IronFX Broker 2025 Review: Pros, Cons, and Features

IronFX

Cyprus

Cyprus

-

Minimum Deposit $100

-

Withdrawal Fee $Varies

-

Leverage 1000:1

-

Minimum Order 0.01

-

Forex Available

-

Crypto Available

-

Stock Unavailable

-

Indices Available

Licenses

Cyprus Market Making (MM)

Cyprus Market Making (MM)

South Africa Retail Forex License

South Africa Retail Forex License

United Kingdom Market Making (MM)

United Kingdom Market Making (MM)

Softwares & Platforms

Customer Support

+35725025000

(English)

+35725025000

(English)

Supported language: Arabic, Chinese (Simplified), English, Russian, Spanish

Social Media

Summary

IronFX, founded in 2010, is a multi-entity CFD broker offering over 300 instruments via the MT4 platform. It operates under regulators like CySEC, FCA, and FSCA, but its main global operations run through an offshore Anguilla entity (formerly Bermuda), offering high leverage (up to 1:1000) with minimal protections. While it provides diverse account types and competitive spreads, it lacks MT5, has outdated educational resources, and mixed reviews—especially concerning withdrawals. Regulatory concerns, including a CySEC settlement and Australian license revocation, make IronFX best suited for experienced traders who understand offshore risk.

- Multiple regulatory licenses including FCA and CySEC

- Wide selection of 300+ tradable instruments

- Competitive spreads starting from 0 pips

- Established broker operating since 2010

- Multiple account types for different needs

- 24/5 multilingual customer support

- Negative balance protection offered

- Popular MT4 platform support

- High leverage available (offshore entity)

- Multiple deposit and withdrawal methods

- Primary operations through offshore Bermuda entity

- Inconsistent marketing claims about client numbers

- No MT5 platform offering

- Educational resources criticised as outdated

- Mixed reviews regarding withdrawal processing

- Recent regulatory settlements and penalties

- Australian operations ceased after legal issues

- Limited cryptocurrency trading options

- High inactivity fees on dormant accounts

- Customer service quality varies significantly

Overview

IronFX, established in 2010, has positioned itself as a global online CFD broker serving traders across multiple continents through its complex multi-entity structure. The broker operates through several regulated entities, including licenses from the Cyprus Securities and Exchange Commission (CySEC), the UK's Financial Conduct Authority (FCA), and South Africa's Financial Sector Conduct Authority (FSCA). However, its primary global operations are conducted through Notesco Limited, a Bermuda-registered entity that offers features like high leverage up to 1:1000 and deposit bonuses not available in stricter regulatory jurisdictions.

The broker claims to serve a client base that varies significantly in reported numbers—from 50,000 to over 1.5 million traders—highlighting concerning inconsistencies in its marketing materials. IronFX provides access to over 300 trading instruments across six major asset classes, utilising the popular MetaTrader 4 platform as its primary trading interface. While the broker has received some industry recognition over its 14-year history, it also carries a complex regulatory past, including a recent €100,000 settlement with CySEC and the cessation of its Australian operations following adverse legal rulings.

Overview Table

| Feature | Details |

|---|---|

| Broker Name | IronFX |

| Year Founded | 2010 |

| Headquarters | Cyprus (operational), Bermuda (global entity) |

| Regulation | CySEC (#125/10), FCA (#585561), FSCA (#45276), BMA (#51491) |

| Active Traders | 50,000+ to 1.5 million (inconsistent claims) |

| Minimum Deposit | $100 |

| Trading Instruments | 300+ CFDs |

| Maximum Leverage | Up to 1:1000 (Bermuda entity) / 1:30 (EU clients) |

| Trading Platforms | MetaTrader 4, WebTrader, TradeCopier |

| Account Types | 8+ including Standard, Premium, VIP, Zero Spread |

| Spreads | From 0 pips (with commission) |

| Customer Support | 24/5 multilingual support |

| Demo Account | Yes |

| Islamic Account | Yes |

Facts List

- IronFX was established in 2010 and operates through multiple legal entities across different jurisdictions worldwide

- The broker offers over 300 tradable CFD instruments spanning forex, metals, indices, commodities, shares, and futures

- Primary global operations are conducted through Notesco Limited in Bermuda, while EU/UK operations use stricter regulated entities

- Multiple account types are available with spreads starting from 0 pips on commission-based accounts

- MetaTrader 4 serves as the core trading platform, supplemented by TradeCopier for social trading capabilities

- Leverage varies dramatically by entity—up to 1:1000 through Bermuda, but capped at 1:30 for EU clients

- The broker settled with CySEC for €100,000 in 2024 regarding potential CFD marketing rule violations

- Australian operations ceased after adverse rulings from AFCA and local courts

- Educational resources have been criticised by Investopedia as "stale" and "outdated" in 2024 reviews

- Minimum deposit requirement is $100 across most account types

IronFX Licenses and Regulatory

IronFX's regulatory framework represents one of the most critical aspects potential traders must understand before opening an account. The broker operates through a multi-entity structure that significantly impacts the level of client protection and available trading conditions.

The Cyprus Securities and Exchange Commission (CySEC) regulates Notesco Financial Services Ltd under license number 125/10. This entity serves EU clients and must comply with MiFID II regulations, providing negative balance protection and limiting leverage to 1:30 for retail clients. However, this entity recently faced regulatory scrutiny, resulting in a €100,000 settlement in April 2024 for possible violations related to CFD marketing rules.

In the United Kingdom, Notesco UK Limited operates under FCA authorisation (reference 585561), providing services to UK residents who benefit from Financial Services Compensation Scheme (FSCS) protection up to £85,000. This represents the highest level of client fund protection available through IronFX's various entities.

The South African operations fall under FSCA regulation through Notesco SA (Pty) Ltd (FSP No. 45276), serving the African market with localised support and regulatory compliance.

Most significantly, Notesco Limited in Bermuda (BMA license 51491) operates the main ironfx.com website and serves the majority of international clients. This offshore entity operates under considerably less stringent regulations, allowing it to offer leverage up to 1:1000 and deposit bonuses that would be prohibited in EU or UK markets. Clients trading through this entity do not receive the same investor protections as those under CySEC or FCA oversight.

Regulations List

- Cyprus Securities and Exchange Commission (CySEC) - License #125/10

- Financial Conduct Authority (FCA) UK - Reference #585561

- Financial Sector Conduct Authority (FSCA) South Africa - FSP No. 45276

- Bermuda Monetary Authority (BMA) - License #51491

- Former Australian Securities and Investments Commission (ASIC) - License revoked

Trading Instruments

IronFX provides access to a comprehensive range of over 300 CFD instruments, positioning itself as a multi-asset broker capable of serving diverse trading strategies. The broker's asset selection spans six major categories, offering sufficient variety for portfolio diversification.

| Asset Class | Instruments Offered | Key Highlights |

|---|---|---|

| Forex | 80+ currency pairs (major, minor, exotic) | Spreads from 0 pips on zero-spread accounts (commission-based); full range of major & emerging markets |

| Commodities | Gold, Silver, Platinum; WTI & Brent Crude Oil; Select Agricultural Commodities | Gold is the most popular; spreads vary by account type and market conditions |

| Indices | S&P 500, Dow Jones 30, FTSE 100, DAX 30, Nikkei 225 | Exposure to global equity markets without needing to trade individual stocks |

| Share CFDs | 150+ stocks (mainly US & European markets); includes Apple, Amazon, Microsoft, etc. | Good blue-chip coverage, but more limited selection compared to full-service stock brokers |

| Futures | Select Commodity, FX, and Index futures | Targeted for advanced traders seeking hedging or speculative strategies |

| Cryptocurrencies | Limited selection; offering described as "not fully integrated" | Minimal commitment; suitable only for light exposure |

Trading Platforms

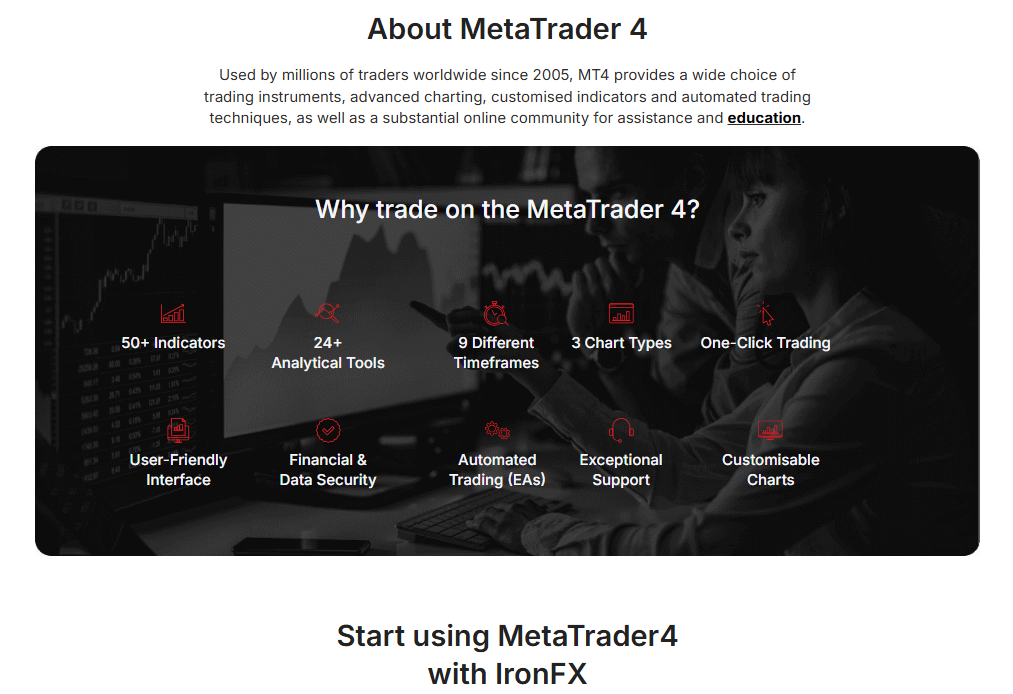

IronFX's trading infrastructure centers around the MetaTrader 4 platform, a decision that offers stability and familiarity but lacks the innovation found at more progressive brokers. The platform selection reflects a conservative approach prioritising reliability over cutting-edge features.

MetaTrader 4 (MT4)

MetaTrader 4 (MT4) serves as the primary platform across all devices. Desktop versions for Windows and Mac provide full functionality including advanced charting, Expert Advisor support, and comprehensive technical analysis tools. The platform includes 30+ technical indicators, multiple chart types, and one-click trading capabilities. Mobile apps for iOS and Android offer essential trading functions, though with reduced analytical capabilities compared to desktop versions.

WebTrade

WebTrader provides browser-based access without software installation, suitable for traders who need platform flexibility across different computers. While functional, it lacks some advanced features of the desktop application.

TradeCopier

TradeCopier represents IronFX's proprietary social trading solution, allowing clients to automatically replicate strategies from successful traders. This platform operates as a bridge to MT4, enabling copy trading functionality not native to the MetaTrader ecosystem.

PAMM System

The PAMM System caters to money managers and investors through a percentage allocation management module, facilitating professional asset management services within the MT4 environment.

Notably absent is MetaTrader 5, the successor to MT4 that offers enhanced features including more timeframes, additional order types, and improved backtesting capabilities. This omission places IronFX behind competitors who offer both platforms.

Trading Platforms Comparison Table

| Feature | MT4 Desktop | MT4 Mobile | WebTrader | TradeCopier |

|---|---|---|---|---|

| Full Charting | Yes | Limited | Moderate | Via MT4 |

| Technical Indicators | 30+ | 30 | 30 | N/A |

| Expert Advisors | Yes | No | No | No |

| One-Click Trading | Yes | Yes | Yes | Yes |

| Copy Trading | No | No | No | Yes |

| Custom Indicators | Yes | No | No | No |

| Multiple Windows | Yes | No | Yes | No |

| News Feed | Yes | Yes | Yes | No |

IronFX How to Open an Account: A Step-by-Step Guide

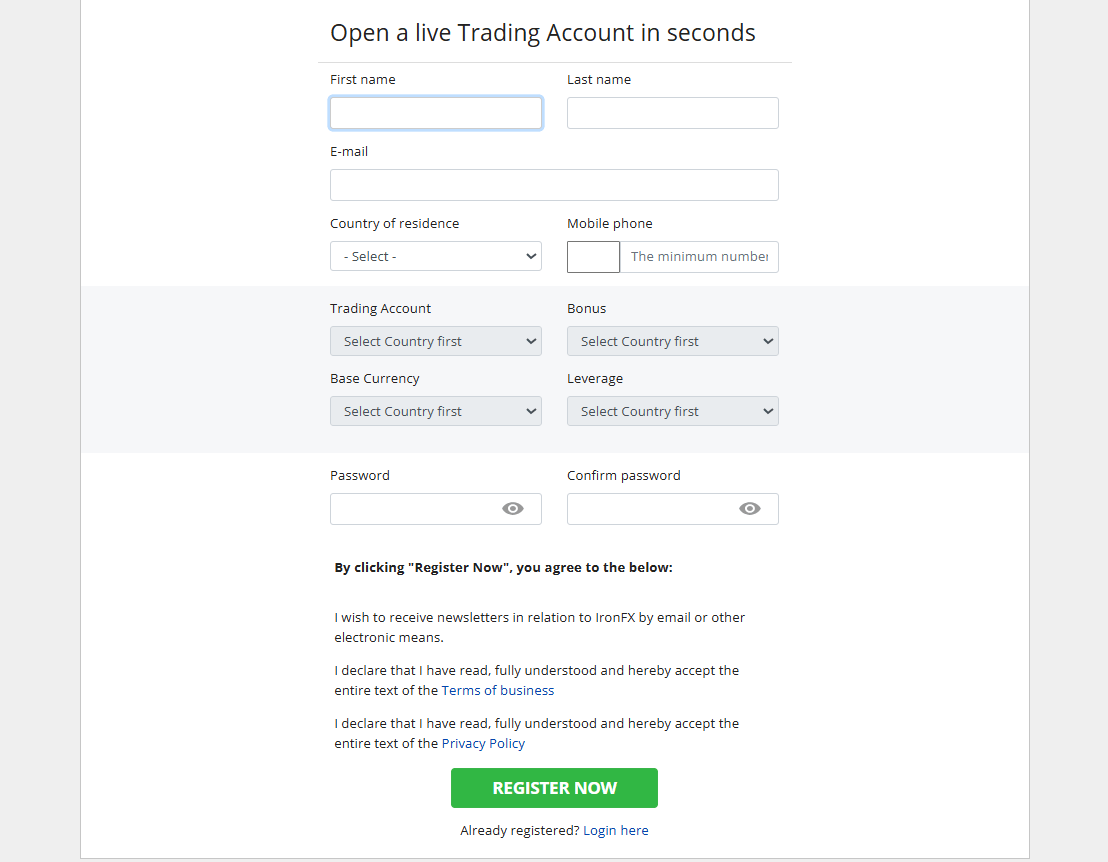

Opening an account with IronFX follows a standard online process, though traders must pay careful attention to which entity they're registering with, as this significantly impacts their trading conditions and protections.

Step 1: Registration - Visit the IronFX website at ironfx.com and click the registration button. You'll need to provide basic personal information including full name, email address, phone number, and country of residence. The country selection is crucial as it determines which IronFX entity will service your account.

Step 2: Account Selection - Choose your preferred account type from the available options. Consider factors like minimum deposit requirements, spread types (fixed vs. floating), and whether you prefer commission-based pricing for tighter spreads.

Step 3: Identity Verification - Upload required KYC documents including a government-issued photo ID (passport or driver's license) and proof of residence dated within the last three months (utility bill or bank statement). This verification process typically takes 1-2 business days.

Step 4: Account Approval - Once documents are verified, you'll receive login credentials for the client portal and trading platform. Download MT4 for your preferred device using the provided links.

Step 5: Fund Your Account - Make your initial deposit using available payment methods. The minimum deposit is $100 for most account types, though some premium accounts require higher initial funding.

Step 6: Platform Setup - Download and install MT4, then log in using your provided credentials. Configure your trading workspace, set up charts, and familiarise yourself with the platform before placing trades.

Charts and Analysis

IronFX offers a comprehensive suite of educational trading resources and tools designed to support traders of all levels, from beginners to advanced investors. These resources aim to enhance clients' trading knowledge, skills, and decision-making capabilities, empowering them to navigate the financial markets with confidence.

| Feature | Details |

|---|---|

| Trading Central | IronFX partners with Trading Central to provide market insights and analysis tools, including: Featured Ideas: Technical analysis of forex pairs with potential trade opportunities. Forex Polls: Real-time sentiment data on major currency pairs. Technical Analysis: Key support/resistance levels, trend lines, and chart patterns for multiple asset classes. |

| Market Insights | IronFX’s market analysts provide daily commentary, analysis, and trade ideas across various asset classes. This includes: Market News: Real-time updates on economic events and geopolitical developments. - Technical Analysis: Insights into major forex pairs, commodities, indices, and stocks. - Fundamental Analysis: Economic data, central bank policies, and market sentiment analysis. |

| Webinars | Regular webinars hosted by expert analysts cover basic to advanced trading strategies. Available in multiple languages, providing interactive learning for traders worldwide. |

| Economic Calendar | A customizable economic calendar featuring upcoming data releases, central bank meetings, and major market-moving events. Helps traders stay informed and plan trades accordingly. |

| Educational Videos | A library of on-demand videos covering trading platforms, technical/fundamental analysis, and risk management. Available through IronFX’s website and YouTube channel. |

| IronFX Academy | Structured online learning platform with courses for beginner to advanced traders. Covers trading psychology, risk management, and strategy development, with quizzes to track progress. |

IronFX Account Types

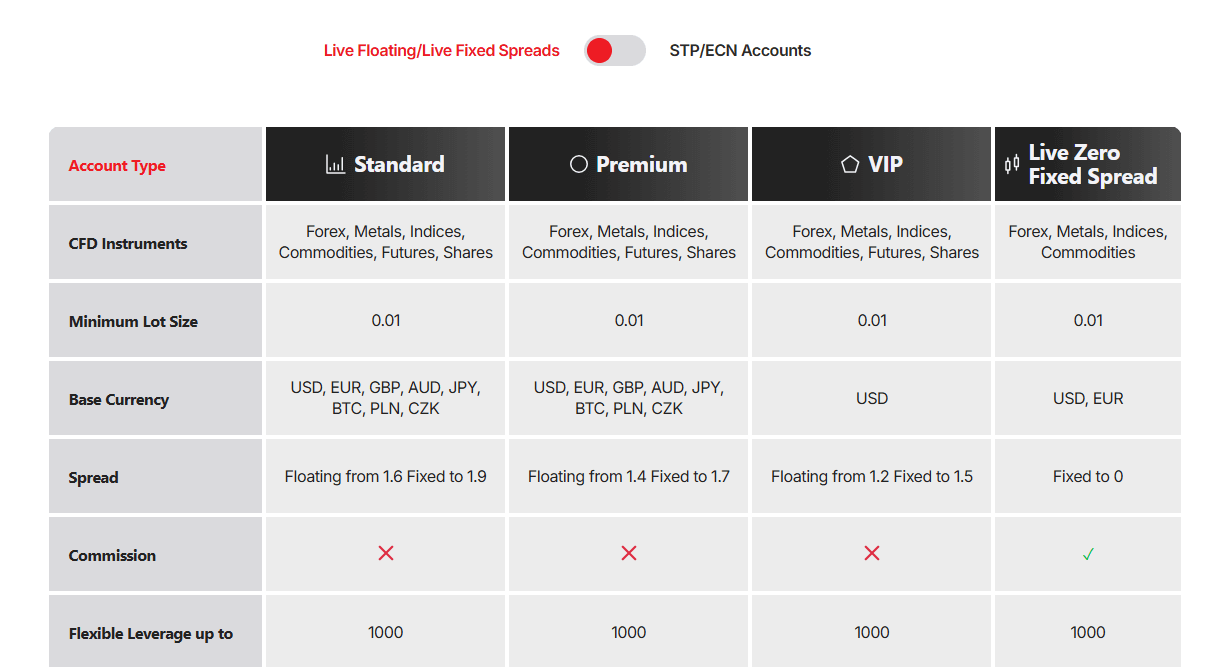

IronFX offers an extensive range of account types designed to accommodate various trading styles, capital levels, and experience. The broker segments these into traditional spread-based accounts and ECN/STP accounts with commission pricing.

Live Floating/Fixed Spread Accounts

Live Floating/Fixed Spread Accounts include Standard, Premium, and VIP tiers with decreasing spreads as minimum deposits increase. The Standard account requires just $100 minimum deposit with spreads from 1.8 pips, while VIP accounts need $10,000 but offer spreads from 1.4 pips. The Zero Fixed Spread account provides 0-pip fixed spreads with commission charges, requiring a $500 minimum deposit.

STP/ECN Accounts

STP/ECN Accounts cater to more advanced traders seeking direct market access. The No Commission account starts at 1.7 pips with no commission charges, while the Zero Spread account offers 0-pip spreads with competitive commissions. The Absolute Zero account uniquely combines zero spreads with no commissions but requires a $5,000 minimum deposit and limits leverage to 1:200.

Demo Accounts are available indefinitely with virtual funds, allowing risk-free platform familiarisation and strategy testing across all account type conditions.

Islamic Accounts provide swap-free trading for clients who cannot pay or receive interest due to religious beliefs, available across most account types with no additional charges.

Account Types Comparison Table

Live Floating/Fixed Spread Accounts

| Feature | Standard | Premium | VIP | Zero Fixed |

|---|---|---|---|---|

| Minimum Deposit | $100 | $1,000 | $10,000 | $500 |

| Spreads | Floating from 1.6 Fixed to 1.9 | Floating from 1.4 Fixed to 1.7 | Floating from 1.2 Fixed to 1.5 | 0 pips fixed |

| Commission | No | No | No | Yes |

| Maximum Leverage | 1:1000* | 1:1000* | 1:1000* | 1:1000* |

| Execution Type | Market | Market | Market | Market |

STP/ECN Accounts

| Feature | No Commission | Zero Spread | Absolute Zero |

|---|---|---|---|

| Minimum Deposit | $500 | $500 | $5,000 |

| Spreads | From 0.9 pips | From 0 pips | 0 pips |

| Commission | No | Yes | No |

| Maximum Leverage | 1:500* | 1:500* | 1:200* |

| Execution Type | STP | ECN | STP/ECN |

Leverage depends on regulatory entity - up to 1:1000 via Bermuda entity, 1:30 for EU clients

Negative Balance Protection

IronFX implements negative balance protection across all its entities, a crucial risk management feature that prevents traders from losing more than their deposited funds. This protection becomes particularly important during extreme market volatility when slippage and gaps can cause positions to close beyond stop-loss levels. The protection works by automatically zeroing any negative balance that might occur after adverse market movements. For example, if a trader has $1,000 in their account and a market gap causes a $1,500 loss, the account will show -$500 briefly before being reset to $0, with IronFX absorbing the $500 deficit. This feature is mandatory for the CySEC and FCA-regulated entities serving EU and UK clients respectively, as required under ESMA regulations. However, IronFX extends this protection to clients of its Bermuda entity as well, providing a consistent safety net across all jurisdictions. Traders should note that while negative balance protection prevents debt to the broker, it doesn't prevent the complete loss of deposited funds. Risk management through appropriate position sizing and stop-loss orders remains essential for capital preservation.

IronFX Deposits and Withdrawals

IronFX supports multiple payment methods for account funding and withdrawals, though the broker's reputation includes numerous complaints about withdrawal processing delays. Understanding the available options and potential issues is crucial for prospective clients.

Deposit Methods

| Method | Processing Time | Fees | Notes |

|---|---|---|---|

| Credit/Debit Cards (Visa, Mastercard) | Instant | No fees from IronFX (card issuer may charge) | Convenient for quick funding |

| Bank Wire Transfers | 3–5 business days | No fees from IronFX (bank fees may apply) | Suitable for larger transactions |

| E-wallets (Skrill, Neteller) | Instant | No fees from IronFX (provider fees possible) | Fast and widely used in FX trading |

Withdrawal Process & Concerns

| Aspect | Details |

|---|---|

| Processing Time | 24–48 hours by IronFX;3–5 business days for cards;Faster for e-wallets |

| Return Method | Must match original deposit method due to AML compliance |

| Fees | Generally no withdrawal fees;Inactive accounts may incur charges |

| Minimum Withdrawal | Around $50 for most e-wallets |

| Client Complaints | Reports of delays, extra documentation requests, and poor support response times |

| Overall Reliability | While many users withdraw without issues, the volume of complaints points to potential systemic problems |

Support Service for Customer

IronFX provides multilingual customer support through various channels, operating 24/5 to accommodate global trading hours. However, the quality and responsiveness of support services have received mixed reviews, with significant variations in user experiences.

.

- Live Chat offers the most immediate assistance, available directly through the website in over 30 languages. Response times vary considerably—while some traders report quick, helpful responses, others describe long waits and unhelpful agents, particularly during withdrawal enquiries.

- Email Support through support@ironfx.com handles more complex queries and document submissions. Email response times range from a few hours to several days, with follow-up often required for resolution.

- Phone Support provides local numbers in multiple countries, offering direct voice communication for urgent issues. Phone support quality varies by region, with some offices providing superior service to others.

- Support Quality remains inconsistent according to user reviews. While routine enquiries typically receive adequate assistance, complex issues—particularly regarding withdrawals or account restrictions—often face delays and require escalation. The support team's knowledge level also varies, with some agents requiring supervisor involvement for technical questions.

Customer Support Comparison Table

| Channel | Availability | Response Time | Languages | Best For |

|---|---|---|---|---|

| Live Chat | 24/5 | 1-30 minutes | 30+ | Quick queries |

| 24/5 | 24-72 hours | Multiple | Complex issues | |

| Phone | Business hours | Immediate | Varies by region | Urgent matters |

| FAQ | 24/7 | N/A | English mainly | Self-service |

Prohibited Countries

IronFX maintains restrictions on service provision to residents of certain countries due to regulatory requirements and company policy. These restrictions primarily stem from local regulations prohibiting CFD trading or requiring specific licenses IronFX doesn't possess.

Primary Restricted Jurisdictions include the United States, where retail forex and CFD trading face strict regulations IronFX doesn't comply with. Canada similarly restricts leveraged trading products to local residents. Cuba, Sudan, Syria, and North Korea face restrictions due to international sanctions.

Recently Restricted countries include Australia, where IronFX ceased operations following adverse regulatory rulings and court decisions. The company's Australian entity faced multiple complaints through AFCA, ultimately leading to license revocation.

Regional Variations exist within the EU, where some countries may have additional restrictions or requirements. Traders should verify their eligibility based on residence, not nationality, as regulations apply based on physical location.

Attempting to circumvent these restrictions through VPNs or false information violates terms of service and can result in account closure and fund freezing. Traders must ensure they're eligible before attempting registration.

Special Offers for Customers

IronFX actively promotes various bonuses and promotions, primarily through its Bermuda entity where such offers remain legal. These promotions require careful consideration as they come with significant terms and restrictions.

| Feature | Details | Key Considerations |

|---|---|---|

| 100% Unlimited Sharing Bonus | Matches deposits with no upper limit | Not withdrawable; used only for increasing margin |

| 40% Power Bonus | Moderate deposit match bonus | Offers balance boost, but still subject to trading volume requirements |

| 20% Iron Bonus | Basic bonus tier | Entry-level promotion for smaller deposits |

| Trading Volume Requirement | All bonuses require significant trading volume before profits can be withdrawn | Often difficult for average traders to meet |

| Trading Competitions | Periodic contests with large prize pools (demo & live) | Participation may require minimum deposits or lot sizes |

| Terms & Conditions | Strict rules on timeframes, trading strategies, and eligibility | Bonuses can be removed if conditions aren't met |

Conclusion

After thoroughly examining IronFX's operations, I find this broker presents a complex proposition requiring careful consideration. They've maintained operations since 2010, demonstrating longevity in a competitive industry, yet their track record raises significant concerns.

The multi-entity structure creates a two-tier system where trader protections vary dramatically based on geographic location. While EU and UK clients receive robust regulatory oversight through CySEC and FCA entities, most international traders fall under the Bermuda entity's minimal protections. This offshore operation enables attractive features like 1:1000 leverage and deposit bonuses but at the cost of reduced security.

Their platform offering, limited to MT4, feels dated compared to competitors offering MT5 or proprietary advanced platforms. The educational resources, criticised as outdated by independent reviewers, suggest insufficient investment in trader development. Combined with inconsistent marketing claims about client numbers and mixed customer service reviews, these factors paint a picture of a broker that may be coasting on past achievements rather than innovating for the future.

The regulatory challenges, including the recent CySEC settlement and Australian exit, cannot be ignored. While not necessarily disqualifying, they indicate ongoing compliance issues that cautious traders should weigh carefully.