Moomoo Review 2025: Pros, Cons, and What You Need to Know

Moomoo

United States

United States

-

Withdrawal Fee $varies

-

Leverage 1:1

-

Spread From 0.6

-

Minimum Order 0.01

-

Forex Unavailable

-

Crypto Unavailable

-

Stock Available

-

Indices Unavailable

Licenses

Australia Retail Forex License

Australia Retail Forex License

Singapore Financial Services License

Singapore Financial Services License

US Securities License

US Securities License

Softwares & Platforms

Customer Support

+18887210610

(English)

+18887210610

(English)

Supported language: English, Chinese (Simplified), Chinese (Traditional), Japanese

Social Media

Summary

Moomoo, developed by Futu Holdings Ltd. in 2018, is a global fintech platform offering access to stocks, ETFs, options, futures, warrants, and ADRs across multiple countries including the US, Australia, Singapore, and Malaysia. Known for its advanced trading tools, competitive fees, and commission-free promotions, Moomoo serves over 22 million users worldwide. The platform operates under strict regulatory oversight from top authorities such as the SEC, FINRA, ASIC, and MAS, ensuring a secure and transparent trading environment. With educational resources and social trading features, Moomoo aims to provide an accessible and innovative experience for investors.

- User-friendly and feature-rich trading platforms

- Wide range of tradable assets

- Competitive fees and occasional promotions

- Strong regulatory compliance

- Social trading features

- 24/7 customer support

- Multiple account types

- Comprehensive mobile trading app

- Real-time market data and advanced charting tools

- Growing global presence

- Limited educational resources for beginner traders

- Services not available in certain countries

- No negative balance protection

- Limited deposit and withdrawal options in some regions

- Occasional delays in customer support response times

- No support for MetaTrader platforms

- Lack of Islamic accounts

- No cryptocurrency trading

- Potential for high fees on inactive accounts

- Limited customization options on trading platforms

Overview

Moomoo, a fintech platform developed by Futu Holdings Ltd., was established in 2018 with the aim of providing users seamless access to various financial markets. The platform has expanded its global presence, now serving over 22 million users in countries such as Australia, Malaysia, Singapore, and the United States.

Known for its advanced trading tools and user-focused features, Moomoo offers a comprehensive suite of investment products, including stocks, ETFs, options, futures, warrants, and American Depositary Receipts (ADRs). The platform's commitment to innovation and accessibility has earned it recognition within the industry.

For more detailed information about Moomoo's offerings, visit their official website at moomoo.com.

Overview Table

| Category | Information |

|---|---|

| Supported Countries | Australia, Malaysia, Singapore, United States, and more |

| Stock and ETF Fees | Low, competitive rates (specific fees vary by region) |

| Options Fees | Low, competitive rates |

| Inactivity Fee | None |

| Withdrawal Fee | Varies by region and method |

| Minimum Deposit | $0 |

| Products Offered | Stocks, ETFs, Options, Futures, Warrants, ADRs |

| Demo Account | Yes |

| Regulatory Entities | ASIC (Australia), CIRO (Canada), SC (Malaysia), SEC & FINRA (USA), MAS (Singapore) |

Facts List

- Moomoo is a subsidiary of Futu Holdings Ltd., a company listed on the NASDAQ stock exchange.

- The platform offers commission-free trading promotions for stocks, ETFs, and options (except in Australia).

- Users can earn interest on uninvested cash, with rates varying by country.

- Moomoo provides advanced trading tools for comprehensive charting and analysis.

- The platform incorporates social trading features, enabling community-driven insights and discussions.

- Moomoo operates under strict regulatory oversight in multiple jurisdictions, ensuring a secure trading environment.

- Educational resources, including tutorials, webinars, and market insights, are available to users.

- The platform supports a wide range of tradable assets but does not offer CFDs, bonds, or cryptocurrencies.

- Deposit and withdrawal options may be limited in some regions.

- Moomoo's services are not available in several countries due to regulatory restrictions.

Moomoo Licenses and Regulatory

Moomoo operates under the regulatory oversight of several top-tier financial authorities, ensuring a high level of investor protection and compliance. As a subsidiary of Futu Holdings Ltd., a company listed on the NASDAQ stock exchange, Moomoo benefits from additional transparency and adheres to strict reporting requirements.

Futu Holdings operates globally through various subsidiaries, each complying with the regulations set forth by their respective jurisdictions:

| Subsidiary | Regulatory Body | Investor Compensation Scheme | Applicable Region |

|---|---|---|---|

| Moomoo Financial Inc. | SEC and FINRA | SIPC protection up to $500,000 (including $250,000 for cash) | United States |

| Moomoo Financial Singapore Pte. Ltd. | MAS | None | Singapore |

| Moomoo Securities Malaysia Sdn. Bhd. | SC | None | Malaysia |

| Futu Securities (Australia) Ltd. | ASIC | None | Australia |

The multi-jurisdictional regulatory framework under which Moomoo operates demonstrates the platform's commitment to maintaining high standards of financial oversight and security. By adhering to the rules and guidelines set by these reputable regulatory bodies, Moomoo fosters trust among its clients and establishes itself as a reliable player in the online brokerage industry.

Trading Instruments

Moomoo offers a diverse range of tradable assets, enabling users to build comprehensive investment portfolios:

| Asset Class | Available Regions |

|---|---|

| US Stocks & ETFs | All supported regions |

| AUS Stocks & ETFs | Australia |

| HK Stocks & ETFs | Australia, Singapore, United States |

| JP Stocks & ETFs | Singapore |

| China A-Shares | Singapore, United States |

| SG Stocks | Singapore, United States |

| MYS Stocks & ETFs | Malaysia |

| Options | Australia, Singapore, United States |

| Futures | Singapore (with some limitations) |

| Funds | Singapore |

| Warrants | Malaysia, Singapore |

| ADRs (American Depositary Receipts) | All supported regions |

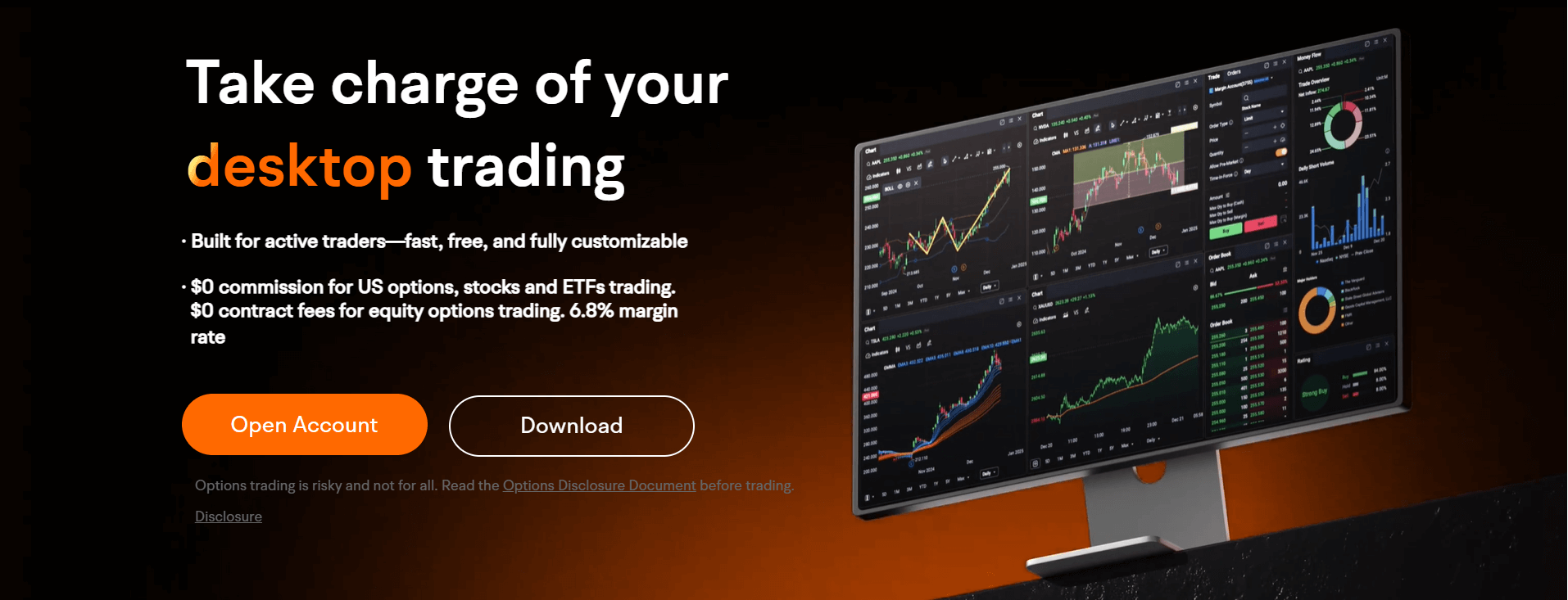

Trading Platforms

Moomoo offers a range of trading platforms to cater to the diverse needs of its users:

- Mobile Trading Apps: Available for both Android and iOS devices, Moomoo's mobile apps provide a seamless and feature-rich trading experience on the go.

- Web Trading Platform: Users can access Moomoo's web-based trading platform through their preferred browser, enabling them to manage their portfolios and execute trades without the need for additional software.

- Desktop Trading Platform: Moomoo offers a downloadable desktop application for Windows and Mac users, equipped with advanced charting tools and customisable layouts.

- APIs: Moomoo provides API access for users who prefer to develop their own trading algorithms or integrate the platform with third-party tools.

While Moomoo does not offer popular third-party platforms like MetaTrader 4 (MT4) or MetaTrader 5 (MT5), its proprietary trading platforms are designed to cater to the needs of both novice and experienced traders. The platform's intuitive interface, coupled with advanced features such as real-time market data, customisable watchlists, and a wide range of order types, empowers users to make informed trading decisions and execute their strategies efficiently.

Platforms Comparison Table

| Platform | Availability |

|---|---|

| MetaTrader 4 (MT4) | Not supported |

| MetaTrader 5 (MT5) | Not supported |

| cTrader | Not supported |

| Proprietary Platform | Supported |

| Desktop (Windows) | Supported |

| Desktop (Mac) | Supported |

| Web Platform | Supported |

| Mobile (Android) | Supported |

| Mobile (iOS) | Supported |

Moomoo How to Open an Account: A Step-by-Step Guide

Opening an account with Moomoo is a straightforward process that can be completed entirely online. Here's a step-by-step guide:

- Registration: Visit Moomoo's official website at moomoo.com and click on the "Sign Up" button. Provide your email address and create a strong password to initiate the registration process.

- Personal Information: Fill in your personal details, including your full name, date of birth, residential address, and contact information.

- Identity Verification: To comply with regulatory requirements, you will need to provide proof of identity and address. This typically involves uploading a government-issued ID (such as a passport or driver's license) and a recent utility bill or bank statement.

- Questionnaire: Complete a brief questionnaire about your financial knowledge, trading experience, and risk tolerance. This helps Moomoo assess the suitability of their products and services for your needs.

- Account Funding: Once your account is approved, you can fund it using one of the available payment methods, such as bank transfer, credit/debit card, or e-wallet. The minimum deposit required to start trading on Moomoo is $0.

- Start Trading: After your account is funded, you can download Moomoo's trading platform on your preferred device (desktop, web, or mobile) and start exploring the markets and placing trades.

Charts and Analysis

Moomoo provides a comprehensive suite of tools and resources to help traders make informed decisions and stay up-to-date with market developments.

These include:

| Feature | Description |

|---|---|

| Advanced Charting | Includes technical indicators, drawing tools, and customizable chart layouts |

| Real-time Market Data | Provides live quotes, trade volumes, and market depth information |

| News and Insights | Aggregates financial news from reputable sources |

| Analyst Ratings | Displays professional analyst ratings and stock price targets |

| Economic Calendar | Lists upcoming economic releases and events |

| Educational Resources | Offers learning tools to help users improve their trading knowledge and skills |

Moomoo Account Types

Moomoo offers a variety of account types to cater to the diverse needs of its users:

- Individual Account: This is the standard account type suitable for most retail traders. It provides access to all of Moomoo's trading platforms, tools, and features.

- Margin Account: Margin accounts allow users to borrow funds from Moomoo to trade larger positions. This account type is suitable for experienced traders who understand the risks involved in trading with leverage.

- Demo Account: Moomoo offers a demo account facility, enabling users to practise trading with virtual funds in a risk-free environment. This is an ideal option for beginners looking to familiarise themselves with the platform and test their trading strategies.

- Islamic Account: No specific information about Islamic accounts is provided in the given context. Moomoo's availability of Islamic accounts may vary depending on the jurisdiction.

Account Types Comparison Table

| Account Type | Availability | Minimum Deposit | Leverage | Margin |

|---|---|---|---|---|

| Individual Account | Available | $0 | 1:1 | None |

| Margin Account | Available | Varies by jurisdiction | Up to 1:4 | Available |

| Demo Account | Available | N/A | 1:1 | None |

| Islamic Account | Not Available | N/A | N/A | N/A |

Negative Balance Protection

Moomoo does not offer negative balance protection. This means that if your account balance goes negative, you are responsible for covering the deficit. Negative balance protection is a risk management feature offered by some brokers to ensure that traders cannot lose more than the funds they have deposited into their trading accounts. Without negative balance protection, traders may be liable for losses that exceed their account balance, potentially resulting in debt owed to the broker.

Moomoo Deposits and Withdrawals

Moomoo supports a range of deposit and withdrawal methods, making it convenient for users to manage their funds. However, the availability of specific payment options may vary depending on the user's country of residence.

Deposits Methods

| Method | Availability | Processing Time | Fees |

|---|---|---|---|

| ACH Transfer | United States | 3–5 business days | Free |

| Wire Transfer | US, Singapore, Australia | 1–3 business days | Varies by region and bank |

| Credit/Debit Card | Not supported | N/A | N/A |

| E-wallets (e.g., PayPal, Skrill, Neteller) | Not supported | N/A | N/A |

Withdrawals Methods

| Method | Availability | Processing Time | Fees |

|---|---|---|---|

| ACH Transfer | United States | 3–5 business days | Typically free |

| Wire Transfer | United States, Singapore, Australia | 1–3 business days | Varies by region and bank |

| E-wallets | Not supported | N/A | N/A |

| Credit/Debit Card | Not supported | N/A | N/A |

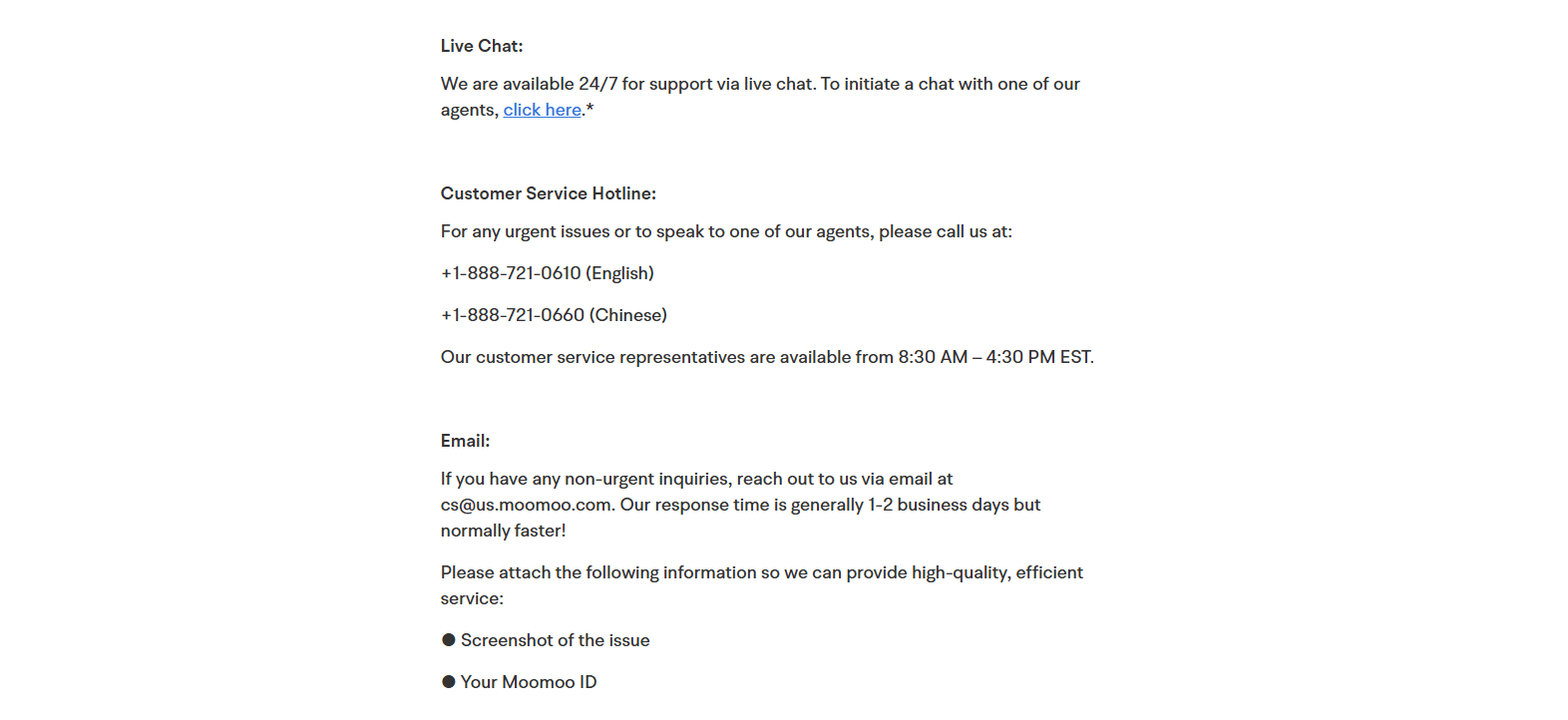

Support Service for Customer

Moomoo recognises the importance of providing reliable and efficient customer support to its users. The platform offers several channels through which users can seek assistance or raise queries:

- Live Chat: Moomoo's website and trading platform feature a live chat option, enabling users to connect with a customer support representative in real-time. This service is available 24/7.

- Email Support: Users can send their enquiries or concerns to Moomoo's customer support team via email. The support email address is cs@us.moomoo.com.

- Phone Support: Moomoo offers phone support for users who prefer to speak with a customer service representative directly. The phone support number is +1 888-721-0610, available from Monday to Friday, 8:30 AM to 4:30 PM Eastern Time.

- Social Media: Users can also reach out to Moomoo through their official social media channels, such as Facebook and Twitter, for general enquiries and updates.

- FAQ and Knowledge Base: Moomoo's website features a comprehensive FAQ section and knowledge base, addressing common user queries and providing guidance on platform features, account management, and trading-related topics.

Customer Support Comparison Table

| Channel | Availability | Response Time |

|---|---|---|

| Live Chat | 24/7 | Usually within minutes |

| Email (cs@us.moomoo.com) | 24/7 | Within 24 hours |

| Phone Support (+1 888-721-0610) | Mon–Fri, 8:30 AM – 4:30 PM ET | Usually within minutes during operating hours |

| Social Media (Facebook, Twitter) | 24/7 | Within 24 hours |

| FAQ and Knowledge Base | 24/7 | Self-serve, instant access |

Prohibited Countries

Due to regulatory requirements and legal restrictions, Moomoo's services are not available in certain countries. At the time of writing, the following regions are restricted from accessing Moomoo's platform:

- European Union (EU) and European Economic Area (EEA) countries

- Canada

- Japan

- New Zealand

- United Kingdom

Moomoo is continually working to expand its services to new markets, while ensuring compliance with local regulations and obtaining necessary licenses. As such, the list of restricted countries may change over time.

It's essential for users to note that attempting to access Moomoo's services from a restricted country may result in account termination and potential legal consequences. Users are responsible for ensuring that they are eligible to use Moomoo's platform based on their country of residence and any applicable regulations.

If you are unsure about whether Moomoo's services are available in your country, it is recommended to visit their official website or contact their customer support team for the most up-to-date information on geographic restrictions and eligibility.

Special Offers for Customers

Moomoo occasionally offers special promotions and incentives to both new and existing users. These offers may include:

- Sign-up Bonus: Receive up to $1,000 in bonus funds when you open a new account and meet deposit and trading requirements.

- Refer-a-Friend Program: Earn $50 for each friend you refer to Moomoo who opens an account and meets deposit and trading criteria.

- Monthly Trading Competition: Compete for a share of a $100,000 prize pool based on your trading volume and profitability.

- Educational Course Completion Bonus: Earn $20 in trading credits for completing Moomoo's "Introduction to Options Trading" course.

Conclusion

After conducting a thorough review of Moomoo, I can confidently say that they have established themselves as a reputable and reliable online broker. With a strong focus on providing a user-friendly and feature-rich trading experience, Moomoo has managed to attract a growing global user base.

One of the key strengths of Moomoo is its commitment to regulatory compliance. By operating under the oversight of multiple well-respected regulatory bodies, such as the SEC, FINRA, and MAS, Moomoo ensures a high level of investor protection and maintains strict standards of transparency and fairness.

Another notable aspect of Moomoo is its comprehensive range of tradable assets. Users can access a wide variety of markets, including stocks, ETFs, options, futures, and more, from a single platform. This diversity allows traders to build well-rounded portfolios and take advantage of different market opportunities.

Moomoo's trading platforms, available on desktop, web, and mobile, are intuitive and packed with advanced features. The platform's real-time market data, advanced charting tools, and customisable layouts cater to the needs of both novice and experienced traders. Additionally, the platform's social trading features foster a sense of community and enable users to learn from and collaborate with one another.

In terms of customer support, Moomoo offers multiple channels for users to seek assistance, including 24/7 live chat, email, phone support, and an extensive FAQ section. While response times may vary, Moomoo strives to provide timely and helpful support to its users.

One area where Moomoo could improve is in its educational resources. While the platform does offer some educational content, such as articles and webinars, there is room for expansion and improvement to better cater to the needs of beginner traders.

Overall, Moomoo presents itself as a reliable and user-focused online broker that prioritises the needs of its clients. With its strong regulatory framework, diverse asset offerings, and feature-rich trading platforms, Moomoo is well-positioned to continue its growth and attract traders from around the world. However, as with any financial decision, it's essential for potential users to conduct their own research and consider their individual trading goals and risk tolerance before choosing a broker.

Our broker reviews quick-view grid highlights key KPIs.

For zero-commission crypto CFDs, read the Trive review.