MTrading Review 2025: Is This Forex Broker Legit or a Scam?

MTrading

Saint Vincent and the Grenadines

Saint Vincent and the Grenadines

-

Minimum Deposit $10

-

Withdrawal Fee $varies

-

Leverage 1000:1

-

Minimum Order 0.01

-

Forex Available

-

Crypto Available

-

Stock Available

-

Indices Available

Licenses

Softwares & Platforms

Customer Support

+35722024166

(English)

+35722024166

(English)

Supported language: English

Social Media

Summary

MTrading is an offshore forex and CFD broker established in 2012, registered in Nevis and Saint Vincent and the Grenadines under Finvest Solutions Limited. The broker lacks regulation from any reputable financial authority such as the FCA, ASIC, or CySEC, raising serious concerns about client fund safety. Numerous traders report issues with withdrawals, hidden fees, and poor customer support. Additionally, the FCA has issued a warning about MTrading operating without proper authorization. While the broker offers MT4/MT5, high leverage, and low minimum deposits, its lack of oversight and troubling client complaints make it a high-risk choice.

- None

- Unregulated offshore broker with no oversight from reputable authorities

- Numerous client complaints about delayed or denied withdrawals, hidden fees, and poor support

- Questionable trading conditions, such as low minimum deposits and high leverage, that may encourage excessive risk-taking

- Limited transparency about ownership, financial standing, and regulatory status

- Insufficient educational resources that fail to provide comprehensive support for client success

- Subpar customer support, with many reports of unresponsive or unhelpful staff

- Potential legal and financial risks associated with trading with an unregulated broker

- Lack of negative balance protection, leaving clients vulnerable to losing more than their account balance

- Inconsistent and unclear information about account types, trading conditions, and platform features

- Overall negative reputation within the trading community, with numerous warnings from experienced traders and industry experts

Overview

MTrading is a forex and CFD broker that was established in 2012. The company is registered offshore in Nevis and Saint Vincent and the Grenadines under the name Finvest Solutions Limited, with registration number 55504. As an offshore entity, MTrading is subject to minimal regulatory oversight, which raises serious concerns about the safety and security of clients' funds.

On its website [MTrading.com], MTrading claims to offer a wide range of tradable instruments, account types, and trading platforms. However, as this extensive review will demonstrate, there are numerous red flags and issues that should give potential clients pause before considering opening an account with this broker.

Overview Table

| Feature | Details |

|---|---|

| Registered In | Nevis and Saint Vincent and the Grenadines |

| Founded | 2012 |

| Regulation | Offshore only, no reputable licenses |

| Customer Support | Questionable – many complaints of unresponsive support |

| Minimum Deposit | $10 |

| Withdrawal Issues Reported | Yes – numerous complaints of delays, denials, and unexpected fees |

| Safety of Funds | Highly concerning due to lack of proper regulation |

| Overall Rating | Not Recommended – Avoid |

Facts List

- Offshore broker registered in Nevis and SVG, which are lax jurisdictions

- No regulation from any respected financial authorities like FCA, ASIC, CySEC

- Operates under the company Finvest Solutions Limited, founded in 2012

- Offers forex, CFDs, stocks, indices, and crypto trading with leverage up to 1:1000

- Provides the MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms

- Extremely low minimum deposit requirement of just $10

- Multiple account types including All In Price, M.Premium, and M.Pro

- Numerous serious complaints from clients about withdrawal delays, denials, and extra fees

- Poor and unhelpful customer support reported by many traders

- FCA warning about MTrading operating as an unauthorized "clone firm" in the UK

MTrading Licenses and Regulatory

One of the most critical aspects to consider when evaluating any forex broker is their regulatory status. Proper regulation from respected financial authorities helps ensure that brokers adhere to strict standards regarding the segregation and protection of client funds, fair and transparent trading practices, and regular audits of their operations.

Unfortunately, MTrading falls far short in this crucial area. The broker is registered offshore in the islands of Nevis and Saint Vincent and the Grenadines (SVG), which are known for their lax regulatory requirements. Offshore registration allows brokers to operate with minimal oversight and compliance, leaving clients vulnerable to potential malpractice and fraud.

Notably, MTrading does not hold any licenses from major, well-respected regulatory bodies such as:

- Financial Conduct Authority (FCA) in the UK

- Australian Securities and Investments Commission (ASIC)

- Cyprus Securities and Exchange Commission (CySEC)

- National Futures Association (NFA) or Commodity Futures Trading Commission (CFTC) in the US

The lack of licensing from these top-tier authorities is a major red flag. These regulators enforce strict rules to protect consumers, such as mandating the segregation of client and company funds, maintaining minimum capital requirements, and regularly auditing brokers' operations. They also provide avenues for client complaints and can enforce sanctions against brokers that violate regulations.

In fact, the FCA has issued a specific warning that MTrading may be providing financial services or products in the UK without proper authorisation. This is a serious allegation that further underscores the risk of dealing with an unregulated, offshore entity.

Without oversight from respected regulators, there is little to prevent MTrading from engaging in unethical or illegal practices, such as misusing client funds, manipulating trading conditions, or refusing to process withdrawals. If clients experience issues, they have limited recourse for resolving disputes or being compensated for losses.

For comparison, well-regulated brokers will prominently display their licensing information and submit to regular audits to maintain compliance. They operate with much greater transparency and provide clients with peace of mind that their funds are safe and their trading is conducted on a level playing field.

Given MTrading's lack of reputable licensing and offshore registration in jurisdictions known for lax oversight, I strongly caution against opening an account with this broker. Traders should instead seek out brokers with verifiable regulation from respected authorities to ensure the safety of their funds and fair treatment.

Trading Instruments

According to MTrading's website, the broker offers the following tradable instruments:

- Forex currency pairs

- CFDs on stocks

- Indices

- Commodities

- Cryptocurrencies

While this represents a fairly standard selection of assets, MTrading provides little specific information about the exact instruments available, their trading conditions, or the competitiveness of their spreads and commissions.

This lack of transparency is concerning, as it makes it difficult for potential clients to assess the true quality and depth of MTrading's offerings. Reputable brokers are typically more forthcoming with detailed information about their asset selection, leverage, fees, and trading requirements.

Without knowing the specific forex pairs, stocks, indices, commodities, and crypto assets available, it's hard to gauge how MTrading's range compares to industry standards. The broker also doesn't provide any clear indication of their typical spreads, overnight financing fees, commissions, or other trading costs.

Trading Platforms

MTrading claims to offer the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms for trading.

These third-party platforms, developed by MetaQuotes Software, are widely used in the industry and offer a range of features, such as:

- Advanced charting with multiple timeframes and chart types

- A wide selection of technical indicators and drawing tools for analysis

- Algorithmic trading support through expert advisors (EAs)

- Customizable watch lists, alerts, and trading reports

- Mobile trading apps for iOS and Android devices

While MT4 and MT5 are certainly robust platforms when offered by reputable brokers, MTrading's lack of regulation raises serious questions about the reliability and integrity of its infrastructure.

With no oversight from major financial authorities, there is a risk that MTrading's servers may be unstable, leading to issues with slippage, requotes, or outright platform failures. This can be especially problematic during times of high market volatility, when reliable order execution is crucial.

Additionally, MTrading provides no clear information about the specific tools, plugins, or customisation options available for its MT4 and MT5 offerings. Many leading brokers offer custom indicators, EAs, or trading tools to enhance the default MetaTrader experience. The absence of these details from MTrading's website suggests its platform offering may be a generic, "out of the box" implementation without the level of support or additional features found at more established brokers.

It's also concerning that MTrading doesn't appear to offer any proprietary, web-based platform or mobile apps of its own. While MT4 and MT5 are widely used, many leading brokers have developed their own platforms to provide a more unique, tailored trading experience. This often includes more user-friendly interfaces, exclusive tools and analysis features, and direct broker support.

The fact that MTrading relies solely on third-party platforms and provides no detailed information about their implementation suggests a lack of commitment to technology and the client trading experience. Traders should be wary of potential platform instability, limited features, and the absence of dedicated broker support.

Before signing up with MTrading, I strongly recommend comparing its platform offerings to those of licensed, reputable brokers. Look for brokers that provide detailed information about the tools, resources, and support available, as well as a track record of stable, reliable platform performance. Don't be swayed by the mere presence of MT4/MT5 – the quality and dependability of the broker's implementation are what matter most.

MTrading How to Open an Account: A Step-by-Step Guide

Opening an account with MTrading is a straightforward process that can be completed online. However, given the numerous red flags and concerns outlined in this review, I strongly caution against proceeding with MTrading and recommend choosing a well-regulated, reputable broker instead.

For informational purposes only, here are the general steps to open an account with MTrading:

- Visit the MTrading website at [MTrading.com] and click on the "Open an Account" or "Sign Up" button.

- Choose your preferred account type from the available options: All In Price, M.Premium, or M.Pro. Be aware that MTrading provides limited information about the specific conditions and features of each account type.

- Fill out the registration form with your personal details, including:

- Full name

- Email address

- Phone number

- Country of residence

- Date of birth Note that MTrading may require additional information or documentation to verify your identity, as per anti-money laundering (AML) and know-your-customer (KYC) regulations. However, as an unregulated offshore broker, MTrading's compliance with these standards is questionable.

- Choose your preferred trading platform: MT4 or MT5. MTrading provides little information about the specific tools, features, or customisation options available for each platform.

- Select your base account currency from the available options. Be aware that MTrading may charge conversion fees for deposits or withdrawals in currencies other than your chosen base currency.

- Read and accept MTrading's Terms and Conditions, Client Agreement, and Privacy Policy. As an unregulated broker, MTrading's legal agreements may not provide the same level of client protection as those of licensed, reputable brokers.

- Submit your registration form and wait for MTrading to process your application. The broker claims that most accounts are approved within 24 hours, but there is limited information about the specific verification process or expected timeframes.

- Once your account is approved, log in to the MTrading client portal to access your trading account details, deposit funds, and start trading. Be aware of the numerous client complaints regarding delayed or denied withdrawals, hidden fees, and other concerning practices by MTrading.

Charts and Analysis

MTrading provides a limited selection of educational resources and trading tools on its website, including:

| Feature | Description | Limitations |

|---|---|---|

| Market Analysis | Daily market updates and analysis on forex, commodities, and global markets | Brief, surface-level commentary; lacks in-depth, actionable insights or trade recommendations |

| Economic Calendar | Basic display of upcoming economic events and data releases | Minimal filtering/customization; no real-time updates or alerts for high-impact events |

| Forex Calculator | Tool for calculating pip value, margin, and potential profit/loss | Limited to basic forex functions; no support for other asset classes or advanced risk management |

| Forex Glossary | Alphabetical list of forex terms with concise definitions | Suitable for beginners but lacks depth, context, examples, and interactive/cross-linked content |

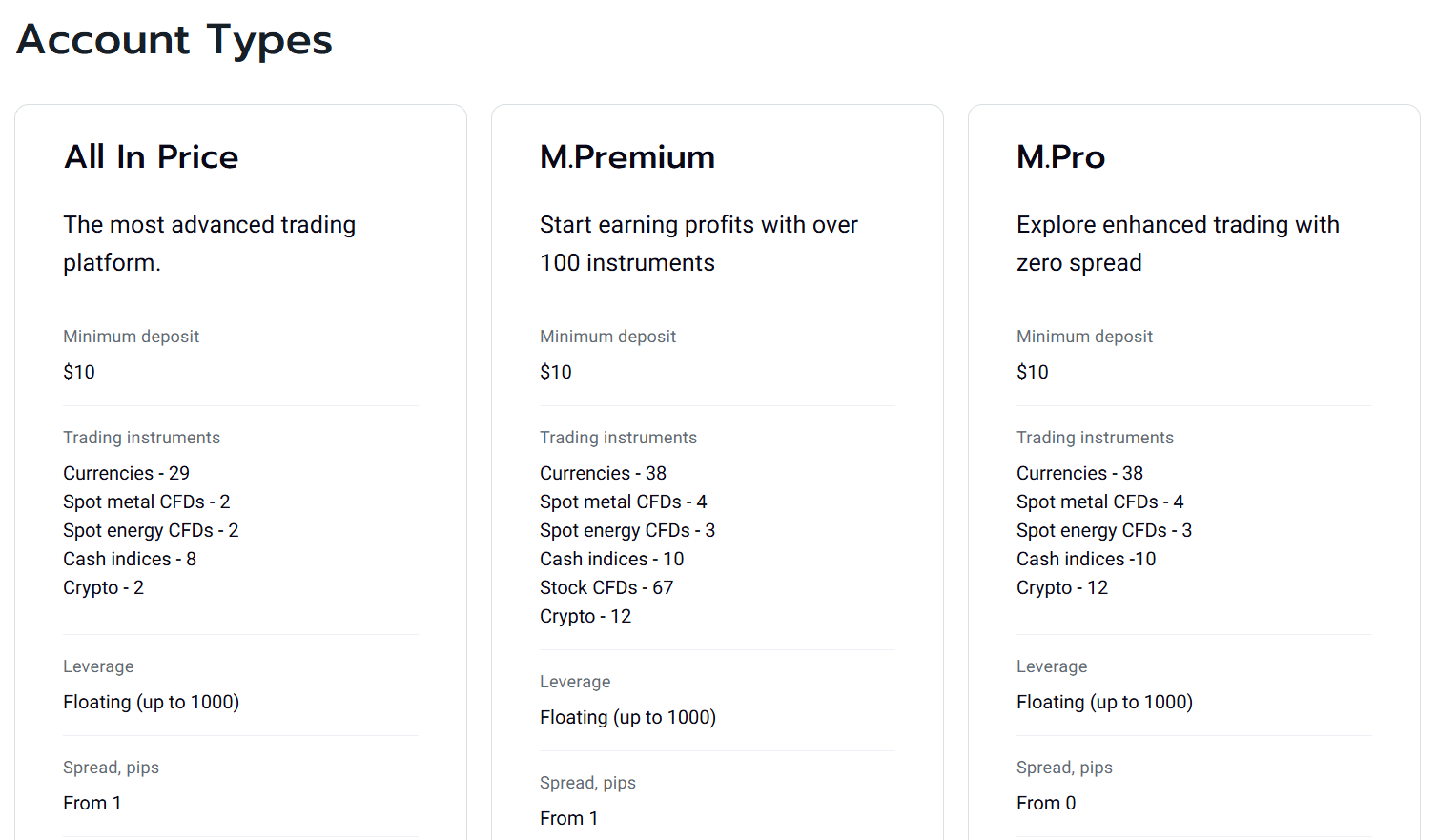

MTrading Account Types

MTrading offers three main account types: All In Price, M.Premium, and M.Pro. While each account has unique features, there are several concerning aspects that potential clients should carefully consider before choosing MTrading as their broker.

- All In Price

- Minimum deposit of just $10, which is unusually low and may attract inexperienced traders

- Access to 29 currency pairs, 2 spot metal CFDs, 2 spot energy CFDs, 8 cash indices, and 2 crypto CFDs

- Floating leverage up to 1:1000, which is extremely high and risky for most retail traders

- Spreads from 1 pip, with no additional commissions

- MT5 platform with mobile trading for iOS and Android devices

- Supports Expert Advisors (EAs) for automated trading

- No MetaTrader Supreme Edition add-on available

- M.Premium

- Minimum deposit of $10, again raising concerns about attracting undercapitalized traders

- Wider range of tradable instruments, including 38 currency pairs, 4 spot metal CFDs, 3 spot energy CFDs, 10 cash indices, 67 stock CFDs, and 12 crypto CFDs

- Floating leverage up to 1:1000, which far exceeds regulatory limits in many jurisdictions

- Spreads from 1 pip, with no commissions

- MT4 platform with mobile trading and support for EAs

- Includes access to the MetaTrader Supreme Edition add-on for enhanced features

- M.Pro

- Minimum deposit of $10, which is alarmingly low for a "pro" account

- Access to 38 currency pairs, 4 spot metal CFDs, 3 spot energy CFDs, 10 cash indices, and 12 crypto CFDs

- Floating leverage up to 1:1000, which is unsuitable for most traders and may lead to rapid account depletion

- Zero spread pricing, but with a commission of $4 per lot traded

- MT4 platform with mobile trading, EA support, and the Supreme Edition add-on

While MTrading offers a range of account types with varying trading instruments and conditions, there are several red flags that should give potential clients pause:

- Extremely low minimum deposits: The $10 minimum deposit across all account types is concerning, as it may attract inexperienced traders who are more likely to lose their money quickly. Reputable brokers typically require higher minimums to ensure clients are adequately capitalised and to comply with regulations.

- Excessive leverage: The floating leverage up to 1:1000 offered by MTrading far exceeds the limits imposed by regulators like ESMA and the FCA, which cap leverage at 1:30 for major forex pairs and lower for more volatile instruments. Such high leverage can amplify losses and lead to rapid account depletion.

- Limited information: MTrading provides only basic information about each account type, lacking details on specific trading conditions, fees, or additional features. This lack of transparency makes it difficult for potential clients to make informed decisions or compare MTrading's offerings to other brokers.

- No demo accounts: MTrading does not appear to offer demo accounts for clients to practise trading or test the platform risk-free. Demo accounts are a standard offering among reputable brokers and are essential for new traders to familiarise themselves with the markets and platform before risking real money.

- Inconsistent features: The availability of certain features, like the MetaTrader Supreme Edition add-on, varies across account types without clear justification. This inconsistency suggests a lack of a cohesive account structure or client-centric approach.

When choosing a broker, it's crucial to look for a well-rounded offering that caters to your specific trading needs and experience level. A trustworthy broker should provide:

- Reasonable minimum deposits that ensure you are sufficiently capitalized

- Leverage limits that comply with regulatory standards and protect your account from excessive risk

- Transparent, detailed information about account features, trading conditions, and fees

- Demo accounts to practice trading and test strategies risk-free

- Consistent access to essential tools and features across account types

While MTrading's range of account types may seem attractive at first glance, the numerous red flags and lack of transparency suggest that traders may be better served by a more reputable, well-regulated broker. Before making a decision, thoroughly compare MTrading's offerings to those of brokers with a proven track record of integrity and client-centric service.

Account Types Comparison Table

| Feature | All In Price | M.Premium | M.Pro |

|---|---|---|---|

| Minimum Deposit | $10 | $10 | $10 |

| Leverage | Up to 1:1000 | Up to 1:1000 | Up to 1:1000 |

| Spread (pips) | From 1 | From 1 | From 0 |

| Commission | No | No | $4 per lot |

| Execution Type | Market (ECN) | Market | Market |

| Minimum Order Size (lots) | 0.01 | 0.01 | 0.01 |

| Maximum Order Size (lots) | 100 | 100 | 200 |

| Stop Out Level | 30% | 30% | 30% |

| Hedging Allowed | Yes | Yes | Yes |

| Platform | MetaTrader 5 | MetaTrader 4 | MetaTrader 4 |

| Mobile Trading | iOS, Android | iOS, Android | iOS, Android |

| Expert Advisors (EAs) | Yes | Yes | Yes |

| MetaTrader Supreme Edition | No | Yes | Yes |

| One-Click Trading | Yes | Yes | Yes |

Negative Balance Protection

Unfortunately, MTrading does not provide any clear information about its negative balance protection policy on its website. As an unregulated offshore broker, MTrading is not required to offer negative balance protection to its clients, which is a significant concern. In contrast, reputable brokers licensed by respected regulatory bodies like the FCA, ASIC, or CySEC are typically required to provide negative balance protection as part of their client protection measures. These brokers have clear policies in place to ensure that clients cannot lose more than their account balance, even in extreme market conditions. The lack of transparency surrounding MTrading's negative balance protection policy is a red flag that potential clients should not ignore. Without clear assurances that their funds are protected, traders may be exposing themselves to unnecessary risk by trading with MTrading.

MTrading Deposits and Withdrawals

According to MTrading's website, the broker offers the following deposit and withdrawal methods:

Deposit Methods

| Method | Minimum Deposit | Maximum Deposit | Fees | Notes |

|---|---|---|---|---|

| Local Depositor | $10 / 50 MYR | Up to $10,000 / 45,000 MYR | Not disclosed | Local Malaysian banks supported |

| FPX | $10 / 50 MYR | Up to $10,000 / 45,000 MYR | Not disclosed | Fast Payment system (Malaysia) |

| Internet Banking | $10 / 50 MYR | Up to $10,000 / 45,000 MYR | Not disclosed | Direct bank transfer |

| Touch 'n Go | $10 / 50 MYR | Up to $10,000 / 45,000 MYR | Not disclosed | Mobile e-wallet option |

| Tether (USDT) | $10 | Not specified | Not disclosed | Cryptocurrency transfer |

| Neteller | $10 | Not specified | Not disclosed | Popular e-wallet for international clients |

Withdrawal Methods

| Method | Availability | Fees | Processing Time | Notes |

|---|---|---|---|---|

| Local Bank Transfer | Available | Not disclosed | Often delayed | Common method but subject to complaints |

| FPX | Available | Not disclosed | Unspecified | Rarely used for withdrawals |

| Tether (USDT) | Available | Not disclosed | Unspecified | Cryptocurrency withdrawal option |

| Neteller | Available | Not disclosed | Unspecified | May have limits and potential delays |

| Internet Banking | Available | Not disclosed | Unspecified | Local option with frequent delays reported |

Support Service for Customer

Reliable customer support is a crucial aspect of a positive trading experience. In the fast-paced world of online trading, clients need access to responsive, knowledgeable support staff who can quickly address their concerns and resolve any issues that may arise. A broker's customer support team serves as the primary point of contact for clients, assisting with account-related questions, technical issues, trading platform guidance, and more. Prompt, helpful customer support can make the difference between a seamless trading experience and a frustrating one. Unfortunately, MTrading falls short in providing transparent, comprehensive information about its customer support offerings. The broker's website mentions a live chat feature but does not specify the hours of operation or expected response times. There is also an email contact form for general enquiries, but no indication of how quickly clients can expect a response. Notably absent from MTrading's website are:

- Telephone support numbers or operating hours

- The availability of a dedicated account manager

- Support in languages other than English

- Country-specific contact details or local support options

- 24/7 live chat for immediate assistance

- Dedicated phone support numbers with specified operating hours

- Email support with clear response time targets

- Social media channels for quick inquiries and updates

- Multilingual support to cater to a global client base

- Personalized support through dedicated account managers

Customer Support Comparison Table

| Support Channel | Availability | Hours of Operation | Languages Supported | Response Time |

|---|---|---|---|---|

| Live Chat | Yes | Not specified | Not specified | Not specified |

| Yes | Not specified | Not specified | Not specified | |

| Phone | Not specified | Not specified | Not specified | Not specified |

| Social Media | Not specified | Not specified | Not specified | Not specified |

| Dedicated Account Manager | Not specified | Not specified | Not specified | Not specified |

Prohibited Countries

MTrading's website does not provide a clear, comprehensive list of countries or regions where it is prohibited from offering its services. This lack of transparency is concerning, as it makes it difficult for potential clients to determine whether they are eligible to open an account with the broker.

As an unregulated offshore broker operating from Nevis and St Vincent and the Grenadines, MTrading may not be subject to the same strict licensing and compliance requirements as brokers registered in more reputable jurisdictions. However, this does not exempt the broker from adhering to international regulations and restrictions.

Many countries have specific laws and regulations governing the provision of financial services, including online trading. These regulations may require brokers to obtain local licenses, comply with consumer protection measures, or adhere to specific operational standards. Failure to comply with these regulations can result in legal consequences and pose risks for both the broker and its clients.

Special Offers for Customers

At the time of this review, MTrading does not appear to offer any special promotions or bonuses to new or existing clients. The broker's website does not mention any sign-up incentives, loyalty programs, trading competitions, or partnerships with third-party service providers.

Conclusion

After carefully examining MTrading's offerings, business practices, and reputation, I strongly advise against choosing this broker for your trading needs. The numerous red flags and concerns identified throughout this review paint a clear picture of an untrustworthy and potentially dangerous broker that should be avoided.

MTrading's lack of proper regulation is the most significant issue. As an offshore broker operating from Nevis and St Vincent and the Grenadines, MTrading is not subject to the strict oversight and client protection measures enforced by reputable regulatory bodies like the FCA, ASIC, or CySEC. This lack of regulation exposes clients to unnecessary risks and leaves them vulnerable to potential fraud or malpractice.

The broker's history of client complaints is another major concern. Numerous traders have reported issues with delayed or denied withdrawals, hidden fees, and unresponsive customer support. These complaints, which are consistent across various online forums and review sites, suggest a pattern of unethical behaviour that should not be ignored.

MTrading's trading conditions also raise several red flags. The extremely low minimum deposit requirement of just $10 and the excessively high leverage of up to 1:1000 are not in line with responsible trading practices. These conditions may lure inexperienced traders into taking on excessive risk, leading to rapid account depletion and substantial financial losses.

The lack of transparency surrounding MTrading's ownership structure, regulatory status, and business practices is another significant issue. The broker provides minimal information about its management team, financial standing, or corporate governance. This opacity makes it difficult for potential clients to make informed decisions and assess the broker's credibility.

Furthermore, MTrading's limited educational resources and subpar customer support fail to inspire confidence in the broker's commitment to client success. The absence of comprehensive, high-quality educational content and the reported issues with unresponsive or unhelpful support staff suggest that MTrading is not prioritising the needs and interests of its clients.

In light of these significant concerns, I cannot in good faith recommend MTrading as a suitable choice for any trader, regardless of their experience level or trading style. The potential risks far outweigh any perceived benefits, and there are numerous other reputable, well-regulated brokers that offer a safer and more supportive trading environment.

If you are considering opening an account with MTrading, I urge you to reconsider and explore alternative options. Prioritise brokers that are fully licensed by respected regulatory authorities, have a proven track record of integrity and client satisfaction, and offer transparent, fair trading conditions. Your hard-earned money and trading success are too valuable to entrust to a broker with such serious red flags.

Remember, the safety and security of your funds should always be your top priority when choosing a broker. Don't be swayed by promises of low minimum deposits, high leverage, or quick profits. These are often tactics used by unscrupulous brokers to attract unsuspecting clients and mask their true intentions.

Instead, focus on finding a broker that aligns with your values, trading goals, and risk tolerance. Look for a partner that prioritises your success, provides robust educational resources and support, and operates with full transparency and regulatory compliance. With the right broker by your side, you can trade with confidence and focus on achieving your financial objectives.

In conclusion, based on the findings of this extensive review, I strongly advise against choosing MTrading as your broker. The numerous red flags and concerns identified throughout this analysis paint a clear picture of an untrustworthy and potentially dangerous broker that should be avoided at all costs. Protect your investments and your trading future by choosing a reputable, well-regulated broker that puts your interests first.

Need a second opinion? Check the full broker reviews library before you commit.

Compare ECN speed in the IC Markets review.