GMI Review 2025: Key Features, Trading Platforms & Account Types

GMI

Saint Lucia

Saint Lucia

-

Minimum Deposit $15

-

Withdrawal Fee $varies

-

Leverage 2000:1

-

Minimum Order 0.01

-

Forex Available

-

Crypto Unavailable

-

Stock Available

-

Indices Available

Licenses

Forex & CFD Brokerage License

Forex & CFD Brokerage License

Softwares & Platforms

Customer Support

Supported language: English

Social Media

Summary

GMI Markets, established in 2009 and headquartered in Saint Lucia, is a multi-regulated forex and CFD broker with entities in Mauritius, Saint Vincent and the Grenadines, and Vanuatu. It offers a wide range of tradable assets including forex, commodities, indices, and stock CFDs, with leverage up to 1:2000 and spreads from 0.0 pips. The broker supports MT4, MAM, and its own GMI Edge platform, and provides various account types with low minimum deposits. Regulated by the FSC of Mauritius, GMI ensures compliance and client fund segregation, though detailed information on awards and education resources is limited.

- Regulated by the Financial Services Commission (FSC) of Mauritius

- Offers popular trading platforms like MetaTrader 4 (MT4) and a proprietary mobile app

- Provides competitive spreads starting from 0.0 pips and leverage up to 1:2000

- Offers a range of trading instruments, including forex, commodities, indices, and stock CFDs

- Provides multiple account types to cater to different trading styles and preferences

- Lacks transparency regarding negative balance protection, withdrawal methods, and prohibited countries

- Limited customer support options, with only a contact form available on the website

- Provides limited information about account types and their specific features

- Offers a limited selection of deposit methods compared to other brokers

- Lacks a clear list of prohibited countries, raising concerns about regulatory compliance and legal obligations

Overview

GMI Markets, also known as Global Market Index, is an online forex and CFD broker that has been operating since 2009. Registered in Saint Lucia, GMI Markets has established a global presence with multiple regulated entities across jurisdictions like Mauritius, Saint Vincent and the Grenadines, and Vanuatu.

One notable aspect of GMI Markets is its regulation by the Financial Services Commission (FSC) of Mauritius. The Mauritius-based entity, Global Market Index Limited, is authorised and regulated by the FSC under license number C118023454, providing an added layer of regulatory oversight and compliance.

Despite its international reach and regulatory status, information about GMI Markets' awards and recognitions is limited on its website. While the broker claims to have details available on its homepage and "About Us" page, clear and specific information about these achievements remains elusive.

GMI Markets offers a range of trading instruments, including forex, indices, commodities like gold and oil, and stock CFDs. The broker provides multiple account types to cater to different trading styles and preferences, along with a proprietary trading platform called GMI Edge, in addition to the popular MetaTrader 4 (MT4) and Multi-Account Manager (MAM) platforms.

For more comprehensive information about GMI Markets' offerings, traders can visit the broker's official website at [gmimarkets.com].

Overview Table

| Broker Information | Details |

|---|---|

| Broker Name | GMI Markets |

| Website | [gmimarkets.com] |

| Headquarters | Saint Lucia |

| Founded | 2009 |

| Regulation | Financial Services Commission (FSC) of Mauritius |

| License Number | C118023454 |

| Trading Platforms | MetaTrader 4 (MT4), Multi-Account Manager (MAM), GMI Edge |

| Minimum Deposit | $15 (Cent Account), $25 (Standard Account), $100 (ECN Account) |

| Account Types | ECN Account, Cent Account, Standard Account |

| Tradable Assets | Forex, Indices, Commodities (Gold, Silver, Oil), Stock CFDs |

| Payment Methods | Bank Transfer, Neteller, Skrill |

| Customer Support | 24/5 via Live Chat, Email, Contact Form |

Facts List

- Established in 2009 and registered in Saint Lucia

- Regulated by the Financial Services Commission (FSC) of Mauritius under license number C118023454

- Offers multiple account types: ECN, Cent, and Standard accounts

- Provides access to various trading instruments, including forex, indices, commodities, and stock CFDs

- Supports trading through MetaTrader 4 (MT4), Multi-Account Manager (MAM), and proprietary GMI Edge platforms

- Minimum deposit requirements: $15 for Cent Account, $25 for Standard Account, and $100 for ECN Account

- Offers leverage up to 1:2000 (Standard Account) and competitive spreads starting from 0.0 pips

- Provides 24/5 customer support via live chat, email, and contact form

- Accepts payment methods such as bank transfer, Neteller, and Skrill

- Limited information available on the website regarding awards, recognitions, and educational resources

GMI Licenses and Regulatory

GMI Markets operates through several regulated entities across different jurisdictions, ensuring compliance with local financial regulations and oversight. The most notable of these is the Mauritius-based entity, Global Market Index Limited, which is authorised and regulated by the Financial Services Commission (FSC) of Mauritius under license number C118023454.

The FSC is responsible for licensing, regulating, and supervising the non-banking financial services sector in Mauritius, including capital markets. By being regulated by the FSC, GMI Markets demonstrates a commitment to adhering to stringent financial regulations and maintaining high operational standards.

Other GMI Markets entities include:

- Global Market Index Limited, registered in Vanuatu under company number 14646, operating from Govant Building, BP 1276 Port Vila, Vanuatu

- Global Market Index LLC, registered in Saint Vincent and the Grenadines under registration number 2763 LLC 2022, with a registered office at Euro House, Richmond Hill Road, Kingstown, Saint Vincent and the Grenadines

Regulation by multiple financial authorities across jurisdictions provides an added layer of security and trust for traders. It ensures that GMI Markets adheres to strict guidelines, maintains segregated client funds, and operates with transparency.

However, it is essential to note that the level of protection and legal recourse available to traders may vary depending on the specific regulatory body and jurisdiction. Traders should carefully review the terms and conditions associated with their chosen entity and understand the implications of the applicable regulatory framework.

GMI Markets Licenses

- Financial Services Commission (FSC) of Mauritius: License number C118023454

- Registered in Vanuatu under company number 14646

- Registered in Saint Vincent and the Grenadines under registration number 2763 LLC 2022

Trading Instruments

GMI Markets offers a range of tradable assets, providing traders with opportunities to diversify their portfolios and access various financial markets. The broker's website, particularly the "Markets" section, offers detailed information on the available trading instruments and their respective trading terms.

| Asset Class | Available Instruments | Spreads (from) | Additional Info |

|---|---|---|---|

| Forex | Major, Minor, and Exotic currency pairs | From 0.0 pips | High liquidity, 24/5 access, MT4 & GMI Edge app available |

| Commodities | Gold (XAUUSD), Silver (XAGUSD), Oil (USOUSD, UKOUSD) | Gold: 0.0 pips Silver: 0.1 pips USOUSD: 1.2 pips UKOUSD: 1.4 pips |

Trading hours: Monday to Friday |

| Indices | Dow Jones (U30USD), FTSE 100 (100GBP), DAX (D40EUR), CHN50U, and more | D40EUR: 0.6 pips CHN50U: 6.0 pips |

Speculation on global market indices |

| Stock CFDs | US and Hong Kong shares | From 0.01 pips | Trade company shares via CFDs without owning underlying assets |

Trading Platforms

GMI Markets offers a choice of trading platforms and methods to cater to the diverse needs and preferences of traders:

MetaTrader 4 (MT4)

GMI Markets provides access to the widely popular MetaTrader 4 platform, renowned for its user-friendly interface, advanced charting tools, and automated trading capabilities. MT4 is available for desktop, web, and mobile devices, allowing traders to access their accounts and trade on the go. The platform supports one-click trading, customisable indicators, and the ability to create and use Expert Advisors (EAs) for automated trading strategies.

Multi-Account Manager (MAM)

The MAM platform is designed for money managers and professional traders who oversee multiple client accounts. It enables efficient management and allocation of trades across various accounts, with features such as one-click execution, customisable allocation methods, and performance tracking.

GMI Edge

GMI Edge is GMI Markets' proprietary trading platform, available as a mobile app for both Android and iOS devices. The platform offers a user-friendly interface, real-time quotes, and a range of trading tools. Traders can access their accounts, place trades, and manage their positions directly from their smartphones or tablets.

Web-based Trading

GMI Markets also offers web-based trading, allowing traders to access their accounts and trade directly through their web browsers without the need for additional software installations. This provides flexibility and convenience for traders who prefer a streamlined trading experience.

Trading Platform Comparison Table

| Feature | MetaTrader 4 (MT4) | MAM (Multi-Account Manager) | GMI Edge |

|---|---|---|---|

| One-Click Trading | Yes | Yes | Yes |

| Charting Package | Advanced | Basic | Basic |

| Automated Trading (EAs) | Yes | No | No |

| Mobile Trading | Yes | No | Yes |

| Web-based Trading | Yes | No | No |

| Customizable Interface | Yes | Limited | Limited |

| Technical Indicators | Yes | Limited | Limited |

| Alerts and Notifications | Yes | No | Yes |

| Social Trading | Add-on Required | No | No |

GMI How to Open an Account: A Step-by-Step Guide

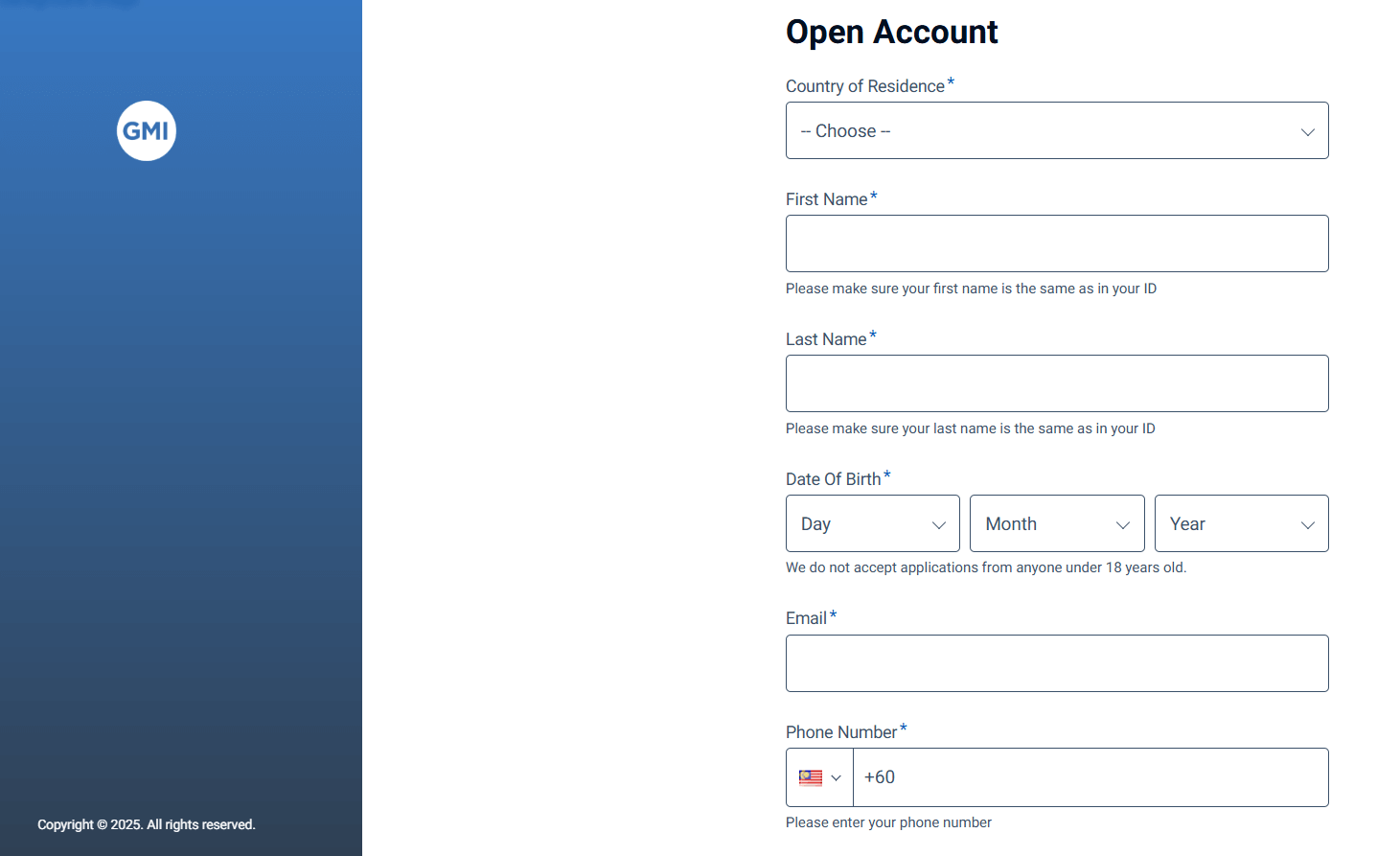

Opening an account with GMI Markets is a straightforward process that can be completed online. Here's a step-by-step guide:

- Visit the GMI Markets website at [gmimarkets.com].

- Click on the "Create Account" button located in the top right corner of the homepage.

- Fill in the required personal information, including your name, email address, phone number, country of residence, and preferred account currency.

- Choose your account type from the available options: ECN Account, Cent Account, or Standard Account.

- Provide additional details such as your date of birth, address, and employment information.

- Upload the necessary documents for identity verification, such as a valid government-issued ID and proof of address.

- Review and accept the broker's terms and conditions.

- Submit your application and wait for the account verification process to be completed.

- Once your account is approved, you can log in to the client area and access the trading platform of your choice.

- Fund your account using one of the available payment methods, such as bank transfer, Neteller, or Skrill.

Charts and Analysis

GMI Markets falls short in providing comprehensive educational resources and trading tools for its clients. The broker's website lacks dedicated sections for market analysis, trading guides, or educational materials that would help traders expand their knowledge and make informed decisions.

While some brokers offer a wide range of educational content, such as webinars, video tutorials, e-books, and interactive courses, GMI Markets does not provide such resources. The absence of educational materials can be a significant drawback for novice traders who are looking to learn about trading strategies, risk management, and market analysis.

GMI Markets also does not appear to offer a variety of trading tools and resources that are commonly found with other brokers. These may include economic calendars, market news feeds, trading signals, and advanced charting tools. The lack of these resources can limit traders' ability to stay informed about market events, analyse price movements, and make well-informed trading decisions.

However, it is worth noting that GMI Markets provides access to the popular MetaTrader 4 (MT4) trading platform, which offers a range of built-in charting tools and technical indicators. MT4 allows traders to analyse price movements, apply various technical analysis techniques, and customise their charts according to their preferences.

GMI Account Types

GMI Markets offers three main account types to cater to the needs of different traders: ECN Account, Cent Account, and Standard Account. Each account type comes with its own set of features and trading conditions:

Electronic Communication Network (ECN) Account

- Designed for active and experienced traders

- Minimum deposit of $100

- Tight spreads starting from 0.0 pips

- Commission of $4 per lot traded

- Maximum leverage up to 1:500

- Suitable for scalping and high-frequency trading

- Access to deep liquidity from multiple providers

Cent Account

- Ideal for novice traders and those with limited capital

- Minimum deposit of $15

- Contract size of 1,000 units (micro lots)

- No commissions

- Maximum leverage up to 1:1000

- Allows for smaller trade sizes and lower risk exposure

- Suitable for practicing trading strategies and building confidence

Standard Account

- Suitable for a wide range of traders

- Minimum deposit of $25

- Contract size of 100,000 units (standard lots)

- Spreads starting from 0.0 pips

- No commissions

- Maximum leverage up to 1:2000

- Access to competitive trading conditions

- Ideal for medium to long-term trading strategies

Account Types Comparison table

| Feature | ECN Account | Cent Account | Standard Account |

|---|---|---|---|

| Minimum Deposit | $100 | $15 | $25 |

| Spreads (from) | 0.0 pips | 0.0 pips* | 0.0 pips |

| Commissions | $4 per lot | None | None |

| Leverage | Up to 1:500 | Up to 1:1000 | Up to 1:2000 |

| Contract Size | 100,000 | 1,000 | 100,000 |

| Scalping Allowed | Yes | Yes | Yes |

| Hedging Allowed | Yes | Yes | Yes |

| Swap-free | Yes | Yes | Yes |

| Minimum Trade Size | 0.01 lots | 0.01 lots | 0.01 lots |

| Maximum Trade Size | 50 lots | 150 lots | 50 lots |

| Expert Advisors (EAs) | Allowed | Allowed | Allowed |

Negative Balance Protection

GMI Markets does not provide clear information on its website regarding negative balance protection. While some external reviews suggest that the broker offers this feature, the lack of explicit confirmation from GMI Markets itself is concerning.

GMI Deposits and Withdrawals

GMI Markets provides a limited selection of deposit and withdrawal methods compared to many other brokers in the industry.

Deposit Methods

| Payment Method | Availability | Notes |

|---|---|---|

| Bank Transfer | Available | May vary by country and regulatory jurisdiction |

| Neteller | Available | Fast and commonly used in supported regions |

| Skrill | Available | Popular e-wallet with relatively quick processing |

| Credit/Debit Card | Not specified | Not confirmed on website; may depend on entity and location |

| Processing Time | Varies by method | Typically instant to 1 business day |

| Fees | Not clearly stated | Users advised to check platform for possible charges |

Withdrawal Methods

| Payment Method | Availability | Processing Time | Fees | Notes |

|---|---|---|---|---|

| Not Specified | Unclear | Not disclosed | Not disclosed | Website lacks clear info on withdrawal methods and timing |

| Documentation Required | Yes (likely) | May affect processing | Possible compliance delay | Verification may be required due to AML and security protocols |

| Transparency | Limited | — | — | Traders should contact support for specific withdrawal details |

Support Service for Customer

Reliable customer support is essential for a positive trading experience, as it ensures that traders can receive assistance and guidance when needed. GMI Markets provides customer support through the following channels:

- Contact Form: Traders can fill out a contact form on the GMI Markets website to submit their enquiries or requests for assistance. The contact form can be found in the footer section of the website.

- Live Chat

- Email Support

- Telephone Support

- Social Media Support

The absence of these support channels may limit traders' options for receiving prompt and efficient assistance.

GMI Markets Customer Support Channels:

The absence of these support channels may limit traders' options for receiving prompt and efficient assistance.

GMI Markets Customer Support Channels:

- Contact Form

Customer Support Comparison Table

| Support Feature | Details |

|---|---|

| Availability | Not specified |

| Languages Supported | English* |

| Contact Form | Available |

| Live Chat | Not available |

| Email Support | cs.global@gmimarkets.com |

| Telephone Support | Not available |

| Social Media Support | Not available |

Prohibited Countries

GMI Markets does not provide a clear list of prohibited countries on its website. The lack of transparency regarding the geographical restrictions on its services is a significant concern for traders, as it may lead to uncertainty about the legality and accessibility of the broker's offerings in their country of residence.

Special Offers for Customers

GMI Markets occasionally provides special offers and promotions to attract new clients and reward existing ones. However, the availability and details of these offers are not prominently displayed on the broker's website.

One notable promotion mentioned in external sources is the GMI Markets 30% Welcome Bonus. This offer is designed for new and existing clients who make their first deposit into a live trading account. According to the terms and conditions, GMI Markets will credit a 30% bonus to the client's trading account upon meeting the specified requirements.

The 30% Welcome Bonus promotion is subject to the following conditions:

- The offer is valid for a limited time, typically with a specified start and end date.

- A minimum deposit of $25 or its equivalent in other currencies is required to qualify for the bonus.

- The maximum bonus amount is capped at $500 or its equivalent.

- The bonus funds are credited to the client's trading account and can be used for trading purposes.

- Withdrawal of the bonus funds may be subject to specific trading volume requirements or other conditions outlined in the offer's terms and conditions.

It's important to note that the availability and terms of the 30% Welcome Bonus promotion may vary over time, and traders should refer to the GMI Markets website or contact customer support for the most up-to-date information.

GMI Markets Special Offers

- 30% Welcome Bonus* *Based on external sources, subject to confirmation from the broker and availability at the time of trading.

Conclusion

Throughout this comprehensive review, I have thoroughly examined the various aspects of GMI Markets, evaluating its regulatory status, trading platforms, account types, customer support, and more. Based on the information gathered, I conclude that while GMI Markets has some positive attributes, there are also significant concerns that traders should consider before opening an account with this broker.

One of the notable strengths of GMI Markets is its regulation by the Financial Services Commission (FSC) of Mauritius through its Mauritius-based entity. This regulatory oversight provides a level of protection and assurance for traders. However, it's important to note that the regulatory landscape and legal protections may vary across different jurisdictions, and traders should carefully evaluate the implications of the specific entity they choose to trade with.

GMI Markets offers a range of trading platforms, including the popular MetaTrader 4 (MT4) and a proprietary mobile app, GMI Edge. These platforms provide traders with access to a variety of trading tools and features. However, when compared to other brokers in the industry, GMI Markets' trading platforms may lack some of the advanced functionalities and customisation options available elsewhere.

The broker provides three main account types – ECN, Cent, and Standard accounts – catering to different trading styles and preferences. However, the information provided on the GMI Markets website regarding account types and their specific features is limited, making it difficult for traders to make fully informed decisions.

One significant concern is the lack of clear information about negative balance protection on the GMI Markets website. While some external sources suggest that the broker offers this feature, the absence of explicit confirmation from GMI Markets itself is a red flag. Traders should exercise caution and seek clarification from the broker before depositing funds.

In terms of customer support, GMI Markets falls short compared to many other brokers. The website only provides a contact form as a means of seeking assistance, with no information about live chat, email support, or telephone support. This limited availability of support channels may be a drawback for traders who require prompt and reliable assistance.

Another area where GMI Markets lacks transparency is in its deposit and withdrawal processes. The website provides limited information about the available payment methods and does not clearly outline the withdrawal procedures or associated fees. Traders should compare GMI Markets' payment options with those of other brokers and seek clarification from the broker before proceeding.

The absence of a clear list of prohibited countries on the GMI Markets website is also a significant concern. Traders should be aware of the regulatory status and legal obligations of the broker in their country of residence to avoid potential legal risks and loss of funds.

Overall, while GMI Markets has some positive aspects, such as its FSC regulation and range of trading platforms, there are notable concerns that traders should carefully consider. The lack of transparency regarding negative balance protection, limited customer support options, and unclear deposit and withdrawal processes are significant drawbacks.

All 180+ verdicts live in our broker review master list.

ASIC + FCA dual regulation? Check the Pepperstone review.