IG Broker Review 2025: Pros, Cons, and Key Features Explored

IG

United Kingdom

United Kingdom

-

Minimum Deposit $250

-

Withdrawal Fee $0

-

Leverage 200:1

-

Spread From 0.6

-

Minimum Order 0.1

-

Forex Available

-

Crypto Available

-

Stock Available

-

Indices Available

Licenses

United Kingdom Market Making (MM)

United Kingdom Market Making (MM)

South Africa Retail Forex License

South Africa Retail Forex License

Japan Forex Trading License

Japan Forex Trading License

Australia Retail Forex License

Australia Retail Forex License

US Retail Forex License

US Retail Forex License

US Commodity Trading License

US Commodity Trading License

Switzerland Financial Services License

Switzerland Financial Services License

Germany Financial Services License

Germany Financial Services License

Singapore Financial Services License

Singapore Financial Services License

UAE Financial Services License

UAE Financial Services License

Softwares & Platforms

Customer Support

+442076335431

(English)

+442076335431

(English)

Supported language: English, French, German, Italian, Spanish

Social Media

Summary

IG Group, a FTSE 250-listed broker founded in 1974, serves over 400,000 traders worldwide through 18 offices, offering access to about 17,000+ markets under 11 top-tier regulators including the FCA, ASIC, and CFTC. Its platform lineup spans six options—Web, Mobile, MT4, ProRealTime, L2 Dealer, and TradingView—catering to beginners through advanced DMA traders. Clients benefit from competitive spreads, negative balance protection for retail accounts, and extensive education via IG Academy. With robust global regulation, a wide market range, and professional-grade tools, IG is widely regarded as one of the industry’s most reliable and versatile brokers.

- Exceptional regulatory framework across 11+ jurisdictions

- 17,000+ tradable markets

- FTSE 250 company with a 50-year track record

- Multiple platform options including MT4

- Comprehensive IG Academy education

- Negative balance protection for retail

- Competitive spreads and transparent fees

- ProRealTime and TradingView integration

- Strong reputation for reliability

- No MetaTrader 5 platform

- Inactivity fee after 2 years

- Guaranteed stops cost extra

- £1000 minimum for L2 Dealer

- Limited promotional bonuses

- Platform customisation restricted

- No social/copy trading features

- Credit card deposit fees

- No negative balance protection for professionals

Overview

IG Group stands as one of the world's most established online brokers, operating since 1974 with over 50 years of market experience. This FTSE 250 company serves 400,000+ traders globally from 18 international offices, offering access to 17,000+ tradable markets. Named #1 Overall Broker in 2024 by ForexBrokers.com, IG maintains regulatory licenses with 11 top-tier authorities, including the FCA, ASIC, and CFTC.

For more detailed information about IG's products, services, and performance, visit their official website.

Overview Table

| Feature | Details |

|---|---|

| Broker Name | IG Group |

| Founded | 1974 |

| Headquarters | London, United Kingdom |

| Global Offices | 18 |

| Client Base | 400,000+ Traders |

| Regulation | FCA, ASIC, CFTC, BaFin, FINMA, MAS, FSCA, DFSA, FSA, FMA, BMA |

| Tradable Markets | 17,000+ |

| Trading Platforms | Proprietary Web & Mobile, MT4, ProRealTime, L2 Dealer, TradingView, ProRealTime |

| Stock Exchange | London Stock Exchange (FTSE 250) |

| Minimum Deposit | £/$250 |

| Key Award 2024 | #1 Overall Broker (ForexBrokers.com) |

Facts List

- Founded in 1974 – one of the world's oldest online brokers

- FTSE 250 publicly traded company

- 400,000+ global traders

- 17,000+ tradable markets

- 11+ regulatory licenses worldwide

- 6 trading platforms available

- Negative balance protection for retail clients

- 18 global offices

- IG Academy educational resources

- 24-hour customer support available

IG Licenses and Regulatory

IG's multi-jurisdictional regulatory framework provides exceptional client protection through strict capital requirements, segregated client funds, and regular audits. This extensive oversight across 11 major authorities demonstrates IG's commitment to maintaining the highest standards of financial security and operational transparency. Each license requires adherence to stringent compliance protocols, ensuring traders benefit from comprehensive investor protection schemes.

- United Kingdom: Financial Conduct Authority (FCA)

- Australia: Australian Securities and Investments Commission (ASIC)

- United States: CFTC and NFA

- Germany: BaFin

- Switzerland: FINMA

- Singapore: MAS

- South Africa: FSCA

- UAE: DFSA

- Japan: FSA

- New Zealand: FMA

- Bermuda: BMA

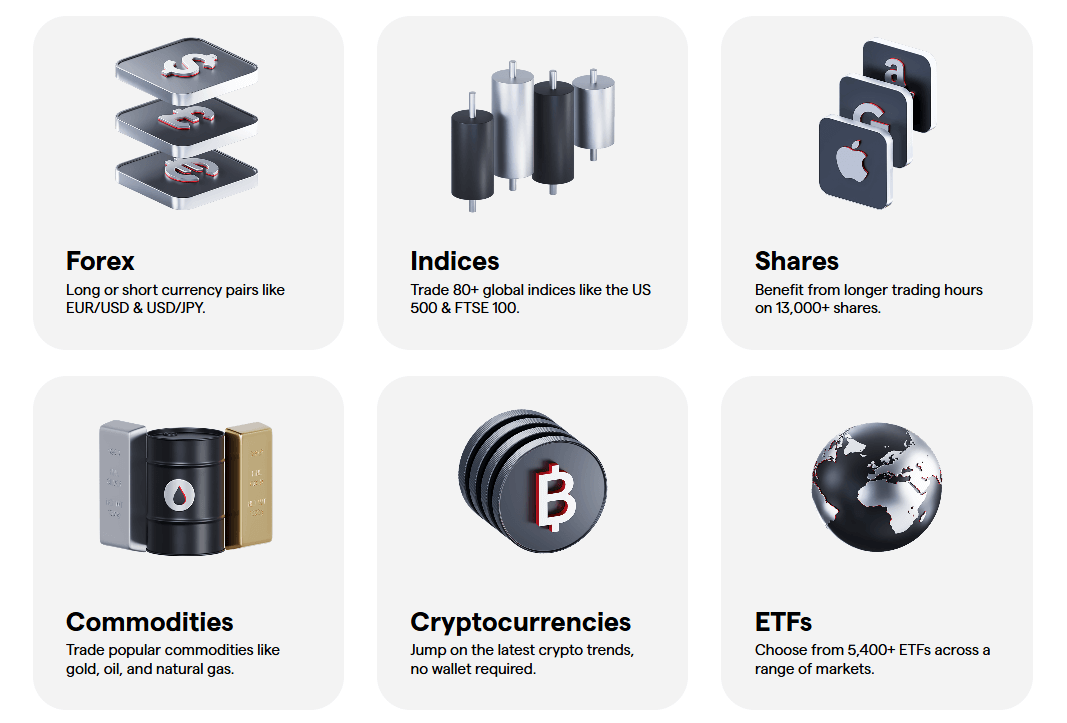

Trading Instruments

IG's extensive market coverage spans over 17,000 instruments, providing traders with unparalleled diversification opportunities across global markets. The broker offers competitive spreads starting from 0.6 pips on major forex pairs and unique features like weekend trading on key indices. This comprehensive asset selection enables traders to implement sophisticated strategies across multiple markets from a single account.

| Asset Class | Number Available | Key Features |

|---|---|---|

| Forex | 80+ currency pairs | EUR/USD from 0.6 pips |

| Indices | 80+ global indices | Weekend trading available |

| Stocks | 13,000+ shares | US, UK, Germany markets |

| Commodities | 30+ markets | Gold, oil, agricultural |

| Cryptocurrencies | 8 major cryptocurrencies | N/A |

| Options | Vanilla & Barriers | Advanced strategies |

| ETFs | 100+ funds | Diversified exposure |

| Bonds | Government & Corporate | Fixed income trading |

| Interest Rates | Major economies | Macro trading |

| Digital 100s | Binary options | Simple up/down trades |

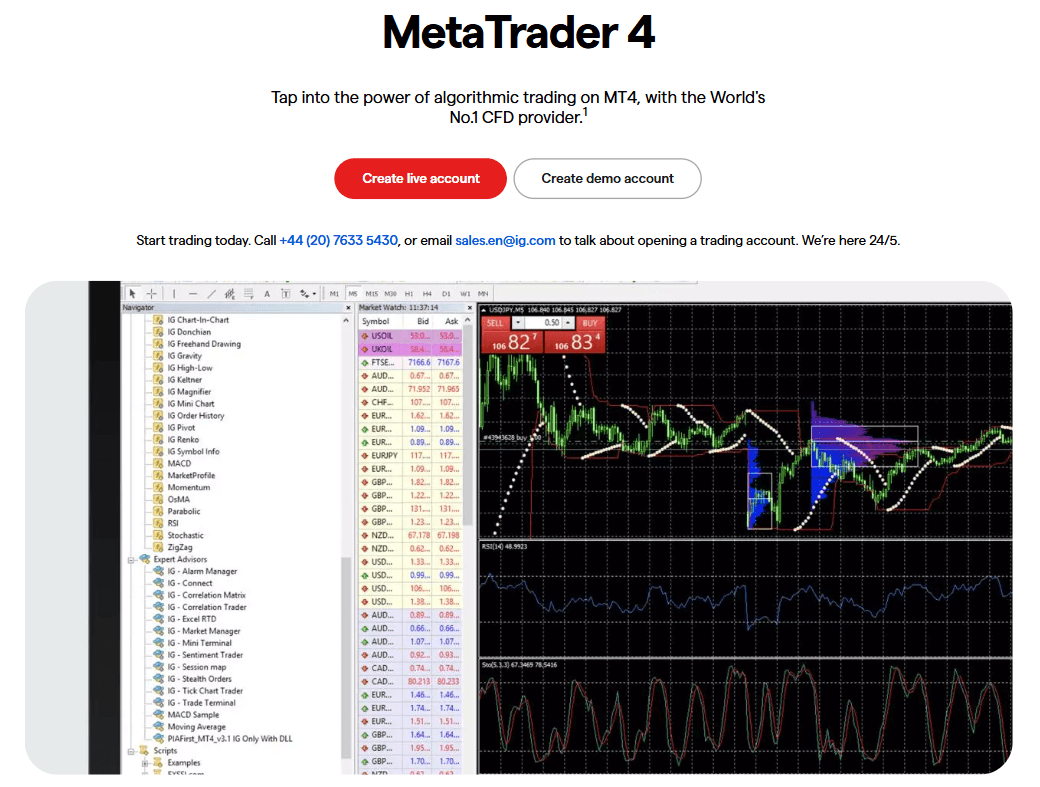

Trading Platforms

IG's multi-platform ecosystem caters to diverse trading styles, from beginners using the intuitive web interface to professionals leveraging L2 Dealer for direct market access. The integration of industry-standard MT4 alongside proprietary solutions ensures traders can choose their preferred environment. Each platform maintains institutional-grade stability while offering unique features tailored to specific trading approaches.

| Platform | Best For | Charting Tools | Automated Trading | Technical Indicators | DMA | Platform Fees |

|---|---|---|---|---|---|---|

| IG Web Platform | All Traders | Advanced | No | 30+ | No | None |

| IG Mobile Apps | Mobile Trading | Advanced | No | 30+ | No | None |

| MetaTrader 4 | Algo Traders | Advanced | Yes (EAs) | 50+ with add-ons | No | None |

| ProRealTime | Chartists | Expert | Yes | 100+ | No | Free if 4+ trades/month |

| L2 Dealer | DMA Pros | Basic | No | Limited | Yes | None (£1000 deposit) |

| TradingView | Social Trading | Advanced | No | 50+ | No | None |

IG offers ProRealTime, an advanced charting and trading platform developed by IT‑Finance, integrated within IG’s infrastructure. It is available as an optional add-on for both live and demo accounts through IG.

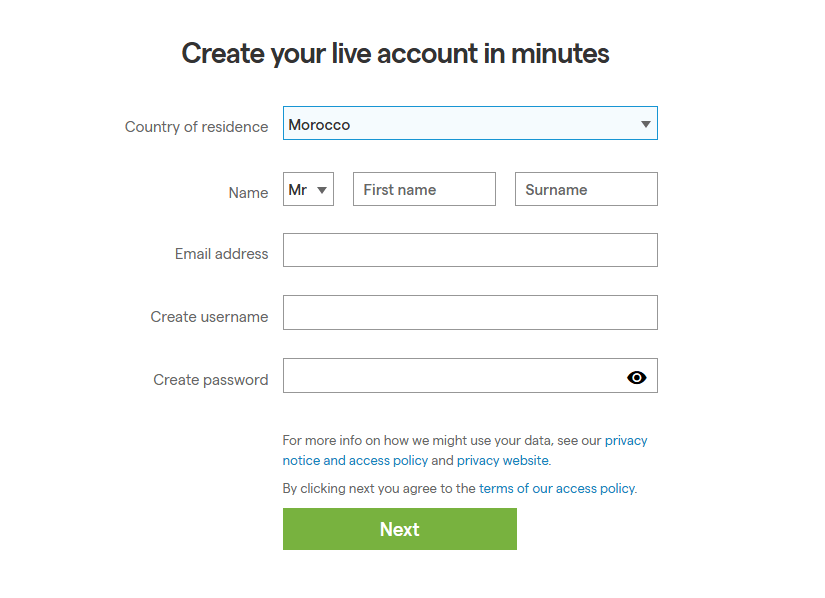

IG How to Open an Account: A Step-by-Step Guide

IG's digital onboarding process typically completes within hours, with automated verification systems expediting approval for most applicants. The platform's suitability assessment ensures traders understand the risks involved while maintaining regulatory compliance. Document upload is streamlined through secure portals, and multiple funding options enable immediate trading once verification completes.

- Visit the IG website and click "Create live account"

- Complete the personal details form (name, address, DOB)

- Answer the financial knowledge questionnaire

- Select base currency and preferred platform

- Accept terms and conditions

- Upload ID and proof of address documents

- Fund account via chosen payment method

Requirements:

- Minimum age: 18 years

- Valid government ID

- Proof of address (utility bill/bank statement)

- Minimum deposit: £/$250

Charts and Analysis

IG Academy represents a significant investment in trader education, offering structured learning paths from beginner fundamentals to advanced strategies. The integration of Reuters news feeds directly into trading platforms ensures real-time market awareness, while Autochartist pattern recognition provides automated technical analysis. These resources combine to create a comprehensive analytical ecosystem supporting informed trading decisions.

| Resource Type | Description | Availability |

|---|---|---|

| Charting Tools | 30+ technical indicators, multiple chart types | All platforms |

| IG Academy | Interactive courses, videos, quizzes | Free access |

| Live Webinars | Expert-led trading sessions | Weekly schedule |

| Reuters News | Real-time market news feed | Integrated platform |

| Market Analysis | Daily reports from in-house experts | Free access |

| Economic Calendar | Track market-moving events | All platforms |

| Trading Signals | Autochartist pattern recognition | Free integration |

| Strategy Guides | Written tutorials and articles | Online library |

| Platform Videos | Step-by-step tutorials | YouTube/Website |

| PIA First | Third-party analysis tool | Premium feature |

IG Account Types

IG's streamlined account structure eliminates confusion while providing specialised options for different trader profiles. Retail accounts receive full regulatory protections including negative balance protection, while professional accounts offer enhanced leverage for qualified traders. The share dealing option caters to long-term investors seeking direct stock ownership rather than CFD exposure.

| Feature | Retail Account | Professional Account | Share Dealing | Demo Account |

|---|---|---|---|---|

| Target Audience | All traders | Experienced traders | Stock investors | Practice trading |

| Minimum Deposit | £/$250 | £/$250 | £/$250 | None |

| Leverage | Up to 1:30 | Up to 1:200+ | None | Variable |

| Negative Balance Protection | Yes | No | N/A | N/A |

| Markets Available | 17,000+ | 17,000+ | Stocks only | 17,000+ |

| Platform Access | All standard | All including L2 | Web/Mobile | All standard |

| Eligibility | Standard check | 2 of 3 criteria | Regional | Anyone |

Negative Balance Protection

Negative balance protection ensures retail traders cannot lose more than their deposits, even during extreme volatility. IG automatically resets retail accounts to zero if losses exceed equity, in line with FCA and EU regulations. This safeguard applies across all instruments and market conditions. Professional traders, however, must waive this protection to access higher leverage, assuming full liability. Overall, it acts as free insurance against catastrophic losses, making it a vital risk management feature for retail clients.

IG Deposits and Withdrawals

IG's payment infrastructure prioritises security and efficiency, with most deposits processed instantly and withdrawals typically completed within one business day. The broker absorbs standard processing costs, though credit card deposits incur minimal fees. Anti-money laundering protocols require funds to return to their original source, ensuring regulatory compliance while protecting client accounts.

| Method | Deposit Fee | Withdrawal Fee | Processing Time |

|---|---|---|---|

| Debit Card (Visa/Mastercard) | None | None | Instant |

| Credit Card (Visa) | 1% | None | Instant |

| Credit Card (Mastercard) | 0.5% | None | Instant |

| PayPal | None | None | Instant |

| Bank Transfer | None | None | 1-3 days |

Support Service for Customer

IG's support infrastructure operates nearly round-the-clock from Saturday morning through Friday evening, accommodating global trading hours across time zones. The multilingual team demonstrates deep product knowledge, resolving complex queries efficiently through multiple channels. Response times consistently meet industry benchmarks, with phone support providing immediate assistance for urgent trading matters.

| Support Channel | Availability (UK/International) | Availability (US) | Other Regions | Notes |

|---|---|---|---|---|

| Live Chat | 8 am Sat – 10 pm Fri (GMT) | 3 am Sat – 5 pm Fri (EST) | — | Nearly 24/7, closed briefly over weekends. |

| Phone Support | 24/5 (same hours as live chat, UK) | 24/5 (3 am Sat – 5 pm Fri EST) | — | Available during market hours. |

| Email Support | Yes (region-specific addresses) | Yes | Yes | Available in all regions. |

| Available via UK help portal | — | — | Region-limited. | |

| Social Media | Twitter: @IGClientHelp | — | — | Used for client queries and updates. |

| Account Opening Support | 9 am – 5 pm (Mon–Fri, UK) | — | — | Dedicated office hours. |

| Switzerland Support | — | — | 9 am – 6 pm (Mon–Fri, English only) | More limited hours compared to UK/US. |

Prohibited Countries

IG Group adheres to strict regulatory requirements and legal obligations in the countries where it operates. Therefore, IG cannot provide its services or accept clients in certain jurisdictions. These restrictions are based on factors such as local regulations, licensing requirements, and geopolitical considerations.

The following countries and regions prohibit IG from offering its services:

- United States (except for IG US LLC, which offers limited services to US clients)

- Canada

- North Korea

- Iran

- Cuba

- Syria

- Sudan

- Crimea

- Nigeria

- Brazil

Special Offers for Customers

Rather than temporary promotional bonuses often restricted by regulators, IG focuses on sustainable value-added programs rewarding client loyalty and trading activity. The IG Club provides tangible benefits for high-volume traders through reduced spreads and dedicated support. Free ProRealTime access for active traders represents significant value, as this professional charting package typically carries substantial subscription fees.

- Refer a Friend Program - Monetary bonus for successful referrals (region-specific)

- IG Club - Exclusive benefits for high-volume traders including reduced spreads

- Free ProRealTime - Complimentary access for traders placing 4+ trades monthly

- MT4 Add-ons - 18 free custom indicators and tools

- Educational Resources - Free access to IG Academy and analysis tools

Note: Availability may vary by region and require confirmation in the official T&Cs.

Conclusion

As I conclude, IG Group stands out as a broker that has consistently earned its place at the top of the industry.

With over 50 years of experience, they have built a reputation for stability and trust in global markets.

Their regulatory framework is unmatched, spanning 11 top-tier authorities, while their FTSE 250 listing adds further credibility.

IG’s vast offering of 17,000+ tradable markets ensures traders have access to unparalleled opportunities.

Their technological edge is clear, with five powerful platforms including MT4, ProRealTime, TradingView, and a proprietary system.

This range allows traders of all levels to find tools suited to their style, from beginners to professionals.

Education and research are another strength, with IG Academy and Reuters news delivering institutional-grade resources.

Although the absence of MT5 and the inactivity fee may be seen as weaknesses, they remain relatively minor.

IG’s transparent approach and commitment to client security set them apart from many competitors.

Ultimately, they represent the gold standard of regulated brokers, combining reliability, innovation, and trader-focused services.