FXCM Review 2025: A Reliable Forex Broker for Serious Traders

FXCM

United Kingdom

United Kingdom

-

Minimum Deposit $50

-

Withdrawal Fee $40

-

Leverage 400:1

-

Spread From 1.2

-

Minimum Order 0.01

-

Forex Available

-

Crypto Available

-

Stock Available

-

Indices Available

Licenses

United Kingdom Market Making (MM)

United Kingdom Market Making (MM)

Cyprus Market Making (MM)

Cyprus Market Making (MM)

South Africa Retail Forex License

South Africa Retail Forex License

Australia Retail Forex License

Australia Retail Forex License

Softwares & Platforms

Customer Support

+442073984050

(English)

+442073984050

(English)

Supported language: Arabic, Chinese (Simplified), English, French, German, Italian, Spanish

Social Media

Summary

FXCM (Forex Capital Markets) is a well-established global broker that provides access to forex, CFDs, cryptocurrencies, and other financial instruments. Known for its user-friendly platforms, such as Trading Station and MetaTrader 4 (MT4), FXCM caters to both beginner and experienced traders. The broker also offers educational resources, market research, and competitive pricing to enhance the trading experience.

- Strong regulation by top-tier authorities like FCA, ASIC, and CySEC.

- 20+ years of industry experience and reputation.

- Competitive spreads starting from 0.2 pips on major forex pairs.

- Wide range of powerful trading platforms, including MT4 and proprietary Trading Station.

- Quality educational resources like webinars, guides, and market analysis.

- 24/5 multilingual customer support via live chat, phone, and email.

- Low $50 minimum deposit requirement.

- Demo accounts are available for practice trading.

- 99.7% trade execution fill rate and robust trading infrastructure.

- Negative balance protection for retail clients.

- Limited range of non-CFD assets like stocks and bonds.

- Relatively high $40 fee for bank withdrawals.

- $50 inactivity fee after 12 months of no trading.

- Past regulatory issues in the US market.

- Maximum leverage of 1:30 may be limiting for some traders.

- No current promotions or loyalty programs.

- Doesn't accept clients from several countries, including the US, Iran, and North Korea.

- Restricted cryptocurrency trading for UK retail clients.

- Lack of investor protection for some entities.

- Limited integration with third-party trading tools.

Overview

FXCM is a reputable forex broker established in 1999, with a global presence across the UK, Australia, South Africa, and Cyprus. Regulated by top-tier authorities like the FCA, ASIC, and CySEC, FXCM offers a secure trading environment for forex, CFDs, and cryptocurrencies. With competitive spreads starting at 0.2 pips, a low $50 minimum deposit, and support for popular platforms like MT4 and Trading Station, FXCM caters to both beginners and algorithmic traders. The broker provides educational resources and tools to support traders' growth. However, FXCM's product range is limited compared to some competitors, and it charges high non-trading fees, such as a $40 bank withdrawal fee. Leverage is capped at 1:30, and investor protection varies by entity. Despite these drawbacks, FXCM's longevity, strong regulation, and commitment to technology make it a solid choice for many traders. Visit fxcm.com for more information.

FXCM Overview Table

| Feature | Details |

| Regulation | FCA (UK), ASIC (Australia), CySEC (Cyprus) |

| Founded | 1999 |

| Headquarters | London, UK |

| Instruments | Forex, CFDs (indices, commodities, crypto) |

| Platforms | MT4, Trading Station, ZuluTrade |

| Minimum Deposit | $50 |

| Spreads | From 0.2 pips (EUR/USD) |

| Leverage | Up to 1:30 |

| Withdrawal Fees | Up to $40 (bank transfer) |

| Investor Protection | Varies by entity, up to £85,000 (UK) |

| Education | Guides, webinars, videos, market analysis |

FXCM Licenses and Regulatory

FXCM is well-regulated, holding licenses from top-tier authorities like the FCA (UK) and ASIC (Australia). These regulators enforce strict standards for financial stability, transparency, and customer protection. Multiple licenses demonstrate FXCM's commitment to compliance and ability to serve clients globally. Compared to the industry, FXCM ranks highly in terms of regulatory oversight. However, investor protection varies by entity, with the FCA offering up to £85,000 and CySEC up to €20,000. FXCM's strong regulation instills trust, though traders should understand the implications of each license.

| Regulatory Authority | Country/Region |

|---|---|

| Financial Conduct Authority (FCA) | United Kingdom |

| Australian Securities and Investments Commission (ASIC) | Australia |

| Financial Sector Conduct Authority (FSCA) | South Africa |

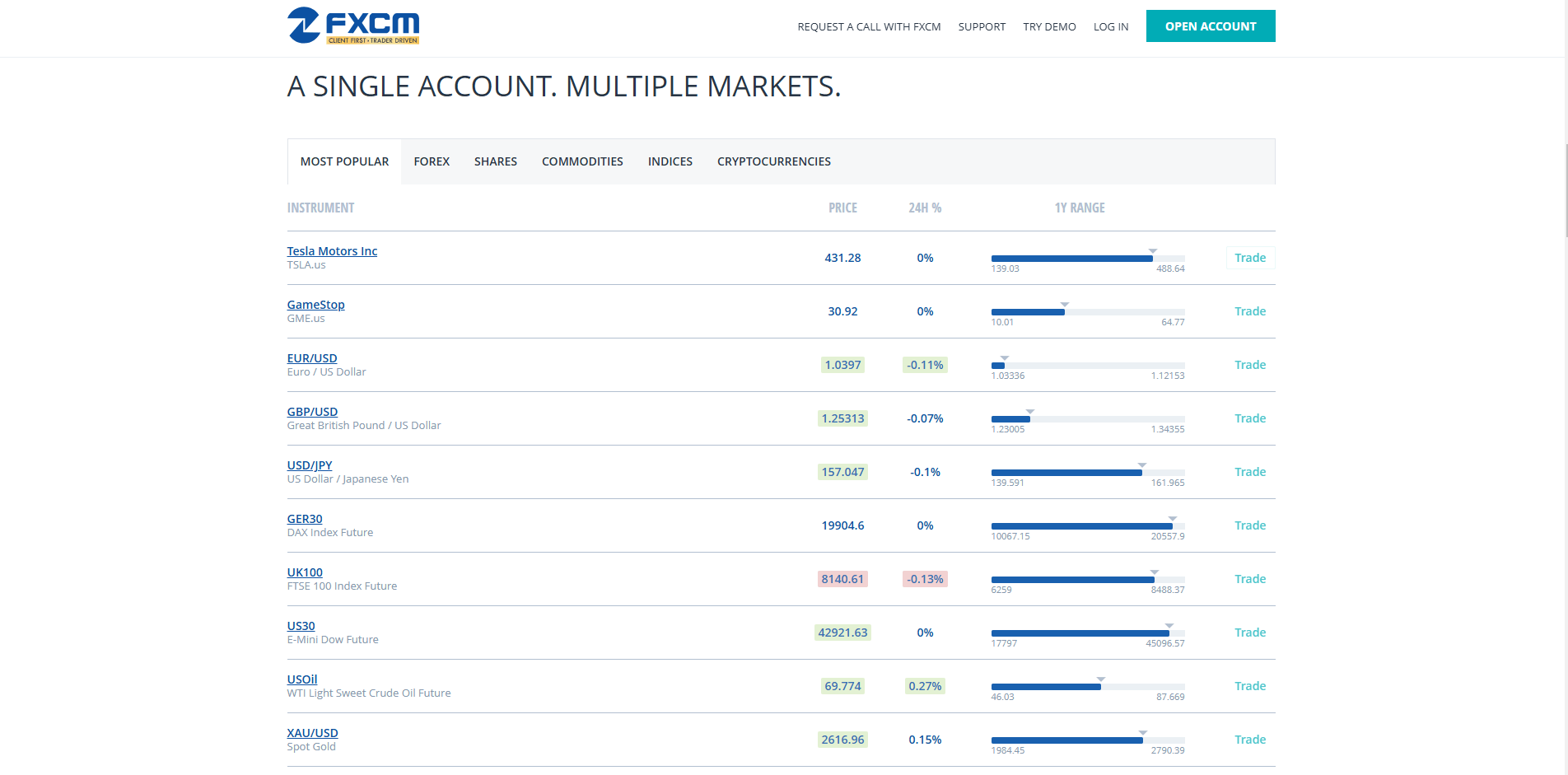

Trading Instruments

FXCM offers a limited range of tradable assets compared to some competitors:

| Asset Class | Details | Key Features |

|---|---|---|

| Forex | 30+ currency pairs (majors, minors, exotics) | Spreads from 0.2 pips (e.g., EUR/USD) |

| CFDs - Indices | 14 global stock indices | Diversified exposure to global markets |

| CFDs - Commodities | Metals, energies, agricultural products | Includes gold, oil, and agricultural goods |

| CFDs - Cryptocurrencies | Bitcoin, Ethereum, Litecoin | Trade popular digital assets |

| CFDs - Shares | 3000+ global company stocks | Access to shares from multiple industries |

While FXCM covers key asset classes, it lacks non-CFD equities, bonds, options, and futures trading. Forex remains its core offering.

Trading Platforms

FXCM offers several popular platforms:

MetaTrader 4 (MT4)

Industry-standard platform with advanced charting, Expert Advisors, and mobile apps.

Trading Station

FXCM's flagship platform with a customizable layout, integrated news and analysis, and algorithmic trading.

ZuluTrade

A social trading platform to follow and copy strategies from top traders.

Web and Mobile

Browser-based and iOS/Android app versions of MT4 and Trading Station for on-the-go access.

FXCM Trading Platforms Comparison Table

| Feature | MT4 | Trading Station |

| Charting | Advanced | Advanced |

| Indicators | 50+ | 65+ |

| Expert Advisors | Yes | Yes |

| Algorithmic Trading | Yes | Yes |

| Mobile Apps | Yes | Yes |

| Web Platform | No | Yes |

| News & Analysis | Basic | Advanced |

| Social Trading | No | Via ZuluTrade |

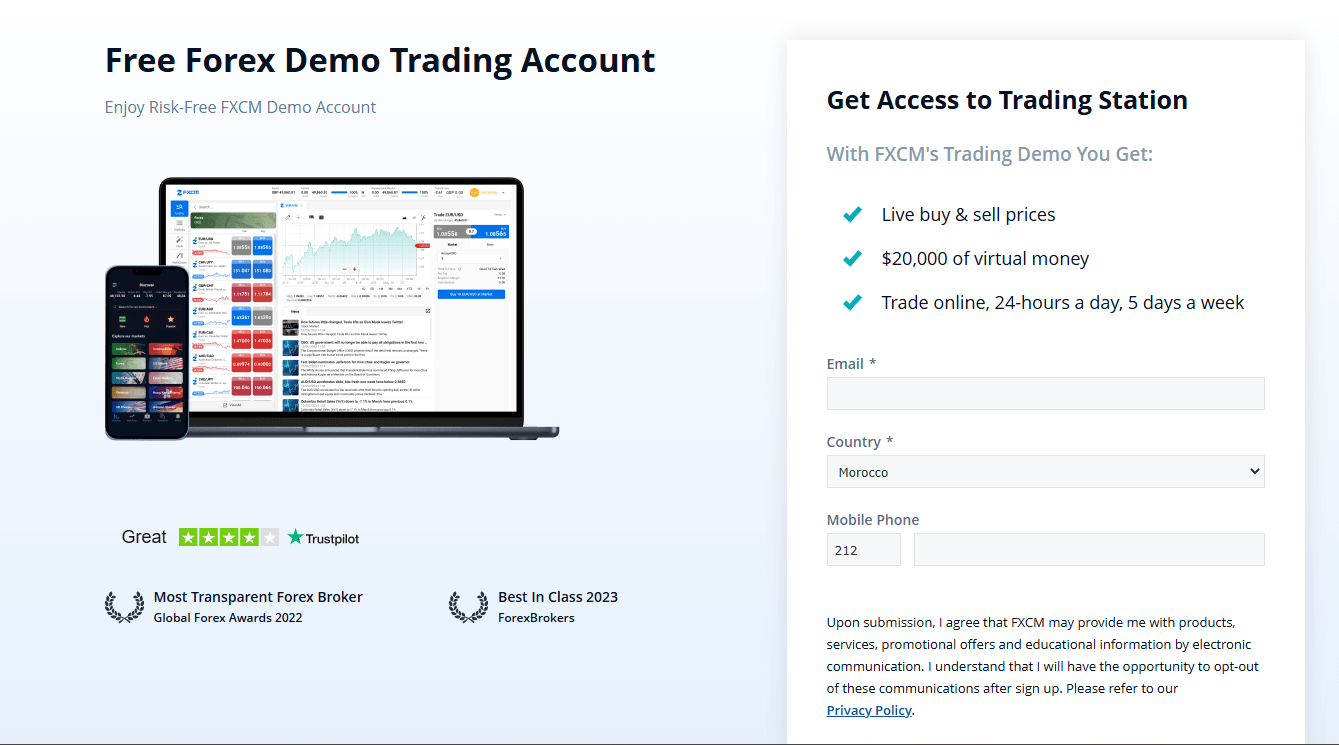

FXCM How to Open an Account: A Step-by-Step Guide

Opening an FXCM account involves a few simple steps:

Step 1: Visitfxcm.com and click "Open Account."

Step 2: Choose account type (Standard or Active Trader).

Step 3: Provide personal info (name, address, etc.).

Step 4: Upload ID and proof of residence.

Step 5: Answer financial experience questions.

Step 6: Select base currency and leverage.

Step 7: Choose a trading platform.

Step 8: Fund account ($50 minimum) via card, bank transfer, Skrill, or Neteller.

Account approval typically takes under 24 hours. See FXCM's website for full details.

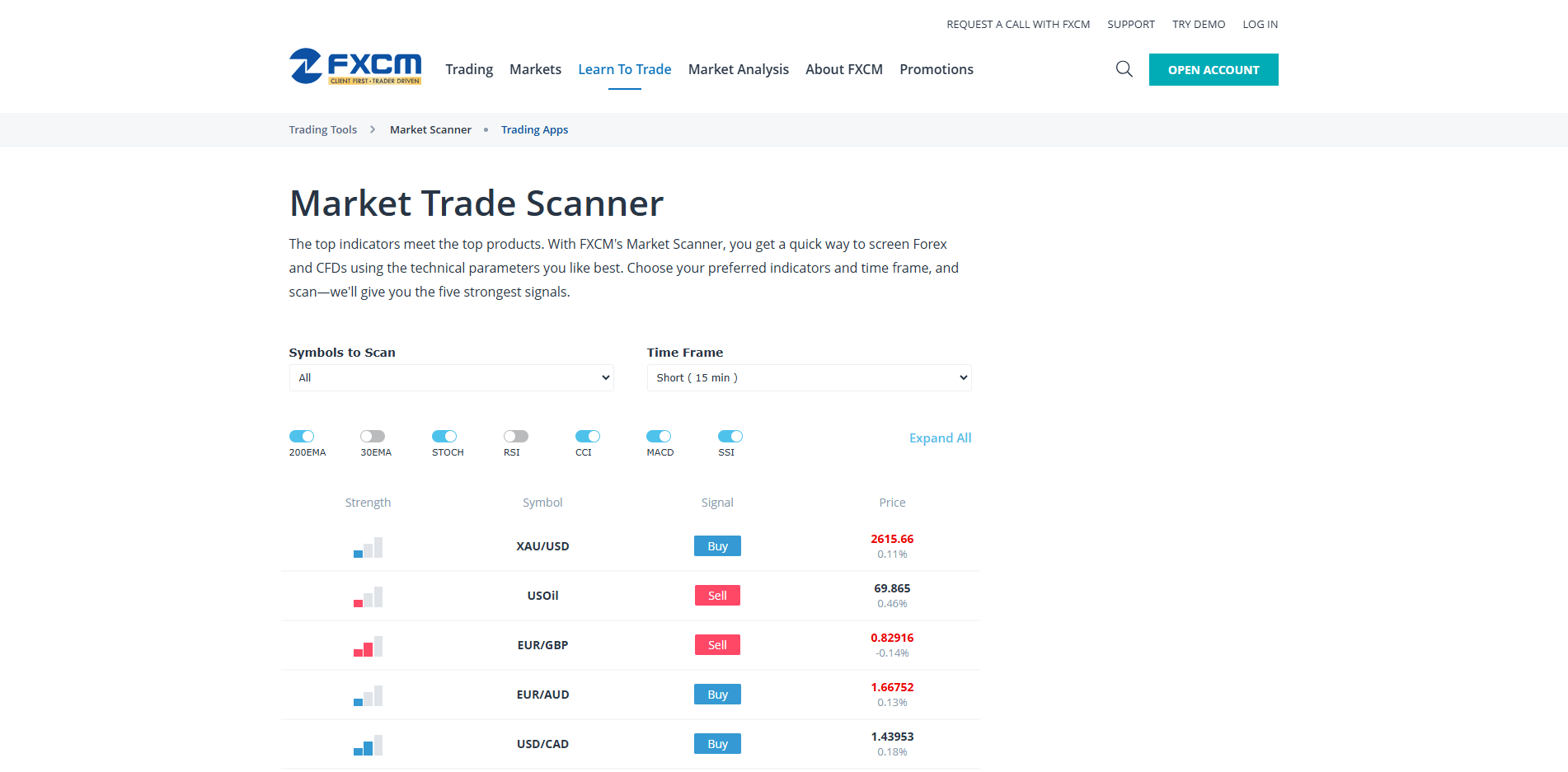

Charts and Analysis

FXCM provides a solid range of educational resources:

- Free live webinars on trading topics

- Trading guides and video tutorials

- Economic calendar with market events

- In-depth research and technical analysis

- Real-time news from Reuters, FxWirePro

- MarketMood behavioral analysis tool

While comprehensive, FXCM's educational content is somewhat standard for the industry. More advanced resources and a larger video library would further enhance their offerings.

FXCM Account Types

FXCM offers two main account options that fulfill the needs of both amateur and professional traders:

| Feature | Standard | Active Trader |

|---|---|---|

| Min. Deposit | $50 | $25,000 |

| Spreads | From 0.2 pips | From 0.1 pips |

| Leverage | Up to 1:30 | Up to 1:30 |

| Dedicated Support | No | Yes |

| VPS Service | No | Yes |

| Target Audience | New Traders | High-Volume Traders |

| Demo Account | Available | Available |

Negative Balance Protection

FXCM provides negative balance protection for retail clients in its regulated entities (UK, EU, Australia). This means clients cannot lose more than their account balance, even in extreme market volatility. If an account goes into negative equity, FXCM will zero out the balance and absorb the loss, rather than pursuing the client for additional funds. However, this protection may not apply to professional clients or those with FXCM's offshore entity. Clients should understand the specific terms based on their categorization and entity.

FXCM Deposits and Withdrawals

Deposit Methods

FXCM accepts the following deposit methods:| Deposit Method | Details | Minimum Deposit | Fees |

|---|---|---|---|

| Bank Wire Transfer | Direct transfer from bank account | $50 | No deposit fees |

| Credit/Debit Cards | Visa, Mastercard | $50 | No deposit fees |

| E-wallets | Skrill, Neteller | $50 | No deposit fees |

| Local Bank Transfers | Available in EU and Australia | $50 | No deposit fees |

Withdrawal Method

For withdrawals, options include:| Method | Fees | Processing Time | Details |

|---|---|---|---|

| Bank Wire Transfer | $40 fee | 1-5 business days | Suitable for larger transactions |

| Credit Card | Free (for deposits only) | 1-5 business days (withdrawal) | Only applicable to deposit amounts |

| Skrill and Neteller | Free | 1-5 business days | Fast and secure e-wallet transactions |

- Credit card withdrawals limited to initial deposit amount

- Withdrawals must go back to the original funding source.

- Additional documentation may be required for withdrawals.

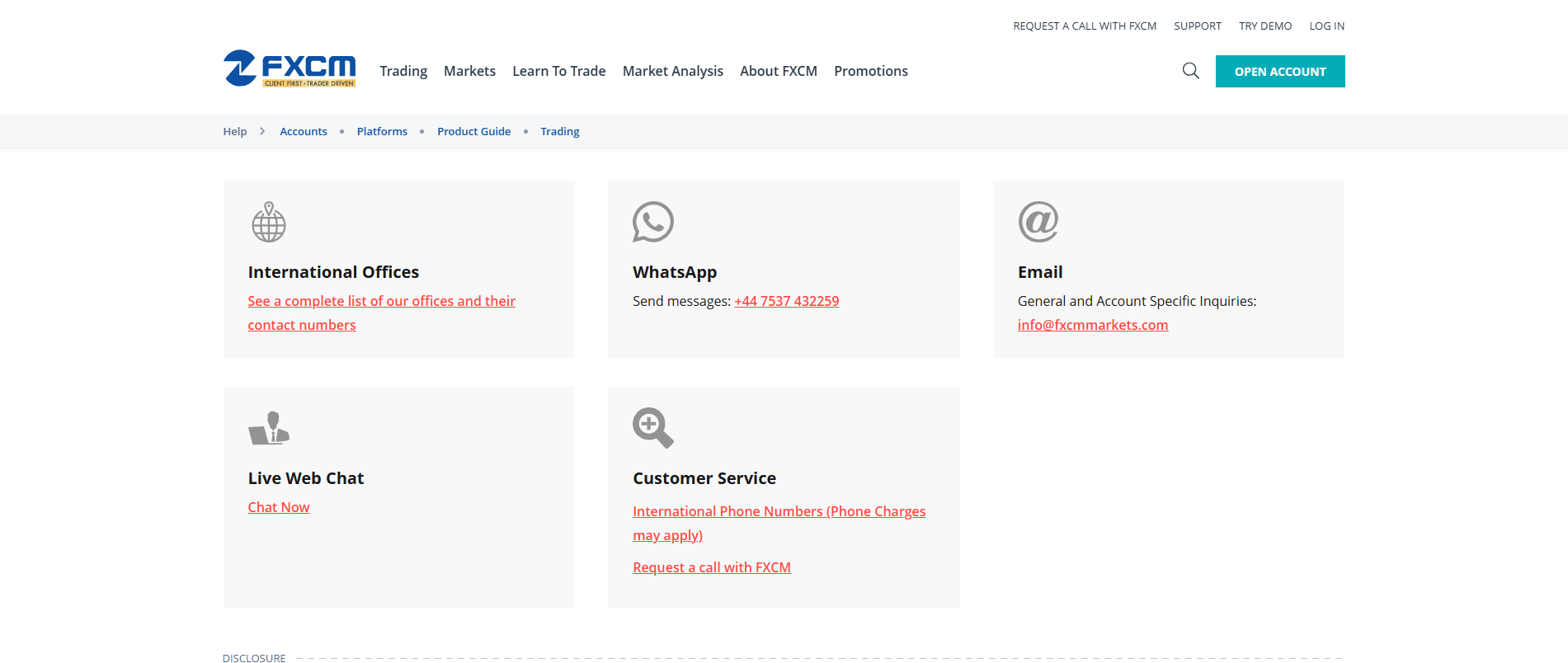

Support Service for Customer

FXCM offers 24/5 support via:

| Support Channel | Availability | Details |

|---|---|---|

| Live Chat | 24/5 | Real-time support; available during trading days. |

| Phone | 24/5 | Local numbers available in 16 countries. |

| 24/5 | Contact via info@fxcm.com or support@fxcm.com. | |

| Online Help Center | 24/7 | Self-help resources at support.fxcm.com. |

| Languages Supported | 18 languages | Multilingual support to cater to global clients. |

Response times vary but aim for under 5 minutes for chat, 10 minutes for phone, and 1 hour for email.

Quality support is critical for a positive trading experience. FXCM's multilingual 24/5 coverage across key channels meets industry standards.

Response times vary but aim for under 5 minutes for chat, 10 minutes for phone, and 1 hour for email.

Quality support is critical for a positive trading experience. FXCM's multilingual 24/5 coverage across key channels meets industry standards.

Prohibited Countries

FXCM does not accept clients from the following countries due to regulatory restrictions:

- United States

- Japan

- Brazil

- Hong Kong

- Israel

- Iran

- North Korea

- Cuba

- Syria

- Sudan

- Turkey

- Russia

These restrictions are based on licensing requirements and geopolitical factors. For example, FXCM withdrew from the US market in 2017 after a settlement with the CFTC.

Attempting to trade from a prohibited country violates FXCM's terms of service and could lead to account termination and funds being withheld.

Clients should only access FXCM's services from countries where it is legally permitted to operate. See FXCM's website for the most up-to-date list of restricted countries.

Regions where FXCM can operate:

- Europe, Asia (except prohibited countries), Africa, Australia/Oceania, South America (except Brazil), Central America, the Caribbean, Canada

Special Offers for Customers

FXCM does not currently appear to offer any special promotions or bonuses for new or existing clients. The broker focuses on providing competitive spreads, reliable execution, and quality educational resources rather than promotional incentives.

This aligns with FXCM's overall positioning as a reputable, long-standing broker that prioritizes client service and trading conditions over short-term promotional offers. The lack of bonuses also ensures compliance with regulatory guidelines in many jurisdictions that restrict such incentives.

While some traders may be drawn to brokers offering sign-up bonuses or other promotions, the absence of these offers at FXCM should not be seen as a drawback. Traders should prioritize factors like regulation, trading costs, platform quality, and customer support when choosing a broker.

Always check FXCM's website or contact their customer support for the most up-to-date information on any special offers, as promotions may change over time. However, as of now, there are no active promotions to list or discuss in detail.

Conclusion

Review & Conclusion: After thoroughly reviewing FXCM, I believe they are a reliable and trustworthy forex broker. With over 20 years in the industry, FXCM has established itself as a reputable player in the online trading space.

One of FXCM's key strengths is their strong regulatory compliance. They are overseen by top-tier regulators like the FCA, ASIC, and CySEC, which ensures a high level of financial security and transparency. While the level of client protection varies by entity, with the UK offering the most robust scheme, FXCM generally provides a safe trading environment.

In terms of trading experience, FXCM offers a solid range of forex and CFDs, though their selection is more limited than some competitors. However, they make up for this with competitive pricing, with spreads as low as 0.2 pips on major pairs. The broker's suite of trading platforms, including the popular MT4 and their proprietary Trading Station, caters well to both beginners and more experienced traders.

FXCM also stands out for its commitment to education, with a good array of articles, webinars, and analytical tools to support trader development. The broker's customer service is another highlight, with 24/5 multilingual support via phone, email, and live chat.

While FXCM does have some shortcomings, like a lack of non-CFD assets, limited long-term trader incentives, and a past regulatory issue in the US, overall, they offer a compelling proposition for those seeking a well-rounded and reliable forex broker.

Check mobile-app scores inside the broker tech reviews hub.

See multi-platform support in the Admirals review.