GVD Markets Review: A Comprehensive Forex Broker Analysis

GVD Markets

Cyprus

Cyprus

-

Minimum Deposit $25

-

Withdrawal Fee $varies

-

Leverage 2000:1

-

Minimum Order 0.01

-

Forex Available

-

Crypto Unavailable

-

Stock Available

-

Indices Available

Licenses

Cyprus Market Making (MM)

Cyprus Market Making (MM)

Financial Services Authority Seychelles

Financial Services Authority Seychelles

Global Business License

Global Business License

Softwares & Platforms

Customer Support

+35725261457

(English)

+35725261457

(English)

Supported language: Chinese (Simplified), English, French, German, Arabic, Spanish, Italian

Social Media

Summary

GVD Markets stands out as a well-regulated and reliable broker, holding licenses from CySEC, FSC, and FSA. It offers a diverse range of tradable assets and advanced platforms like MT4 and MT5, catering to both beginners and experienced traders. The broker provides strong educational resources, multiple account types, and responsive multilingual support. While it lacks 24/7 customer service and has regional restrictions, its overall offering remains competitive and client-focused, making it a solid choice for those seeking a secure and supportive trading environment.

- No 24/7 customer support

- Restrictions on clients from certain countries

- Limited information on specific trading conditions for each account type

- Potential fees associated with inactive accounts

- Bonuses and promotions subject to specific terms and conditions

- No 24/7 customer support

- Restrictions on clients from certain countries

- Limited information on specific trading conditions for each account type

- Potential fees associated with inactive accounts

- Bonuses and promotions subject to specific terms and conditions

Overview

GVD Markets is a relatively new online forex and CFD broker, established in 2022 with headquarters in Limassol, Cyprus. Despite its young age, the company has quickly made a name for itself in the competitive world of online trading by offering a diverse range of financial instruments, competitive trading conditions, and a commitment to security and transparency.

Regulated by the Cyprus Securities and Exchange Commission (CySEC), the Financial Services Commission (FSC) in Mauritius, and the Seychelles Financial Services Authority (FSA), GVD Markets operates under strict guidelines to ensure the safety of client funds and fair trading practices. The broker's multi-jurisdictional regulation demonstrates its dedication to providing a trustworthy and reliable trading environment for its clients.

GVD Markets offers access to over 100 tradable instruments, including forex pairs, indices, metals, energies, and stocks, catering to the diverse needs and preferences of traders worldwide. The company's partnership with MetaTrader, one of the most popular trading platforms in the industry, ensures a seamless and efficient trading experience for both novice and experienced traders alike.

With a low minimum deposit requirement, competitive spreads, and a wide range of account types, GVD Markets aims to make online trading accessible and advantageous for traders of all levels. The broker's website provides comprehensive educational resources, including webinars, tutorials, and market analysis, empowering clients to make informed trading decisions and enhance their skills.

Throughout this in-depth review, we will delve into the various aspects of GVD Markets' offerings, evaluating their services, platforms, and overall user experience. By providing an objective and thorough assessment of the broker's strengths, weaknesses, and unique selling points, we aim to assist potential clients in determining whether GVD Markets is the right choice for their online trading needs.

For more detailed information about GVD Markets' products, services, and regulatory compliance, visit their official website at [gvdmarkets.com].

Overview Table

| Feature | Details |

|---|---|

| Headquarters | Limassol, Cyprus |

| Established | 2022 |

| Regulation | CySEC (Cyprus), FSC (Mauritius), FSA (Seychelles) |

| Tradable Instruments | Forex, Indices, Metals, Energies, Stocks |

| Minimum Deposit | $25 |

| Trading Platforms | MetaTrader 4, MetaTrader 5 |

| Account Types | Cent, Standard, Premium, Pro |

| Educational Resources | Webinars, Tutorials, Market Analysis |

| Customer Support | Email, Phone, Live Chat |

Facts List

- Established in 2022, with headquarters in Limassol, Cyprus

- Regulated by CySEC, FSC, and FSA, ensuring a secure trading environment

- Offers over 100 tradable instruments across various asset classes

- Low minimum deposit requirement of just $25

- Provides access to popular MetaTrader 4 and MetaTrader 5 platforms

- Offers competitive spreads and leverage of up to 1:2000

- Multiple account types to cater to different trading styles and preferences

- Comprehensive educational resources to support traders' growth and development

- Negative balance protection to safeguard clients' funds

- Multilingual customer support via email, phone, and live chat

GVD Markets Licenses and Regulatory

GVD Markets operates under the regulatory oversight of three major financial authorities: the Cyprus Securities and Exchange Commission (CySEC), the Financial Services Commission (FSC) in Mauritius, and the Seychelles Financial Services Authority (FSA). This multi-jurisdictional regulation ensures that the broker adheres to strict guidelines and maintains high standards of security, transparency, and fair trading practices.

CySEC, the primary regulator, has granted GVD Markets a Straight Through Processing (STP) license (license number 411/22), which means that the broker acts as an intermediary between traders and liquidity providers, without intervening in the trade execution process. This license type emphasises the broker's commitment to maintaining a transparent and fair trading environment for its clients.

The FSC and FSA licenses held by GVD Markets are categorised as Retail Forex Licenses, which allow the broker to offer its services to retail clients in their respective jurisdictions. Although these licenses are considered offshore regulations, they still require the broker to comply with specific rules and guidelines to protect client interests.

In addition to its regulatory licenses, GVD Markets implements several security measures to safeguard client funds and ensure a secure trading environment. These measures include the segregation of client funds from the company's operational funds, negative balance protection to prevent clients from losing more than their account balance, and an investor compensation fund designed to protect covered clients in the event of the broker's insolvency.

By adhering to the regulations set forth by CySEC, FSC, and FSA, GVD Markets demonstrates its commitment to providing a trustworthy and reliable trading environment for its clients. The broker's compliance with industry standards and best practices instills confidence in traders, knowing that their funds and personal information are protected by a well-regulated entity.

Regulations List

- Cyprus Securities and Exchange Commission (CySEC) - Straight Through Processing (STP) License, license number 411/22

- Financial Services Commission (FSC), Mauritius – Retail Forex License

- Seychelles Financial Services Authority (FSA) – Retail Forex License

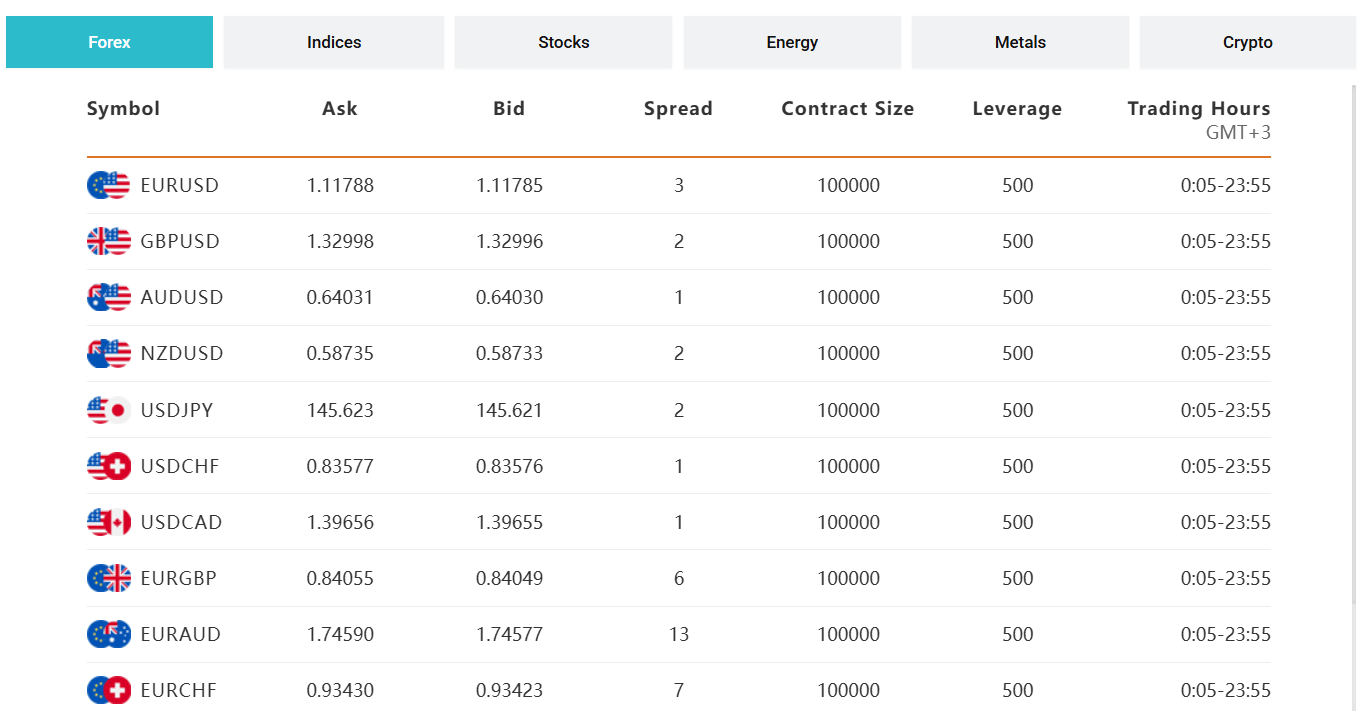

Trading Instruments

GVD Markets offers a diverse range of tradable assets, catering to the preferences and risk appetites of various traders. The broker's extensive portfolio includes over 100 financial instruments across multiple asset classes, allowing clients to diversify their investments and capitalise on market opportunities.

| Asset Class | Description | Examples |

|---|---|---|

| Forex | Wide range of currency pairs with competitive spreads and high liquidity. | EUR/USD, GBP/USD, USD/JPY, USD/CHF |

| Indices | Access to global stock indices for broad market exposure. | S&P 500, NASDAQ 100, FTSE 100, DAX 30, Nikkei 225 |

| Metals | Precious metals trading for portfolio diversification and safe-haven investment. | Gold, Silver |

| Energies | Trade energy commodities responsive to global events and market dynamics. | Brent Crude Oil, WTI Crude Oil |

| Stocks | Invest in individual company stocks across industries and regions. | Various global stocks (specifics depend on broker’s offering) |

The diverse array of tradable assets offered by GVD Markets sets the broker apart from competitors and demonstrates its adaptability to market trends and client needs. By providing access to multiple asset classes, the broker empowers traders to create well-rounded portfolios and seize opportunities across different markets.

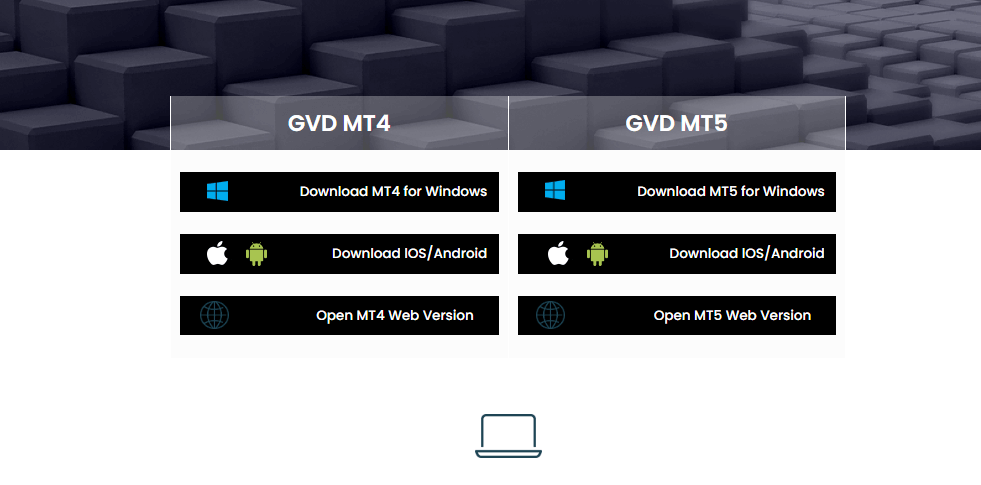

Trading Platforms

GVD Markets offers its clients access to the renowned MetaTrader trading platforms, specifically MetaTrader 4 (MT4) and MetaTrader 5 (MT5). These platforms are widely recognised in the industry for their user-friendly interface, advanced charting capabilities, and extensive range of trading tools.

MetaTrader 4 (MT4)

MT4 is a popular choice among traders due to its intuitive design and comprehensive features. The platform supports automated trading through Expert Advisors (EAs), which allow clients to implement custom trading strategies and algorithms. MT4 also offers a wide range of technical indicators and charting tools, enabling traders to perform in-depth market analysis and make informed trading decisions.

MetaTrader 5 (MT5)

MT5 is the successor to MT4 and offers enhanced functionality and advanced trading features. The platform supports multi-asset trading, allowing clients to access forex, indices, metals, energies, and stocks from a single account. MT5 also provides a more extensive range of technical indicators and graphical objects, as well as the ability to create custom indicators using the MQL5 programming language.

Web and Mobile Trading In addition to the desktop versions of MT4 and MT5, GVD Markets offers web-based and mobile trading solutions. The MetaTrader WebTrader allows clients to access their trading accounts and execute trades directly from their web browsers, without the need to download or install any software. This feature is particularly useful for traders who prefer to trade on the go or from different devices.

For mobile trading, GVD Markets provides dedicated mobile apps for both MT4 and MT5. The apps are available for iOS and Android devices, enabling clients to monitor their positions, analyse markets, and place trades from their smartphones or tablets. The mobile apps offer a streamlined version of the desktop platforms, ensuring a seamless trading experience across all devices.

By offering the MetaTrader platforms, GVD Markets ensures that its clients have access to industry-leading trading technology and a wide range of tools to support their trading activities. The availability of web and mobile trading solutions further enhances the broker's accessibility and flexibility, catering to the needs of both desktop and mobile traders.

Trading Platforms Comparison Table

| Feature | MT4 | MT5 |

|---|---|---|

| User Interface | User-friendly | Advanced |

| Charting | Comprehensive | Enhanced |

| Technical Indicators | 30+ | 40+ |

| Timeframes | 9 | 21 |

| Automated Trading | Yes (EAs) | Yes (EAs & Robots) |

| Multi-Asset Trading | No | Yes |

| Hedging | Yes | Yes |

| Custom Indicators | MQL4 | MQL5 |

| Web Trading | Yes (WebTrader) | Yes (WebTrader) |

| Mobile Trading | iOS & Android | iOS & Android |

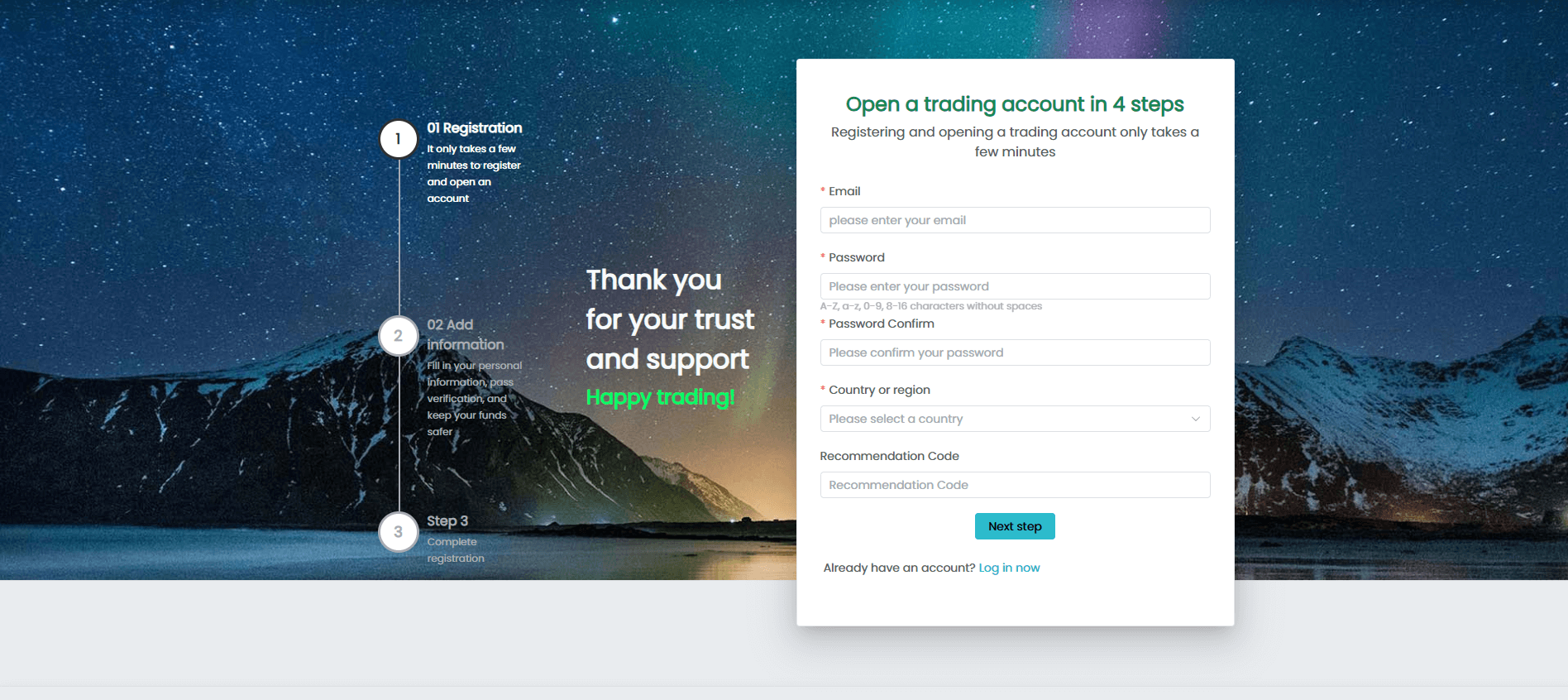

GVD Markets How to Open an Account: A Step-by-Step Guide

Opening an account with GVD Markets is a straightforward process that can be completed entirely online. To get started, follow these simple steps:

- Visit the GVD Markets official website [gvdmarkets.com] and click on the "Open an Account" button.

- Fill out the registration form with your personal information, including your name, email address, phone number, and country of residence.

- Choose your account type (Cent, Standard, Premium, or Pro) and select your preferred base currency (USD or EUR).

- Provide proof of identity and residence by uploading a valid government-issued ID (e.g., passport or driver's license) and a recent utility bill or bank statement.

- Review and accept the broker's terms and conditions, as well as the privacy policy.

- Submit your application and wait for the broker to verify your information and approve your account.

Once your account is approved, you can log in to the client portal and access the trading platform of your choice (MT4 or MT5). To start trading, you'll need to fund your account using one of the available payment methods, such as credit/debit cards, bank wire transfers, or e-wallets.

GVD Markets offers a simple and efficient account opening process, allowing clients to start trading quickly and securely. The broker's commitment to client verification and due diligence ensures a safe and compliant trading environment for all users.

Charts and Analysis

GVD Markets provides its clients with a comprehensive suite of educational resources and trading tools to support their market analysis and decision-making processes. These resources are designed to cater to traders of all skill levels, from beginners to experienced professionals.

| Feature | Description | Benefits |

|---|---|---|

| Economic Calendar | Detailed schedule of key economic events and data releases. | Helps anticipate market volatility and plan trades effectively. |

| Market Analysis | Regular insights and commentary from expert analysts. | Covers technical and fundamental analysis; delivered via articles, videos, and webinars. |

| Charting Tools | Advanced charting on MetaTrader platforms with multiple chart types and technical indicators. | Customisable interface; supports custom indicators via MQL programming. |

| Educational Resources | A wide range of learning materials including eBooks, video tutorials, and courses. | Suitable for all levels; includes webinars and seminars for live learning. |

| Trading Signals & Copy Trading | Real-time trade recommendations and automated trade copying. | Ideal for beginners or those wanting to diversify using expert strategies. |

By offering a diverse range of educational resources and trading tools, GVD Markets empowers its clients to make informed trading decisions and continuously improve their skills. The broker's commitment to education and analysis sets it apart from competitors and demonstrates its dedication to supporting the success of its clients.

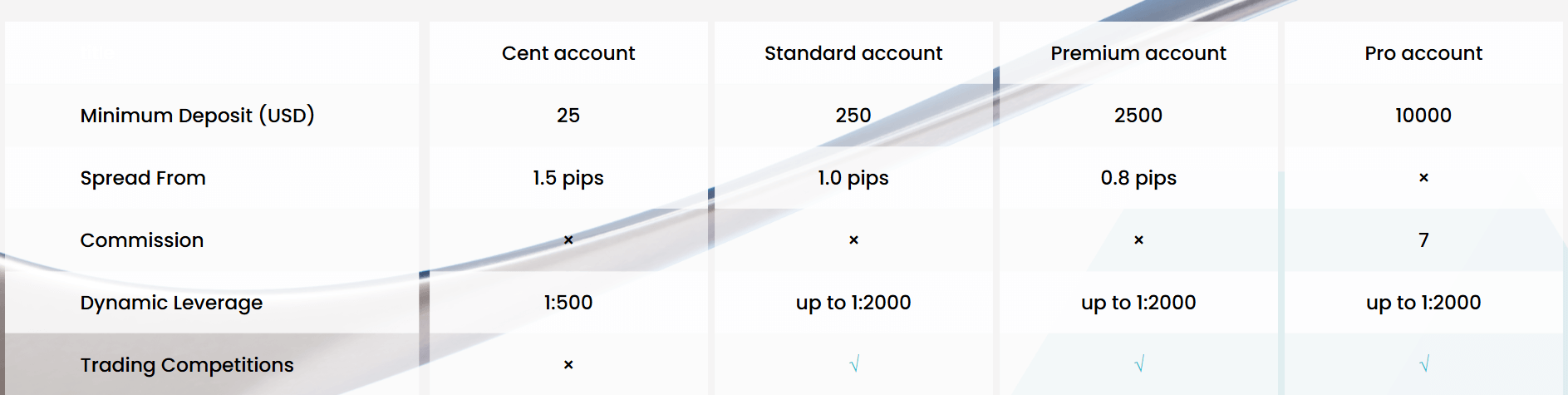

GVD Markets Account Types

GVD Markets offers a range of account types to cater to the diverse needs and preferences of its clients. Each account type comes with its own set of features and trading conditions, allowing traders to choose the most suitable option based on their experience level, trading style, and investment goals.

Cent Account

The Cent Account is designed for novice traders or those looking to test their strategies with minimal risk.

Key features include:

- Minimum deposit of $25

- Leverage up to 1:500

- Spreads from 1.5 pips

- No commission fees

- Access to all trading platforms and tools

Standard Account

The Standard Account is suitable for traders with some experience and offers a balance between competitive trading conditions and accessible minimum deposit requirements.

Key features include:

- Minimum deposit of $250

- Leverage up to 1:2000

- Spreads from 1.0 pips

- No commission fees

- Access to all trading platforms and tools

- Eligibility for bonus programs

Premium Account

The Premium Account caters to more experienced traders and offers enhanced trading conditions and additional benefits.

Key features include:

- Minimum deposit of $2,500

- Leverage up to 1:2000

- Spreads from 0.8 pips

- No commission fees

- Access to all trading platforms and tools

- Eligibility for bonus programs

- Personal account manager

- Priority customer support

Pro Account

The Pro Account is tailored for professional traders and high-volume investors, offering the most competitive trading conditions and exclusive benefits.

Key features include:

- Minimum deposit of $10,000

- Leverage up to 1:2000

- Raw spreads

- Commission of $7 per standard lot

- Access to all trading platforms and tools

- Eligibility for bonus programs

- Personal account manager

- Priority customer support

- VIP events and exclusive market insights

Demo Account In addition to the live trading accounts, GVD Markets offers a Demo Account that allows traders to practise their skills and test strategies in a risk-free environment. The Demo Account comes with virtual funds and provides access to all trading platforms and tools, enabling traders to familiarise themselves with the broker's offerings before committing to a live account.

By providing a range of account types with varying minimum deposit requirements, leverage, spreads, and additional features, GVD Markets ensures that traders can find an account that aligns with their specific needs and goals. This flexibility demonstrates the broker's commitment to catering to a wide spectrum of traders and fostering a supportive trading environment.

Account Types Comparison Table

| Feature | Cent | Standard | Premium | Pro |

|---|---|---|---|---|

| Minimum Deposit | $25 | $250 | $2,500 | $10,000 |

| Leverage | 1:500 | 1:2000 | 1:2000 | 1:2000 |

| Spreads (from) | 1.5 pips | 1.0 pips | 0.8 pips | Raw |

| Commission (per lot) | No | No | No | $7 |

| Trading Platforms | MT4, MT5 | MT4, MT5 | MT4, MT5 | MT4, MT5 |

| Bonus Programs | No | Yes | Yes | Yes |

| Personal Account Manager | No | No | Yes | Yes |

| Priority Support | No | No | Yes | Yes |

| VIP Events & Insights | No | No | No | Yes |

Negative Balance Protection

GVD Markets understands the importance of risk management and offers negative balance protection to all its clients. Negative balance protection is a risk management feature that ensures a trader's account balance never falls below zero, even in the event of extreme market volatility or unexpected market gaps. In the context of online trading, negative balance protection acts as a safeguard against situations where a trader's losses exceed their account balance. This can occur due to factors such as high market volatility, insufficient margin, or the execution of large orders during periods of low liquidity. Without negative balance protection, a trader could potentially owe money to the broker if their losses surpass their available account balance. However, with GVD Markets' negative balance protection policy in place, the broker absorbs any losses that exceed the trader's account balance, preventing the account from going into a negative balance. This feature provides traders with peace of mind, knowing that their maximum potential loss is limited to the funds available in their trading account. It also demonstrates GVD Markets' commitment to responsible trading practices and client protection. It is essential to note that while negative balance protection is an important risk management tool, it should not be relied upon as a substitute for proper risk management practices, such as maintaining appropriate position sizes, using stop-loss orders, and diversifying trading strategies. Traders should always strive to manage their risk effectively and never trade with more than they can afford to lose. By offering negative balance protection, GVD Markets showcases its dedication to creating a secure and transparent trading environment for its clients, where their interests and financial well-being are prioritised.

GVD Markets Deposits and Withdrawals

GVD Markets offers a range of convenient deposit and withdrawal methods to facilitate smooth and secure transactions for its clients. The broker understands the importance of efficient fund management and strives to provide a seamless experience for both deposits and withdrawals.

Deposit Methods

| Method | Processing Time | Fees | Minimum Deposit |

|---|---|---|---|

| Credit/Debit Cards (Visa, Mastercard) | Instant | No fees charged by GVD Markets | $25 - $10,000 (depending on account type) |

| Bank Wire Transfer | 3-5 business days | Fees may apply (depending on client's bank) | $25 - $10,000 (depending on account type) |

| E-wallets (Skrill, Neteller) | Instant | Fees may apply (charged by payment provider) | $25 - $10,000 (depending on account type) |

Withdrawal Methods

| Method | Processing Time | Fees | Notes |

|---|---|---|---|

| Credit/Debit Cards (Visa, Mastercard) | 1–3 business days | May apply | Must match the deposit method used |

| Bank Wire Transfer | 3–5 business days | May apply | Ideal for larger withdrawals |

| E-wallets (Skrill, Neteller) | 1–3 business days | May apply | Fast and convenient for online users |

Support Service for Customer

GVD Markets prides itself on providing exceptional customer support to its clients. The broker understands that prompt and reliable assistance is crucial for a smooth trading experience, and as such, it offers a range of support channels to cater to its clients' needs. Support Channels Clients can reach GVD Markets' customer support team through the following channels:

- Live Chat: Available on the broker's website, allowing clients to instantly connect with a support representative.

- Email: Clients can send their enquiries to support@gvdmarkets.com for general questions or to specific departmental email addresses for targeted assistance.

- Phone: Clients can contact GVD Markets' support team via phone at +0035725250025.

- Social Media: The broker maintains an active presence on social media platforms such as Facebook, Twitter, and LinkedIn, providing clients with additional avenues to seek assistance or stay informed about the latest updates

Support Languages

To cater to its international clientele, GVD Markets offers support in multiple languages, including:- English

- Spanish

- French

- German

- Italian

- Arabic

- Chinese

Response Times

The broker's target response times are as follows:- Live Chat: Instant response

- Email: 24 hours

- Phone: Immediate response during operating hours

- Social Media: 24 hours

Customer Support Comparison Table

| Channel | Availability | Languages | Response Time |

|---|---|---|---|

| Live Chat | Website | Multilingual | Instant |

| support@gvdmarkets.com | Multilingual | 24 hours | |

| Phone | +0035725250025 | Multilingual | Immediate |

| Social Media | Facebook, Twitter, LinkedIn | Multilingual | 24 hours |

Prohibited Countries

Due to regulatory restrictions and legal requirements, GVD Markets does not offer its services to residents of certain countries. These restrictions are put in place to ensure compliance with international laws and to protect both the broker and its clients from potential legal and financial risks.

The list of prohibited countries includes:

- United States of America

- Canada

- Japan

- Australia

- Belgium

- Israel

- Iran

- North Korea

- Sudan

- Syria

- Cuba

Residents of these countries are not permitted to open an account with GVD Markets or access its trading services. The broker implements strict verification procedures to ensure that clients are not from prohibited jurisdictions.

It is essential for potential clients to be aware of these restrictions and to refrain from attempting to open an account with GVD Markets if they reside in one of the prohibited countries. Providing false information about one's country of residence may result in the immediate termination of the trading account and potential legal consequences.

GVD Markets regularly reviews and updates its list of prohibited countries to ensure ongoing compliance with international regulations. Clients are encouraged to check the broker's website for the most up-to-date information on country restrictions.

By adhering to these country restrictions, GVD Markets demonstrates its commitment to operating within the bounds of the law and protecting its clients' interests. The broker strives to maintain a safe and compliant trading environment for all its eligible clients.

Prohibited Countries List

- United States of America, Canada, Japan, Australia, Belgium, Israel, Iran, North Korea, Sudan, Syria, and Cuba.

Special Offers for Customers

GVD Markets offers a range of special promotions and bonuses to reward its clients and enhance their trading experience. These offers are designed to cater to both new and existing clients, providing them with additional trading benefits and incentives.

- Welcome Bonus New clients who open a live trading account with GVD Markets can benefit from a Welcome Bonus. The bonus amount varies depending on the initial deposit, with higher deposits qualifying for larger bonuses. The Welcome Bonus is credited to the client's account and can be used for trading purposes, subject to specific terms and conditions, such as minimum trading volume requirements and time limitations.

- Loyalty Program GVD Markets values its long-term clients and offers a Loyalty Program to reward them for their continued patronage. The Loyalty Program is a tiered system, where clients can earn points based on their trading activity and account balance. As clients accumulate more points, they can unlock higher loyalty tiers, each offering a range of benefits, such as reduced spreads, faster withdrawal processing, and personalised support.

- Trading Competitions To encourage active trading and foster a competitive spirit among its clients, GVD Markets organises regular trading competitions. These competitions typically run for a specific period, and participants compete for prizes based on criteria such as trading volume, profitability, or the number of trades executed. Prizes can include cash rewards, trading bonuses, or exclusive access to VIP events.

- Refer-a-Friend Program GVD Markets' Refer-a-Friend Program allows existing clients to earn rewards by introducing new clients to the broker. When a referred friend opens a live trading account and meets certain trading volume requirements, the referring client receives a bonus or a percentage of their friend's trading volume as a reward. This program benefits both the referring client and the new trader, fostering a sense of community and encouraging client loyalty.

Seasonal Promotions Throughout the year, GVD Markets offers seasonal promotions and special offers to mark specific events or holidays. These promotions may include deposit bonuses, trading competitions with unique themes, or exclusive educational resources. Seasonal promotions help keep the trading experience fresh and engaging, providing clients with additional opportunities to benefit from their trading activities.

It is essential for clients to carefully review the terms and conditions associated with each special offer, as they may be subject to specific requirements, such as minimum deposit amounts, trading volume thresholds, or time limitations. By providing transparent and fair promotional offers, GVD Markets aims to enhance its clients' trading experience and build long-lasting relationships based on trust and mutual benefit.

Conclusion

Throughout this comprehensive review, I have thoroughly examined the various aspects of GVD Markets' operations, services, and offerings. From their regulatory compliance and range of tradable assets to their user-friendly trading platforms and comprehensive educational resources, GVD Markets has demonstrated a strong commitment to providing a reliable, secure, and supportive trading environment for its clients.

One of the key strengths of GVD Markets is its multi-jurisdictional regulation, with licenses from CySEC, FSC, and FSA. This regulatory oversight ensures that the broker adheres to strict guidelines and maintains high standards of transparency and fair trading practices, providing clients with peace of mind and protection for their funds.

The broker's wide range of tradable assets, including forex, indices, metals, energies, and stocks, caters to the diverse needs and preferences of traders, allowing them to diversify their portfolios and seize opportunities across various markets. GVD Markets' partnerships with industry-leading platforms, such as MetaTrader 4 and MetaTrader 5, ensure that clients have access to cutting-edge trading technology and tools to support their trading activities.

Furthermore, GVD Markets' commitment to client education and support is evident through its extensive collection of educational resources, including webinars, tutorials, market analysis, and trading tools. These resources empower traders to make informed decisions, develop their skills, and stay up-to-date with the latest market developments.

The broker's range of account types, from Cent Accounts to Pro Accounts, accommodates traders of all experience levels and investment goals, while its competitive trading conditions, such as low minimum deposits, tight spreads, and high leverage, provide clients with the flexibility to customise their trading experience.

GVD Markets' customer support services are another notable aspect of their offering, with multiple channels available for clients to seek assistance, including live chat, email, phone, and social media. The broker's multilingual support team and commitment to prompt response times ensure that clients can access the help they need when they need it.

While GVD Markets has many strengths, it is essential to consider some limitations, such as the absence of 24/7 customer support and the restrictions on clients from certain countries. However, these limitations are not uncommon in the industry and do not significantly detract from the overall quality of the broker's services.

In conclusion, GVD Markets presents itself as a reliable and well-rounded broker that prioritises client satisfaction, security, and support. Its strong regulatory standing, diverse product offering, advanced trading platforms, and comprehensive educational resources make it an attractive choice for both novice and experienced traders seeking a trustworthy partner in their trading journey.

As with any financial decision, it is crucial for potential clients to conduct their own research and consider their individual trading needs and goals before choosing a broker. However, based on the findings of this review, I believe that GVD Markets is well-positioned to provide a positive and rewarding trading experience for those who choose to trade with them.

Find zero-commission deals in our no-fee broker reviews table.

Round out your research with our IronFX review.