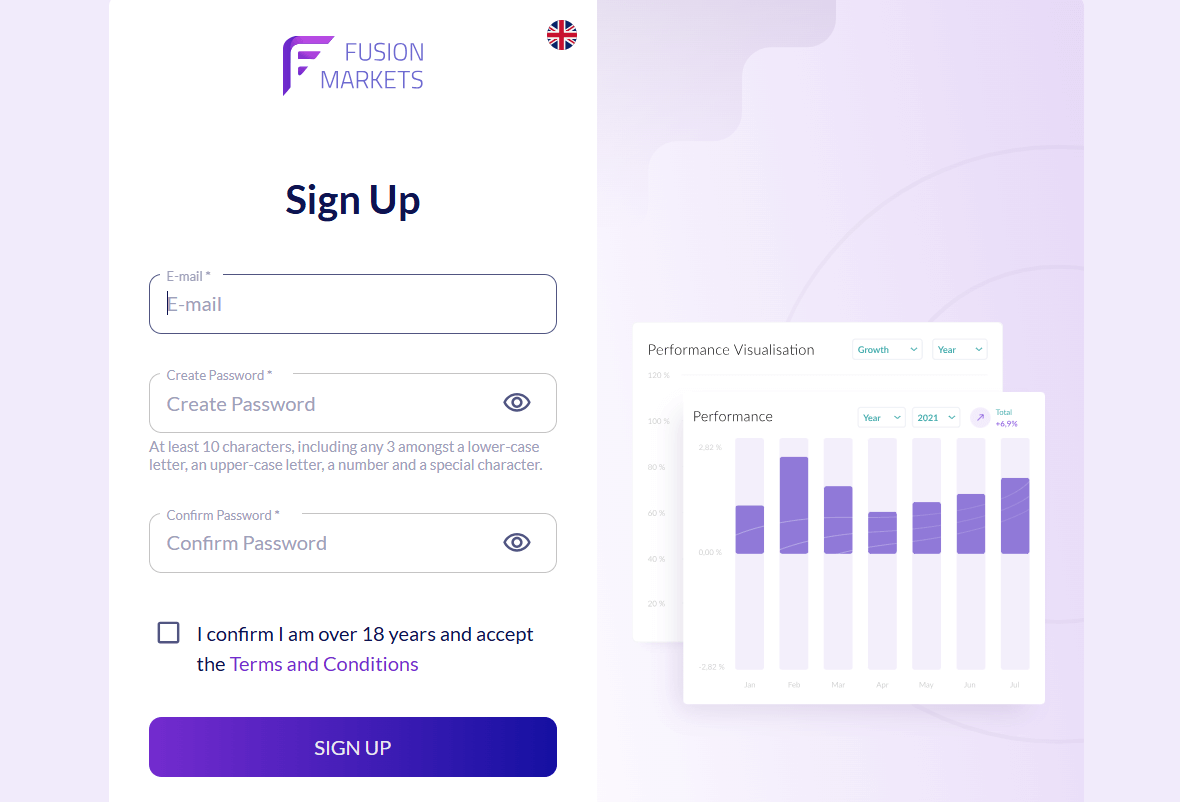

Opening an account with Fusion Markets is a straightforward and user-friendly process. The broker has streamlined the registration procedure to ensure that traders can start exploring the markets quickly and easily.

- No minimum deposit

- Valid government-issued ID (passport, driver's license, or national ID card)

- Proof of residence (utility bill, bank statement, or credit card statement)

Step-by-Step Guide:

- Visit the Fusion Markets website (fusionmarkets.com) and click on the "Open an Account" button.

- Fill in your email address and create a strong password.

- Select your preferred account type (Classic or Zero) and base currency.

- Provide your personal information, including full name, date of birth, address, and phone number.

- Complete the brief trading experience questionnaire.

- Upload your identification documents (proof of identity and proof of residence).

- Choose your preferred trading platform (MT4 or MT5) and download the software.

- Fund your account using one of the available payment methods.

- Start trading once your account is verified and funded.

Charts and Analysis

Fusion Markets provides a range of tools and resources to help traders analyse the markets and make informed decisions. While the broker's educational offerings may not be as extensive as some larger competitors, they focus on delivering high-quality, actionable insights to support their clients' trading journeys.

| Category | Details |

|---|---|

| Analyst Views | Daily expert insights on key events, trade ideas, and market strategies. |

| Technical Insights | Detailed analysis including chart patterns, indicators, and trade setups. |

| Market Buzz | AI-driven tool aggregating news & social sentiment for real-time trends. |

| Charting Platforms | MT4 & MT5 with advanced indicators, plus TradingView integration. |

| Economic Calendar | Live updates on global economic events to support strategy planning. |

| Webinars | Live sessions on trading techniques, market outlooks, and platform use. |

| Video Tutorials | Step-by-step guides on MT4/MT5 usage and core trading concepts. |

| eBooks & Articles | Educational content covering beginner to advanced topics and strategies. |

| Industry Standing | While less extensive than top-tier brokers, Fusion Markets focuses on high-quality, practical resources to support trader success. |

Fusion Markets Account Types

The Classic account suits newcomers with its commission-free structure and competitive spreads from 0.9 pips. Zero accounts target cost-conscious active traders, offering raw spreads plus transparent commission. The availability of Swap-Free accounts addresses a previously identified gap, enabling Muslim traders to participate without conflicting with Islamic finance principles. Pro accounts provide institutional-grade conditions with reduced commissions for high-volume traders meeting the $50,000 minimum deposit requirement.

Accounts Comparison Table

| Account Feature | Classic | Zero | Swap-Free | Pro |

|---|---|---|---|---|

| Minimum Deposit | $0 | $0 | $0 | $50,000 |

| Spreads From | 0.9 pips | 0.0 pips | 0.9 pips | 0.0 pips |

| Commission | None | $4.50/lot RT | None | $3.50/lot RT |

| Max Leverage | 500:1* | 500:1* | 500:1* | 500:1* |

| Overnight Fees | Yes | Yes | No | Yes |

| Target Audience | Beginners | Active Traders | Islamic Traders | Institutions |

Negative Balance Protection

negative balance protection is an essential safety net that shields traders from losses exceeding their account balance. Fusion Markets' ASIC-regulated entity provides this protection to retail clients, demonstrating the broker's dedication to risk management and client satisfaction. As with any trading activity, however, traders should still employ responsible risk management practices and carefully consider the potential drawbacks of high leverage.

Fusion Markets Deposits and Withdrawals

Fusion Markets maintains a trader-friendly approach to account funding by absorbing all deposit and withdrawal fees on their end. The variety of payment methods accommodates global clients, from traditional bank transfers to modern e-wallets and cryptocurrency options. Processing times remain competitive, with most withdrawals completed within 48 hours of approval.

| Method | Deposit Time | Withdrawal Time | Fees | Min Amount |

|---|---|---|---|---|

| Visa/Mastercard | Instant | 1-5 days | $0 | None |

| Bank Wire | 1-3 days | 2-5 days | $0* | None |

| Skrill | Instant | 1-2 days | $0 | None |

| Neteller | Instant | 1-2 days | $0 | None |

| BitPay | 30 mins | 1-2 days | $0 | None |

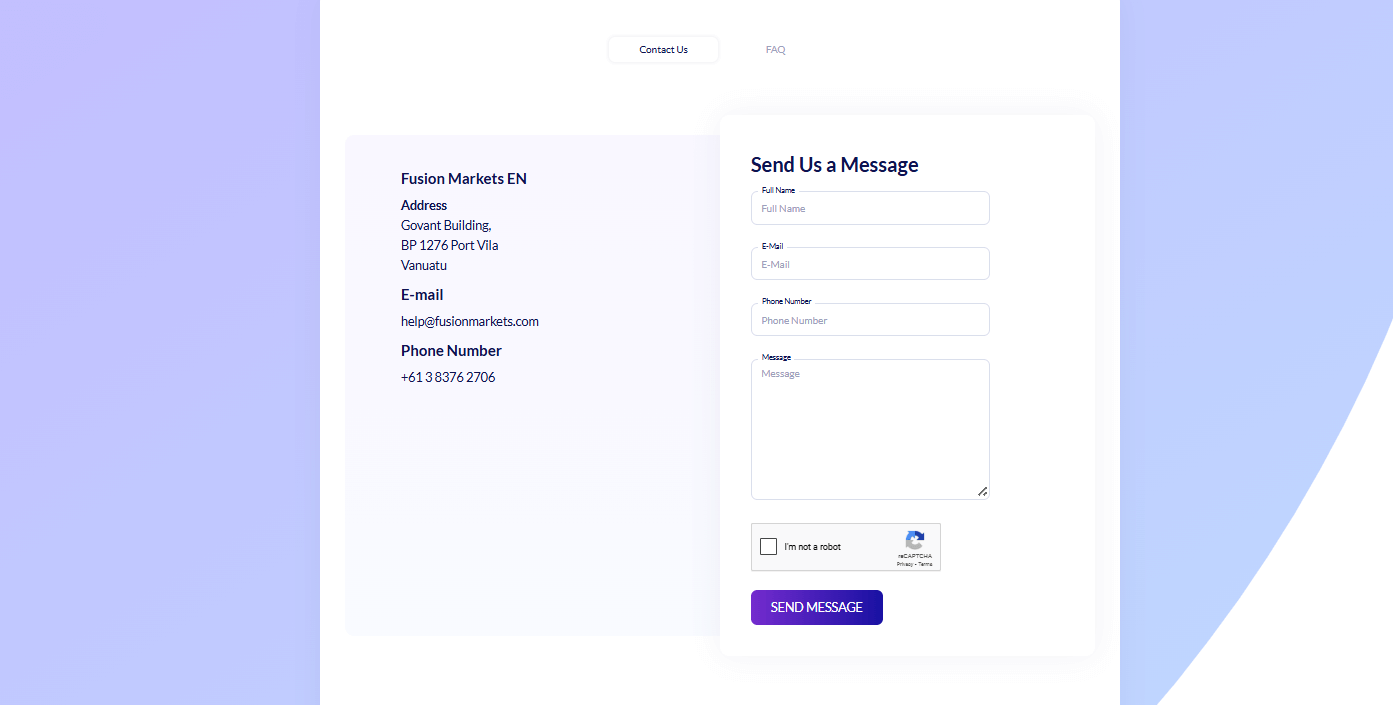

Support Service for Customer

Support quality extends beyond availability metrics. The team demonstrates strong product knowledge, efficiently resolving platform issues, account queries, and trading-related questions. While currently English-only, the support staff includes members familiar with various international markets, providing culturally aware assistance to global clients.

| Support Channel | Availability | Response Time | Languages |

|---|---|---|---|

| Live Chat | 24/7 | <2 minutes | English |

| 24/7 | <24 hours | English | |

| Phone | Business hours | Immediate | English |

| Social Media | Daily monitoring | <4 hours | English |

Prohibited Countries

Fusion Markets maintains strict adherence to international financial regulations, resulting in service restrictions for residents of certain jurisdictions. These limitations stem from complex regulatory requirements, licensing obligations, and the broker's strategic decision to focus resources on markets where they hold appropriate authorizations.

Countries where Fusion Markets cannot provide services:

| Region | Restricted Countries | Reason for Restriction |

|---|---|---|

| North America | United States, Canada | Stringent CFTC/NFA and IIROC regulations |

| Europe | All EU member states | MiFID II compliance requirements |

| Asia-Pacific | Japan, New Zealand | FSA Japan and FMA licensing requirements |

| Other | Various sanctioned nations | International compliance obligations |

Special Offers for Customers

Fusion Markets maintains a no-bonus policy, aligning with their transparent, professional approach. Rather than temporary promotions, they focus on consistently delivering:

- Permanently low trading costs through tight spreads and competitive commissions

- No hidden fees on deposits, withdrawals, or account maintenance

- Free VPS eligibility for active traders meeting volume requirements

- Refer-a-friend programs offering mutual benefits without affecting trading conditions

Conclusion

After thorough analysis incorporating the latest fact-checked information, I find Fusion Markets has evolved into a more comprehensive broker than initially apparent. Their triple regulation across ASIC, VFSC, and FSA jurisdictions provides exceptional regulatory coverage rarely seen among mid-sized brokers. The expansion to 250+ instruments and 90+ forex pairs positions them competitively against larger rivals.

The addition of TradingView and cTrader alongside MT4/MT5 addresses previous platform limitations, offering traders genuine choice in their trading environment. Particularly noteworthy is the introduction of Islamic accounts, expanding accessibility to Muslim traders previously excluded from their services.

Their core value proposition—institutional-grade pricing with minimal fees—remains intact while adding features that broaden market appeal. The $0 minimum deposit, absence of inactivity fees, and free deposit/withdrawal processing create an accessible environment for traders at all levels.

However, geographic restrictions limiting access from major markets (US, EU, Japan) remain a significant constraint on growth potential. Educational resources, while present, lag behind comprehensive offerings from tier-1 brokers, potentially challenging complete beginners.