Markets.com Review 2025: Is This Forex & CFD Broker Right for You?

Markets.com

Cyprus

Cyprus

-

Minimum Deposit $100

-

Withdrawal Fee $varies

-

Leverage 500:1

-

Spread From 0.6

-

Minimum Order 0.01

-

Forex Available

-

Crypto Available

-

Stock Unavailable

-

Indices Available

Licenses

Cyprus Market Making (MM)

Cyprus Market Making (MM)

South Africa Retail Forex License

South Africa Retail Forex License

Australia Retail Forex License

Australia Retail Forex License

United Kingdom Market Making (MM)

United Kingdom Market Making (MM)

Forex & CFD Brokerage License

Forex & CFD Brokerage License

Softwares & Platforms

Customer Support

+35722278807

(English)

+35722278807

(English)

Supported language: English

Social Media

Summary

Markets.com is a globally regulated broker established in 2008, offering access to over 2,200 instruments across forex, stocks, indices, commodities, and more. It is licensed by top-tier regulators including CySEC, FCA, ASIC, FSCA, and FSC. The broker supports MetaTrader 4/5 and its own Marketsx platform, with a minimum deposit of $100. Markets.com provides multilingual support, competitive spreads starting from 0.6 pips, and robust educational resources for all trader levels.

- Strong regulatory framework with multiple top-tier licenses

- Wide range of tradable assets across various markets

- Advanced trading platforms, including MT4, MT5, and Marketsx

- Competitive spreads and no commissions on most trades

- Comprehensive educational resources and market analysis tools

- Reliable customer support available 24/5 through multiple channels

- Suitable for both beginner and experienced traders

- No fees charged for deposits and withdrawals

- Negative balance protection for Retail accounts

- Regular promotions and bonus offers for clients

- Not available to residents of certain countries, including the US, Canada, and Japan

- Limited range of cryptocurrencies compared to some other brokers

- No direct telephone number for customer support (only callback service)

- Inactivity fee charged after 3 months of no trading activity

- Professional and Institutional accounts require higher minimum deposits

Overview

Markets.com is a well-established online broker that has been providing trading services to clients worldwide since 2008. Founded by Safecap Investments Limited, the company is headquartered in Limassol, Cyprus, and maintains a strong global presence with offices in the UK, Australia, and South Africa.

Over the years, Markets.com has built a solid reputation for offering a wide range of tradable assets, competitive trading conditions, and advanced trading platforms. The broker caters to both beginner and experienced traders, providing educational resources and tools to support their trading journeys.

Markets.com has received numerous industry awards, including "Best Forex Broker" at the UK Forex Awards 2020 and "Best Trading Platform" at the Shares Awards 2019. The broker's commitment to innovation and customer satisfaction has earned them a loyal client base of over 4.3 million traders worldwide.

For more details about Markets.com's offerings, visit their official website at markets.com.

Overview Table

| Category | Details |

|---|---|

| Founded | 2008 |

| Headquarters | Limassol, Cyprus |

| Regulation | CySEC, FCA, ASIC, FSCA, FSC |

| Awards | Best Forex Broker – UK Forex Awards 2020 Best Trading Platform – Shares Awards 2019 |

| Trading Platforms | MetaTrader 4, MetaTrader 5, Marketsx |

| Mobile Apps | iOS, Android |

| Tradable Assets | Forex, Shares, Indices, Commodities, ETFs, Bonds, Options, Cryptocurrencies |

| Base Currencies | USD, EUR, GBP, AUD, PLN, CHF, JPY |

| Deposit Methods | Credit/Debit Card, Bank Transfer, E-wallets (Skrill, Neteller, PayPal) |

| Minimum Deposit | $100 |

| Customer Support | 24/5 via Live Chat, Email, Phone |

| Supported Languages | English, German, Spanish, French, Italian, Arabic, Polish, Russian, Dutch, Swedish |

Facts List

- Markets.com is a multi-asset broker offering over 2,200 tradable instruments.

- The broker is regulated by top-tier authorities such as CySEC, FCA, ASIC, FSCA, and FSC.

- Markets.com offers competitive spreads starting from 0.6 pips on major forex pairs.

- Traders can choose from three account types: Retail, Professional, and Institutional.

- The broker provides access to advanced trading platforms, including MetaTrader 4, MetaTrader 5, and Marketsx.

- Markets.com offers a wide range of educational resources, including webinars, e-books, and video tutorials.

- The broker has a dedicated customer support team available 24/5 via live chat, email, and phone.

- Markets.com has won multiple industry awards for its services and platforms.

- The minimum deposit required to open an account is $100.

- Markets.com serves over 4.3 million clients worldwide.

Markets.com Licenses and Regulatory

Markets.com operates under the strict regulatory oversight of several top-tier authorities, ensuring a safe and transparent trading environment for its clients. The broker's primary regulator is the Cyprus Securities and Exchange Commission (CySEC), which has authorised Safecap Investments Limited, the company behind Markets.com, under license number 092/08.

In addition to CySEC, Markets.com is also regulated by the following authorities:

- Financial Conduct Authority (FCA) in the United Kingdom

- Australian Securities and Investments Commission (ASIC)

- Financial Sector Conduct Authority (FSCA) in South Africa

- Financial Services Commission (FSC) in Mauritius

These multiple regulatory licenses demonstrate Markets.com's commitment to complying with the highest industry standards and providing a secure trading environment for its clients. The broker adheres to strict rules and regulations regarding client fund segregation, risk management, and transparency.

By operating under the supervision of reputable regulatory bodies, Markets.com instills confidence in its clients, knowing that their funds and personal information are protected. The broker's strong regulatory framework sets it apart from less-regulated or offshore brokers that may not offer the same level of security and transparency.

Trading Instruments

Markets.com offers a diverse range of tradable assets, catering to the needs and preferences of various types of traders. The broker provides access to over 2,200 financial instruments across multiple asset classes, including:

| Asset Class | Details |

|---|---|

| Forex | 67 currency pairs (majors, minors, exotics) with spreads starting from 0.6 pips on major pairs like EUR/USD. |

| Shares | Access to 2,000+ global shares from markets including the US, UK, Germany, France, Spain, Italy, Sweden, Norway, and Denmark. |

| Indices | Trade 16 major indices such as the S&P 500, NASDAQ 100, FTSE 100, DAX 30, and Nikkei 225, with spreads from 0.4 points. |

| Commodities | Wide range including gold, silver, oil, natural gas, and agricultural products like wheat, coffee, and sugar. Spreads from 0.03 (gold). |

| ETFs | 50+ exchange-traded funds, offering portfolio diversification across various sectors and asset classes. |

| Bonds | Trade major government bonds, such as the US 10-Year Treasury Note and the German 10-Year Bund. |

| Options | Access to options trading, ideal for hedging strategies or speculating on market volatility. |

| Cryptocurrencies | Trade major cryptos like Bitcoin, Ethereum, Litecoin, and Ripple with competitive spreads and leverage. |

Trading Platforms

Markets.com offers its clients a choice of advanced trading platforms to suit their preferences and trading styles. The broker provides access to the following platforms:

MetaTrader 4 (MT4)

MT4 is one of the most popular trading platforms in the world, known for its user-friendly interface, advanced charting tools, and extensive customisation options. Markets.com's MT4 platform allows traders to access a wide range of trading instruments, execute trades quickly, and use automated trading strategies through Expert Advisors (EAs).

MetaTrader 5 (MT5)

MT5 is the successor to MT4, offering enhanced features and functionality. The platform provides access to a wider range of markets, including stocks and commodities, and offers advanced charting tools, technical indicators, and trading signals. Markets.com's MT5 platform also supports automated trading through EAs and allows for hedging and netting of positions.

Markets

Marketsx is Markets.com's proprietary trading platform, designed to provide a seamless and intuitive trading experience. The platform offers a user-friendly interface, advanced charting tools, and a wide range of trading instruments. Marketsx also provides access to real-time market news, analysis, and insights, helping traders make informed decisions.

Mobile Trading

Markets.com offers mobile trading apps for both iOS and Android devices, allowing traders to access their accounts, execute trades, and monitor the markets on the go. The mobile apps provide a streamlined trading experience and offer features such as real-time quotes, charts, and secure account management.

Web Trading

Traders can access Markets.com's trading platforms directly through their web browsers without the need for any software downloads. The web trading platform offers a convenient way to trade and manage accounts from any computer with an internet connection.

Markets.com's range of trading platforms caters to the needs of both beginner and experienced traders, providing them with the tools and resources necessary to execute their trading strategies effectively. The broker continuously updates and enhances its platforms to ensure that clients have access to the latest technology and features.

Trading Platforms Comparison Table

| Feature | MetaTrader 4 (MT4) | MetaTrader 5 (MT5) | Markets | Mobile Trading App | Web Trading |

|---|---|---|---|---|---|

| Markets | Forex, CFDs | Forex, CFDs, Stocks, Futures | Forex, CFDs, Stocks, Options | Forex, CFDs, Stocks | Forex, CFDs |

| Charting Tools | 30+ indicators, 9 timeframes | 38+ indicators, 21 timeframes | 35+ indicators, 9 timeframes | 30+ indicators, 9 timeframes | 30+ indicators, 9 timeframes |

| Automated Trading | Yes (EAs) | Yes (EAs) | No | No | No |

| Trading Signals | Yes | Yes | Yes | Yes | Yes |

| Platform Type | Desktop, Web, Mobile | Desktop, Web, Mobile | Web, Mobile | Mobile | Web |

| Customization | High | High | Medium | Low | Medium |

| Offline Mode | Yes | Yes | No | No | No |

Markets.com How to Open an Account: A Step-by-Step Guide

Opening an account with Markets.com is a straightforward process that can be completed entirely online. Follow these steps to get started:

Step 1: Visit the Markets.com website at www.markets.com and click on the "Open an Account" button.

Step 2: Choose your account type (Retail, Professional, or Institutional) and fill out the registration form with your personal information, including your name, email address, phone number, and country of residence.

Step 3: Verify your email address by clicking on the confirmation link sent to your registered email.

Step 4: Complete the account application by providing additional information, such as your employment status, financial experience, and trading knowledge.

Step 5: Upload the required documentation for identity and address verification. This typically includes a valid government-issued ID (e.g., passport, driver's license) and a recent utility bill or bank statement.

Step 6: Choose your preferred trading platform (MetaTrader 4, MetaTrader 5, or Marketsx) and base currency for your account.

Step 7: Fund your account using one of the available deposit methods, such as credit/debit card, bank transfer, or e-wallets (Skrill, Neteller, PayPal).

Step 8: Once your account is funded and verified, you can start trading on the Markets.com platform.

Charts and Analysis

Markets.com offers a comprehensive range of educational resources and tools to help traders improve their skills and make informed trading decisions. The broker provides access to the following resources:

| Tool | Description |

|---|---|

| Webinars | Regular sessions led by experienced traders and analysts, covering market analysis, strategies, and platform tutorials. |

| Video Tutorials | Comprehensive videos on trading basics, platform navigation, technical analysis, and risk management, suitable for all experience levels. |

| E-books | Downloadable e-books on forex, CFD trading, and trading psychology, written by industry experts for in-depth learning. |

| Trading Guides | Step-by-step guides for beginners covering market fundamentals, leverage use, and risk management principles. |

| Economic Calendar | A dynamic calendar showing key upcoming economic events and releases to help traders anticipate market movements. |

| Market Analysis | Daily analysis from in-house experts covering global markets, with insights on trends, key levels, and trading opportunities. |

| Traders' Trends | Real-time tool showing the most traded instruments among Markets.com clients, useful for gauging market sentiment. |

| Trading Central | Integrated service providing professional technical analysis, trading signals, and actionable market insights from a trusted third-party provider. |

By providing a wide range of educational resources and tools, Markets.com aims to support its clients in their trading journeys and help them develop the knowledge and skills necessary to succeed in the financial markets. The broker regularly updates and expands its educational offering to ensure that traders have access to the latest market insights and analysis.

Markets.com Account Types

Markets.com offers three main account types to cater to the needs of different types of traders:

Retail Account

The Retail account is designed for individual traders who are new to trading or have limited experience. Key features of the Retail account include:

- Minimum deposit of $100

- Access to all trading platforms (MetaTrader 4, MetaTrader 5, Marketsx)

- Competitive spreads starting from 0.6 pips on forex

- Leverage up to 1:30 for forex and 1:20 for indices and commodities

- Negative balance protection

- Access to educational resources and market analysis

Professional Account

The Professional account is suitable for experienced traders who meet certain eligibility criteria, such as having sufficient trading experience and trading volume. Key features of the Professional account include:

- Minimum deposit of $100

- Access to all trading platforms (MetaTrader 4, MetaTrader 5, Marketsx)

- Tighter spreads compared to Retail accounts

- Higher leverage up to 1:300 for forex and 1:200 for indices and commodities

- Access to advanced trading tools and market insights

- Dedicated account manager

Institutional Account

The Institutional account is tailored for corporate clients, such as hedge funds, asset managers, and brokers. Key features of the Institutional account include:

- Customized trading conditions and solutions

- Access to deep liquidity from top-tier banks and liquidity providers

- Flexible leverage and margin requirements

- Advanced reporting and risk management tools

- Dedicated account management and support

In addition to these account types, Markets.com also offers a Demo account, which allows traders to practise trading in a risk-free environment with virtual funds. The Demo account is available for all trading platforms and provides access to real-time market data and trading conditions.

Markets.com's account types are designed to accommodate the diverse needs and preferences of its clients, from beginner traders to professional and institutional investors. The broker offers competitive trading conditions, advanced platforms, and comprehensive support to help traders achieve their financial goals.

Account Types Comparison Table

| Feature | Retail Account | Professional Account | Institutional Account |

|---|---|---|---|

| Minimum Deposit | $100 | $100 | Customized |

| Leverage | Up to 1:30 (forex), 1:20 (indices, commodities) | Up to 1:300 (forex), 1:200 (indices, commodities) | Customized |

| Spreads | From 0.6 pips (forex), competitive | Tighter than Retail | Customized |

| Trading Platforms | MT4, MT5, Marketsx | MT4, MT5, Marketsx | MT4, MT5, Marketsx |

| Educational Resources | Yes | Yes | Yes |

| Market Analysis | Yes | Advanced | Advanced |

| Account Manager | No | Yes | Yes |

| Reporting | Standard | Advanced | Customized |

| Negative Balance Protection | Yes | No | Customized |

Negative Balance Protection

Markets.com offers negative balance protection for its Retail account holders, providing an additional layer of security for traders. Negative balance protection ensures that a trader's account balance cannot fall below zero, even in the event of extreme market volatility or unexpected market movements. With negative balance protection, if a trader's account balance reaches zero due to trading losses, Markets.com will absorb the negative balance, and the trader will not be required to pay additional funds to cover the deficit. This feature helps limit the potential losses a trader can incur and prevents them from owing money to the broker. It is important to note that negative balance protection applies only to Retail accounts and is not available for Professional or Institutional accounts. Professional and Institutional clients are expected to have sufficient experience and risk management strategies in place to manage their trading activities and potential losses. While negative balance protection provides a safety net for Retail traders, it should not be relied upon as a substitute for proper risk management. Traders should always use appropriate risk management techniques, such as setting stop-loss orders and managing their position sizes, to control their exposure to potential losses. Markets.com's negative balance protection is a valuable feature that demonstrates the broker's commitment to protecting its clients' interests and providing a secure trading environment. However, traders should be aware of the terms and conditions associated with negative balance protection and ensure that they fully understand how it works before relying on it as part of their trading strategy.

Markets.com Deposits and Withdrawals

Markets.com offers a range of convenient deposit and withdrawal options to facilitate the smooth transfer of funds for its clients. The broker supports the following payment methods:

Deposit Methods

| Method | Processing Time | Fees Charged by Markets.com | Notes |

|---|---|---|---|

| Credit/Debit Cards | Instant | No | Visa and Mastercard supported |

| Bank Transfer | 2–5 business days | No | International wire transfers |

| E-wallets | Instant | No | Skrill, Neteller, PayPal supported |

Withdrawal Methods

| Method | Processing Time | Fees Charged by Markets.com | Notes |

|---|---|---|---|

| Credit/Debit Cards | 1–5 business days | No | Withdrawals sent to original card used |

| Bank Transfer | 2–5 business days | No | To registered bank account via wire |

| E-wallets | Within 24 hours | No | Skrill, Neteller, PayPal supported |

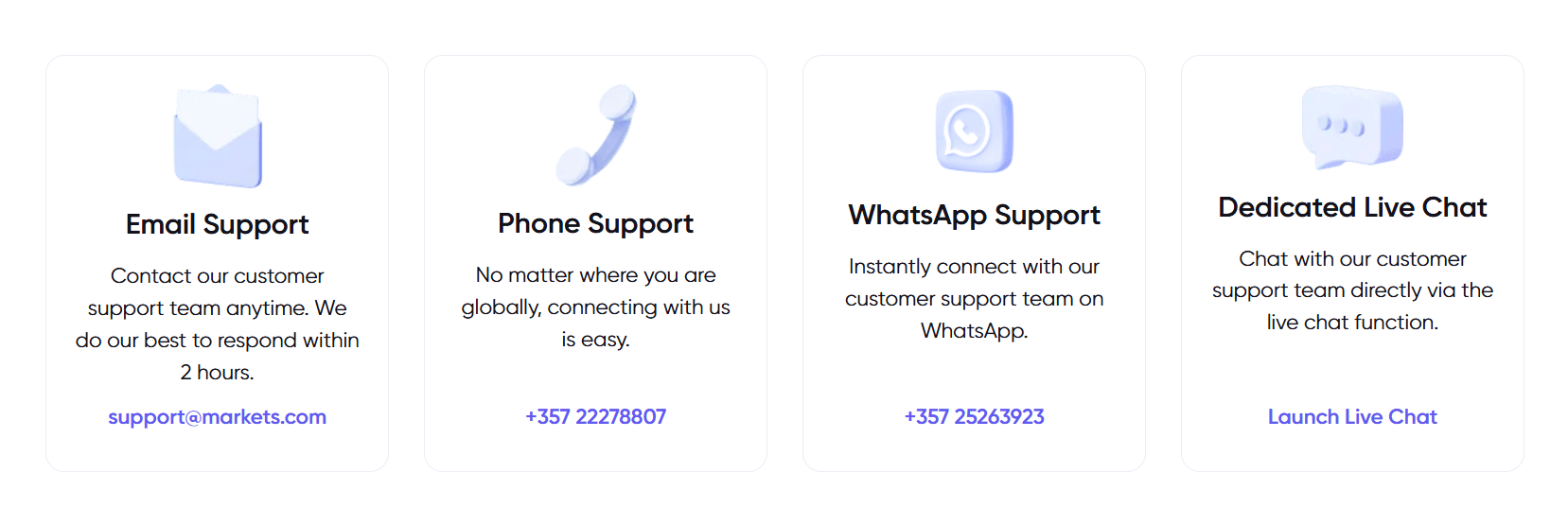

Support Service for Customer

Markets.com places a strong emphasis on providing excellent customer support to ensure that its clients have a smooth and satisfactory trading experience. The broker offers multiple channels for clients to reach out for assistance or enquiries:

- Live Chat: Markets.com provides a live chat feature on its website, allowing traders to connect with a customer support representative in real-time. The live chat service is available 24/5, from Monday to Friday.

- Email Support: Traders can send their enquiries or concerns via email to support@markets.com. The customer support team aims to respond to all emails within 24 hours.

- Phone Support: Markets.com offers phone support in multiple languages, with local phone numbers available for different regions. Traders can find the relevant phone number for their country on the broker's website.

- Knowledge Centre: The Markets.com website features a comprehensive Knowledge Centre that provides answers to frequently asked questions (FAQs) and guides on various topics, such as account opening, trading platforms, and payment methods. The Knowledge Centre is a useful resource for traders to find solutions to common issues or queries.

- Social Media: Markets.com maintains an active presence on social media platforms, such as Facebook, Twitter, and LinkedIn. Traders can follow the broker's social media channels to stay updated on the latest news, promotions, and market insights.

The Markets.com customer support team consists of knowledgeable and experienced professionals who are well-versed in the broker's products, services, and trading platforms. The team strives to provide prompt, accurate, and helpful responses to clients' enquiries and concerns.

In addition to the standard customer support channels, Markets.com also offers a dedicated account management service for its Professional and Institutional clients. These clients have access to a personal account manager who can provide personalised support and guidance on trading-related matters.

Markets.com's commitment to excellent customer support is reflected in the positive feedback and testimonials from its clients. The broker consistently receives high ratings for its responsive and helpful customer service, which is a testament to its client-centric approach.

The Markets.com customer support team consists of knowledgeable and experienced professionals who are well-versed in the broker's products, services, and trading platforms. The team strives to provide prompt, accurate, and helpful responses to clients' enquiries and concerns.

In addition to the standard customer support channels, Markets.com also offers a dedicated account management service for its Professional and Institutional clients. These clients have access to a personal account manager who can provide personalised support and guidance on trading-related matters.

Markets.com's commitment to excellent customer support is reflected in the positive feedback and testimonials from its clients. The broker consistently receives high ratings for its responsive and helpful customer service, which is a testament to its client-centric approach.

Customer Support Comparison Table

| Feature | Availability |

|---|---|

| Live Chat | Yes (24/5) |

| Email Support | Yes |

| Phone Support | Yes (local numbers) |

| Knowledge Center | Yes |

| Social Media | Yes (Facebook, Twitter, LinkedIn) |

| Support Languages | English, German, Spanish, French, Italian, Arabic, Polish, Russian, Dutch, Swedish |

Prohibited Countries

Due to regulatory restrictions and legal requirements, Markets.com does not provide its services to residents of certain countries. The following countries are currently prohibited from opening an account with Markets.com:

- United States

- Canada

- Japan

- Brazil

- Mexico

- Turkey

- Israel

- Iran

- North Korea

- Cuba

- Sudan

- Syria

Please note that this list is subject to change, and additional countries may be added or removed based on changes in regulations or Markets.com's internal policies.

Residents of prohibited countries are not allowed to open an account or trade with Markets.com. The broker implements strict verification procedures to ensure compliance with these restrictions and may request additional documentation to confirm a client's country of residence.

If a trader from a prohibited country attempts to open an account or trade with Markets.com, the broker reserves the right to immediately close the account and cancel any trades. Any funds deposited will be returned to the original source, subject to applicable laws and regulations.

It is the responsibility of the trader to ensure that they are not residing in a prohibited country before attempting to open an account with Markets.com. The broker provides clear information on its website regarding the prohibited countries and updates this information as necessary.

Traders who are unsure about their eligibility to open an account with Markets.com should contact the broker's customer support team for clarification before proceeding with the account opening process.

Regions Where Markets.com Operates

- Europe, Asia, Africa, Middle East, South America, Oceania (excluding prohibited countries)

Special Offers for Customers

Markets.com offers a range of special promotions and bonus programs to reward its clients and enhance their trading experience. Some of the notable offers include:

Welcome Bonus: New clients who open a live trading account and make a qualifying deposit may be eligible for a welcome bonus. The bonus amount varies depending on the size of the deposit and the specific terms of the promotion. For example, Markets.com may offer a 50% bonus on deposits up to a certain amount.

Refer-a-Friend Program: Markets.com runs a referral program that allows existing clients to earn rewards by referring new clients to the broker. When a referred friend opens a live trading account and meets certain trading volume requirements, the referring client may receive a cash bonus or other incentives.

Loyalty Program: Markets.com offers a loyalty program that rewards clients based on their trading activity and account balance. Clients can earn points for each trade they make and for maintaining a certain account balance. These points can be redeemed for various benefits, such as cash bonuses, trading credits, or exclusive event invitations.

Trading Competitions: Periodically, Markets.com organises trading competitions that allow clients to compete against each other for prizes. These competitions typically have specific rules and criteria, such as achieving the highest trading volume or the most profitable trades within a given period. Winners may receive cash prizes, trading credits, or other rewards.

Educational Webinars: While not strictly a promotional offer, Markets.com regularly hosts educational webinars that provide valuable insights and trading strategies from industry experts. These webinars are free to attend for Markets.com clients and can help traders improve their knowledge and skills.

It is important to note that the specific terms and conditions of each promotional offer may vary and are subject to change. Traders should carefully review the details of any promotion before participating and ensure that they understand the requirements and restrictions.

Markets.com's promotional offers are designed to incentivise and reward client loyalty, as well as attract new clients to the broker. However, traders should always consider the overall trading conditions and the suitability of the broker for their individual needs, rather than basing their decision solely on promotional offers.

Conclusion

After conducting a thorough review of Markets.com, I can confidently say that they are a reputable and trustworthy broker that offers a comprehensive trading experience for both beginner and experienced traders.

One of the standout features of Markets.com is their strong regulatory framework. The broker is regulated by multiple top-tier authorities, including CySEC, FCA, ASIC, FSCA, and FSC. This level of regulation provides clients with a high level of protection and ensures that the broker adheres to strict standards of transparency and fair trading practices.

Markets.com offers a wide range of tradable assets, with over 2,200 instruments available across various asset classes, including forex, shares, indices, commodities, ETFs, bonds, options, and cryptocurrencies. This extensive selection allows traders to diversify their portfolios and take advantage of different market opportunities.

The broker provides access to advanced trading platforms, including the popular MetaTrader 4 and MetaTrader 5, as well as their proprietary Marketsx platform. These platforms offer a range of tools and features, such as advanced charting, automated trading, and mobile trading apps, catering to the needs of different types of traders.

Markets.com also offers competitive trading conditions, with tight spreads starting from 0.6 pips on major forex pairs and no commissions on most trades. The broker supports a range of payment methods for deposits and withdrawals, with no fees charged by the broker.

In terms of education and support, Markets.com provides a comprehensive selection of educational resources, including webinars, video tutorials, e-books, and trading guides. The broker also offers daily market analysis and insights, as well as advanced tools like Trading Central and Traders' Trends. The customer support team is available 24/5 through various channels, including live chat, email, and phone, providing prompt and professional assistance.

One potential drawback of Markets.com is that they do not offer their services to residents of certain countries, including the United States, Canada, and Japan, due to regulatory restrictions. However, this is a common limitation among many international brokers and does not detract from the overall quality of their services.

In conclusion, Markets.com is a well-rounded broker that offers a secure, transparent, and feature-rich trading environment. With their strong regulation, wide range of tradable assets, advanced platforms, competitive trading conditions, and comprehensive education and support, Markets.com is well-suited for traders of all levels who are looking for a reliable and reputable broker.

Of course, as with any financial decision, it is essential to conduct your own research and consider your individual trading needs and risk tolerance before choosing a broker. However, based on my assessment, I believe that Markets.com is a solid choice for those seeking a high-quality trading experience.

See which firms offer DMA in the DMA broker reviews catalogue.

Check copy-trading extras in the StarTrader review.