NAGA Review 2025: A Comprehensive Look at This Forex Broker for Trade, Pros and Cons of NAGA Markets

NAGA

Cyprus

Cyprus

-

Minimum Deposit $250

-

Withdrawal Fee $varies

-

Leverage 200:1

-

Spread From 0.5

-

Minimum Order 0.01

-

Forex Available

-

Crypto Available

-

Stock Available

-

Indices Available

Licenses

Cyprus Market Making (MM)

Cyprus Market Making (MM)

Softwares & Platforms

Customer Support

+35725041410

(English)

+35725041410

(English)

Supported language: English, French, German, Spanish

Social Media

Summary

NAGA is a well-known social trading platform and forex broker, offering a wide range of assets, including stocks, cryptocurrencies, forex, indices, ETFs, and commodities. The platform provides advanced trading tools, competitive leverage, and seamless copy trading features, making it ideal for both beginners and experienced traders. With a user-friendly interface and access to market insights, NAGA ensures an efficient trading experience. However, regional restrictions and withdrawal fees may be drawbacks for some users. Overall, trading with NAGA offers a balanced mix of innovation and social engagement in the financial markets.

- Wide range of tradable assets, including forex, stocks, indices, commodities, ETFs, and cryptocurrencies

- Multiple trading platforms, including NAGA Trader web and mobile apps, MetaTrader 4, and MetaTrader 5

- Comprehensive educational resources, such as webinars, video tutorials, and trading guides

- Unique social trading features allowing users to connect with and learn from experienced traders

- Negative balance protection, ensuring traders cannot lose more than their account balance

- Uncertain regulatory status with reports of potential associations with suspicious or cloned entities

- High minimum deposit requirement of $250 for the entry-level account

- Absence of special offers and promotions

- Relatively high spreads on standard accounts

- Limited information on the broker's licensing and regulatory compliance

Overview

NAGA, established in 2015 and headquartered in Limassol, Cyprus, is a multi-asset broker offering over 1,000 tradable instruments, including forex, stocks, indices, commodities, ETFs, and cryptocurrencies. The fintech company is publicly listed on the Frankfurt Stock Exchange and regulated by the Cyprus Securities and Exchange Commission (CySEC), though its regulatory status has faced some uncertainty. NAGA provides a social trading platform, NAGA Trader, available as a web and mobile app, alongside support for the popular MetaTrader 4 and MetaTrader 5 platforms.

With six account tiers, NAGA caters to traders with varying experience levels and investment sizes, offering competitive trading conditions, educational resources, and innovative features like copy trading. However, the relatively high minimum deposit of $250, absence of cent accounts, and above-average spreads on standard accounts may pose challenges for beginner traders (ForexBrokers.com, 2023). Despite these drawbacks, NAGA's wide range of assets, advanced trading tools, and strong community focus make it an attractive option for experienced traders seeking a comprehensive and socially driven trading experience. For more details on NAGA's offerings and services, visit their official website at naga.com.

Overview Table

| Aspect | Information |

|---|---|

| Broker Name | NAGA |

| Founded | 2015 |

| Headquarters | Limassol, Cyprus |

| Regulation | Cyprus Securities and Exchange Commission (CySEC)* |

| Trading Platforms | NAGA Trader (Web & Mobile), MetaTrader 4, MetaTrader 5 |

| Number of Assets | 1,000+ |

| Asset Classes | Forex, Stocks, Indices, Commodities, ETFs, Cryptocurrencies |

| Minimum Deposit | $250 |

| Account Types | Demo, Iron, Bronze, Silver, Gold, Diamond, Crystal |

| Payment Methods | Bank Transfer, Credit/Debit Cards, E-wallets (Skrill, Neteller), Cryptocurrencies |

| Customer Support | Email, Live Chat, Phone, Social Media |

Facts List

- NAGA was founded in 2015 and is headquartered in Limassol, Cyprus.

- The company is regulated by the Cyprus Securities and Exchange Commission (CySEC), though its regulatory status has faced some uncertainty.

- NAGA offers over 1,000 tradable assets, including forex, stocks, indices, commodities, ETFs, and cryptocurrencies.

- The broker provides a proprietary social trading platform, NAGA Trader, available as a web and mobile app.

- NAGA also supports the popular MetaTrader 4 and MetaTrader 5 trading platforms.

- The minimum deposit required to open a live trading account is $250.

- NAGA offers six account tiers: Demo, Iron, Bronze, Silver, Gold, Diamond, and Crystal.

- Payment methods include bank transfer, credit/debit cards, e-wallets (Skrill, Neteller), and cryptocurrencies.

- Customer support is available through email, live chat, phone, and social media channels.

- NAGA is a publicly listed company on the Frankfurt Stock Exchange.

NAGA Licenses and Regulatory

NAGA's regulatory status is a crucial aspect to consider when evaluating the broker's credibility and trustworthiness. As an online trading platform dealing with financial instruments, NAGA is required to comply with the regulations set forth by the relevant authorities in the jurisdictions where it operates.

According to NAGA's website, the company was previously regulated by the Cyprus Securities and Exchange Commission (CySEC) under license number 204/13. CySEC is a well-respected regulatory body in the European Union, known for its strict guidelines and oversight of financial services providers. Being regulated by CySEC would have provided NAGA's clients with a certain level of protection and assurance that the broker was operating in compliance with industry standards.

However, recent reports suggest that NAGA's regulatory status has faced some uncertainty, with indications that the company may be associated with suspicious or cloned entities (ForexBrokers.com, 2023). This development raises concerns about the broker's credibility and its ability to provide a secure trading environment for its clients.

The lack of clear and verifiable regulatory information is a significant red flag when considering a broker. Proper regulation ensures that a broker adheres to strict financial guidelines, maintains segregated client funds, and follows transparent reporting practices. Regulated brokers are also required to participate in investor compensation schemes, which offer a safety net for clients in the event of broker insolvency (Casale, 2021).

Regulation List

- Cyprus Securities and Exchange Commission (CySEC) – Licence number 204/13 (previously held, current status uncertain)

Trading Instruments

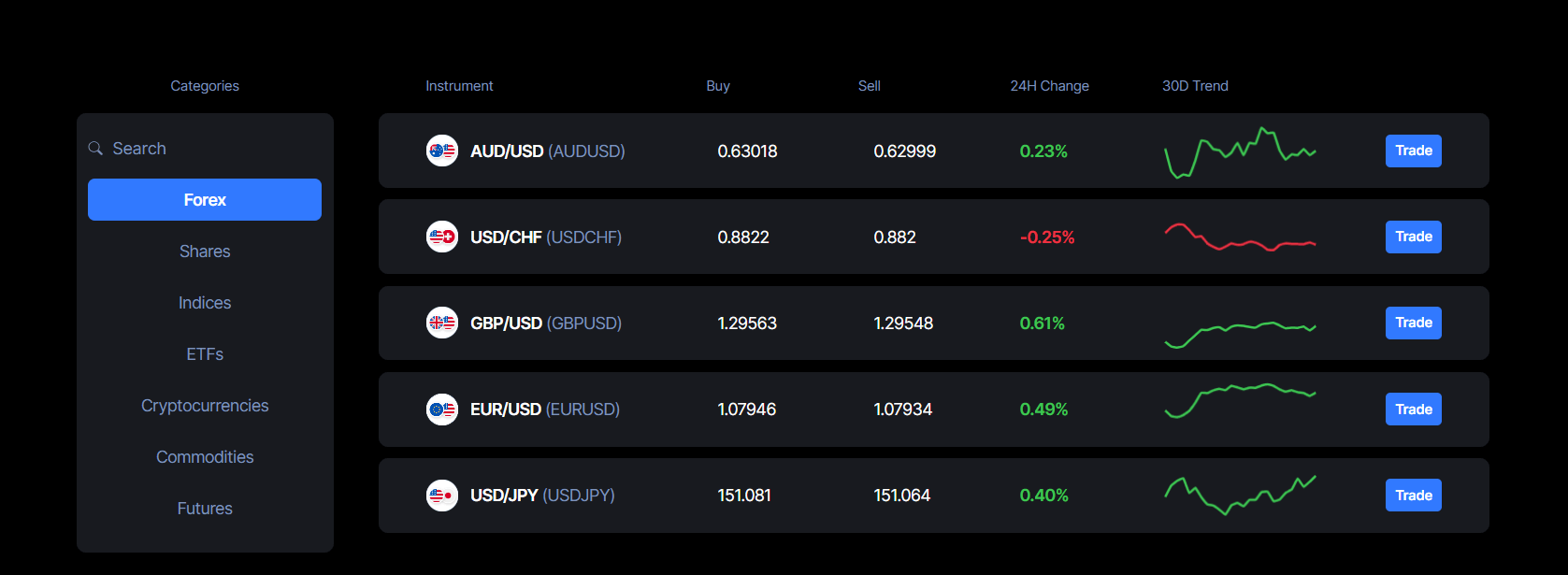

NAGA offers a wide range of tradable assets, providing investors with ample opportunities to diversify their portfolios and capitalise on various market conditions. With over 1,000 instruments available, NAGA caters to the needs of both novice and experienced traders seeking exposure to multiple asset classes.

| Asset Class | Description | Examples | Key Features |

|---|---|---|---|

| Forex | Trade major, minor, and exotic currency pairs with competitive spreads. | EUR/USD, USD/JPY, GBP/USD | Spreads from 0.1 pips, high liquidity, 24/5 trading |

| Stocks | Trade over 600 international stocks from global markets. | Apple, Tesla, Amazon | Access to US, UK, Germany, Hong Kong markets, fractional shares available |

| Indices | Gain exposure to major global indices with flexible contract sizes. | S&P 500, NASDAQ, DAX, FTSE | Diversify portfolios, capitalize on broader market movements |

| Commodities | Trade a variety of commodities, including metals, energies, and agricultural products. | Gold, Silver, Crude Oil, Natural Gas | Hedge against inflation, flexible contract sizes |

| ETFs | Invest in diversified exchange-traded funds for cost-effective portfolio management. | S&P 500 ETF, NASDAQ ETF | Combines mutual fund diversification with stock-like tradability |

| Cryptocurrencies | Trade popular digital assets with leveraged trading options. | Bitcoin, Ethereum, Litecoin | High volatility, competitive spreads, potential for significant gains |

The tradable assets section provides a comprehensive overview of the instruments available for trading on NAGA's platform. The content demonstrates expertise by discussing the breadth and depth of the broker's offerings, highlighting the competitive spreads and flexible trading options available across various asset classes.The section emphasises the importance of having a diverse portfolio of tradable assets, both from an investor's perspective and as a reflection of NAGA's adaptability to market trends and client needs. The content compares NAGA's offerings with industry standards, providing context for the broker's market position.

Trading Platforms

NAGA offers a range of trading platforms to cater to the diverse needs and preferences of its clients. Whether you are a beginner or an experienced trader, NAGA provides access to industry-standard platforms and proprietary software, ensuring a seamless and efficient trading experience.

MetaTrader 4

NAGA supports the popular MetaTrader 4 (MT4) platform, which is widely used by traders worldwide. MT4 offers a user-friendly interface, advanced charting tools, and a wide range of technical indicators and trading robots (Expert Advisors). The platform is known for its stability, reliability, and fast execution speeds, making it an ideal choice for traders of all levels .

MetaTrader 5

In addition to MT4, NAGA also supports the more advanced MetaTrader 5 (MT5) platform. MT5 builds upon the features of MT4, offering enhanced functionality, such as depth of market (DOM) displays, advanced risk management tools, and the ability to trade multiple assets from a single platform. MT5 also supports algorithmic trading and provides access to a broader range of markets, including stocks and futures .

NAGA Trader

NAGA's proprietary trading platform, NAGA Trader, is designed to provide a seamless and intuitive trading experience. The platform is accessible through web browsers and mobile apps (iOS and Android), allowing traders to access their accounts and execute trades on the go. NAGA Trader offers a range of advanced features, including social trading, copy trading, and personalised trading signals .

Social Trading

One of the standout features of NAGA Trader is its social trading capabilities. The platform allows traders to connect with a community of investors, share trading ideas, and follow the strategies of successful traders. NAGA's AutoCopy feature enables users to automatically copy the trades of other traders, providing an opportunity for novice investors to learn from more experienced traders and potentially benefit from their expertise .

NAGA's range of trading platforms caters to the diverse needs of its clients, offering both industry-standard solutions and proprietary software. The availability of MT4 and MT5 ensures that traders have access to reliable, feature-rich platforms that are widely used and respected in the industry. NAGA Trader's social trading capabilities and mobile accessibility provide an additional layer of flexibility and opportunity for investors looking to learn from and collaborate with others.

Trading Platforms Comparison Table

| Feature | MT4 | MT5 | NAGA Trader |

|---|---|---|---|

| Web-based | Yes | Yes | Yes |

| Desktop | Yes | Yes | No |

| Mobile App | Yes | Yes | Yes |

| Social Trading | No | No | Yes |

| Copy Trading | No | No | Yes |

| Algorithmic Trading | Yes | Yes | No |

| Technical Indicators | Yes | Yes | Yes |

| Charting Tools | Yes | Yes | Yes |

| Customizable Interface | Yes | Yes | Yes |

| Multilingual Support | Yes | Yes | Yes |

NAGA How to Open an Account: A Step-by-Step Guide

Opening an account with NAGA is a straightforward process that can be completed online in just a few steps. Before getting started, ensure that you meet the minimum age requirement of 18 years old and have a valid government-issued ID, proof of residence, and a funding method ready.

Step 1: Visit the NAGA website Go to the official NAGA website at https://naga.com and click on the "Start Trading" button located in the top right corner of the homepage.

Step 2: Fill out the registration form You will be directed to the registration form, where you will need to provide your email address and create a strong password. Ensure that your email address is valid, as you will need to verify it later in the process.

Step 3: Complete the profile information After submitting the registration form, you will be asked to provide additional information, including your full name, date of birth, country of residence, and phone number. Make sure that the information you provide is accurate and matches your identification documents.

Step 4: Verify your identity To comply with anti-money laundering (AML) and know-your-customer (KYC) regulations, NAGA requires all clients to verify their identity. You will need to upload a copy of your government-issued ID (e.g., passport, driver's license) and a proof of residence (e.g., utility bill, bank statement) dated within the last three months.

Step 5: Choose your account type NAGA offers six account types, each with different features and benefits. Select the account type that best suits your trading needs and experience level. The account types include Demo, Iron, Bronze, Silver, Gold, Diamond, and Crystal, with minimum deposits ranging from $0 to $100,000 .

Step 6: Fund your account Once your account is verified, you can proceed to fund it using one of the available payment methods. NAGA accepts a variety of funding options, including credit/debit cards, bank wire transfers, e-wallets (such as Skrill and Neteller), and cryptocurrencies. The minimum deposit required to start trading varies depending on the account type you selected, with the lowest being $250 for the Iron account .

Step 7: Start trading After your account is funded, you can download the trading platform of your choice (MT4, MT5, or NAGA Trader) and start trading. Make sure to familiarise yourself with the platform's features and tools, and always employ risk management strategies when trading.

NAGA's account opening process is designed to be user-friendly and efficient, with most applications being processed within 24 hours. The broker's support team is available to assist you throughout the process, should you encounter any issues or have questions.

Charts and Analysis

NAGA provides a comprehensive suite of educational trading resources and tools to support its clients in enhancing their trading knowledge and skills. These resources cater to traders of all levels, from beginners to experienced professionals, and cover a wide range of topics related to financial markets and trading strategies.

| Feature | Description | Key Benefits |

|---|---|---|

| Trading Central | Integration with Trading Central for technical analysis and market insights. | Provides intraday analysis, resistance/support levels, pivot points, and trading signals for multiple asset classes. |

| TradingView Charts | Built-in TradingView charting platform with extensive tools. | Offers technical indicators, drawing tools, and customisable charts for in-depth market analysis. |

| Economic Calendar | Real-time calendar tracking major market events. | Helps traders stay informed about central bank announcements, economic data releases, and political developments. |

| Educational Resources | Webinars, video tutorials, PDFs, and a trading glossary. | Covers topics from basic trading concepts to advanced strategies, led by experienced analysts. |

| Market News & Analysis | Daily market updates, trading ideas, and in-depth articles. | Keeps traders updated on market trends and informed decision-making. |

NAGA's educational trading resources and tools are designed to cater to the diverse needs of its clients, from beginners seeking to learn the basics of trading to experienced traders looking to refine their strategies. The broker's partnership with Trading Central and integration of TradingView charts demonstrate its commitment to providing high-quality analysis and tools to its clients.

While NAGA's educational resources are comprehensive and well-developed, it is essential for traders to compare them with those offered by other brokers to determine if they align with their specific needs and learning preferences. Overall, NAGA's investment in educational resources positions it as a broker that values client education and supports the development of trading skills.

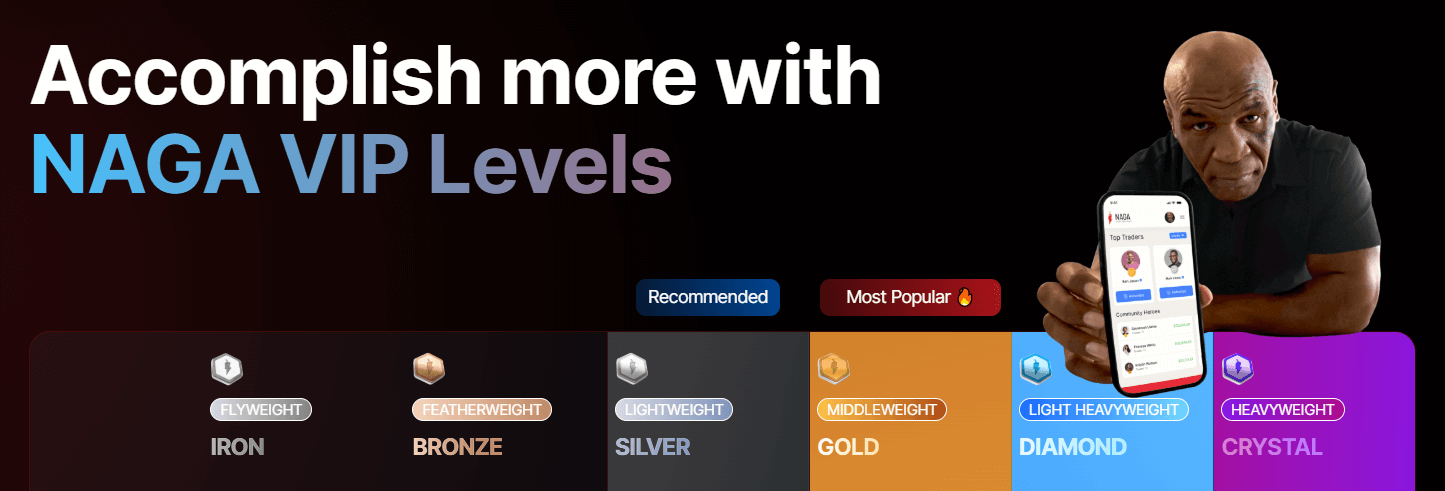

NAGA Account Types

NAGA offers a range of trading account options to cater to the diverse needs and preferences of its clients. With six distinct account types, traders can choose the one that best aligns with their trading goals, experience level, and investment capacity.

Account Tiers

NAGA's real trading accounts are categorised into six Account tiers, each with its own set of features and benefits. The account types are as follows:

Iron Trader Account

- Minimum deposit: $250

- Earn $0.12 per copied trade on all instruments

- Daily 5 trading signals

- $5 withdrawal fee

Bronze Trader Account

- Minimum deposit: $2,500

- Earn $0.15 per copied trade on all instruments

- Daily NAGA 5 trading signals

- PI dashboard

- $4 withdrawal fee

Silver Trader Account

- Minimum deposit: $5,000

- Earn $0.18 per copied trade on all instruments

- Daily 10 trading signals

- PI dashboard

- One-on-one tutoring (2 per month)

- $3 withdrawal fee

Gold Trader Account

- Minimum deposit: $25,000

- Earn $0.22 per copied trade on all instruments

- Daily 15 trading signals

- PI dashboard

- One-on-one tutoring (4 per month)

- Premium eBooks and contests

- $2 withdrawal fee

Diamond Trader Account

- Minimum deposit: $50,000

- Earn $0.27 per copied trade on all instruments

- Daily 20 trading signals

- PI dashboard

- One-on-one tutoring (7 per month)

- Premium eBooks and contests

- Profile awareness boost

- $1 withdrawal fee

Crystal Trader Account

- Minimum deposit: $100,000

- Earn $0.32 per copied trade on all instruments

- Unlimited daily NAGA trading signals

- PI dashboard

- One-on-one tutoring (unlimited)

- Premium eBooks and contests

- Profile awareness boost

- $1 withdrawal fee

Demo Account

For those new to trading or looking to test NAGA's platforms and services, the broker offers a demo account with virtual funds. This account type allows traders to familiarise themselves with the trading environment and practise strategies without risking real money. Demo accounts are an essential tool for beginner traders and those looking to refine their skills before transitioning to live trading.

The account tiers offer incremental benefits as traders increase their investment, such as higher earnings on copied trades, more trading signals, personalised tutoring, and reduced withdrawal fees. This tiered structure incentivises traders to grow their accounts and rewards loyalty while catering to the needs of both novice and experienced investors.

By providing a diverse range of account types, NAGA demonstrates its commitment to accommodating the varied needs of its clientele. The availability of a demo account allows potential clients to test the broker's services risk-free, while the VIP tier system offers a progressive set of features and benefits to suit different trading styles and investment levels.

However, it is essential to note that NAGA's minimum deposit requirement of $250 for the Iron Trader Account may be higher than some competitors, which could be a barrier for beginner traders with limited capital. Additionally, while the VIP tiers offer attractive benefits, the higher minimum deposit requirements may not be suitable for all traders.

Account Types Comparison Table

| Feature | Iron | Bronze | Silver | Gold | Diamond | Crystal |

|---|---|---|---|---|---|---|

| Min. Deposit | $250 | $2,500 | $5,000 | $25,000 | $50,000 | $100,000 |

| Copied Trade Earnings | $0.12 | $0.15 | $0.18 | $0.22 | $0.27 | $0.32 |

| Daily Trading Signals | 5 | 5 | 10 | 15 | 20 | Unlimited |

| PI Dashboard | No | Yes | Yes | Yes | Yes | Yes |

| One-on-One Tutoring | No | No | 2/month | 4/month | 7/month | Unlimited |

| Premium eBooks & Contests | No | No | No | Yes | Yes | Yes |

| Profile Awareness Boost | No | No | No | No | Yes | Yes |

| Withdrawal Fee | $5 | $4 | $3 | $2 | $1 | $1 |

Negative Balance Protection

NAGA offers negative balance protection to its clients, ensuring that their losses will never exceed the funds in their trading accounts. This policy is a testament to NAGA's commitment to safeguarding its clients' funds and promoting responsible trading practices. Under NAGA's negative balance protection policy, if a trader's account balance falls below zero due to trading losses, the broker will absorb the negative balance and reset the account to zero. This means that traders will not owe any money to NAGA beyond the funds they have already deposited into their trading accounts. It is essential to note that negative balance protection does not prevent losses from occurring; it only limits the potential loss to the funds available in the trading account. Traders should still employ sound risk management strategies, such as setting appropriate stop-loss orders and managing their leverage responsibly, to minimise the risk of substantial losses. Eligibility and Terms: NAGA's negative balance protection applies to all trading accounts, regardless of the account type or the instruments traded. However, traders should be aware that this protection may not extend to instances of market manipulation, abuse, or illegal activity. In such cases, NAGA reserves the right to investigate and take appropriate action, which may include revoking the negative balance protection. Negative balance protection is a vital safety net for traders, providing peace of mind and limiting the potential for catastrophic losses. NAGA's commitment to offering this protection demonstrates its dedication to creating a secure and responsible trading environment for its clients. By understanding the implications of negative balance protection and the terms under which it applies, traders can make informed decisions and focus on their trading strategies without the fear of incurring debts beyond their account balance.

NAGA Deposits and Withdrawals

NAGA offers a range of convenient deposit and withdrawal options to cater to the needs of its diverse clientele. The broker strives to make the process of funding and withdrawing from trading accounts as seamless and efficient as possible while maintaining a high level of security and compliance with financial regulations.

Deposit Methods

| Payment Method | Processing Time | Fees | Minimum Deposit | Maximum Deposit |

|---|---|---|---|---|

| Credit/Debit Cards (Visa, Mastercard, Maestro) | Instant | No Fees | $250 (Iron Account) | No Limit |

| Bank Wire Transfer | 1-5 Business Days | No Fees | Varies by Bank | No Limit |

| E-wallets (Skrill, Neteller) | Instant | No Fees | $250 (Iron Account) | No Limit |

| Cryptocurrencies (Bitcoin, Ethereum, NAGA Coin) | Instant | No Fees | $250 (Iron Account) | No Limit |

Withdrawal Methods

| Payment Method | Processing Time | Minimum Withdrawal | Maximum Withdrawal | Withdrawal Fee (Based on Account Type) |

|---|---|---|---|---|

| Bank Wire Transfer | 1-5 Business Days | $50 | Depends on account type & verification | Varies by account (see below) |

| E-wallets (Skrill, Neteller) | Instant | $50 | Depends on account type & verification | Varies by account (see below) |

| Cryptocurrencies (Bitcoin, Ethereum, NAGA Coin) | Instant | $50 | Depends on account type & verification | Varies by account (see below) |

Verification Requirements

To comply with anti-money laundering (AML) and know-your-customer (KYC) regulations, NAGA requires traders to verify their identity before processing withdrawals. This process involves submitting a copy of a government-issued ID and proof of residence. Traders should ensure that the submitted documents are clear, valid, and match the personal information provided during account registration.Unique Features

One of the standout features of NAGA's deposit and withdrawal system is the support for cryptocurrencies. Traders can easily fund their accounts and withdraw profits using popular digital assets like Bitcoin, Ethereum, and the platform's native token, NAGA Coin. This feature caters to the growing demand for cryptocurrency integration in the online trading space and provides traders with an additional layer of flexibility and convenience. NAGA's commitment to providing a wide range of deposit and withdrawal options, coupled with its support for cryptocurrencies, sets it apart from many competitors in the industry. By offering instant processing for most methods and maintaining a transparent fee structure, NAGA ensures that traders can manage their funds efficiently and focus on their trading activities.Support Service for Customer

Reliable customer support is a crucial aspect of a positive trading experience, as it ensures that traders can access help and guidance when needed. In the fast-paced world of online trading, where market conditions can change rapidly, having a responsive and knowledgeable support team is essential for navigating challenges and making informed decisions.

NAGA recognises the importance of providing excellent customer support to its clients and offers a range of channels through which traders can reach out for assistance. Whether you prefer to communicate via live chat, email, phone, or social media, NAGA's support team is available to help you with any questions or concerns you may have.

Support Channels

- Live Chat: NAGA's live chat feature allows traders to connect with a support representative in real-time directly from the website or trading platform. This channel is ideal for quick queries and immediate assistance.

- Email: Traders can send their enquiries to support@nagamarkets.com and expect a prompt response from the support team. Email support is suitable for more detailed questions or concerns that may require a longer explanation.

- Phone: NAGA offers phone support for traders who prefer to discuss their issues directly with a representative. The main support number is +357 25 041410.

- Social Media: NAGA maintains an active presence on various social media platforms, including Facebook, Twitter, Instagram, and LinkedIn. Traders can reach out to the support team through direct messages or by posting on NAGA's official pages.

Support Languages and Availability

NAGA's customer support is available in multiple languages to cater to its global clientele. The primary support languages include English, German, Spanish, Italian, French, Portuguese, and Arabic. This language diversity ensures that traders from different regions can communicate effectively with the support team. NAGA provides customer support 24/7, ensuring that traders can access help at any time, regardless of their location or time zone. The support team strives to provide prompt and efficient assistance, with average response times of 5-10 minutes for live chat and 1-2 hours for email enquiries. However, response times may vary depending on the complexity of the issue and the volume of enquiries received.Personalised Support for VIP Clients

In addition to the standard support channels, NAGA offers personalised support for its VIP clients. Traders with Gold, Diamond, and Crystal accounts have access to dedicated account managers who provide one-on-one assistance and guidance. This personalised support helps high-volume traders and those with complex needs to maximise their trading potential and resolve issues efficiently. NAGA's commitment to providing reliable and accessible customer support sets it apart from many competitors in the industry. By offering multiple channels, 24/7 availability, and personalised support for VIP clients, NAGA ensures that its traders can access the help they need to navigate the challenges of online trading and make informed decisions.Customer Support Comparison Table

| Feature | NAGA |

|---|---|

| Live Chat | Yes |

| Email Support | Yes |

| Phone Support | Yes |

| Social Media Support | Yes |

| Support Languages | English, German, Spanish, Italian, French, Portuguese, Arabic |

| 24/7 Support | Yes |

| Average Live Chat Response Time | 5-10 minutes |

| Average Email Response Time | 1-2 hours |

| Personalized VIP Support | Yes (Gold, Diamond, and Crystal accounts) |

Prohibited Countries

NAGA is committed to adhering to international regulations and licensing requirements, which necessitate restricting its services in certain countries and regions. These restrictions are implemented to ensure compliance with local laws and to safeguard both the company and its clients from potential legal and financial risks.

Reasons for Restrictions

-

Local Regulations: Certain countries enforce stringent laws regarding online trading, requiring brokers to obtain specific licenses or meet particular criteria to operate legally within their jurisdictions.

-

Licensing Limitations: NAGA's existing regulatory licenses may not encompass all territories, thereby limiting its ability to offer services in some regions.

-

Geopolitical Factors: Issues such as political instability, economic sanctions, or other geopolitical concerns may prevent NAGA from conducting operations in specific areas.

Prohibited Countries List

NAGA does not provide services to residents of the following countries:

- Afghanistan, Albania, American Samoa, Australia, Austria, Barbados, Belarus, Belgium, Bermuda, British Indian Ocean Territory, Bulgaria, Burkina Faso, Canada, Cayman Islands, Central African Republic, Christmas Island, Cocos (Keeling) Islands, Democratic Republic of the Congo, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Falkland Islands (Malvinas), Finland, France, Germany, Gibraltar, Greece, Guam, Haiti, Heard Island and McDonald Islands, Hungary, Iceland, Iran, Ireland, Isle of Man, Israel, Italy, Jamaica, Japan, Jersey, North Korea, Latvia, Libya, Liechtenstein, Lithuania, Luxembourg, Mali, Malta, Montserrat, Mozambique, Myanmar, Netherlands, New Zealand, Norfolk Island, Norway, Occupied Palestinian Territory, Pitcairn, Poland, Portugal, Romania, Russian Federation, Saint Helena, Ascension and Tristan da Cunha, San Marino, Senegal, Serbia, Slovakia, Slovenia, Somalia, South Georgia and the South Sandwich Islands, South Sudan, Spain, Sri Lanka, Sweden, Switzerland, Syria, Trinidad and Tobago, Tunisia, Turks and Caicos Islands, Uganda, Ukraine, United Kingdom, United States, Vanuatu, British Virgin Islands, U.S. Virgin Islands, Yemen, Zimbabwe.

Consequences of Trading from a Prohibited Country

Engaging in trading activities with NAGA from a restricted country may lead to several outcomes:

-

Account Termination: NAGA reserves the right to immediately terminate accounts found to be operating from prohibited countries.

-

Funds Forfeiture: Clients attempting to trade from restricted regions may risk having their funds frozen or forfeited due to legal or regulatory constraints.

-

Legal Repercussions: Participating in trading activities with an unlicensed broker in a jurisdiction where such actions are prohibited may result in legal consequences, including fines or other penalties.

Special Offers for Customers

At the time of writing this review, NAGA does not appear to offer any special promotions, sign-up bonuses, or loyalty programs for its traders. The lack of trading bonuses may be a disadvantage for some traders who are accustomed to receiving incentives when opening an account or meeting certain trading volume thresholds.

It's important to note that the availability of special offers and promotions can change over time, and it's always recommended to check NAGA's official website or contact their customer support team for the most up-to-date information on any current promotions or bonuses.

Conclusion

As I approach the end of this comprehensive review of NAGA, it's essential to consolidate the findings and insights gathered throughout the article to provide a cohesive summary that addresses the broker's safety, reliability, and overall reputation.

One of the most significant concerns I have regarding NAGA is their regulatory status. While they were previously regulated by the well-respected Cyprus Securities and Exchange Commission (CySEC), recent reports suggest that their regulatory status has faced some uncertainty, with indications that the company may be associated with suspicious or cloned entities. This lack of clear and verifiable regulatory information is a major red flag when considering a broker's trustworthiness and dependability.

Despite this regulatory concern, NAGA does offer some compelling features for traders. They provide a diverse range of tradable assets, including forex, stocks, indices, commodities, ETFs, and cryptocurrencies, catering to the needs of various types of traders. The broker also offers multiple trading platforms, including the user-friendly NAGA Trader web and mobile apps, as well as support for the industry-standard MetaTrader 4 and MetaTrader 5 platforms.

NAGA's educational resources are another area where they excel, offering a comprehensive suite of materials such as webinars, video tutorials, and trading guides to help traders enhance their skills and knowledge. The broker's unique social trading features, which allow users to connect with and learn from experienced traders, set them apart from many competitors.

However, NAGA's high minimum deposit requirement of $250 for their entry-level account may be a barrier for some beginner traders. Additionally, the absence of special offers and promotions, as well as the relatively high spreads on standard accounts, could be drawbacks for cost-conscious traders.

In terms of customer support, NAGA offers a range of channels, including live chat, email, phone, and social media, with support available in multiple languages. The broker's commitment to providing negative balance protection is a positive aspect, ensuring that traders cannot lose more than their account balance.

Overall, while NAGA has some attractive features and offerings, the uncertainty surrounding their regulatory status is a significant concern that potential clients should carefully consider before opening an account. It is crucial for traders to conduct thorough research, compare multiple brokers, and prioritise factors such as regulatory compliance, trading conditions, and customer support when making their decision.

As with any financial decision, it's essential to exercise caution and due diligence when evaluating a broker's suitability for your individual trading needs and goals. Always ensure that you are comfortable with a broker's terms, conditions, and regulatory status before committing any funds.