Huatai International 2025 Review: Tech-Driven Market Leader

Huatai International

Hong Kong

Hong Kong

-

Withdrawal Fee $varies

-

Minimum Order 0.01

-

Forex Unavailable

-

Crypto Available

-

Stock Available

-

Indices Available

Licenses

Hong Kong Securities and Futures License

Hong Kong Securities and Futures License

Softwares & Platforms

Customer Support

Supported language: English, Chinese (Simplified), Chinese (Traditional)

Social Media

Summary

Huatai International Financial Holdings serves as a vital link between international investors and Chinese markets, operating from a prime location in Hong Kong. Supported by Huatai Securities’ strong capital and global credibility, it emphasizes innovation with zero minimum deposits and competitive commissions. Its expertise in Stock Connect programs and diverse financial services positions it as a key player in the Greater Bay Area’s financial landscape.

- Strong SFC regulation and triple-listed parent company backing

- Sophisticated ZhangLe Global trading platform with mobile-first design

- Commission-free promotions and highly competitive ongoing rates

- No minimum deposit requirement for account opening

- Specialised Stock Connect expertise for China market access

- Comprehensive educational resources and market analysis

- Multi-currency support with competitive exchange rates

- Negative balance protection for retail clients

- Full-service integration from retail to institutional

- Premium office location indicating financial stability

- Limited brand recognition outside Greater China region

- Customer support not available 24/7

- Geographic focus may not suit Western market investors

- No cryptocurrency trading currently available

- Withdrawal processing cutoff at 11:00 AM HKT

- Limited payment methods compared to some FinTech brokers

- Platform primarily optimised for China/HK markets

- Language support is limited to Chinese and English

- No US resident account opening

- Physical presence limited to Hong Kong

Overview

Huatai International Financial Holdings Company Limited stands as a prominent bridge between international investors and Chinese markets since its establishment in 2006.

Operating from prestigious offices spanning floors 58-62 of The Center in Hong Kong's financial district, this wholly-owned subsidiary of Huatai Securities leverages its parent company's triple-listing status (Shanghai, Hong Kong, London) to provide sophisticated cross-border investment services. The company's ZhangLe Global platform represents a significant technological achievement in connecting global investors with Greater China opportunities, while maintaining stringent SFC regulatory compliance under license AOK809.

For more information, visit Huatai International’s official website at htsc.com.

Overview Table

| Feature | Details |

|---|---|

| Company Name | Huatai International Financial Holdings Company Limited |

| Established | 2006 |

| Headquarters | 58-62/F, The Center, 99 Queen's Road Central, Hong Kong |

| Parent Company | Huatai Securities Co., Ltd (Founded 1991) |

| Regulation | SFC Hong Kong (AOK809) |

| Trading Platform | ZhangLe Global |

| Minimum Deposit | $0 |

| Commission Rates | HK Stocks: 0.03%, US Stocks: $0.0049/share |

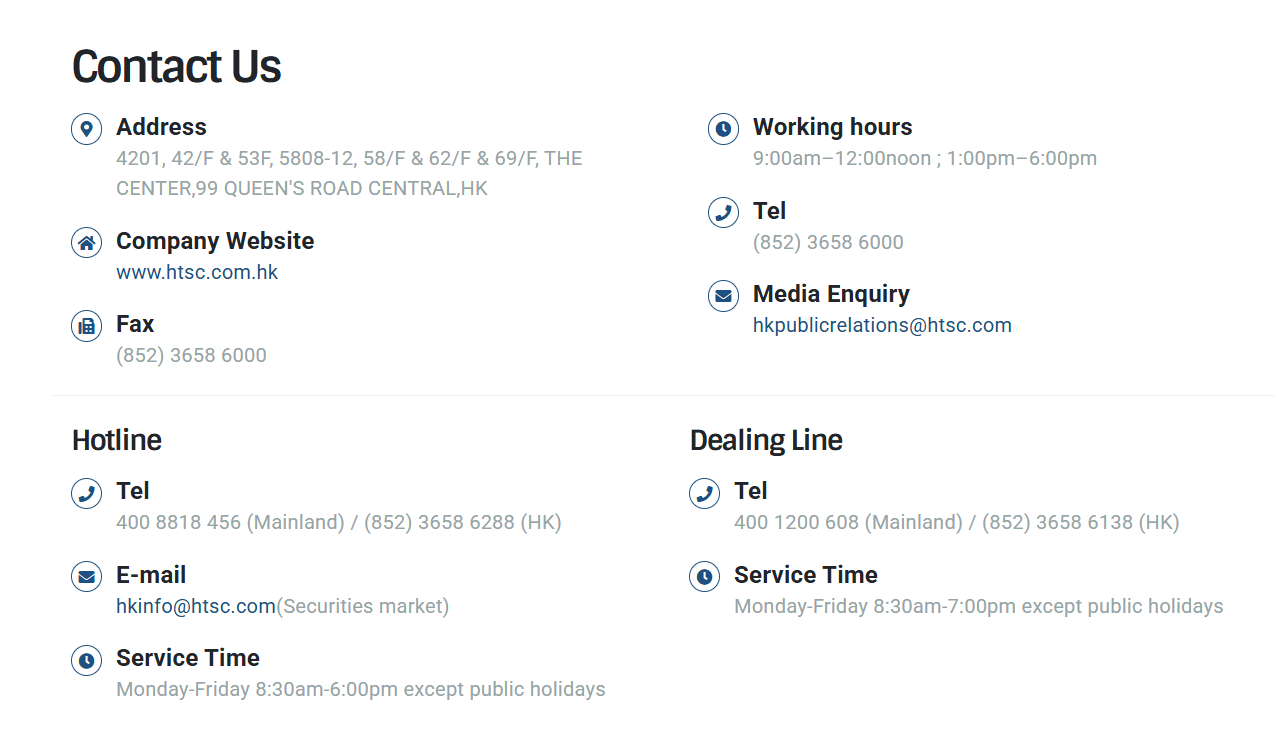

| Customer Support | +852 3658 6000 |

| Website | htsc.com |

Facts List

- Zero Minimum Deposit - No barriers to entry for retail investors

- Triple-Listed Parent - First Chinese firm listed in Shanghai, Hong Kong, and London

- Stock Connect Expertise - Specialized access to A-shares via Shanghai-Hong Kong programs

- Commission-Free Promotion - First 3 months free trading for new clients

- Multi-Floor Headquarters - Occupies 5 floors in Hong Kong's prestigious The Center

- 34-Year Heritage - Parent company operating since 1991

- Eight Core Services - Comprehensive offerings from retail to institutional banking

- Advanced Technology - Proprietary ZhangLe Global platform with mobile-first design

- Negative Balance Protection - Automatic protection for retail clients

- Multi-Currency Support - HKD, USD, CNY, EUR with competitive exchange rates

Huatai International Licenses and Regulatory

Huatai International operates under Hong Kong's Securities and Futures Commission, maintaining multiple license types that enable comprehensive financial services. The SFC regulation ensures adherence to international standards for capital adequacy, risk management, and client asset segregation. Their regulatory framework exceeds regional standards through the combination of SFC oversight and parent company CSRC compliance in mainland China.

Regulatory Licenses

- Securities and Futures Commission (SFC) of Hong Kong - License Number: AOK809

- Type 1 License: Dealing in Securities

- Type 2 License: Dealing in Futures Contracts

- Type 4 License: Advising on Securities

- Type 5 License: Advising on Futures Contracts

- Type 6 License: Advising on Corporate Finance

- Type 9 License: Asset Management

- Parent Company regulated by China Securities Regulatory Commission (CSRC)

- Compliance with Hong Kong Monetary Authority requirements for certain activities

Trading Instruments

Huatai International offers a comprehensive suite of tradable assets that reflects its position as a full-service investment platform connecting international and Chinese markets. The breadth and depth of offerings cater to diverse investment strategies and risk profiles, from conservative fixed-income investors to sophisticated derivatives traders.

| Asset Class | Key Features | Markets & Instruments | Client Benefits |

|---|---|---|---|

| Equities | Core strength, direct A-shares trading via Stock Connect | Shanghai & Shenzhen A-shares, HK-listed H-shares, red chips, blue chips | Access Greater China markets, plus major US markets; competitive pricing |

| Fixed Income (FICC) | Wide range of debt instruments, including government & corporate bonds, structured products | Offshore & onshore Chinese bonds | Portfolio diversification with unique Chinese bond access |

| Derivatives | Equity options and futures on major indices and individual stocks; futures on commodities and currencies | Equity indices, commodities, currency pairs | Supports hedging, arbitrage, structured trading strategies |

| Foreign Exchange | Major currency pairs and crosses, with both offshore (CNH) and onshore (CNY) Renminbi trading | Global currencies, CNH and CNY | Valuable for managing China exposure internationally |

| Alternative Investments | Private equity via Private Capital Investment; various funds including mutual funds, hedge funds, structured products | Greater China private equity, diverse fund products | Access to private capital and alternative investment options |

Trading Platforms

ZhangLe Global serves as the primary trading interface, available across mobile (iOS/Android), web-based platforms, and API integration for algorithmic trading. The platform features 50+ technical indicators, real-time streaming quotes, and integrated research tools specifically optimized for China-Hong Kong market connectivity.

Trading Platform Comparison Table

| Feature | Mobile App | Web Platform | API Access |

|---|---|---|---|

| Real-Time Data | Yes | Yes | Yes |

| Technical Indicators | 50+ | 50+ | Customizable |

| Order Types | All | All | All |

| Languages | Chinese, English | Chinese, English | Multiple |

| Algo Trading | Limited | Yes | Full |

| Research Access | Yes | Yes | Yes |

Huatai International How to Open an Account: A Step-by-Step Guide

- Download Application - Access ZhangLe Global app or web portal

- Complete Registration - Provide personal information and investment objectives

- Document Submission - Upload passport/ID and proof of address (within 3 months)

- Video Verification - Complete remote identity verification

- Investment Assessment - Complete risk profile questionnaire

- Account Approval - Receive credentials within 1-2 business days

- Fund Account - Deposit via bank wire or transfer (no minimum required)

Charts and Analysis

Huatai International's commitment to client education and market analysis reflects its understanding that informed investors make better trading decisions. The comprehensive suite of educational resources and analytical tools rivals those of major international investment banks.

| Category | Features & Services | Details & Benefits |

|---|---|---|

| Market Analysis and Research | - Daily market commentary on Greater China & global markets- Proprietary research from extensive analyst network- Third-party research partnerships- Advanced technical analysis tools (50+ indicators, pattern recognition, backtesting)- Integrated economic calendar with Chinese & international data | - Unique insights on Chinese market dynamics- Broad market & sector coverage- Tools to anticipate market-moving events |

| Educational Content | - Structured learning paths: Beginner, Intermediate, Advanced- Topics: market basics, risk management, technical & fundamental analysis, derivatives, algo trading, cross-border investments- Video content: weekly multilingual webinars, tutorials, market analysis- Regular content updates | - Tailored to all experience levels- Helps users build skills progressively- Keeps learners updated on current market themes |

| Interactive Tools | - Practice portfolios for risk-free strategy testing- Trading simulators to learn platform features- Risk calculators for position sizing and risk assessment- Mobile app integration with learning resources- Push notifications for content, market events, personalised recommendations | - Enhances user confidence before real trading- Supports on-the-go learning and timely updates- Personalised learning experience |

Huatai International Account Types

The broker offers Standard Accounts (zero minimum), Premium Accounts (HKD 100,000 minimum), Professional Accounts (qualification-based), and Institutional Accounts (negotiated terms). Each tier provides progressively enhanced benefits including reduced commissions, priority support, and advanced tools.

Account Types Detailed Comparison Table

| Feature | Standard | Premium | Professional | Institutional |

|---|---|---|---|---|

| Min Deposit | $0 | HKD 100,000 | Varies | Negotiable |

| Commission | Standard | Reduced | Institutional | Negotiated |

| Support | Standard | Priority | Dedicated RM | Team |

| Research | Basic | Enhanced | Comprehensive | Tailored |

| Margin Trading | Yes | Yes | Enhanced | Prime Brokerage |

| API Access | Limited | Available | Full | Customized |

Negative Balance Protection

Automatic protection ensures retail clients cannot lose more than their deposited funds. The system monitors account equity in real-time, triggering position closures when approaching zero balance. This protection covers market gaps, flash crashes, and extreme volatility events, though it doesn't guarantee against losses within the account balance.

Huatai International Deposits and Withdrawals

Deposits process within 1-2 business days for international wires, instantly via Hong Kong FPS. Withdrawals submitted before 11:00 AM HKT process same-day. The platform supports multiple currencies with no deposit fees for most methods.

Payment Methods Comparison Table

| Method | Deposit Time | Withdrawal Time | Fees | Currencies |

|---|---|---|---|---|

| Bank Wire | 1-2 days | 2-3 days | Bank fees | Multi-currency |

| HK FPS | Instant | 24 hours | Free | HKD |

| Check | 2-3 days | N/A | None | HKD |

Support Service for Customer

Customer support operates Monday-Friday, 9:00 AM - 6:00 PM HKT via phone (+852 3658 6000), email (hkinfo@htsc.com), and live chat. Services available in Cantonese, Mandarin, and English.

Customer Support Availability Table

| Channel | Hours | Languages | Response Time |

|---|---|---|---|

| Phone | 9AM-6PM HKT | Chinese, English | Immediate |

| 24/7 submission | Chinese, English | 4-6 hours | |

| Live Chat | 9AM-6PM HKT | Chinese, English | <5 minutes |

| Office Visit | Business hours | Multiple | Walk-in |

Prohibited Countries

Services unavailable to residents of United States, North Korea, Iran, Syria, and other sanctioned nations. EU residents face restrictions except professional investors. Japanese residents prohibited, though nationals residing elsewhere may apply.

Special Offers for Customers

New clients receive commission-free trading for 3 months on HK and US stocks, plus HKD 500-2,000 trading credits based on initial deposit. Active traders access rebate programs approaching institutional rates. Referral bonuses available for both parties.

Conclusion

After conducting this comprehensive analysis of Huatai International, I find them to be a legitimate and sophisticated financial services provider with particular strengths in bridging international and Chinese markets. Their regulatory compliance through the SFC (License #AOK809), combined with the backing of a triple-listed parent company, provides substantial credibility and financial stability.

The technological infrastructure, particularly the ZhangLe Global platform, demonstrates their commitment to modern, efficient trading solutions. I'm particularly impressed by their competitive fee structure, which has evolved dramatically from traditional pricing to match or beat FinTech competitors. The commission-free promotions and low ongoing rates (0.03% for HK stocks) make them accessible to retail investors while maintaining institutional-grade services.

Their Stock Connect expertise stands out as a unique value proposition. For investors seeking exposure to Chinese A-shares or international investors in mainland China wanting global market access, they provide unmatched connectivity and local knowledge. This specialisation, combined with their comprehensive service offerings across eight business lines, positions them uniquely in the market.

However, they do have limitations. Their geographic focus, while a strength for China-focused investors, may not suit those primarily interested in Western markets. The customer support hours, while extensive, don't provide 24/7 coverage, which could inconvenience global traders. Additionally, their brand recognition outside Asia remains limited compared to global investment banks.

The zero minimum deposit requirement and streamlined digital onboarding process demonstrate their commitment to accessibility. The educational resources and analytical tools rival those of much larger institutions, particularly valuable for investors new to Chinese markets. Their negative balance protection and clear fee structures show responsible business practices.

For the right investor - particularly those with interests in Greater China markets or seeking a technology-forward broker with institutional heritage - Huatai International presents a compelling option. They successfully balance the stability of traditional finance with the innovation of modern FinTech, creating a platform suitable for both retail traders and sophisticated institutions.

Check out our latest broker reviews.

Have you read our review of First Shanghai?