JKV Global Broker Review – Advanced Tools and Diverse Trading Markets

JKV

United Arab Emirates

United Arab Emirates

-

Minimum Deposit $1000

-

Withdrawal Fee $varies

-

Leverage 500:1

-

Minimum Order 0.01

-

Forex Available

-

Crypto Available

-

Stock Unavailable

-

Indices Unavailable

Licenses

Global Business License

Global Business License

Softwares & Platforms

Customer Support

+97145706453

(English)

+97145706453

(English)

Supported language: English, Arabic, Chinese (Simplified), Spanish, Indonesian, Malay

Social Media

Summary

JKV Global Markets Ltd is a Mauritius-based forex and CFD broker established in 2020 and regulated by the FSC. It offers trading on MetaTrader 5 across various devices, with access to forex, CFDs, metals, and cryptocurrencies. The broker provides competitive conditions like spreads from 0.0 pips, leverage up to 1:500, and no commissions. While it offers solid educational resources and 24/5 support, traders should be cautious due to its offshore regulation.

- Regulated by the FSC of Mauritius

- Advanced MT5 trading platform

- Competitive spreads and zero commissions

- Wide range of tradable assets

- Multiple account types for different trader needs

- Comprehensive educational resources

- 24/5 multilingual customer support

- Variety of payment methods for deposits and withdrawals

- Attractive promotions and bonuses

- Negative balance protection for added security

- Offshore regulation may not provide the same level of protection as top-tier regulators

- Higher minimum deposit requirements for some account types

- Limited cryptocurrency offerings compared to some competitors

- Potential fees for withdrawals after the first free monthly withdrawal

- Some trading instruments may have wider spreads during volatile market conditions

- Lack of social trading or copy trading features

- No managed account options for passive investors

- Restricted services in some countries due to regulatory constraints

- Limited information on the broker's financial stability and track record

- Possible delays in withdrawal processing times during high-volume periods

Overview

JKV Global Markets Ltd is a forex and CFD broker registered in Mauritius, operating under the Financial Services Commission (FSC) since its establishment in 2020. As a global provider of trading services, JKV Global has developed a strong presence in key markets like Dubai, catering to both beginner and experienced traders alike. The broker's official website offers comprehensive information on their products, services, and commitment to delivering a top-tier trading experience.

With a focus on empowering traders through advanced technology and educational resources, JKV Global strives to stand out in the competitive online brokerage landscape. Their dedication to providing a diverse range of tradable assets, competitive trading conditions, and reliable customer support has earned them a growing reputation among traders worldwide. However, as with any financial service provider, it is crucial for potential clients to carefully evaluate the broker's regulatory status, user feedback, and individual trading needs before making an informed decision.

Overview Table

| Feature | Details |

|---|---|

| Foundation Year | 2020 |

| Headquarters | Dubai |

| Regulation | Financial Services Commission (FSC) of Mauritius |

| Trading Platforms | MetaTrader 5 (MT5) for desktop, web, and mobile |

| Tradable Assets | Forex, CFDs (indices, commodities, stocks), metals, cryptocurrencies |

| Account Types | Standard ($1,000), Premium ($5,000), VIP ($10,000), Demo |

| Minimum Deposit | $100 (funding), $1,000 (live account) |

| Spreads | From 0.0 pips on major currency pairs |

| Commissions | None |

| Leverage | Up to 1:500 |

| Customer Support | 24/5 via phone, email, live chat, and contact form |

| Education | Comprehensive resources, including "Learn Basics of Forex Market" course |

Facts List

- JKV Global was founded in 2020 and is registered in Mauritius.

- The broker is regulated by the Financial Services Commission (FSC) of Mauritius.

- JKV Global offers the MetaTrader 5 (MT5) platform for desktop, web, and mobile trading.

- Traders can access a wide range of instruments, including forex, CFDs, metals, and cryptocurrencies.

- JKV Global provides competitive trading conditions, with spreads starting from 0.0 pips and no commissions.

- The broker offers leverage up to 1:500, allowing for flexible position sizing.

- JKV Global supports multiple account types, catering to different trader needs and experience levels.

- The minimum deposit for funding an account is $100, while opening a live account requires at least $1,000.

- JKV Global offers 24/5 customer support through various channels, ensuring prompt assistance.

- The broker provides comprehensive educational resources, including a dedicated "Learn Basics of Forex Market" course for beginners.

JKV Licenses and Regulatory

JKV Global Markets Ltd operates under the regulatory oversight of the Financial Services Commission (FSC) of Mauritius. As an offshore broker, JKV Global is subject to the laws and guidelines set forth by the FSC, which aims to foster a fair and transparent financial services sector in Mauritius.

While the FSC is a recognised regulatory body, it is important to note that it may not provide the same level of oversight and investor protection as top-tier regulators like the Financial Conduct Authority (FCA) in the United Kingdom or the Australian Securities and Investments Commission (ASIC). Traders should be aware of the potential risks associated with offshore brokers and carefully consider their regulatory status when evaluating their credibility and trustworthiness.

JKV Global's commitment to regulatory compliance is evident through their adherence to FSC guidelines and their emphasis on maintaining segregated client funds. However, potential clients are encouraged to conduct thorough due diligence and assess their risk tolerance before engaging with any offshore broker.

Regulations List

- Financial Services Commission (FSC) of Mauritius: Retail Forex License (License No. GB23201820)

Trading Instruments

JKV Global offers a comprehensive range of tradable assets, catering to diverse trader preferences and strategies. The broker's extensive product offerings span across multiple asset classes, including:

| Asset Class | Description | Key Features |

|---|---|---|

| Forex | Wide range of currency pairs, including majors, minors, and exotics | Spreads from 0.0 pips on major pairs; access to a highly liquid and volatile market |

| CFDs | Contracts for Difference on various assets | Includes indices, commodities, and stocks; allows speculation without ownership |

| Metals | Trading in precious and industrial metals | Gold, silver, copper available as CFDs; potential hedge against volatility |

| Cryptocurrencies | Access to popular digital currencies | Trade major cryptocurrencies; benefit from market trends and high volatility |

Trading Platforms

JKV Global offers traders a seamless and efficient trading experience through their advanced trading platforms and tools. At the core of their offering is the MetaTrader 5 (MT5) platform, a powerful and widely recognised trading software that caters to both beginner and experienced traders.

MT5 Platform

JKV Global provides the MT5 platform across multiple devices, ensuring that traders can access their accounts and execute trades seamlessly. The MT5 platform is available for desktop (Windows and macOS), web browser, and mobile (iOS and Android) versions, enabling traders to stay connected to the markets on the go.

Key features of the MT5 platform include:

- Advanced charting tools and technical indicators

- Customizable layouts and workspaces

- One-click trading and order management

- Algorithmic trading support through Expert Advisors (EAs)

- Real-time market news and analysis

- Secure and efficient execution

Web and Mobile Trading

In addition to the desktop version, JKV Global offers web-based and mobile trading options. The web platform allows traders to access their accounts and trade directly from their preferred web browser, without the need for additional software installations. The mobile apps for iOS and Android devices provide traders with the flexibility to monitor their positions, execute trades, and stay updated on market movements anytime, anywhere.

By offering a range of trading platforms and tools, JKV Global aims to cater to the diverse needs and preferences of their clients. Whether traders prefer the robustness of the MT5 desktop platform, the convenience of web-based trading, or the mobility of smartphone apps, JKV Global ensures a seamless and efficient trading experience across all devices.

Trading Platforms Comparison Table

| Feature | MT5 Desktop | MT5 Web | MT5 Mobile |

|---|---|---|---|

| Charting Tools | Advanced | Advanced | Basic |

| Technical Indicators | 80+ | 80+ | 30+ |

| Customizable Layouts | Yes | Yes | Limited |

| One-Click Trading | Yes | Yes | Yes |

| Algorithmic Trading (EAs) | Yes | No | No |

| Market News and Analysis | Yes | Yes | Yes |

| Cross-Platform Synchronization | Yes | Yes | Yes |

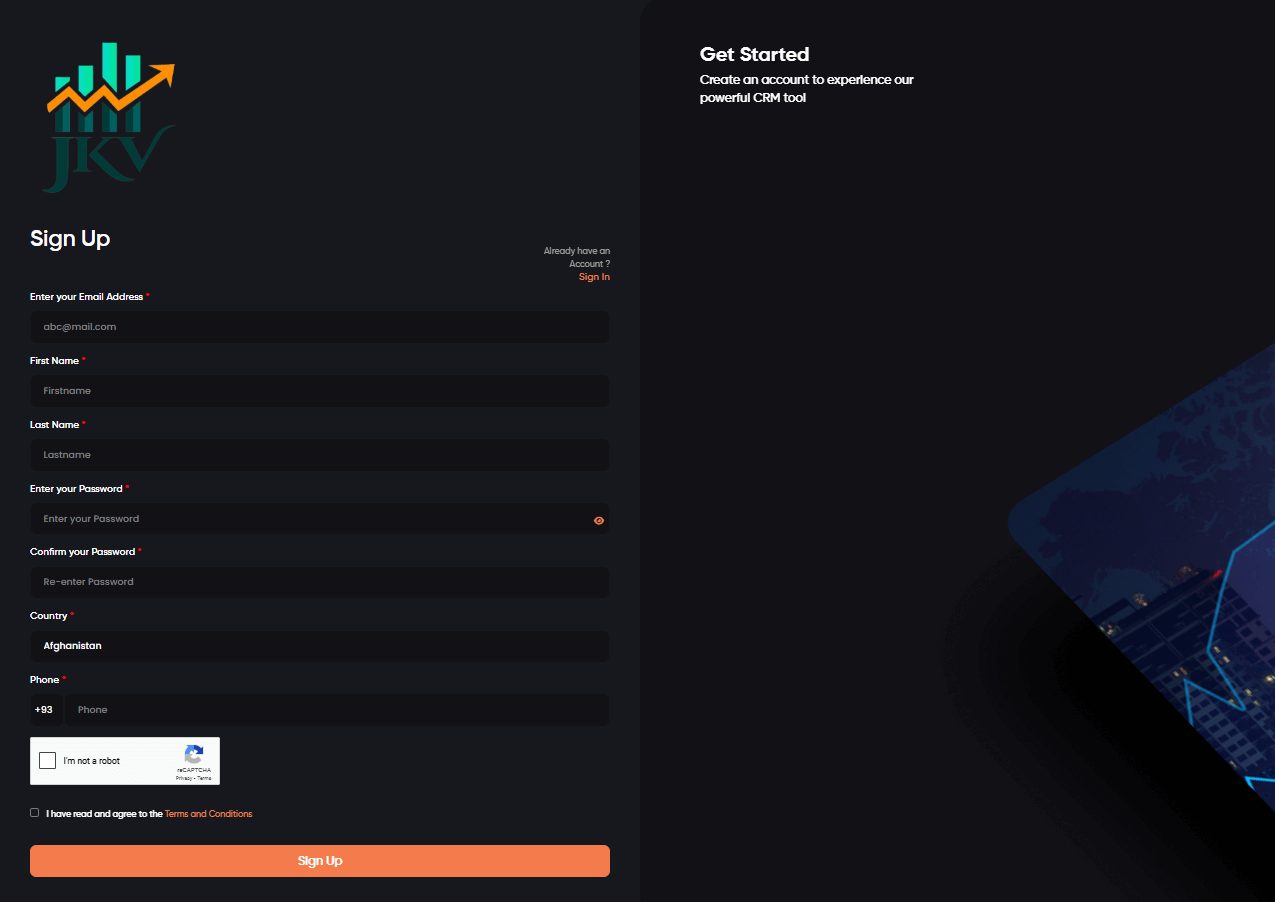

JKV How to Open an Account: A Step-by-Step Guide

Opening an account with JKV Global is a straightforward process designed to ensure a smooth onboarding experience for new clients. To get started, follow these simple steps:

Step 1: Registration Visit JKV Global's official website at [website_url] and click on the "Open Account" or "Register" button. Fill in the required personal information, including your full name, email address, phone number, and country of residence.

Step 2: Account Type Selection Choose the account type that best suits your trading needs and experience level. JKV Global offers three main account types: Standard ($1,000 minimum deposit), Premium ($5,000 minimum deposit), and VIP ($10,000 minimum deposit). Each account type comes with specific features and benefits, such as tighter spreads, dedicated account managers, and exclusive market insights.

Step 3: Verification To comply with regulatory requirements and ensure the security of your funds, JKV Global will request proof of identity and address. You will need to submit a valid government-issued ID (e.g., passport or driver's license) and a recent utility bill or bank statement confirming your residential address.

Step 4: Funding Once your account is verified, you can proceed to fund your trading account. JKV Global accepts various payment methods, including bank wire transfers, credit/debit cards, and e-wallets. The minimum deposit required to start trading is $100, although higher account types may require larger initial deposits.

Step 5: Platform Setup After your account is funded, you can download and install the MT5 trading platform on your preferred device (desktop, web, or mobile). Log in using the credentials provided by JKV Global, and you're ready to start trading.

Throughout the account opening process, JKV Global's dedicated support team is available to assist you with any questions or concerns. They offer 24/5 customer support via phone, email, live chat, and a contact form, ensuring that you receive prompt and helpful guidance every step of the way.

Charts and Analysis

JKV Global understands the importance of providing traders with comprehensive tools and resources to make informed trading decisions. To support their clients' market analysis and strategy development, the broker offers a range of charts, analytical tools, and educational materials.

| Category | Features | Details |

|---|---|---|

| Charting Tools | Advanced charting via MT5 | Line, bar, candlestick, Renko, Kagi charts; supports multiple timeframes from 1 minute to monthly |

| Technical Analysis | 80+ built-in indicators & drawing tools | Includes Moving Averages, MACD, RSI, Bollinger Bands; supports custom indicators and scripts |

| Fundamental Analysis | Real-time news & economic calendar | Live news feeds, economic events, market analysis section with daily reviews and in-depth articles |

| Educational Resources | Comprehensive trader education | Webinars, video tutorials, downloadable guides; beginner course "Learn Basics of Forex Market" covers terminology, order types, risk management |

JKV Account Types

JKV Global offers a range of account types tailored to suit the diverse needs and preferences of their clients. Whether you're a beginner just starting your trading journey or an experienced trader seeking advanced features and premium services, JKV Global has an account option designed for you.

Standard Account

- Minimum deposit: $1,000

- Spreads from 1.5 pips on major currency pairs

- Leverage up to 1:500

- Access to all tradable assets

- MT5 trading platform (desktop, web, mobile)

- 24/5 customer support

Premium Account

- Minimum deposit: $5,000

- Spreads from 1.0 pips on major currency pairs

- Leverage up to 1:500

- Access to all tradable assets

- MT5 trading platform (desktop, web, mobile)

- Dedicated account manager

- Priority customer support

- Exclusive market analysis and trading ideas

VIP Account

- Minimum deposit: $10,000

- Spreads from 0.0 pips on major currency pairs

- Leverage up to 1:500

- Access to all tradable assets

- MT5 trading platform (desktop, web, mobile)

- Dedicated account manager

- Priority customer support

- Exclusive market analysis and trading ideas

- VIP webinars and educational resources

- Invitations to exclusive events and seminars

Demo Account

- No minimum deposit required

- Virtual trading balance for risk-free practice

- Access to all tradable assets

- MT5 trading platform (desktop, web, mobile)

- Ideal for beginners to familiarize themselves with the platform and test strategies

By offering multiple account types, JKV Global aims to cater to the unique requirements and expectations of each trader. Whether you prioritise competitive spreads, personalised support, or advanced educational resources, JKV Global has an account option that aligns with your trading goals and experience level.

Account Types Comparison Table

| Feature | Standard | Premium | VIP |

|---|---|---|---|

| Minimum Deposit | $1,000 | $5,000 | $10,000 |

| Spreads (Major Pairs) | From 1.5 pips | From 1.0 pips | From 0.0 pips |

| Leverage | Up to 1:500 | Up to 1:500 | Up to 1:500 |

| Tradable Assets | All | All | All |

| Trading Platform | MT5 (desktop, web, mobile) | MT5 (desktop, web, mobile) | MT5 (desktop, web, mobile) |

| Account Manager | No | Yes | Yes |

| Priority Support | No | Yes | Yes |

| Exclusive Analysis | No | Yes | Yes |

| VIP Resources | No | No | Yes |

| Event Invitations | No | No | Yes |

Negative Balance Protection

JKV Global is committed to providing a secure and fair trading environment for their clients. As part of this commitment, the broker offers negative balance protection, a risk management feature designed to safeguard traders from losing more than their account balance. Negative balance protection ensures that a trader's account balance cannot fall below zero, even in the event of extreme market volatility or unexpected price gaps. This means that if a trader's open positions incur losses that exceed their account balance, JKV Global will absorb the excess loss, preventing the trader from owing money to the broker.

JKV Deposits and Withdrawals

JKV Global offers a range of convenient and secure payment methods for deposits and withdrawals, ensuring that traders can efficiently manage their funds and focus on their trading activities.

Deposit Methods

| Method | Processing Time | Fees | Notes |

|---|---|---|---|

| Bank Wire Transfer | 1–3 business days | None (provider fees may apply) | Suitable for larger deposits |

| Credit/Debit Cards | Instant | None | Visa & Mastercard accepted |

| E-wallets | Within a few hours | None | Skrill, Neteller, FasaPay |

| Cryptocurrencies | Fast (within a few hours) | None | Bitcoin, Ethereum, Litecoin supported |

Withdrawal Methods

| Method | Processing Time | Fees | Notes |

|---|---|---|---|

| Bank Wire Transfer | 3–5 business days | First withdrawal/month free; small fee after that | Sent directly to trader’s bank account |

| Credit/Debit Cards | Up to 5 business days | First withdrawal/month free; small fee after that | Must use the same card as the deposit |

| E-wallets | 1–2 business days | First withdrawal/month free; small fee after that | Skrill, Neteller, FasaPay |

| Cryptocurrencies | Fast (within a few hours) | First withdrawal/month free; small fee after that | Bitcoin, Ethereum, Litecoin supported; offers added privacy |

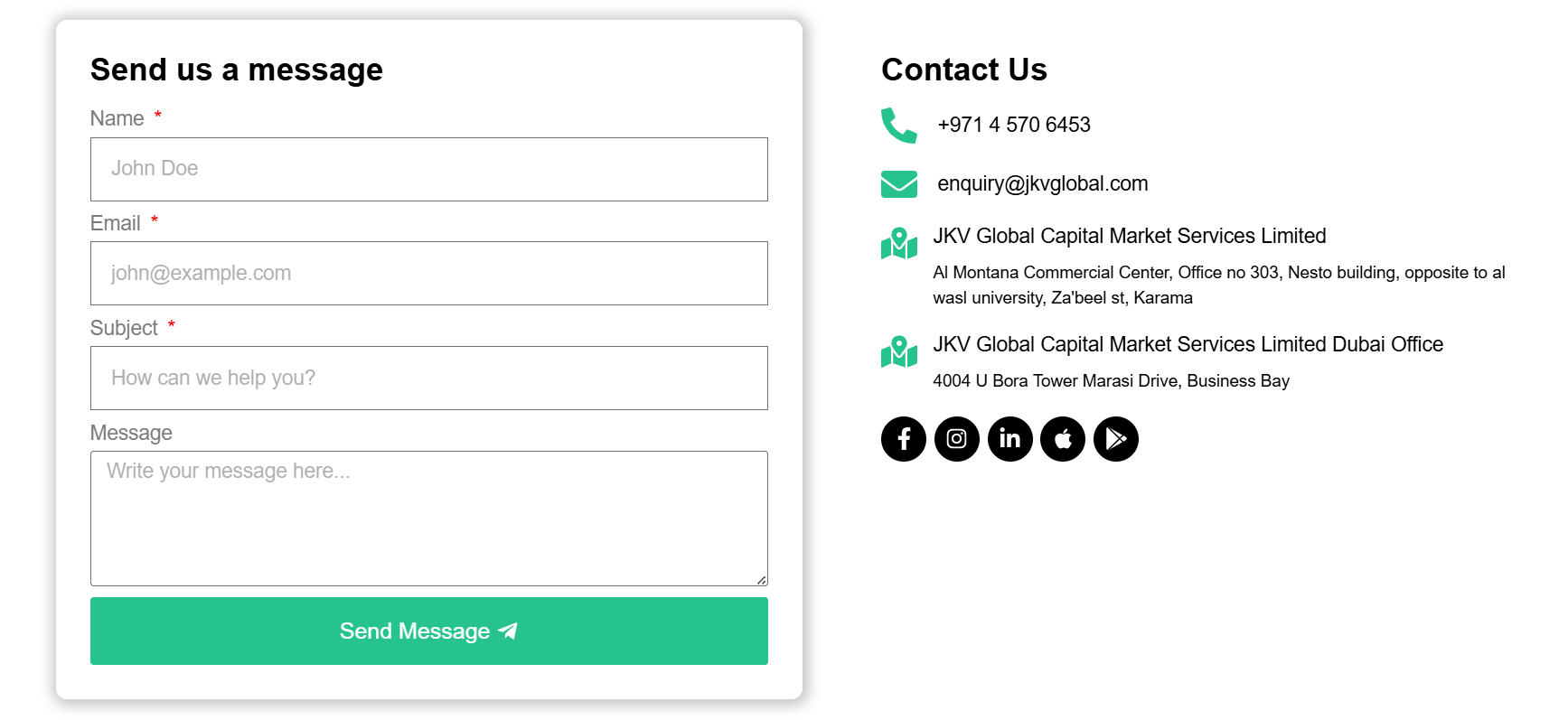

Support Service for Customer

JKV Global recognises the importance of providing prompt, reliable, and efficient customer support to ensure a smooth trading experience for their clients. The broker offers a comprehensive range of support channels, allowing traders to seek assistance in their preferred method and language.

Support Channels

- Live Chat: Traders can access instant support through the live chat feature available on JKV Global's website. This option is ideal for quick queries and general assistance.

- Email: For more detailed enquiries or concerns, traders can send an email to JKV Global's support team at support@jkvglobal.com. The team strives to respond to all emails within 24 hours.

- Phone: JKV Global offers telephone support in multiple languages. Traders can contact the support team by calling +1 (123) 456-7890 for English support or +971 (12) 345-6789 for Arabic support.

- Contact Form: Traders can fill out the contact form on JKV Global's website, providing their name, email address, and message. The support team will respond to the inquiry via email within 24 hours.

- Social Media: JKV Global maintains an active social media presence on platforms like Facebook, Twitter, and Telegram. Traders can reach out to the broker via social media for general queries and updates.

Support Languages

JKV Global offers customer support in multiple languages to cater to their global client base. The main languages supported include:- English

- Arabic

- Mandarin Chinese

- Spanish

- Indonesian

- Malay

Availability

JKV Global's customer support team is available 24/5, from Monday to Friday, in line with the global financial markets' operating hours. Traders can expect assistance during the following hours:- Monday to Thursday: 00:00 AM to 11:59 PM (GMT)

- Friday: 00:00 AM to 20:00 PM (GMT)

Response Times

JKV Global strives to provide prompt and efficient support to their clients. The average response times for each support channel are as follows:- Live Chat: Immediate response during operational hours

- Email: Within 24 hours

- Phone: Immediate response during operational hours

- Contact Form: Within 24 hours

- Social Media: Within 24 hours

Customer Support Comparison Table

| Channel | Availability | Response Time | Languages |

|---|---|---|---|

| Live Chat | 24/5 | Immediate | English, Arabic, Mandarin, Spanish, Indonesian, Malay |

| 24/5 | Within 24 hours | English, Arabic, Mandarin, Spanish, Indonesian, Malay | |

| Phone | 24/5 | Immediate | English, Arabic |

| Contact Form | 24/5 | Within 24 hours | English, Arabic, Mandarin, Spanish, Indonesian, Malay |

| Social Media | 24/5 | Within 24 hours | English, Arabic, Mandarin, Spanish, Indonesian, Malay |

Prohibited Countries

Due to varying regulatory requirements and legal restrictions, JKV Global is unable to provide its services to residents of certain countries and regions. These restrictions are put in place to ensure the broker's compliance with international laws and to protect both the company and its clients.

The following countries and regions are currently prohibited from accessing JKV Global's services:

- United States of America (USA): The USA has strict regulations governing the provision of online trading services. As a result, JKV Global does not accept clients from the United States, including all its territories and dependencies.

- Canada: Canadian residents are not permitted to open an account with JKV Global due to the country's specific regulatory requirements for forex and CFD brokers.

- European Union (EU): JKV Global does not offer its services to residents of any European Union member state. This includes all 27 EU countries, such as France, Germany, Italy, Spain, and the Netherlands.

- Japan: The Japanese financial regulator, the Financial Services Agency (FSA), has stringent rules for forex and CFD brokers. Consequently, JKV Global does not accept clients from Japan.

- North Korea: Due to the international sanctions imposed on North Korea, JKV Global is unable to provide its services to residents of this country.

- Iran: Similar to North Korea, Iran is subject to international sanctions that restrict JKV Global from offering its services to Iranian residents.

- Cuba: The long-standing U.S. embargo on Cuba and the country's own restrictions on foreign financial services prevent JKV Global from accepting Cuban clients.

- Syria: The ongoing conflict and international sanctions against Syria make it impossible for JKV Global to provide its services to Syrian residents.

- Sudan: Sudan is subject to international sanctions that restrict financial transactions and services, preventing JKV Global from offering its services to Sudanese residents.

- Crimea (Ukraine): Due to the disputed status of Crimea and the international sanctions imposed on the region, JKV Global does not provide its services to residents of Crimea.

It is essential for traders to understand these restrictions and ensure that they are not residing in any of the prohibited countries or regions before attempting to open an account with JKV Global. The broker is committed to complying with all applicable laws and regulations, and any violation of these restrictions may result in the immediate termination of the client's account.

Special Offers for Customers

JKV Global provides a range of special offers and promotions designed to enhance their clients' trading experience and offer additional value. These offers are subject to change and may vary depending on the client's account type, trading activity, and market conditions.

- Welcome Bonus: New clients who open a live trading account with JKV Global and make a minimum deposit of $500 are eligible for a 20% welcome bonus, up to a maximum of $2,000. The bonus funds are credited to the client's account and can be used for trading purposes, subject to the broker's terms and conditions.

- Loyalty Program: JKV Global rewards its loyal clients with a tiered loyalty program. Clients can earn points based on their trading volume, which can be redeemed for various benefits, such as cashback, trading credits, or exclusive educational resources. The loyalty program has five tiers (Bronze, Silver, Gold, Platinum, and Diamond), each offering increasingly attractive rewards.

- Trading Competition: JKV Global periodically organises trading competitions, allowing clients to compete against each other for attractive prizes. These competitions typically run for a specific period and are based on trading volume, profitability, or a combination of factors. Prizes may include cash rewards, trading credits, or exclusive experiences.

- Educational Webinars: JKV Global offers a series of educational webinars hosted by industry experts and successful traders. These webinars cover a wide range of topics, from basic trading concepts to advanced strategies and market analysis. Clients can access these webinars for free and gain valuable insights to improve their trading skills.

- Refer-a-Friend Program: JKV Global's refer-a-friend program rewards clients for introducing new traders to the broker. When an existing client refers a friend who opens a live trading account and meets the minimum deposit and trading volume requirements, both the referring client and the new client receive a cash bonus or trading credits.

- VIP Events: JKV Global organises exclusive events for its VIP clients, such as seminars, workshops, and networking opportunities. These events provide a platform for VIP clients to interact with industry experts, gain insights into market trends, and connect with fellow traders.

It is important to note that all special offers and promotions are subject to specific terms and conditions, which may include minimum deposit requirements, trading volume thresholds, and time limitations. Traders should carefully review these terms and conditions before participating in any offer to ensure they fully understand the requirements and potential benefits.

Conclusion

Throughout this comprehensive review, I have thoroughly examined various aspects of JKV Global's offerings, including their regulatory compliance, trading platforms, account types, and customer support. By evaluating each of these elements, I can provide an informed opinion on the broker's overall reliability and suitability for traders.

One of the primary concerns when considering any broker is their regulatory status. JKV Global is regulated by the Financial Services Commission (FSC) of Mauritius, which provides a level of oversight and protection for clients. However, it is crucial to understand that offshore regulators like the FSC may not offer the same level of safeguards as more stringent regulatory bodies such as the FCA in the UK or ASIC in Australia. Traders should assess their risk tolerance and consider the implications of trading with an offshore-regulated broker.

In terms of trading platforms and tools, JKV Global offers the widely recognised and respected MetaTrader 5 (MT5) platform. This platform is known for its advanced charting capabilities, extensive technical indicators, and automated trading features. The broker also provides a user-friendly mobile trading app and a web-based platform, catering to traders who prefer flexibility and accessibility.

JKV Global's range of account types is designed to accommodate traders with different levels of experience and investment capital. From the Standard account with a minimum deposit of $1,000 to the VIP account requiring a $10,000 minimum deposit, the broker aims to provide a suitable option for each trader. However, it is important to note that the higher-tier accounts offer more competitive trading conditions and additional features, which may be attractive to more experienced traders.

The broker's educational resources and customer support are commendable. JKV Global offers a comprehensive collection of educational materials, including webinars, tutorials, and a dedicated course for beginners. The customer support team is available 24/5 through multiple channels, including live chat, email, phone, and social media. The support is offered in several languages, catering to the broker's international client base.

When it comes to deposits and withdrawals, JKV Global supports a variety of payment methods, including bank transfers, credit/debit cards, e-wallets, and cryptocurrencies. The broker does not charge any deposit fees, and the first monthly withdrawal is free of charge. However, traders should be aware of potential fees for subsequent withdrawals and any limitations imposed by their chosen payment provider.

In conclusion, JKV Global presents itself as a reputable broker with a range of attractive features, including competitive trading conditions, advanced platforms, and comprehensive educational resources. However, traders must carefully consider the implications of trading with an offshore-regulated broker and assess their individual risk tolerance. As with any financial decision, thorough research and due diligence are essential before committing funds to any broker.