Markets4you Review 2025: MT4/MT5, Spreads & Copy Trading

Markets4you

British Virgin Islands

British Virgin Islands

-

Withdrawal Fee $varies

-

Leverage 4000:1

-

Spread From 0.1

-

Minimum Order 0.01

-

Forex Available

-

Crypto Available

-

Stock Available

-

Indices Available

Licenses

Forex & CFD Brokerage License

Forex & CFD Brokerage License

Global Business License

Global Business License

Softwares & Platforms

Customer Support

Supported language: Arabic, English

Social Media

Summary

Markets4you, rebranded from Forex4you, has been operating since 2007 and is regulated in the BVI and Mauritius. It offers over 150 CFD instruments across forex, stocks, indices, metals, energies, and crypto. Traders can choose between MT4, MT5, or the proprietary Markets4you app with TradingView-style charts, plus copy trading via Share4you. Accounts include Classic Standard, Classic Pro, and Cent Pro, with leverage up to 1:4000 and Islamic (swap-free) options. Deposits and withdrawals feature 0% transfer fees, ~30-minute processing, and Auto-Withdrawal convenience. While competitive in pricing and features, its offshore regulation and very high leverage warrant cautious risk management; service is restricted in the US, EEA, Australia, and other regions.

- Competitive spreads from 0.1 pip on Pro accounts

- Fast execution speeds advertised at 0.1 seconds

- Zero deposit and withdrawal fees from broker

- Multiple platform options including MT4/MT5

- Established operation since 2007

- Copy trading via Share4you platform

- High leverage up to 1:4000 available

- Negative balance protection implemented

- Islamic account options available

- 24/7 global customer support

- Offshore regulatory framework (BVI/Mauritius)

- Restricted from major regulated markets

- Extremely high leverage poses significant risk

- Limited transparency on fund segregation

- No compensation scheme coverage

- Cent account history retention only 3 weeks

- Limited educational content compared to tier-one brokers

- No guaranteed stop-loss options

- Spread markup on Standard accounts

- Marketing claims require verification

Overview

Markets4you, formerly known as Forex4you, represents a multi-asset CFD brokerage platform that has operated in the international trading space since 2007. The broker functions under E-Global Trade & Finance Group, Inc., maintaining primary regulatory authorisation through the British Virgin Islands Financial Services Commission under license SIBA/L/12/1027. Additionally, the company operates through Trade4you International Ltd., a Mauritius-regulated affiliate holding license GB21026460.

The platform advertises impressive operational metrics including over 3 million registered accounts and more than 1.3 billion executed orders throughout its 17-year history. Markets4you positions itself competitively with spreads starting from 0.1 pip, execution speeds from 0.1 seconds, and leverage options extending up to 1:4000. The broker supports industry-standard MetaTrader 4 and MetaTrader 5 platforms alongside proprietary Markets4you Mobile and WebTrader solutions, complemented by Share4you copy trading functionality.

Visit their Official Website at Markets4you.com — Learn More Information About Accounts, Platforms, and Trading Tools

Overview Table

| Aspect | Details |

|---|---|

| Legal Entity | E-Global Trade & Finance Group, Inc. |

| Brand Name | Markets4you (rebranded from Forex4you) |

| Established | 2007 |

| Headquarters | Road Town, Tortola, British Virgin Islands |

| Primary Regulation | BVI FSC - SIBA/L/12/1027 |

| Secondary Entity | Trade4you International Ltd. (Mauritius) |

| Client Base | 3+ million accounts |

| Total Orders | 1.3+ billion executed |

| Awards Claimed | 35 global awards |

| Copy Trading Platform | Share4you (1000+ Leaders) |

Facts List

- Established 2007 – 17 years of operational history in CFD trading

- 3M+ accounts registered with 1.3B+ total orders executed

- Spreads from 0.1 pip on Classic Pro accounts with commission structure

- Execution from 0.1 seconds, according to platform marketing claims

- Leverage up to 1:4000 available across all account types

- Zero deposit/withdrawal fees with 30-minute average processing

- MT4, MT5, and proprietary platforms with TradingView charting integration

- Share4you copy trading featuring 1000+ Leader traders

- Negative balance protection implemented for account safety

- Restricted in major markets, including the US, EEA, Australia and Japan

Markets4you Licenses and Regulatory

| Jurisdiction | Regulator | Entity | License Number | Protection Level |

|---|---|---|---|---|

| British Virgin Islands | FSC BVI | E-Global Trade & Finance Group | SIBA/L/12/1027 | Medium-Low |

| Mauritius | FSC Mauritius | Trade4you International Ltd. | GB21026460 | Medium-Low |

Trading Instruments

Markets4you provides access to CFD trading across multiple asset classes, enabling portfolio diversification and varied trading strategies. The platform offers contracts for difference on major, minor, and exotic forex pairs; global stock CFDs; international equity indices; precious metals and energies; plus cryptocurrency CFDs for digital asset exposure without actual ownership.

Asset Categories Table

| Asset Class | Instruments Available | Typical Spreads | Trading Hours |

|---|---|---|---|

| Forex Pairs | Major, Minor, Exotic | From 0.1 pip (Pro) | 24/5 Market Hours |

| Stock CFDs | Global Equities | Variable by stock | Exchange hours |

| Indices | Major Global Indices | From 0.5 points | Extended hours |

| Commodities | Metals, Energies | From 0.3 points | Market specific |

| Crypto CFDs | Major Cryptocurrencies | From 0.1% | 24/7 Available |

Trading Platforms

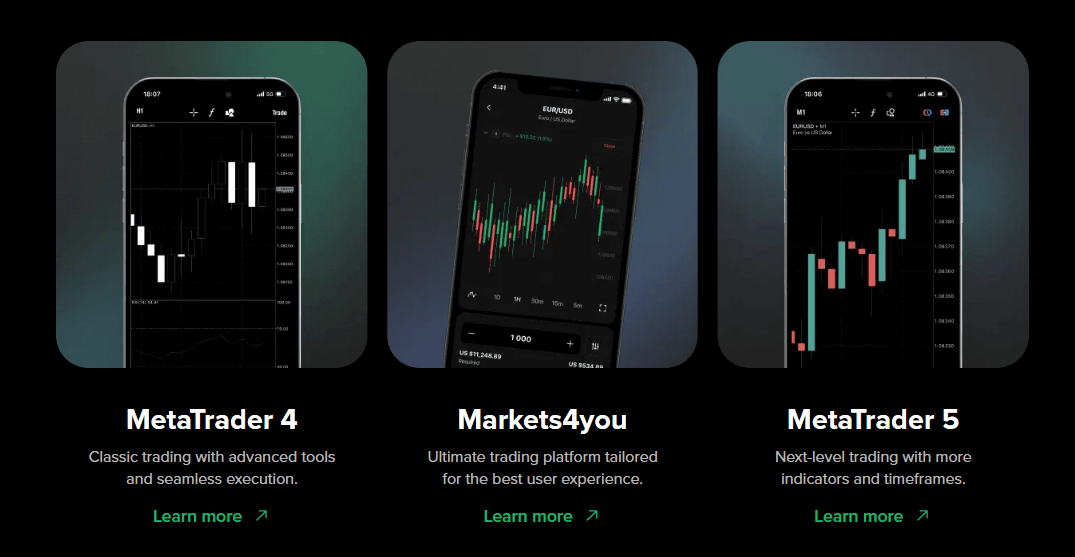

Markets4you provides traders with a comprehensive selection of trading platforms designed to accommodate various trading styles and technical requirements. The broker supports both industry-standard MetaTrader platforms and proprietary solutions, ensuring broad compatibility across desktop, web, and mobile devices.

MetaTrader 4 remains available for traders preferring the classic interface, offering extensive Expert Advisor support, customisable indicators, and one-click trading functionality. MetaTrader 5 expands capabilities with additional timeframes, enhanced order types, and improved backtesting features. The proprietary Markets4you Mobile and WebTrader platforms integrate TradingView charting technology, providing advanced technical analysis tools alongside streamlined deposit and withdrawal processes directly within the interface.

Trading Platform Comparison Table

| Feature | MT4 | MT5 | Markets4you App/Web |

|---|---|---|---|

| Desktop Version | Yes | Yes | Web-based only |

| Mobile Apps | iOS/Android | iOS/Android | iOS/Android |

| Expert Advisors | Full support | Full support | Not advertised |

| Custom Indicators | Unlimited | Unlimited | TradingView library |

| Timeframes | 9 | 21 | TradingView standard |

| Order Types | Standard | Extended | Standard + risk tools |

| Copy Trading | Via Share4you | Via Share4you (Jan 2025) | Integrated Share4you |

| In-app Funding | No | No | Yes |

| Charting Package | MT4 standard | MT5 enhanced | TradingView charts |

| One-click Trading | Yes | Yes | Yes |

Markets4you How to Open an Account: A Step-by-Step Guide

Opening a Markets4you account follows a structured process designed for regulatory compliance while maintaining user convenience. The registration system implements know-your-customer (KYC) requirements progressively, allowing initial platform exploration before full verification.

Account Opening Steps Table

| Step | Action Required | Time Required | Documents Needed |

|---|---|---|---|

| 1. Registration | Email, password, country | 2-3 minutes | None initially |

| 2. Profile Setup | Personal details, phone | 5 minutes | None |

| 3. Account Selection | Choose type and leverage | 2 minutes | None |

| 4. Identity Verification | Upload ID document | 5-10 minutes | Passport/ID card |

| 5. Address Verification | Proof of residence | 5 minutes | Utility bill/Statement |

| 6. Initial Deposit | Select payment method | 3-5 minutes | Payment details |

| 7. Platform Download | MT4/MT5 or web access | 5-15 minutes | None |

Charts and Analysis

Markets4you provides educational resources through multiple channels designed to support trader development. The Education Hub features scheduled webinars covering market analysis, platform tutorials, and trading strategies. On-demand video content allows self-paced learning, while downloadable e-books provide comprehensive guides on various trading topics.

Trading tools include an Economic Calendar for tracking market-moving events and a Trader's Calculator for position sizing and risk management calculations. The Share4you platform includes dedicated educational content for copy trading, including selection criteria for Leaders and portfolio diversification strategies.

Educational Resources Table

| Resource Type | Format | Availability | Topics Covered |

|---|---|---|---|

| Webinars | Live/Recorded | Weekly schedule | Market analysis, strategies |

| Video Tutorials | On-demand | 24/7 access | Platform guides, basics |

| E-books | PDF downloads | Free registration | Trading fundamentals |

| Economic Calendar | Web-based | Real-time updates | Economic events |

| Trader's Calculator | Interactive tool | Free access | Position sizing |

| Share4you Guides | Video/Written | Platform integrated | Copy trading strategies |

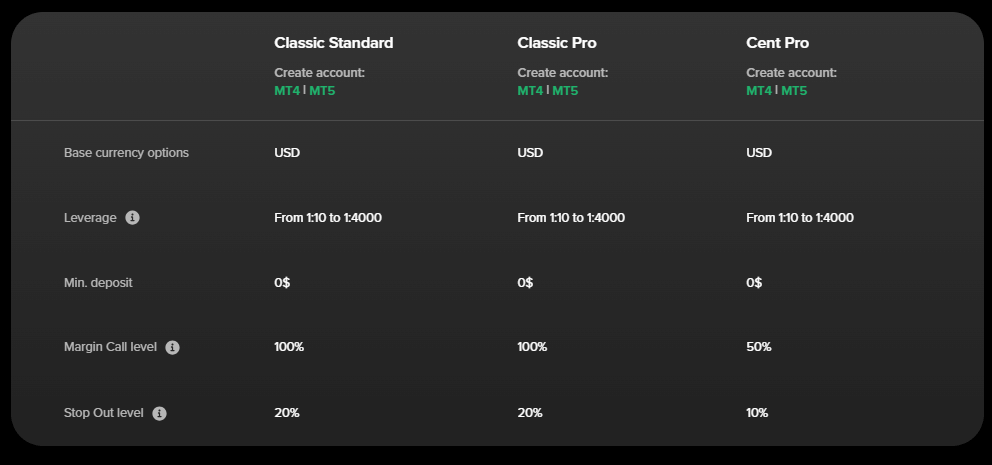

Markets4you Account Types

Markets4you offers three distinct account types tailored to different trading preferences and experience levels. The Classic Standard account operates on a spread-only model with no commissions, making cost calculations straightforward for beginners. Classic Pro accounts feature raw spreads from 0.1 pip plus $7 per lot commission, appealing to high-volume traders seeking tighter pricing. The Cent Pro account enables micro-lot trading with 1,000-unit contracts, allowing precise position sizing for conservative traders or those testing strategies.

All account types advertise zero minimum deposit requirements, though practical funding minimums depend on payment methods. Leverage ranges from 1:10 to 1:4000 across all accounts, with margin call and stop-out levels varying between account types. The broker implements negative balance protection as a safety measure, particularly important given the extreme leverage available.

Account Types Detailed Comparison Table

| Feature | Classic Standard | Classic Pro | Cent Pro |

|---|---|---|---|

| Contract Size | 100,000 units | 100,000 units | 1,000 units |

| Minimum Trade | 0.01 lot | 0.01 lot | 0.01 cent lot |

| Maximum Trade | 500 lots | 500 lots | 1000 cent lots |

| Spread Type | Variable | Raw | Raw |

| Typical Spread | From 0.9 pip | From 0.1 pip | From 0.1 pip |

| Commission | None | $7 per lot | $0.07 per cent lot |

| Leverage Range | 1:10 to 1:4000 | 1:10 to 1:4000 | 1:10 to 1:4000 |

| Margin Call | 100% | 100% | 50% |

| Stop Out Level | 20% | 20% | 10% |

| Execution Type | Market | Market | Market |

| Stop/Limit Distance | No limit | No limit | From 2 pips |

| History Retention MT4 | 6 months | 6 months | 3 weeks |

| History Retention MT5 | Unlimited | Unlimited | Unlimited |

| Hedging Allowed | Yes | Yes | Yes |

| Islamic Option | Available | Available | Available |

| Share4you Access | Yes | Yes | Yes |

Negative Balance Protection

Markets4you implements Negative Balance Protection across all account types, preventing accounts from falling below zero during extreme volatility or gap events. This feature is essential given the broker's extreme leverage of up to 1:4000, where small price movements could otherwise create debts exceeding deposits. NBP automatically resets negative balances to zero within 24 hours, ensuring maximum loss is limited to the deposited amount. Traders should verify specific NBP terms in the client agreement, as coverage details and exceptions may apply.

Markets4you Deposits and Withdrawals

Markets4you emphasizes efficient fund management with zero transfer fees from the broker side and average processing times of 30 minutes. The platform supports multiple payment channels including e-wallets, bank cards, local payment systems, and cryptocurrency rails. Minimum deposits start from $1 on select electronic methods, while typical card and bank transfers require $10 minimum funding.

Payment Methods Comparison Table

| Method Category | Deposit Min | Withdrawal Min | Processing Time | Fees |

|---|---|---|---|---|

| E-wallets | $1-10 | $1-10 | Instant-30 min | 0% broker fee |

| Bank Cards | $10 | $10 | 30 min-3 days | 0% broker fee |

| Local Banks | $10 | $10 | 30 min-24 hours | 0% broker fee |

| Crypto Rails | Varies | Varies | 30 min-1 hour | 0% broker fee |

| Bank Wire | $50 | $50 | 1-5 business days | 0% broker fee |

Support Service for Customer

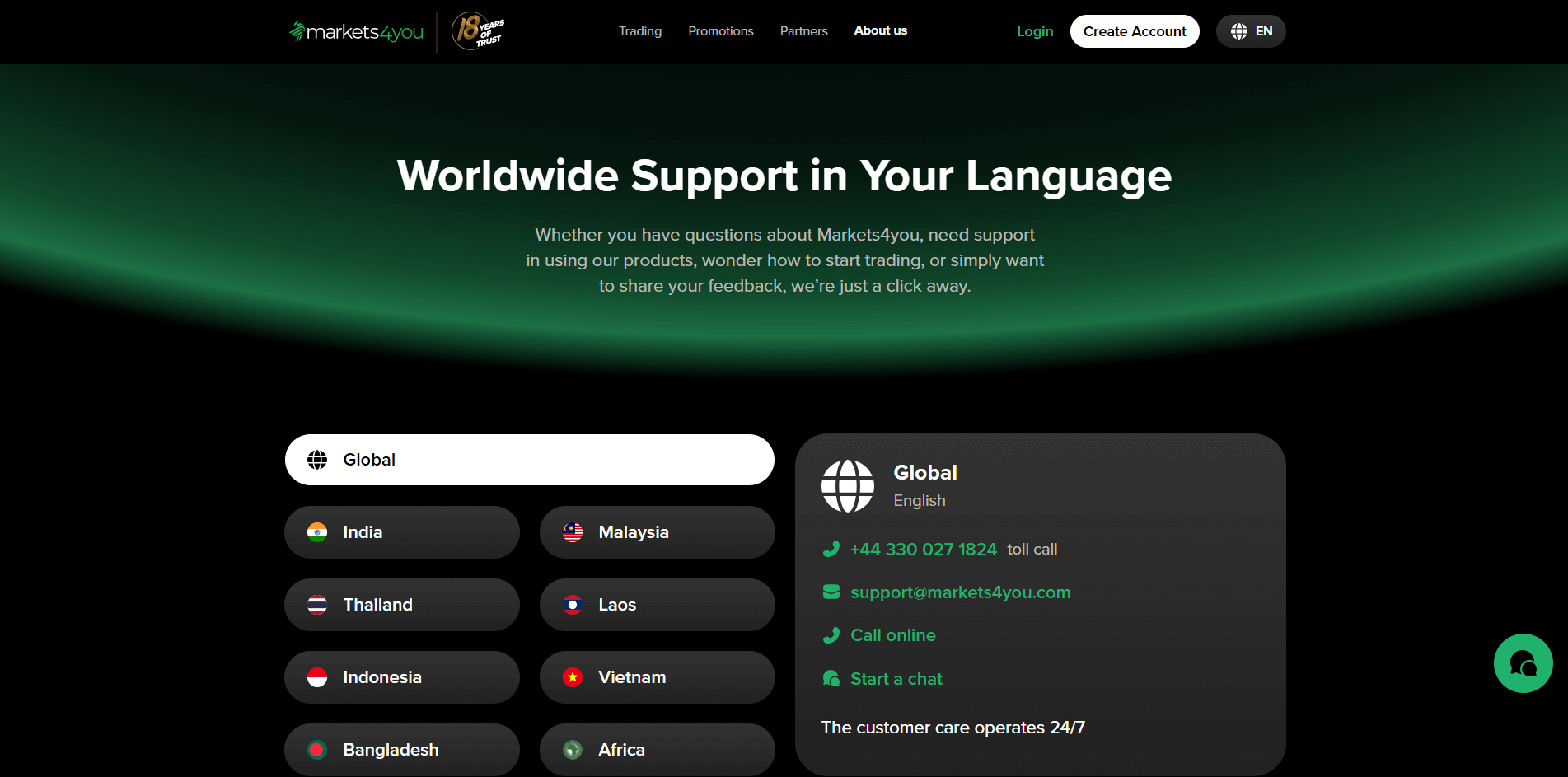

Markets4you maintains multilingual customer support through various communication channels. Global English support operates 24/7, while regional offices provide localized assistance during specific hours. The broker maintains dedicated support lines for major markets including India, Malaysia, Thailand, Indonesia, Vietnam, Bangladesh, Africa, and Greater China regions.

Customer Support Availability Table

| Region | Languages | Hours | Contact Methods |

|---|---|---|---|

| Global | English | 24/7 | Chat, Email, Phone |

| Asia-Pacific | Local languages | Business hours | Regional numbers |

| Africa | English, French | Business hours | Dedicated line |

| Middle East | English, Arabic | Sunday-Thursday | All channels |

Prohibited Countries

| Region | Countries/Territories | Reason for Restriction |

|---|---|---|

| North America | United States, Canada | Regulatory prohibition |

| Europe | All EEA member states | MiFID II non-compliance |

| Asia-Pacific | Japan, Australia | Local licensing requirements |

| Sanctioned | Iran, North Korea, Myanmar | International sanctions |

| CIS Region | Russia | Regulatory/sanctions |

Special Offers for Customers

Markets4you maintains various promotional campaigns designed to attract new traders and reward existing clients. These offers typically include deposit bonuses, referral programs, and seasonal promotions with specific terms and conditions governing eligibility and withdrawal requirements.

| Promotion Type | Benefit | Requirements | Restrictions |

|---|---|---|---|

| 100% Deposit Bonus | Match up to certain amount | Minimum deposit | Volume requirements |

| Refer-a-Friend | $50 per referral | Friend must deposit/trade | Regional limitations |

| Prime Rate Program | Reduced spreads | Volume thresholds | Time-limited |

| Loyalty Rewards | Cashback on trades | Monthly volume | Account type specific |

| Contest Participation | Prize pools | Registration required | Terms apply |

Conclusion

Markets4you operates as a functional offshore broker offering competitive trading conditions for risk-aware traders. The platform's strengths lie in its established history, competitive pricing structure, and diverse platform offerings. However, the offshore regulatory framework, extreme leverage options, and exclusion from major markets position this as a higher-risk choice compared to tier-one regulated brokers.

Prospective clients should carefully evaluate their risk tolerance, verify all marketing claims independently, and consider starting with minimal capital to assess platform performance. The broker suits experienced traders seeking specific conditions unavailable from strictly regulated brokers, particularly high leverage and flexible trading terms. Conservative investors and beginners should explore alternatives offering stronger regulatory protection and more comprehensive educational resources.

The combination of competitive spreads, efficient payment processing, and copy trading capabilities creates value for appropriate users. However, the regulatory trade-offs and extreme leverage require thorough understanding and acceptance of elevated risks. Traders must implement strict risk management, verify negative balance protection coverage, and maintain realistic expectations regarding the protection levels available from offshore brokers.