FXGlory Review 2025: Pros and Cons, and Crucial Considerations

FXGlory

Saint Vincent and the Grenadines

Saint Vincent and the Grenadines

-

Minimum Deposit $1

-

Withdrawal Fee $5

-

Leverage 3000:1

-

Spread From 0.1

-

Minimum Order 0.01

-

Forex Available

-

Crypto Unavailable

-

Stock Unavailable

-

Indices Unavailable

Licenses

Softwares & Platforms

Customer Support

+442037696830

(English)

+442037696830

(English)

Supported language: Arabic, English, Russian, Spanish

Social Media

Summary

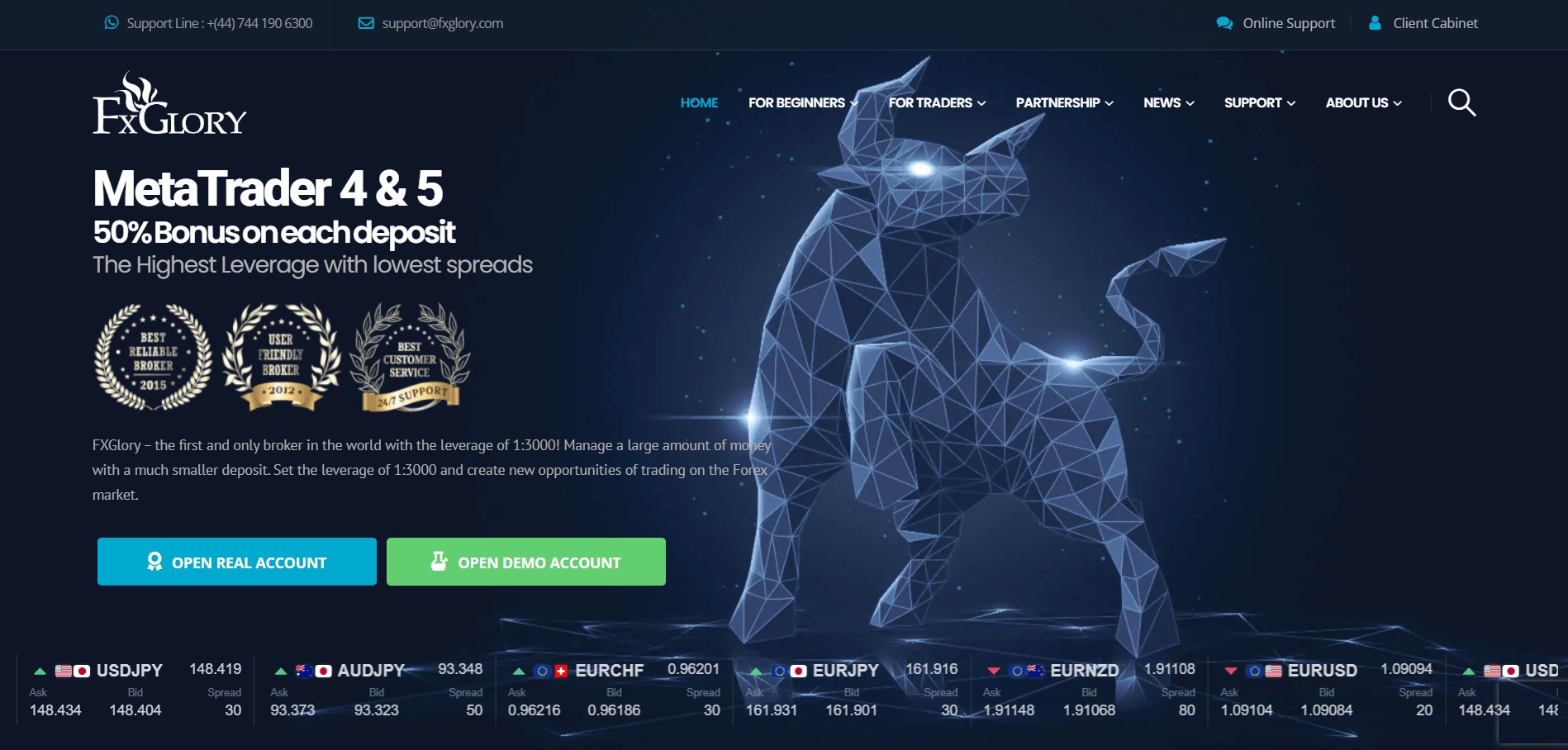

FXGlory is a forex and CFD broker known for its accessible trading conditions, including a low minimum deposit requirement of just $1. The broker offers various account types with high leverage options, fixed spreads, and commission-free trading. FXGlory supports both MetaTrader 4 and MetaTrader 5 platforms, providing a user-friendly experience for traders of all levels. With a focus on customer support and fast execution, FXGlory aims to cater to both beginner and experienced traders.

- Low minimum deposit of $1 for Standard accounts

- Supports popular MetaTrader 4 and 5 platforms

- Offers high leverage up to 1:3000

- Provides a 50% deposit bonus (terms apply)

- Supports a wide range of payment methods, including credit/debit cards, e-wallets, and cryptocurrencies

- Not regulated by any major financial authority

- High withdrawal fees ranging up to 9%

- Mixed user reviews, with concerns about withdrawal issues and customer support

- Limited educational resources and market analysis compared to competitors

- Potential risks associated with offshore registration and lack of regulatory oversight

Overview

FXGlory is an online forex and CFD broker that was established in 2011. Based out of Saint Vincent and the Grenadines, FXGlory has grown its presence to include offices in the UK, Malaysia, Cyprus, and Spain. While the broker is not regulated by major financial authorities, it has operated for over 14 years and attracts traders with its high leverage offerings up to 1:3000, low minimum deposit of just $1, and support for the popular MetaTrader 4 and 5 platforms.

FXGlory provides access to a limited range of trading instruments, mainly focusing on forex currency pairs, precious metals like gold and silver, and some commodities like oil. The broker offers four main account types - Standard, Premium, VIP, and CIP - which cater to different trading styles and budgets. Islamic swap-free accounts are also available.

One notable aspect of FXGlory is the very wide range of payment methods supported, including credit/debit cards, various e-wallets like PayPal, Skrill, and Neteller, cryptocurrencies, and traditional bank wire transfers. The broker does not charge any deposit fees. However, withdrawals incur a complex fee structure ranging from 0-9% depending on the amount and processor.

For more details on FXGlory's offerings, traders can visit the official website at fxglory.com. While the broker provides opportunities with its high leverage and bonuses, potential clients should carefully consider the risks that come with trading with an unregulated offshore entity. As always, thorough research and comparison with other brokers is recommended before signing up.

Overview Table

| Field | Details |

|---|---|

| Broker Name | FXGlory |

| Founded | 2011 |

| Headquarters | Saint Vincent and the Grenadines |

| Regulation | Unregulated |

| Minimum Deposit | $1 |

| Maximum Leverage | 1:3000 |

| Instruments | Forex, metals, oil |

| Trading Platforms | MetaTrader 4, MetaTrader 5 |

| Account Types | Standard, Premium, VIP, CIP |

| Website | fxglory.com |

Facts List

- FXGlory was established in 2011 and is based in Saint Vincent and the Grenadines.

- The broker is not regulated by any major financial authorities like FCA, ASIC or CySEC.

- The maximum leverage offered is very high at 1:3000.

- The minimum deposit required is just $1, making it accessible to a wide range of traders.

- FXGlory supports the popular MetaTrader 4 and MetaTrader 5 trading platforms.

- The main instruments available for trading are forex currency pairs, precious metals like gold and silver, and some commodities like oil.

- Four account types are offered - Standard, Premium, VIP, and CIP - catering to different trading needs. Islamic swap-free accounts are also available.

- A very wide range of payment methods are supported including credit/debit cards, e-wallets like PayPal, Skrill, Neteller, cryptocurrencies, and bank wire.

- No deposit fees are charged. However, withdrawals incur fees ranging from 0-9% based on the amount and processor.

- As an unregulated offshore broker, traders should carefully consider the potential risks and weigh the pros and cons before signing up with FXGlory.

FXGlory Licenses and Regulatory

FXGlory operates as an offshore broker and is not regulated by any major financial authorities. The company is registered in Saint Vincent and the Grenadines, a jurisdiction known for its lax financial oversight.

The lack of regulation from respected bodies like the FCA (UK), ASIC (Australia), or CySEC (Cyprus) means that FXGlory is not held to the strict standards these authorities impose on brokers. Unregulated brokers are not required to segregate client funds, submit to regular audits, or provide the same level of transparency and consumer protection that regulated entities must.

For traders, using an unregulated broker comes with significantly higher risks. In the event of a dispute or the broker's insolvency, clients have little to no recourse for recovering their funds. Regulated brokers, in contrast, typically offer clients some protections through government-mandated compensation schemes if the company goes under.

The absence of oversight also means that there is no external body ensuring that FXGlory is adhering to best practices around trade execution, fee disclosures, or client order handling. Regulated brokers must comply with strict rules in these areas, which helps to foster a fairer trading environment.

List of FXGlory's Regulatory Licenses

- FXGlory does not currently hold any licenses with major regulatory bodies like the FCA, ASIC, CySEC, or others.

- The broker is registered in Saint Vincent and the Grenadines as an International Business Company (IBC), but this jurisdiction does not provide any significant regulatory oversight of forex brokers.

Trading Instruments

FXGlory offers a relatively limited selection of tradable assets compared to many other brokers. The company's focus is primarily on providing forex currency pairs, with some additional options in metals and commodities.

| Asset Class | Key Details |

|---|---|

| Forex | 28 currency pairs including majors (e.g., EUR/USD, GBP/USD), minors, and exotics. Spreads start at 0.2 pips (can widen to 2+ pips on less liquid pairs/high volatility). |

| Metals | Trading on spot gold and silver against the US dollar, enabling speculation on precious metal price movements. |

| Commodities | Spot contracts on crude oil (WTI and Brent), offering exposure to volatile energy markets. |

| What's Missing | FXGlory does not offer stocks, stock indices, or cryptocurrencies, which are commonly available at many other brokers. |

The lack of asset diversity at FXGlory may be a drawback for traders looking to construct varied portfolios or speculate on instruments beyond forex and commodities. However, for those focused primarily on currency trading, the broker's offerings may suffice.

Trading Platforms

FXGlory provides clients with access to the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) trading platforms. These industry-standard platforms offer a robust and user-friendly trading experience with a wide range of features.

MetaTrader 4 (MT4)

MT4 is the most widely used forex trading platform globally. It offers an intuitive interface, advanced charting tools, and the ability to automate trading strategies using Expert Advisors (EAs). Key features of MT4 include:

- 30 built-in technical indicators and 24 graphical objects for analysis

- 9 timeframes for each financial instrument

- 3 execution modes: Instant, Request, and Market

- One-click trading and trading from the chart

- Customizable alerts

- 21 timeframes for better analysis

- MQL4 programming language for creating EAs and indicators

- Available as a desktop application for Windows and Mac, web platform, and mobile apps for iOS and Android

MetaTrader 5 (MT5)

MT5 is the successor to MT4, offering even more advanced trading features and tools. Some key advantages of MT5 over MT4 include:

- Access to more markets including stocks, futures, and options

- 80+ pre-installed technical indicators and 40+ graphical objects

- 21 timeframes for analysis

- Depth of Market (DOM)

- Economic Calendar

- MQL5 programming language which is more efficient than MQL4

- Available as a desktop application for Windows and Mac, web platform, and mobile apps for iOS and Android

Web and Mobile Trading

For traders who prefer not to install software, FXGlory offers a web-based version of both MT4 and MT5 that can be accessed from any modern web browser. This provides flexibility and allows for trading from anywhere with an internet connection.

Mobile apps for iOS and Android devices are also available for both platforms, allowing traders to monitor their accounts and place trades on the go.

FXGlory Trading Platform Comparison

| Feature | MT4 | MT5 |

|---|---|---|

| Markets | Forex, CFDs | Forex, CFDs, Stocks, Futures |

| Technical Indicators | 30 | 80+ |

| Timeframes | 9 | 21 |

| One-Click Trading | Yes | Yes |

| Automated Trading | Yes (EAs) | Yes (EAs) |

| Web Platform | Yes | Yes |

| Mobile Apps | iOS, Android | iOS, Android |

FXGlory How to Open an Account: A Step-by-Step Guide

Opening an account with FXGlory is a straightforward process that can be completed online in a few simple steps. Here's what you need to do:

Step 1: Visit the FXGlory website at fxglory.com and click on the "Open a Real Account" button.

Step 2: Choose your preferred account type - Standard, Premium, VIP, or CIP. Each account type has different minimum deposit requirements and features.

Step 3: Fill out the registration form with your personal details, including your name, email address, phone number, and country of residence. You'll also need to create a password for your account.

Step 4: Select your preferred account currency (USD only) and leverage.

Step 5: Agree to the broker's terms and conditions and submit your registration.

Step 6: To activate your account and start trading, you'll need to verify your identity by providing some documents. This typically includes:

- Proof of identity: A copy of your passport, national ID card, or driver's license

- Proof of address: A copy of a recent utility bill, bank statement, or other official document showing your name and address

You can upload these documents directly in your FXGlory client area. The verification process usually takes 1-2 business days.

Step 7: Fund your account. Once your account is verified, you can make your initial deposit using one of the supported payment methods (see below). The minimum deposit varies by account type:

- Standard: $1

- Premium: $1,000

- VIP: $5,000

- CIP: $50,000

Step 8: Download the trading platform (MT4 or MT5) or use the web version, and start trading.

Supported Payment Methods: FXGlory supports a wide variety of payment methods for deposits and withdrawals, including:

- Credit/debit cards: Visa, Mastercard

- E-wallets: Skrill, Neteller, PayPal, WebMoney, Perfect Money, SticPay

- Cryptocurrencies: Bitcoin, Ethereum, and others

- Bank wire transfer

Deposit processing times are instant for most methods, except for bank wire, which can take a few business days. There are no deposit fees charged by FXGlory.

Charts and Analysis

FXGlory provides a limited selection of educational resources and trading tools compared to many other brokers in the industry. The focus seems to be more on providing the trading platforms and basic account functionality rather than extensive education.

| Category | Key Details |

|---|---|

| Charts | Uses MT4/MT5 charting tools with interactive charts (zoom, scroll, technical analysis), multiple chart types (line, bar, candlestick), and built-in technical indicators (30+ on MT4, 80+ on MT5). Trades can be placed directly from the chart. Functional and reliable, though not as advanced as some proprietary platforms. |

| Analysis Tools | A basic economic calendar available on the website that displays upcoming major economic events and data releases. Lacks advanced customization and filtering options; no additional standalone analysis tools are provided. |

| Educational Resources | Sparse content with a few short articles on basic forex concepts and glossary terms. No in-depth articles, video tutorials, webinars, or interactive courses are offered, which may limit support for beginner traders seeking comprehensive education. |

| Market News & Analysis | No market news updates, daily reports, or analyst commentary on the website. Traders need to rely on third-party sources for market insights and timely updates on market conditions. |

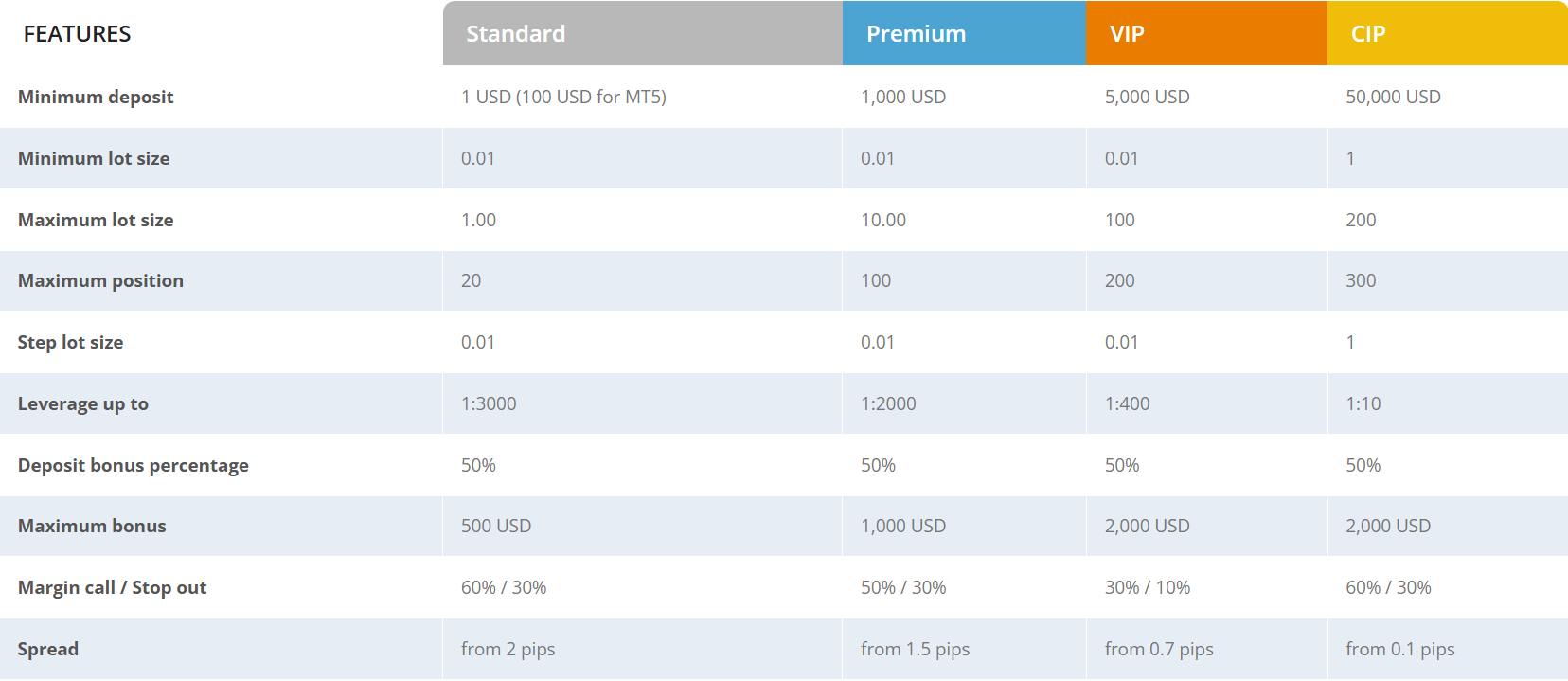

FXGlory Account Types

FXGlory offers four main types of trading accounts to cater to the needs of different traders: Standard, Premium, VIP, and CIP. Each account type comes with its own set of features and benefits.

Standard Account

The Standard account is the entry-level option, suitable for novice traders or those looking to start with a low initial investment. Key features include:

- Minimum deposit: $1 for MT4, $100 for MT5

- Leverage: Up to 1:3000

- Minimum order size: 0.01 lots

- Maximum trade size: 1 lot

- Spread: From 2 pips

- 50% deposit bonus up to $500

This account provides access to all the tradable instruments and the MT4/MT5 platforms. The low minimum deposit makes it highly accessible, though the spreads are higher than other account types.

Premium Account

The Premium account is a step up from the Standard, offering improved trading conditions for a higher minimum deposit. Features include:

- Minimum deposit: $1,000

- Leverage: Up to 1:2000

- Minimum order size: 0.01 lots

- Maximum trade size: 10 lots

- Spread: From 2 pips

- 50% deposit bonus up to $1,000

VIP Account

Designed for more experienced traders and those with larger investments, the VIP account provides enhanced benefits:

- Minimum deposit: $5,000

- Leverage: Up to 1:300

- Minimum order size: 0.01 lots

- Maximum trade size: 1,000 lots

- Spread: From 0.7 pips

- 50% deposit bonus up to $2,000

- Free VPS service

The higher maximum trade size and tighter spreads can be advantageous for high-volume traders. The included VPS service ensures stable and reliable trade execution.

CIP Account

The CIP (Capital Investment Program) account is tailored for high net worth individuals and institutional investors. It offers the most competitive trading conditions:

- Minimum deposit: $50,000

- Leverage: Up to 1:50

- Minimum order size: 1 lot

- Maximum trade size: 5 lots

- Spread: From 0.1 pips

The extremely low spreads and high minimum deposit set this account apart. However, the maximum leverage is significantly lower than other account types.

Demo Account

In addition to the live trading accounts, FXGlory also offers a demo account. This allows traders to practice trading strategies and familiarize themselves with the MT4/MT5 platforms using virtual funds, without risking real money.

Islamic Account

For traders who follow Islamic principles, FXGlory provides swap-free Islamic accounts. These accounts do not incur overnight interest charges, complying with Sharia law. Islamic accounts are available for all live account types.

FXGlory Account Types Comparison Table

| Feature | Standard | Premium | VIP | CIP |

|---|---|---|---|---|

| Min Deposit | $1 (MT4) / $100 (MT5) | $1,000 | $5,000 | $50,000 |

| Max Leverage | 1:3000 | 1:2000 | 1:300 | 1:50 |

| Spreads | From 2 pips | From 2 pips | From 0.7 pips | From 0.1 pips |

| Min Order | 0.01 lots | 0.01 lots | 0.01 lots | 1 lot |

| Max Trade | 1 lot | 10 lots | 1,000 lots | 5 lots |

| Size Deposit | 50% up to $500 | 50% | 50% | N/A |

| Bonus | $1,000 | $2,000 | – | – |

| Free VPS | No | No | Yes | Yes |

The variety of account types at FXGlory caters to a wide spectrum of traders, from beginners to high net worth individuals. The Standard account's low entry threshold makes it accessible to almost anyone, while the VIP and CIP accounts offer more competitive trading conditions for larger investments.

Negative Balance Protection

FXGlory does offer negative balance protection to its clients. This means that even if a trader's account balance drops below zero due to trading losses, they will not be required to pay additional funds to cover the negative balance. However, it's important to note that the specific terms and conditions of this protection are not clearly detailed on the FXGlory website. Traders should be aware that negative balance protection policies can vary between brokers and may have certain limitations or exceptions. For example, some brokers may only provide negative balance protection in certain circumstances, such as for retail clients or for specific trade types. There may also be cases where the protection does not apply, such as if the negative balance is due to fees or charges rather than trading losses.

FXGlory Deposits and Withdrawals

FXGlory offers a wide range of deposit and withdrawal options to cater to the needs of traders around the world. The broker supports various payment methods, including credit/debit cards, e-wallets, cryptocurrencies, and bank wire transfers.

Deposit Methods

| Category | Details | Fees | Processing Time | Minimum Deposit |

|---|---|---|---|---|

| Payment Methods | ||||

| Credit/Debit Cards (Visa, Mastercard) | For quick funding | No fees | Instant | – |

| E-wallets (Perfect Money, Skrill, Neteller, WebMoney, PayPal) | Widely available; ideal for fast deposits | No fees | Instant | – |

| Cryptocurrencies (Bitcoin, Ethereum, etc.) | For borderless transfers | No fees | Instant | – |

| Bank Wire Transfer | Suitable for larger transactions; supports multiple currencies | No fees* | 1–5 business days | Varies by account/jurisdiction |

| Account Type Minimum Deposits | ||||

| Standard Account | Entry-level account | – | – | $1 |

| Premium Account | Enhanced features | – | – | $1,000 |

| VIP Account | For advanced traders | – | – | $5,000 |

| CIP Account | Highest tier with premium services | – | – | $50,000 |

Withdrawal Methods

FXGlory supports the same methods for withdrawals as for deposits. However, there are some fees and restrictions to be aware of:| Payment Method | Fee | Minimum Withdrawal | Processing Time |

|---|---|---|---|

| Credit/Debit Cards (Visa, Mastercard) | 5% | $5 | 1–5 business days |

| E-wallets (Perfect Money, Skrill, Neteller, WebMoney, PayPal) | 3–9% (depending on amount) | $5 | 1–24 hours |

| Cryptocurrencies (Bitcoin, Ethereum, etc.) | 0.5% | $5 | 1–24 hours |

| Bank Wire Transfer | 9% | $5 | 1–10 business days |

Verification Requirements

To comply with anti-money laundering regulations, FXGlory requires all clients to verify their identity before making a withdrawal. This typically involves submitting the following documents:- Proof of identity: A copy of a government-issued ID, such as a passport or driver's license

- Proof of address: A copy of a utility bill or bank statement showing the trader's name and address

- Copy of the credit card used to deposit (if applicable): Showing the first 6 and last 4 digits of the card number

Support Service for Customer

Reliable customer support is a crucial aspect of any trading broker. Traders need to know that they can get help quickly and efficiently when issues arise. A responsive and knowledgeable support team can make a significant difference in the overall trading experience.

- Live Chat: Available 24/5 directly on the FXGlory website

- Email: support@fxglory.com

- Phone: +44 322 473 800

- Online Contact Form: On the "Contact Us" page of the website

FXGlory Customer Support Comparison

| Feature | Details |

|---|---|

| Support Channels | Live Chat, Email, Phone, Contact Form |

| Support Hours | 24/5 |

| Support Languages | English (others not specified) |

| Average Response Time | Not specified |

| Response Time Target | Not specified |

| User Review Sentiment | Mixed |

Prohibited Countries

When considering a forex broker, it's crucial to check if they are allowed to operate in your country of residence. Different brokers have varying restrictions based on local regulations, licensing requirements, and other legal considerations.

FXGlory is an offshore broker registered in Saint Vincent and the Grenadines. As an unregulated entity, it has more flexibility in terms of the countries it can serve compared to brokers licensed by major regulatory bodies like the FCA or ASIC.

However, there are still several regions where FXGlory is not allowed to provide services. According to the information on its website, FXGlory does not accept clients from the following countries:

- North Korea

- Italy

- Iran

- Bulgaria

- United States

- Russia

- United Kingdom

- China

- Canada

- Japan

- Australia

- EU countries (including EEA countries like Iceland, Norway, and Liechtenstein)

- Syria

- Sudan

- Cuba

- Any other region subject to international sanctions

It's important to note that attempting to trade with a broker from a prohibited country can have serious consequences. If a broker detects that a client is from a restricted jurisdiction, they may freeze or close the account and withhold any funds. In some cases, there could even be legal repercussions.

Special Offers for Customers

FXGlory provides several promotional offers and bonuses to attract new clients and reward existing traders for their loyalty. These offers can provide extra trading capital or improved trading conditions, but it's important to understand the terms and conditions attached to each promotion.

| Promotion | Description | Terms & Conditions | Eligibility/Notes |

|---|---|---|---|

| 50% Deposit Bonus | FXGlory credits an extra 50% of your deposit as bonus funds (e.g., a $1,000 deposit yields a $500 bonus, for a total of $1,500 in trading capital). | Bonus funds are non-withdrawable until you meet specific trading volume requirements. Maximum bonus: $500 for Standard, $1,000 for Premium, $2,000 for VIP. CIP accounts are not eligible. Only one bonus per household/IP/payment method. | Read full terms before accepting; best suited for traders comfortable with volume requirements and bonus conditions. |

| Free VPS Service | VIP account holders receive free VPS hosting to run trading platforms and expert advisors for uninterrupted trading and faster execution. | Must maintain a VIP account with a minimum deposit of $5,000. | Valuable for high-volume or automated trading strategies. |

| Other Promotions | No additional unique promotions (e.g., trading competitions, cashback deals, third-party partnerships) are offered by FXGlory. | N/A | FXGlory’s promotional lineup is standard compared to many other brokers. |

Conclusion

After an in-depth analysis of FXGlory's offerings, I have mixed feelings about recommending them as a broker. While they have some appealing features, there are also significant concerns that traders should be aware of.

On the positive side, FXGlory offers a user-friendly trading experience with the popular MetaTrader 4 and 5 platforms. The low minimum deposit of just $1 for standard accounts makes forex trading accessible to a wide range of traders. The high-leverage options, going up to 1:3000, can be attractive for those looking to maximize their trading capital, although it's important to use leverage cautiously.

FXGlory also supports a variety of payment methods, including credit/debit cards, e-wallets, and cryptocurrencies, making it convenient to fund an account. The 50% deposit bonus can provide a boost to trading capital, although the terms and conditions should be carefully reviewed.

However, there are several red flags that give me pause. The most significant is the lack of regulation from any major financial authority. As an offshore broker registered in Saint Vincent and the Grenadines, FXGlory operates with minimal oversight. This lack of regulation means there are fewer protections in place for traders' funds and less recourse if issues arise.

The high withdrawal fees, ranging up to 9%, are another concern. These costs can significantly eat into trading profits and may make it difficult to withdraw funds efficiently. The mixed user reviews, particularly regarding withdrawal issues and inconsistent customer support, are also worrying.

Additionally, the educational resources and market analysis offered by FXGlory are quite limited compared to many other brokers. This may not be an issue for experienced traders, but beginners looking for more guidance and support may find the offerings lacking.

Ultimately, whether FXGlory is a suitable broker for you will depend on your individual trading needs and risk tolerance. If you prioritize low minimum deposits, high leverage, and the potential upside of deposit bonuses, FXGlory may be worth considering. However, the lack of regulation and concerning withdrawal terms are significant risks to weigh.

In my opinion, most traders, especially beginners, would be better served by a broker with strong regulatory oversight, transparent fee structures, and a solid reputation for reliability and customer support. While FXGlory may work for some, I believe there are safer and more trustworthy options available.

As with any financial decision, I recommend thoroughly researching and comparing multiple brokers before committing funds. Look for brokers regulated by respected authorities like the FCA, ASIC, or CySEC, and carefully review the terms and conditions. Test out the trading platforms, contact customer support, and read user reviews to get a well-rounded picture.

Remember, successful trading depends on much more than just choosing a broker. Developing a solid trading plan, practicing risk management, and continually educating yourself are all essential. No broker, no matter how attractive their offers may seem, can guarantee profits. Approach trading with caution and never risk more than you can afford to lose.

Check EA compatibility via the algo-friendly broker guide.

Bank-backed alternative? See the Swissquote review.