Moneta Markets Review 2025: A Comprehensive Guide to Forex & CFD Trading

Moneta Markets

Australia

Australia

-

Minimum Deposit $50

-

Withdrawal Fee $0

-

Leverage 1000:1

-

Minimum Order 0.01

-

Forex Available

-

Crypto Available

-

Stock Unavailable

-

Indices Available

Licenses

South Africa Retail Forex License

South Africa Retail Forex License

Japan Forex Trading License

Japan Forex Trading License

Softwares & Platforms

Customer Support

+61283195477

(English)

+61283195477

(English)

Supported language: Arabic, Chinese (Simplified), English, French, Korean, Malay, Portuguese

Social Media

Summary

Moneta Markets is an independent online broker that has operated on its own since separating from the Vantage Group in 2022. The platform appeals to active traders by offering advanced technology like ProTrader, a low $50 minimum deposit, and competitive ECN accounts with raw spreads. However, these strong features are matched by a complex regulatory framework. While it holds licenses in South Africa (FSCA) and Seychelles (FSA), it also onboards clients through a completely unregulated entity in Saint Lucia. This creates a two-tiered system of client safety, making it crucial for traders to verify which entity they are registered with before depositing funds.

- Regulated by FSCA (South Africa) and FSA (Seychelles)

- Low $50 minimum deposit

- Flexible demo account with 90-day inactivity expiry

- Advanced ProTrader platform powered by TradingView

- ECN spreads from 0.0 pips

- Negative balance protection offered

- Free VPS for active traders

- No inactivity fees

- Offers MT4 and MT5 platforms

- No longer has backing of larger Vantage Group

- Onboards some clients through unregulated Saint Lucia entity

- Best educational content gated behind $500 deposit

- High leverage up to 1:1000 increases risk

- Not available in US, UK, Canada, Australia

- High $20,000 deposit for Ultra ECN account

- Phone support limited to single South African number

- Conflicting regulatory framework creates uncertainty

- Limited transparency about actual headquarters location

Overview

Moneta Markets emerges as a distinctive player in the online trading landscape, having transformed from a subsidiary launched under the Vantage Group umbrella in mid-2020 to a fully independent brokerage following a management buyout in 2022. This comprehensive review examines Moneta Markets as it stands today—a standalone global broker offering Contracts for Difference (CFDs) with a multi-jurisdictional presence spanning South Africa, Seychelles, and Saint Lucia.

The broker's journey to independence marks a pivotal moment in its corporate evolution. While not decorated with major industry awards, Moneta Markets has carved out its niche through diverse asset selection and modern trading platforms. Operating across multiple regulatory jurisdictions, the broker serves traders worldwide with a comprehensive suite of trading instruments and competitive trading conditions.

As this review addresses a "Your Money, Your Life" (YMYL) topic, evaluating Moneta Markets' safety framework becomes paramount, particularly given its transition to operating as an independent entity. The broker's regulatory structure combines credible licenses with an unregulated offshore entity—a configuration that demands thorough scrutiny. This fact-checked analysis provides transparent insights to help traders assess whether Moneta Markets' offerings align with their risk tolerance and financial objectives.

Overview Table

| Category | Information (August 2025) |

|---|---|

| Founded | 2020 (Became independent from Vantage Group in 2022) |

| Regulation | FSCA (South Africa), FSA (Seychelles), and an unregulated IBC registration in Saint Lucia |

| Platforms | MetaTrader 4, MetaTrader 5, ProTrader (Web), AppTrader (Mobile) |

| Tradable Instruments | Forex, Indices, Commodities, Share CFDs, ETFs, Bonds, Cryptocurrencies |

| Minimum Deposit | $50 |

| Maximum Leverage | Up to 1:1000 |

| Spreads | From 0.0 pips (ECN) / From 1.2 pips (STP) |

| Customer Support | 24/5 via Live Chat, Email, and a South African Phone Number |

| Headquarters | Multiple registered offices, no single official headquarters |

Facts List

- Moneta Markets launched in 2020 and achieved independence in 2022 after separating from Vantage Group

- The broker maintains two financial licenses: FSCA in South Africa (Tier-2) and FSA in Seychelles (Tier-3) • An unregulated International Business Company (IBC) in Saint Lucia serves some international clients

- Website claims over 1,000 tradable instruments

- Accessible entry with just $50 minimum deposit requirement

- Demo accounts remain active with 90-day inactivity expiration policy

- Trading platform suite includes MT4, MT5, and modern web-based ProTrader

- ECN accounts feature competitive raw spreads starting from 0.0 pips

- Negative balance protection safeguards all client accounts

- Direct phone support consolidated to single South African contact number

Moneta Markets Licenses and Regulatory

The regulatory framework serves as the cornerstone of any broker's credibility and client safety measures. As an independent entity since 2022, Moneta Markets operates under a multi-jurisdictional model that offers varying levels of protection—making it crucial for traders to understand which entity governs their account.

Financial Sector Conduct Authority (FSCA), South Africa: Moneta Markets South Africa (Pty) Ltd holds license FSP number 47490 from the FSCA, a respected Tier-2 regulator. This regulatory body enforces stringent requirements including mandatory segregation of client funds, regular financial reporting, and adherence to strict operational standards. The FSCA's oversight provides South African clients with robust protection mechanisms and clear avenues for dispute resolution.

Financial Services Authority (FSA), Seychelles: The Seychelles entity, Moneta Markets Ltd, operates under FSA License No. SD144. As an offshore Tier-3 regulator, the FSA provides a formal regulatory framework but with generally less stringent oversight compared to Tier-1 or Tier-2 authorities. While legitimate, this license offers reduced client protection levels and limited compensation schemes.

International Business Company (IBC), Saint Lucia: Perhaps most concerning is the broker's utilization of an entity registered as IBC No. 2023-00068 in Saint Lucia. This registration represents merely a corporate structure, not a financial services license. Clients onboarded through this entity receive no formal regulatory protection or recourse mechanisms—a significant risk factor that traders must carefully consider.

This mixed regulatory environment creates a two-tiered protection system where client safety varies dramatically based on the specific entity managing their account. The disparity between regulated and unregulated entities within the same brand presents challenges for risk assessment and underscores the importance of verifying which entity governs your trading account before depositing funds.

Regulations List

- Financial Sector Conduct Authority (FSCA), South Africa: FSP number 47490

- Financial Services Authority (FSA), Seychelles: License No. SD144

- Registry of International Business Companies, Saint Lucia: Registration No. 2023-00068 (Note: This is not a financial license)

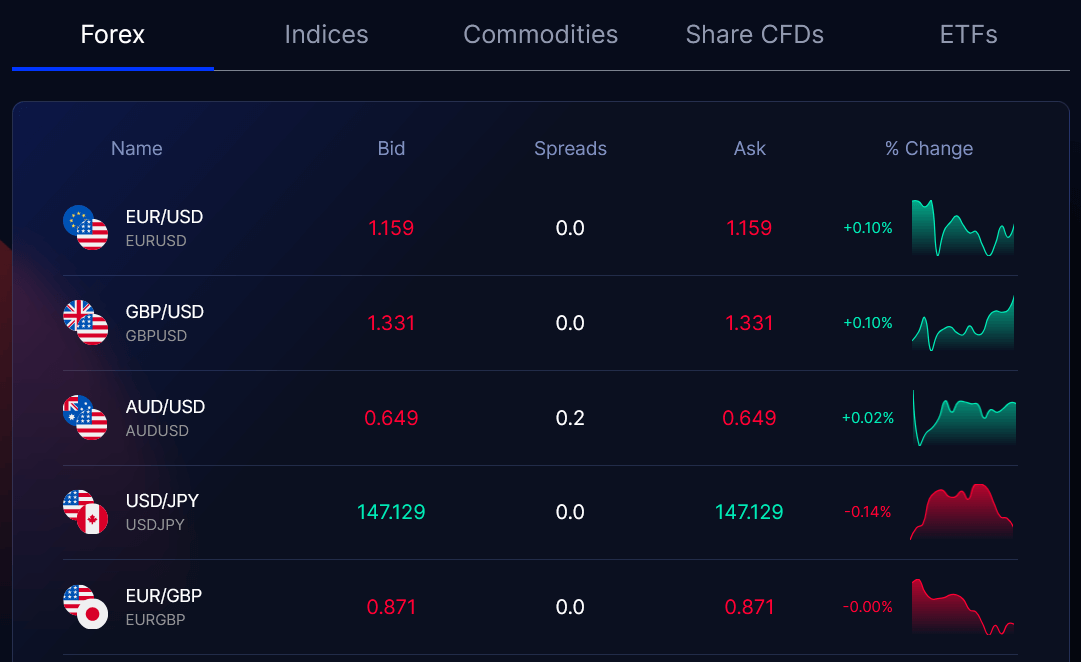

Trading Instruments

Moneta Markets offers a wide-ranging portfolio of trading instruments, with its main pages highlighting access to over 1,000 tradable assets. The broker provides comprehensive market coverage through CFDs across various asset classes, including forex, indices, commodities, shares, and cryptocurrencies. This breadth allows traders to diversify their strategies and access global financial markets from a single platform.

| Asset Class | Instruments Offered | Key Features | Ideal For |

|---|---|---|---|

| Forex | - Major pairs (e.g., EUR/USD, GBP/USD, USD/JPY) - Minor pairs - Exotic currencies | - Spreads from 0.0 pips (on ECN) - High liquidity - Supports scalping, hedging, and swing trading | All traders—from scalpers to long-term strategists |

| Indices | - S&P 500 - FTSE 100 - DAX 30 - Nikkei 225 | - Broad market exposure - Lower volatility vs. stocks - Leverage available | Index and macro traders |

| Commodities | - Precious metals (Gold, Silver) - Energy (Crude Oil, Natural Gas) - Agricultural products | - Inflation hedge (metals) - Global economic exposure (energy/agriculture) | Diversifiers, safe-haven seekers |

| Share CFDs | - US, UK, EU, and AUS companies | - No ownership complexities - Trade price movements without dividend or voting concerns | Company-focused traders |

| Cryptocurrencies | - BTC/USD, ETH/USD, and other major tokens | - 24/7 market access - CFD format eliminates wallet/security risks | Volatility-focused and short-term traders |

| ETFs & Bonds | - Sectoral & strategic ETFs - Government bond CFDs | - Diversification tool - Conservative options - Lower-risk instruments | Balanced or cautious portfolio builders |

Trading Platforms

Moneta Markets delivers flexible trading experiences through a comprehensive suite of platforms catering to different trader preferences and experience levels. The broker's platform selection balances industry-standard solutions with proprietary innovations.

MetaTrader 4 (MT4)

The industry's most popular platform remains central to Moneta Markets' offering. MT4's stability, extensive Expert Advisor (EA) ecosystem, and familiar interface make it ideal for automated trading strategies. The platform supports custom indicators, advanced charting, and one-click trading functionality across desktop, web, and mobile versions.

MetaTrader 5 (MT5)

The successor to MT4 brings enhanced capabilities including additional timeframes, more order types, and improved backtesting functionality. MT5's multi-asset capabilities align perfectly with Moneta Markets' diverse instrument selection, offering seamless transitions between forex, stocks, and commodities trading.

ProTrader

This web-based platform powered by TradingView technology represents Moneta Markets' commitment to modern trading interfaces. ProTrader combines professional-grade charting tools with an intuitive design, eliminating download requirements while maintaining sophisticated analytical capabilities. The platform particularly appeals to technical analysts who prioritize advanced charting features.

AppTrader

The native mobile application for iOS and Android ensures trading continuity away from desktop environments. AppTrader provides full account management capabilities, real-time quotes, and essential trading functions optimized for smartphone and tablet interfaces.

CopyTrader App

Social trading functionality through the dedicated CopyTrader app enables less experienced traders to automatically replicate strategies from successful traders. This platform democratizes trading expertise while providing transparency through detailed performance statistics.

Trading Platforms Comparison Table

| Feature | MetaTrader 4 (MT4) | MetaTrader 5 (MT5) | ProTrader | AppTrader |

|---|---|---|---|---|

| Platform Type | Desktop, Web, Mobile | Desktop, Web, Mobile | Web-based | Mobile App |

| Charting Tools | Advanced | Advanced | Advanced (TradingView) | Streamlined |

| Automated Trading | Yes (Expert Advisors) | Yes (Expert Advisors) | No | No |

| Custom Indicators | Yes | Yes | Yes (100+) | Limited |

| Best For | All traders, EA users | Advanced traders | Chart analysis, web users | On-the-go trading |

| Ease of Use | Moderate | Moderate | High | High |

Moneta Markets How to Open an Account: A Step-by-Step Guide

Opening an account with Moneta Markets follows a streamlined digital process designed for efficiency while maintaining regulatory compliance. The broker has eliminated paperwork requirements in favor of online verification systems that typically complete within one business day.

Before initiating registration, prepare essential documents including a valid government-issued identification (passport or national ID) and recent proof of residence dated within the last three months (utility bill, bank statement, or official correspondence). The $50 minimum deposit accommodates traders across various budget levels, while multiple payment methods ensure accessibility.

The registration process begins at the Moneta Markets website, where prospective clients complete initial forms capturing personal details and trading experience. The broker's compliance with anti-money laundering (AML) regulations necessitates thorough identity verification, though the digital process minimizes delays typically associated with traditional brokers.

Payment flexibility extends across credit/debit cards, bank transfers, and popular e-wallets, each processed without internal fees. However, traders should verify potential charges from payment providers or intermediary banks, particularly for international transactions.

Account Opening Process List

- Step 1 : Register Online - Visit Moneta Markets website and complete initial registration form

- Step 2 : Complete Your Profile - Provide detailed personal and financial information

- Step 3 : Upload Documents - Submit proof of identity and proof of residence for KYC verification

- Step 4 : Fund Your Account - Deposit minimum $50 using preferred payment method

- Step 5 : Start Trading - Download chosen platform and begin trading

Charts and Analysis

Moneta Markets provides comprehensive analytical resources, though access restrictions based on deposit size limit availability for smaller accounts. This tiered approach to educational content creates barriers for beginners who might benefit most from these resources.

| Feature | Platform/Access | Key Benefits | Limitations |

|---|---|---|---|

| ProTrader (TradingView Integration) | Available via ProTrader platform | - Advanced charts - 100+ indicators - Drawing tools - Layout customization | Only available via ProTrader; may require higher-tier account |

| MT4 / MT5 Platforms | All account holders | - Custom indicators - EAs (Expert Advisors) - Automated strategies - Historical data | UI less modern; limited visual comparison to TradingView |

| Market News & TV | Free via blog and video content | - Daily commentary - Market summaries - Accessible to all users | Content quality varies; some reports may be promotional rather than analytical |

| Trading Central Integration | Funded live accounts only | - Institutional-grade analysis - Technical signals - Covers FX, indices, stocks, commodities | No access for demo or unfunded users |

| Economic Calendar | Basic: FreePremium: $500+ deposit | - Filter by impact/region - Set alerts - Covers major economic events | Premium tools behind paywall; basic users get limited functionality |

| Market Masters Video Course | $500 minimum deposit | - Structured course - Covers beginner to advanced concepts - Video-based learning | Educational content gated; goes against best practice of open-access learning |

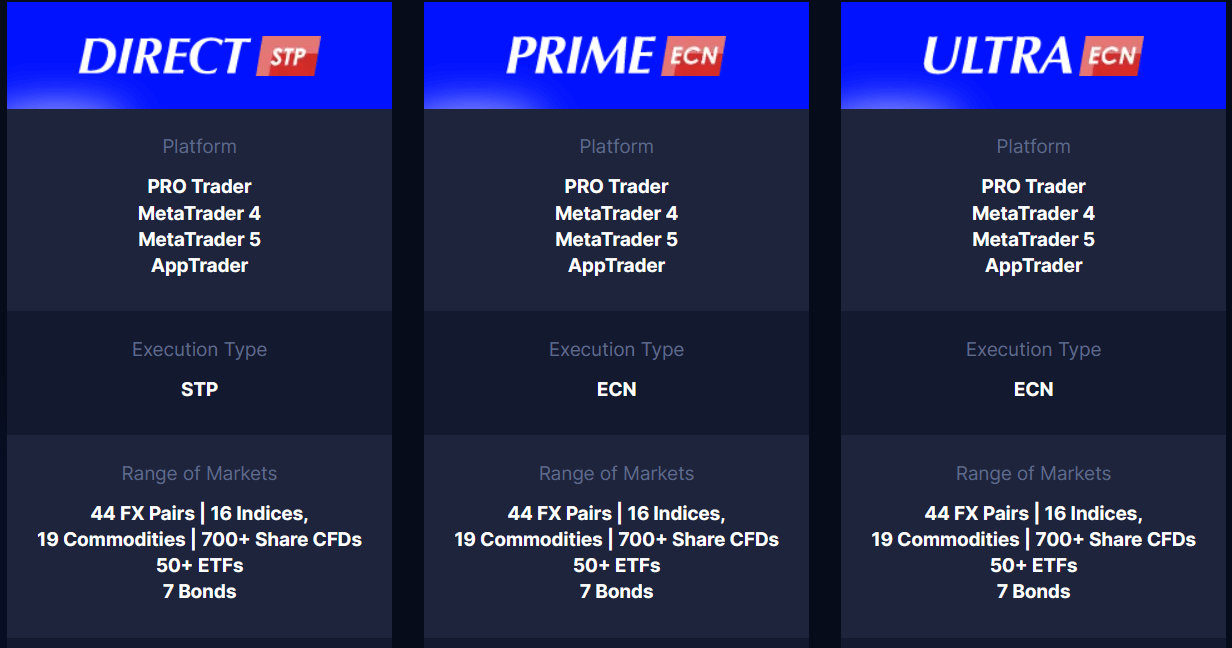

Moneta Markets Account Types

Moneta Markets structures its account offerings to accommodate diverse trading styles and experience levels, from beginners to institutional traders. Each account type balances features, costs, and accessibility, though the Ultra ECN account's high entry barrier limits access for most retail traders.

Direct STP Account

Designed for newcomers, this commission-free account builds trading costs into spreads starting from 1.2 pips. The straightforward pricing model eliminates confusion about total trading costs, making it ideal for traders prioritizing simplicity over absolute lowest costs. The $50 minimum deposit ensures accessibility while maintaining sustainable operations.

Prime ECN Account

Active traders gravitate toward this account's raw ECN spreads from 0.0 pips combined with competitive $3 per lot per side commission ($6 round turn). This transparent pricing structure often results in lower total trading costs for frequent traders, particularly those focusing on major currency pairs during peak liquidity periods.

Ultra ECN Account

Professional traders with substantial capital gain access to the lowest commission rates at $1 per lot per side ($2 round turn). However, the $20,000 minimum deposit creates an exclusive tier accessible only to well-capitalized traders, potentially alienating successful traders who haven't yet accumulated such capital.

Islamic Accounts: Swap-free versions accommodate traders requiring Sharia-compliant trading conditions. Available across STP and ECN account types, these maintain competitive pricing while eliminating overnight interest charges that conflict with Islamic finance principles.

Demo Account: Practice accounts provide risk-free environments for strategy testing and platform familiarization. The 90-day inactivity expiration offers generous trial periods compared to industry standards, though active traders can maintain demo access indefinitely through regular use.

Account Types Comparison Table

| Feature | Direct STP Account | Prime ECN Account | Ultra ECN Account |

|---|---|---|---|

| Spreads From | 1.2 Pips | 0.0 Pips | 0.0 Pips |

| Commission | $0 | $6 per round turn | $2 per round turn |

| Minimum Deposit | $50 | $50 | $20,000 |

| Execution Model | STP | ECN | ECN |

| Ideal For | Beginners | Active Traders & Scalpers | Professionals |

| Max Leverage | 1:1000 | 1:1000 | 1:500 |

| Islamic Option | Yes | Yes | Yes |

Negative Balance Protection

Negative balance protection represents a crucial safety mechanism preventing traders from losing more than their deposited funds during extreme market volatility. Moneta Markets implements this protection across all account types, providing essential financial safeguards regardless of chosen entity or account tier. This protection mechanism activates during exceptional market events when rapid price movements might otherwise push account balances below zero. Rather than pursuing clients for additional funds to cover negative balances, Moneta Markets automatically resets affected accounts to zero, absorbing the loss internally. This policy proves particularly valuable during events like flash crashes or major economic announcements that can trigger unprecedented volatility. For clients under FSCA and FSA regulation, negative balance protection constitutes a regulatory requirement, ensuring compliance with investor protection standards. Even clients trading through the unregulated Saint Lucia entity receive this protection as a company policy, though without regulatory backing, enforcement relies solely on Moneta Markets' discretion. The implementation doesn't restrict trading strategies or require additional fees, operating transparently in the background. However, traders should understand that negative balance protection doesn't prevent losses up to their account balance—it merely ensures losses cannot exceed deposited funds. Risk management through appropriate position sizing and stop-loss orders remains essential for capital preservation.

Moneta Markets Deposits and Withdrawals

Moneta Markets maintains a client-friendly approach to funding and withdrawals by eliminating internal processing fees. This fee-free structure represents significant value, particularly for active traders making frequent deposits or withdrawals. However, traders must remain aware of potential third-party charges from payment providers or intermediary banks.

Deposit Methods

| Method | Processing Time | Minimum/Maximum Limits | Notes |

|---|---|---|---|

| Visa/Mastercard | Instant | Subject to card limits | Fast and widely available; suitable for smaller to mid-sized deposits |

| Bank Transfer | 1–3 business days | Higher limits supported | Best for large deposits; time varies by country and bank |

| FasaPay | Instant | Varies by provider | Popular in Asia; fast processing and convenient |

| Sticpay | Instant | Varies by provider | International e-wallet; faster than bank transfers |

Withdrawal Methods

| Method | Processing Time | Verification Required | Limitations |

|---|---|---|---|

| Visa/Mastercard | Typically 1–3 business days | Yes (especially first-time) | Subject to card issuer limits; may take longer due to bank-side delays |

| Bank Transfer | 1–3 business days | Yes | Best for large withdrawals; may incur bank fees and delays |

| FasaPay | Instant to few hours | Yes | Moderate capacity; faster than bank wires, suitable for quick transfers |

| Sticpay | Instant to few hours | Yes | Balanced option for speed and capacity; often preferred by international users |

Support Service for Customer

Reliable customer support forms the backbone of positive trading experiences, particularly during technical difficulties or urgent account issues. Moneta Markets provides multichannel support operating 24 hours, 5 days per week, though the consolidation to a single phone line may limit accessibility for international clients.

- Live Chat: The primary support channel delivers near-instantaneous responses during business hours. Embedded directly on the website, live chat eliminates email delays while maintaining conversation records for future reference. Support quality generally meets industry standards, though response times may extend during peak trading hours.

- Email Support: Complex inquiries benefit from email communication to support@monetamarkets.com, allowing detailed explanations and document attachments. The 24-hour response commitment provides reasonable expectations, though urgent matters warrant live chat or phone contact.

- Phone Support: Direct phone access via +27 10 594 2390 connects traders with South African support staff. While beneficial for complex issues requiring verbal communication, international calling costs and time zone differences may create barriers for global clients. The absence of regional phone numbers represents a service gap compared to truly international brokers.

- Social Media: Active social media presence across major platforms facilitates community engagement and announcement distribution. However, these channels shouldn't substitute proper support channels for account-specific issues due to security concerns.

Customer Support Comparison Table

| Support Channel | Availability | Average Response Time | Languages |

|---|---|---|---|

| Live Chat | 24/5 | < 1 Minute | Multiple |

| 24/5 | Within 24 Hours | Multiple | |

| Phone | Business Hours | < 5 Minutes | English |

Prohibited Countries

International regulations and business decisions restrict Moneta Markets from servicing residents of numerous countries. These restrictions stem from various factors including local regulatory requirements, sanctions, and corporate risk assessments. Prospective clients must verify their eligibility before attempting registration to avoid disappointment and potential legal complications.

The prohibited list encompasses major markets including the United States, where stringent regulations make international broker operations challenging. The United Kingdom's exclusion reflects post-Brexit regulatory changes and FCA requirements. Australia's ASIC regulations similarly create barriers for international brokers without local licenses.

Additional restrictions cover countries under international sanctions like Iran, Syria, and North Korea, where financial services face legal prohibitions. The inclusion of developed markets like Japan and Canada reflects local regulatory requirements rather than political considerations, highlighting the complex international landscape facing modern brokers.

This extensive prohibited list significantly limits Moneta Markets' addressable market, potentially affecting liquidity and development resources. Traders from restricted countries must seek locally regulated alternatives, while Moneta Markets focuses on permitted jurisdictions where regulatory compliance remains feasible.

Prohibited Countries List

• Afghanistan, Australia, Belarus, Canada, Cuba, Cyprus, Iran, Iraq, Japan, North Korea, Russia, Spain, Syria, United Kingdom, United States, and additional jurisdictions subject to change

Special Offers for Customers

Moneta Markets implements several promotional programs designed to enhance trading value, though most require substantial deposits that may exclude smaller traders. These offers balance client acquisition with sustainable business practices, avoiding the unsustainable bonuses that have plagued some brokers.

| Feature | Description | Key Conditions | Benefits |

|---|---|---|---|

| 50% Deposit Bonus | Structured as a cashback rebate based on trading volume instead of upfront credit. | - Minimum deposit: $500 - Conversion to cash based on trading volume | - Encourages active trading - Reduces bonus abuse - Potentially withdrawable over time |

| Free VPS Hosting | Rebate on VPS subscription for traders using automated strategies, enabling 24/7 trading infrastructure. | - Minimum deposit: $500 - Monthly volume: 5 FX lots | - Essential for running Expert Advisors - Low latency execution |

| Trading Central Access | Access to institutional-grade market analysis, signals, and educational content from a leading third-party research provider. | - Available to all funded accounts | - No additional cost - Enhances trading decisions with objective analysis and forecasts |

Conclusion

As I conclude this comprehensive review, Moneta Markets presents a complex picture that demands nuanced evaluation. Their transformation from a Vantage Group subsidiary to an independent broker in 2022 marks both opportunity and challenge—freedom to innovate balanced against loss of established corporate backing.

The broker's technological infrastructure impresses, particularly the ProTrader platform's modern interface and comprehensive mobile solutions. Competitive ECN spreads from 0.0 pips serve active traders well, while the $50 minimum deposit maintains accessibility. The absence of deposit/withdrawal fees and inactivity charges demonstrates client-friendly policies often overlooked by competitors.

However, the multi-tiered regulatory structure remains the elephant in the room. While the FSCA license provides solid protection for South African clients, the weaker FSA (Seychelles) oversight and unregulated Saint Lucia entity create a two-class system of client protection. This regulatory inconsistency poses the primary risk factor that overshadows the broker's operational strengths.

Gating educational content behind $500 deposits contradicts industry best practices. These issues, combined with limited phone support and extensive country restrictions, suggest an operation still finding its footing as an independent entity.

My recommendation requires careful consideration of your specific circumstances. Traders who can confirm registration under the FSCA-regulated South African entity gain access to a competitive, well-equipped broker with reasonable protection. However, those directed to Seychelles or Saint Lucia entities face significantly elevated risks that may outweigh the platform's benefits.

For risk-averse traders or those prioritizing regulatory security, established brokers with consistent Tier-1 regulation across all entities provide safer alternatives. Moneta Markets suits experienced traders who understand regulatory nuances and can navigate the protection disparities while capitalizing on competitive trading conditions.