FXPrimus Review 2025: A Comprehensive Look at the Trustworthy Broker

FXPrimus

Vanuatu

Vanuatu

-

Minimum Deposit $15

-

Withdrawal Fee $varies

-

Leverage 1000:1

-

Minimum Order 0.01

-

Forex Available

-

Crypto Available

-

Stock Available

-

Indices Available

Licenses

Cyprus Market Making (MM)

Cyprus Market Making (MM)

Forex Trading License

Forex Trading License

Softwares & Platforms

Customer Support

+442035192105

(English)

+442035192105

(English)

Supported language: Chinese (Simplified), English, Malay, Spanish

Social Media

Summary

FXPrimus is a forex and CFD broker offering a variety of trading instruments, including commodities, indices, and cryptocurrencies. It provides competitive spreads, fast execution, and a secure trading environment with negative balance protection. Traders can access MetaTrader 4, MetaTrader 5, WebTrader, and cTrader, offering flexibility across different platforms. FXPrimus is regulated by multiple authorities, ensuring compliance with financial standards. With different account types and flexible trading conditions, it caters to both beginner and professional traders.

- Strong regulatory compliance with licenses from top-tier authorities CySEC and VFSC

- Wide range of tradable assets, including forex, commodities, indices, stocks, and cryptocurrencies

- Variety of account types to suit different trading needs and experience levels

- User-friendly and advanced trading platforms, including MetaTrader 4 and MetaTrader 5

- Competitive spreads and low minimum deposit requirements

- Responsive, multilingual customer support via multiple channels

- Negative balance protection and segregated client funds for enhanced security

- Established in 2009 with a long-standing presence in the industry

- Caters to both beginner and experienced traders

- Offers demo accounts for risk-free practice trading

- Educational resources and research tools could be expanded for better trader support

- No current special promotions or bonuses available

- Lack of 24/7 customer support may be inconvenient for some traders

- Limited number of base currencies compared to some competitors

- Minimum withdrawal amount of $100 may be high for some traders

- Inactivity fees applied after 180 days of no trading activity

- Maximum leverage for EU clients restricted to 1:30 due to ESMA regulations

- Some trading instruments have higher spreads compared to other brokers

- Website can be confusing to navigate with some duplicate information

- Does not accept clients from several countries, including the US, Japan, and Canada

Overview

FXPrimus is a global forex and CFD broker established in 2009, with headquarters in Limassol, Cyprus and a presence in over 140 countries. Regulated by CySEC (Cyprus Securities and Exchange Commission) and VFSC (Vanuatu Financial Services Commission), FXPrimus has built a reputation as a trustworthy broker, earning recognition such as 'Most Trusted Broker' at the 2015 MENA Forex Show and three International Investor Magazine awards.

With a client base of over 300,000 traders, FXPrimus offers a robust trading environment including MetaTrader 4, MetaTrader 5, cTrader and WebTrader platforms, competitive spreads from 0 pips, and leverage up to 1:1000. The broker provides access to 120+ instruments across forex, commodities, indices, shares and crypto CFDs for portfolio diversification.

FXPrimus prioritizes client security, offering negative balance protection, insurance coverage up to €5 million, and segregated client funds. The broker supports multiple deposit and withdrawal options and provides 24/5 customer support via live chat, email, phone and social media.

While FXPRIMUS offers some educational resources through a client-only blog, research and learning materials are relatively limited compared to larger brokers. Expansion of their trading education would further support clients.

For more details on account types, trading conditions and funding, visit the official FXPRIMUS website at fxprimus.com. As with any broker, carefully evaluate FXPRIMUS' services against your individual trading needs before investing.

Overview Table

| Characteristic | Details |

|---|---|

| Foundation | 2009 |

| Headquarters | Limassol, Cyprus |

| Regulation | CySEC (261/14), VFSC (14595) |

| Global Presence | 140+ countries |

| Active Clients | 300,000+ |

| Trading Platforms | MetaTrader 4, MetaTrader 5, cTrader, WebTrader |

| Instruments | Forex, Commodities, Indices, Shares, Crypto CFDs |

| Minimum Deposit | $15 (varies by account) |

| Maximum Leverage | Up to 1:1000 |

| Minimum Spreads | 0 pips (varies by account) |

| Funding Options | Bank wire, credit/debit cards, e-wallets |

| Withdrawal Processing | Up to 5 business days |

| Customer Support | 24/5 via live chat, email, phone, social media |

| Client Security | Negative balance protection, €5m client insurance, segregated client funds |

Facts List

- Founded in 2009 with headquarters in Limassol, Cyprus

- Regulated by top-tier CySEC and offshore VFSC

- Global presence in over 140 countries with 300,000+ active clients

- Offers MetaTrader 4, MetaTrader 5, cTrader and WebTrader platforms

- 120+ tradable instruments including forex, commodities, indices, shares and crypto CFDs

- Flexible account types with low $15 minimum deposit (Classic) up to $1000 (Zero)

- Tight spreads from 0 pips and leverage up to 1:1000 (depending on account)

- Supports bank wire, credit/debit cards and e-wallet funding; no deposit fees

- Withdrawals processed within 5 business days; $100 minimum withdrawal

- 24/5 customer support via live chat, email, phone and social media

FXPrimus Licenses and Regulatory

FXPrimus operates under the regulatory oversight of two key authorities: the Cyprus Securities and Exchange Commission (CySEC) and the Vanuatu Financial Services Commission (VFSC). The broker's primary entity, Primus Global Ltd, is authorized and regulated by CySEC under license number 261/14. This license enables FXPrimus to provide investment and ancillary services across the European Economic Area (EEA).

CySEC is a highly respected regulatory body known for its stringent rules and oversight, aligning with the Markets in Financial Instruments Directive (MiFID) framework. Brokers licensed by CySEC must adhere to strict requirements related to client fund segregation, capital adequacy, transparency, and investor protection. CySEC regulation is widely regarded as a benchmark for trust and reliability in the forex industry.

FXPrimus' second entity, Primus Markets INTL Limited, is authorized by the VFSC under registration number 14595. The VFSC license allows the broker to cater to clients outside the EEA. While the VFSC is not considered as rigorous as CySEC, it still subjects brokers to a range of compliance standards and regulatory requirements.

Regulations List

- Cyprus Securities and Exchange Commission (CySEC) - License number 261/14

- Vanuatu Financial Services Commission (VFSC) - Registration number 14595

Trading Instruments

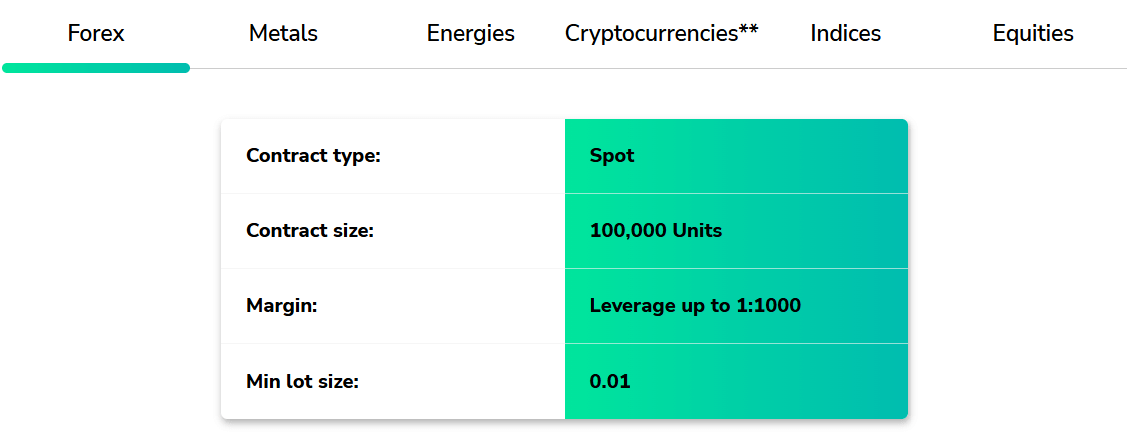

FXPrimus offers a diverse range of tradable assets, enabling clients to access over 120 instruments across multiple markets. The broker's extensive product offering caters to various trading strategies and risk appetites, empowering investors to build well-rounded portfolios.

| Instrument Category | Details |

|---|---|

| Forex | Over 43 currency pairs including major, minor, and exotic pairs. Notable pairs include EUR/USD, GBP/USD, USD/JPY, and USD/CAD. Offers competitive spreads starting from 0.1 pips on major pairs, ensuring cost-effective trading opportunities. |

| Metals | CFD trading on precious metals, specifically gold and silver against the US dollar. Provides a hedge against market volatility and serves as a safe haven during economic uncertainty. Competitive spreads and flexible contract sizes cater to both novice and experienced traders. |

| Energies | Trade CFDs on energy commodities such as crude oil and natural gas. With competitive spreads and leveraged trading, this segment allows traders to capitalize on price fluctuations in markets crucial to the global economy. |

| Stocks | Access a wide array of stock CFDs from major companies across various sectors like technology, healthcare, and finance. Enables leveraged trading with the flexibility to go long or short, allowing traders to potentially profit from both rising and falling stock prices. |

| Indices | Provides exposure to global stock market indices, including the S&P 500, NASDAQ 100, FTSE 100, and DAX 30. Trading index CFDs allows investors to diversify their portfolios and take advantage of broad market movements. |

| Cryptocurrencies | Offers cryptocurrency CFDs on digital assets such as Bitcoin, Ethereum, Litecoin, and Ripple. This segment caters to risk-tolerant investors with high volatility and 24/7 trading opportunities, reflecting the growing popularity of digital currencies. |

FXPrimus' extensive range of tradable assets sets it apart in the industry, catering to the diverse needs of both beginner and experienced traders. By offering such a comprehensive product portfolio, the broker enables clients to explore various markets, diversify their investments, and implement multi-asset trading strategies.

Trading Platforms

FXPrimus offers a suite of robust trading platforms catering to the diverse needs of its clients. The broker understands the importance of providing reliable, user-friendly, and feature-rich platforms to ensure a seamless trading experience. Let's explore the various trading platforms available at FXPrimus.

MetaTrader 4 (MT4)

MT4 is one of the most popular trading platforms in the forex industry, known for its intuitive interface, advanced charting capabilities, and extensive range of technical indicators. FXPrimus offers the MT4 platform for desktop, web, and mobile devices (iOS and Android), allowing traders to access their accounts and execute trades from anywhere at any time.

The MT4 platform at FXPrimus comes equipped with a range of powerful tools, including one-click trading, automated trading through Expert Advisors (EAs), and customizable templates. Traders can also benefit from the platform's real-time market news, economic calendar, and built-in risk management tools.

MetaTrader 5 (MT5)

FXPrimus also provides access to the MT5 platform, an upgraded version of MT4 with enhanced features and functionalities. MT5 offers advanced charting tools, a wider selection of timeframes, and an expanded range of technical indicators, making it well-suited for experienced traders and those employing complex trading strategies.

Like MT4, the MT5 platform is available for desktop, web, and mobile devices, ensuring a consistent trading experience across all devices. MT5 also supports automated trading through EAs and provides access to a broader range of markets, including stocks, futures, and options, in addition to forex.

cTrader

For traders seeking a more advanced and customizable trading experience, FXPrimus offers the cTrader platform. Known for its fast execution speeds, depth of market (DOM) functionality, and advanced order types, cTrader caters to the needs of professional traders and those employing scalping or high-frequency trading strategies.

The cTrader platform features a clean, modern interface and provides a range of tools for in-depth market analysis, including customizable charts, detachable trading windows, and advanced risk management features. Traders can access cTrader through desktop, web, and mobile applications.

WebTrader

FXPrimus' WebTrader platform is a browser-based trading solution that allows clients to trade directly from their web browser without the need to download or install any software. WebTrader offers a user-friendly interface, real-time quotes, interactive charts, and a range of trading tools, making it an ideal choice for traders who prefer a lightweight, accessible platform.

The WebTrader platform is compatible with all major web browsers and supports a wide range of trading instruments, including forex, metals, energies, indices, and cryptocurrencies. Traders can access their accounts, execute trades, and manage their positions seamlessly through the WebTrader platform.

Trading Platforms Comparison Table

| Feature | MetaTrader 4 (MT4) | MetaTrader 5 (MT5) | cTrader | WebTrader |

|---|---|---|---|---|

| Charting Tools | ✔️ | ✔️ (Advanced) | ✔️ (Advanced) | ✔️ |

| Technical Indicators | 30+ | 38+ | 70+ | ✔️ |

| Timeframes | 9 | 21 | ✔️ | ✔️ |

| One-Click Trading | ✔️ | ✔️ | ✔️ | ✔️ |

| Automated Trading (EAs) | ✔️ | ✔️ | ✔️ | ❌ |

| Customizable Interface | ✔️ | ✔️ | ✔️ (Advanced) | Limited |

| Market Depth (DOM) | ❌ | ✔️ | ✔️ | ❌ |

| Mobile Trading | ✔️ (iOS & Android) | ✔️ (iOS & Android) | ✔️ (iOS & Android) | ✔️ (Web Browser) |

| Web-Based Platform | ✔️ | ✔️ | ✔️ | ✔️ |

| Desktop Platform | ✔️ | ✔️ | ✔️ | ❌ |

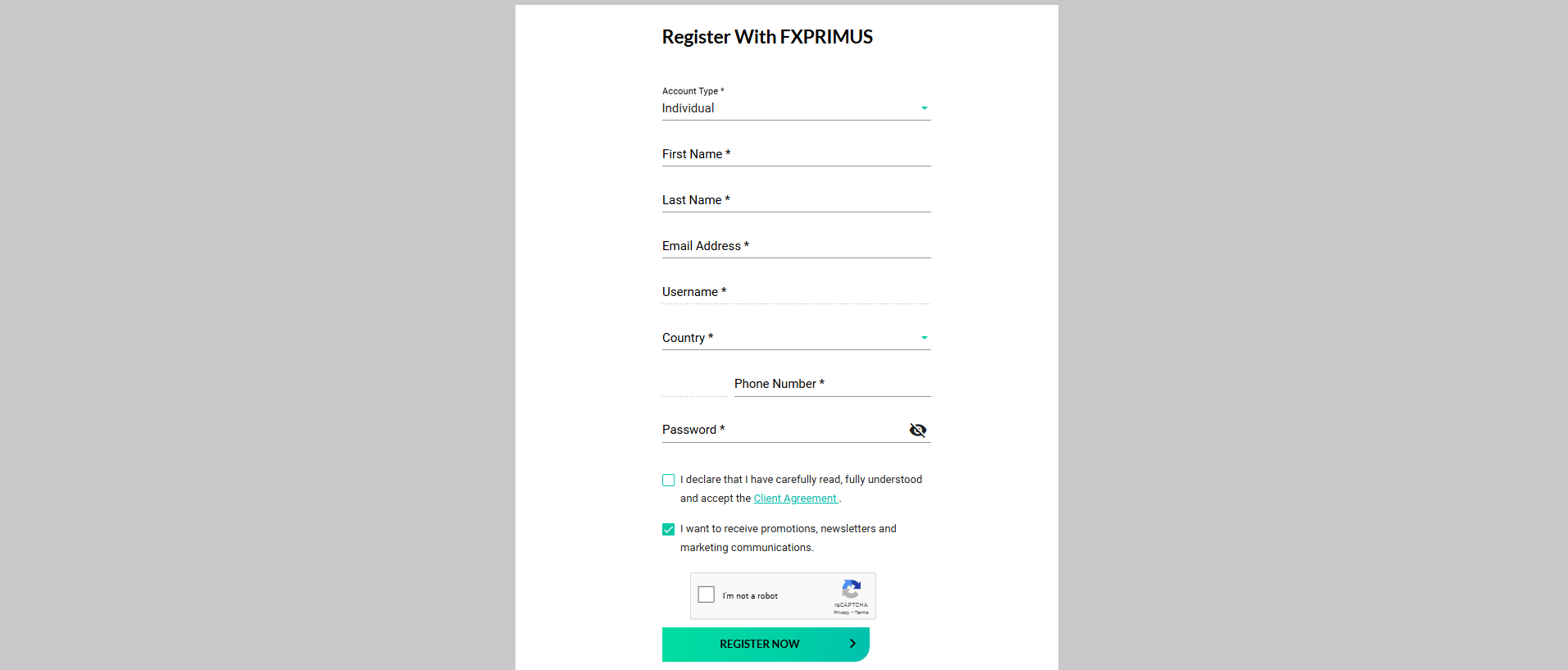

FXPrimus How to Open an Account: A Step-by-Step Guide

Opening an account with FXPrimus is a straightforward process designed to get you started on your trading journey quickly and efficiently. Follow these simple steps to create your account and begin trading with FXPrimus.

Step 1: Visit the FXPrimus Website

Start by navigating to the official FXPrimus website at fxprimus.com. Click on the "Open an Account" button located in the top right corner of the homepage.

Step 2: Choose Your Account Type

Select the type of account you wish to open from the available options: PrimusClassic, PrimusPRO, or PrimusZERO. Each account type has different features, minimum deposit requirements, and trading conditions, so choose the one that best suits your trading style and preferences.

Step 3: Complete the Registration Form

Fill out the online registration form with your personal information, including your full name, email address, phone number, country of residence, and preferred account currency. You will also need to create a unique username and password for your account.

Step 4: Verify Your Identity

To comply with anti-money laundering (AML) and know-your-customer (KYC) regulations, FXPrimus requires all clients to verify their identity and proof of residence. Upload a copy of your government-issued ID (e.g., passport or driver's license) and a recent utility bill or bank statement that confirms your address.

Step 5: Fund Your Account

Once your account is approved, you can make your initial deposit using one of the accepted payment methods, such as bank wire transfer, credit/debit card, or e-wallet. The minimum deposit amount varies depending on your chosen account type:

- PrimusClassic: $15

- PrimusPRO: $500

- PrimusZERO: $1,000

Processing times for deposits also vary based on the payment method used, ranging from instant to several business days for bank wire transfers.

Step 6: Download and Install the Trading Platform

Choose your preferred trading platform (MT4, MT5, cTrader, or WebTrader) and download the software from the FXPrimus website. Install the platform on your device and log in using your account credentials.

Step 7: Start Trading

With your account funded and your trading platform set up, you can now begin trading the various instruments offered by FXPrimus, including forex, metals, energies, indices, stocks, and cryptocurrencies. Be sure to familiarize yourself with the platform's features and tools, and always practice risk management when trading.

FXPrimus offers a user-friendly account opening process, with a quick and easy online application and a variety of funding options to suit your needs. The broker's commitment to security and regulatory compliance ensures that your personal information and funds are protected at all times.

Charts and Analysis

FXPrimus provides a range of educational resources and tools to support its clients in their trading journey. However, the broker's offerings in this area are somewhat limited compared to industry leaders, leaving room for improvement in terms of depth and variety.

| Category | Description |

|---|---|

| Blog Articles | The primary educational resource is provided by FXPrimus, featuring articles on forex trading, market analysis, and trading strategies. Accessible only to registered clients, the content is more suited for beginner and intermediate traders, lacking the depth and structured approach of top-tier educational programs for advanced traders. |

| Market News and Analysis | FXPrimus offers some market news and analysis via its blog and social media channels, helping traders stay updated on current events and trends. However, there is no dedicated market news section or real-time news feed, which may limit the depth of insights available for informed decision-making. |

| Webinars and Video Tutorials | Occasional webinars and video tutorials provide visual and interactive learning opportunities. The offerings are limited in frequency and variety compared to the extensive, structured programs provided by industry leaders, which may restrict access to targeted, regular educational content. |

| Trading Tools and Calculators | Basic trading tools are available, such as an economic calendar and a currency converter. However, the range of tools is relatively limited, missing advanced calculators like position and risk management calculators, as well as market sentiment indicators that can further aid in comprehensive market analysis. |

Incorporating a wider range of trading tools and calculators would demonstrate FXPrimus' commitment to empowering its clients with the resources they need to succeed in the forex market. By investing in the development of these tools, the broker could enhance its educational offering and provide a more well-rounded trading experience for its clients.

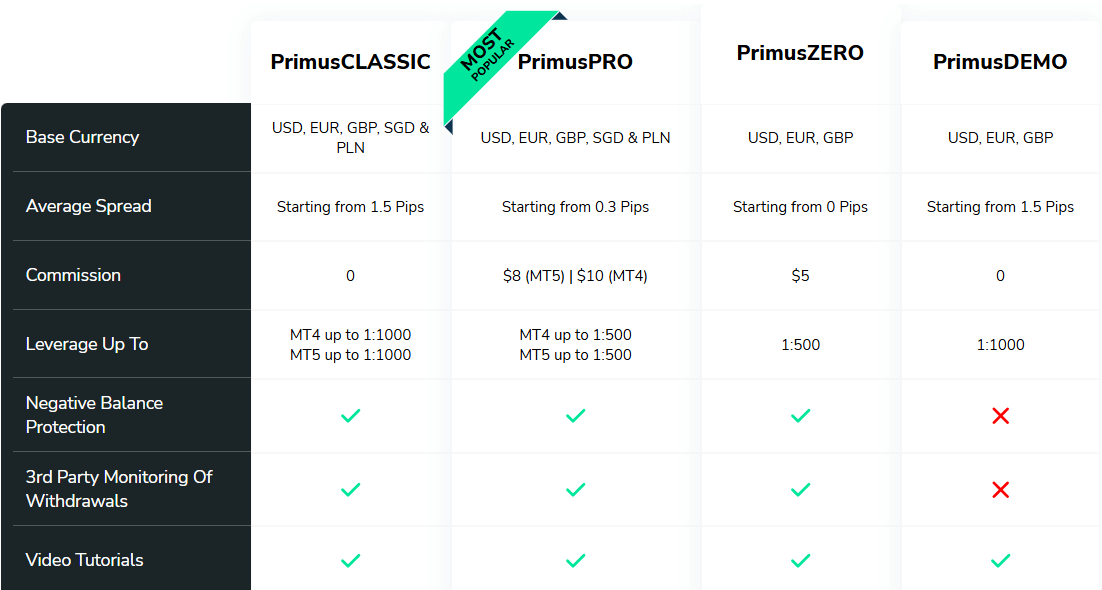

FXPrimus Account Types

FXPrimus offers a range of trading account types tailored to suit the diverse needs of traders at various levels of experience and with different trading styles. By providing multiple account options, the broker ensures that clients can select an account that aligns with their specific goals, risk tolerance, and investment capital.

PrimusClassic Account

The PrimusClassic account is designed for beginner traders and those looking to start with a low minimum deposit. Key features include:

- Minimum deposit of $15

- Spreads starting from 1.5 pips

- No commission fees

- Leverage up to 1:1000

- Access to Copy Trading

- Negative balance protection

This account type is ideal for traders who are new to forex trading and want to gain experience with a small initial investment.

PrimusPRO Account

The PrimusPRO account caters to more experienced traders seeking tighter spreads and higher leverage. Key features include:

- Minimum deposit of $500

- Spreads starting from 0.3 pips

- Commission fees of $8 per lot on MT5 and $10 per lot on MT4

- Leverage up to 1:500 on MT4 and 1:1000 on MT5

- Negative balance protection

This account type is suitable for traders who have a solid understanding of forex trading and are looking to capitalize on more competitive trading conditions.

PrimusZERO Account

The PrimusZERO account is tailored for experienced traders who prefer a commission-based pricing structure and the lowest possible spreads. Key features include:

- Minimum deposit of $1,000

- Spreads starting from 0 pips

- Commission fee of $5 per lot

- Leverage up to 1:500

- Negative balance protection

This account type is designed for sophisticated traders who employ high-frequency trading strategies and require the most cost-effective trading conditions.

PrimusDEMO Account

FXPrimus offers a demo account option, allowing traders to practice their strategies and familiarize themselves with the trading platforms in a risk-free environment. Key features include:

- No minimum deposit required

- Virtual trading balance

- Access to real-time market conditions

- Ability to test trading strategies without risking real money

The demo account is an invaluable tool for both beginner and experienced traders looking to refine their skills and test new strategies before applying them to live trading.

By offering a diverse range of account types, FXPrimus demonstrates its commitment to catering to the needs of traders at every level. The broker's account options provide flexibility in terms of minimum deposit requirements, spreads, commissions, and leverage, ensuring that clients can select an account that best suits their trading style and risk profile.

Account Types Comparison Table

| Feature | PrimusClassic | PrimusPRO | PrimusZERO | PrimusDEMO |

|---|---|---|---|---|

| Minimum Deposit | $15 | $500 | $1,000 | N/A |

| Spreads (from) | 1.5 pips | 0.3 pips | 0 pips | 1.5 pips |

| Commissions | None | $8/lot (MT5) $10/lot (MT4) | $5/lot | None |

| Leverage (up to) | 1:1000 | 1:500 (MT4) 1:1000 (MT5) | 1:500 | 1:1000 |

| Negative Balance Protection | Yes | Yes | Yes | N/A |

| Copy Trading | Yes | No | No | No |

| Demo Account | Available | Available | Available | N/A |

Negative Balance Protection

FXPrimus recognizes the importance of protecting its clients from the risks associated with negative balances. As such, the broker offers negative balance protection on all trading account types, except for the demo account. This means that FXPrimus clients can trade with peace of mind, knowing that their losses will never exceed their account balance. It's essential to note that while negative balance protection provides a safety net, it should not be relied upon as a substitute for proper risk management. Traders should always implement sound risk management strategies, such as setting appropriate stop-loss levels, managing position sizes, and maintaining a balanced portfolio.

Terms and Conditions

To benefit from FXPrimus' negative balance protection, clients must adhere to the broker's terms and conditions. This includes:- Trading responsibly and within one's means

- Not engaging in any form of market manipulation or abuse

- Complying with all applicable laws and regulations

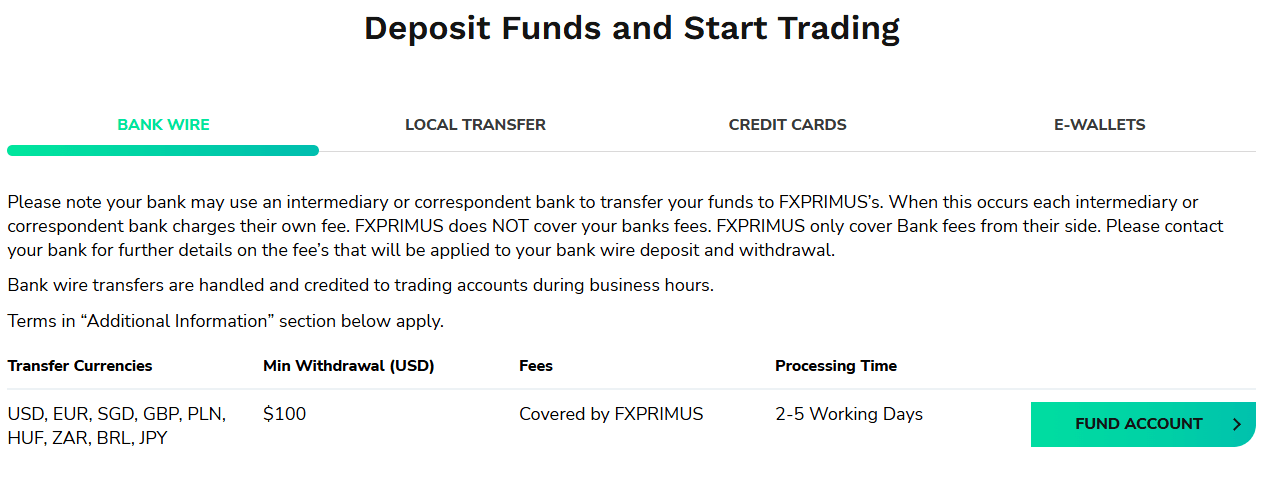

FXPrimus Deposits and Withdrawals

FXPrimus offers a range of deposit and withdrawal options to cater to the diverse needs of its global client base. The broker aims to provide a seamless and secure funding experience, ensuring that traders can efficiently manage their account balances and access their funds when needed.

Deposit Options

FXPrimus accepts the following deposit methods:| Payment Method | Description | Supported Currencies | Processing Time | Additional Details |

|---|---|---|---|---|

| Bank Wire Transfer | Allows traders to deposit funds directly from their bank account. Suitable for larger deposits and offers a wide range of currencies. | USD, EUR, GBP, SGD, PLN, HUF, ZAR, BRL | 2-5 working days | Ideal for larger deposits; clients can deposit in multiple currencies. |

| Credit/Debit Cards | Deposits via Visa and Mastercard provide instant funding. Requires additional documentation to ensure security and AML compliance. | USD, EUR, SGD, GBP, PLN, HUF | Instant | Not available for clients based in the USA. |

| E-wallets | Deposits through e-wallet services such as Skrill and Neteller are processed instantly, offering quick access to funds. | USD, EUR, SGD, GBP, PLN, HUF | Instant | Provides a convenient and fast funding option. |

| Local Transfers | Local bank transfers enable traders to deposit funds in their local currency, minimizing conversion fees. | MYR, IDR, VND, THB | 1-5 working days | Available in select countries; helps avoid currency conversion fees. |

Withdrawal Options

FXPrimus processes withdrawal requests using the same method as the initial deposit, in accordance with anti-money laundering regulations. If the requested withdrawal amount exceeds the total deposits made using a specific method, traders can choose an alternative withdrawal option. The available withdrawal methods include:| Payment Method | Processing Time | Additional Details |

|---|---|---|

| Bank Wire Transfer | 2-5 working days | Traders can withdraw funds directly to their bank account. |

| Credit/Debit Cards | Up to 5 working days | Withdrawals are processed back to the original card used for depositing. |

| E-wallets | Up to 5 working days | Funds are withdrawn to the trader's Skrill or Neteller account. |

| Local Transfers | 1-5 working days | Withdrawals can be made via local bank transfer in select countries. |

Fees and Minimum Amounts

FXPrimus does not charge any deposit fees, and the minimum deposit amount varies depending on the account type:- PrimusClassic: $15

- PrimusPRO: $500

- PrimusZERO: $1,000

Verification and Security

To ensure the security of clients' funds and compliance with regulatory standards, FXPrimus implements strict verification procedures for deposits and withdrawals. Traders may be required to submit additional documentation, such as proof of identity or address, to process their transactions successfully. FXPrimus employs advanced security measures, including data encryption and segregated client funds, to protect traders' financial information and assets. The broker's commitment to safety and transparency ensures that clients can deposit and withdraw funds with confidence.Support Service for Customer

In the fast-paced world of online trading, reliable customer support is crucial to ensuring a positive trading experience. Traders often require assistance with account management, platform navigation, technical issues, or general inquiries, and a responsive support team can make all the difference. FXPrimus understands the importance of customer support and strives to provide its clients with multiple channels for reaching out and receiving timely assistance.

Support Channels

FXPrimus offers several ways for traders to get in touch with their customer support team:| Support Channel | Description |

|---|---|

| Live Chat | Traders can access live chat directly on the FXPrimus website for quick queries and real-time assistance during business hours. |

| Clients can send inquiries to support@fxprimus.com, with an expected response within 24 hours. Ideal for detailed questions or concerns that are not time-sensitive. | |

| Contact Form | The FXPrimus website features a contact form where traders provide their name, email, and message. It serves a similar function to email support but offers a structured format for submitting inquiries. |

| Social Media | Traders can reach out via official social media channels (Facebook, Twitter, LinkedIn). While not as immediate as live chat, this provides an alternative way to connect with support and stay informed about updates and promotions. |

| Messaging Apps | FXPrimus support is also accessible through messaging apps such as Messenger, WhatsApp, WeChat, Zalo, Line, and Telegram, offering a convenient option for clients to seek assistance using their preferred communication platform. |

Support Hours and Languages

FXPrimus customer support is available 24/5, Monday through Friday. The multilingual support team can assist traders in English, Chinese, Spanish, Arabic, French, German, Italian, Portuguese, Russian, and Vietnamese, catering to a global clientele.Response Times

FXPrimus aims to provide prompt and efficient customer support. The live chat feature offers the quickest response times, with most queries addressed within a few minutes during business hours. Email and contact form inquiries are typically responded to within 24 hours, while social media and messaging app response times may vary depending on the platform and the complexity of the issue.Dedicated Account Managers

For clients with higher trading volumes or more specific needs, FXPrimus offers dedicated account managers. These personal support representatives provide one-on-one assistance, helping traders navigate the platform, offering guidance on trading strategies, and addressing any account-related concerns.Continuous Improvement

FXPrimus regularly collects feedback from its clients to improve its customer support services. The broker values the opinions and experiences of its traders, using this information to refine its support processes, train its representatives, and ensure that clients receive the highest level of assistance.Customer Support Comparison Table

| Feature | FXPrimus |

|---|---|

| Support Channels | Live Chat, Email, Contact Form, Social Media, Messaging Apps |

| Support Hours | 24/5 (Monday - Friday) |

| Support Languages | English, Chinese, Spanish, Arabic, French, German, Italian, Portuguese, Russian, Vietnamese |

| Live Chat Response Time | Within minutes (during business hours) |

| Email Response Time | Within 24 hours |

| Dedicated Account Managers | Available for high-volume traders or specific needs |

Prohibited Countries

FXPrimus is a global forex and CFD broker that aims to provide its services to traders worldwide. However, due to various regulatory requirements, licensing restrictions, and geopolitical factors, the broker is prohibited from operating or offering its services in certain countries and regions.

Reasons for Restrictions

The primary reasons behind these restrictions include:

- Local Regulations: Many countries have specific laws and regulations governing the provision of financial services, including online trading. If a broker does not hold the necessary licenses or meet the required regulatory standards in a particular jurisdiction, they may be prohibited from operating there.

- Licensing Requirements: Obtaining and maintaining licenses to operate as a financial services provider can be a complex and costly process. In some cases, brokers may choose not to pursue licensing in certain countries due to the associated costs and regulatory burdens.

- Geopolitical Factors: Political instability, economic sanctions, or other geopolitical issues can also impact a broker's ability to offer services in specific regions. In such cases, brokers may be required to comply with international laws and restrictions.

Countries Where FXPrimus is Prohibited

Based on the information provided, FXPrimus is prohibited from operating or offering its services in the following countries:

- Australia

- Belgium

- Iran

- Japan

- North Korea

- United States

It is essential for traders to note that attempting to access FXPrimus' services from a prohibited country may result in legal consequences and the termination of their trading account. Traders are responsible for ensuring that they comply with their local laws and regulations when engaging in online trading activities.

Special Offers for Customers

FXPrimus does not currently offer any special promotions, bonuses, or incentives for their traders.

While many online brokers use various promotional strategies to attract new clients and retain existing ones, FXPrimus seems to focus more on providing competitive trading conditions, a wide range of trading instruments, and a user-friendly platform. However, the absence of special offers may make the broker less appealing to some traders who are seeking additional value or incentives.

It's important to note that the availability of special offers can change over time, and it's always a good idea to check the broker's official website or contact their customer support for the most up-to-date information on any promotions or incentives.

Conclusion

After conducting a thorough review of FXPrimus, I can confidently say that they have established themselves as a reliable and trustworthy broker in the online trading industry. With a strong focus on regulatory compliance, client security, and user-friendly trading solutions, FXPrimus has earned a solid reputation among traders worldwide.

One of the key factors that set FXPrimus apart is their commitment to operating within a robust regulatory framework. By holding licenses from top-tier authorities such as CySEC and VFSC, they demonstrate a dedication to maintaining high standards of transparency and integrity. This regulatory oversight provides clients with an added layer of protection and peace of mind when trading with FXPrimus.

Throughout my analysis of FXPrimus, I was impressed by their efforts to cater to the diverse needs of traders. The broker offers a range of account types, from the beginner-friendly PrimusClassic to the more advanced PrimusPRO and PrimusZERO, ensuring that traders of all experience levels can find a suitable option. Additionally, their wide selection of tradable assets, including forex, commodities, indices, stocks, and cryptocurrencies, allows for ample diversification opportunities.

FXPrimus' trading platforms, particularly the industry-standard MT4 and MT5, provide a seamless and efficient trading experience. The broker's commitment to offering advanced charting tools, automated trading capabilities, and a user-friendly interface further enhances the overall trading environment.

While FXPrimus excels in many areas, there is room for improvement in their educational resources and research tools. Although they provide a blog with market analysis and trading insights, the depth and breadth of these materials are somewhat limited compared to other industry leaders. Expanding their educational offering would further support traders in their learning journey and decision-making process.

In terms of customer support, FXPrimus offers a responsive and knowledgeable team, available through multiple channels such as live chat, email, and social media. The support is provided in several languages, catering to their global client base. However, the lack of 24/7 support may be a drawback for some traders who require assistance outside of standard business hours.

It is worth noting that FXPrimus does not currently offer any special promotions or bonuses, which may be a disadvantage for traders seeking additional incentives. However, the broker's competitive spreads, low minimum deposit requirements, and transparent fee structure still make them an attractive choice for cost-conscious traders.

In conclusion, FXPrimus has proven to be a reliable and trustworthy broker that prioritizes client security and satisfaction. Their strong regulatory compliance, diverse trading offerings, and user-friendly platforms make them a solid choice for traders seeking a reputable partner in their trading journey. While there are areas where FXPrimus could enhance their services, such as educational resources and customer support hours, the overall package they offer is competitive and well-suited to a wide range of traders.

Compare tiered accounts in the broker account matrix.

Regional regulation focus? Read the Uniglobe Markets review.