ICM Capital Review : Pros and Cons of a Trusted Global Broker

ICM Capital

United Kingdom

United Kingdom

-

Minimum Deposit $200

-

Withdrawal Fee $varies

-

Leverage 200:1

-

Minimum Order 0.01

-

Forex Available

-

Crypto Available

-

Stock Available

-

Indices Available

Licenses

United Kingdom Market Making (MM)

United Kingdom Market Making (MM)

Forex & CFD Brokerage License

Forex & CFD Brokerage License

Softwares & Platforms

Customer Support

+97144295800

(Arabic)

+97144295800

(Arabic)

+442039181490

(English)

+442039181490

(English)

Supported language: Arabic, Chinese (Simplified), English, Spanish

Social Media

Summary

ICM Capital is a globally recognised forex and CFD broker, regulated by the FCA and other international authorities. It offers trading on forex, commodities, indices, and cryptocurrencies through the MetaTrader 4 and MetaTrader 5 platforms. Traders can choose from various account types with spreads starting from 0.0 pips. The minimum deposit is $200, and leverage is available up to 1:200. ICM Capital provides secure deposit and withdrawal options, along with 24/5 customer support via live chat, email, and phone.

- Well-regulated by multiple tier-1 and tier-2 authorities

- Global presence catering to traders worldwide

- Advanced trading platforms: MetaTrader 4, MetaTrader 5, and cTrader

- Competitive account types with low minimum deposit

- Access to a wide range of markets for diverse trading opportunities

- Excellent 24/5 multilingual customer support

- Valuable trading tools and market insights

- Unique ICM Mastercard prepaid debit card for convenient fund access

- Negative balance protection and segregated client accounts for fund safety

- Secure, transparent, and user-friendly trading experience for all levels of traders

- Limited educational resources compared to some competitors

- Only two main account types available

- Maximum leverage limited to 1:200

- Inactivity fee charged after 180 days of no trading activity

- No 24/7 customer support available

- Restricted from offering services in certain countries, including the US and Canada

- Withdrawal fees applied to some payment methods

- No copy trading or social trading features

- No additional account types for high-volume or institutional traders

- Educational content primarily focuses on basic concepts rather than advanced strategies

Overview

ICM Capital is a well-established international online forex and CFD broker founded in 2009. With headquarters in London, UK and a global presence spanning Europe, Asia, Africa, and the Middle East, ICM Capital has built a strong reputation over the years, earning numerous industry awards for its innovative services. As an ECN/STP broker, ICM Capital provides traders with direct market access and competitive trading conditions across a wide range of assets, including forex, stocks, commodities, indices, and cryptocurrencies.

Regulated by multiple tier-1 authorities such as the Financial Conduct Authority (FCA) in the UK, as well as respected regulators in Mauritius, Seychelles, Switzerland, Sweden, and Qatar, ICM Capital prioritises the safety and security of client funds. The broker segregates client accounts and provides negative balance protection to mitigate risk.

ICM Capital caters to both retail and institutional clients, offering two primary account types – the zero-spread ICM Direct account and the commission-free ICM Zero account. The minimum deposit for both accounts is a competitive $200, with leverage up to 1:200 available.

Clients can trade using the industry-standard MetaTrader 4, MetaTrader 5, and cTrader platforms, accessible on desktop, web, and mobile devices. ICM Capital also provides the proprietary ICM Securities platform for dedicated share trading.

Overview Table

| Characteristic | Details |

|---|---|

| Broker Type | ECN/STP |

| Regulation | FCA (UK), FSC (Mauritius), FSA (Seychelles), ARIF (Switzerland), Stockholm County Administrative Board (Sweden), QFC (Qatar) |

| Year Founded | 2009 |

| Headquarters | London, UK |

| International Offices | Europe, Asia, Africa, Middle East |

| Minimum Deposit | $200 |

| Account Types | ICM Direct, ICM Zero |

| Trading Platforms | MetaTrader 4, MetaTrader 5, cTrader, ICM Securities |

| Tradable Assets | Forex, Stocks, Commodities, Indices, Cryptocurrencies |

| Customer Support | 24/5 live chat, email, phone |

| Educational Resources | Limited |

Facts List

- ICM Capital was established in 2009 and is headquartered in London, UK.

- The broker is regulated by six respected authorities worldwide, including the FCA, FSC, FSA, ARIF, Stockholm County Administrative Board, and QFC.

- ICM Capital offers two primary account types: ICM Direct with 0 pip spreads and ICM Zero with no commissions.

- The minimum deposit for both account types is $200, and the maximum leverage is 1:200.

- Clients can trade forex, stocks, commodities, indices, and cryptocurrencies.

- ICM Capital provides access to the MetaTrader 4, MetaTrader 5, cTrader, and proprietary ICM Securities platforms.

- Trading platforms are available on desktop, web, and mobile devices.

- ICM Capital offers 24/5 multilingual customer support via live chat, email, and phone.

- The broker provides negative balance protection and segregates client funds for added security.

- ICM Capital has won numerous industry awards for its innovative services and global reach.

ICM Capital Licenses and Regulatory

ICM Capital operates under a robust regulatory framework, holding licenses from multiple respected authorities worldwide. This extensive oversight ensures that the broker adheres to strict standards of conduct, transparency, and client fund protection, instilling trust and confidence among traders.

As an FCA-regulated broker (license number 520965), ICM Capital is subject to one of the most stringent regulatory environments globally. The Financial Conduct Authority (FCA) is a tier-1 regulator known for its rigorous supervision and enforcement of financial services providers in the United Kingdom. FCA regulation requires brokers to maintain segregated client accounts, report transactions, and adhere to strict capital requirements to ensure financial stability.

In addition to FCA regulation, ICM Capital holds licenses from several other reputable authorities:

- The Financial Services Commission (FSC) of Mauritius (license number C118023357)

- The Financial Services Authority (FSA) of Seychelles

- The Association Romande des Intermédiaires Financiers (ARIF) in Switzerland (registration number CHE-497.911.976)

- The Stockholm County Administrative Board in Sweden (registration number: 969792-7961)

- The Qatar Financial Centre (QFC) in Qatar (license number 00908)

This multi-jurisdictional regulation demonstrates ICM Capital's commitment to operating transparently and ethically across its global offices. By submitting to oversight from numerous respected regulators, the broker provides an added layer of protection for its clients, ensuring that their funds are secure and their interests are prioritised.

Regulations List

- Financial Conduct Authority (FCA) in the United Kingdom – license number 520965

- Financial Services Commission (FSC) of Mauritius – license number C118023357

- Financial Services Authority (FSA) of Seychelles

- Association Romande des Intermédiaires Financiers (ARIF) in Switzerland – registration number CHE-497.911.976

- Stockholm County Administrative Board in Sweden – registration number 969792-7961

- Qatar Financial Centre (QFC) in Qatar – licence number 00908

Trading Instruments

ICM Capital offers a diverse range of tradable assets, catering to the varied needs and preferences of traders worldwide. The broker's extensive portfolio spans multiple asset classes, including forex, stocks, indices, commodities, and cryptocurrencies, providing clients with ample opportunities to diversify their investment strategies and capitalise on market movements.

| Asset Class | Key Details |

|---|---|

| Forex | Over 60 currency pairs (majors, minors, exotics) with spreads from 0.1 pips and deep liquidity. |

| Stocks | CFDs on US stocks like Apple, Amazon, Google, and Microsoft for diversified exposure. |

| Indices | CFDs on global indices (S&P 500, NASDAQ 100, FTSE 100, DAX 30, Nikkei 225) for broad market participation. |

| Commodities | CFDs on precious metals (gold, silver) and energy (oil, natural gas) with competitive spreads. |

| Cryptocurrencies | CFDs on major digital assets (Bitcoin, Ethereum, Litecoin) to benefit from volatility without owning the assets. |

Trading Platforms

ICM Capital offers a comprehensive suite of trading platforms, catering to the diverse needs and preferences of its global client base. By providing access to industry-standard platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5), along with the innovative cTrader platform, ICM Capital ensures that traders have the tools they need to execute their strategies effectively and efficiently.

MetaTrader 4 (MT4)

MT4 is a widely-used trading platform known for its user-friendly interface, advanced charting capabilities, and extensive range of technical indicators. ICM Capital offers MT4 across multiple devices, including desktop, web, and mobile apps for Android and iOS. This versatility allows traders to access their accounts and manage their positions on the go, ensuring they never miss an opportunity in the fast-paced financial markets.

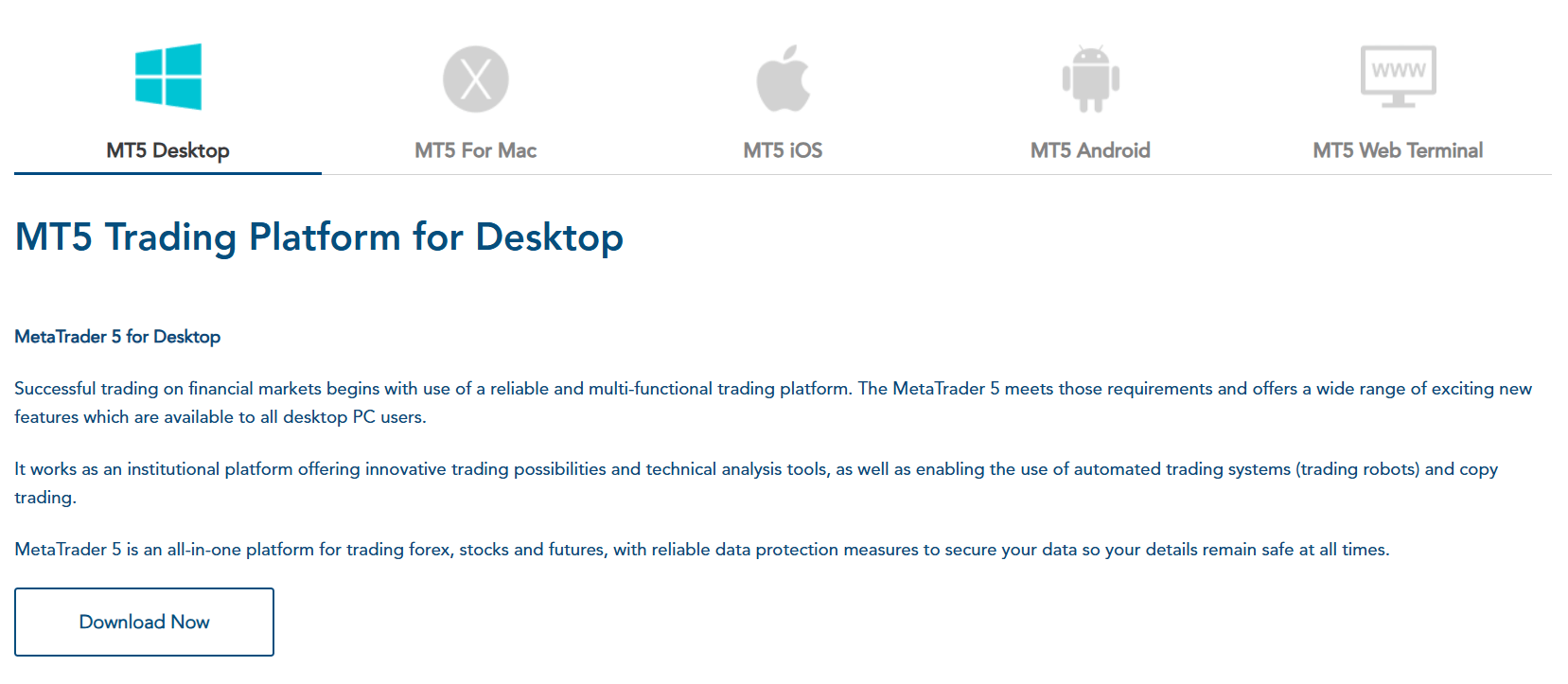

MetaTrader 5 (MT5)

MT5 is the successor to MT4, offering enhanced features and functionality for more advanced traders. With ICM Capital, clients can access MT5 on desktop, web, and mobile platforms, enjoying the benefits of multi-asset trading, advanced risk management tools, and a built-in economic calendar. MT5's algorithmic trading capabilities and support for custom indicators make it an ideal choice for traders looking to automate their strategies and take their trading to the next level.

cTrader

In addition to MT4 and MT5, ICM Capital offers the cutting-edge cTrader platform, designed for traders who demand the ultimate in speed, reliability, and customisation. cTrader boasts a user-friendly interface, advanced charting tools, and deep liquidity, making it an attractive choice for both novice and experienced traders. The platform's support for algorithmic trading and real-time market data ensures that traders have the information they need to make informed decisions in the dynamic financial markets.

Web and Mobile Trading

ICM Capital understands the importance of flexibility and accessibility in today's fast-paced trading environment. That's why the broker offers web-based trading platforms and mobile apps for both MT4 and MT5, allowing traders to access their accounts and manage their positions from anywhere, at any time. The web and mobile platforms provide a seamless trading experience, with intuitive interfaces and advanced features that empower traders to stay on top of the markets, even when they're on the move.

Trading Platforms Comparison Table

| Feature | MetaTrader 4 (MT4) | MetaTrader 5 (MT5) | cTrader |

|---|---|---|---|

| One-Click Trading | Yes | Yes | Yes |

| Algorithmic Trading | Yes | Yes | Yes |

| Advanced Charting | Yes | Yes | Yes |

| Technical Indicators | 30+ | 38+ | 70+ |

| Custom Indicators | Yes | Yes | Yes |

| Economic Calendar | No | Yes | No |

| Web Platform | Yes | Yes | Yes |

| Mobile Apps | Android, iOS | Android, iOS | Android, iOS |

| Automated Trading | Yes | Yes | Yes |

| Market Depth | No | Yes | Yes |

| Social Trading | No | No | Yes |

ICM Capital How to Open an Account: A Step-by-Step Guide

Opening an account with ICM Capital is a straightforward process designed to get traders up and running quickly. By following a few simple steps, clients can start trading on the broker's advanced platforms and accessing the global financial markets.

Account Types and Requirements

ICM Capital offers two main account types: ICM Direct and ICM Zero. Both accounts require a minimum deposit of $200 and support a range of base currencies, including USD, EUR, GBP, and SGD. To open an account, traders must provide proof of identity (POI) and proof of residence (POR) documents, in compliance with international anti-money laundering (AML) and know-your-customer (KYC) regulations.

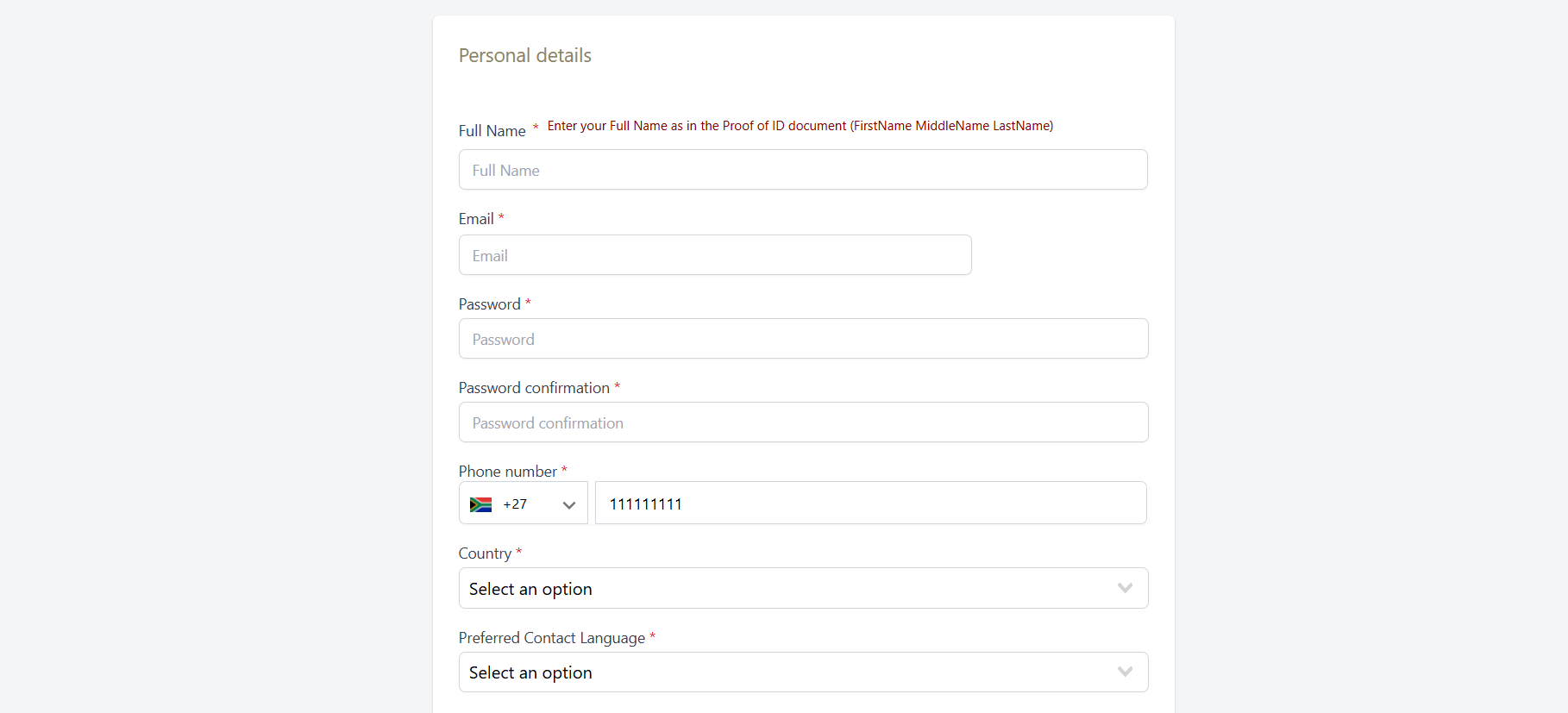

Step 1: Registration To begin the account opening process, visit ICM Capital's official website at www.icmcapital.co.uk and click on the "Open an Account" button. Fill in the required personal information, including your name, email address, phone number, and country of residence.

Step 2: Account Verification After submitting your registration form, you'll receive an email containing a verification link. Click on the link to verify your email address and proceed to the next step. You'll then be prompted to provide additional personal information, such as your date of birth, address, and national ID number.

Step 3: Document Upload To complete the account verification process, you'll need to upload your POI and POR documents. Acceptable POI documents include a valid passport, national ID card, or driver's license. For POR, you can provide a recent utility bill, bank statement, or government-issued document showing your current address. ICM Capital uses advanced encryption technology to ensure the security of your personal information.

Step 4: Select Account Type and Platform Once your documents have been verified, you can choose your preferred account type (ICM Direct or ICM Zero) and trading platform (MT4, MT5, or cTrader). If you're unsure which account type or platform best suits your needs, ICM Capital's support team can help guide you through the selection process.

Step 5: Fund Your Account With your account set up and verified, you're ready to fund it and start trading. ICM Capital supports a variety of deposit methods, including credit/debit cards, bank wire transfers, and e-wallets like Skrill and Neteller. The minimum deposit for both account types is $200, and funds are typically credited to your account instantly or within a few hours, depending on the payment method used.

Charts and Analysis

ICM Capital provides a range of educational resources and tools to support its clients in their trading journey. By offering a combination of market analysis, trading insights, and educational content, the broker aims to empower traders with the knowledge and skills they need to navigate the complex world of online trading.

| Resource | Key Details |

|---|---|

| Trading Central | Provides expert technical analysis, trading ideas, daily reports, an economic calendar, and tools like pattern recognition and sentiment analysis. |

| Market Analysis & Insights | Regular commentary on economic events, geopolitical developments, and market trends via blogs, webinars, and video updates. |

| Educational Resources | Includes webinars, video tutorials, downloadable guides, and a comprehensive trading glossary covering technical analysis, risk management, and trading psychology. |

| Economic Calendar | Offers a clear overview of upcoming high-impact events such as central bank meetings, GDP releases, and employment reports to help plan trading activities. |

ICM Capital Account Types

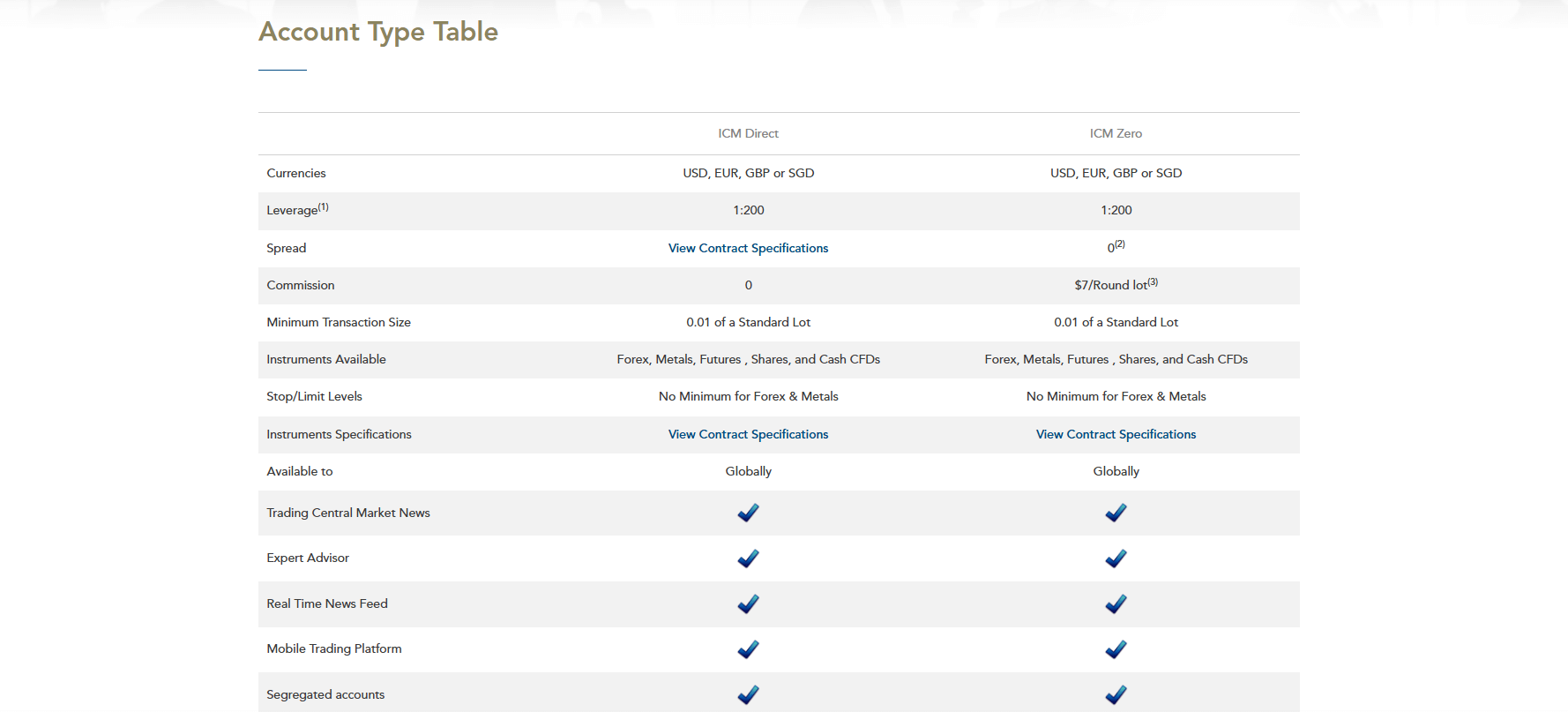

ICM Capital offers two primary account types designed to cater to the diverse needs and preferences of traders worldwide. By providing a choice between the ICM Direct and ICM Zero accounts, the broker ensures that clients can select the option that best aligns with their trading style, experience level, and financial goals.

ICM Direct Account

The ICM Direct account is a popular choice among traders seeking competitive spreads and no commission fees. With spreads starting from just 0.7 pips on major currency pairs, this account type offers an attractive option for cost-conscious traders. The ICM Direct account requires a minimum deposit of $200, making it accessible to a wide range of traders, from beginners to experienced professionals.

Key features of the ICM Direct account include:

- Spreads from 0.7 pips on major currency pairs

- No commission fees

- Minimum deposit of $200

- Leverage up to 1:200

- Access to a wide range of trading instruments, including forex, stocks, indices, commodities, and cryptocurrencies

- Choice of trading platforms, including MT4, MT5, and cTrader

ICM Zero Account

The ICM Zero account is designed for traders who prioritise raw market spreads and are willing to pay a small commission fee in exchange for tighter pricing. With spreads starting from 0.0 pips on major currency pairs, this account type offers some of the most competitive pricing in the industry. Like the ICM Direct account, the ICM Zero account requires a minimum deposit of $200.

Key features of the ICM Zero account include:

- Spreads from 0.0 pips on major currency pairs

- Commission fee of $7 per standard lot traded

- Minimum deposit of $200

- Leverage up to 1:200

- Access to a wide range of trading instruments, including forex, stocks, indices, commodities, and cryptocurrencies

- Choice of trading platforms, including MT4, MT5, and cTrader

Demo Account

In addition to its live trading accounts, ICM Capital offers a demo account option, allowing prospective clients to test the broker's platforms and trading conditions risk-free. The demo account is an ideal choice for beginners looking to gain experience in the markets or for experienced traders seeking to test new strategies without putting real money on the line. Demo accounts come pre-loaded with virtual funds and offer access to the same trading instruments and platforms as live accounts.

Account Types Comparison Table

| Feature | ICM Direct | ICM Zero |

|---|---|---|

| Minimum Deposit | $200 | $200 |

| Spreads | From 0.7 pips | From 0.0 pips |

| Commissions | None | $7 per standard lot |

| Leverage | Up to 1:200 | Up to 1:200 |

| Trading Instruments | Forex, Stocks, Indices, Commodities, Cryptocurrencies | Forex, Stocks, Indices, Commodities, Cryptocurrencies |

| Trading Platforms | MT4, MT5, cTrader | MT4, MT5, cTrader |

| Suitable For | Cost-conscious traders seeking competitive spreads | Traders prioritizing raw market pricing |

| Demo Account | Available | Available |

Negative Balance Protection

ICM Capital offers negative balance protection to all its clients, regardless of their account type or trading style. This means that traders cannot lose more than the funds they have deposited in their trading account, providing peace of mind and limiting potential losses. Under ICM Capital's negative balance protection policy:

- If a trader's account equity falls below zero due to trading losses, the broker will absorb the negative balance and reset the account balance to zero.

- Traders are not required to pay back any negative balances to the broker.

- Negative balance protection applies to all trading instruments offered by ICM Capital, including forex, stocks, indices, commodities, and cryptocurrencies.

- The policy is automatically applied to all client accounts and does not require any additional action or opt-in from the trader.

ICM Capital Deposits and Withdrawals

ICM Capital accepts the following deposit methods:

| Payment Method | Processing Time | Fees | Minimum Deposit |

|---|---|---|---|

| Credit/Debit Cards (Visa, Mastercard) | Instant | No fees | $200 |

| Bank Wire Transfer | 1–3 business days | No fees | $200 |

| E-wallets (Skrill, Neteller) | Instant | Skrill: 1.9%; Neteller: 2.5% | $200 |

| Bitcoin | Instant | No fees | $200 |

| China UnionPay | Instant | No fees | $200 |

Withdrawal Methods

ICM Capital offers the following withdrawal methods:| Payment Method | Processing Time | Fees |

|---|---|---|

| Credit/Debit Cards (Visa, Mastercard) | 1–3 business days | No fees |

| Bank Wire Transfer | 1–3 business days | $15 fee per withdrawal |

| E-wallets (Skrill, Neteller) | 1–3 business days | Skrill: 1%; Neteller: 3% fee |

| Bitcoin | 1–3 business days | 0.5% fee per withdrawal |

| China UnionPay | 1–3 business days | No fees |

Unique Deposit and Withdrawal Features

ICM Capital offers a unique ICM Mastercard debit card which provides convenient global access to your trading account funds. Cardholders can make ATM withdrawals, online purchases, as well as in-store transactions wherever Mastercard is accepted. The card has a one-time setup fee of $50, no annual fees, and enables free ATM withdrawals up to £2,000 per month.Support Service for Customer

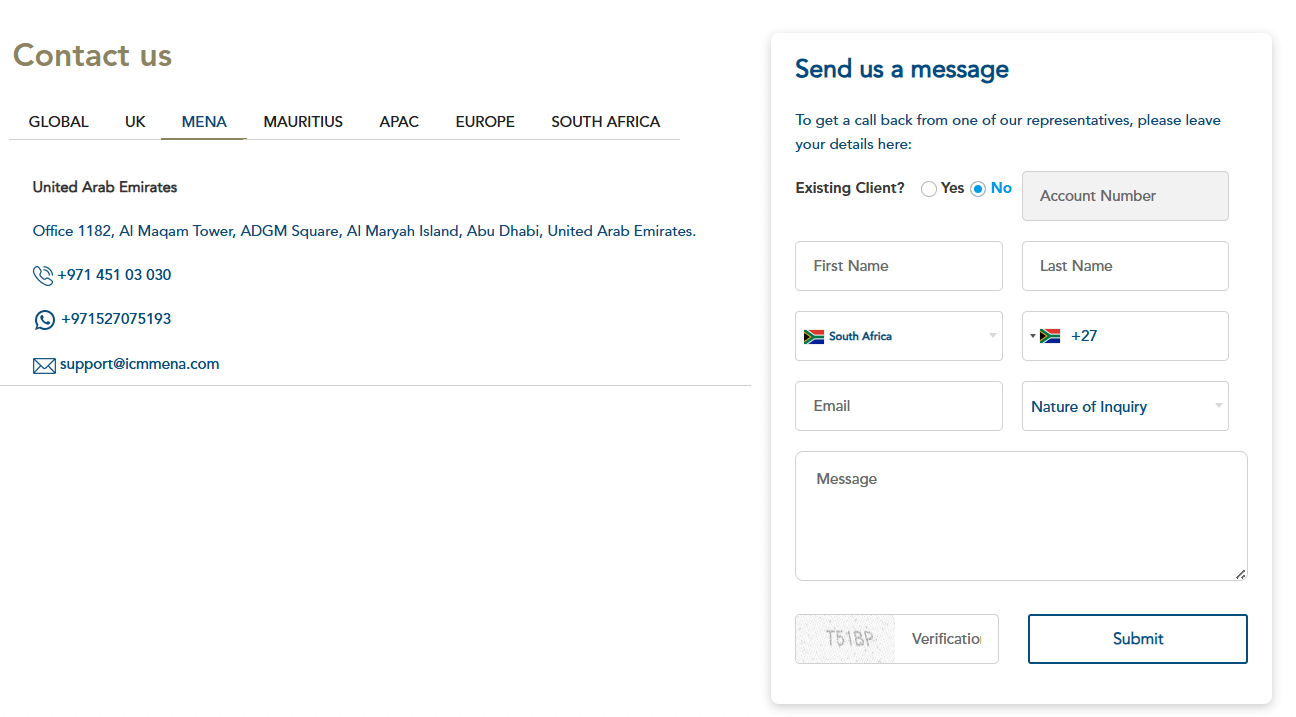

In the fast-paced world of online trading, reliable customer support is crucial for a positive trading experience. Traders often require assistance with account management, platform troubleshooting, or general enquiries, and a responsive support team can make all the difference. ICM Capital understands the importance of providing excellent customer service and offers a range of support channels to cater to their clients' needs.

Support Channels

ICM Capital provides the following customer support channels:- Live Chat: Available on the ICM Capital website, live chat enables traders to connect with a support representative in real-time for quick assistance.

- Email: Traders can send their enquiries to support@icmcapital.co.uk for general support or compliance@icmcapital.co.uk for account verification and compliance-related matters.

- Phone: ICM Capital offers dedicated phone support numbers for different regions:

- UK: +44 20 7634 9770

- UAE: +971 4 429 5800

- General: +44 20 3918 1490

- Social Media: Traders can reach out to ICM Capital via their official Facebook, Twitter, Instagram, and LinkedIn accounts for general enquiries and updates.

- Contact Form: A contact form is available on the ICM Capital website for traders to submit their enquiries and requests.

Support Languages

ICM Capital provides customer support in 8 languages to cater to their global client base:- English

- Spanish

- German

- Portuguese

- Chinese

- Arabic

- Italian

- French

Support Hours and Response Times

ICM Capital's customer support team is available 24/5, from Sunday 10:00 PM to Friday 10:00 PM (GMT). The average response times for each support channel are as follows:- Live Chat: 1-2 minutes

- Email: 1-2 hours

- Phone: 1-2 minutes

- Social Media: 1-2 hours

- Contact Form: 1-2 hours

Customer Support Comparison Table

| ICM Capital Customer Support | Details |

|---|---|

| Supported Languages | English, Spanish, German, Portuguese, Chinese, Arabic, Italian, French |

| Customer Service Hours | 24/5 (Sunday 10:00 PM to Friday 10:00 PM GMT) |

| Live Chat Response Time | 1-2 minutes |

| Email Response Time | 1-2 hours |

| Phone Response Time | 1-2 minutes |

| Social Media Response Time | 1-2 hours |

| Contact Form Response Time | 1-2 hours |

| Customer Support Channels | Live Chat, Email, Phone, Social Media, Contact Form |

Prohibited Countries

ICM Capital is an international broker that aims to provide its services to a wide range of clients globally. However, due to various legal, regulatory, and operational constraints, the broker is prohibited from offering its services in certain countries and regions.

Reasons for Restrictions

There are several reasons why ICM Capital may be restricted from operating in specific countries:

- Local Regulations: Some countries have strict regulations governing the provision of online trading services. These regulations may require brokers to obtain specific licences, comply with local laws, or adhere to certain operational standards. If ICM Capital does not meet these requirements, it may be prohibited from offering its services in those countries.

- Licensing Requirements: In addition to local regulations, some countries require brokers to obtain specific licences to operate legally. These licences may be difficult or costly to obtain, making it impractical for ICM Capital to offer its services in those jurisdictions.

- Geopolitical Factors: Political instability, economic sanctions, or other geopolitical factors may make it difficult or impossible for ICM Capital to operate in certain regions. In such cases, the broker may choose to restrict its services to comply with international laws and avoid potential legal or financial risks.

Prohibited Countries List

ICM Capital does not provide services to residents of the following countries:

- United States

- North Korea

- Iran

- Cuba

- Syria

- Sudan

- Canada

- Japan

- Israel

- Singapore

Consequences of Trading from Prohibited Countries

Attempting to trade with ICM Capital from a prohibited country may result in several consequences:

- Account Closure: If ICM Capital discovers that a client is trading from a prohibited country, the broker may immediately close the client's account and terminate their services.

- Funds Forfeiture: In some cases, clients trading from prohibited countries may forfeit their account balances and any profits earned, as the broker may be unable to process withdrawals due to legal restrictions.

- Legal Action: Clients who knowingly or unknowingly violate ICM Capital's prohibited countries policy may face legal action, including fines or penalties, depending on the jurisdiction and the severity of the violation.

It is crucial for traders to carefully review ICM Capital's prohibited countries list and ensure that they are eligible to open an account and trade with the broker. By complying with these restrictions, traders can avoid potential legal and financial risks and ensure a smooth trading experience.

Special Offers for Customers

ICM Capital provides a range of special offers and promotions designed to attract new clients and reward existing traders for their loyalty. These offers can help traders maximise their potential returns, minimise trading costs, and enhance their overall trading experience.

- 10% Credit Bonus: New and existing clients can receive a 10% credit bonus on all deposits above $1,000. The bonus funds are credited to the trader's account and can be used for trading purposes, providing additional capital to open and maintain positions. To be eligible for the bonus, traders must deposit a minimum of $1,000 in a single transaction. The bonus is subject to a trading volume requirement of 20 times the bonus amount before withdrawal.

- ICM Mastercard: Traders can apply for an ICM Mastercard, a prepaid debit card that allows them to access their trading account funds instantly. The card can be used for online purchases, in-store transactions, and ATM withdrawals worldwide. ICM Mastercard holders enjoy competitive exchange rates, low transaction fees, and exclusive rewards. The card has a one-time setup fee of $50 and no annual fees. Traders can apply for the card directly from their ICM Capital client portal.

- Trading Cashback Program: ICM Capital offers a trading cashback program that rewards traders with cashback on their trading volume. The cashback percentage varies based on the trader's monthly trading volume, with higher volumes earning higher cashback rates. The cashback is calculated daily and credited to the trader's account at the end of each month. This program helps traders reduce their overall trading costs and maximise their potential returns.

- Refer a Friend: ICM Capital's refer-a-friend program rewards traders for introducing new clients to the broker. For each referred friend who opens a live trading account and meets the minimum deposit and trading volume requirements, the referring trader receives a $100 credit bonus. The referred friend also receives a 10% credit bonus on their first deposit. This program is an excellent way for traders to earn additional rewards while helping their friends discover the benefits of trading with ICM Capital.

Conclusion

Throughout this comprehensive review, I have thoroughly examined various aspects of ICM Capital's operations, from their regulatory compliance and global presence to their trading platforms, account types, and customer support. Having analysed these factors in detail, I can confidently conclude that ICM Capital is a safe, reliable, and reputable broker that prioritises the needs of its clients.

One of the key strengths of ICM Capital is its commitment to regulatory compliance. With licenses from multiple tier-1 and tier-2 regulators, including the FCA, FSC, FSA, and ARIF, the broker demonstrates a strong dedication to maintaining the highest standards of transparency and security. This robust regulatory framework provides traders with peace of mind, knowing that their funds are protected and their interests are safeguarded.

ICM Capital's global presence is another testament to their reliability. With offices spanning Europe, Asia, Africa, and the Middle East, the broker has established itself as a trusted provider of online trading services worldwide. This international reach not only reflects ICM Capital's stability but also allows them to cater to the diverse needs of traders from different regions and cultures.

In terms of trading platforms, ICM Capital offers a comprehensive suite of tools and technologies, including the industry-standard MetaTrader 4, MetaTrader 5, and cTrader. These platforms provide traders with a seamless, feature-rich trading experience, complete with advanced charting tools, automated trading capabilities, and mobile accessibility. By offering multiple platform options, ICM Capital ensures that traders can choose the tools that best suit their individual trading styles and preferences.

ICM Capital's account types are another area where the broker excels. With two primary account options – the ICM Direct and ICM Zero accounts – traders can select the pricing structure that aligns with their needs, whether it be lower spreads or zero commissions. The low minimum deposit requirement of just $200 makes ICM Capital accessible to a wide range of traders, from beginners to experienced professionals.

Customer support is a critical component of any broker's services, and ICM Capital does not disappoint in this regard. With a knowledgeable, multilingual support team available 24/5 through various channels, including live chat, email, and phone, traders can rest assured that any issues or concerns will be promptly addressed. The broker's commitment to providing excellent customer service is evident in their fast response times and helpful, professional support staff.

While ICM Capital's educational resources may not be as extensive as some competitors, the broker still offers a solid foundation of trading tools and market analysis, including Trading Central, daily market reports, and an economic calendar. These resources provide traders with valuable insights and support their ongoing learning and development.

In conclusion, ICM Capital stands out as a trustworthy and dependable broker that offers a well-rounded trading experience. With strong regulation, a global presence, advanced trading platforms, competitive account types, and dedicated customer support, ICM Capital is well-positioned to meet the needs of traders at all levels. Whether you are a novice or an experienced trader, ICM Capital provides a secure and supportive environment for pursuing your trading goals.

Crypto CFD fans can start with the crypto-friendly broker set.

MetaTrader power-users: read the Orbex review.