GO Markets Review 2025: Learn more about the Leading Australian Forex and CFD Broker

GO Markets

Australia

Australia

-

Minimum Deposit $200

-

Withdrawal Fee $0

-

Leverage 500:1

-

Minimum Order 0.01

-

Forex Available

-

Crypto Available

-

Stock Unavailable

-

Indices Available

Licenses

Cyprus Market Making (MM)

Cyprus Market Making (MM)

Japan Forex Trading License

Japan Forex Trading License

Australia Retail Forex License

Australia Retail Forex License

Forex & CFD Brokerage License

Forex & CFD Brokerage License

Softwares & Platforms

Customer Support

+61385667680

(English)

+61385667680

(English)

Supported language: Arabic, Chinese (Simplified), English, Spanish

Social Media

Summary

GO Markets is a reputable forex and CFD broker established in 2006, headquartered in Melbourne, Australia, and regulated by ASIC, CySEC, FSC Mauritius, and FSA Seychelles. It offers access to over 1,000 tradable instruments, including forex, shares, indices, metals, commodities, and cryptocurrencies. Traders can choose between Standard and GO+ accounts, with spreads starting from 0.0 pips and commissions of $2.50 per side for GO+ Account. The broker supports MetaTrader 4, MetaTrader 5, cTrader, and its mobile platform. With a minimum deposit of $200 and leverage up to 1:500, GO Markets provides competitive trading conditions.

- Well-regulated by top-tier authorities like ASIC, CySEC, FSC, and FSA

- Offers a wide range of tradable assets, including forex, shares, indices, commodities, and metals

- Provides competitive spreads, low commissions, and high leverage options

- Advanced trading platforms - MetaTrader 4, MetaTrader 5, and cTrader

- Excellent customer support available 24/5 through multiple channels

- Extensive educational resources, including webinars, tutorials, and market analysis

- Negative balance protection for all clients

- No deposit or withdrawal fees

- Offers Islamic (swap-free) accounts

- Demo account available for practice trading

- Relatively high minimum deposit of $200 compared to some competitors

- No US clients accepted due to regulatory restrictions

- Limited range of funding methods compared to some brokers

- No managed or copy trading services offered

- Occasional requotes and slippage reported during high market volatility

- No cryptocurrency trading available

- VPS service is not free

- Limited customization options on trading platforms

- No 24/7 customer support

- Doesn't offer bonus programs or loyalty rewards for frequent traders

Overview

GO Markets is a leading forex and CFD broker established in 2006 in Australia. The company has grown its global presence over the years, with offices in major financial hubs such as London, Hong Kong and Taipei. GO Markets is regulated by top-tier authorities including the Australian Securities and Investments Commission (ASIC), the Cyprus Securities and Exchange Commission (CySEC), the Financial Services Commission (FSC) of Mauritius, and the Seychelles Financial Services Authority (FSA).

As a pioneer in offering MetaTrader 4 (MT4) to Australian traders, GO Markets has consistently focused on delivering innovative trading solutions and exceptional customer service. The broker provides access to over 1000 tradable instruments across forex, shares, indices, commodities, metals and cryptocurrencies. Clients can trade using powerful platforms like MT4, MetaTrader 5 (MT5), cTrader, and dedicated mobile apps.

GO Markets has won numerous industry awards for its services, including "Best Forex Broker Australia" at the Global Forex Awards 2020 and "Best Trade Execution" at the 2020 Forex Awards. More details about the company's offerings, regulatory status, account types and trading conditions are available on their official website at gomarkets.com.

With competitive spreads starting from 0 pips, fast execution speeds, and a strong commitment to regulatory compliance and security of client funds, GO Markets has established itself as a trusted broker for forex and CFD traders worldwide. However, potential clients should be aware of the risks associated with derivative trading and carefully evaluate their financial goals and risk tolerance before investing.

For more information, visit GoMarkets.com.

Overview Table

| Feature | Details |

|---|---|

| Broker | GO Markets |

| Established Year | 2006 |

| Regulation | ASIC, CySEC, FSC Mauritius, FSA Seychelles |

| Headquarters | Melbourne, Australia |

| Global Offices | London, Hong Kong, Taipei |

| Trading Platforms | MT4, MT5, cTrader, GO Markets Mobile |

| Asset Classes | Forex, Shares, Indices, Metals, Commodities, Cryptocurrencies |

| Tradable Instruments | 1000+ |

| Minimum Deposit | $200 |

| Account Types | Standard Account, GO+ Account |

| Spread Type | Fixed & Variable |

| Minimum Spread | 0.0 pips |

| Commissions From | $2.50 per side per standard lot (GO+ Account) |

| Maximum Leverage | 1:500 |

| Deposit Methods | Credit/Debit Card, Bank Transfer, Skrill, Neteller |

| Withdrawal Methods | Credit/Debit Card, Bank Transfer, Skrill, Neteller |

| Customer Support | 24/5 via live chat, email, phone |

| Website | GO Markets |

Facts List

- GO Markets was founded in 2006 in Melbourne, Australia and has since expanded globally

- The broker is regulated by ASIC, CySEC, FSC Mauritius and FSA Seychelles

- GO Markets offers 1000+ tradable instruments across forex, shares, indices, commodities, metals and cryptocurrencies

- Clients can trade using MetaTrader 4, MetaTrader 5, cTrader platforms and mobile apps

- Minimum deposit is $200 to open a live trading account

- Two main account types - Standard Account and GO+ Account with spreads from 0.0 pips

- Standard Account has no commissions while GO+ charges from $2.50 per side per standard lot

- Maximum leverage up to 1:500 is available

- Funds can be deposited and withdrawn via credit/debit card, bank transfer, Skrill and Neteller

- 24/5 customer support provided via live chat, email and phone

GO Markets Licenses and Regulatory

GO Markets operates under a robust regulatory framework, holding licenses from multiple top-tier financial authorities worldwide. This multi-jurisdictional regulation ensures that the broker adheres to strict industry standards, providing clients with a secure and transparent trading environment.

The company's primary regulator is the Australian Securities and Investments Commission (ASIC), which oversees GO Markets' operations in Australia under the license number AFSL 254963. ASIC is known for its stringent regulations and proactive approach to consumer protection, requiring brokers to maintain high levels of financial stability, risk management, and client fund segregation.

In addition to ASIC, GO Markets is regulated by the Cyprus Securities and Exchange Commission (CySEC) under license number 322/17. CySEC is the supervisory authority for investment firms in Cyprus and enforces the Markets in Financial Instruments Directive (MiFID) across the European Union. This license enables GO Markets to offer its services to clients in Europe while complying with the region's strict regulatory requirements.

GO Markets also holds licenses from the Financial Services Commission (FSC) of Mauritius (license number GB19024896) and the Financial Services Authority (FSA) of Seychelles (license number SD043). These licenses allow the broker to cater to a broader international client base while maintaining high standards of operation and client protection.

The significance of multi-jurisdictional regulation lies in the enhanced level of oversight and accountability it provides. By submitting to the authority of multiple regulators, GO Markets demonstrates its commitment to transparency, fair business practices, and the safeguarding of client interests. This, in turn, fosters trust among traders and investors, as they can be confident that the broker is subject to regular audits, reporting requirements, and compliance checks.

Regulations List Here

is a list of the licenses GO Markets holds with various regulators:

- Australian Securities and Investments Commission (ASIC): AFSL 254963

- Cyprus Securities and Exchange Commission (CySEC): 322/17

- Financial Services Commission (FSC) of Mauritius: GB19024896

- Financial Services Authority (FSA) of Seychelles: SD043

Trading Instruments

GO Markets offers a diverse range of tradable assets, catering to the varying needs and preferences of traders worldwide. With over 1,000 instruments available across multiple asset classes, the broker provides ample opportunities for portfolio diversification and exposure to global financial markets.

| Asset Class | Key Details |

|---|---|

| Forex | Extensive selection of currency pairs, including majors (e.g., EUR/USD, GBP/USD, USD/JPY, AUD/USD), minors, and exotics. Offers competitive spreads and deep liquidity, providing opportunities in both popular and niche markets. |

| Shares | Trade global shares via CFDs on major exchanges (NYSE, NASDAQ, LSE, ASX). Gain exposure to renowned companies like Apple, Amazon, Facebook, and BHP Billiton without owning the underlying shares. |

| Indices | Access a range of global stock indices through CFDs, including benchmarks like the S&P 500, NASDAQ 100, FTSE 100, DAX 30, and ASX 200, enabling traders to speculate on overall market or sector performance. |

| Commodities | Trade CFDs on various commodities, including precious metals, energies, and agricultural products. Instruments include gold, silver, crude oil, natural gas, copper, corn, and wheat, allowing for portfolio diversification and hedging against volatility. |

| Metals | Dedicated trading on metal CFDs such as gold, silver, platinum, and palladium. Offers competitive spreads and flexible contract sizes tailored for both retail and institutional traders. |

| Treasuries | CFDs on government bonds allow speculation on interest rate movements and credit risks. Instruments include U.S. Treasury Bonds, German Bunds, and UK Gilts, providing exposure to major economies' debt markets. |

GO Markets' extensive range of tradable assets sets it apart from many competitors, reflecting the broker's commitment to providing a versatile and adaptable trading environment. By offering a diverse selection of instruments across multiple asset classes, GO Markets empowers traders to pursue their unique trading strategies and diversify their portfolios effectively.

Trading Platforms

GO Markets offers a range of trading platforms to cater to the diverse needs and preferences of its clients. The broker provides access to industry-standard platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5), as well as the advanced cTrader platform. These platforms are accessible through desktop, web, and mobile applications, ensuring flexibility and convenience for traders.

MetaTrader 4 (MT4)

- MT4 is a widely used trading platform known for its user-friendly interface, extensive charting tools, and customizable indicators. GO Markets' MT4 platform offers a seamless trading experience, with features such as one-click trading, automated trading through Expert Advisors (EAs), and a wide range of technical analysis tools. The platform supports multiple asset classes, including forex, shares, indices, and commodities.

MetaTrader 5 (MT5)

- MT5 is the successor to MT4, offering enhanced features and functionality. GO Markets' MT5 platform provides advanced charting tools, a built-in economic calendar, and a greater number of timeframes and execution modes. The platform also supports multi-asset trading, allowing traders to access a wider range of financial instruments. MT5's advanced order types and hedging capabilities make it suitable for more experienced traders.

cTrader

- cTrader is a powerful trading platform designed for traders who demand advanced features and fast execution speeds. GO Markets' cTrader platform offers a user-friendly interface, extensive charting tools, and advanced order types. The platform supports algorithmic trading through cAlgo, allowing traders to develop and backtest custom trading strategies. cTrader's depth of market (DOM) functionality provides enhanced transparency and control over order execution.

Web Trading

- For traders who prefer browser-based trading, GO Markets offers web versions of MT4, MT5, and cTrader. These web platforms provide access to trading accounts without the need for software installation. Web trading platforms offer a streamlined trading experience, with essential features like real-time quotes, interactive charts, and one-click trading.

Mobile Trading

- GO Markets provides mobile trading apps for MT4, MT5, and cTrader, enabling traders to access their accounts and trade on the go. The mobile apps are available for both iOS and Android devices, offering a responsive and user-friendly interface. Mobile trading allows traders to monitor their positions, place trades, and manage their accounts from anywhere with an internet connection.

The availability of multiple trading platforms is a significant advantage for GO Markets' clients. Traders can choose the platform that best suits their trading style, experience level, and technical requirements. The combination of industry-standard platforms like MT4 and MT5, along with the advanced cTrader platform, ensures that traders have access to the tools and features necessary for effective trading.

| Feature | MT4 | MT5 | cTrader |

|---|---|---|---|

| Charting Tools | Extensive | Advanced | Extensive |

| Timeframes | 9 | 21 | 9 |

| Indicators | 30+ | 38+ | 70+ |

| Automated Trading | Expert Advisors | Expert Advisors | cAlgo |

| Order Types | Market, Limit, Stop, Trailing Stop | Market, Limit, Stop, Stop Limit, Trailing Stop | Market, Limit, Stop, Trailing Stop, OCO |

| Web Trading | Yes | Yes | Yes |

| Mobile Trading | iOS, Android | iOS, Android | iOS, Android |

| Algorithmic Trading | MQL4 | MQL5 | cAlgo |

| Depth of Market (DOM) | No | No | Yes |

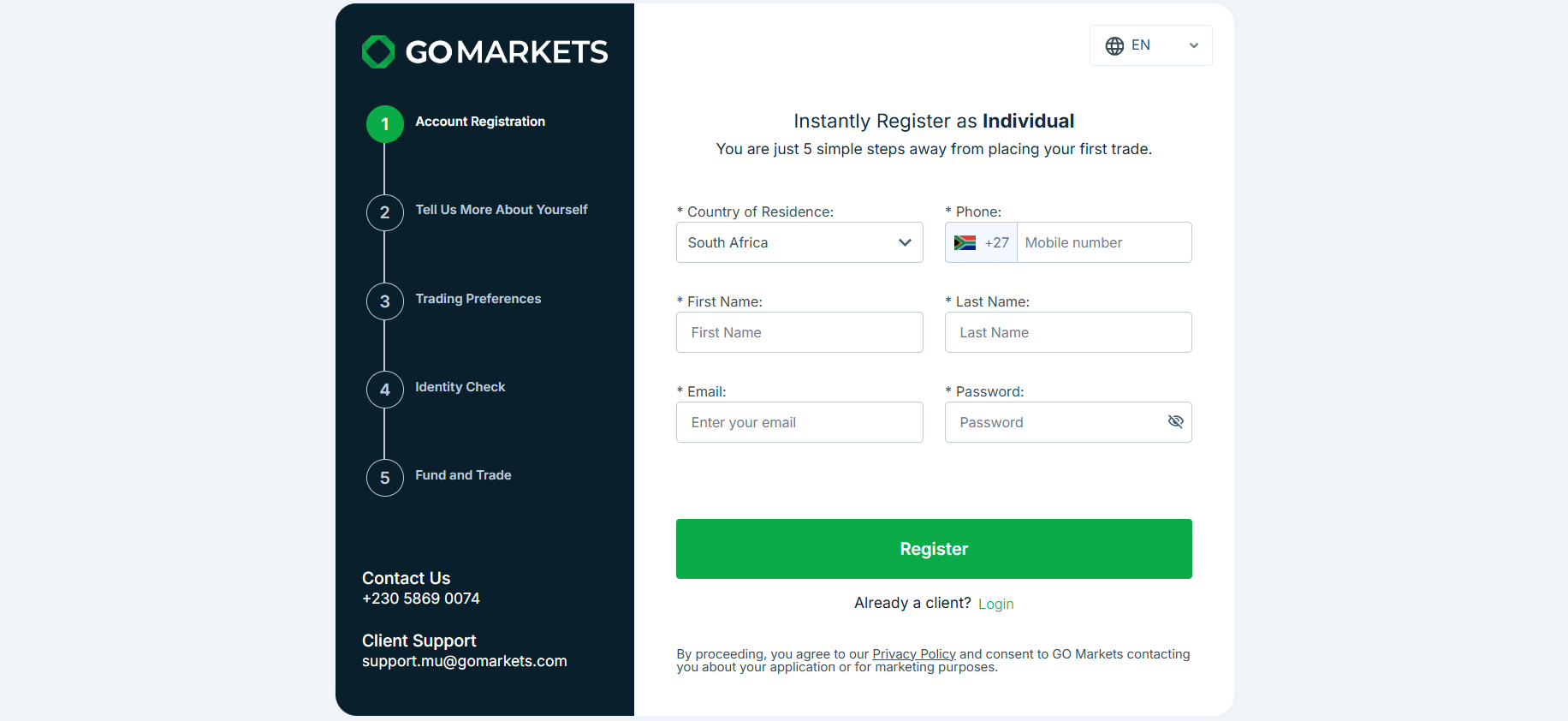

GO Markets How to Open an Account: A Step-by-Step Guide

Opening an account with GO Markets is a straightforward process designed to get traders started quickly and efficiently. This step-by-step guide will walk you through the account opening process, highlighting the requirements, accepted payment methods, and unique features offered by GO Markets.

Requirements for Opening an Account

To open an account with GO Markets, you will need to meet the following requirements:

- Minimum deposit of $200 for both Standard and GO+ Accounts

- Valid government-issued identification document (e.g., passport, driver's license, or national ID card)

- Proof of address (e.g., utility bill, bank statement, or credit card statement)

- Completed online application form

Accepted Payment Methods

GO Markets accepts the following payment methods for account funding:

- Credit/Debit Cards: Instant processing

- Bank Wire Transfer: 1-3 business days processing time

- E-wallets (Skrill, Neteller): Instant processing

Account Registration Process

- Visit the GO Markets website and click on the "Open an Account" button.

- Select the account type you wish to open (Standard or GO+ Account).

- Fill out the online application form with your personal information, including your name, address, date of birth, and contact details.

- Provide your trading experience and financial information, as required by regulators.

- Upload your identification documents and proof of address.

- Review and accept the terms and conditions of the client agreement.

- Submit your application and wait for GO Markets to verify your account, which typically takes 1-2 business days.

- Once your account is verified, log in to the client portal and navigate to the deposit section.

- Select your preferred payment method and follow the instructions to fund your account.

- Download the trading platform of your choice (MT4, MT5, or cTrader) and start trading.

Unique Features and Benefits

GO Markets offers several unique features to streamline the account opening process:

- Fully digital application process with no paperwork required

- Quick and easy online verification with fast turnaround times

- Low minimum deposit requirement of $200, making it accessible for beginner traders

- Multiple funding options with instant processing for credit/debit cards and e-wallets

By following these simple steps and providing the necessary information, traders can open an account with GO Markets and start trading within a matter of days. The broker's user-friendly application process, coupled with its low minimum deposit requirement and fast verification times, makes it an attractive choice for both novice and experienced traders.

Charts and Analysis

GO Markets provides a comprehensive suite of educational trading resources and tools to support its clients' trading knowledge and skill development. These resources cater to traders of all experience levels, offering valuable insights into market trends, trading strategies, and risk management.

| Category | Key Features & Details |

|---|---|

| Charting Tools | - Advanced charting on MT4, MT5, and cTrader- Multiple chart types (line, bar, candlestick)- Customizable timeframes - Extensive collection of technical indicators - Drawing tools for trend lines, support/resistance, and chart patterns - Ability to save and load custom chart templates |

| Analysis Tools | - Real-time market news and analysis (via providers like Trading Central) - Economic calendar for key global events and data releases - Autochartist for pattern recognition and technical analysis - Sentiment indicators to gauge market sentiment - Correlation matrix to analyze relationships between different trading instruments |

| Educational Resources | - Webinars: Live and recorded sessions covering trading topics, strategies, and platform tutorials - Video tutorials explaining key trading concepts and platform features - eBooks and guides in downloadable PDF format (covering trading basics, technical analysis, and risk management) - Comprehensive trading glossary - FAQ section for common trading and account questions |

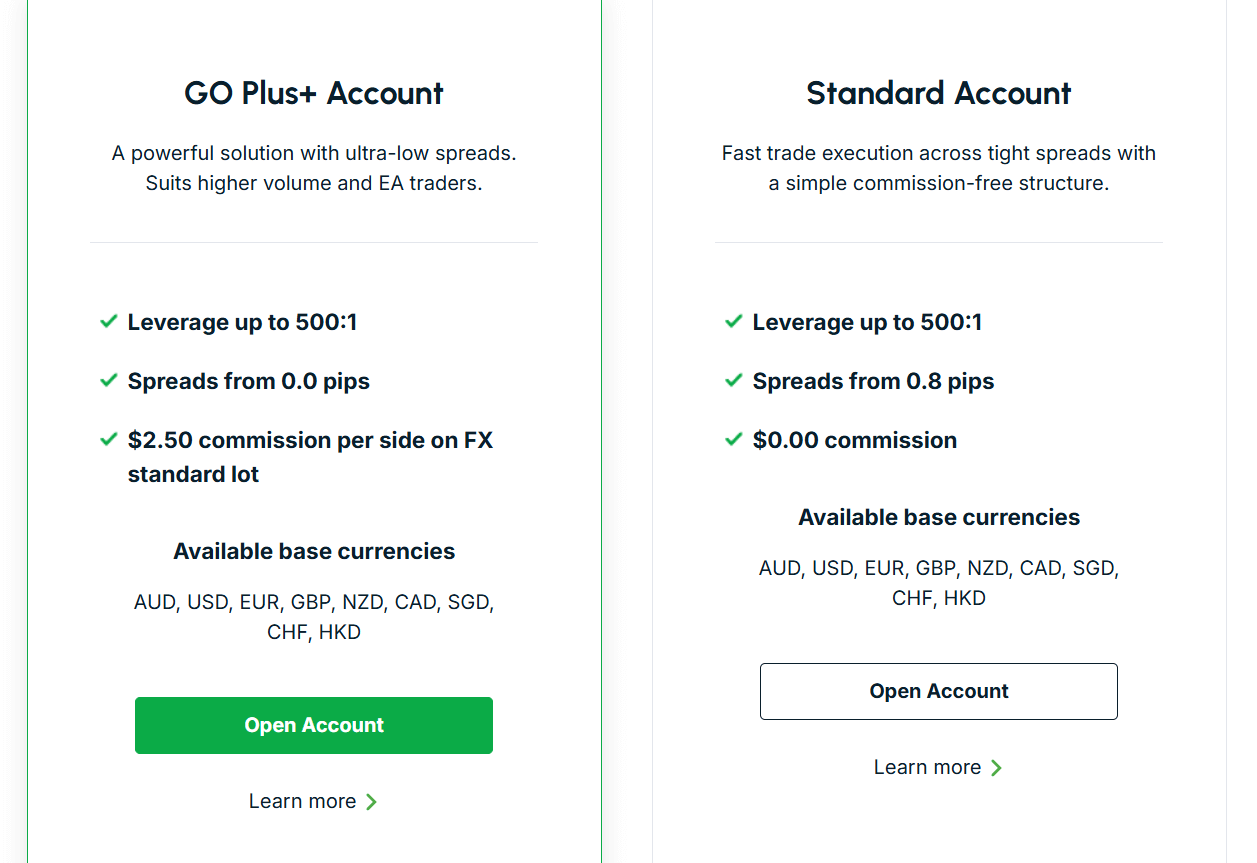

GO Markets Account Types

GO Markets offers a range of trading account options designed to cater to the diverse needs and preferences of traders. By providing multiple account types, the broker ensures that clients can select an account that aligns with their trading style, experience level, and financial goals.

Standard Account

The Standard Account is GO Markets' entry-level trading account, suitable for both beginner and experienced traders. Key features include:

- Minimum deposit: $200

- Spreads from 1 pip

- No commission fees

- Maximum leverage up to 1:500

- Minimum trade size of 0.01 lots

- Access to all tradable instruments

This account type is ideal for traders who prefer a simple, cost-effective trading environment without additional fees. The competitive spreads and high leverage options make it an attractive choice for those looking to maximize their trading potential.

GO+ Account

The GO+ Account is designed for more advanced traders seeking tighter spreads and a more competitive trading environment. Key features include:

- Minimum deposit: $200

- Raw spreads from 0.0 pips

- Commission of $2.50 per side per standard lot

- Maximum leverage up to 1:500

- Minimum trade size of 0.01 lots

- Access to all tradable instruments

This account type is well-suited for high-volume traders, scalpers, and those utilizing expert advisors (EAs). The combination of raw spreads and low commissions allows traders to take advantage of even the smallest price movements in the market.

Demo Account

GO Markets offers a demo account option for traders who wish to practice their strategies and familiarize themselves with the trading platforms without risking real money. Key features include:

- No minimum deposit required

- Virtual funds for trading

- Access to all tradable instruments

- Unlimited demo account validity

- Option to choose between Standard and GO+ Account conditions

The demo account is an essential tool for both new and experienced traders, as it allows them to test trading strategies, practice risk management, and explore the broker's offerings in a risk-free environment.

Islamic Account

For traders who adhere to Islamic religious principles, GO Markets offers an Islamic Account, also known as a swap-free account. Key features include:

- No swap or interest charges on overnight positions

- Compliant with Sharia law

- Same trading conditions as Standard or GO+ Accounts

- Minimum deposit of $200

The Islamic Account enables Muslim traders to participate in the financial markets without compromising their religious beliefs. By eliminating swap fees, GO Markets ensures that these traders can hold long-term positions without incurring interest charges.

GO Markets' diverse range of account types demonstrates the broker's commitment to accommodating the unique requirements of its clients. By offering accounts tailored to different trading styles, experience levels, and religious beliefs, GO Markets ensures that all traders can access the markets on their own terms.

Account Types Comparison Table

| Feature | Standard Account | GO+ Account | Demo Account | Islamic Account |

|---|---|---|---|---|

| Minimum Deposit | $200 | $200 | N/A | $200 |

| Spreads | From 1 pip | From 0.0 pips | Same as real account | Same as Standard or GO+ |

| Commissions | None | $2.50 per side per lot | N/A | Same as Standard or GO+ |

| Maximum Leverage | 1:500 | 1:500 | Same as real account | Same as Standard or GO+ |

| Minimum Trade Size | 0.01 lots | 0.01 lots | 0.01 lots | 0.01 lots |

| Tradable Instruments | All instruments | All instruments | All instruments | All instruments |

| Swap Fees | Applicable | Applicable | N/A | No swap fees |

| Account Validity | Unlimited | Unlimited | Unlimited | Unlimited |

Negative Balance Protection

GO Markets' negative balance protection policy applies to all trading accounts, including Standard, GO+, and Islamic Accounts. However, traders should be aware that this protection may not cover losses incurred due to technical issues, such as platform malfunctions or internet connectivity problems. It is crucial for traders to familiarize themselves with the terms and conditions of the negative balance protection policy to understand its scope and limitations. In addition to negative balance protection, GO Markets offers a range of educational resources and risk management tools to help traders make informed decisions and manage their risk effectively. These include educational articles, webinars, and risk management calculators that assist traders in determining appropriate position sizes and leverage levels based on their account balance and risk tolerance. By offering negative balance protection, GO Markets demonstrates its commitment to client safety and fair trading practices. This policy provides traders with an added layer of security, allowing them to focus on their trading strategies without worrying about the possibility of falling into debt due to unexpected market events.

GO Markets Deposits and Withdrawals

GO Markets offers a variety of secure and convenient deposit and withdrawal options to cater to the needs of traders worldwide. The broker aims to make funding and withdrawing from trading accounts as seamless as possible, supporting a range of payment methods and currencies.

Deposit Methods

Traders can fund their GO Markets trading accounts using the following methods:| Payment Method | Processing Time | Minimum Deposit | Maximum Deposit | Additional Details |

|---|---|---|---|---|

| Credit/Debit Cards | Instant | $200 | No limit | Accepts Visa and Mastercard; funds available immediately for trading. |

| Bank Wire Transfer | 1–3 business days | $200 | No limit | Deposits from personal bank accounts; funds credited after 1–3 days. |

| E-wallets | Instant | $200 | No limit | Supports Skrill and Neteller; funds available immediately. |

Withdrawal Methods

GO Markets offers the following withdrawal methods:| Payment Method | Processing Time | Withdrawal Limits | Additional Information |

|---|---|---|---|

| Credit/Debit Cards | 1–3 business days | No minimum or maximum limits | Withdrawals are made to the same card used for deposits. |

| Bank Wire Transfer | 1–3 business days | No minimum or maximum limits | Funds are sent directly to personal bank accounts; bank fees may apply. |

| E-wallets | Instantly, funds available within a few hours | No minimum or maximum limits | Supports Skrill and Neteller; fast processing. |

Verification Requirements

To comply with anti-money laundering (AML) and know-your-customer (KYC) regulations, GO Markets requires traders to verify their accounts before processing withdrawals. Traders need to provide proof of identification and proof of address documents, such as a government-issued ID and a utility bill or bank statement. GO Markets may also request additional documentation on a case-by-case basis to ensure the security of clients' funds.Unique Features

One of the standout features of GO Markets' deposit and withdrawal process is the absence of any internal fees. This means that traders can fund their accounts and withdraw their profits without incurring additional costs from the broker. However, it is essential to note that third-party fees from banks or payment service providers may still apply. Another advantage of trading with GO Markets is the quick processing times for deposits and withdrawals. With instant funding options like credit/debit cards and e-wallets, traders can start trading almost immediately after making a deposit. Withdrawals are also processed efficiently, with most requests handled within 1 business day. In terms of security, GO Markets employs stringent measures to protect clients' funds and personal information. The broker segregates clients' funds from its own operating funds and holds them in trusted bank accounts. GO Markets also utilizes advanced encryption technologies to safeguard sensitive data during transactions.Support Service for Customer

In the fast-paced world of online trading, reliable customer support is crucial for a positive trading experience. Traders often require assistance with account management, platform troubleshooting, or general inquiries, and prompt, helpful support can make a significant difference in their overall satisfaction with a broker.

GO Markets understands the importance of providing excellent customer support and offers several channels through which traders can reach out for assistance.

Support Channels

- Live Chat: Traders can access GO Markets' live chat support directly from the broker's website. This option allows for quick and convenient interaction with a support representative.

- Email: Traders can send their inquiries to GO Markets' support email address (support@gomarkets.com). The support team aims to respond to all emails within 24 hours.

- Phone: GO Markets provides dedicated phone support numbers for traders in different regions:

- Australia: +61 3 8566 7680

- United Kingdom: +44 20 3865 3305

- Indonesia: +62 21 515 1633

- Malaysia: +60 3 9212 4799

- Rest of the World: +44 20 3150 0206

- Social Media: Traders can connect with GO Markets' support team through social media platforms like Facebook, Twitter, and LinkedIn. The broker's social media team is responsive and can assist with general inquiries or direct traders to the appropriate support channel for more specific issues.

Support Hours and Languages

GO Markets provides customer support 24 hours a day, 5 days a week (Monday to Friday). This extended availability ensures that traders in different time zones can access assistance when needed. The broker's support team is multilingual, offering assistance in several languages, including English, Indonesian, Italian, Malaysian, Portuguese, Spanish, and Thai. This language diversity caters to GO Markets' global client base and ensures that traders can communicate effectively with the support team.Response Times and Quality

GO Markets strives to provide prompt and efficient customer support across all channels. The broker aims to respond to live chat inquiries within a few minutes, ensuring that traders can get immediate assistance for urgent matters. Email inquiries are typically addressed within 24 hours, while phone support offers real-time assistance during trading hours. In addition to timely responses, GO Markets focuses on the quality of support provided. The broker's support team undergoes regular training to stay up-to-date with the latest platform features, market developments, and common trading issues. This knowledge enables them to provide accurate and helpful information to traders, contributing to a positive customer experience.Customer Support Comparison Table

| Feature | GO Markets |

|---|---|

| Live Chat | ✓ |

| Email Support | ✓ |

| Phone Support | ✓ |

| Social Media Support | ✓ |

| Support Languages | English, Indonesian, Italian, Malaysian, Portuguese, Spanish, Thai |

| Support Hours | 24/5 |

| Live Chat Response Time | Within minutes |

| Email Response Time | Within 24 hours |

Prohibited Countries

GO Markets is a global online trading broker that aims to provide its services to clients around the world. However, due to various regulatory requirements, licensing restrictions, and geopolitical factors, the broker is prohibited from operating or offering its services in certain countries and regions.

These restrictions are put in place to ensure compliance with international laws and to protect both the broker and its clients from potential legal consequences. It is essential for traders to be aware of these limitations before attempting to open an account or trade with GO Markets.

Prohibited Regions and Countries

GO Markets is currently unable to provide its services to residents of the following countries:

- United States of America (USA)

- Canada

- Japan

- New Zealand

- Iran

- North Korea

- Cuba

- Sudan

- Syria

- Belgium

The primary reason for these restrictions is the strict regulatory environment in these countries. For example, in the United States, online trading is heavily regulated by the Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA). GO Markets is not registered with these authorities and, therefore, cannot legally accept clients from the USA.

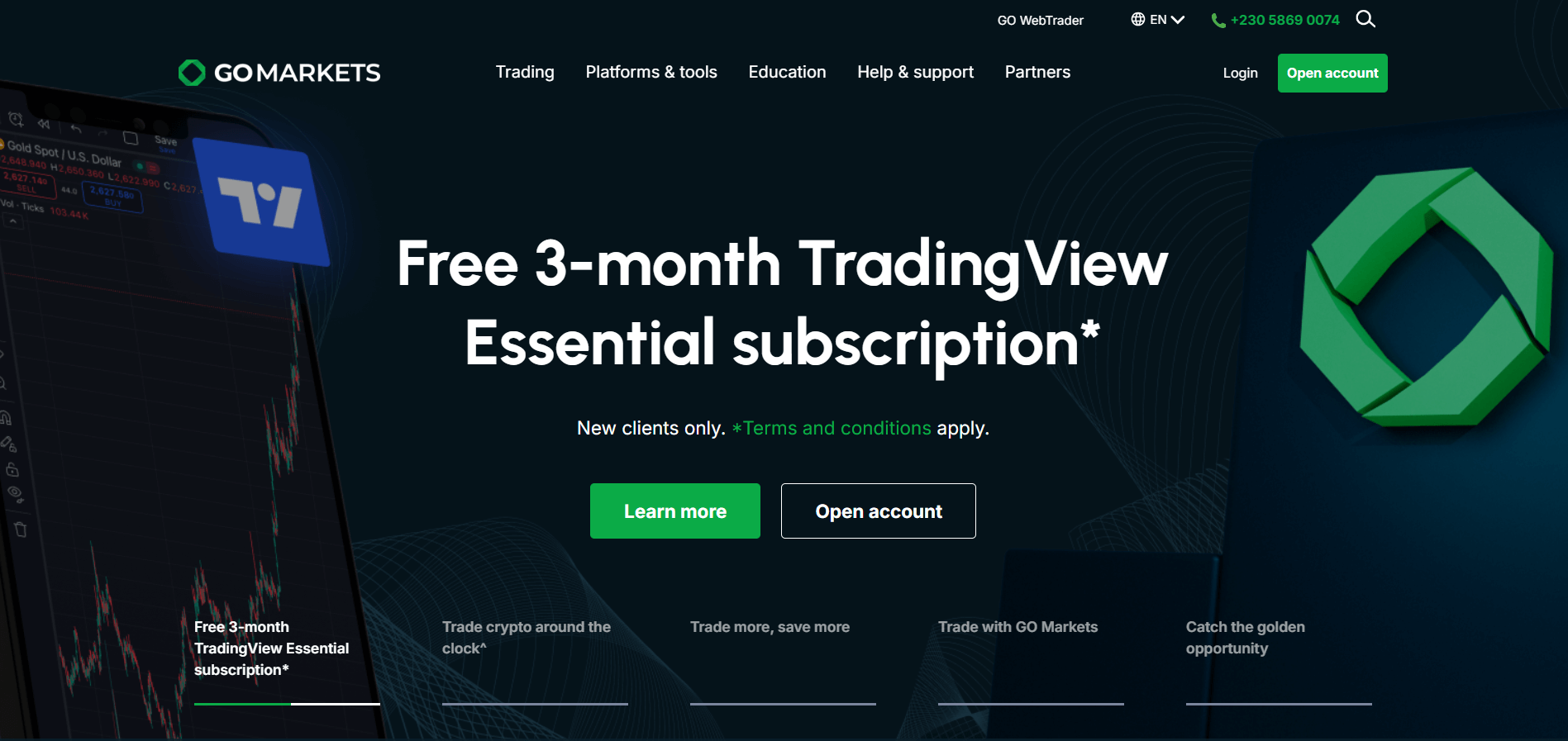

Special Offers for Customers

GO Markets occasionally provides special promotions and offers to both new and existing traders, aimed at enhancing their trading experience and providing additional value. While these offers may vary over time, they typically include sign-up bonuses, loyalty programs, trading competitions, and partnerships with third-party service providers.

| Promotion | Benefits | Key Terms/Details |

|---|---|---|

| Sign-up Bonuses | Extra trading capital | Offered to new live accounts; subject to deposit, trading volume, and time conditions. |

| Loyalty Programs | Reduced fees, premium educational resources, exclusive events | Rewards active/long-term clients; specific benefits vary; check the website for details. |

| Trading Competitions | Cash bonuses, luxury items, trading perks | Periodically held; rewards based on trading performance; rules and conditions apply. |

| Third-Party Partnerships | Discounted/free access to trading courses, VPS hosting, analytics | Collaborations with external providers; offer exclusive deals on trading-related software and educational resources. |

Conclusion

Throughout this comprehensive review of GO Markets, I have delved into various aspects of their operations, including regulatory compliance, geographical jurisdictions, account types, trading platforms, customer support, and more. By consolidating these findings and insights, I aim to provide a cohesive summary that addresses GO Markets' safety, reliability, and overall reputation as a broker.

One of the most compelling factors that sets GO Markets apart is their strong regulatory compliance. They are regulated by top-tier authorities such as ASIC, CySEC, FSC, and FSA across multiple jurisdictions, ensuring a high level of oversight and protection for their clients. This commitment to operating within strict regulatory frameworks instills confidence in their reliability and trustworthiness as a broker.

In terms of trading offerings, GO Markets provides a diverse range of account types and tradable assets, catering to the needs of both novice and experienced traders. The broker's competitive spreads, low commissions, and high leverage options make them an attractive choice for cost-conscious traders seeking to maximize their potential returns.

GO Markets' advanced trading platforms, including MetaTrader 4, MetaTrader 5, and cTrader, offer a seamless and efficient trading experience. These platforms are packed with powerful tools, comprehensive charting capabilities, and automated trading features, empowering traders to execute their strategies with precision and ease.

Another area where GO Markets excels is in their commitment to customer support and education. With a knowledgeable and responsive customer service team available 24/5 through multiple channels, traders can access timely assistance whenever they need it. The broker's extensive educational resources, including webinars, tutorials, and market analysis, provide valuable insights and support for traders of all skill levels.

While GO Markets occasionally offers special promotions and bonuses, they prioritize providing a transparent and fair trading environment over short-term incentives. The broker's focus on building long-term relationships with their clients through consistent, reliable service is evident in their approach to customer support and account management.

Based on my analysis, I believe that GO Markets is a trustworthy and dependable broker that prioritizes the safety and satisfaction of their clients. Their strong regulatory standing, comprehensive trading offerings, advanced platforms, and dedication to customer support make them a compelling choice for traders seeking a reliable and user-focused trading experience.

As with any financial decision, it is essential for traders to carefully consider their individual needs, goals, and risk tolerance when choosing a broker. However, for those seeking a well-regulated, versatile, and customer-centric brokerage, GO Markets stands out as a strong contender in the competitive online trading landscape.

Find tight swaps in the overnight-cost broker lineup.

High-risk, high-reward broker? Scan our Achiever Global Markets review.