Inveslo Review: A Comprehensive Look at This Forex Broker

Inveslo

-

Minimum Deposit $30

-

Withdrawal Fee $varies

-

Leverage 2000:1

-

Spread From 0.1

-

Minimum Order 0.01

-

Forex Available

-

Crypto Available

-

Stock Unavailable

-

Indices Available

Licenses

Softwares & Platforms

Customer Support

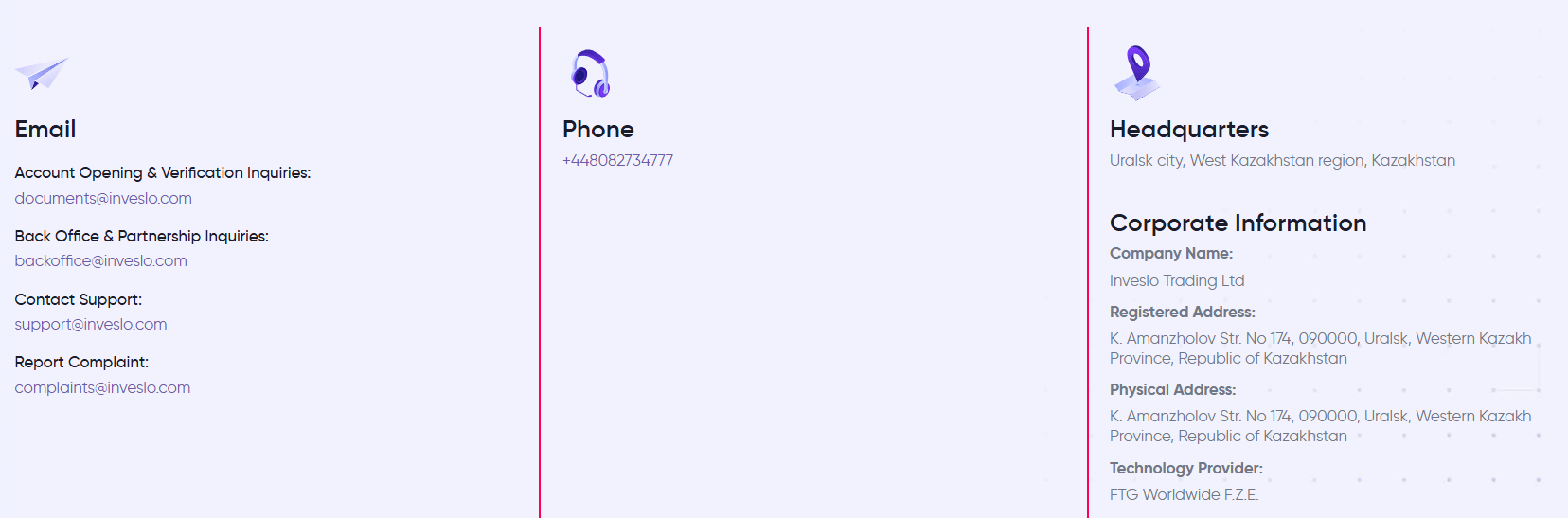

+448082734777

(English)

+448082734777

(English)

Supported language: English, Arabic

Social Media

Summary

Inveslo is a Kazakhstan-based forex and CFD broker offering a wide range of instruments, high leverage, and commission-free trading with low entry costs. It stands out for its 24/7 customer support and solid educational content for beginners. However, its limited regulation under AFSA, lack of desktop/mobile platforms, and relatively short track record may raise concerns for some traders. The web-only MT4 platform and absence of advanced tools also limit flexibility. Overall, Inveslo suits cost-conscious beginners but may fall short for experienced or security-focused traders.

- Wide range of tradable instruments

- Competitive spreads starting from 0.1 pips

- High leverage up to 1:2000

- Low minimum deposit of $30

- No fees for deposits and withdrawals

- 24/7 customer support via live chat, email, and phone

- Extensive educational resources, including webinars and guides

- User-friendly MetaTrader 4 (MT4) web platform

- Multiple account types catering to different trading styles

- Supports various payment methods for convenience

- Regulated only by the AFSA in Kazakhstan, lacking top-tier oversight

- Limited track record, established only in 2020

- No desktop or mobile trading platforms, only web-based MT4

- Educational resources could be more advanced and interactive

- Customer support available only in English and Arabic

- No special promotions or bonuses at the time of the review

- Restricted services in several regions, including Africa, Asia, Europe, and North America

- Potential concerns about the broker's credibility and reputation due to its relatively new status

- Variable spreads that may widen during high volatility or low liquidity periods

- Lack of additional trading tools and features compared to some competitors

Overview

Inveslo is an online forex and CFD broker that began its operations in 2020, with its headquarters located in Kazakhstan. Despite being a relatively new player in the industry, Inveslo has managed to attract traders' attention by offering a wide range of tradable instruments, competitive trading conditions, and a user-friendly platform.

As a global broker, Inveslo aims to cater to the needs of both novice and experienced traders by providing multiple account types, educational resources, and advanced trading tools. However, as with any financial service provider, it is essential to conduct a thorough review before committing funds.

In this comprehensive Inveslo review, we will delve into the various aspects of the broker's offerings, including its regulatory status, account types, trading platforms, fees, and customer support. By weighing the pros and cons, we aim to provide an unbiased assessment to help potential clients make an informed decision.

For more details, visit Inveslo's official website at [inveslo.com].

Overview Table

| Aspect | Information |

|---|---|

| Headquarters | Kazakhstan |

| Established | 2020 |

| Regulator | Astana Financial Services Authority (AFSA) |

| Minimum Deposit | $30 |

| Maximum Leverage | 1:2000 |

| Instruments | 300+ (Forex, Metals, Energies, Indices, Cryptos) |

| Platforms | MetaTrader 4 (MT4) WebTrader |

| Account Types | Standard STP, ECN Commission-Free, ECN, Premium |

| Customer Support | 24/7 via Live Chat, Email, Phone |

Facts List

- Inveslo is a relatively new forex and CFD broker, established in 2020.

- The company is headquartered in Kazakhstan and regulated by the Astana Financial Services Authority (AFSA).

- Inveslo offers a diverse range of over 300 tradable instruments, including forex pairs, metals, energies, indices, and cryptocurrencies.

- The broker provides high leverage of up to 1:2000, allowing traders to amplify their potential profits (and losses).

- Inveslo offers four main account types: Standard STP, ECN Commission-Free, ECN, and Premium, catering to different trading styles and preferences.

- The minimum deposit required to open an account with Inveslo is $30, making it accessible to a wide range of traders.

- The broker utilises the popular MetaTrader 4 (MT4) platform, albeit only as a web-based version.

- Inveslo provides competitive spreads starting from 0.1 pips, with the actual spread depending on the account type and instrument.

- The company offers 24/7 customer support through live chat, email, and phone, ensuring assistance is available whenever needed.

- Inveslo provides a range of educational resources, including webinars, guides, and video tutorials, to help traders improve their skills and knowledge.

Inveslo Licenses and Regulatory

Inveslo is regulated by the Astana Financial Services Authority (AFSA) in Kazakhstan. The company operates under the business name Inveslo Trading Ltd and holds a license from the AFSA with the number 210540039066.

While having a license from a local regulator is a positive sign, it is essential to note that the AFSA is not considered a top-tier regulatory authority. Kazakhstan's financial market is not as stringently regulated as those in more established jurisdictions like the United Kingdom, Australia, or the European Union.

The lack of oversight from well-respected regulatory bodies such as the Financial Conduct Authority (FCA), the Australian Securities and Investments Commission (ASIC), or the Cyprus Securities and Exchange Commission (CySEC) may raise concerns about the broker's credibility and its ability to protect clients' interests.

Potential customers should exercise caution and thoroughly assess their risk tolerance before opening an account with Inveslo. It is always recommended to choose a broker regulated by reputable authorities to ensure a higher level of security and transparency.

Trading Instruments

Inveslo offers a wide range of tradable instruments, providing traders with ample opportunities to diversify their portfolios and take advantage of various market conditions.

| Asset Class | Description |

|---|---|

| Forex | Trade a wide selection of major, minor, and exotic currency pairs, with competitive spreads and high leverage. |

| Metals | Access popular precious metals markets, such as gold and silver, to hedge against market volatility or speculate on price movements. |

| Energies | Trade energy commodities like oil and natural gas, taking advantage of the dynamic nature of these markets. |

| Indices | Speculate on the performance of global stock indices, such as the S&P 500, FTSE 100, and DAX 30, without the need to own individual stocks. |

| Cryptocurrencies | Trade leading cryptocurrencies like Bitcoin, Ethereum, and Litecoin, capitalizing on the growing popularity of digital assets. |

Trading Platforms

Inveslo provides access to the widely-used MetaTrader 4 (MT4) platform, which is known for its user-friendly interface, advanced charting tools, and extensive customization options. However, it is important to note that the broker only offers the web-based version of MT4, which may limit some of the platform's functionality compared to the downloadable desktop version.

The MT4 WebTrader allows traders to access their accounts and trade directly through a web browser without the need to install additional software. This can be convenient for traders who prefer a more lightweight and accessible trading experience.

While the MT4 WebTrader offers a solid foundation for trading, the lack of support for the desktop version, as well as the absence of mobile trading apps, may be a drawback for some traders who require more advanced features or the flexibility to trade on-the-go.

Trading Platforms Comparison Table

| Feature | MT4 WebTrader |

|---|---|

| Charting Tools | Yes |

| Technical Indicators | 30+ |

| Timeframes | 9 |

| Automated Trading | Yes |

| Mobile App | No |

| Desktop Platform | No |

Inveslo How to Open an Account: A Step-by-Step Guide

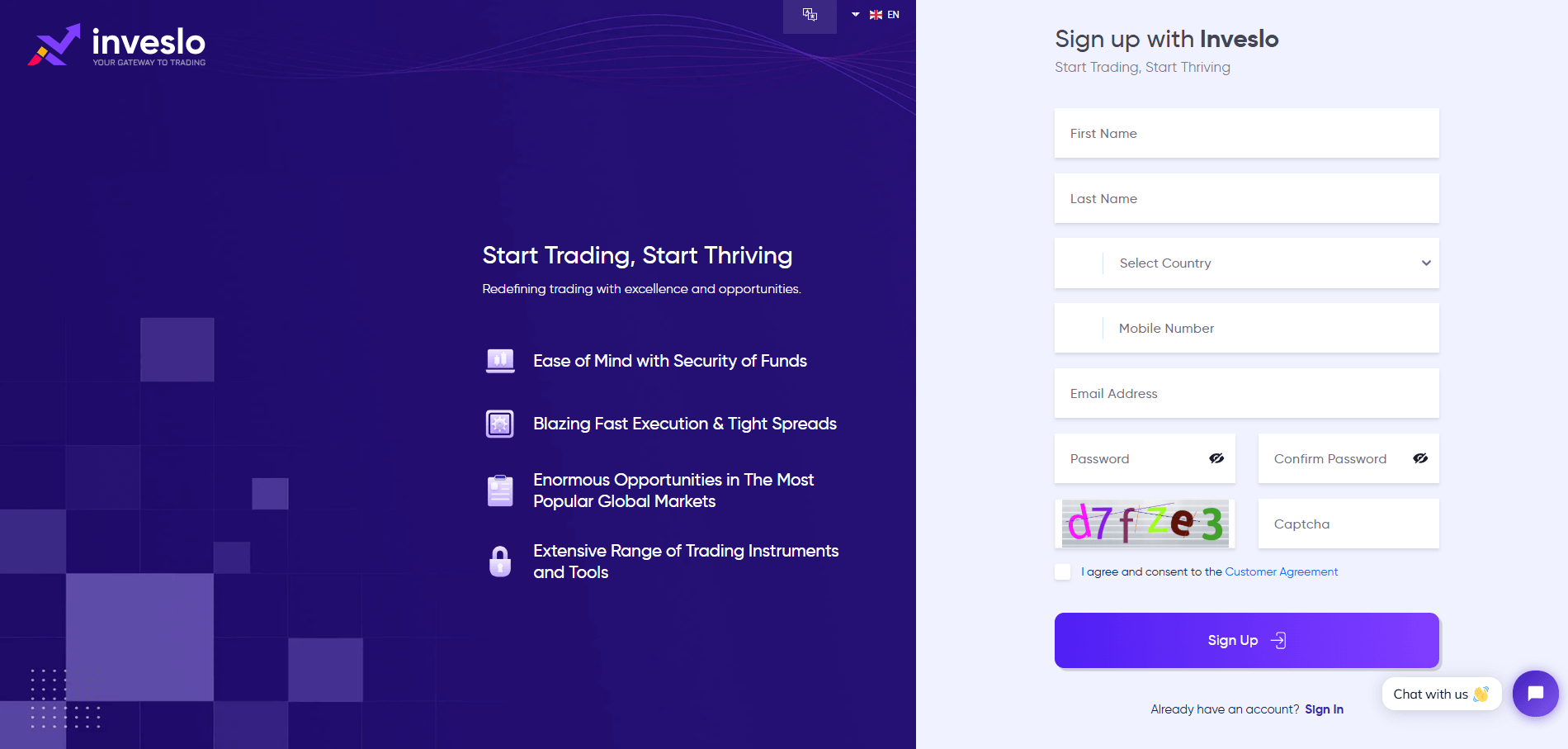

To open an account with Inveslo, follow these step-by-step instructions:

Step 1: Visit the official Inveslo website

- Open your web browser and go to the official Inveslo website at [inveslo.com].

Step 2: Click on the "Open an Account" button

- On the homepage, locate and click on the "Open an Account" or "Sign Up" button, usually found in the top right corner of the website.

Step 3: Fill in the registration form

- You will be redirected to the account registration form.

- Provide your personal information, including your full name, email address, phone number, country of residence, and date of birth.

- Create a strong password for your account.

- Choose your preferred account base currency (USD or EUR).

- Select the account type you wish to open (Standard STP, ECN-Commission Free, ECN, or Premium).

Step 4: Accept the terms and conditions

- Read through Inveslo's terms and conditions, client agreement, and privacy policy.

- Check the box to confirm that you have read and agreed to these documents.

Step 5: Submit your registration

- After completing the form and agreeing to the terms and conditions, click on the "Submit" or "Register" button to proceed.

Step 6: Verify your email address

- Upon successful registration, Inveslo will send a verification email to the email address you provided.

- Open your email inbox and look for the email from Inveslo.

- Click on the verification link within the email to confirm your email address.

Step 7: Complete your profile and submit documentation

- Once your email is verified, log in to your newly created Inveslo account.

- Complete your trading profile by providing additional information, such as your address, occupation, and trading experience.

- Upload the required verification documents, which typically include a valid government-issued ID (passport or national ID card) and a proof of residence (utility bill or bank statement).

Step 8: Fund your account

- After your account is verified, navigate to the deposit section of your Inveslo account.

- Choose your preferred deposit method from the available options (credit/debit card, bank transfer, e-wallets, or cryptocurrencies).

- Follow the instructions provided to complete the deposit process and transfer funds into your trading account.

Step 9: Start trading

- Once your account is funded, you can access the Inveslo MetaTrader 4 (MT4) web platform.

- Log in to the platform using your account credentials.

- Familiarize yourself with the platform's features and tools.

- Begin trading your preferred instruments using the available market analysis and risk management tools.

Charts and Analysis

Inveslo provides a range of educational resources to help traders improve their knowledge and skills, regardless of their experience level.

| Resource Type | Description |

|---|---|

| Webinars | Live and recorded sessions covering trading topics and strategies. |

| Guides | Written tutorials on forex basics, trading concepts, and risk management. |

| Video Tutorials | Short videos explaining key trading concepts and platform usage. |

| E-books | Downloadable books covering a variety of forex and trading topics. |

| Trading Strategies | Articles and guides explaining different strategies and how to apply them. |

| Forex Trading Concepts | In-depth explanations of fundamental trading concepts and terminology. |

| How to Protect Your Money | Guides focused on risk management and capital preservation. |

| Planning Trades | Materials on trade planning and strategic execution. |

| Blog | Market news, trading insights, and analysis through regular posts. |

| Glossary | Dictionary of essential trading and financial terms. |

In addition to the written and visual content, Inveslo also provides a range of tools to support traders' decision-making process, such as an economic calendar, technical analysis tools, and market news updates.

While the educational resources offered by Inveslo are extensive, there is still room for improvement in terms of depth and interactivity. The broker could consider adding more advanced materials, live trading sessions, and personalized coaching to further enhance the learning experience for its clients.

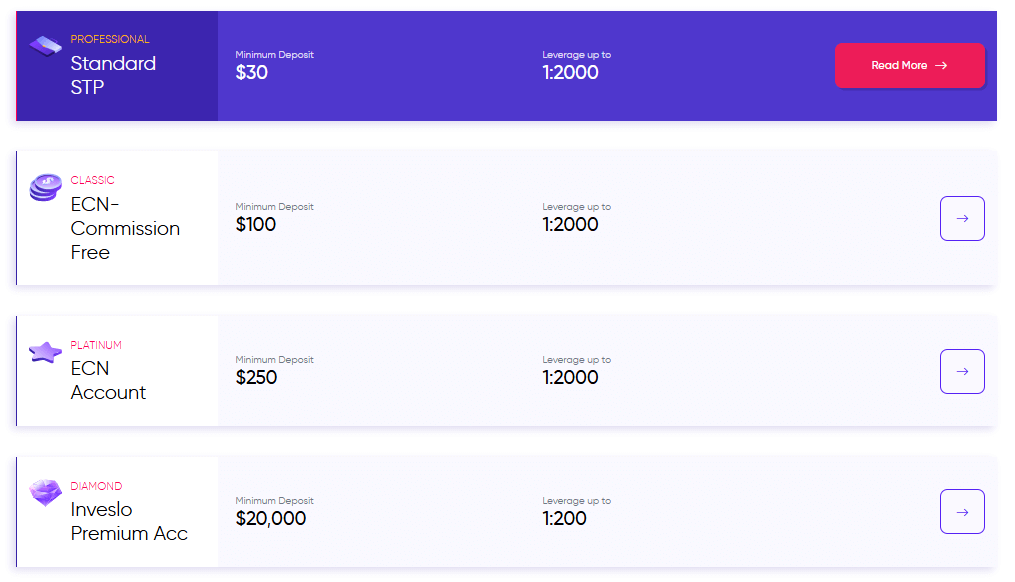

Inveslo Account Types

Inveslo offers a range of account types designed to cater to the needs of different traders, from beginners to experienced professionals.

The main account types include:

Standard STP Account

- Minimum deposit: $30

- Spreads from 2.1 pips

- Commission: No

- Maximum leverage: 1:2000

- Minimum lot size: 0.01

- Account currencies: USD, EUR

ECN-Commission Free Account

- Minimum deposit: $100

- Spreads from 1.9 pips

- Commission: No

- Maximum leverage: 1:2000

- Minimum lot size: 0.01

- Account currencies: USD, EUR

ECN Account

- Minimum deposit: $250

- Spreads from 0.1 pips

- Commission: From $3 per lot

- Maximum leverage: 1:2000

- Minimum lot size: 0.01

- Account currencies: USD, EUR

Premium Account

- Minimum deposit: $20,000

- Spreads from 0.1 pips

- Commission: No

- Maximum leverage: 1:200

- Minimum lot size: 0.01

- Account currencies: USD, EUR

Inveslo also offers a demo account option, allowing traders to practice their strategies and familiarize themselves with the platform using virtual funds before investing real money.

Account Types Comparison Table

| Feature | Standard | ECN-Commission Free | ECN | Premium |

|---|---|---|---|---|

| Minimum Deposit | $30 | $100 | $250 | $20,000 |

| Spreads | From 2.1 pips | From 1.9 pips | From 0.1 pips | From 0.1 pips |

| Commission | No | No | From $3 per lot | No |

| Maximum Leverage | 1:2000 | 1:2000 | 1:2000 | 1:200 |

| Minimum Lot Size | 0.01 | 0.01 | 0.01 | 0.01 |

| Account Currencies | USD, EUR | USD, EUR | USD, EUR | USD, EUR |

Negative Balance Protection

Inveslo does offer negative balance protection to its clients. This means that if a trader's account balance reaches zero due to trading losses, the broker will absorb any additional losses, and the trader will not be required to pay back any negative balance. Here's how negative balance protection works at Inveslo:

- Trader opens a position: A trader opens a leveraged trade on a particular instrument, such as a forex pair or CFD.

- Market moves against the trader: If the market moves in the opposite direction of the trader's position, the trader starts to incur losses.

- Margin call and stop-out: As the losses increase, the trader's account equity (balance + floating profit/loss) approaches the minimum margin requirement. If the equity falls below the minimum margin level (e.g., 50% of the required margin), the broker will initiate a margin call. If the equity continues to fall and reaches the stop-out level (e.g., 20% of the required margin), the broker will automatically close the trader's open positions to prevent further losses.

- Negative balance protection activates: If, after the stop-out, the trader's account balance is negative (i.e., the losses exceed the deposited funds), negative balance protection will kick in. Inveslo will reset the account balance to zero, effectively forgiving the negative balance and ensuring the trader does not owe any money to the broker.

Inveslo Deposits and Withdrawals

Inveslo supports a variety of deposit and withdrawal methods, providing traders with flexibility and convenience when managing their funds.

Deposit Methods

| Method | Processing Time | Fees Charged by Inveslo | Notes |

|---|---|---|---|

| Cryptocurrencies | Instant | None | Subject to blockchain network speed |

| Virtual Pay | Instant | None | Fast and convenient |

| Credit/Debit Cards | Instant | None | Visa and Mastercard supported |

| Bank Transfers | 1–3 business days | None | May incur bank fees |

| Local Bank Transfers | Instant to 24h | None | Depends on local bank operations |

Withdrawal Methods

| Method | Processing Time | Fees Charged by Inveslo | Notes |

|---|---|---|---|

| Cryptocurrencies | Within 24 hours | None | Subject to blockchain confirmation time |

| Virtual Pay | Within 24 hours | None | Efficient and user-friendly |

| Credit/Debit Cards | Within 24 hours | None | Visa and Mastercard supported |

| Bank Transfers | Within 24 hours | None | Bank fees may apply |

| Local Bank Transfers | Within 24 hours | None | Faster in certain regions |

Support Service for Customer

Inveslo offers 24/7 customer support through various channels, ensuring that traders can reach out for assistance whenever needed. The available support options include:

- Live Chat: Accessible directly through the broker's website, providing instant support for general inquiries and technical issues.

- Email: Traders can send their questions or concerns to the relevant email addresses, such as support@inveslo.com for general support or backoffice@inveslo.com for account-related queries.

- Phone: The broker provides a dedicated phone number for customer support, allowing traders to speak directly with a representative.

In addition to the direct support channels, Inveslo also offers an extensive FAQ section on its website, addressing common questions and concerns related to account opening, trading, funding, and more.

The broker's customer support is available in two languages – English and Arabic – which may be a limitation for traders who prefer support in their native language.

In addition to the direct support channels, Inveslo also offers an extensive FAQ section on its website, addressing common questions and concerns related to account opening, trading, funding, and more.

The broker's customer support is available in two languages – English and Arabic – which may be a limitation for traders who prefer support in their native language.

customer support Comparison Table

| Support Channel | Availability | Languages |

|---|---|---|

| Live Chat | 24/7 | English, Arabic |

| 24/7 | English, Arabic | |

| Phone | 24/7 | English, Arabic |

| FAQ | 24/7 | English, Arabic |

Prohibited Countries

Inveslo provides services to a global client base, with a few exceptions.

The broker does not accept clients from the following regions:

- Africa

- Asia

- Europe

- North America

Traders from these regions are advised to seek alternative brokers that are licensed and authorized to operate in their respective countries. It is essential for traders to comply with local laws and regulations when engaging in online trading activities.

Special Offers for Customers

At the time of this review, Inveslo does not appear to offer any special promotions or bonuses for new or existing clients. The broker seems to focus more on providing competitive trading conditions and a solid platform rather than short-term incentives.

Conclusion

After conducting a thorough review of Inveslo, I have found both strengths and weaknesses in their offerings as a forex and CFD broker.

On the positive side, Inveslo provides a diverse range of tradable instruments, competitive spreads, and high leverage, giving traders ample opportunities to potentially profit from various market conditions. The broker's educational resources, including webinars, guides, and video tutorials, can be beneficial for beginners looking to improve their trading knowledge and skills.

Moreover, Inveslo's 24/7 customer support via live chat, email, and phone is a notable advantage, ensuring that traders can receive assistance whenever needed. The broker's low minimum deposit requirement of $30 and the absence of fees for deposits and withdrawals are also attractive features for cost-conscious traders.

However, there are some concerns that potential clients should consider before opening an account with Inveslo. The broker's regulation under the Astana Financial Services Authority (AFSA) in Kazakhstan may not provide the same level of oversight and protection as more reputable regulatory bodies like the FCA, ASIC, or CySEC. This lack of top-tier regulation could be a red flag for some traders prioritizing security and transparency.

Additionally, while Inveslo offers the MetaTrader 4 (MT4) platform, it is only available as a web-based version, which may limit functionality and customization options compared to the downloadable desktop version. The absence of mobile trading apps could also be a drawback for traders who value flexibility and the ability to trade on-the-go.

Another aspect to consider is Inveslo's relatively short track record, having been established only in 2020. While the broker has managed to attract attention, it may not have the same level of trust and reputation as more established brokers in the industry.

Ultimately, the decision to trade with Inveslo depends on individual preferences, risk tolerance, and trading needs. Traders should carefully weigh the pros and cons, conduct further due diligence, and consider their own goals and expectations before making a choice. It is always recommended to start with a small investment and test the broker's services before committing significant funds.

By providing an in-depth analysis of Inveslo's offerings, including its strengths, limitations, and potential concerns, I aim to empower readers with the information needed to make an informed decision about whether this broker aligns with their trading requirements and expectations.

Compare TradingView integrations through the chart-friendly broker reviews map.