Interactive Brokers Review 2025: Pros and Cons, Trading Tools and Regulations Covered

Interactive Brokers

United States

United States

-

Minimum Deposit $0.01

-

Withdrawal Fee $varies

-

Leverage 1:30

-

Spread From 0.1

-

Minimum Order 0.01

-

Forex Available

-

Crypto Available

-

Stock Available

-

Indices Unavailable

Licenses

United Kingdom Market Making (MM)

United Kingdom Market Making (MM)

Japan Forex Trading License

Japan Forex Trading License

Hong Kong Securities and Futures License

Hong Kong Securities and Futures License

Australia Retail Forex License

Australia Retail Forex License

US Commodity Trading License

US Commodity Trading License

Singapore Financial Services License

Singapore Financial Services License

US Securities License

US Securities License

IIROC Investment Dealer

IIROC Investment Dealer

Softwares & Platforms

Customer Support

+18774422757

(English)

+18774422757

(English)

Supported language: Chinese (Simplified), English, French, German, Italian, Japanese, Russian, Spanish

Social Media

Summary

Interactive Brokers is a leading global brokerage offering low-cost trading, access to 160+ markets in 36 countries, and a wide range of assets including stocks, options, futures, forex, bonds, and cryptocurrencies. Serving both retail and institutional clients, it is favored by active and professional traders for its competitive pricing, advanced platforms, and robust research tools, while also providing educational resources to help new traders navigate its complex interface.

- Extensive global market access (160+ markets)

- Competitive margin rates for Pro accounts

- Direct market routing ensures best execution

- Strong regulatory oversight globally

- Advanced trading platforms and APIs

- $30M excess SIPC coverage

- 11 cryptocurrencies available

- Fractional shares trading

- 43,000+ mutual funds

- Professional-grade research tools

- Steep learning curve for the TWS platform

- IBKR Lite has limited features

- Withdrawal fees after the first month free

- Recent regulatory fine ($11.83M)

- Complex fee structure for Pro accounts

- Limited cryptocurrency selection vs crypto exchanges

- No 24/7 customer support

- Margin account requires a $2,000 minimum

- Inactivity fees for small accounts

- Not available in all countries

Overview

Interactive Brokers (IBKR), founded in 1977 by electronic trading pioneer Thomas Peterffy, stands as one of the most established online brokers globally. With access to 160+ markets across 36 countries and managing $685.8B in client equity across 3.87M accounts , IBKR offers comprehensive trading solutions for both retail and institutional investors. The broker operates under strict regulatory oversight from tier-1 authorities worldwide, including the SEC, FINRA, and FCA, ensuring robust investor protection and compliance standards.

Overview Table

| Feature | Details |

|---|---|

| Founded | 1977 |

| Headquarters | One Pickwick Plaza, Greenwich, Connecticut, USA |

| Regulation | SEC, FINRA, CFTC, FCA, ASIC, MAS, CIRO, SFC, JFSA |

| Account Types | Individual, Joint, Trust, IRA, UGMA/UTMA, Institutional |

| Minimum Deposit | $0 (cash accounts); $2,000 (margin accounts) |

| Commissions | $0 IBKR Lite; Tiered/Fixed pricing IBKR Pro |

| Trading Platforms | TWS, IBKR Desktop, GlobalTrader, Mobile, WebTrader |

| Market Access | 160+ markets, 36 countries |

| Client Assets | $685.8 billion |

| Customer Support | 24/5 phone, email, live chat, AI-powered IBot |

Facts List

- Largest broker by Daily Average Revenue Trades - processes millions of trades daily

- $685.8 billion in client equity with 3.87M accounts globally

- 11 cryptocurrencies available, including BTC, ETH, and SOL through regulated custodians

- SIPC coverage up to $500,000 plus excess coverage to $30 million via Lloyd's

- Recognised by Investopedia 2025 as Best for Advanced Options Traders

- Direct market routing ensures best execution through transparent order handling

- 43,000+ mutual funds with 19,000+ commission-free options

- Fractional shares available for stock and ETF trading

- Considering proprietary stablecoin launch for 24/7 funding capabilities

- Recent $11.83M OFAC settlement (July 2025) for sanctions violations

Interactive Brokers Licenses and Regulatory

Interactive Brokers maintains one of the industry's most comprehensive regulatory frameworks, operating under supervision from multiple tier-1 authorities globally. This extensive oversight provides clients with confidence in the broker's financial stability and operational integrity. U.S. clients benefit from SIPC protection up to $500,000, with additional excess SIPC coverage extending to $30 million through Lloyd's of London.

Regulatory Licenses

- United States: SEC, FINRA, CFTC

- United Kingdom: Financial Conduct Authority (FCA)

- European Union: Central Bank of Ireland, CSSF Luxembourg

- Asia-Pacific: ASIC (Australia), MAS (Singapore), SFC (Hong Kong), JFSA (Japan), SEBI (India)

- Canada: Canadian Investment Regulatory Organisation (CIRO)

Trading Instruments

IBKR provides access to one of the industry's widest ranges of tradable instruments, spanning traditional securities to emerging digital assets. The platform supports everything from basic stock trading to complex derivatives strategies, with over 1 million bonds available and 43,000+ mutual funds from 600+ fund families.

| Asset Class | Volume | Key Features |

|---|---|---|

| Stocks & ETFs | 135+ exchanges | 2,300+ ETFs, fractional shares |

| Options | 100+ markets | Advanced analytics tools |

| Futures | 30+ markets | Professional-grade execution |

| Forex | 24+ pairs | Competitive spreads |

| Bonds | 1M+ bonds | Corporate, municipal, treasury |

| Mutual Funds | 43,000+ funds | 19,000+ commission-free |

| Cryptocurrencies | 11 coins | BTC, ETH, SOL, ADA, XRP, DOGE |

| Precious Metals | Spot trading | Gold and silver |

Trading Platforms

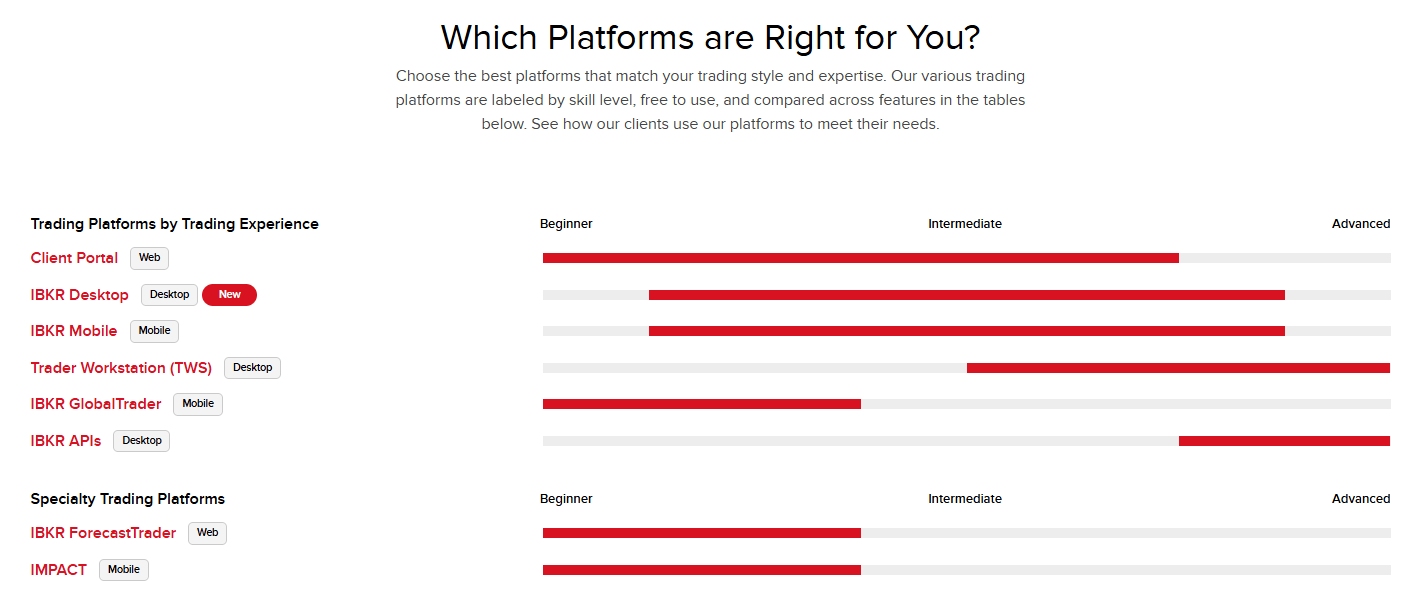

Interactive Brokers offers multiple platform options to accommodate different trader profiles, from the professional-grade Trader Workstation to the simplified GlobalTrader app. Each platform provides specific advantages, with TWS remaining the flagship for serious traders requiring advanced functionality, while newer offerings like IBKR Desktop balance sophistication with usability.

| Platform | Type | Best For | Key Features |

|---|---|---|---|

| TWS | Desktop | Professional traders | Advanced charting, algos, multi-asset |

| IBKR Desktop | Desktop | Active traders | Modern interface, streamlined tools |

| GlobalTrader | Mobile | Beginners | Simple interface, stocks/crypto focus |

| IBKR Mobile | Mobile | All traders | Full functionality, real-time data |

| WebTrader | Browser | Quick access | No download required |

| APIs | Programming | Algo traders | TWS API, FIX protocol support |

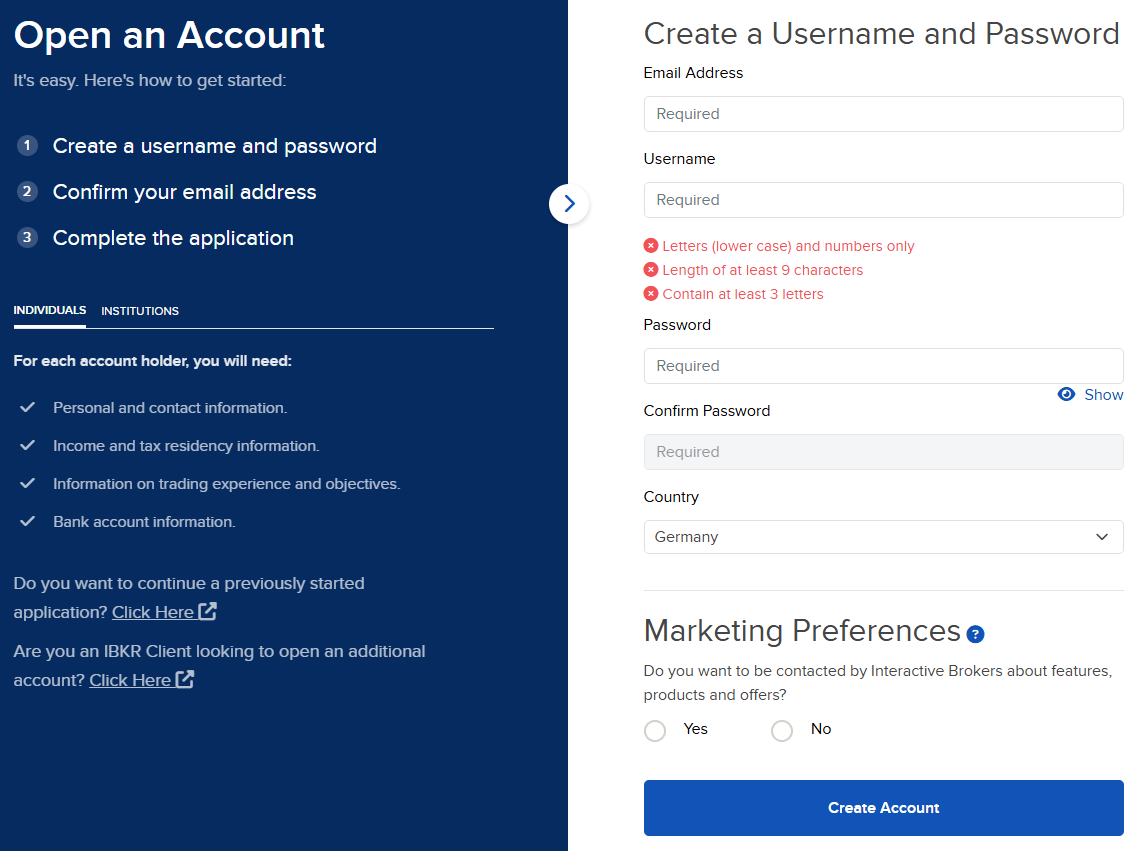

Interactive Brokers How to Open an Account: A Step-by-Step Guide

Opening an account with Interactive Brokers follows a streamlined online process that typically completes within 1-2 business days. The platform requires standard KYC documentation and offers multiple funding methods to accommodate different preferences.

How to Open an Account

- Visit the Interactive Brokers website and click "Open Account".

- Choose account type (Individual, Joint, IRA, etc.).

- Complete the online application (10-15 minutes).

- Submit identity verification documents.

- Fund the account via ACH, wire, or check deposit.

- Wait for approval (typically 1-2 business days).

- Download the preferred trading platform.

- Begin trading.

Charts and Analysis

IBKR provides extensive educational resources through Trader's Academy and IBKR Campus, complemented by professional-grade research from third-party providers including Morningstar and Reuters. The platform's analytical tools support both fundamental and technical analysis across all asset classes.

| Resource Type | Available Tools |

|---|---|

| Charting | TradingView integration, 120+ indicators |

| Research | Third-party reports from Morningstar, Reuters |

| Education | Trader's Academy, IBKR Campus |

| Market Data | Real-time quotes, Level II data |

| News | Reuters, Dow Jones, Bloomberg feeds |

| Webinars | Daily live sessions, recorded library |

| Analysis | Options Analytics, Portfolio Analyst |

| Economic Calendar | Global event tracking |

Interactive Brokers Account Types

IBKR's dual account structure (Pro and Lite) allows traders to choose between commission-free trading with some limitations or full-featured access with competitive pricing. The Pro account's tiered pricing can significantly benefit high-volume traders, while Lite serves casual investors seeking simple stock and ETF trading without fees.

| Account Type | Minimum | Commission | Features | Best For |

|---|---|---|---|---|

| IBKR Pro | $0 | Tiered/Fixed | Full features, API access | Active traders |

| IBKR Lite | $0 | $0 US stocks | Limited features | Casual investors |

| Margin | $2,000 | Variable | Leverage trading | Experienced traders |

| IRA | $0 | Per Pro/Lite | Tax advantages | Retirement savings |

| Institutional | $10,000 | Negotiable | Prime services | Hedge funds, RIAs |

Negative Balance Protection

EU retail clients trading CFDs receive ESMA-mandated Negative Balance Protection, ensuring they cannot lose more than their deposited funds. However, U.S. margin accounts do not have full negative balance protection and traders can potentially lose more than their initial investment during extreme market conditions. IBKR implements risk management tools including real-time margin monitoring and automatic liquidation to minimise this risk.

Interactive Brokers Deposits and Withdrawals

Interactive Brokers offers flexible deposit and withdrawal options with competitive pricing. The first withdrawal each month is free, with subsequent transactions incurring modest fees. Processing times vary by method, with wire transfers providing same-day availability for urgent needs.

Deposits & Withdrawals

| Method | Deposit Fee | Withdrawal Fee | Processing Time |

|---|---|---|---|

| ACH | Free | $1 (after 1st free month) | 1-2 days |

| Wire (Domestic) | Free | $10 | Same day |

| Wire (International) | Free | $25+ | 1-3 days |

| Check | Free | $5 | 3-5 days |

| Online Bill Pay | Free | N/A | 2-4 days |

| ACATS Transfer | Free | N/A | 5-7 days |

Support Service for Customer

Customer support operates 24/5 with multilingual assistance available through multiple channels. The AI-powered IBot provides instant responses to common queries, while human representatives handle complex issues through phone, chat, and email support.

| Channel | Availability | Languages | Response Time |

|---|---|---|---|

| Phone | 24/5 | 14 languages | Immediate |

| Live Chat | 24/5 | English, Chinese | 1-2 minutes |

| 24/7 | Multiple | 24 hours | |

| IBot (AI) | 24/7 | English | Instant |

| Help Center | 24/7 | Multiple | Self-service |

Prohibited Countries

Interactive Brokers cannot provide services to residents or citizens of certain countries due to regulatory restrictions, sanctions, or compliance requirements. Service availability depends on local regulations and international sanctions.

Countries Where IBKR Services Are NOT Available:

Sanctioned Countries:

- Iran

- North Korea

- Syria

- Cuba

- Crimea region (Ukraine)

- Russia (restricted as of 2022)

- Belarus (restricted)

African Countries with Restrictions:

- Sudan

- South Sudan

- Somalia

- Libya

- Central African Republic

- Democratic Republic of Congo

- Eritrea

- Burundi

- Zimbabwe

Other Restricted Regions:

- Afghanistan

- Myanmar (Burma)

- Yemen

- Iraq (limited access)

- Venezuela (restricted)

Partially Restricted:

- Pakistan (limited services)

- Nigeria (limited services)

- Ghana (limited services)

- Ukraine (limited due to conflict)

Special Offers for Customers

- IBKR Pro margin rates starting at 5.83% (USD)

- Free withdrawal once per calendar month

- Commission-free US stock/ETF trading (IBKR Lite)

- $0 account minimum for cash accounts

- Free market data for active traders

Conclusion

Interactive Brokers remains a top-tier broker for serious traders in 2025, offering unmatched global market access and professional-grade tools. The platform excels with competitive margin rates, comprehensive asset coverage, and strong regulatory compliance across multiple jurisdictions. While the learning curve for TWS can challenge beginners, the addition of user-friendly alternatives like GlobalTrader and IBKR Desktop addresses this concern.

The broker's commitment to transparent execution through direct market routing, combined with extensive educational resources through Trader's Academy, positions IBKR as ideal for traders prioritising transparency and education. Recent expansion into cryptocurrencies and consideration of a proprietary stablecoin demonstrate forward-thinking innovation.