Libertex Review 2025: A Comprehensive Forex Broker for Modern Traders

Libertex

Cyprus

Cyprus

-

Minimum Deposit $10

-

Withdrawal Fee $varies

-

Leverage 1000:1

-

Minimum Order 0.01

-

Forex Available

-

Crypto Available

-

Stock Available

-

Indices Available

Licenses

Cyprus Market Making (MM)

Cyprus Market Making (MM)

Softwares & Platforms

Customer Support

+35722025100

(English)

+35722025100

(English)

Supported language: Chinese (Simplified), English, Portuguese, Arabic, Spanish

Social Media

Summary

Libertex is a long-standing online broker with over 25 years in the industry, offering a user-friendly trading platform, low minimum deposit, and access to over 250 assets across forex, stocks, crypto, and more. The platform supports both MT4 and MT5 alongside its proprietary software, catering to various trader preferences. While it boasts competitive spreads and commission-free investing for stocks and ETFs, concerns remain due to its unverifiable regulatory status under CySEC. Educational tools and promotions are available, but there’s no Islamic account option, and geographic restrictions apply. Overall, it’s a solid choice for low-budget or experienced traders—provided regulatory caution is exercised.

- Wide range of tradable assets across multiple markets

- Low minimum deposit of just $10

- User-friendly proprietary trading platform

- Commission-free stock and ETF investing

- Competitive spreads and leverage Up to 1:30 for retail clients, 1:1000 for professionals

- 24/5 multilingual customer support

- Free demo account for practice trading

- Unverifiable regulatory status

- Limited educational resources compared to some competitors

- No Islamic swap-free accounts

- Inactivity fees after 180 days of no trading activity

- Restricted in some countries, including the USA and Japan

Overview

Libertex, established in 1997 as part of the Forex Club Group, is an internationally recognised online broker that offers a wide range of trading instruments to millions of clients across 120+ countries. With a strong focus on user-friendly platforms and low-cost trading, Libertex aims to make financial markets accessible to investors and traders of all experience levels.

Over the years, Libertex has received numerous prestigious awards for its services, including "Best Trading Platform" (Forex Report, 2020) and "Best Crypto Broker" (European CEO Awards, 2021). As part of the Libertex Group, which boasts over 2.9 million clients worldwide and a history spanning more than two decades, Libertex leverages extensive industry expertise to deliver a competitive and reliable trading environment.

For more detailed information on Libertex's offerings, visit the broker's official website at www.libertex.com.

Overview table

| Key Facts | |

|---|---|

| Website | libertex.com |

| Headquarters | Cyprus |

| Founded | 1997 |

| Regulation | Claims CySEC, but unverifiable |

| Trading Platforms | Libertex, MT4, MT5 |

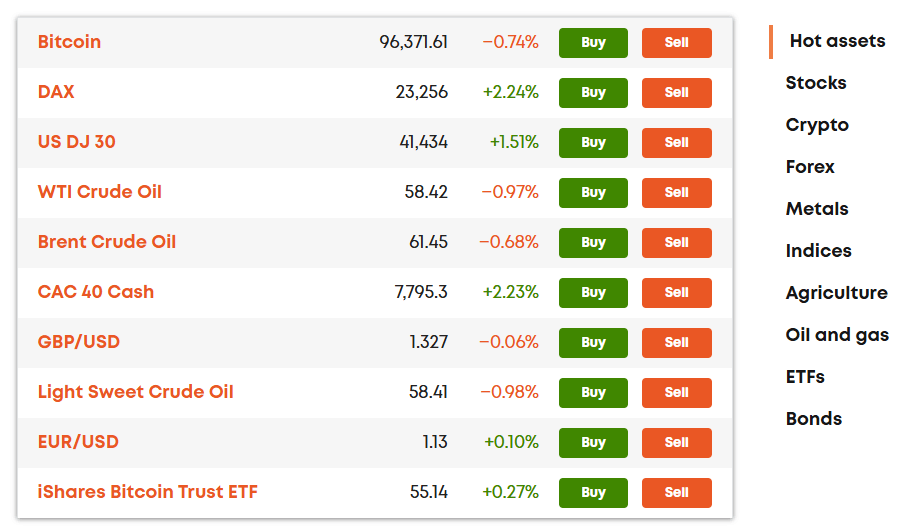

| Markets | Forex, Stocks, Indices, Commodities, Crypto, ETFs, Bonds |

| Minimum Deposit | $10 |

| Deposit Methods | Credit/Debit Cards, E-wallets, Bank Transfer |

| Customer Support | 24/5 via Live Chat, Email, Phone |

Facts List

- Part of the Libertex Group, serving over 2.9 million clients globally

- 25+ years of experience in the online trading industry

- Offers 250+ tradable assets across forex, stocks, commodities, indices, and crypto

- Tight spreads starting from 0.0 pips on EUR/USD

- Leverage Up to 1:30 for retail clients, 1:1000 for professionals

- Minimum deposit of just $10 to start trading

- Supports the user-friendly Libertex platform, as well as MT4 and MT5

- Provides commission-free stock and ETF investing through the Libertex Invest account

- Offers educational resources, including webinars, tutorials, and a demo account

- 24/5 customer support available in 9 languages via live chat, email, and phone

Libertex Licenses and Regulatory

Libertex claims to be regulated by the Cyprus Securities and Exchange Commission (CySEC) through its Cypriot subsidiary, Indication Investments Ltd. The company states that it operates under CySEC license number 164/12. However, upon attempting to verify this information, I could not find definitive confirmation of Libertex's regulatory status on the CySEC website or other official sources.

It's important to note that proper regulation is crucial for ensuring the safety and security of client funds. Regulated brokers must adhere to strict guidelines regarding segregation of client funds, financial reporting, and transparency in their operations. The lack of verifiable regulatory oversight raises concerns about Libertex's trustworthiness and reliability.

While the broker does implement security measures like SSL encryption, two-factor authentication, and segregated client funds, the absence of confirmed regulation remains a significant red flag. As with any financial decision, I recommend exercising caution and conducting thorough due diligence before depositing funds or trading with Libertex.

Regulations

Cyprus Securities and Exchange Commission (CySEC)

- Subsidiary: Indication Investments Ltd

- License Number: 164/12

Trading Instruments

Libertex offers a diverse selection of tradable instruments, enabling clients to access multiple financial markets from a single platform. The broker's asset lineup includes:

| Asset Class | Details |

|---|---|

| Forex Currency Pairs | 50+ pairs including majors, minors, and exotics with competitive spreads |

| Global Stocks | 250+ stocks from US, Europe, and Asia-Pacific regions |

| Stock Indices | 10+ indices including S&P 500, NASDAQ, FTSE 100, DAX |

| Commodities | 10+ commodities including gold, silver, oil, and agricultural products |

| Cryptocurrencies | 25+ cryptos including Bitcoin, Ethereum, Litecoin, and Ripple |

| ETFs and Bonds | A range of ETFs and government bonds for portfolio diversification |

Trading Platforms

Libertex provides clients with a choice of advanced trading platforms to suit different preferences and needs:

Libertex Platform

The broker's proprietary web and mobile platform offers a user-friendly interface with intuitive navigation, making it suitable for both beginners and experienced traders. Key features include:

- Advanced charting tools with 100+ indicators and drawing tools

- Customizable layouts and watchlists

- Integrated news feed and economic calendar

- One-click trading and risk management tools

MetaTrader 4 (MT4)

Libertex supports the popular MT4 platform, known for its reliability, advanced charting capabilities, and extensive range of technical indicators. MT4 also allows for automated trading through expert advisors (EAs) and custom scripts.

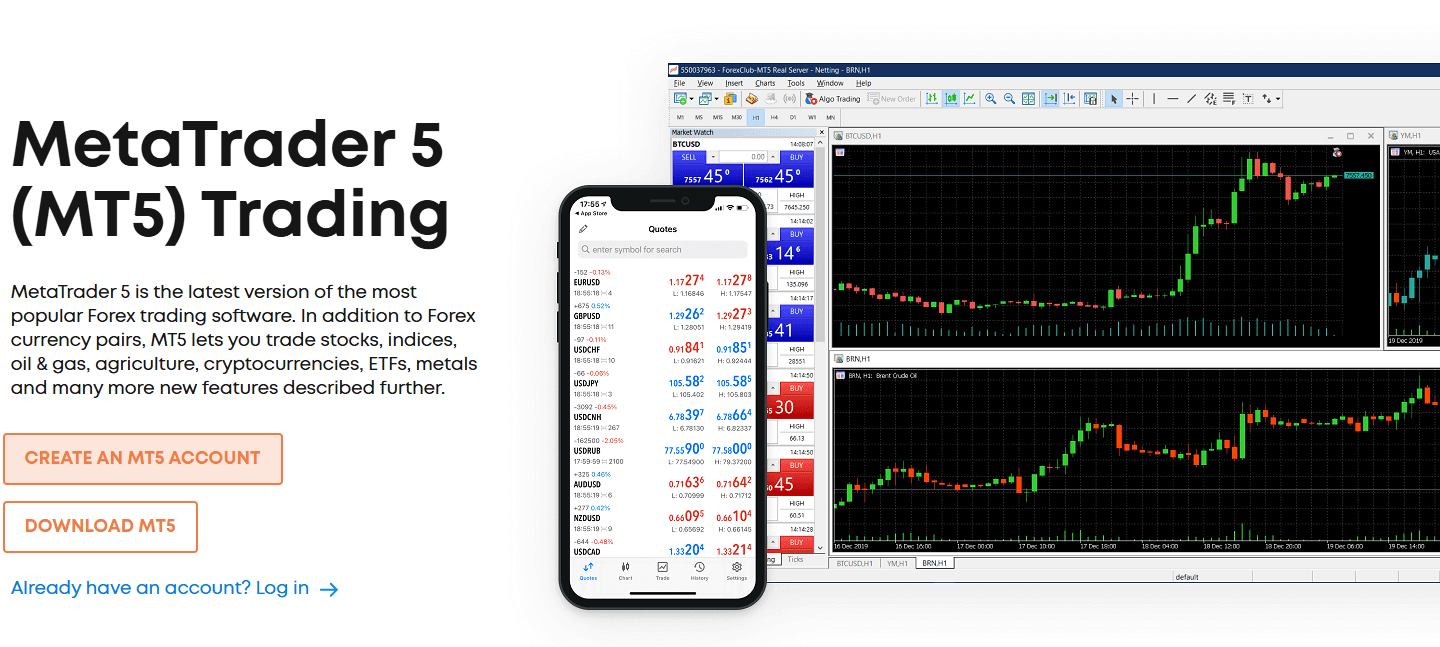

MetaTrader 5 (MT5)

Traders can also opt for the MT5 platform, which builds upon the features of MT4 while offering additional functionalities such as depth of market (DOM), a built-in economic calendar, and expanded timeframes.

All three platforms are available as web-based versions and mobile apps for iOS and Android devices, ensuring that traders can access their accounts and manage positions on the go.

Trading Platforms Comparison Table

| Feature | Libertex | MT4 | MT5 |

|---|---|---|---|

| Web Platform | ✓ | ✓ | ✓ |

| Mobile Apps | ✓ | ✓ | ✓ |

| Desktop Platform | - | ✓ | ✓ |

| Automated Trading | - | ✓ | ✓ |

| Technical Indicators | 100+ | 30+ | 40+ |

| Drawing Tools | ✓ | ✓ | ✓ |

| Integrated News | ✓ | - | ✓ |

| Economic Calendar | ✓ | - | ✓ |

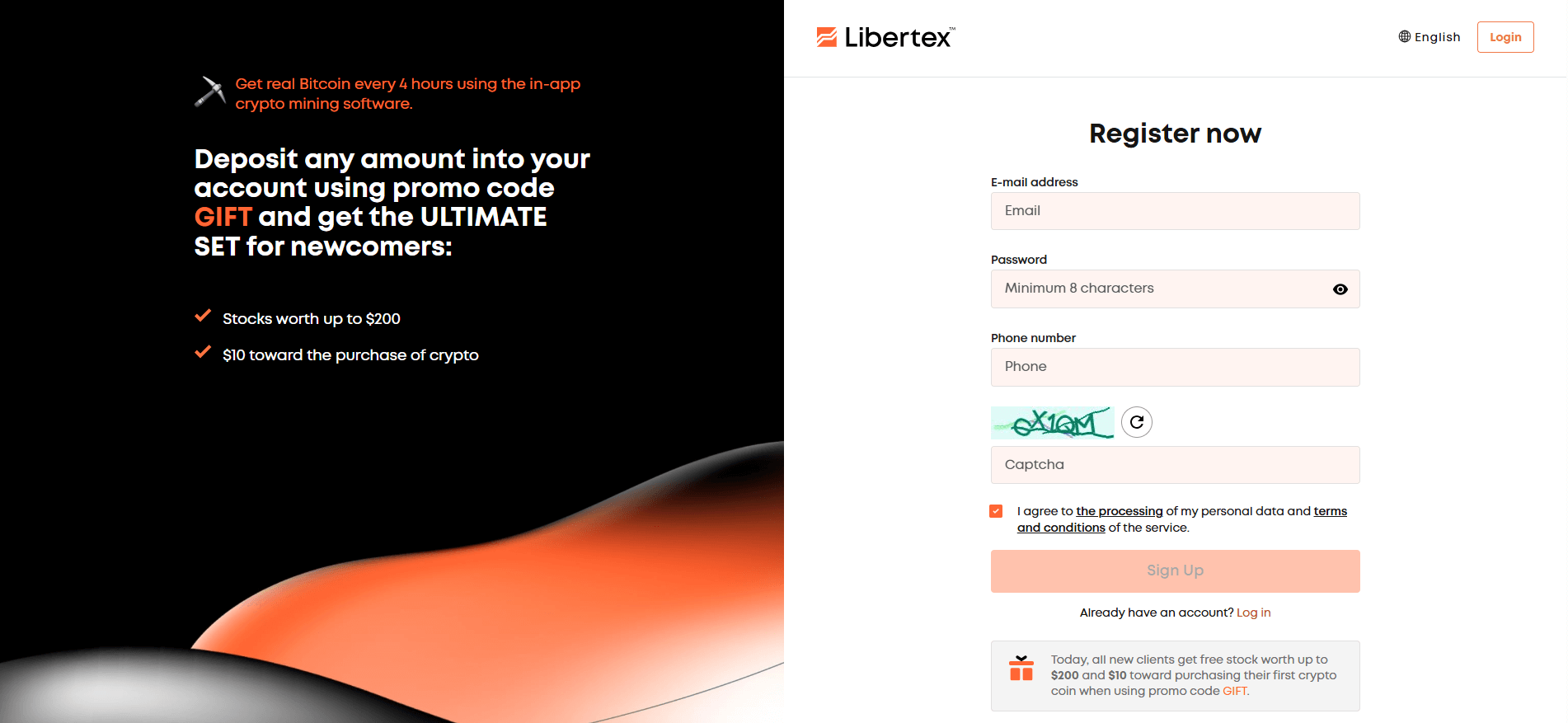

Libertex How to Open an Account: A Step-by-Step Guide

Opening an account with Libertex is a straightforward process that can be completed online in a few simple steps:

- Visit the Libertex website at www.libertex.com and click on the "Open Account" button.

- Fill in the registration form with your personal details, including your name, email address, phone number, and country of residence.

- Choose your preferred account type (Libertex Invest or Libertex Trade) and base currency.

- Agree to the broker's terms and conditions and privacy policy.

- Verify your email address by clicking on the confirmation link sent to your registered email.

- Log in to your newly created account and complete the verification process by submitting proof of identity (e.g., passport, ID card) and proof of address (e.g., utility bill, bank statement).

- Once your account is verified, you can make your initial deposit using one of the available payment methods (credit/debit card, e-wallet, bank transfer).

- Download the Libertex trading platform or log in to the web-based platform to start trading.

The minimum deposit required to open an account is $10, and the verification process typically takes 1-2 business days. If you have any issues or questions during the account opening process, you can contact Libertex's customer support team for assistance.

Charts and Analysis

Libertex provides a range of tools and resources to help traders analyse the markets and make informed trading decisions. The broker's offerings include:

| Feature | Description |

|---|---|

| Advanced Charting | Customisable charting tools with various indicators and drawing tools; supports line, bar, and candlestick charts across multiple timeframes. |

| Technical Analysis Tools | 100+ built-in indicators (e.g., moving averages, oscillators, trend tools) and drawing tools (e.g., Fibonacci retracements, trend lines, support/resistance). |

| Fundamental Analysis | Real-time news feeds, economic calendars, market reports, webinars, and educational content on fundamental analysis and trading strategies. |

| Sentiment Indicators | Displays buyer/seller percentages and long/short ratios to help assess market sentiment and spot potential reversals. |

| Libertex Market Insights | Daily video overviews and detailed analysis reports on major assets and economic events, offering actionable trading ideas. |

Libertex Account Types

Libertex offers two main account types catering to different trading styles and objectives:

Libertex Invest Account

Designed for long-term investing, this account allows clients to buy and hold real stocks and ETFs without paying commissions. Features include:

- Minimum deposit of $10

- Fractional share trading (from 0.01 shares)

- No fees for trades, swaps, or inactivity

- Dividend payments credited directly to your account balance

Libertex Trade Account

Tailored for active traders, this account provides access to leveraged CFD trading on forex, stocks, indices, commodities, and cryptocurrencies. Key features include:

- Minimum deposit of $10

- Leverage Up to 1:30 for retail clients, 1:1000 for professionals

- Tight spreads and competitive commissions

- Negative balance protection

- Access to advanced trading platforms (Libertex, MT4, MT5)

- Demo account with virtual funds for risk-free practice

Account Types Comparison Table

| Feature | Libertex Invest | Libertex Trade |

|---|---|---|

| Minimum Deposit | $10 | $10 |

| Instruments | Stocks, ETFs | Forex, Stocks, Indices, Commodities, Crypto |

| Commission | No | Yes |

| Leverage | 1:1 | Up to 1:30 for retail clients, 1:1000 for professionals |

| Trading Platforms | Libertex | Libertex, MT4, MT5 |

| Fractional Shares | Yes | No |

| Demo Account | No | Yes |

Negative Balance Protection

Libertex offers negative balance protection to all clients, ensuring that they cannot lose more than their account balance. In the event that a trader's position goes into negative equity due to extreme market volatility or unexpected events, Libertex will absorb the loss and reset the account balance to zero. This protection is an essential risk management tool, particularly for traders using leverage, as it helps limit potential losses. However, it's important to note that negative balance protection does not cover losses incurred due to slippage, order execution delays, or other technical issues. Traders should still exercise caution and employ proper risk management strategies, such as setting appropriate stop-loss orders and managing their position sizes, to minimise the risk of substantial losses.

Libertex Deposits and Withdrawals

Libertex supports a range of deposit and withdrawal methods, making it easy for clients to manage their funds:

- Credit/Debit Cards: Visa, Mastercard

- E-wallets: Skrill, Neteller, WebMoney, Perfect Money

- Bank Wire Transfer: SEPA, International

- Local Payment Methods: Sofort, iDeal, Giropay, Multibanco, Przelewy24

Deposit and Withdrawal Methods

| Payment Method | Deposit | Withdrawal | Processing Time |

|---|---|---|---|

| Credit/Debit Card | Free | 1-2% | Instant (Deposit), 1-5 days (Withdrawal) |

| Skrill | Free | Free | Instant (Deposit), 1-3 days (Withdrawal) |

| Neteller | Free | Free | Instant (Deposit), 1-3 days (Withdrawal) |

| Bank Wire | Free | €29 | 3-5 business days |

Support Service for Customer

Libertex offers multilingual customer support through various channels:

- Live Chat: Available 24/5 on the Libertex website and trading platforms

- Email: support@libertex.com for general enquiries and finance@libertex.com for account-related questions

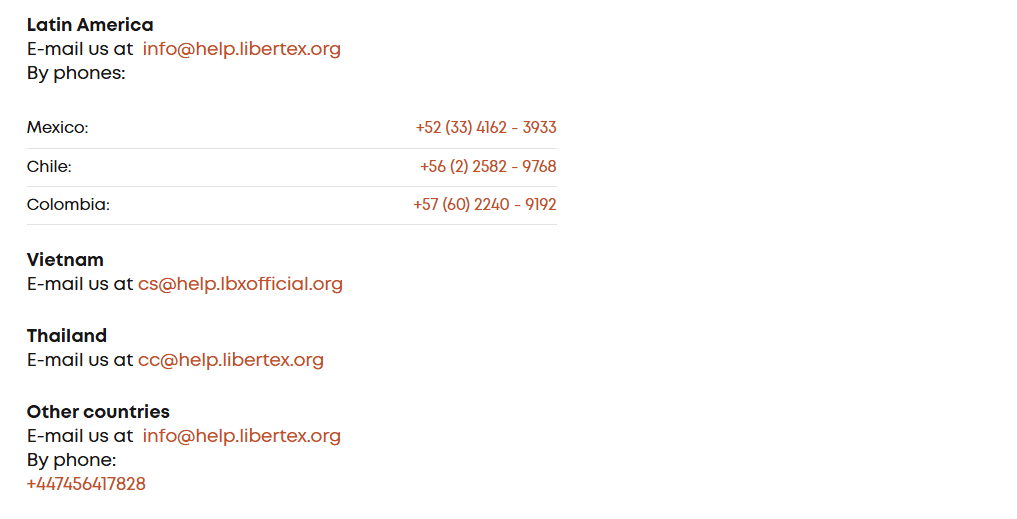

- Phone: +35722025100 (Cyprus), +442036087870 (UK), +61291104156 (Australia)

- Social Media: Facebook, Twitter, Instagram

- Online Contact Form

Customer Support Comparison Table

| Support Channel | Availability | Languages |

|---|---|---|

| Live Chat | 24/5 | 9 |

| 24/5 | 9 | |

| Phone | 24/5 | 9 |

Prohibited Countries

Libertex does not accept clients from the following countries and regions due to regulatory restrictions and legal requirements:

- United States

- Canada

- Japan

- Belgium

- Israel

- Palestine

- Iran

- North Korea

- Sudan

- Syria

- Yemen

Additionally, residents of countries identified as high-risk or non-cooperative jurisdictions by the Financial Action Task Force (FATF) may also be restricted from opening an account with Libertex.

It's important to note that these restrictions are subject to change based on evolving regulations and the broker's internal policies. If you are unsure about your eligibility to open an account with Libertex, it's best to contact their customer support team for clarification.

Special Offers for Customers

Libertex frequently offers special promotions and bonuses to attract new clients and reward existing ones. Some of the current offers include:

- Welcome Bonus: New clients can receive a bonus of up to 100% on their first deposit, subject to terms and conditions.

- Loyalty Program: Libertex runs a loyalty program that rewards active traders with cashback, lower spreads, and other exclusive perks based on their trading volume.

- Trading Contests: The broker regularly hosts trading contests where participants can win cash prizes and other rewards based on their trading performance.

It's important to carefully review the terms and conditions of any special offer before participating, as there may be specific requirements or limitations that apply.

Conclusion

Libertex is an established online broker that offers a user-friendly trading experience with a wide range of assets, competitive pricing, and innovative features like commission-free stock investing. The broker's proprietary trading platform, along with support for MT4 and MT5, caters to both beginner and experienced traders.

However, the lack of verifiable regulatory status remains a significant concern for potential clients. While Libertex implements security measures such as segregated client funds and negative balance protection, the absence of confirmed oversight from a reputable regulatory body raises questions about the broker's transparency and reliability.

Before opening an account with Libertex or any other broker, it's crucial to conduct thorough research, compare multiple options, and assess your own trading goals and risk tolerance. If you do decide to trade with Libertex, start with a small amount of capital and ensure that you fully understand the risks involved in trading leveraged products like CFDs.

As with any financial decision, it's essential to exercise caution, use appropriate risk management strategies, and never invest more than you can afford to lose.

See leverage tiers across the margin broker reviews grid.