FxGrow Review 2025: Competitive Spreads, Diverse Assets, and Client-Centric Approach

FxGrow

Cyprus

Cyprus

-

Minimum Deposit $100

-

Withdrawal Fee $varies

-

Leverage 100:1

-

Spread From 0.2

-

Minimum Order 0.01

-

Forex Available

-

Crypto Available

-

Stock Unavailable

-

Indices Available

Licenses

Cyprus Market Making (MM)

Cyprus Market Making (MM)

Forex Trading License

Forex Trading License

Softwares & Platforms

Customer Support

+35725211707

(English)

+35725211707

(English)

Supported language: Arabic, Chinese (Simplified), English, Spanish

Social Media

Summary

FxGrow is a Cyprus-based forex and CFD broker offering a wide range of trading instruments, including indices, commodities, and cryptocurrencies. It provides competitive spreads and fast execution through the ECN trading model. Traders can access the MetaTrader 5 platform, known for its advanced charting and automated trading capabilities. FxGrow is regulated by CySEC, ensuring compliance with strict financial standards. With multiple account types and flexible trading conditions, it caters to both beginner and experienced traders.

- Regulated by CySEC and VFSC, providing oversight and protection for clients

- Wide range of tradable assets, including 60+ forex pairs, indices, commodities, and cryptocurrencies

- Competitive spreads and flexible account types for novice and experienced traders

- Comprehensive educational resources and tools, including Trading Central partnership

- Knowledgeable and helpful customer support available 24/5 through multiple channels

- Attractive special offers, such as the 20% Profit Bonus and Refer-a-Friend program

- Commitment to empowering clients with knowledge and skills

- Suitable for traders of all levels, from beginners to advanced investors

- Solid regulatory framework, competitive trading conditions, and client-centric approach

- Negative balance protection to safeguard clients' funds

- Lacks top-tier regulation from authorities like FCA or ASIC

- Educational resources may not be as extensive as larger, more established brokers

- Customer support not available 24/7

- Limited brand recognition compared to larger, more well-known brokers

- No deposit bonus currently available

- Inactivity fees may apply to dormant accounts

- Limited number of payment options compared to some competitors

- Minimum deposit requirements may be higher than some other brokers

- Some withdrawal methods may incur fees

- No US clients accepted

Overview

FxGrow is a well-established online forex and CFD broker, founded in 2008 and headquartered in Cyprus. With over 15 years of operational history, the company serves a global client base spanning more than 100 countries. FxGrow is regulated by the Cyprus Securities and Exchange Commission (CySEC) and the Vanuatu Financial Services Commission (VFSC), providing a level of regulatory oversight, though it lacks top-tier regulation from authorities such as the FCA or ASIC.

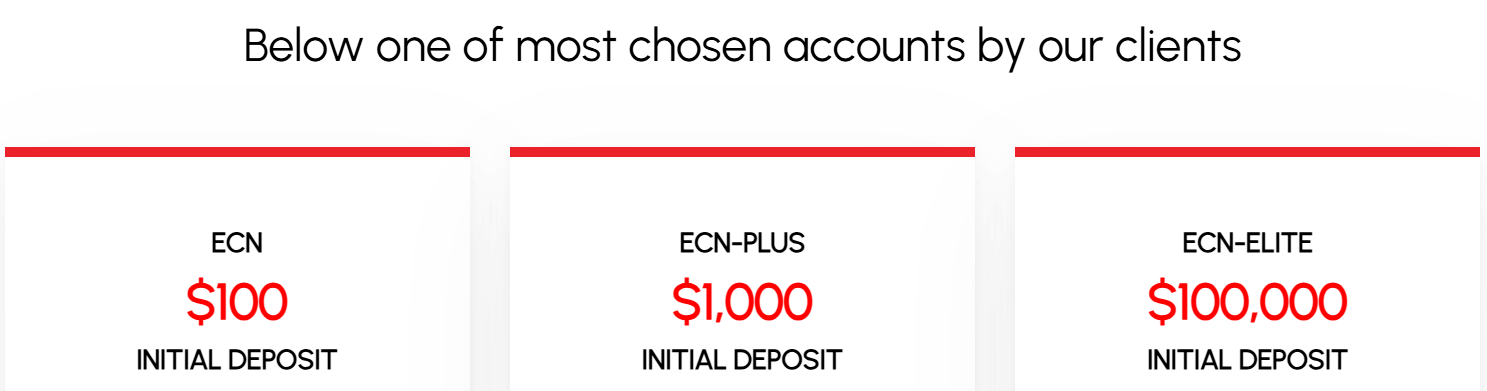

The broker offers a range of trading instruments, including over 60 forex pairs, indices, commodities, metals, energies, and a selection of cryptocurrencies. Clients can choose from three account types—ECN, ECN Plus, and ECN Elite—with minimum deposits ranging from $100 to $100,000. FxGrow provides the MetaTrader 5 platform for desktop, web, and mobile trading, as well as an automated trading platform for copy trading.

While FxGrow offers competitive spreads starting from 0.2 pips and leverage up to 1:100, some account types come with high minimum deposit requirements. The broker has received recognition, including being named the "Most Transparent Broker of the Year" at the Jordan Forex Expo in 2021. However, customer reviews are mixed, with some clients reporting slow order execution and withdrawal issues.

For more details on FxGrow's offerings, visit their official website at fxgrow.com

Overview Table

| Field | Details |

|---|---|

| Broker | FxGrow |

| Headquarters | Cyprus |

| Founded | 2008 |

| Regulation | CySEC, VFSC |

| Minimum Deposit | $100 - $100,000 |

| Instruments | Forex, CFDs, Indices, Commodities, Metals, Energies, Cryptocurrencies |

| Platforms | MetaTrader 5, Automated Trading |

| Customer Support | Phone, Email, Live Chat (24/5) |

| Website | www.fxgrow.co |

Facts List

- FxGrow was established in 2008 and is based in Cyprus.

- The broker is regulated by CySEC (license number 214/13) and VFSC.

- FxGrow offers over 500 trading instruments, including 60+ forex pairs.

- Clients can choose from three account types: ECN, ECN Plus, and ECN Elite.

- Minimum deposits range from $100 to $100,000, depending on the account type.

- The broker provides the MetaTrader 5 platform for desktop, web, and mobile trading.

- FxGrow also offers an automated trading platform for copy trading.

- Spreads start from 0.2 pips, and maximum leverage is up to 1:100.

- The company provides customer support via phone, email, and live chat 24/5.

- FxGrow has received awards, including "Most Transparent Broker of the Year" at the Jordan Forex Expo in 2021.

FxGrow Licenses and Regulatory

FxGrow operates under the regulatory oversight of the Cyprus Securities and Exchange Commission (CySEC) and the Vanuatu Financial Services Commission (VFSC). The broker's Cyprus-based entity, Growell Capital Limited, is authorized and regulated by CySEC under license number 214/13. This license allows FxGrow to provide investment services across the European Economic Area (EEA) under the Markets in Financial Instruments Directive (MiFID).

CySEC is a well-respected regulatory body known for its stringent requirements and supervision of financial services providers. Brokers regulated by CySEC must adhere to strict guidelines designed to protect clients' interests, ensure transparency, and maintain the integrity of financial markets. These requirements include regular reporting, segregation of client funds, and participation in investor compensation schemes.

While CySEC oversight provides a level of trust and security for clients, it's important to note that FxGrow lacks regulation from top-tier authorities such as the Financial Conduct Authority (FCA) in the United Kingdom or the Australian Securities and Investments Commission (ASIC). These regulators are known for their robust regulatory frameworks and are often considered the gold standard in the industry.

FxGrow's VFSC license, issued by the financial regulator of Vanuatu, provides an additional layer of regulatory oversight. However, it's crucial to understand that the VFSC's regulatory standards may not be as stringent as those of CySEC or other top-tier regulators.

In terms of client protection, FxGrow segregates clients' funds from its own operating funds, in accordance with CySEC regulations. This segregation ensures that clients' money is protected in the event of the broker's insolvency. Additionally, FxGrow participates in the Investor Compensation Fund (ICF), which provides coverage of up to €20,000 per client in case the broker is unable to meet its financial obligations.

While FxGrow's regulatory status provides a measure of trust and security, traders should always conduct their own due diligence and assess their risk tolerance before engaging with any broker. It's essential to carefully review the broker's terms and conditions, disclosure documents, and regulatory compliance to make an informed decision.

List of FxGrow's Regulatory Licenses

- Cyprus Securities and Exchange Commission (CySEC): License number 214/13, authorized to provide investment services across the European Economic Area (EEA) under the Markets in Financial Instruments Directive (MiFID).

- Vanuatu Financial Services Commission (VFSC): Authorized to provide financial services under the Vanuatu Financial Services Commission.

Trading Instruments

| Category | Details |

|---|---|

| Forex | Offers an extensive range of forex trading options with over 60 currency pairs, including majors (e.g., EUR/USD, GBP/USD), minors, and exotic pairs. Competitive spreads are available, with the EUR/USD spread starting from as low as 0.2 pips on the ECN Plus and ECN Elite accounts, allowing traders to diversify their portfolios and take advantage of various market conditions. |

| Indices | Provides access to popular indices through CFDs, such as the S&P 500, NASDAQ, DOW JONES, FTSE 100, and DAX 30. Competitive spreads on these benchmark market indicators enable traders to capitalize on their price movements. |

| Commodities and Metals | Offers trading opportunities in various commodities and metals, including gold, silver, oil, natural gas, and more. These instruments help traders hedge against market volatility and diversify their portfolios, with attractive spreads that offer the potential for high returns. |

| Cryptocurrencies | Provides CFDs on popular digital currencies such as Bitcoin, Ethereum, Litecoin, and Bitcoin Cash. This access allows traders to capitalize on the volatility and potential growth of the cryptocurrency market. |

| Energies | Offers energy CFDs that enable traders to speculate on the price movements of oil and natural gas, thereby diversifying trading portfolios and potentially profiting from fluctuations in the global energy markets. |

| Futures | Provides access to a range of futures CFDs, offering exposure to various financial and commodity markets. This enables traders to speculate on future price movements of underlying assets with the potential for significant returns. |

FxGrow's diverse range of tradable assets caters to the needs of both novice and experienced traders, allowing them to create well-rounded portfolios and seize opportunities across different markets. The broker's competitive spreads and leverage options make it an attractive choice for traders seeking exposure to a wide array of financial instruments.

Trading Platforms

FxGrow offers a suite of robust trading platforms catering to the diverse needs of its clients. The broker understands the importance of providing reliable, user-friendly, and feature-rich platforms to ensure a seamless trading experience.

MetaTrader 5 (MT5)

FxGrow offers the MetaTrader 5 (MT5) platform, a powerful and versatile trading software that caters to the needs of both novice and experienced traders. MT5 is an upgraded version of the popular MetaTrader 4 (MT4) platform, providing enhanced features and functionality. The platform offers advanced charting tools, a wide range of technical indicators, and the ability to trade multiple assets, including forex, indices, commodities, and cryptocurrencies.

One of the key advantages of MT5 is its algorithmic trading capabilities. Traders can develop, test, and deploy custom trading robots (Expert Advisors) and indicators using the MQL5 programming language. This feature allows for automated trading strategies and the implementation of complex trading systems.

FxGrow's MT5 platform is accessible through desktop, web, and mobile applications, providing traders with the flexibility to manage their accounts and execute trades from anywhere at any time. The web-based version of MT5 allows users to access their accounts through a web browser without the need for software installation, while the mobile apps for iOS and Android devices enable traders to monitor markets and trade on the go.

Automated Trading Platform

In addition to MT5, FxGrow offers an automated trading platform that allows clients to copy the trades of successful traders. This feature is particularly useful for novice traders who may lack the experience or time to develop their own trading strategies. By following the trades of experienced traders, clients can potentially benefit from their expertise and market knowledge.

The automated trading platform also enables traders to allocate a portion of their funds to be managed by professional money managers. This service provides an opportunity for passive investment and diversification of trading portfolios.

FxGrow's trading platforms are designed to cater to the diverse needs of their clients, offering a range of tools and features to suit different trading styles and preferences. The broker's commitment to providing stable and reliable trading platforms ensures a seamless trading experience for their clients.

Trading Platforms Comparison Table

| Feature | MT5 | Automated Trading Platform |

|---|---|---|

| Charting Tools | Advanced | Basic |

| Technical Indicators | Wide range | Limited |

| Algorithmic Trading | Yes (Expert Advisors) | No |

| Copy Trading | No | Yes |

| Funds Allocation | No | Yes |

| Mobile Apps | iOS and Android | No |

| Web-Based Trading | Yes | No |

| Programming Language | MQL5 | N/A |

FxGrow How to Open an Account: A Step-by-Step Guide

Opening an account with FxGrow is a straightforward process that can be completed online in a few simple steps. Here's a step-by-step guide to help you get started:

Step 1: Visit the FxGrow website Go to the official FxGrow website at fxgrow.com and click on the "Open an Account" button located in the top right corner of the homepage.

Step 2: Fill in the registration form You will be directed to the account registration form. Provide your personal information, including your full name, email address, phone number, country of residence, and create a secure password.

Step 3: Choose your account type Select the type of account you wish to open from the available options: ECN, ECN Plus, or ECN Elite. Each account type has different minimum deposit requirements and trading conditions, so choose the one that best suits your trading needs and experience level.

Step 4: Verify your identity To comply with anti-money laundering (AML) and know-your-customer (KYC) regulations, FxGrow requires you to verify your identity and address. Upload a valid government-issued ID, such as a passport or driver's license, and a recent proof of address, such as a utility bill or bank statement.

Step 5: Fund your account Once your account is approved, you can fund it using one of the accepted payment methods, which include credit/debit cards, bank wire transfers, Skrill, and Neteller. The minimum deposit amount varies depending on your chosen account type, starting from $100 for the ECN account.

Step 6: Start trading After your account is funded, you can download the MT5 trading platform or use the web-based version to start trading. FxGrow also offers an automated trading platform for copy trading and allocating funds to professional money managers.

FxGrow's streamlined account opening process enables traders to start trading quickly and easily. The broker's multilingual support team is available 24/5 to assist with any questions or issues you may encounter during the registration process.

Charts and Analysis

FXGrow provides a range of educational resources and tools to support its clients in their trading journey. However, the broker's offerings in this area are somewhat limited compared to industry leaders, leaving room for improvement in terms of depth and variety.

| Category | Details |

|---|---|

| Trading Central Partnership | FxGrow has partnered with Trading Central, a respected third-party provider of market research and investment analytics. This collaboration gives clients access to detailed technical analysis reports on various assets, including currencies and indices, covering multiple time frames to support diverse trading strategies. The reports offer insights into market trends, potential entry/exit points, and risk management considerations. |

| Economic Calendar | FxGrow provides an economic calendar that offers a comprehensive overview of upcoming economic events and data releases. The calendar includes information on the expected impact of each event, assisting traders in making informed decisions and adjusting their strategies around potential periods of volatility. |

| Webinars and Educational Videos | FxGrow offers a range of educational webinars and videos designed to enhance trading knowledge and skills. Topics covered range from basic trading concepts to advanced strategies, market analysis techniques, and platform tutorials (e.g., using MT5). Webinars are hosted by experienced traders and financial experts, and the video library serves as a valuable resource for ongoing learning. |

| Market News and Analysis | FxGrow keeps clients informed with regular market news updates and analysis. The broker's team of experienced analysts delivers daily commentary on key economic events, political developments, and other factors that may impact financial markets, ensuring that traders remain up-to-date with the latest market trends. |

Traders can access these updates through the FxGrow website or by subscribing to the broker's email newsletter. The analysis is designed to be easily digestible and actionable, helping traders make informed decisions based on current market conditions.

While FxGrow's educational resources and tools are comprehensive and well-developed, they may not be as extensive as those offered by some larger, more established brokers. However, the partnership with Trading Central sets FxGrow apart, providing clients with access to high-quality, professional-grade market analysis and insights.

Overall, FxGrow's commitment to providing educational resources demonstrates their understanding of the importance of ongoing learning and development for traders. By equipping clients with the knowledge and tools they need to succeed, FxGrow positions itself as a supportive and reliable partner in the trading journey.

FxGrow Account Types

FXGrow offers a range of trading account types tailored to suit the diverse needs of traders at various levels of experience and with different trading styles. By providing multiple account options, the broker ensures that clients can select an account that aligns with their specific goals, risk tolerance, and investment capital.

ECN Account

The ECN account is designed for beginner traders, offering a low minimum deposit of just $100. This account type provides access to variable spreads starting from 1.10 pips and does not charge any commissions on trades. Traders can choose from three base currencies: USD, EUR, and PLN.

The ECN account allows for flexible trading strategies, including hedging and scalping, and offers leverage up to 1:30. It also provides access to the MT5 trading platform and a range of educational resources and tools.

ECN Plus Account

The ECN Plus account is geared towards intermediate traders, with a minimum deposit requirement of $1,000. This account type offers tighter spreads starting from 0.20 pips but charges a commission of $8 per lot traded.

Like the ECN account, the ECN Plus account allows for hedging and scalping strategies and offers leverage up to 1:30. Traders can access the MT5 platform and benefit from the educational resources provided by FxGrow.

ECN Elite Account

The ECN Elite account is tailored for experienced and high-volume traders, with a minimum deposit requirement of $100,000. This account type offers the tightest spreads, starting from 0.20 pips, and charges a reduced commission of $6 per lot traded.

ECN Elite account holders can access higher leverage options, up to 1:100, and enjoy priority customer support. They also have access to the MT5 platform and the full suite of educational resources and tools provided by FxGrow.

Demo Account

FxGrow offers a demo account option, allowing traders to practice their strategies and familiarize themselves with the MT5 platform in a risk-free environment. The demo account mirrors real trading conditions, providing access to live market data and the full range of trading tools and features.

FxGrow's range of account types caters to traders of all experience levels and trading styles. The broker's commitment to offering competitive spreads, flexible leverage options, and a choice of base currencies demonstrates their understanding of the diverse needs of their clientele.

Account Types Comparison Table

| Feature | ECN Account | ECN Plus Account | ECN Elite Account |

|---|---|---|---|

| Min. Deposit | $100 | $1,000 | $100,000 |

| Spread (from pips) | 1.10 | 0.20 | 0.20 |

| Commission (per lot) | $0 | $8 | $6 |

| Leverage | Up to 1:30 | Up to 1:30 | Up to 1:100 |

| Base Currencies | USD, EUR, PLN | USD, EUR, PLN | USD, EUR |

| Trading Platform | MT5 | MT5 | MT5 |

| Hedging Allowed | Yes | Yes | Yes |

| Scalping Allowed | Yes | Yes | Yes |

| Educational Resources | Yes | Yes | Yes |

| Demo Account | Yes | Yes | Yes |

| Customer Support | Standard | Standard | Priority |

Negative Balance Protection

FxGrow's negative balance protection policy ensures that clients cannot lose more than the funds in their trading account. In the event that a client's account balance falls into negative territory, FxGrow will absorb the loss and reset the account balance to zero. This policy applies to all trading accounts, regardless of the account type or the size of the negative balance. FxGrow's commitment to negative balance protection provides traders with peace of mind, knowing that their losses are limited to the funds they have invested. It is important to note that while negative balance protection is a valuable safety net, it should not be relied upon as a primary risk management strategy. Traders should still employ prudent risk management techniques, such as setting appropriate stop-loss orders and managing their leverage responsibly.

FxGrow Deposits and Withdrawals

FxGrow offers a variety of deposit and withdrawal options to cater to the diverse needs of its global client base. The broker strives to make the process of funding and withdrawing from trading accounts as seamless and efficient as possible, while adhering to strict security and regulatory standards.

Deposit Methods

FxGrow accepts the following deposit methods:| Payment Method | Processing Time | Fees |

|---|---|---|

| Credit/Debit Cards (Visa, Mastercard) | Instant | No fees |

| Bank Wire Transfer | 2-5 business days | No fees |

| Skrill | Instant | No fees |

| Neteller | Instant | No fees |

| Bitcoin | Instant | No fees |

Withdrawal Methods

FxGrow supports the following withdrawal methods:| Payment Method | Processing Time | Fees | Minimum Withdrawal |

|---|---|---|---|

| Credit/Debit Cards (Visa, Mastercard) | 1-3 business days | 2 EUR fee | $10 |

| Bank Wire Transfer | 2-5 business days | No fees for withdrawals above $100 | $100 |

| Skrill | 1-3 business days | 2.9% + 0.28 EUR fee | $10 |

| Neteller | 1-3 business days | 3.9% fee | $10 |

| Bitcoin | 1-3 business days | No fees | $10 |

Verification Requirements

To comply with anti-money laundering (AML) and know-your-customer (KYC) regulations, FxGrow requires clients to verify their identity and address before processing withdrawals. Traders must submit a valid government-issued ID, such as a passport or driver's license, and a recent proof of address, such as a utility bill or bank statement.Processing Times and Fees

Deposit processing times range from instant to 2-5 business days, depending on the chosen method. Most deposit methods do not incur any fees, except for bank wire transfers below $500, which may be subject to intermediary bank charges. Withdrawal processing times range from 1 to 3 business days for most methods, while bank wire transfers can take up to 5 business days. FxGrow does not charge any internal fees for withdrawals, but some payment providers may apply their own fees, which are clearly stated on the broker's website. FxGrow's commitment to offering a wide range of deposit and withdrawal options, along with its transparent fee structure and adherence to regulatory requirements, demonstrates the broker's dedication to providing a secure and user-friendly trading environment.Support Service for Customer

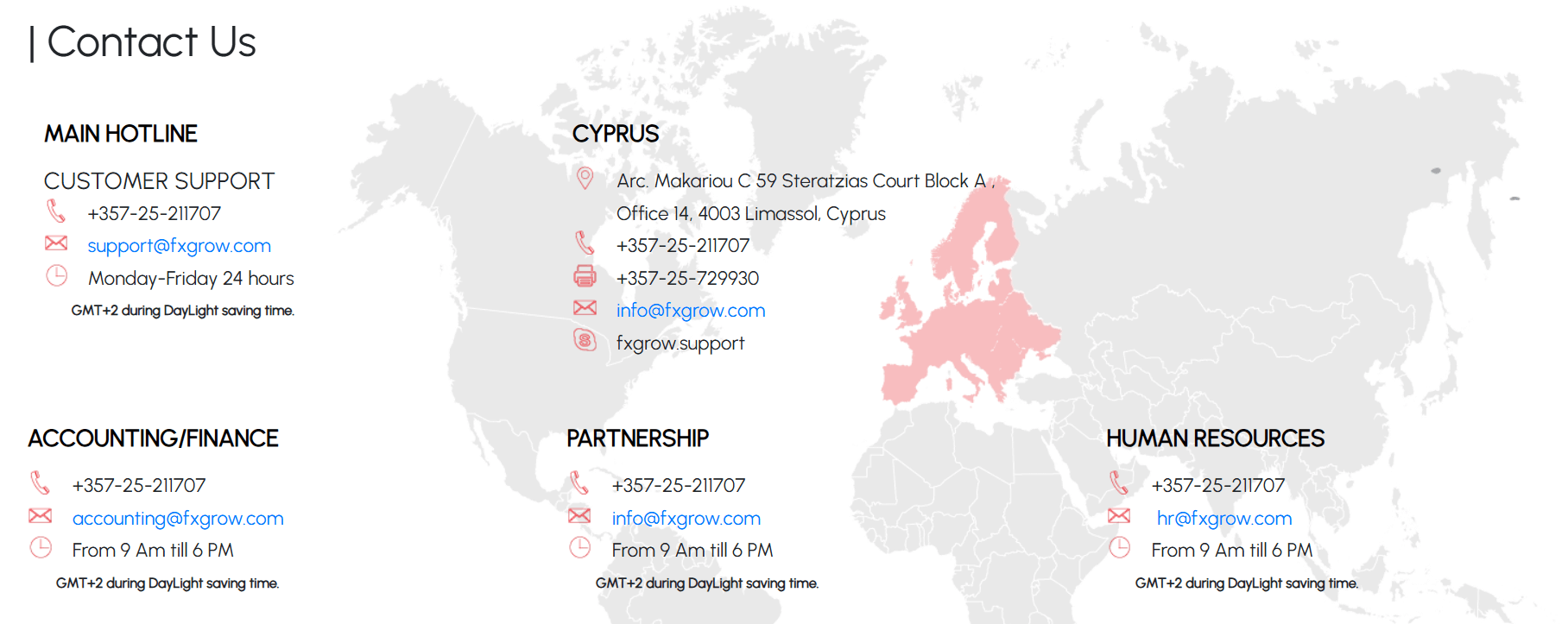

In the fast-paced world of online trading, reliable customer support is crucial for a positive trading experience. Traders often need assistance with account-related queries, technical issues, or general guidance, and a broker's ability to provide prompt and helpful support can make a significant difference in building trust and loyalty. FxGrow understands the importance of customer support and offers several channels through which traders can reach out for assistance.

Customer Support Channels

- Live Chat: Available 24/5 on the FxGrow website.

- Email: support@fxgrow.com

- Phone: +357-25-211707

- Social Media: Facebook, Twitter, LinkedIn

Support Hours and Response Times

FxGrow's customer support team is available 24 hours a day, 5 days a week (24/5), from Monday to Friday. This extensive availability ensures that traders can access support during their trading hours, regardless of their time zone. The broker aims to provide prompt responses to all inquiries, with an average response time of 5-10 minutes for live chat and 1-2 hours for email. Phone support is available during regular business hours, and traders can expect to be connected with a support representative within a few minutes. While FxGrow does not offer 24/7 support, their 24/5 availability covers the most active trading periods and caters to the majority of their clients' needs.

Knowledgeable and Helpful Support

Staff FxGrow's customer support team consists of knowledgeable professionals who are well-versed in the broker's products, services, and trading platforms. They are trained to provide accurate and helpful information, guiding traders through various aspects of their trading experience.Customer Support Comparison Table

| Feature | FxGrow |

|---|---|

| Support Channels | Live Chat, Email, Phone, Social Media |

| Support Hours | 24/5 |

| Support Languages | English, Arabic |

| Live Chat Response Time | 5-10 minutes |

| Email Response Time | 1-2 hours |

| Phone Support | Available during business hours |

| Phone Response Time | Within a few minutes |

| 24/7 Support | No |

| Support Quality | Knowledgeable and helpful staff |

Prohibited Countries

In the global landscape of online trading, brokers must adhere to various local regulations and licensing requirements to legally provide services in different countries and regions. FxGrow, like many other international brokers, is restricted from operating in certain jurisdictions due to regulatory constraints or geopolitical factors.

Reasons for Restrictions

- Local Regulations: Some countries have strict regulations governing the provision of financial services, including online trading. These regulations may require brokers to obtain specific licenses or meet certain criteria to operate legally within their borders.

- Licensing Requirements: Each country or region may have its own set of licensing requirements for financial service providers. Obtaining and maintaining these licenses can be a complex and costly process, leading some brokers to limit their services to specific jurisdictions.

- Geopolitical Factors: Political instability, economic sanctions, or international trade agreements can also influence a broker's ability to provide services in certain countries or regions.

Consequences of Trading from Prohibited Countries

Attempting to trade with FxGrow from a prohibited country can result in several risks and consequences:

- Account Termination: If FxGrow discovers that a client is trading from a prohibited country, they may terminate the account without prior notice, potentially leading to the loss of funds.

- Legal Consequences: Trading with a broker that is not licensed to operate in your country may violate local laws and regulations, potentially resulting in legal consequences.

- Limited Recourse: Clients from prohibited countries may have limited recourse in the event of a dispute with the broker, as they are not protected by the laws and regulations of their home country.

It is crucial for traders to verify whether FxGrow is allowed to provide services in their country of residence before opening an account. Traders should also familiarize themselves with their local laws and regulations regarding online trading to ensure compliance and protect their interests.

Special Offers for Customers

FxGrow provides a range of special promotions and offers designed to attract new traders and reward existing clients for their loyalty. These offers can help traders maximize their potential returns and enhance their overall trading experience.

| Feature | Description |

|---|---|

| Profit Bonus | FxGrow's Profit Bonus rewards traders for successful trading activities. Clients with a live account and a minimum deposit of $1,000 are eligible for a 20% bonus on their trading profits within each 30-day trading period. This bonus is automatically credited to the trader's account and can be withdrawn or used for further trading. |

| Refer-a-Friend Program | This program incentivizes existing clients to refer new traders to FxGrow. When a referred friend opens a live trading account and meets specific trading volume requirements, both the referrer and the referred client receive a cash bonus, rewarding client loyalty and helping FxGrow expand its client base through word-of-mouth marketing. |

| Partnership with Trading Central | FxGrow has partnered with Trading Central, a leading provider of technical analysis and market insights. This partnership grants FxGrow clients access to advanced analytical tools and research materials, empowering them to make more informed trading decisions. |

This partnership adds value to FxGrow's services and demonstrates the broker's commitment to providing its clients with the resources they need to succeed in the markets.

Conclusion

As I approach the end of my comprehensive review of FxGrow, I can confidently say that they have established themselves as a reliable and trustworthy broker in the online trading industry. Throughout my analysis, I have been impressed by their commitment to regulatory compliance, extensive range of tradable assets, and user-focused approach to providing a seamless trading experience.

One of the key factors that sets FxGrow apart is their strong regulatory framework. They are authorized and regulated by the Cyprus Securities and Exchange Commission (CySEC) and the Vanuatu Financial Services Commission (VFSC), which provides a level of oversight and protection for their clients. While they may not have the top-tier regulation of some larger brokers, their compliance with these respected authorities demonstrates their dedication to maintaining a safe and transparent trading environment.

FxGrow's wide array of tradable assets is another compelling aspect of their offering. With over 60 forex pairs, numerous indices, commodities, and cryptocurrencies, traders have ample opportunities to diversify their portfolios and capitalize on market movements. The broker's competitive spreads and flexible account types cater to the needs of both novice and experienced traders, making them an accessible choice for a broad range of clients.

I was particularly impressed by FxGrow's commitment to providing educational resources and tools to support their clients' trading journeys. Their partnership with Trading Central, a leading provider of technical analysis and market insights, gives traders access to valuable research and analytics to inform their decision-making. The broker's webinars, educational videos, and daily market analysis demonstrate their genuine interest in empowering their clients with the knowledge and skills needed to succeed in the markets.

While FxGrow's customer support may not be available 24/7, their 24/5 availability and multiple contact channels ensure that traders can access assistance when needed. The broker's knowledgeable and helpful support staff are well-equipped to handle a wide range of queries and concerns, contributing to a positive overall trading experience.

In terms of special offers and promotions, FxGrow's 20% Profit Bonus and Refer-a-Friend program offer attractive incentives for both new and existing clients. These offers not only reward traders for their loyalty and success but also help the broker expand their client base through word-of-mouth marketing.

Overall, I believe that FxGrow is a solid choice for traders seeking a reliable, well-rounded broker with a strong focus on client support and education. While they may not have the same level of name recognition as some of the larger, more established brokers, their comprehensive offering and commitment to providing a positive trading experience make them a compelling option in the competitive online brokerage landscape.

As with any financial decision, I encourage potential clients to conduct their own due diligence and carefully consider their individual trading needs and risk tolerance before choosing a broker. However, based on my thorough review, I can confidently recommend FxGrow as a reputable and trustworthy choice for those seeking a reliable partner in their trading journey.

Need MT4? Check the MT4 broker roster.

See copy-trading widgets in the XS review.