Guotai Junan International 2025 Review: HK Stocks & Forex

Guotai Junan International

Hong Kong

Hong Kong

-

Withdrawal Fee $varies

-

Leverage 100:1

-

Minimum Order 0.01

-

Forex Available

-

Crypto Unavailable

-

Stock Available

-

Indices Unavailable

Licenses

Hong Kong Securities and Futures License

Hong Kong Securities and Futures License

Softwares & Platforms

Customer Support

Supported language: English, Chinese (Simplified)

Social Media

Summary

GTJAI is a well-regulated Hong Kong broker established in 1993, offering comprehensive Asian market access through dual SFC licensing and pioneering virtual asset capabilities since June 2025. The company provides multiple trading platforms, investment-grade credit ratings, and strong ESG credentials, though lacks transparency on minimum deposits and explicit negative balance protection. Best suited for Hong Kong residents and conservative investors prioritizing regulatory security over aggressive leverage or global accessibility. The firm represents a solid choice for serious traders seeking Asian market expertise through an established, compliant intermediary.

- Dual SFC regulation (ADI115, AUZ981) ensures strong oversight

- First China-backed broker with virtual asset approval (June 2025)

- Investment-grade credit ratings from Moody's (Baa2) and S&P (BBB+)

- MSCI ESG "A" rating demonstrates sustainability commitment

- Comprehensive F10 data for Hong Kong-listed companies

- Multiple platform options including MaxxTrader and MT4

- 30-year operational history since 1993

- First Chinese securities firm to IPO on HKEX (2010)

- Strategic regional presence in Singapore and Vietnam

- Seven business divisions offering integrated financial services

- No publicly disclosed minimum deposit requirements

- Limited leverage at 20:1 maximum for forex trading

- Absence of explicit negative balance protection guarantee

- Customer support restricted to Asian business hours

- Junhong Global mobile app available in Chinese only

- US residents face account opening restrictions

- No 24/7 support for international clients

- Limited promotional offers compared to retail brokers

- Fee structure complexity not fully transparent

- Virtual asset trading has stringent eligibility requirements

Overview

Guotai Junan International (1788.HK) is a Hong Kong-based financial services provider established in 1993. As the first Chinese securities company to IPO on HKEX in 2010, GTJAI operates under SFC regulation with dual licenses for futures and forex trading.

The company received virtual asset approval in June 2025, pioneering digital asset access among China-backed brokers. With offices in Hong Kong, Singapore, and Vietnam, GTJAI bridges Asian and global markets.

For Complete Details, Visit the Official Site at gtjai.com.

Overview Table

| Feature | Details |

|---|---|

| Company | Guotai Junan International |

| Founded | 1993 |

| Headquarters | Hong Kong |

| Stock Code | 1788.HK |

| Parent | Guotai Junan Securities Co. Ltd |

| Regulation | SFC Hong Kong |

| Licenses | ADI115, AUZ981 |

| Credit Rating | Baa2 (Moody's), BBB+ (S&P) |

Facts List

- First Chinese securities IPO on HKEX (2010)

- Dual SFC licensing since 2004

- Virtual asset trading approved June 2025

- 30 forex pairs with 20:1 leverage

- MSCI ESG "A" rating

- Seven business divisions

- Regional presence in three countries

- Investment-grade credit ratings

- Multiple trading platforms available

- F10 data for HK stocks

Guotai Junan International Licenses and Regulatory

GTJAI holds SFC licenses ADI115 (futures) and AUZ981 (leveraged forex). The futures license dates from 2004, demonstrating long-term compliance. Virtual asset approval in 2025 adds cryptocurrency capabilities. Hong Kong regulation ensures client fund segregation and capital adequacy.

Trading Instruments

Assets include 30 forex pairs, Hong Kong stocks, derivatives (warrants, CBBCs), futures, options, bonds, mutual funds, and virtual assets. Forex spreads start at 0.5 pips with 20:1 maximum leverage per SFC rules.

Asset Categories Table

| Category | Instruments | Features |

|---|---|---|

| Forex | 30 pairs | 20:1 leverage, 0.5 pip spreads |

| Equities | HK stocks | Margin trading, IPO access |

| Derivatives | Futures, options | Global exchanges |

| Fixed Income | Bonds | Government, corporate |

| Virtual Assets | Cryptocurrencies | Restricted access |

Trading Platforms

MaxxTrader serves leveraged forex trading. MT4 provides automated trading capabilities. Junhong Global App (Chinese only) offers mobile access with 3-minute account opening. Global Express delivers desktop analytics with F10 data. Web platform ensures universal access.

Trading Platform Comparison Table

| Platform | Assets | Devices | Auto Trading | Languages |

|---|---|---|---|---|

| MaxxTrader | Forex | Desktop | Limited | Multi |

| MT4 | Forex | All | Yes | Multi |

| Junhong Global | Stocks, Crypto | Mobile | No | Chinese |

| Global Express | All | Windows | Limited | Chinese/English |

| Web Platform | All | Browser | No | Chinese/English |

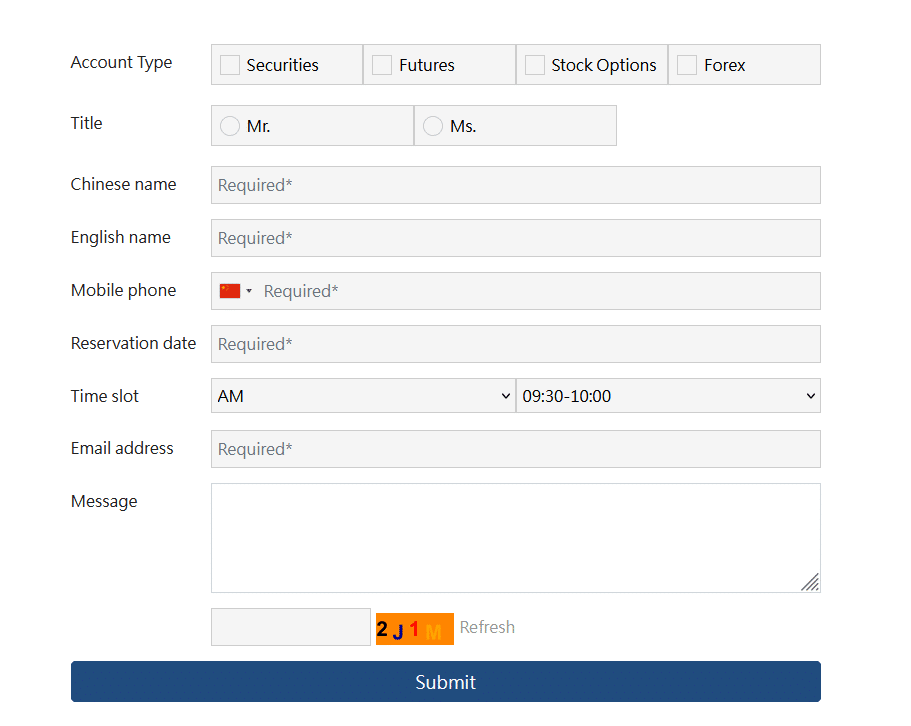

Guotai Junan International How to Open an Account: A Step-by-Step Guide

Opening an account with GTJAI follows a structured process designed to ensure regulatory compliance while minimizing client friction. The company offers multiple account types tailored to different trading needs, from basic securities accounts to comprehensive multi-asset trading accounts.

- Select account type (securities, futures, forex, comprehensive)

- Prepare ID and proof of address (within 3 months)

- Complete online application or use mobile app

- Submit documents electronically

- Make initial deposit (amount varies by account)

- Receive credentials after 1-2 day verification

Charts and Analysis

GTJAI's commitment to trader education and market analysis tools reflects understanding that informed traders generate better returns and remain loyal clients longer. The comprehensive suite of analytical resources spans from basic charting to advanced quantitative tools, supported by educational content helping traders maximize these capabilities.

| Category | Key Features | Ideal For |

|---|---|---|

| Technical Analysis Tools | - 100+ indicators (trend, momentum, volatility, volume)- Proprietary Asia-specific tools (e.g., HK lunch break patterns)- Elliott Wave, Fibonacci, multi-timeframe charts | Technical traders, chartists, swing and day traders |

| Fundamental Analysis Resources | - F10 data for HK-listed stocks (financials, ownership, actions)- Analyst estimates and news feeds- Global Express screeners for P/E, dividends, growth | Long-term investors, value and growth stock pickers |

| Economic Calendar & Events | - Key Asian economic data, central bank meetings, earnings- Historical data, forecast impact, volatility alerts | Macro traders, event-driven strategists |

| Educational Resources | - Weekly webinars (basic to advanced topics)- Platform guides, trading strategy PDFs- Specialized HK market content (e.g., CBBCs, IPOs) | Beginners to advanced traders, self-learners |

| Market News & Research | - Daily market commentary, sector and stock analysis- Push alerts, live video interviews- Global Express broadcast integration | Traders needing timely insights and market direction |

| Blogs & Social Learning | - Expert blogs on trading psychology, strategies- Community comments and forums- Moderated for quality and relevance | Active traders, peer learners, strategy exchangers |

| Advanced Analytics | - API access for real-time data, historical backtesting- Order management integration- Retail-level algorithmic trading tools | Quantitative traders, coders, algo strategy developers |

Guotai Junan International Account Types

Securities accounts access Hong Kong stocks with margin facilities. Futures accounts trade global derivatives. Forex accounts offer 30 pairs through MaxxTrader/MT4. Wealth management includes funds and advisory services. Institutional accounts provide API access and prime brokerage. Virtual asset accounts require eligibility verification.

Account Types Comparison Table

| Type | Minimum | Leverage | Platforms | Advisory |

|---|---|---|---|---|

| Securities | Not specified | Margin | All | No |

| Futures | Higher | Varies | Global Express | No |

| Forex | Moderate | 20:1 | MaxxTrader/MT4 | No |

| Wealth | Varies | Limited | All | Yes |

| Institutional | High | Custom | All+API | Dedicated |

Negative Balance Protection

No explicit guarantee exists. Conservative 20:1 leverage limits risk. Margin calls trigger at 100% requirements. Automatic liquidation at 50% maintenance margin. Strong financial position provides buffer, but losses exceeding deposits possible during extreme volatility.

Guotai Junan International Deposits and Withdrawals

Local bank transfers process same-day with partner banks. FPS enables instant 24/7 transfers. International wires take 1-5 days. Withdrawals require matching account names. Partner banks offer fee-free transfers. International transfers cost HKD 160 plus fees.

Payment Methods Comparison Table

| Method | Time | Fees | Currencies |

|---|---|---|---|

| Bank Transfer | Same day | Free (partners) | HKD |

| FPS | Instant | Free | HKD, CNY |

| International | 1-5 days | HKD 160+ | Multi |

| Cheque | 1-3 days | HKD 50 | HKD |

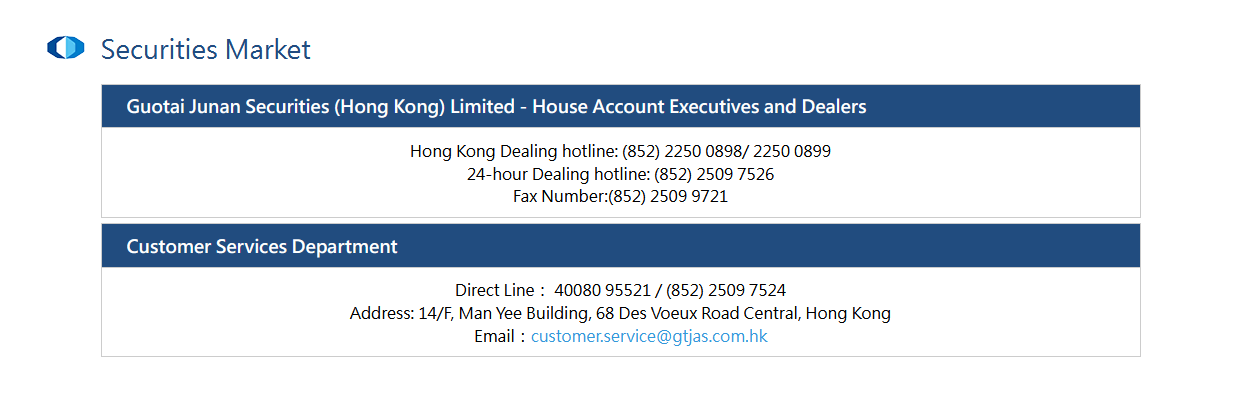

Support Service for Customer

Phone support (852) 2509 9118 operates business hours in three languages. Email responds within 24 hours. Live chat available during market hours. Social media provides updates. Institutional clients receive dedicated managers.

Customer Support Availability Table

| Channel | Hours | Response | Languages |

|---|---|---|---|

| Phone | Business | Immediate | Cantonese/Mandarin/English |

| 24/7 submit | 24 hours | Multi | |

| Chat | Market hours | Real-time | Multi |

| Social | 24/7 | Business hours | Chinese/English |

Prohibited Countries

US residents face FATCA restrictions. Sanctioned countries excluded. High-risk FATF jurisdictions require enhanced verification. EU countries need MiFID authorization. Virtual assets have additional restrictions.

Special Offers for Customers

Limited promotional offers focus on value over incentives. New clients receive platform training. Volume traders earn automatic commission reductions. Educational webinars provided free. IPO fee waivers during active periods. Referral programs offer service credits.

Conclusion

After comprehensive analysis, GTJAI emerges as a legitimate, well-regulated broker particularly suited for investors prioritizing Asian market access with strong regulatory oversight. The company's evolution from traditional Chinese brokerage to integrated financial services provider is evident in its diverse offerings, dual SFC licensing, and pioneering virtual asset approval in June 2025. The investment-grade credit ratings and MSCI ESG "A" rating provide additional confidence in institutional stability. However, the lack of transparency regarding minimum deposits, absence of explicit negative balance protection, and conservative 20:1 leverage limits may disappoint aggressive traders. Customer support confined to Asian business hours and the Chinese-only mobile app further limit global accessibility. GTJAI best serves Hong Kong residents, institutional investors requiring compliant Asian market access, and conservative traders valuing security over promotional incentives. While the recent digital asset capabilities mark significant innovation, stringent eligibility requirements restrict access. Ultimately, GTJAI represents a solid choice for serious, long-term investors who prioritize regulatory security and Asian market expertise over aggressive leverage or round-the-clock support.

Compare costs in our broker pricing index.

US regulation focus? Start with the FOREX.com review.