LegacyFX Review: Trusted Forex Broker for Secure and Diverse Trading

LegacyFX

Cyprus

Cyprus

-

Minimum Deposit $500

-

Withdrawal Fee $0

-

Leverage 200:1

-

Spread From 0.1

-

Minimum Order 0.01

-

Forex Available

-

Crypto Available

-

Stock Available

-

Indices Available

Licenses

Cyprus Market Making (MM)

Cyprus Market Making (MM)

United Kingdom Market Making (MM)

United Kingdom Market Making (MM)

Forex Trading License

Forex Trading License

Softwares & Platforms

Customer Support

+357291788410

(English)

+357291788410

(English)

Supported language: English

Social Media

Summary

LegacyFX is a multi-regulated forex and CFD broker established in 2017 and headquartered in Vanuatu.

It is licensed by top regulators including CySEC, FCA, BaFin, NBRB, and VFSC.

Traders can access over 200 assets including forex, stocks, indices, commodities, and crypto.

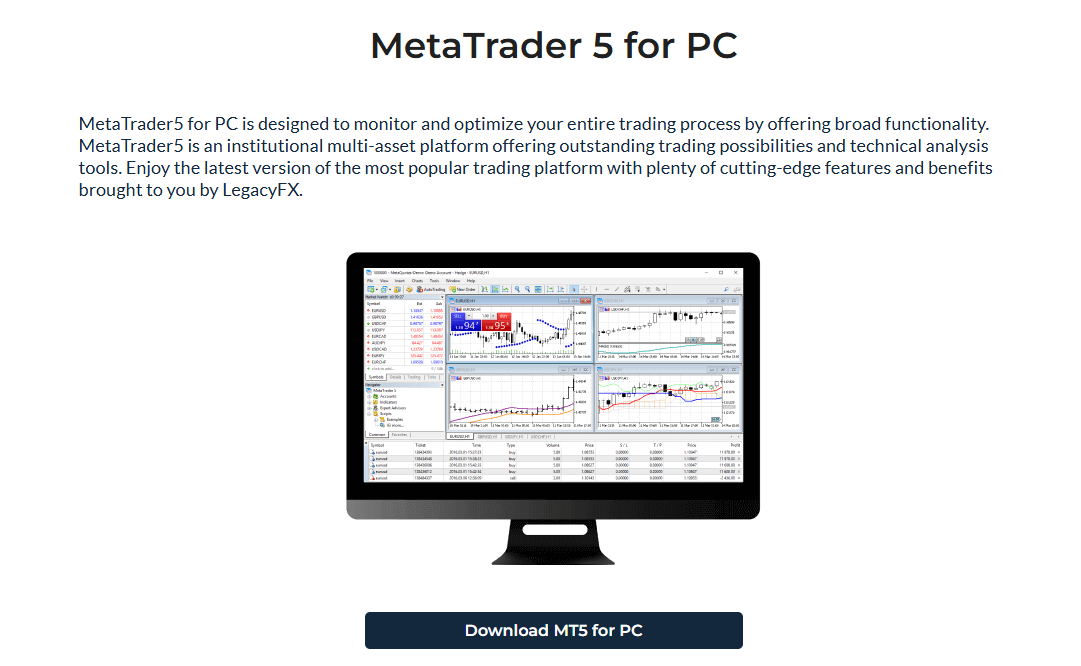

The broker offers the MetaTrader 5 platform along with web and mobile trading options.

LegacyFX provides seven account types with a minimum deposit starting at $500 and spreads from 0.6 pips.

It also offers strong educational support through webinars, tutorials, and market analysis.

- Multi-regulated by the VFSC, CySEC, FCA, NBRB, and BaFin, providing a high level of client protection.

- Offers a wide range of over 200 tradable assets across multiple markets.

- Provides access to the popular MetaTrader 5 platform, as well as web and mobile trading.

- Offers seven different account types to suit various trading needs and budgets.

- Competitive spreads starting from 0.6 pips and leverage up to 1:200.

- No commissions charged on most tradable assets.

- Negative balance protection ensures clients cannot lose more than their deposited funds.

- Supports multiple payment methods for deposits and withdrawals.

- Offers a comprehensive suite of educational resources and trading tools.

- Provides responsive customer support through various channels.

- High minimum deposit requirements for some account types may be a barrier for beginner traders.

- Limited range of cryptocurrency assets compared to some other brokers.

- No direct phone support for clients outside of local operating hours.

- Some educational resources may be more suitable for beginners than advanced traders.

- Lack of social trading or copy trading features for those interested in these strategies.

- Relatively high spreads for certain account types compared to other brokers.

- Limited customisation options for the MetaTrader platforms.

- No guaranteed stop-loss orders, which may be a concern for some risk-averse traders.

- Potential for occasional slippage during high-volatility market conditions.

- Funding methods may be limited in certain countries due to regulatory restrictions.

Overview

LegacyFX is a prominent multi-regulated online forex and CFD broker that has been serving traders worldwide since its establishment in 2017. The broker is regulated by several well-respected financial authorities, including the Vanuatu Financial Services Commission (VFSC), Cyprus Securities and Exchange Commission (CySEC), Financial Conduct Authority (FCA) in the UK, National Bank of the Republic of Belarus (NBRB), and Federal Financial Supervisory Authority (BaFin) in Germany.

With a strong presence in the financial markets, LegacyFX has earned recognition for its comprehensive range of trading instruments, competitive trading conditions, and commitment to providing a top-notch trading experience for its clients.

LegacyFX offers a diverse selection of trading instruments, including over 200 assets across various classes such as forex, stocks, indices, commodities, and cryptocurrencies. The broker provides access to the popular MetaTrader 5 (MT5) platform, which is renowned for its advanced charting tools, extensive technical indicators, and automated trading capabilities.

Catering to both novice and experienced traders, LegacyFX offers a range of account types with flexible trading conditions and competitive spreads. The broker also provides educational resources, including webinars, tutorials, and market analysis, to support traders in their learning journey and help them make informed trading decisions.

For more in-depth information about LegacyFX's offerings, visit their official website at [legacyfx.com].

Overview Table

| Aspect | Details |

|---|---|

| Broker Name | LegacyFX |

| Headquarters | Vanuatu |

| Year Founded | 2017 |

| Regulation | Multi-regulated: VFSC (Vanuatu, License 14579), CySEC, FCA, NBRB, BaFin |

| Tradable Assets | 200+ including Forex, Stocks, Indices, Commodities, Cryptocurrencies |

| Platforms | MetaTrader 5, Web Trader, Mobile Trading |

| Account Types | Standard, Bronze, Silver, Gold, Platinum, Premium, VIP |

| Minimum Deposit | $500 (Standard Account) |

| Spreads | From 0.6 pips |

| Deposit/Withdrawal | Credit/Debit Cards, Bank Wire Transfer, E-wallets |

Facts List

- LegacyFX was founded in 2017 and is headquartered in Vanuatu.

- The broker is multi-regulated by the VFSC (Vanuatu, License 14579), CySEC (Cyprus), FCA (UK), NBRB (Belarus), and BaFin (Germany)

- LegacyFX offers over 200 tradable assets, including forex, stocks, indices, commodities, and cryptocurrencies.

- Trading is available on the MetaTrader 5 platform, as well as through web and mobile trading interfaces.

- The broker provides seven different account types: Standard, Bronze, Silver, Gold, Platinum, Premium, and VIP.

- The minimum deposit requirement for a Standard account is $500.

- Spreads start from as low as 0.6 pips, offering competitive trading costs.

- LegacyFX supports various deposit and withdrawal methods, including credit/debit cards, bank wire transfers, and e-wallets.

- The broker offers educational resources, such as webinars, tutorials, and market analysis, to support traders' learning and decision-making.

- LegacyFX operates with transparency and adheres to strict regulatory guidelines to ensure the safety and security of clients' funds.

LegacyFX Licenses and Regulatory

LegacyFX is a multi-regulated broker, ensuring a high level of security and protection for its clients. The broker operates under the regulatory oversight of several well-respected financial authorities, including:

- Vanuatu Financial Services Commission (VFSC) – License No. 14579

- Cyprus Securities and Exchange Commission (CySEC)

- Financial Conduct Authority (FCA) – United Kingdom

- National Bank of the Republic of Belarus (NBRB)

- Federal Financial Supervisory Authority (BaFin) – Germany

By being regulated by multiple authorities, LegacyFX demonstrates its commitment to maintaining the highest standards of financial regulation and client protection. Each of these regulatory bodies imposes strict requirements on the broker, ensuring that it operates with transparency, fairness, and integrity.

The VFSC, CySEC, FCA, NBRB, and BaFin are all respected regulatory authorities that oversee the financial markets in their respective jurisdictions. They enforce rules and guidelines to protect investors, prevent fraud, and maintain the stability of the financial system.

LegacyFX's multi-regulatory status provides clients with several key benefits:

- Segregation of client funds: The broker is required to keep client funds separate from its own operating capital, ensuring that clients' money is protected in the event of financial instability.

- Regular audits and reporting: LegacyFX must undergo regular audits and provide financial reports to its regulatory authorities, demonstrating its compliance with financial regulations and maintaining transparency.

- Investor compensation schemes: In the unlikely event that LegacyFX becomes insolvent, clients may be eligible for compensation through the investor protection schemes offered by the broker's regulatory bodies.

- Strict conduct requirements: The regulatory authorities impose strict requirements on LegacyFX's business practices, ensuring that the broker acts in the best interests of its clients and maintains a fair and transparent trading environment.

By adhering to the regulations set forth by the VFSC, CySEC, FCA, NBRB, and BaFin, LegacyFX provides its clients with a secure and reliable trading experience. Traders can have confidence in the broker's operations and trust that their funds and personal information are well protected.

Regulations List

- Vanuatu Financial Services Commission (VFSC) – License No. 14579

- Cyprus Securities and Exchange Commission (CySEC)

- Financial Conduct Authority (FCA) – United Kingdom

- National Bank of the Republic of Belarus (NBRB)

- Federal Financial Supervisory Authority (BaFin) – Germany

Trading Instruments

LegacyFX offers a comprehensive range of tradable assets, catering to the diverse needs and preferences of traders worldwide. With over 200 instruments available, the broker provides access to a wide array of markets, including:

| Asset Class | Description | Key Highlights |

|---|---|---|

| Forex | Trade major, minor, and exotic currency pairs | Competitive spreads from 0.6 pips, pairs like EUR/USD, USD/JPY |

| Stocks (CFDs) | Access global stocks from major companies across sectors | Trade Apple, Amazon, Google, and more via CFDs |

| Indices | Speculate on global indices such as S&P 500, NASDAQ, FTSE, DAX, and Nikkei | Flexible leverage, broad market exposure, tight spreads |

| Commodities | Trade precious metals, energies, and agricultural goods | Includes gold, silver, oil, natural gas, coffee |

| Cryptocurrencies | Trade CFDs on top digital assets without owning them | Includes Bitcoin, Ethereum, Litecoin, Ripple; leverage up to 1:5 |

Trading Platforms

LegacyFX offers its clients access to a range of powerful trading platforms, enabling them to trade the financial markets with ease and efficiency.

The broker's primary trading platforms include:

MetaTrader 5 (MT5)

MT5 is the latest version of the MetaTrader platform, offering enhanced functionality and a more powerful trading environment. In addition to the features available on MT4, MT5 includes advanced risk management tools, more timeframes for analysis, and the ability to trade a wider range of financial instruments, including cryptocurrencies.

Web Trader

For traders who prefer to access their trading accounts via a web browser, LegacyFX offers a web-based trading platform. The Web Trader provides a streamlined trading experience, allowing users to place trades, monitor positions, and analyse the markets without the need to download and install additional software.

Mobile Trading

LegacyFX offers mobile trading apps for both iOS and Android devices, enabling traders to access their accounts and trade on the go. The mobile apps provide a range of features, including real-time quotes, interactive charts, and the ability to place and manage trades directly from a smartphone or tablet.

In addition to these platforms, LegacyFX also supports the use of automated trading strategies through expert advisors (EAs) and trading bots. Traders can develop and implement their own EAs or use third-party solutions to automate their trading activities based on predefined rules and algorithms.

To start trading with LegacyFX, simply choose the platform that best suits your needs and preferences, and log in using your account credentials. For more information on how to set up and use each platform, visit the broker's official website [LegacyFX] or contact their customer support team for assistance.

Trading Platforms Comparison Table

| Feature | MT5 | Web Trader | Mobile Trading |

|---|---|---|---|

| User-friendly Interface | Yes | Yes | Yes |

| Advanced Charting | Yes | Limited | Limited |

| Technical Indicators | 38+ | Basic | Basic |

| Timeframes | 21 | 7 | 7 |

| Forex Instruments | Yes | Yes | Yes |

| Stocks | Yes | Limited | Yes |

| Indices | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes |

| Cryptocurrencies | Yes | No | No |

| Automated Trading | Yes | No | No |

| Customizable Layout | Yes | Limited | Limited |

| One-Click Trading | Yes | Yes | Yes |

| Mobile Apps | Yes | Yes | n/a |

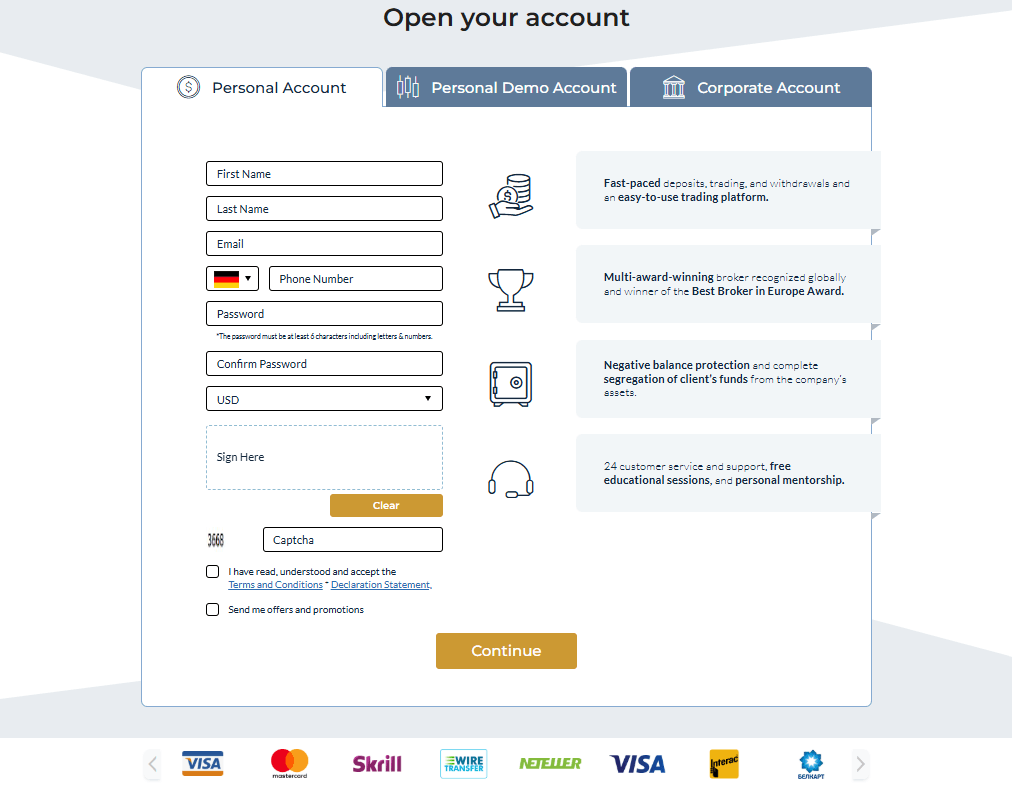

LegacyFX How to Open an Account: A Step-by-Step Guide

Opening an account with LegacyFX is a straightforward process that can be completed in a few simple steps:

- Visit the LegacyFX website: Navigate to the official LegacyFX website [legacyfx.com] and click on the "Open an Account" or "Sign Up" button.

- Choose your account type: Select the type of account you wish to open, such as Standard, Bronze, Silver, Gold, Platinum, Premium, or VIP. Each account type has different features, minimum deposit requirements, and trading conditions.

- Complete the registration form: Fill out the registration form with your personal information, including your name, email address, phone number, and country of residence. You will also need to create a password for your account.

- Verify your email: After submitting the registration form, you will receive an email from LegacyFX with a verification link. Click on the link to verify your email address and activate your account.

- Provide additional information: Once your email is verified, log in to your LegacyFX account and complete your profile by providing additional information, such as your full address, date of birth, and proof of identity (e.g., passport or government-issued ID).

- Fund your account: To start trading, you will need to fund your account. Go to the deposit section of your account and choose your preferred payment method, such as credit/debit card, bank wire transfer, or e-wallet. Follow the instructions provided to complete the deposit process.

- Start trading: Once your account is funded, you can download and install the trading platform of your choice (e.g., MetaTrader 4 or MetaTrader 5) or access the web-based trading platform. Log in using your account credentials and start trading the markets.

Note: LegacyFX may require additional documentation, such as proof of address or proof of funds, to comply with anti-money laundering (AML) and know-your-customer (KYC) regulations. Be sure to provide any requested documents promptly to avoid delays in account verification and funding.

If you encounter any issues or have questions during the account opening process, don't hesitate to contact LegacyFX's customer support team for assistance.

Charts and Analysis

LegacyFX provides its clients with a comprehensive suite of trading tools and educational resources to support their trading activities and help them make informed decisions. These include:

Trading Tools

- Advanced charting package with a wide range of technical indicators and drawing tools

- Real-time market news and analysis from top providers

- Economic calendar highlighting key market events and data releases

- Forex calculator for computing potential profits, losses, and margin requirements

- Volatility protection tools for managing risk in fast-moving markets

Educational Resources

- Beginner's guide to forex trading, covering the basics of the market and how to get started

- Video tutorials on using the MetaTrader 4 and MetaTrader 5 platforms

- Webinars hosted by expert traders, covering various trading strategies and market analysis

- E-books and articles on trading psychology, risk management, and advanced trading concepts

- FAQ section addressing common questions about the broker's services and trading conditions

Market Insights

- Daily market analysis and trading ideas from LegacyFX's team of experts

- Weekly market outlook, providing an overview of key events and potential trading opportunities

- Fundamental analysis reports on major currencies and asset classes

- Technical analysis reports highlighting key levels and chart patterns to watch

- Market sentiment indicators and positioning data to gauge market trends

These resources can be accessed through the LegacyFX website [legacyfx.com], within the trading platforms, or via email subscription. The broker regularly updates and expands its educational offerings to ensure that clients have access to the latest tools and insights to support their trading.

While LegacyFX provides a robust selection of educational resources, it's important for traders to carefully consider the quality and relevance of these materials to their individual trading needs and goals. The broker's educational content may be more suitable for beginner to intermediate traders, while advanced traders may require more specialised resources.

As with any educational material, it's crucial to combine the insights gained from LegacyFX's resources with independent research and analysis to develop a well-rounded understanding of the markets and trading strategies. Traders should also be aware that educational content provided by brokers may be influenced by the broker's own interests and may not always be entirely objective.

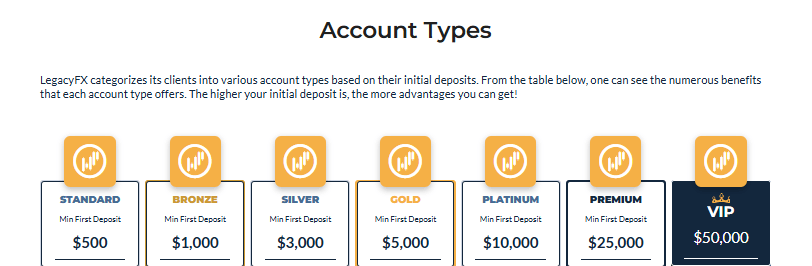

LegacyFX Account Types

LegacyFX offers a range of account types to cater to the diverse needs and preferences of traders at different levels of experience and with varying investment objectives.

The broker's account types include:

Standard Account

- Minimum deposit: $500

- Spreads from 1.6 pips

- Leverage up to 1:200

- No commission on trades

- Minimum lot size: 0.01

- Swap-free option available

Bronze Account

- Minimum deposit: $1,000

- Spreads from 1.5 pips

- Leverage up to 1:200

- No commission on trades

- Minimum lot size: 0.01

- Swap-free option available

- Access to additional trading tools and resources

Silver Account

- Minimum deposit: $3,000

- Spreads from 1.2 pips

- Leverage up to 1:200

- No commission on trades

- Minimum lot size: 0.01

- Swap-free option available

- Access to additional trading tools and resources

- Personal account manager

Gold Account

- Minimum deposit: $5,000

- Spreads from 0.9 pips

- Leverage up to 1:200

- No commission on trades

- Minimum lot size: 0.01

- Swap-free option available

- Access to additional trading tools and resources

- Personal account manager

- Priority withdrawal processing

Platinum Account

- Minimum deposit: $10,000

- Spreads from 0.7 pips

- Leverage up to 1:200

- No commission on trades

- Minimum lot size: 0.01

- Swap-free option available

- Access to additional trading tools and resources

- Personal account manager

- Priority withdrawal processing

- VIP customer support

Premium Account

- Minimum deposit: $25,000

- Spreads from 0.5 pips

- Leverage up to 1:200

- No commission on trades

- Minimum lot size: 0.01

- Swap-free option available

- Access to additional trading tools and resources

- Personal account manager

- Priority withdrawal processing

- VIP customer support

- Exclusive market insights and analysis

VIP Account

- Minimum deposit: $50,000

- Spreads from 0.1 pips

- Leverage up to 1:200

- No commission on trades

- Minimum lot size: 0.01

- Swap-free option available

- Access to additional trading tools and resources

- Dedicated personal account manager

- Priority withdrawal processing

- VIP customer support

- Exclusive market insights and analysis

- Invitations to VIP events and webinars

All LegacyFX accounts offer access to the broker's range of trading platforms, including MetaTrader 4, MetaTrader 5, Web Trader, and mobile trading apps. Clients can also benefit from the broker's educational resources, market analysis, and customer support, regardless of their account type.

When choosing an account type, traders should consider factors such as their investment budget, trading style, and the level of support and resources they require. It's important to note that higher-tier accounts may offer tighter spreads and additional features but also require a larger minimum deposit.

Traders can upgrade their account type at any time by meeting the minimum deposit requirement for the desired account level and contacting LegacyFX's customer support team.

Account types Comparison Table

| Feature | Standard | Bronze | Silver | Gold | Platinum | Premium | VIP |

|---|---|---|---|---|---|---|---|

| Min. Deposit | $500 | $1,000 | $3,000 | $5,000 | $10,000 | $25,000 | $50,000 |

| Spreads From | 1.6 pips | 1.5 pips | 1.2 pips | 0.9 pips | 0.7 pips | 0.5 pips | 0.1 pips |

| Leverage | 1:200 | 1:200 | 1:200 | 1:200 | 1:200 | 1:200 | 1:200 |

| Commission | No | No | No | No | No | No | No |

| Min. Lot Size | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 |

| Swap-Free | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Trading Tools | Standard | Extra | Extra | Extra | Extra | Extra | Extra |

| Account Manager | No | No | Yes | Yes | Yes | Yes | Dedicated |

| Withdrawal Priority | Standard | Standard | Standard | High | High | High | High |

| VIP Support | No | No | No | No | Yes | Yes | Yes |

| Exclusive Insights | No | No | No | No | No | Yes | Yes |

| VIP Events | No | No | No | No | No | No | Yes |

Negative Balance Protection

Negative balance protection is a crucial risk management feature offered by LegacyFX to ensure that traders cannot lose more than the funds available in their trading account. This protection is particularly important for traders who use leverage, as it helps to mitigate the risk of incurring substantial losses that exceed the account balance. In the event of extreme market volatility or unexpected market gaps, traders with leveraged positions may see their account balance fall into negative territory, effectively owing money to the broker. However, with LegacyFX's negative balance protection, the broker assumes responsibility for any negative balance, effectively capping the trader's maximum loss at the level of their account balance. For example, if a trader has an account balance of $1,000 and experiences a loss that would typically result in a negative balance of -$500, LegacyFX's negative balance protection would kick in, and the trader's balance would be brought back to zero. This ensures that traders cannot lose more than their initial investment, providing a crucial safety net and peace of mind. It's important to note that while negative balance protection is an essential risk management tool, it should not be relied upon as a substitute for proper risk management and trading discipline. Traders should still employ sound risk management strategies, such as setting appropriate stop-loss orders, maintaining reasonable leverage levels, and diversifying their trading portfolio to minimise potential losses. LegacyFX's commitment to providing negative balance protection demonstrates the broker's focus on client welfare and risk management. This feature, combined with the broker's other risk management tools and educational resources, helps create a more secure and supportive trading environment for both novice and experienced traders.

LegacyFX Deposits and Withdrawals

LegacyFX offers a range of convenient deposit and withdrawal methods to cater to the needs of its global client base. The broker aims to make the process of funding and withdrawing from trading accounts as seamless and efficient as possible.

deposit Method

| Method | Available Options | Processing Time | Minimum Deposit |

|---|---|---|---|

| Credit/Debit Cards | Visa, Mastercard | Instant | Varies by account type |

| Bank Wire Transfer | N/A | Few business days | Varies by account type |

| E-wallets | Skrill, Neteller | Instant | Varies by account type |

| Cryptocurrency | Bitcoin, Ethereum, Litecoin | Instant | Varies by account type |

Withdrawal Methods

| Method | Available Options | Processing Time | Notes |

|---|---|---|---|

| Credit/Debit Cards | Visa, Mastercard | Processed within 24 hours | Time to reach client may vary |

| Bank Wire Transfer | N/A | Processed within 24 hours | May take a few business days |

| E-wallets | Skrill, Neteller | Processed within 24 hours | Time to reach client may vary |

| Cryptocurrency | Bitcoin, Ethereum, Litecoin | Processed within 24 hours | Time to reach client may vary |

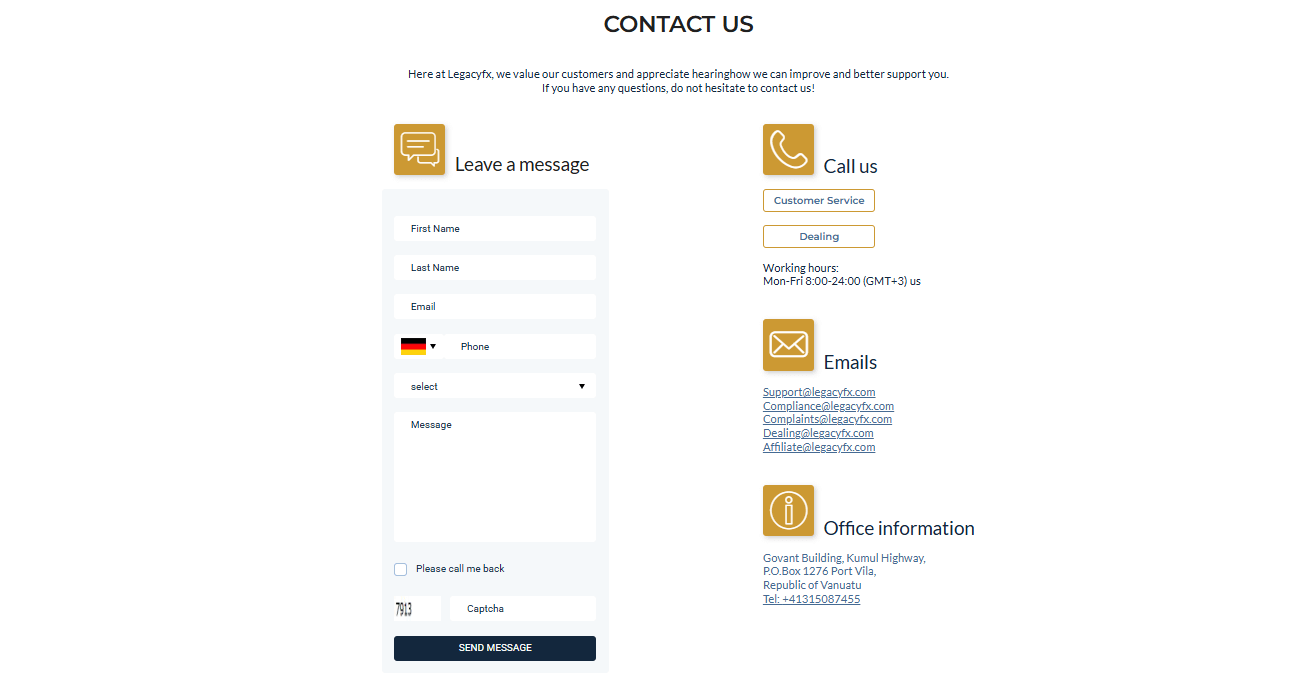

Support Service for Customer

The broker offers several channels through which clients can reach out for support:

Live Chat: LegacyFX provides a live chat feature on its website, allowing clients to connect with a support representative in real-time. This is often the quickest way to get answers to simple queries or to address urgent issues.

Email: Clients can send an email to support@legacyfx.com for any enquiries or concerns. The customer support team aims to respond to all emails within 24 hours, although response times may be longer during weekends or public holidays.

Phone: LegacyFX offers phone support via the following numbers:

The broker offers several channels through which clients can reach out for support:

Live Chat: LegacyFX provides a live chat feature on its website, allowing clients to connect with a support representative in real-time. This is often the quickest way to get answers to simple queries or to address urgent issues.

Email: Clients can send an email to support@legacyfx.com for any enquiries or concerns. The customer support team aims to respond to all emails within 24 hours, although response times may be longer during weekends or public holidays.

Phone: LegacyFX offers phone support via the following numbers:

- International: +41-315087455

- Email: info@legacyfx.by

- Phone: +375 291788410

Customer Support Comparison Table

| Support Channel | Availability |

|---|---|

| Live Chat | 24/5 |

| support@legacyfx.com | |

| Phone | +41-315087455 (International), +375 291788410 (Local) |

| Social Media | Facebook, Twitter |

| FAQ Section | Available on website |

Prohibited Countries

LegacyFX adheres to strict regulatory guidelines and legal requirements, which means that it cannot offer its services to residents of certain countries. These restrictions are put in place to ensure compliance with international laws and to protect both the broker and its clients from potential legal repercussions.

The list of prohibited countries includes:

- United States of America

- Canada

- Iran

- North Korea

- Sudan

- Syria

- Cuba

- Ivory Coast

- Jamaica

- Morocco

Residents of these countries are not permitted to open an account with LegacyFX or access its trading services. The broker implements strict identity verification procedures to ensure that clients from prohibited countries cannot register or trade on its platform.

The reasons for these restrictions vary from country to country but generally stem from factors such as:

- Local regulations: Some countries have stringent regulations governing online trading and forex brokers, making it difficult or impossible for LegacyFX to operate legally in those jurisdictions.

- Economic sanctions: Countries like Iran, North Korea, and Syria are subject to international economic sanctions, which prohibit companies from offering financial services to residents of these nations.

- High-risk jurisdictions: Some countries are considered high-risk due to factors such as money laundering, terrorist financing, or political instability. LegacyFX may choose to avoid operating in these jurisdictions to mitigate potential risks.

Clients who attempt to access LegacyFX's services from a prohibited country may have their accounts blocked or terminated, and any funds in the account may be frozen pending further investigation. It is the client's responsibility to ensure that they are not breaching any laws or regulations by trading with LegacyFX.

If you are a resident of a prohibited country and wish to trade forex or other financial instruments, it is advisable to seek out a broker that is legally authorised to operate in your jurisdiction. Always ensure that you are trading with a properly regulated and licensed broker to protect your funds and ensure a safe trading experience.

Prohibited Countries List

- LegacyFX does not provide services for residents of the United States of America, Canada, Iran, North Korea, Sudan, Syria, Cuba, Ivory Coast, Jamaica, and Morocco.

Special Offers for Customers

LegacyFX provides a range of special offers and promotions designed to enhance the trading experience for both new and existing clients. These offers can help traders maximise their potential returns, reduce trading costs, and access exclusive features and resources.

Some of the notable special offers provided by LegacyFX include:

- Loyalty Program: LegacyFX rewards its loyal clients with a tiered loyalty program that offers various benefits, such as cashback on trades, access to exclusive market analysis, and invitations to VIP events. Clients can progress through the loyalty tiers by maintaining a certain trading volume or account balance.

- Refer-a-Friend: Clients who refer their friends or family to LegacyFX can earn a referral bonus of up to $500 per referred client who opens an account and meets the minimum trading requirements. This offer allows clients to earn additional income while helping their friends benefit from LegacyFX's services.

- Trading Competitions: LegacyFX occasionally hosts trading competitions where clients can compete against each other for prizes such as cash rewards, bonus funds, or luxury items. These competitions can add an element of excitement to trading and provide an opportunity for skilled traders to showcase their abilities.

- Educational Offers: LegacyFX may offer free or discounted access to educational resources, such as webinars, e-books, or trading courses, to help clients improve their trading knowledge and skills. These offers can be especially valuable for novice traders looking to learn more about the markets and trading strategies.

It is important to note that special offers and promotions may be subject to specific terms and conditions, such as minimum deposit requirements, trading volume thresholds, or time limitations. Clients should carefully review the terms of each offer before participating to ensure that they understand the requirements and potential benefits.

Additionally, while special offers can provide a boost to trading capital or help reduce costs, they should not be the sole reason for choosing a broker. Clients should always prioritise factors such as regulation, trading conditions, and overall security when selecting a broker.

Conclusion

Based on my comprehensive review of LegacyFX, I can confidently say that they are a reliable and trustworthy broker that offers a solid trading experience for both novice and experienced traders.

One of the key factors that sets LegacyFX apart is their commitment to regulatory compliance. As a multi-regulated broker, they adhere to strict guidelines set by several well-respected financial authorities, including the VFSC, CySEC, FCA, NBRB, and BaFin. This level of oversight provides traders with peace of mind, knowing that their investments are in safe hands.

Another notable aspect of LegacyFX is the wide range of tradable assets they offer. With over 200 instruments across forex, stocks, indices, commodities, and cryptocurrencies, traders have ample opportunities to diversify their portfolios and capitalise on market movements. The broker's competitive spreads and flexible leverage options further enhance the trading experience.

LegacyFX's choice of trading platform, the industry-standard MetaTrader 5, ensures that traders have access to powerful tools and features for analysing markets, executing trades, and managing their positions. The user-friendly interface and availability of multiple account types cater to traders with varying needs and preferences.

The broker's educational resources and customer support are also commendable. The comprehensive collection of educational materials, including webinars, e-books, and tutorials, helps traders improve their knowledge and skills. Meanwhile, the responsive and knowledgeable customer support team ensures that any issues or concerns are promptly addressed.

However, it is worth noting that LegacyFX's high minimum deposit requirements for some account types may be a barrier for traders with limited capital.

Despite this minor drawback, LegacyFX's overall offering is solid and well-rounded. The broker's commitment to security, transparency, and client satisfaction shines through in their services and support. Traders can benefit from the diverse range of assets, competitive trading conditions, and user-friendly platforms.

In conclusion, I believe that LegacyFX is a reliable choice for traders seeking a reputable and well-established broker. Their comprehensive offering caters to a wide range of trading styles and preferences, while their focus on regulation and client support provides a secure and user-friendly trading environment. As with any financial decision, traders should carefully consider their individual needs and conduct thorough research before selecting a broker. However, based on my review, LegacyFX is certainly a strong contender in the competitive world of online trading.

See user ratings across the broker reviews scoreboard.

Deep liquidity pools detailed in the FXPrimus review.