FXTM Review 2025: Regulations, Trading Conditions, and Platforms of this Trusted Forex Broker Tested

FXTM

Cyprus

Cyprus

-

Minimum Deposit $10

-

Withdrawal Fee $0

-

Leverage 2000:1

-

Spread From 0.1

-

Minimum Order 0.01

-

Forex Available

-

Crypto Available

-

Stock Available

-

Indices Available

Licenses

United Kingdom Market Making (MM)

United Kingdom Market Making (MM)

Cyprus Market Making (MM)

Cyprus Market Making (MM)

South Africa Retail Forex License

South Africa Retail Forex License

Japan Forex Trading License

Japan Forex Trading License

Belize Financial Services License

Belize Financial Services License

Softwares & Platforms

Customer Support

+35725558777

(English)

+35725558777

(English)

Supported language: Arabic, Chinese (Simplified), English, French, German, Hindi, Indonesian, Italian, Japanese, Korean, Malay, Polish, Portuguese, Russian, Spanish, Thai, Urdu, Vietnamese

Social Media

Summary

FXTM (ForexTime) is a globally recognized forex and CFD broker known for its competitive spreads, diverse account types, and high leverage options of up to 1:3000. Established in 2011, the broker offers trading on MT4 and MT5 platforms, catering to both beginner and professional traders with advanced tools and educational resources.

- Well-regulated by top-tier authorities like FCA and CySEC

- Wide range of tradable assets including forex, CFDs, and shares

- Multiple account types catering to different trading styles and experience levels

- Advanced trading platforms (MT4/MT5) with robust tools and features

- Comprehensive educational resources for traders of all skill levels

- 24/5 multilingual customer support via live chat, email, and phone

- Competitive spreads, low commissions, and flexible leverage

- Negative balance protection and segregated client funds for added security

- Attractive promotions and loyalty programs for new and existing clients

- Transparency in fees, regulations, and trading conditions

- Limited range of tradable instruments compared to some competitors

- Higher minimum deposit for ECN accounts ($500) compared to Standard accounts

- Inactivity fees applied after 6 months of no trading activity

- No support for automated trading platforms like cTrader or NinjaTrader

- Relatively high minimum withdrawal amount of $50

- Varying leverage restrictions based on country of residence

- No guaranteed stop-loss orders available

- Occasional requotes and slippage during high market volatility

- Limited customization options for trading platforms

- No 24/7 customer support, only available 24/5

Overview

Established in 2011, FXTM (ForexTime) is an international forex and CFD broker with a strong presence in Europe, Asia, and Africa. Regulated by top-tier authorities like the FCA (UK), CySEC (Cyprus), and the FSCA (South Africa), FXTM has built a reputation for providing a secure and transparent trading environment.

Through its entities, FXTM offers access to over 600 tradable instruments, including forex, shares, indices, commodities, and cryptocurrencies. Clients can trade using the industry-standard MetaTrader 4 and 5 platforms, available on desktop, web, and mobile, or opt for FXTM's proprietary mobile app for on-the-go trading.

FXTM has received numerous accolades over the years, including "Most Transparent Broker Global 2022" by World Business Outlook and "Best Forex Broker Africa 2021" by the Global Business Review Magazine. The broker's commitment to education is evident through its extensive library of articles, webinars, and video tutorials, catering to both beginners and experienced traders.

While FXTM offers competitive trading conditions, such as low spreads and flexible leverage, potential clients should be aware of the risks associated with forex and CFD trading. As with any financial investment, it is crucial to conduct thorough research and consider individual risk tolerance before trading.

For more information about FXTM's services, regulation, and offerings, please visit their official website at forextime.com.

Overview Table

| Category | Details |

|---|---|

| Establishment | 2011 |

| Headquarters | Limassol, Cyprus |

| Regulation | FCA (UK), CySEC (Cyprus), FSCA (South Africa), FSC (Mauritius) |

| Tradable Instruments | Forex, Shares, Indices, Commodities, Cryptocurrencies |

| Trading Platforms | MetaTrader 4, MetaTrader 5, FXTM Trader App |

| Minimum Deposit | $50 (Standard Accounts), $500 (ECN Accounts) |

| Customer Support | 24/5 via Live Chat, Email, Phone |

| Education | Articles, Webinars, Video Tutorials, Ebooks |

| Awards | "Best FX Broker 2020" (European CEO Awards), "Best Forex Broker Africa 2021" (Global Business Review Magazine) |

Fact List

- FXTM was founded in 2011 and is headquartered in Limassol, Cyprus.

- The broker is regulated by the FCA (UK), CySEC (Cyprus), FSCA (South Africa), and FSC (Mauritius).

- FXTM offers over 600 tradable instruments, including forex, shares, indices, commodities, and cryptocurrencies.

- Clients can trade using MetaTrader 4, MetaTrader 5, or FXTM's proprietary mobile app.

- The minimum deposit for Standard Accounts is $50, while ECN Accounts require a minimum of $500.

- FXTM provides 24/5 customer support via live chat, email, and phone.

- The broker offers an extensive library of educational materials, including articles, webinars, video tutorials, and ebooks.

- FXTM has received awards such as "Best FX Broker 2020" (European CEO Awards) and "Best Forex Broker Africa 2021" (Global Business Review Magazine).

- The broker offers competitive trading conditions, such as low spreads and flexible leverage.

- As with any financial investment, forex and CFD trading carries risks, and potential clients should carefully consider their risk tolerance before trading.

FXTM Licenses and Regulatory

FXTM operates under a robust regulatory framework, holding licenses from multiple top-tier financial authorities worldwide. This multi-jurisdictional approach to regulation provides clients with an enhanced level of security and trust, as the broker must adhere to strict guidelines and maintain high standards of operational integrity.

The primary regulatory bodies overseeing FXTM's activities include:

| Country | Regulatory Authority | Abbreviation | License Number | Entity |

|---|---|---|---|---|

| United Kingdom | Financial Conduct Authority | FCA | 777911 | Exinity UK Ltd |

| Cyprus | Cyprus Securities and Exchange Commission | CySEC | 185/12 | ForexTime Ltd |

| South Africa | Financial Sector Conduct Authority | FSCA | 46614 | ForexTime Ltd |

| Mauritius | Financial Services Commission | FSC | C113012295 | Exinity Limited |

| Seychelles | Financial Services Authority | FSA | SD037 | Exinity Limited |

| Belize | International Financial Services Commission | IFSC | IFSC/60/345/TS/17 | FT Global Ltd |

Each of these regulators has its own set of rules and requirements that FXTM must comply with, covering aspects such as client fund segregation, transparent pricing, and fair business practices. The FCA and CySEC, in particular, are known for their stringent regulations and are considered top-tier authorities in the industry.

By maintaining multiple licenses, FXTM demonstrates its commitment to providing a secure and transparent trading environment for its clients. This is particularly important in the context of online trading, where the safety of client funds and the integrity of the broker are paramount.

In addition to the above-mentioned licenses, FXTM is also registered with the Financial Services Authority (FSA) in Seychelles and the International Financial Services Commission (IFSC) in Belize. While these regulatory bodies may not have the same level of oversight as the FCA or CySEC, they still require the broker to adhere to certain standards and provide an additional layer of accountability.

Compared to industry standards, FXTM's regulatory framework is comprehensive and on par with other well-respected brokers. The combination of top-tier and secondary licenses demonstrates the broker's commitment to maintaining a high level of regulatory compliance and providing a secure trading environment for its clients.

Trading Instruments

FXTM offers a diverse range of tradable assets, catering to the needs and preferences of both novice and experienced traders. The broker's extensive portfolio spans multiple asset classes, allowing clients to diversify their investments and take advantage of various market opportunities.

| Asset Class | Instruments Offered | Leverage | Other Features |

|---|---|---|---|

| Forex | - 62 currency pairs (including majors like EUR/USD, GBP/USD, USD/JPY) | - Non-EU: Up to 1:1000

- EU: Up to 1:30 |

- Competitive spreads (as low as 0.1 pips on EUR/USD)- Fast execution speeds |

| Spot Metals | - Gold (XAUUSD)- Silver (XAGUSD) | - Non-EU: Up to 1:500-

EU: Up to 1:20 |

- Competitive spreads- Flexible contract sizes |

| CFDs on Indices, Commodities, and Shares | - 11 index CFDs (e.g., S&P 500, NASDAQ 100, DAX 30)- 3 commodity CFDs (e.g., Brent Crude Oil, WTI Crude Oil)- 172 share CFDs covering major companies (US, UK, Europe) | - Non-EU: Up to 1:100

- EU: Up to 1:10 (lower for shares) |

- Speculate on price movements without owning the underlying assets |

| Cryptocurrencies | - 4 crypto CFDs (Bitcoin, Ethereum, Litecoin, Ripple) | - Non-EU: Up to 1:10-

EU: Up to 1:2 |

- Competitive spreads- High liquidity |

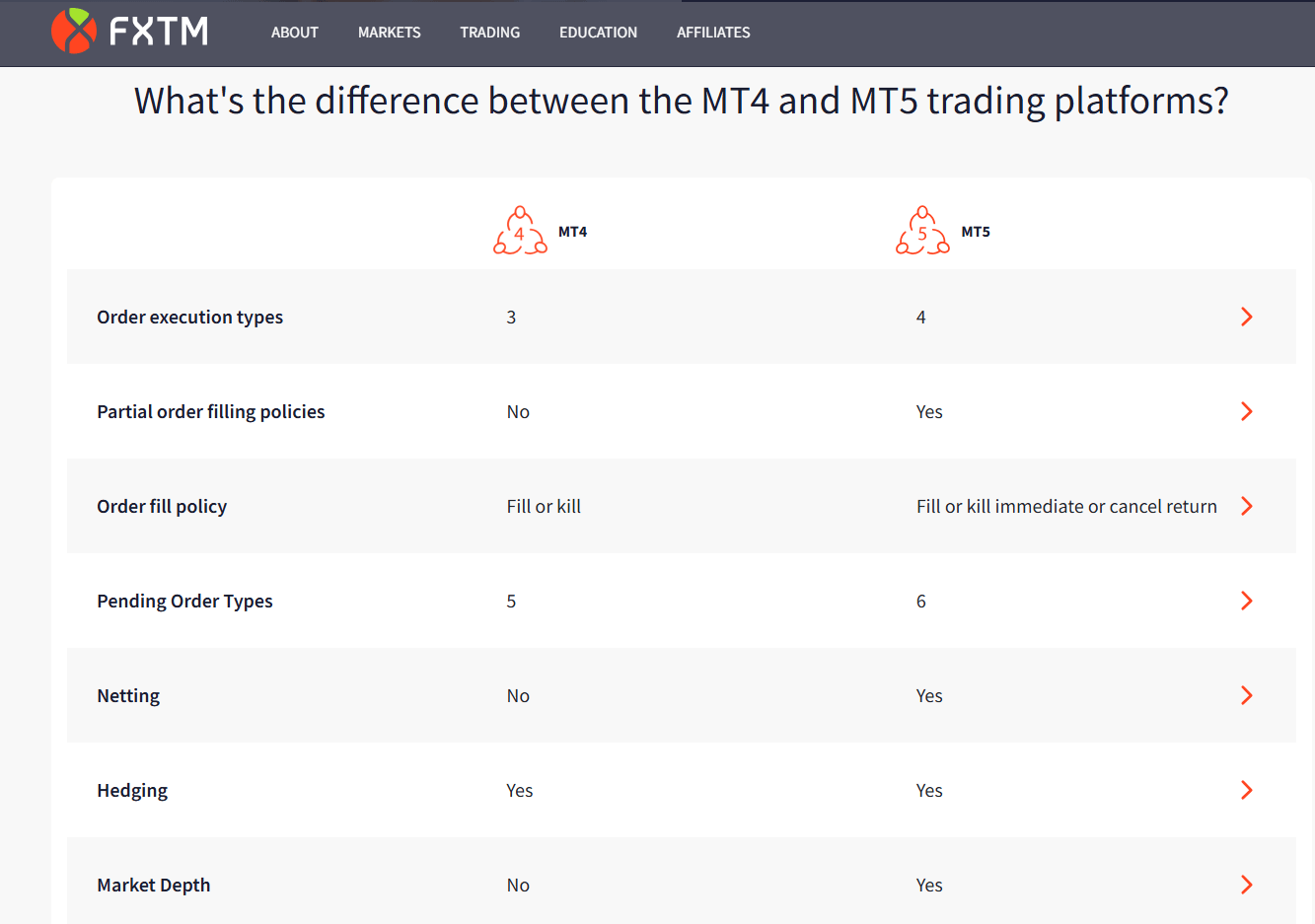

Trading Platforms

FXTM offers a range of trading platforms to cater to the diverse needs and preferences of its clients. These platforms include industry-standard options like MetaTrader 4 (MT4) and MetaTrader 5 (MT5), as well as FXTM's proprietary mobile trading app.

| Trading Platform | Description |

|---|---|

| MetaTrader 4 (MT4) | - User-friendly interface with advanced charting tools - 30+ technical indicators and 24 analytical objects - 9 timeframes and 3 chart types - One-click trading and trading from the chart - Supports automated trading with Expert Advisors (EAs) - Available for desktop, web, and mobile (iOS and Android) |

| MetaTrader 5 (MT5) | - Enhanced version of MT4 with more features - 38+ technical indicators and 44 analytical objects - 21 timeframes and 3 chart types - One-click trading and trading from the chart - Supports automated trading with Expert Advisors (EAs) - Available for desktop, web, and mobile (iOS and Android) |

| FXTM Trader App | - Proprietary mobile trading app for on-the-go account management - Intuitive and user-friendly interface - Real-time quotes and interactive charts - Place and manage trades securely - Secure login with biometric authentication - Available for iOS and Android devices |

| Web-based Trading | - Web versions of both MT4 and MT5 available - No software download required - Provides the same features and functionality as desktop versions - Accessible directly through a web browser |

FXTM's range of trading platforms caters to the needs of both novice and experienced traders. The broker's offerings are in line with industry standards, ensuring that clients have access to reliable and user-friendly tools for executing their trades.

The availability of automated trading through Expert Advisors (EAs) on both MT4 and MT5 is particularly attractive for traders who employ algorithmic strategies. Additionally, the FXTM Trader App provides a convenient solution for traders who wish to monitor and manage their accounts while on the move.

Trading Platforms Comparison Table

| Feature | MT4 | MT5 | FXTM Trader App |

|---|---|---|---|

| One-click trading | ✓ | ✓ | ✓ |

| Trading from the chart | ✓ | ✓ | ✗ |

| Automated trading (EAs) | ✓ | ✓ | ✗ |

| Technical indicators | 30+ | 38+ | ✗ |

| Analytical objects | 24 | 44 | ✗ |

| Timeframes | 9 | 21 | ✗ |

| Chart types | 3 | 3 | ✓ |

| Web-based version | ✓ | ✓ | N/A |

| Mobile app (iOS & Android) | ✓ | ✓ | ✓ |

| Secure login (biometric) | ✗ | ✗ | ✓ |

FXTM How to Open an Account: A Step-by-Step Guide

FXTM account opening is a straightforward process that can be completed online in a few simple steps. Before getting started, it's important to ensure that you meet the minimum requirements and have the necessary documents ready.

Requirements:

- Minimum age: 18 years old

- Valid government-issued ID (passport, national ID card, or driver's license)

- Proof of residence (utility bill, bank statement, or government-issued document)

- Minimum deposit: $50 for Standard Accounts, $500 for ECN Accounts

Step 1: Visit the FXTM website and click on the "Open Account" button in the top right corner of the page.

Step 2: Choose the account type that best suits your trading style and needs. FXTM offers Standard Accounts, ECN Accounts, and Shares Accounts.

Step 3: Fill out the online registration form with your personal information, including your name, email address, phone number, and country of residence.

Step 4: Provide your trading experience and financial information, such as your employment status, annual income, and source of funds. This information is required by regulators to ensure that trading is appropriate for your financial situation.

Step 5: Choose your preferred trading platform (MT4 or MT5) and your account base currency (USD, EUR, or GBP).

Step 6: Review and accept the FXTM Client Agreement, Risk Disclosure, and Privacy Policy.

Step 7: Submit your application and wait for FXTM to review and approve your account. This process typically takes 1-2 business days.

Step 8: Once your account is approved, you will receive an email with your account details and login credentials.

Step 9: Log in to your MyFXTM dashboard and navigate to the "Deposit" section to fund your account. FXTM accepts a variety of payment methods, including bank wire transfers, credit/debit cards, and e-wallets like Skrill and Neteller.

Step 10: Once your deposit is processed, you can start trading on your chosen platform.

FXTM offers a user-friendly account opening process, with a quick online application and a variety of account types to choose from. The broker also provides a demo account option for those who wish to practice trading before committing to real funds.

Charts and Analysis

FXTM offers a comprehensive suite of educational resources and tools designed to support traders at all levels of experience. These resources aim to enhance clients' trading knowledge and skills, empowering them to make informed decisions in the markets.

| Feature | Description |

|---|---|

| Trading Calculator | - Calculates required margin, pip value, and potential profit/loss - Based on factors like account currency, trade size, and leverage |

| Pip Calculator | - Determines the value of a pip for various currency pairs - Helps traders manage risk and position sizes effectively |

| Profit Calculator | - Calculates potential profits or losses for a trade - Factors include account currency, trade size, entry/exit prices, stop loss/take profit levels |

| FXTM Pivot Points | - Identifies daily support and resistance levels - Helps traders with entry and exit decisions based on the previous day's range |

| Market Analysis and Insights | - Daily Market Analysis: Updates on most traded instruments, key levels, and market-moving events - Weekly Market Forecast: Outlook on major currency pairs, commodities, and indices - Market News: Real-time updates on economic events impacting the markets |

| Educational Resources | - Webinars: Live sessions by experienced traders covering beginner to advanced topics - Educational Videos: Short, informative videos on trading concepts - Trading Guides: Downloadable materials covering forex basics, technical analysis, and risk management - Glossary: Comprehensive list of trading terms and definitions |

In comparison to industry standards, FXTM's educational resources and tools are comprehensive and well-developed. The broker offers a diverse range of materials that cater to traders of all experience levels, from beginners to advanced traders.

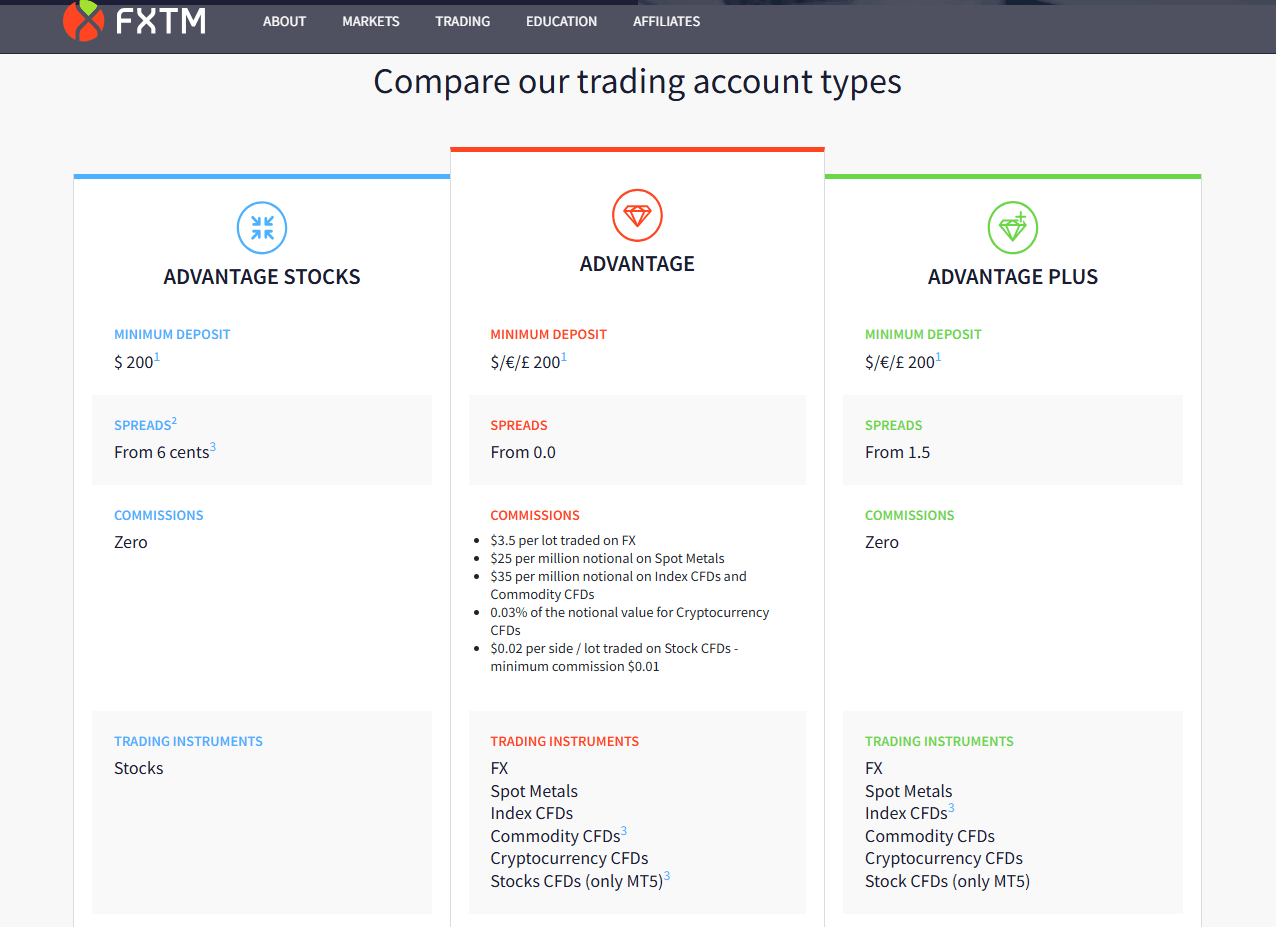

FXTM Account Types

FXTM offers a range of trading account types designed to cater to the diverse needs and preferences of traders at various levels of experience and with different trading styles.

| Account Type | Minimum Deposit | Spreads (Floating) | Commission | Trading Instruments | Platforms | Leverage (up to) | Swap-Free Option |

|---|---|---|---|---|---|---|---|

| Advantage Account | $200 | From 0.0 pips | - $3.5 per lot on FX - $25 per million on Spot Metals - $35 per million on Index/Commodity CFDs - 0.05% of notional value for Crypto CFDs - $0.02 per side/lot on Stock CFDs (min $0.01) | FX, Spot Metals, Index CFDs, Commodity CFDs, Crypto CFDs, Stock CFDs (MT5 only) | MT4, MT5 | 1:3000 | Yes |

| Advantage Plus Account | $200 | From 1.5 pips | Zero | FX, Spot Metals, Index CFDs, Commodity CFDs, Crypto CFDs, Stock CFDs (MT5 only) | MT4, MT5 | 1:3000 | Yes |

| Advantage Stocks Account | $200 | From 6 cents | Zero | Stocks | MT4 | 1:1 | No |

Additional Notes

- Spreads are floating and may increase depending on market conditions.

- Leverage may vary depending on the instrument and regulatory restrictions in your region.

Negative Balance Protection

FXTM is committed to safeguarding its clients' funds and providing a secure trading environment. As part of this commitment, FXTM offers negative balance protection to all its clients, regardless of their account type or trading platform. Under FXTM's negative balance protection policy:

- Traders cannot lose more than their account balance

- In the event of a negative balance, FXTM will absorb the loss and reset the account balance to zero

- Negative balance protection applies to all trading instruments offered by FXTM, including forex, metals, commodities, indices, and cryptocurrencies

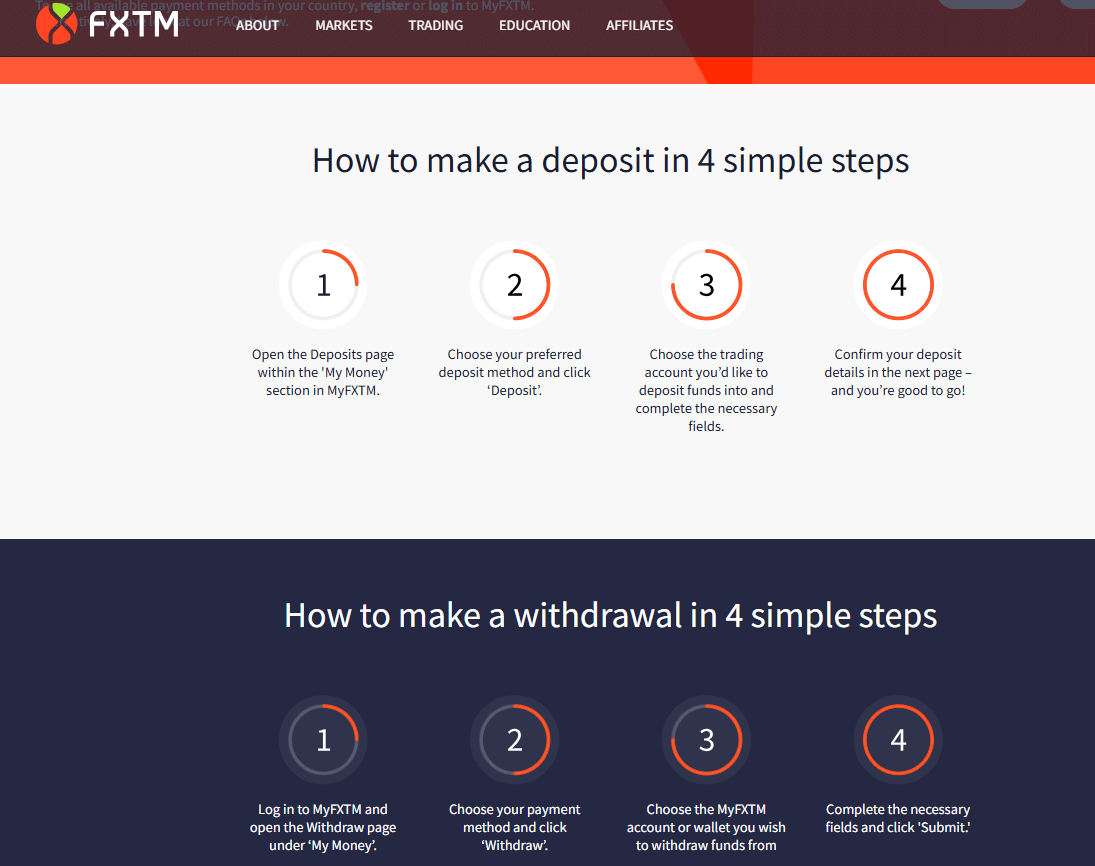

FXTM Deposits and Withdrawals

FXTM offers a wide range of convenient deposit and withdrawal options to cater to the diverse needs of its global client base.

Deposit Options

| Deposit Method | Details |

|---|---|

| Bank Wire Transfer | - Direct deposit from a bank account- No fees charged by FXTM (bank processing fees may apply) |

| Credit/Debit Cards | - Accepted cards: Visa, Mastercard, Maestro- Instant deposits- Free of charge |

| E-Wallets | - Popular options include Skrill, Neteller, and Rapid Transfer- Instant deposits- Free of charge |

| Local Payment Methods | - Includes methods such as Multibanko, Przelewy24, iDEAL, GiroPay, and SOFORT- Availability and fees may vary based on the trader's country of residence |

Withdrawal Options

| Withdrawal Method | Description | Fee | Processing Time |

|---|---|---|---|

| Bank Wire Transfer | Funds are withdrawn directly to the trader's bank account. | $5 flat fee | 2-5 business days |

| Credit/Debit Cards | Withdrawals are processed back to the credit/debit card used for funding. | No fee | 1-2 business days |

| E-Wallets | Funds can be withdrawn to Skrill, Neteller, or Rapid Transfer accounts. | No fee | Instant |

Verification Requirements

To comply with anti-money laundering (AML) and know-your-customer (KYC) regulations, FXTM requires traders to verify their identity and address before processing withdrawals. Traders need to submit the following documents:- Proof of Identity: A valid government-issued ID, such as a passport, national ID card, or driver's license.

- Proof of Address: A recent utility bill, bank statement, or government-issued document confirming the trader's address.

- Proof of Payment: A copy of the credit/debit card or e-wallet account used for funding, showing the trader's name and account number.

Unique Features

FXTM offers a unique feature called "Express Withdrawals" for VIP clients, which ensures that withdrawal requests are processed within 24 hours. This service is available to traders who maintain a minimum balance of $10,000 and have a trading volume of at least 10 standard lots per month.Support Service for Customer

FXTM provides the following customer support channels:

| Support Channel | Availability/Details | Response Time |

|---|---|---|

| Live Chat | - Access via FXTM's website- Available 24/5 | Under 1 minute (average) |

| - Send queries to support@forextime.com | Within 24 hours | |

| Phone | - Local and international support in multiple languages- Global number: +44 203 734 1025- Country-specific numbers available on the website | Immediate assistance while on call |

| Contact Form | - Submit via FXTM's website with name, email, and query | Within 24 hours |

| Social Media | - Reach out via official Facebook, Twitter, and Instagram accounts | Varies based on platform and query complexity |

Support Languages

FXTM's customer support team is multilingual, offering assistance in the following languages:- English

- Arabic

- Chinese

- French

- German

- Hindi

- Indonesian

- Italian

- Japanese

- Korean

- Malay

- Polish

- Portuguese

- Russian

- Spanish

- Thai

- Urdu

- Vietnamese

Response Times and Guarantees

FXTM strives to provide prompt and efficient customer support. The average response times for each support channel are as follows:- Live Chat: Under 1 minute

- Email: Within 24 hours

- Phone: Immediate, subject to call volume

- Contact Form: Within 24 hours

- Social Media: Varies depending on the platform and query complexity

Customer Support Comparison Table

| Support Channel | Availability | Average Response Time | Languages |

|---|---|---|---|

| Live Chat | 24/5 | Under 1 minute | Multiple |

| 24/7 | Within 24 hours | Multiple | |

| Phone | 24/5 | Immediate | Multiple |

| Contact Form | 24/7 | Within 24 hours | Multiple |

| Social Media | 24/7 | Varies | Multiple |

Prohibited Countries

FXTM, like many international forex brokers, is subject to various regulations and licensing requirements that restrict its operations in certain countries and regions. These restrictions are put in place to ensure compliance with local laws, protect consumers, and maintain the integrity of the financial markets.

FXTM is currently prohibited from offering its services in the following countries:

- United States of America

- Japan

- Canada

- Haiti

- Suriname

- Democratic People's Republic of Korea (North Korea)

- Puerto Rico

- Occupied Area of Cyprus

- Iran

- Brazil

- New Zealand

- Hong Kong

Consequences of Trading from Prohibited Countries:

Attempting to trade with FXTM from a prohibited country can result in several consequences:

- Account Termination: If FXTM discovers that a client is trading from a prohibited country, the broker reserves the right to terminate the account immediately and without prior notice.

- Funds Forfeiture: In some cases, clients from prohibited countries may forfeit their account balances, as FXTM is not allowed to process withdrawals to these jurisdictions.

- Legal Action: Trading with FXTM from a prohibited country may violate local laws, resulting in legal consequences for the client.

It is essential for traders to familiarize themselves with the regulations in their country of residence and ensure that they are eligible to trade with FXTM before opening an account.

Special Offers for Customers

FXTM offers a range of special promotions and offers designed to enhance traders' experiences and provide additional value. These offers cater to both new and existing clients, rewarding them for their loyalty and encouraging them to explore new trading opportunities.

| Program | Benefits/Rewards | Key Terms and Conditions |

|---|---|---|

| Refer a Friend Program | - Earn up to $250 for each referred friend- Bonus credited to the referrer's account (withdrawable or used for trading) | - Referred friend must be a new client and register via the referrer's unique referral link- Minimum deposit of $100 by the referred friend- The referred friend must trade at least 5 standard lots within 30 days of registration- Bonus is capped at $250 per referred friend |

| Loyalty Program | - Earn loyalty points for each completed trade- Redeem points for rewards such as cashback, trading bonuses, or branded merchandise | - Points are earned based on trading volume and instrument type- Loyalty points expire after 12 months if not redeemed- Redeemed rewards may have additional requirements (e.g., trading volume conditions or withdrawal restrictions) |

| Trading Competitions | - Opportunity to win prizes such as cash, trading bonuses, or other rewards- Gain recognition by competing on various trading metrics | - Competition rules and eligibility vary by event- Prizes and conditions are specific to each competition- Participants must adhere to all competition rules and FXTM's general terms and conditions |

| Third-Party Partnerships | - Access to advanced trading tools, analytics, and educational resources via partner platforms (e.g., PsyQuation) | - Partnerships are subject to change and may be available for a limited time- Clients might need to meet specific criteria or incur additional fees to access these services- FXTM is not responsible for the content, accuracy, or reliability of third-party services |

Conclusion

Throughout this comprehensive review, I have thoroughly examined FXTM's offerings, services, and reputation as a global forex and CFD broker. Drawing upon the analysis conducted across various aspects of their operations, I can confidently conclude that FXTM is a trustworthy and reliable broker that prioritizes the safety and satisfaction of its clients.

One of the key factors contributing to FXTM's credibility is their strong regulatory compliance. With licenses from top-tier authorities such as the FCA in the UK and CySEC in Cyprus, as well as oversight from the FSCA in South Africa and FSC in Mauritius, FXTM demonstrates a commitment to operating transparently and adhering to strict financial regulations. This multilateral regulatory framework provides clients with peace of mind, knowing that their funds are protected and that the broker is held to high standards of conduct.

In terms of trading offerings, FXTM caters to a wide range of traders through their diverse account types, competitive trading conditions, and extensive range of tradable assets. Whether you are a beginner seeking a user-friendly introduction to forex trading or an experienced trader looking for advanced tools and tight spreads, FXTM has an account type suited to your needs. Their robust trading platforms, including the industry-standard MetaTrader 4 and MetaTrader 5, along with their proprietary mobile app, ensure that clients have access to cutting-edge technology and can trade seamlessly across devices.

FXTM's commitment to client support is evident in their multilingual customer service, available 24/5 through various channels such as live chat, email, and telephone. The broker's extensive educational resources, including webinars, tutorials, and market analysis, further demonstrate their dedication to empowering traders with the knowledge and skills needed to succeed in the markets.

Moreover, FXTM's regular promotions and loyalty programs add value for both new and existing clients, providing opportunities to earn bonuses, cashback, and other rewards. The broker's transparency regarding its fee structure, with clear information on spreads, commissions, and swap rates, allows traders to make informed decisions and manage their trading costs effectively.

While FXTM's offerings are well-rounded and cater to a broad audience, it is essential for prospective clients to carefully consider their individual trading needs and risk tolerance before selecting a broker. As with any financial decision, thorough research and due diligence are crucial.

In conclusion, FXTM stands out as a reputable and trustworthy broker, offering a secure and supportive trading environment for forex and CFD enthusiasts worldwide. With their strong regulatory foundation, comprehensive trading services, and client-centric approach, FXTM is well-positioned to meet the diverse needs of traders at every level of experience.

Check TradingView integration on the chart-ready broker page.

Prefer a household name? Dive into the Rakuten Securities review.