OANDA Review 2025: A Trusted Forex Broker’s Pros, Cons, and Key Features

OANDA

United States

United States

-

Withdrawal Fee $0

-

Leverage 50:1

-

Spread From 1.2

-

Minimum Order 0.01

-

Forex Available

-

Crypto Available

-

Stock Unavailable

-

Indices Available

Licenses

United Kingdom Market Making (MM)

United Kingdom Market Making (MM)

Japan Forex Trading License

Japan Forex Trading License

Australia Retail Forex License

Australia Retail Forex License

US Retail Forex License

US Retail Forex License

US Commodity Trading License

US Commodity Trading License

Singapore Financial Services License

Singapore Financial Services License

IIROC Investment Dealer

IIROC Investment Dealer

Softwares & Platforms

Customer Support

+61280466258

(English)

+61280466258

(English)

+4402031512050

(English)

+4402031512050

(English)

Supported language: Chinese (Simplified), Chinese (Traditional), English, French, German, Italian, Japanese, Russian, Spanish

Social Media

Summary

OANDA, a pioneering online forex and CFD broker, was founded in 1996 and has since established a strong global presence spanning major financial centers. Regulated by top-tier authorities such as the FCA (UK), ASIC (Australia), MAS (Singapore), and the CFTC/NFA (US), OANDA has earned a reputation for transparency, innovation, and commitment to its clients. The broker has received numerous accolades, including being named the "World's Best Retail FX Platform" at the prestigious e-FX awards in 2020.

- Regulated by top-tier authorities like the FCA, ASIC, and CFTC

- Wide range of tradable assets, including forex, CFDs, and metals

- User-friendly trading platforms with advanced features

- Competitive spreads and transparent pricing

- No minimum deposit requirement on standard accounts

- Comprehensive educational resources for traders of all levels

- Responsive customer support via multiple channels

- Strong commitment to fairness and integrity

- Well-suited for both beginner and experienced traders

- Established reputation and long operating history

- Limited product offerings compared to some competitors

- No guaranteed stop losses for all account types

- Negative balance protection not available for all clients

- Inactivity fees charged after prolonged dormancy

- No automated trading on proprietary platform

- Higher minimum deposits for premium accounts

- Spreads may widen during volatile market conditions.

- No 24/7 customer support

- Cryptocurrency trading is only available via CFDs.

- Limited availability of advanced trading tools compared to some brokers

Overview

With a focus on forex and CFD trading, OANDA offers competitive spreads starting from 0.6 pips on major currency pairs, along with the option for commission-based pricing on its core accounts. The broker provides access to over 100 forex pairs, as well as a range of CFDs on indices, commodities, bonds, and metals. OANDA's proprietary trading platform, available on web and mobile, is lauded for its user-friendly interface and advanced charting powered by TradingView. The broker also supports the popular MetaTrader 4 platform, catering to the needs of algorithmic traders.

OANDA's educational resources are extensive, with a comprehensive learning portal featuring articles, webinars, and tutorials suitable for traders of all levels. The broker's research and analysis offerings are equally impressive, with insights from an in-house team of experts and third-party providers like Dow Jones and AutoChartist. OANDA's commitment to innovation is evident in its API and plugin ecosystem, which allows developers to create custom trading applications.

While OANDA's product catalog may not be as extensive as some of its competitors, the broker's emphasis on quality over quantity has earned it a loyal following among serious traders. The broker's website provides detailed information on account types, trading conditions, and regulatory licenses, empowering potential clients to make informed decisions. As with any broker, it's essential to consider individual trading needs and risk tolerance before opening an account. For more information, visit oanda.com.

OANDA Overview Table

| Founded | 1996 |

| Headquarters | New York, USA |

| Regulation | FCA, ASIC, MAS, CFTC/NFA, IIROC |

| Trading Platforms | OANDA Trade, MetaTrader 4 |

| Minimum Deposit | $0 on standard accounts |

| Maximum Leverage | 50:1 (US), 30:1 (UK/EU), 200:1 (Elsewhere) |

| Instruments | Forex, CFDs (Indices, Commodities, Bonds, Metals) |

| Spread (EUR/USD) | From 0.6 pips |

| Commission | No (spread-only), Yes (core pricing) |

| Education | Articles, Webinars, Tutorials |

| Analysis | MarketPulse, AutoChartist |

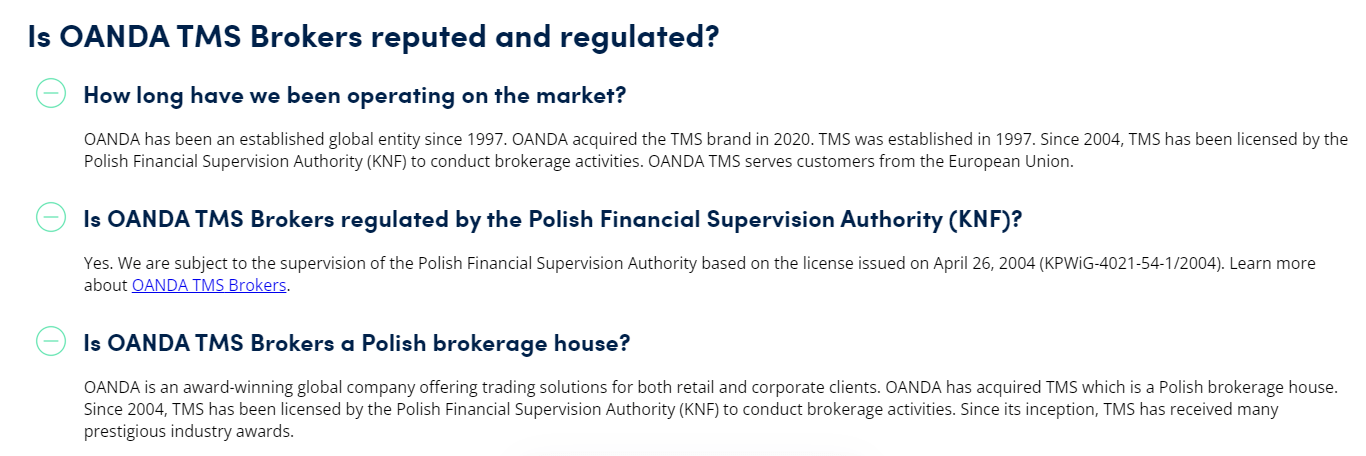

OANDA Licenses and Regulatory

OANDA operates under the oversight of several respected regulatory bodies worldwide, ensuring a high level of client protection and financial security. The broker holds licenses from top-tier authorities such as the Financial Conduct Authority (FCA) in the United Kingdom, the Australian Securities and Investments Commission (ASIC), the Monetary Authority of Singapore (MAS), the Commodity Futures Trading Commission (CFTC), and the National Futures Association (NFA) in the United States.

| Regulatory Authority | Country | License Number | Entity |

|---|---|---|---|

| Financial Conduct Authority (FCA) | United Kingdom | 542574 | OANDA Europe Limited |

| Australian Securities and Investments Commission (ASIC) | Australia | 412981 | OANDA Australia Pty Ltd |

| Monetary Authority of Singapore (MAS) | Singapore | CMS100122-4 | OANDA Asia Pacific Pte Ltd |

| Commodity Futures Trading Commission (CFTC) | United States | Retail Foreign Exchange Dealer (RFED) | OANDA Corporation |

| National Futures Association (NFA) | United States | 0325821 | OANDA Corporation |

| Investment Industry Regulatory Organization of Canada (IIROC) | Canada | 121925 | OANDA (Canada) Corporation ULC |

| Financial Services Agency (FSA) | Japan | Kanto Finance Bureau No. 2609 | OANDA Japan Inc. |

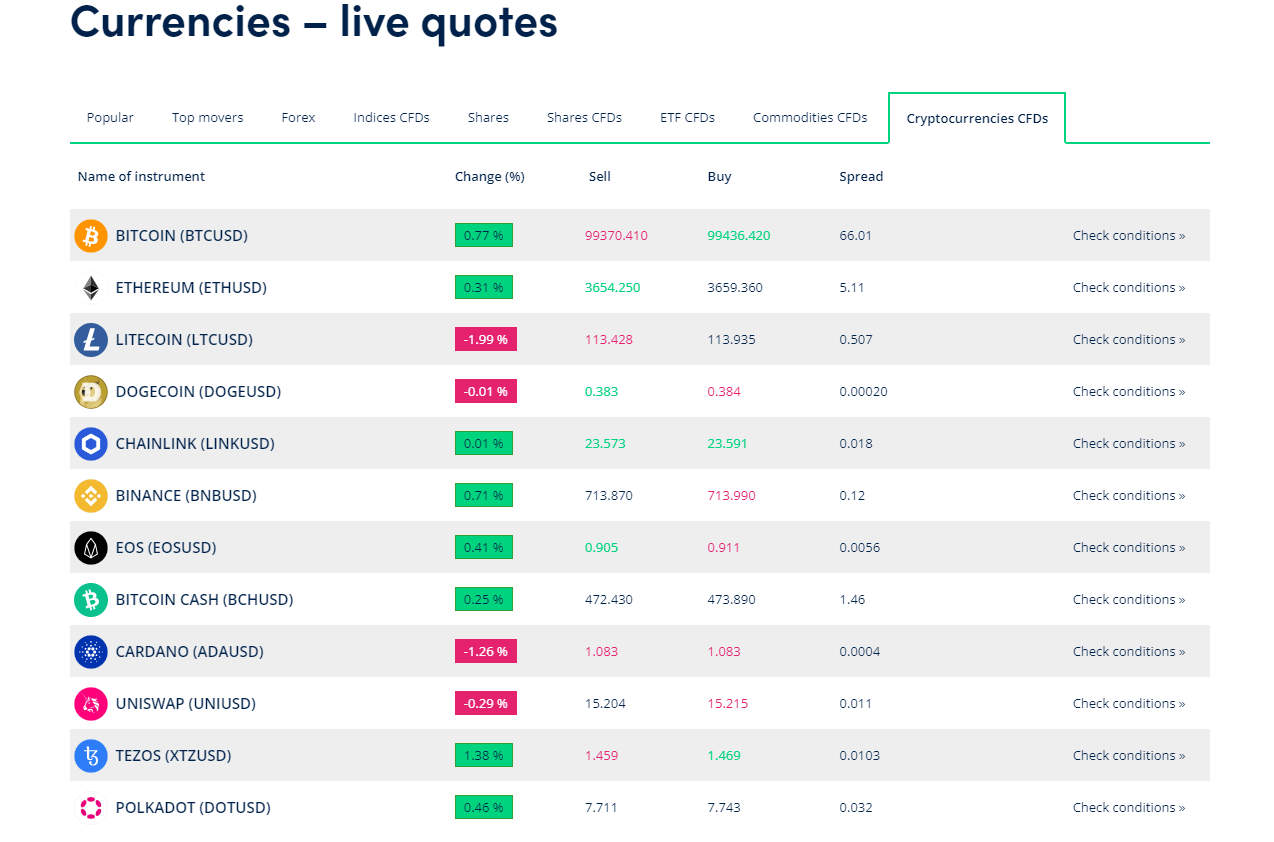

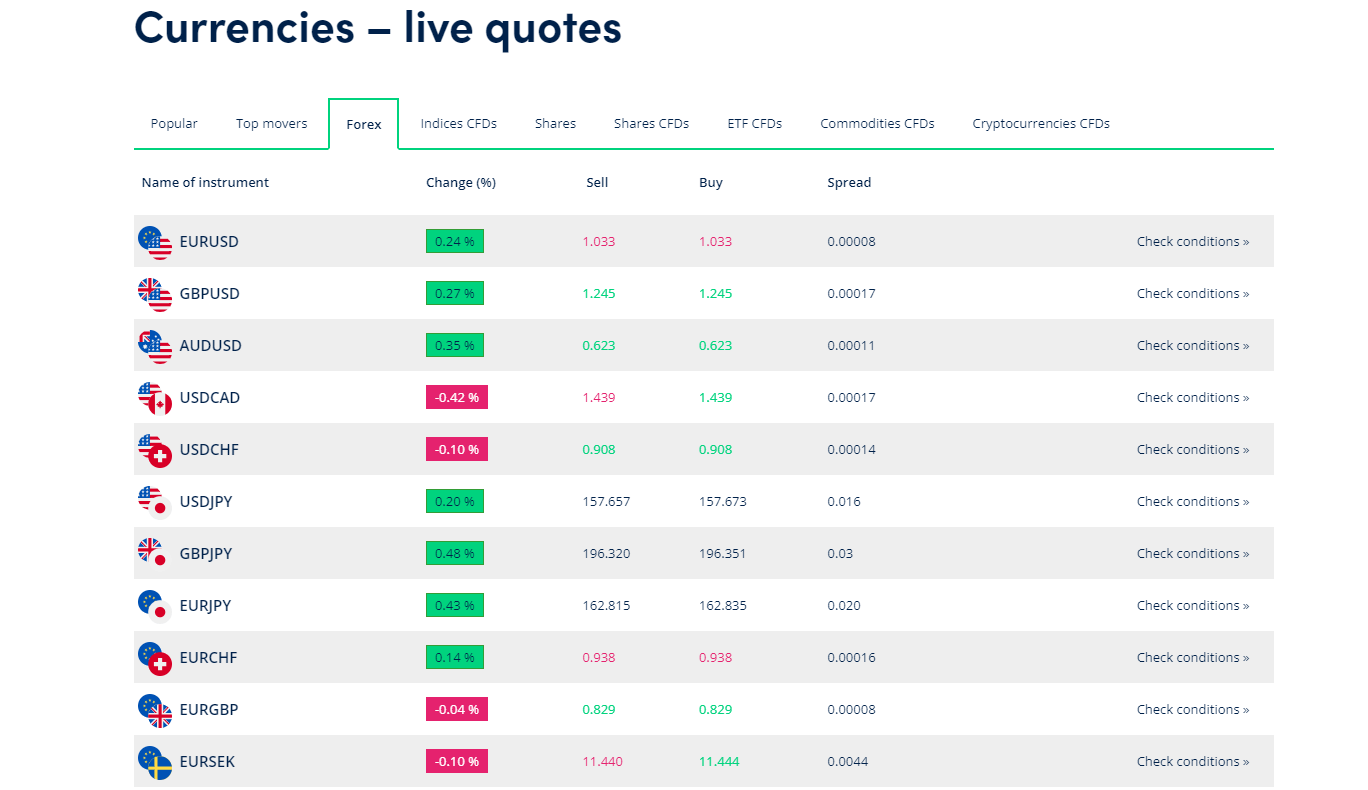

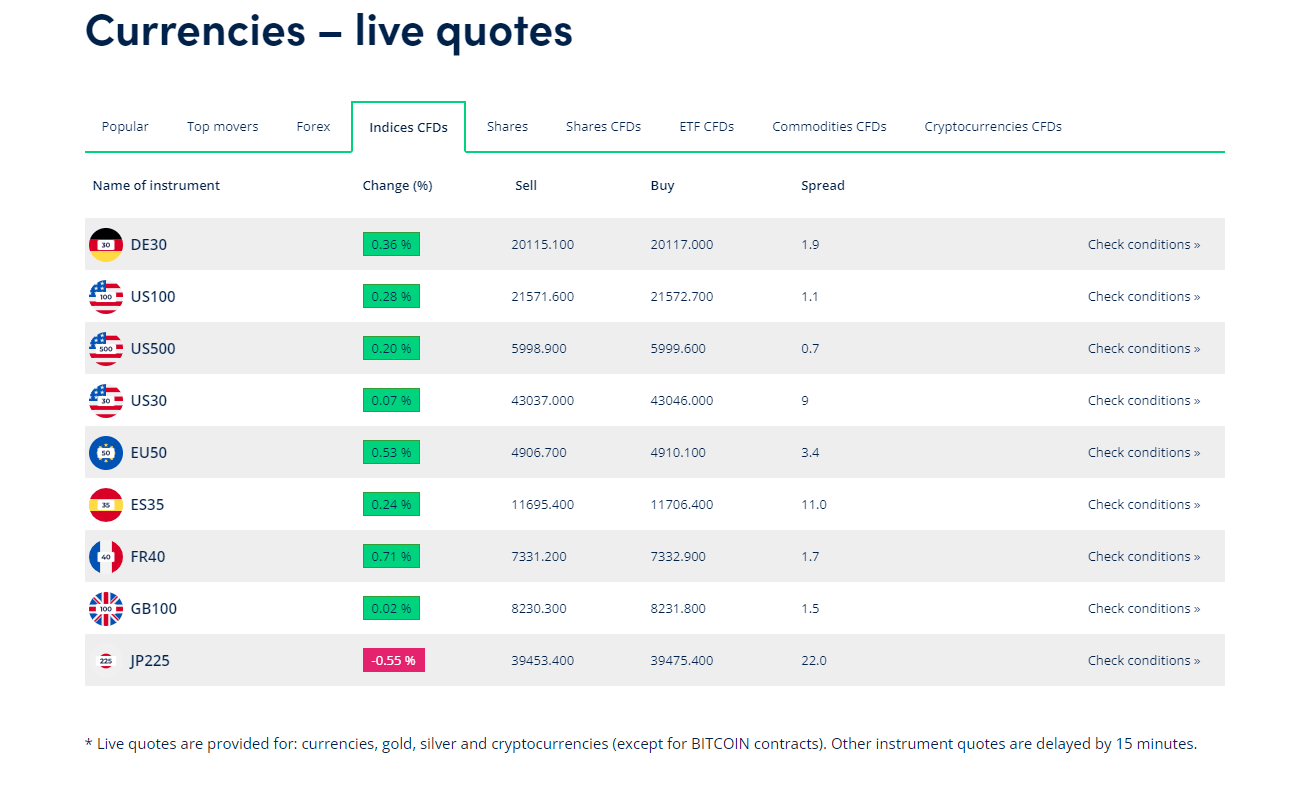

Trading Instruments

As a reputable broker, OANDA offers a diverse range of trading instruments for its clients:

| Market | Instruments/Offerings | Key Features/Benefits |

|---|---|---|

| Forex | - Over 70 currency pairs available, including: • Major pairs: EUR/USD, GBP/USD, USD/JPY, USD/CHF • Minor and exotic pairs | - Competitive spreads: as low as 0.6 pips on core pricing accounts- Suitable for a diverse range of trading strategies and risk appetites |

| CFDs | - Comprehensive selection across multiple asset classes, including: • Indices: S&P 500, NASDAQ 100, FTSE 100, DAX 30 • Commodities: Oil, Gold, Silver, Agricultural products • Bonds: US Treasury Bonds, German Bunds • Metals: Gold, Silver, Platinum, Palladium | - Diversify portfolios- Flexibility to trade price movements without owning the underlying assets- Useful for hedging positions or capitalizing on short-term trends |

| Cryptocurrencies | - CFD trading available for popular digital assets, including: • Bitcoin • Ethereum • Litecoin | - Leverage available- Ability to go long or short- No support for direct crypto purchases or wallet transfers |

Comparison to Industry Standards

OANDA's offering is competitive:

A diverse range of instruments across multiple markets.

Focus on core assets with competitive pricing.

While some brokers may offer a wider selection of exotic pairs or CFDs, OANDA remains an attractive choice for most traders.

Regulatory Considerations

Asset availability may vary by location: Example: CFDs are restricted for traders in the United States due to regulatory constraints.

Trading Platforms

Comparison to Industry Standards OANDA's trading platform offerings are competitive within the industry, catering to the needs of both beginner and advanced traders.

MetaTrader 4 (MT4)

- Platform Features: Reliable, widely-used trading platform with advanced charting tools.

- Automated Trading: Supports Expert Advisors (EAs) for complex strategies and algorithmic trading.

- Technical Analysis Tools: Wide range of technical indicators and drawing tools for in-depth market analysis.

- Availability: Desktop, web, and mobile apps (iOS and Android) for anytime, anywhere access.

- Customization Options: Offers plugins and add-ons to extend functionality.

Proprietary Trading Platform: OANDA Trade

- Platform Type: Proprietary platform available via web browser and mobile app.

- Charting: Advanced charting powered by TradingView for an interactive trading experience.

- Order Types: Supports market, limit, stop orders, and advanced risk management tools (e.g., trailing stops, take profit).

- Customization: Clean, customizable interface with personalized watchlists and detailed trade performance reports.

- Integration: Includes OANDA’s educational resources and contextual tutorials directly within the platform.

TradingView Integration

| Feature | Details |

|---|---|

| Charting Tools | Access to TradingView’s advanced technical analysis tools. |

| Community | Traders can share ideas and connect with a vibrant community of traders. |

| Execution | Execute trades directly from TradingView charts using an OANDA account. |

Mobile Trading

- Platforms: Mobile apps available for both MT4 and OANDA Trade on iOS and Android devices.

- Trading Features: Includes real-time quotes, intuitive order placement, and account management.

- Notifications: Push notifications for market events and price alerts.

- Flexibility: Designed for on-the-go access and a streamlined trading experience.

Trading Platforms Comparison Table

| Feature | MT4 | OANDA Trade | TradingView Integration |

| Charting | Advanced | Advanced | Advanced |

| Technical Indicators | 30+ | 100+ | 100+ |

| Drawing Tools | Yes | Yes | Yes |

| Automated Trading (EAs) | Yes | No | No |

| Order Types | Multiple | Multiple | Multiple |

| Mobile App | Yes | Yes | Yes |

| Web Platform | Yes | Yes | Yes |

| Customizable Interface | Yes | Yes | Yes |

| Integrated News Feed | Yes | Yes | No |

| Social Trading | No | No | Yes |

Note: Specific features and availability may vary based on the trader's location and regulatory jurisdiction.

OANDA How to Open an Account: A Step-by-Step Guide

Step 1: Visit the OANDA website. Go to the official OANDA website at oanda.com and click on the "Open an Account" button in the top right corner of the page.

Step 2: Select your account type. Choose between a demo account or a live trading account. Demo accounts are ideal for practicing trading strategies and familiarizing yourself with the platform, while live accounts allow you to trade with real funds.

Step 3: Provide personal information Fill out the registration form with your personal details, including your full name, date of birth, address, phone number, and email address. OANDA uses this information to verify your identity and comply with regulatory requirements.

Step 4: Choose your account settings. Select your account currency, leverage, and any other preferences available during the registration process. OANDA offers accounts in several major currencies, including USD, EUR, GBP, and JPY.

Step 5: Verify your identity To comply with anti-money laundering (AML) and know-your-customer (KYC) regulations, OANDA requires you to submit proof of identity and address. This typically includes a copy of your government-issued ID, such as a passport or driver's license, and a recent utility bill or bank statement showing your current address.

Step 6: Fund your account Once your account is verified, you can deposit funds using one of OANDA's accepted payment methods, such as bank transfer, credit/debit card, or e-wallet. The minimum deposit amount varies depending on your account currency, but OANDA generally has low or no minimum deposit requirements.

Step 7: Start trading After your funds are credited to your account, you can begin trading using OANDA's trading platforms, such as OANDA Trade, MetaTrader 4, or TradingView. Be sure to familiarize yourself with the platform's features and tools before placing your first trade.

Account Opening Requirements:

- Minimum age: 18 years old

- Valid government-issued ID (e.g., passport, driver's license)

- Proof of residence (e.g., utility bill, bank statement)

- Email address and phone number

Charts and Analysis

OANDA provides a comprehensive suite of educational resources and tools designed to support traders at all levels of experience. These resources aim to enhance clients' trading knowledge, skills, and decision-making abilities, empowering them to navigate the financial markets with confidence.

Charting Tools

OANDA offers advanced charting capabilities through its proprietary trading platform, OANDA Trade, as well as its TradingView integration. These tools provide a wide range of technical indicators, drawing tools, and customizable chart layouts, allowing traders to perform in-depth market analysis and identify potential trading opportunities. The user-friendly interface and interactive features make it easy for traders to visualize price action and apply their preferred technical analysis strategies.

Market Analysis and Insights

OANDA's in-house team of market analysts and industry experts provides regular market commentary, analysis, and insights through various channels, including:

- MarketPulse: A dedicated blog featuring daily market updates, technical analysis, and trading ideas across multiple asset classes.

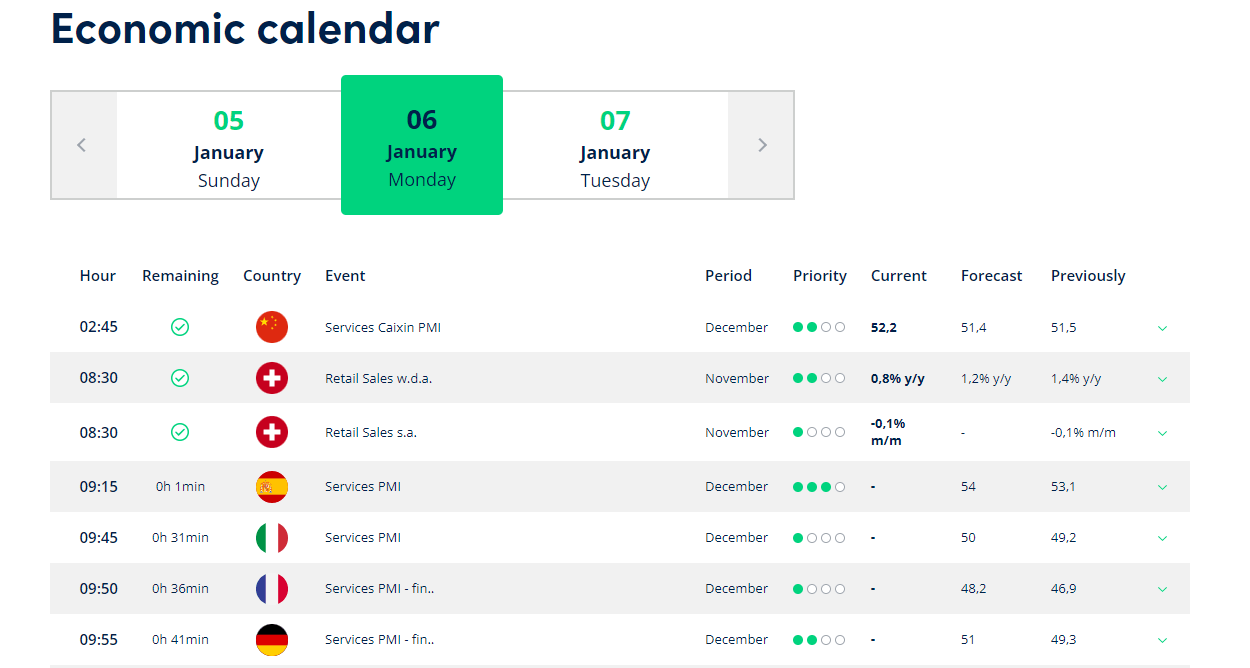

- Market News and Economic Calendar: Real-time news updates and an economic calendar highlighting key global events and data releases that may impact financial markets.

- Webinars and Video Tutorials: Live and on-demand webinars hosted by OANDA's analysts, covering market analysis, trading strategies, and platform tutorials.

Educational Resources

In addition to market analysis, OANDA offers a range of educational resources designed to help clients improve their trading knowledge and skills:

- OANDA Academy: A comprehensive online learning center featuring articles, guides, and video tutorials on various trading topics, from basic concepts to advanced strategies.

- Ebooks and Trading Guides: Downloadable PDFs covering a wide range of trading subjects, such as risk management, technical analysis, and trading psychology.

- Glossary: An extensive dictionary of trading and financial terms, helping clients understand the complex terminology used in the industry.

OANDA Account Types

OANDA offers a range of trading account types designed to cater to the diverse needs and preferences of traders at various levels of experience and with different trading goals.

Standard Account

| Feature | Details |

|---|---|

| Minimum Deposit | $0 |

| Spreads | Competitive, starting from 0.6 pips on major currency pairs |

| Leverage | Up to 50:1 (depending on regulatory jurisdiction) |

| Commission | No additional commission charges |

| Tradable Assets | Forex, CFDs (indices, commodities, metals), and cryptocurrencies* |

Premium Account

| Feature | Details |

|---|---|

| Minimum Deposit | $20,000 |

| Spreads | Tighter spreads compared to the Standard Account |

| Leverage | Up to 50:1 (depending on regulatory jurisdiction) |

| Commission | No additional commission charges |

| Tradable Assets | Forex, CFDs (indices, commodities, metals), and cryptocurrencies* |

| Additional Perks | Dedicated account manager, priority customer support, and exclusive market analysis |

Premium Plus Account

| Feature | Details |

|---|---|

| Minimum Deposit | $100,000 |

| Spreads | Lowest spreads offered by OANDA |

| Leverage | Up to 50:1 (depending on regulatory jurisdiction) |

| Commission | No additional commission charges |

| Tradable Assets | Forex, CFDs (indices, commodities, metals), and cryptocurrencies* |

| Additional Perks | Personalized service, advanced trading tools, and custom trading solutions |

Demo Account

| Feature | Details |

|---|---|

| Minimum Deposit | Virtual funds (free) |

| Spreads | Mimics real trading conditions |

| Leverage | Reflects live market conditions |

| Commission | Not applicable |

| Tradable Assets | Same as live accounts: Forex, CFDs (indices, commodities, metals), and cryptocurrencies* |

| Additional Features | Practice trading strategies and familiarize with trading platforms using live market prices |

- Compared to Industry Standards, OANDA's account type offerings are competitive within the industry, providing a range of options to suit different trader profiles. The broker's commitment to offering low minimum deposit requirements and competitive spreads across all account types demonstrates a focus on accessibility and cost-effectiveness for clients.

OANDA Account Types Comparison Table

| Feature | Standard | Premium | Premium Plus |

| Minimum Deposit | $0 | $20,000 | $100,000 |

| Spreads | From 0.6 | Tighter | Lowest |

| Leverage | Up to 50:1 | Up to 50:1 | Up to 50:1 |

| Commission | No | No | No |

| Tradable Assets | Forex, CFDs | Forex, CFDs | Forex, CFDs |

| Additional Perks | - | Dedicated manager, priority support | Personalized service, advanced tools |

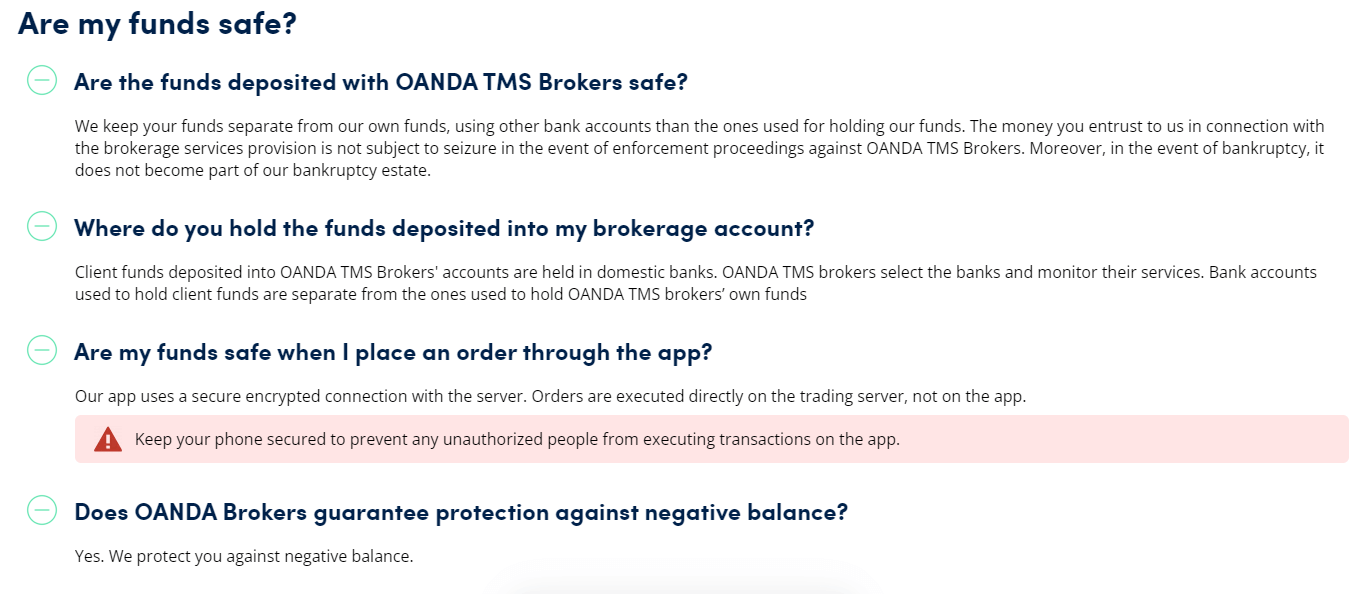

Negative Balance Protection

OANDA's Negative Balance Protection: Policy OANDA's negative balance protection policy applies to all client accounts, regardless of the account type or trading platform used. The policy is automatically enforced, and clients do not need to opt in or take any additional steps to benefit from this protection.

However, it is essential to note that negative balance protection does not prevent losses altogether. Traders can still lose up to the full amount of their account balance. Negative balance protection simply ensures that losses do not exceed the available funds in the account.

Terms and Conditions

While OANDA offers negative balance protection, traders should be aware of the following terms and conditions:- Abuse: OANDA reserves the right to remove negative balance protection if the broker suspects abuse or manipulation of the policy.

- Margin Calls: Negative balance protection does not eliminate the possibility of margin calls. Traders must still maintain sufficient margin in their accounts to support their open positions.

- Regulatory Restrictions: The availability and extent of negative balance protection may vary depending on the trader's location and applicable regulatory requirements.

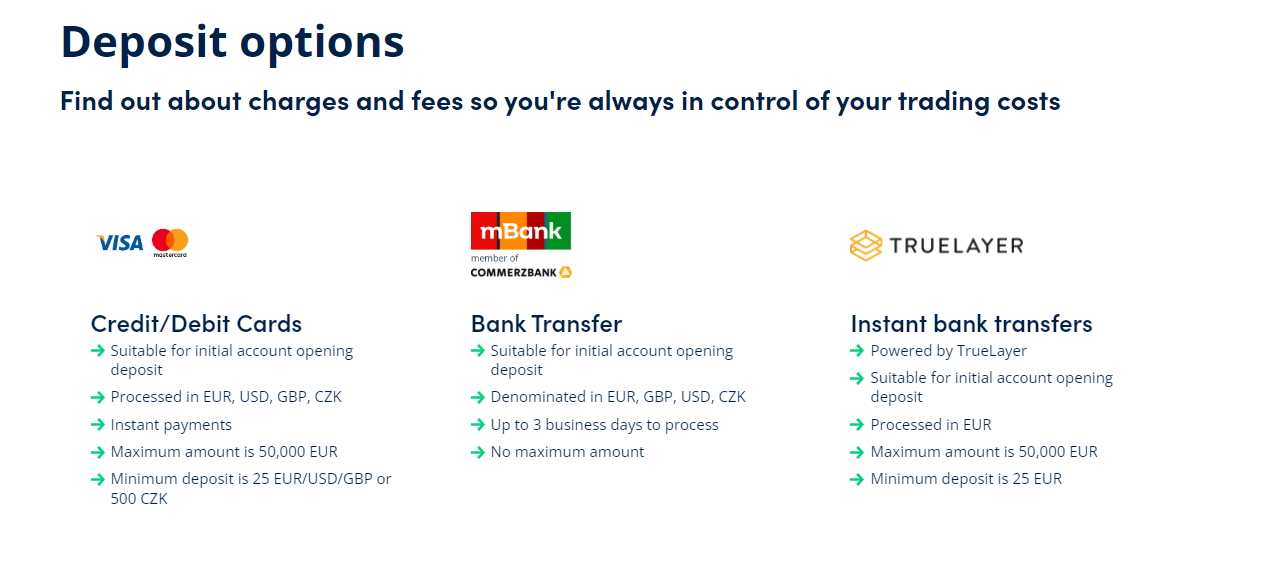

OANDA Deposits and Withdrawals

Deposit Methods

OANDA accepts the following deposit methods:| Deposit Method | Details |

|---|---|

| Bank Transfer | - Funds can be deposited directly from a bank account to an OANDA trading account. |

| - Available in most countries. | |

| - Supports various currencies. | |

| Credit/Debit Card | - Accepts Visa, Mastercard, and Maestro. |

| - Offers instant funding, enabling immediate trading. | |

| PayPal | - Available in select countries. |

| - Provides a fast and convenient funding option. | |

| e-Wallets | - Supports popular e-wallets such as Skrill and Neteller. |

| - An alternative to traditional banking methods. |

Minimum and Maximum Deposit Amounts

OANDA has no minimum deposit requirement for most account types, making it accessible to traders with various capital levels. However, some account types, such as Premium and Premium Plus, may have higher minimum deposit thresholds. The maximum deposit amount varies depending on the payment method and the trader's location. Traders should consult the OANDA website or contact customer support for specific information on deposit limits.

OANDA withdrawal Methods

OANDA supports the following withdrawal methods:OANDA Withdrawal Methods

| Withdrawal Method | Details |

|---|---|

| Bank Transfer | - Withdraw funds directly to a bank account. |

| - Available in most countries. | |

| - Supports various currencies. | |

| Credit/Debit Card | - Withdrawals processed back to the original card used for deposits. |

| - Subject to certain conditions and limitations. | |

| PayPal | - Available in select countries. |

| - Provides a fast and convenient withdrawal option. | |

| e-Wallets | - Supports withdrawals to Skrill and Neteller. |

| - Offers quick access to funds through popular e-wallet services. |

Withdrawal Processing Times and Fees

The processing time for withdrawals varies depending on the chosen method:- Bank Transfer: 1-5 business days

- Credit/Debit Card: 1-5 business days

- PayPal: 1-2 business days

- e-Wallets: 1-2 business days

Deposit and Withdrawal Policies

OANDA implements strict security measures to protect clients' funds and prevent fraudulent activities. As part of these measures, traders may be required to complete a verification process before making a withdrawal. This process typically involves providing proof of identity and proof of address. Traders should also ensure that the name on their trading account matches the name on their funding source to avoid delays or rejections in deposit and withdrawal processing.

Unique Features

One of the unique features of OANDA's funding process is the ability to make deposits and withdrawals in multiple currencies. This feature is particularly beneficial for traders who operate in various currency pairs and wish to avoid currency conversion fees.Support Service for Customer

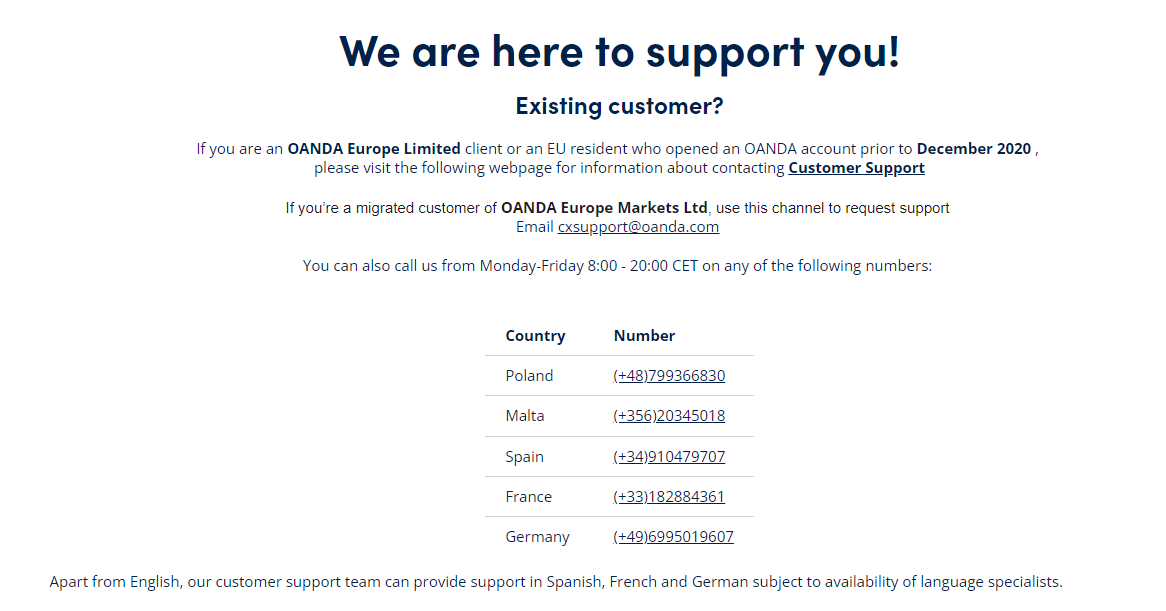

Traders need access to knowledgeable and responsive support teams to address their questions, concerns, and technical issues promptly. OANDA recognizes the importance of excellent customer support and provides multiple channels for traders to reach out for assistance. OANDA Customer Support Channels

| Support Channel | Details |

|---|---|

| Live Chat | - Instant support through the live chat feature on the OANDA website. |

| - Ideal for quick queries and real-time assistance. | |

| - Inquiries can be sent to OANDA's support email address. | |

| - Expected response time: within 24 hours. | |

| Phone Support | - Local phone support numbers available for various countries. |

- English

- Japanese

- Chinese (Simplified and Traditional)

- German

- French

- Spanish

- Italian

- Russian

OANDA Customer Support Overview

| Support Feature | Details |

|---|---|

| Support Hours | Monday to Friday: 24 hours a day |

| Saturday and Sunday: Closed | |

| Live Chat | - Instant support through the live chat feature on the OANDA website. |

| - Response Time: Instant to 5 minutes | |

| - Send inquiries to OANDA's support email address. | |

| - Response Time: Within 24 hours | |

| Phone Support | - Local phone numbers available for various countries. |

| - Speak directly with a support representative. | |

| - Response Time: Immediate to 5 minutes | |

| Social Media | - Contact support via OANDA's official social media channels (e.g., Twitter, Facebook). |

| - Ideal for general inquiries and updates. | |

| - Response Time: Within 24 hours |

Prohibited Countries

OANDA is a globally regulated broker that adheres to the laws and regulations of the jurisdictions in which it operates. As a result, there are certain countries and regions where OANDA is not permitted to provide its services due to local regulations, licensing requirements, or geopolitical factors.

Reasons for Restrictions

| Category | Details |

|---|---|

| Local Regulations | - Some countries have strict regulations governing online trading and forex services. |

| - Brokers may need to obtain specific licenses, meet capital requirements, or adhere to operational standards. | |

| - If OANDA cannot meet these requirements, it may be prohibited from operating in those countries. | |

| Licensing Requirements | - Each jurisdiction has unique licensing requirements for financial service providers. |

| - Licensing may be too complex, time-consuming, or economically unfeasible for OANDA in some countries. | |

| Geopolitical Factors | - Political instability, economic sanctions, or trade restrictions can prevent OANDA from operating in certain regions. |

| - These factors create legal and financial risks for OANDA and its clients. |

Consequences of Trading from Prohibited Countries

Account Termination:OANDA may terminate the client’s account and close open positions if trading from a prohibited country is discovered.This can result in potential financial losses for the trader.

Legal Consequences:Trading from a prohibited country may violate local laws, resulting in fines or penalties.

Inability to Withdraw Funds:Clients from restricted countries may face difficulties withdrawing funds.OANDA may be unable to process withdrawals to bank accounts or payment methods in prohibited jurisdictions.

Special Offers for Customers

OANDA periodically provides special promotions and offers to both new and existing traders. These offers are designed to enhance the trading experience, reward loyalty, and provide additional value to clients. However, it is important to note that OANDA does not typically offer sign-up bonuses or other monetary incentives to new traders, as the broker focuses on providing competitive spreads, reliable execution, and top-tier educational resources as its primary value proposition.

| Feature/Program | Details |

|---|---|

| Trading Competitions | - Periodically organized, theme-based competitions. |

| - Allows traders to compete for prizes based on their trading performance. | |

| Refer-a-Friend Program | - Currently unavailable. |

| - Previously allowed existing clients to earn trading credits by referring new clients. | |

| TradingView Partnership | - Access to advanced charting tools and features. |

| - Integration with TradingView's social trading community for sharing ideas and strategies. |

Conclusion

As I conclude this comprehensive review of OANDA, I can confidently say that they have established themselves as a reliable and trustworthy broker in the online trading industry. With a strong commitment to regulatory compliance, a wide range of tradable assets, and a user-focused approach to their services, OANDA has earned a solid reputation among traders worldwide.

One of the key factors that sets OANDA apart is their dedication to operating within the legal frameworks of multiple jurisdictions. By obtaining licenses from top-tier regulatory bodies such as the FCA, ASIC, and the CFTC, OANDA demonstrates their commitment to maintaining high standards of financial security and customer protection. This regulatory oversight provides traders with the peace of mind that their funds are safe and that OANDA adheres to strict guidelines to ensure fair and transparent trading practices.

Throughout this review, I have explored various aspects of OANDA's offerings, including their trading platforms, account types, educational resources, and customer support. In each area, OANDA has shown a dedication to providing a high-quality trading experience tailored to the needs of both beginner and experienced traders.

OANDA's trading platforms, particularly their proprietary web-based platform and MetaTrader 4 integration, offer a seamless and intuitive interface for traders to analyze markets, execute trades, and manage their positions. The platforms are equipped with advanced charting tools, technical indicators, and automated trading capabilities, empowering traders to make informed decisions and implement their strategies effectively.

When it comes to account types, OANDA offers a range of options to suit different trading styles and preferences. From the standard account with competitive spreads and no minimum deposit to the premium accounts with additional perks and tighter pricing, OANDA caters to the diverse needs of their clients. The broker's transparency in pricing and the absence of hidden fees further reinforce their commitment to fairness and integrity.

OANDA's educational resources are another standout feature, with a comprehensive library of articles, webinars, and tutorials designed to help traders improve their knowledge and skills. The broker's emphasis on education demonstrates their desire to empower their clients and support their long-term success in the markets.

In terms of customer support, OANDA provides multiple channels for traders to seek assistance, including live chat, email, and phone support. While their support hours are not 24/7, they offer coverage during the most active trading periods and strive to provide prompt and helpful responses to client inquiries.

As with any broker, there are some areas where OANDA has room for improvement. The lack of guaranteed stop losses and negative balance protection for all account types may be a concern for some traders, especially those with a lower risk tolerance. Additionally, while OANDA's pricing is competitive, some brokers may offer even tighter spreads or lower commissions, which could be a consideration for cost-sensitive traders.

Despite these minor drawbacks, OANDA's overall reputation and track record in the industry are solid. They have demonstrated a consistent commitment to providing a reliable, transparent, and user-focused trading environment. For traders seeking a well-regulated broker with a wide range of assets, competitive pricing, and robust trading platforms, OANDA is a strong contender.

As with any financial decision, traders should carefully consider their individual needs, goals, and risk tolerance before choosing a broker. However, based on the findings of this review, I can confidently recommend OANDA as a reputable and trustworthy choice for those looking to engage in online trading.

Find hidden gems via the broker reviews directory we update weekly.