Octa Review 2025: Low Fees, Copy Trading, and Comprehensive Education

OctaFx

Saint Vincent and the Grenadines

Saint Vincent and the Grenadines

-

Minimum Deposit $25

-

Withdrawal Fee $0

-

Leverage 1:1000

-

Spread From 0.4

-

Minimum Order 0.01

-

Forex Available

-

Crypto Available

-

Stock Unavailable

-

Indices Available

Licenses

Cyprus Market Making (MM)

Cyprus Market Making (MM)

South Africa Retail Forex License

South Africa Retail Forex License

Softwares & Platforms

Customer Support

+442033221059

(English)

+442033221059

(English)

Supported language: Chinese (Simplified), English, Hindi, Indonesian, Portuguese, Spanish

Social Media

Summary

OctaFX is a global forex and CFD broker known for its competitive spreads, low minimum deposit of $25, and high leverage options up to 1:1000. It offers popular trading platforms like MetaTrader 4, MetaTrader 5, and its proprietary OctaTrader, catering to traders of all experience levels. The broker supports multiple deposit and withdrawal methods, including bank transfers, credit/debit cards, e-wallets, and cryptocurrencies, with no fees charged by OctaFX. Additionally, OctaFX provides educational resources, market insights, copy trading services, and a user-friendly trading experience designed to help traders succeed.

- Competitive spreads and no hidden fees

- Low $25 minimum deposit requirement

- Wide range of account types for different trader needs

- Advanced trading platforms: MT4, MT5, and OctaTrader

- Strong focus on forex and cryptocurrency trading

- Comprehensive educational resources and market analysis

- Responsive 24/5 customer support in multiple languages

- Transparency and user-focused approach prioritizing client needs

- Integrated copy trading functionality

- Fast and free deposits and withdrawals

- Mixed regulatory profile with an unregulated global entity

- Limited range of tradable assets compared to larger multi-asset brokers

- No phone support available

- Educational content could be better organized by skill level

- Lack of additional account protection measures like third-party insurance

- Trailing stop orders only available on MT5 desktop platform

- Social trading is primarily focused on forex, with fewer options for other assets

- No direct market access (DMA) for trading real stocks or bonds

- Potential conflicts of interest due to dealing desk execution model

- Limited research and analysis for less popular asset classes

Overview

Octa, formerly known as OctaFX, is a global forex and CFD broker that has been providing online trading services since 2011. Headquartered in Saint Vincent and the Grenadines, Octa has expanded its reach to serve over 21 million trading accounts across 180 countries. The broker has earned recognition for its innovative platforms and client-centric approach, receiving over 70 international industry awards.

Octa offers a range of trading instruments including 52 forex pairs, 34 cryptocurrency CFDs, 150 share CFDs, 10 index CFDs, and 5 commodity CFDs. Clients can access popular platforms like MetaTrader 4, MetaTrader 5, and the broker's proprietary OctaTrader web platform. Copy trading is also available.

One of Octa's key strengths is its competitive pricing, with tight spreads starting from 0.6 pips, no commissions, and no fees on swaps, deposits, or withdrawals. The broker also excels in research and education, providing detailed market analysis, webinars, tutorials, and a comprehensive beginner's course.

Customer support is available 24/7 through live chat and email in over 20 languages. Account opening is fully digital and requires a low minimum deposit of just $25. However, it's important to note that while Octa is regulated by CySEC, FSCA, and MISA, its Saint Lucia entity is unregulated, which may present risks for some traders.

For more details on Octa's regulations, accounts, platforms, and offerings, visit their official website at octafx.com.

Octa Overview Table

| Company | Octa Markets Inc. |

|---|---|

| Founded | 2011 |

| Headquarters | 1st Floor, Meridian Place, Choc Estate, Castries, Saint Lucia |

| Regulation | CySEC (Cyprus), FSCA (South Africa), MISA (Comoros). Saint Lucia entity is unregulated. |

| Minimum Deposit | $25 USD |

| Instruments | Forex, Cryptocurrencies, Indices, Commodities, Share CFDs |

| Platforms | MetaTrader 4, MetaTrader 5, OctaTrader Web, Mobile Apps |

| Key Features | Tight spreads, no commissions or swap fees, copy trading, fast execution (59 ms for EURUSD), 24/7 support |

| Accounts | Standard ($25 min), Pro ($100 min), Islamic available, 1:1000 max leverage (non-CySEC) |

| Deposits | Visa, bank wire, e-wallets (Neteller, Skrill), crypto - no fees |

| Withdrawals | Same options as deposit, processed within 1-3 hours. No fees. |

Facts List

- Octa was founded in 2011 and is headquartered in Saint Vincent and the Grenadines.

- The broker has over 21 million registered trading accounts globally across 180 countries.

- Octa is regulated by CySEC (Cyprus), FSCA (South Africa), and MISA (Comoros). However, its Saint Lucia entity Octa Markets Inc. is unregulated.

- Octa offers CFD trading on forex, cryptocurrencies, shares, indices, and commodities. 50+ forex pairs and 34 crypto CFDs are available.

- Minimum deposit is $25. Maximum leverage is 1:1000 (1:30 for CySEC accounts).

- Spreads are very competitive, starting from 0.6 pips on majors. No commissions or swap fees.

- Octa provides the MT4, MT5 and proprietary OctaTrader platforms for web, desktop and mobile.

- Impressive copy trading service boasts over 6 million users. Full suite of algorithmic trading tools.

- Research includes daily technical and fundamental analysis from in-house team, economic calendar, and Autochartist signals.

- Extensive educational articles, videos, webinars, and full course. Suitable for beginner to advanced.

OctaFx Licenses and Regulatory

Octa operates under a mixed regulatory framework, with licenses from authorities in Cyprus, South Africa, and Comoros, while its Saint Lucia entity remains unregulated. This diversified oversight provides a degree of client protection, but also highlights potential risks that traders should consider.

Octa's primary regulated entity, Octa Markets Cyprus Ltd, holds a license from the Cyprus Securities and Exchange Commission (CySEC) under registration number 372/18. As a CySEC-regulated broker, Octa must adhere to strict financial standards, maintain segregated client funds, offer negative balance protection, and participate in the Investor Compensation Fund (ICF) which provides coverage up to €20,000 per client.

In South Africa, Octa's services are provided through Orinoco Capital (Pty) Ltd, which is authorized and regulated by the Financial Sector Conduct Authority (FSCA) with FSP No. 51913. The FSCA regulatory framework offers prudential oversight to ensure fair business practices and safeguard client assets.

Octa Markets Ltd, based in Comoros, is regulated by the Mwali International Services Authority (MISA) under license number HY00623410 and international brokerage and clearing house license T2023320. While MISA oversight indicates some regulatory compliance, it is generally considered less stringent than top-tier authorities like CySEC.

However, it's crucial to note that Octa's global entity, Octa Markets Inc., headquartered in Saint Lucia, is currently unregulated. This lack of regulatory oversight may present risks for clients, as unregulated brokers are not held to the same standards of capital requirements, account segregation, or client protection measures.

In comparison to industry benchmarks, Octa's regulatory profile is mixed. While the CySEC license aligns with top-tier standards, the FSCA and MISA licenses provide a lower level of oversight. The unregulated status of the global entity may be a red flag for some traders, particularly those prioritizing the security of their funds.

To mitigate potential risks, Octa maintains segregated client accounts and offers negative balance protection across all entities. However, additional measures such as third-party insurance could further enhance client protection.

When choosing a broker, it's essential to consider the regulatory implications and align your priorities with the level of oversight provided. While Octa's CySEC regulation offers a robust framework, the unregulated global entity may not be suitable for all traders. As always, thorough due diligence and an understanding of the risks involved are crucial when engaging in online trading.

Regulations List

- Cyprus Securities and Exchange Commission (CySEC): Octa Markets Cyprus Ltd is authorized and regulated by CySEC under license number 372/18.

- Financial Sector Conduct Authority (FSCA): Orinoco Capital (Pty) Ltd holds an FSCA license with FSP No. 51913.

- Mwali International Services Authority (MISA): Octa Markets Ltd is regulated by MISA under license number HY00623410 and international brokerage and clearing house license T2023320.

- Saint Lucia: Octa Markets Inc., the global entity, is currently unregulated.

Trading Instruments

Octa offers a diverse range of tradable instruments, allowing clients to access multiple markets through a single platform. While the broker's asset selection may not match the breadth of the largest multi-asset brokers, it provides a solid foundation for traders seeking exposure to popular markets.

| Asset Class | Details |

|---|---|

| Forex | - 52 currency pairs (majors, minors, and exotics)- EUR/USD spread as low as 0.6 pips- No-commission trading model |

| Cryptocurrencies | - 34 crypto CFDs, including Bitcoin, Ethereum, Litecoin, and emerging altcoins- Allows diversification into high-volatility digital assets |

| Share CFDs | - 150 global shares from NYSE, NASDAQ, and other major exchanges- Leverage capped at 1:20 |

| Indices | - 10 global indices, including S&P 500, FTSE 100, and DAX 30- Competitive spreads, Germany 30 as low as 2 pips |

| Commodities | - 5 commodities (gold, silver, Brent crude oil, natural gas)- Provides opportunities for hedging and speculation |

Trading Platforms

Octa offers a range of trading platforms to suit different preferences and needs, ensuring that clients can access the markets through their preferred method.

| Platform/Feature | Details |

|---|---|

| MetaTrader 4 (MT4) | - User-friendly interface with advanced charting tools and customization options- Supports automated trading via Expert Advisors (EAs)- Available on desktop, web, and mobile |

| MetaTrader 5 (MT5) | - More advanced than MT4 with additional tools, indicators, and improved backtesting- Supports multi-asset trading (forex, CFDs, futures)- Accessible via desktop, web, and mobile |

| OctaTrader Web Platform | - Proprietary web-based trading platform- Features interactive charts, one-click trading, and trading from the chart- Designed for simplicity and ease of use, ideal for beginners |

| Copy Trading | - Allows users to mirror trades of successful traders ("Masters")- Integrated into the mobile app for easy access- Suitable for beginners or those preferring passive trading |

| Mobile Trading | - Supports MT4, MT5, and OctaTrader on iOS and Android- Provides real-time quotes, trade execution, and account management- Includes push notifications for market alerts |

Octa's range of trading platforms caters to the diverse needs of its client base, from beginners to advanced traders.

Trading Platforms Comparison Table

| Feature | MT4 | MT5 | OctaTrader | Mobile Apps |

|---|---|---|---|---|

| User Interface | ⭐ 4.5/5 | ⭐ 4/5 | ⭐ 5/5 | ⭐ 4.5/5 |

| Charting | ⭐ 4.5/5 | ⭐ 5/5 | ⭐ 4/5 | ⭐ 4/5 |

| Technical Indicators | 30+ | 40+ | 30+ | 30+ |

| Timeframes | 9 | 21 | 9 | 9 |

| Automated Trading | ✅ Yes | ✅ Yes | ❌ No | ❌ No |

| Web Platform | ✅ Yes | ✅ Yes | ✅ Yes | N/A |

| Mobile Apps | iOS, Android | iOS, Android | N/A | iOS, Android |

| Copy Trading | ✅ Via mobile app | ✅ Via mobile app | ❌ No | ✅ Yes |

| One-Click Trading | ✅ Yes | ✅ Yes | ✅ Yes | ✅ Yes |

OctaFx How to Open an Account: A Step-by-Step Guide

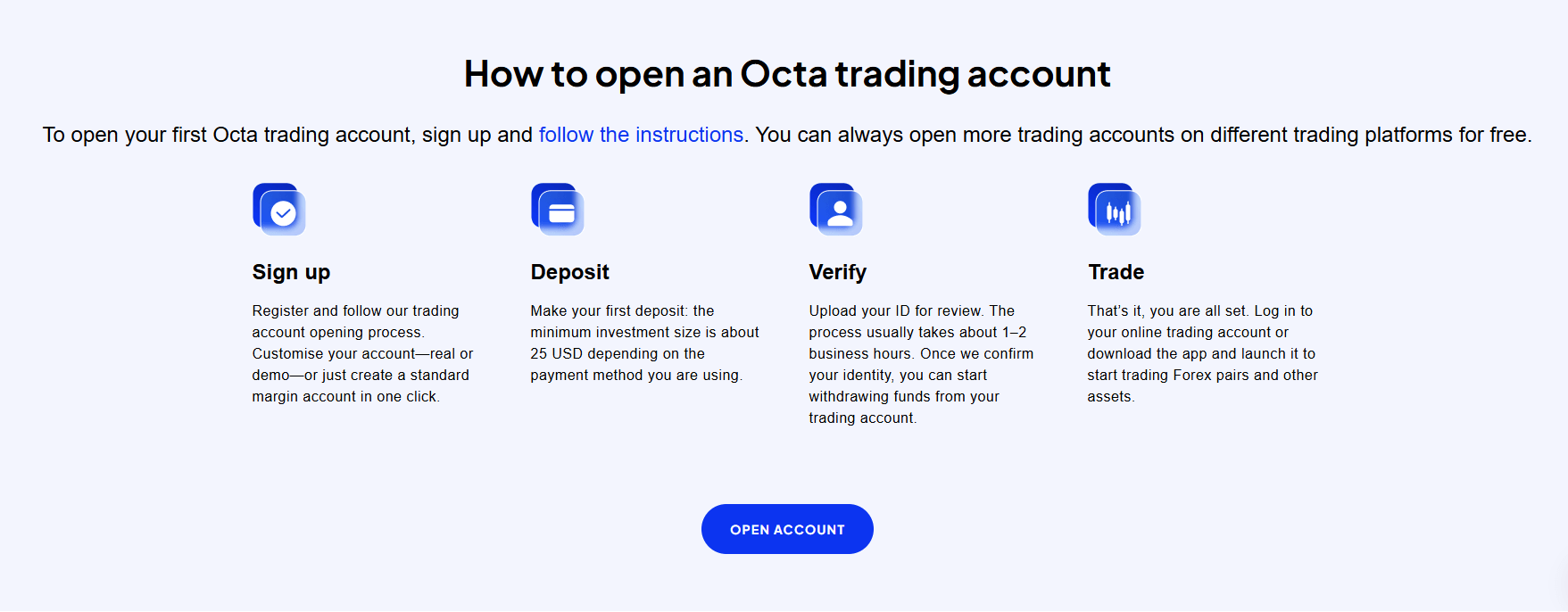

Opening an account with Octa is a straightforward process that can be completed entirely online. The broker has streamlined the registration procedure to ensure a user-friendly experience for new clients.

Registration Process

- Visit the official Octa website.

- Click on the "Open an Account" button at the top right corner of the page

- Select your preferred account type (OctaFX MT4, OctaFX MT5, or OctaTrader)

- Fill in your personal details, including full name, email address, phone number, and country of residence

- Provide your trading experience and employment information

- Choose your preferred account currency and leverage

- Agree to the terms and conditions and privacy policy

- Click on "Register" to submit your application

| Requirement | Details |

|---|---|

| Minimum Age | Must be at least 18 years old |

| Government-Issued ID | Passport, national ID card, or driver's license |

| Proof of Residence | Utility bill, bank statement, or government-issued document |

| Contact Information | Valid email address and phone number |

Octa Minimum Deposit

| Category | Details |

|---|---|

| Minimum Deposit | $25 |

| Payment Methods | - Credit/Debit Cards (Visa, Mastercard) - Bank Wire Transfer - E-Wallets (Neteller, Skrill) - Cryptocurrencies (Bitcoin, Ethereum, Litecoin, and more) |

To verify your account, follow these steps:

- Log in to your Octa account dashboard

- Navigate to the "Verification" section

- Upload a clear copy of your government-issued ID and proof of residence

- Submit the documents for review

- Octa's compliance team will review your documents within 1-2 business days

- Once your account is verified, you can proceed to fund your account and start trading

Charts and Analysis

Octa provides a comprehensive suite of educational resources and tools to support traders in their learning journey and decision-making process. These resources cater to both novice and experienced traders, offering insights and analysis to help navigate the financial markets

| Feature | Details |

|---|---|

| Market Insights | Daily technical and fundamental analysis is provided by in-house analysts, covering market trends and key levels. Insights are easy to understand and accessible to all traders. |

| Economic Calendar | Customizable calendar highlighting key market events and data releases. Helps traders plan based on market-moving news. |

| Webinars | Regular live sessions led by experienced analysts on market analysis, strategies, and platform tutorials. Interactive format with Q&A; recordings available for later viewing. |

| Educational Articles | Well-structured articles on trading topics like technical analysis, risk management, and psychology. Suitable for traders of all levels. |

| Video Tutorials | Step-by-step guides on trading basics, platform usage, and strategy implementation. Visually engaging and beginner-friendly. |

| Trading Glossary | Comprehensive and searchable glossary of trading terms, making it easy for beginners to understand industry terminology. |

In comparison to industry standards, Octa's educational resources are comprehensive and well-developed. The broker goes beyond the basics, offering a mix of market analysis, educational content, and interactive learning opportunities.

OctaFx Account Types

Octa offers three main account types designed to cater to the diverse needs of traders, from beginners to experienced professionals. Each account type comes with unique features and benefits, allowing traders to choose the best fit for their trading style and goals.

| Account Type | Details |

|---|---|

| Demo Account | Virtual funds for risk-free trading, mimics real market conditions. Ideal for beginners and strategy testing. |

| OctaFX MT4 Account | Designed for MetaTrader 4 users; spreads from 0.6 pips on major pairs, no commissions, $25 minimum deposit, leverage up to 1:1000. |

| OctaFX MT5 Account | Advanced version for MetaTrader 5 users; spreads from 0.6 pips, no commissions, $25 minimum deposit, leverage up to 1:1000, additional instruments and analytical tools. |

| OctaTrader Account | Web-based platform with a user-friendly interface; spreads from 0.6 pips, no commissions, $100 minimum deposit, leverage up to 1:200. Suitable for beginners. |

| Islamic Account | Swap-free, compliant with Sharia law, no overnight interest charges. Same features as standard accounts. Requires contacting support for activation. |

Octa's range of account types demonstrates the broker's commitment to accommodating the diverse needs of its client base.

Account Types Comparison Table

| Feature | Demo Account | OctaFX MT4 | OctaFX MT5 | OctaTrader |

|---|---|---|---|---|

| Platform | MT4/MT5 | MetaTrader 4 | MetaTrader 5 | OctaTrader |

| Minimum Deposit | N/A | $25 | $25 | $100 |

| Spreads (EUR/USD) | From 0.6 | From 0.6 | From 0.6 | From 0.6 |

| Commissions | N/A | None | None | None |

| Leverage | Up to 1:1000 | Up to 1:1000* | Up to 1:1000* | Up to 1:200 |

| Instruments | 72 | 80 | 95 | 80 |

| Order Execution | Instant | Instant | Instant | Instant |

| Swap-Free (Islamic) | N/A | Available | Available | Available |

| Minimum Trade Size | 0.01 lots | 0.01 lots | 0.01 lots | 0.01 lots |

| Maximum Trade Size | 100 lots | 200 lots | 500 lots | 50 lots |

| Hedging Allowed | Yes | Yes | Yes | Yes |

| Scalping Allowed | Yes | Yes | Yes | Yes |

| EA (Expert Advisors) | Yes | Yes | Yes | No |

| Mobile Trading | Yes | Yes | Yes | Yes |

Leverage restrictions may apply based on jurisdiction and regulatory requirements.

Negative Balance Protection

Negative balance protection is a crucial risk management feature that ensures traders cannot lose more than the funds available in their trading account. This protection is particularly important in the volatile world of forex and CFD trading, where rapid market movements can potentially lead to significant losses. Negative balances can occur in several scenarios, such as:

- Extreme Market Volatility: During times of high market volatility, prices can move rapidly and unexpectedly, potentially leading to substantial losses.

- Overexposure: Traders who overleverage their positions or fail to implement appropriate risk management techniques may be more susceptible to negative balances.

- Gaps in Pricing: Market gaps, which occur when prices change abruptly with no trading activity in between, can result in negative balances if stop-loss orders are not executed at the expected price.

OctaFx Deposits and Withdrawals

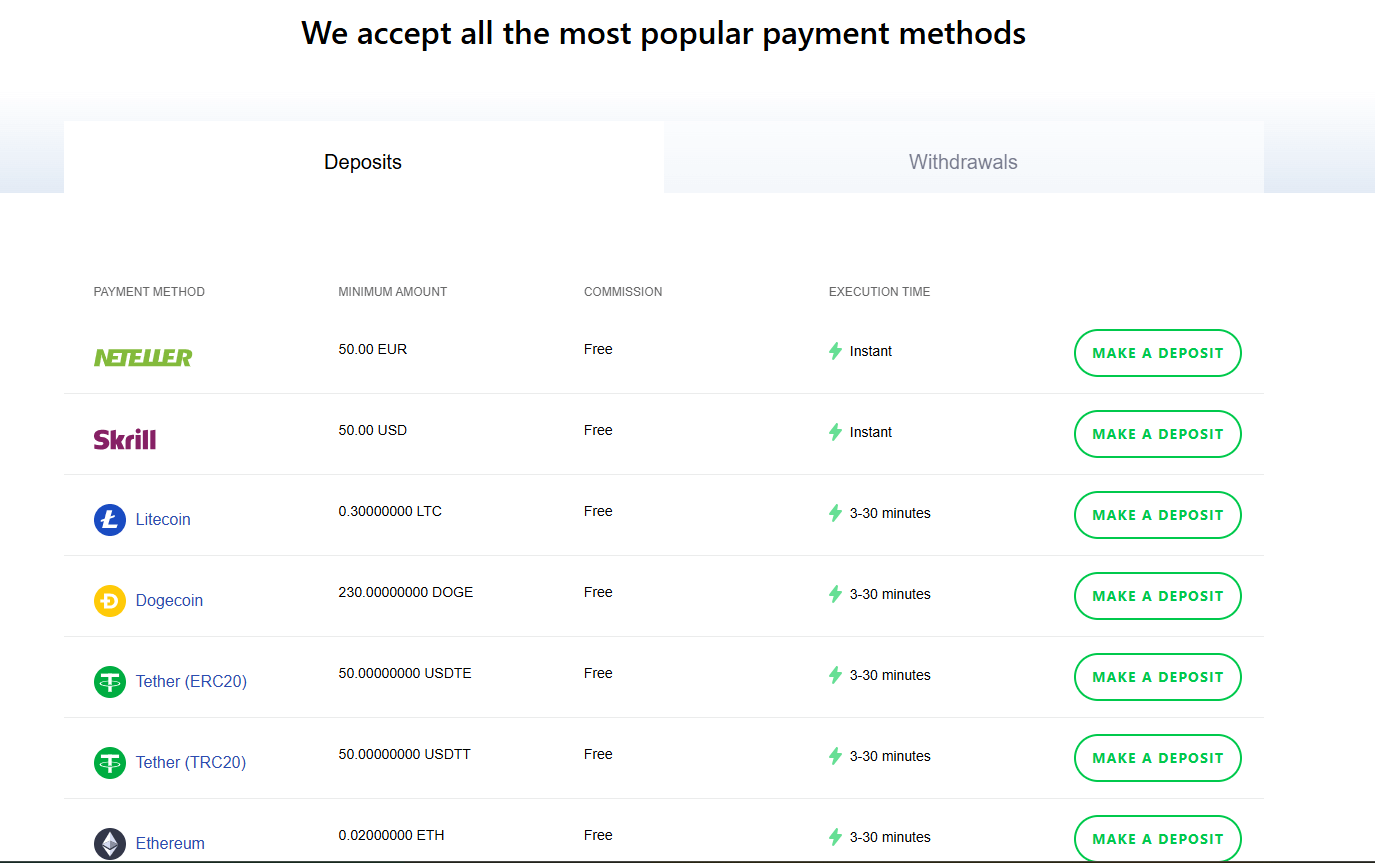

As a trusted forex broker, Octa offers a wide range of deposit and withdrawal options to cater to the diverse needs of its global client base.

| Category | Details |

|---|---|

| Deposit Methods | - Bank Wire Transfer: Takes 1-5 business days, may incur bank fees.- Credit/Debit Cards (Visa, Mastercard): Instant, no fees.- E-wallets (Neteller, Skrill): Instant, no fees.- Cryptocurrencies (Bitcoin, Ethereum, Litecoin, etc.): Processed within 1-3 hours, no fees. |

| Minimum Deposit | $25 |

| Deposit Processing | - Instant for credit/debit cards, e-wallets, and cryptocurrencies.- Bank wire transfers take 1-5 business days.- No deposit fees charged by Octa, but payment provider fees may apply. |

| Withdrawal Methods | - Bank Wire Transfer: 1-3 business days, may incur receiving bank fees.- Credit/Debit Cards (Visa, Mastercard): 1-5 business days, no fees.- E-wallets (Neteller, Skrill): 1-3 hours, no fees.- Cryptocurrencies (Bitcoin, Ethereum, Litecoin, etc.): 1-3 hours, no fees. |

| Minimum Withdrawal | $5 |

| Withdrawal Processing | Octa processes withdrawals within 1-3 business days, but actual transfer time depends on the payment provider. |

Verification Requirements

As part of its anti-money laundering (AML) and know-your-customer (KYC) policies, Octa requires traders to complete a verification process before making their first withdrawal. This process involves submitting proof of identity and proof of residence. Once the documents are verified, subsequent withdrawals can be processed without delay.Support Service for Customer

Support Channels

- Live Chat: Octa's website features a live chat option, allowing traders to connect with a support representative in real-time. This is often the quickest way to get assistance for common issues and inquiries.

- Email: Traders can send their questions or concerns to Octa's support email address. The broker aims to respond to all email inquiries within 24 hours.

- Social Media: Octa maintains an active presence on popular social media platforms, such as Facebook, Twitter, and Instagram. Traders can reach out to the support team through direct messages or by posting on the broker's official pages.

- Telephone: For more complex issues or personalized assistance, traders can contact Octa's support team via telephone. The broker provides multiple phone numbers for different regions, ensuring that traders can reach out from various countries.

Support Languages

Octa offers customer support in several languages to cater to its global client base. These languages include:- English

- Spanish

- Portuguese

- Chinese

- Indonesian

- Vietnamese

- Malay

- Arabic

- Hindi

- Urdu

Support Hours

Octa's customer support operates 24/5. The live chat and phone support are available around the clock from Monday to Friday, allowing traders to get assistance at any time during the trading week. Email support operates 24/7, with responses provided within 24 hours.Response Times

Octa aims to provide prompt assistance to its clients. The average response times for each support channel are as follows:- Live Chat: 1-2 minutes

- Email: 1-24 hours

- Social Media: 1-6 hours

- Telephone: 1-5 minutes

Customer Support Channels List

- Live Chat: Available 24/5

- Email: support@octafx.com

- Social Media: Facebook, Twitter, Instagram

- Telephone: Multiple numbers for different regions

- International: +44 20 3322 1059

- Indonesia: +62 21 2555 6820

- Mexico: +52 55 8526 5503

- Brazil: +55 11 4949 5196

Prohibited Countries

In the global landscape of online trading, brokers must comply with various regulatory requirements and legal restrictions. As a result, Octa is prohibited from providing services to clients in certain countries and regions.

Prohibited Countries List

Octa is prohibited from offering its services to clients in the following regions:

- North America

- European Union (excluding Estonia)

- Japan

- Australia

- New Zealand

- Iran

- North Korea

- Sudan

- Syria

- Cuba

- Crimea Region

Please note that this list is subject to change based on regulatory updates and Octa's internal policies. Traders are encouraged to visit Octa's official website for the most up-to-date information on prohibited countries.

Consequences of Trading from Prohibited Countries

Attempting to trade with Octa from a prohibited country may result in several consequences, such as:

- Account Suspension: Octa reserves the right to suspend or terminate accounts that are found to be operating from prohibited countries.

- Funds Seizure: In some cases, funds deposited from prohibited countries may be seized or frozen, making it difficult for traders to withdraw their money.

- Legal Action: Traders who violate international regulations by trading with Octa from a prohibited country may face legal consequences in their jurisdiction.

To avoid these risks, traders should always ensure that they are eligible to trade with Octa based on their country of residence. If in doubt, contacting Octa's customer support team for clarification is recommended.

Special Offers for Customers

Octa provides a range of special promotions and offers designed to attract new clients and reward existing traders for their loyalty. These offers can help traders maximize their potential returns and enhance their overall trading experience.

| Program | Requirements/Criteria | Benefits/Rewards | Additional Notes |

|---|---|---|---|

| Sign-Up Bonus | - Open a new account with Octa- Deposit a minimum of $50 within 30 days of registration- Complete required trading volume within 60 days of deposit | - Receive a welcome bonus of up to 50% on the initial deposit (usable as additional trading capital) | - Subject to specific terms & conditions (e.g., withdrawal restrictions, trading volume requirements) |

| Loyalty Program | - Based on trader’s account balance and trading activity- Participation across four tiers: Bronze, Silver, Gold, and Platinum | - Reduced spreads on selected instruments- Faster withdrawal processing- Dedicated account managers- Exclusive market analysis and trading strategies- Invitations to VIP events and webinars | - Benefits increase as traders move up the tiers |

| Trading Competitions | - Participation subject to specific rules and criteria for each competition | - Attractive prizes including cash rewards, trading bonuses, or luxury experiences (e.g., trips to exotic destinations) | - Competitions run for a limited time- Provide a platform for testing strategies and learning from others |

| Refer-a-Friend Program | - Existing client refers a friend- The referred friend must open an account and meet minimum deposit and trading volume requirements | - Both the referrer and the new client receive trading bonuses or other incentives | - Encourages word-of-mouth marketing and expands Octa’s client base |

| Third-Party Partnerships | - Collaboration with various external service providers (no direct requirements from the client’s side) | - Access to exclusive discounts, educational resources, and value-added services through partners such as trading signal providers, educational platforms, market analysis firms, and payment solution providers | - Enhances overall trading activities with additional benefits from trusted third-party partners |

Conclusion

Throughout this comprehensive review, I have delved into various aspects of Octa's operations, from their regulatory compliance and geographical reach to their trading platforms, account types, and customer support. By consolidating these findings, I aim to provide a cohesive evaluation of Octa's safety, reliability, and overall reputation as a broker.

One of the key factors that contribute to Octa's trustworthiness is their regulatory compliance. While their global entity, Octa Markets Inc., is unregulated, their EU entity, Octa Markets Cyprus Ltd, is regulated by CySEC, a top-tier authority. This mixed regulatory profile offers a degree of protection for clients, particularly those residing in the EU, but also highlights the importance of carefully considering the jurisdiction under which one's account falls.

Octa demonstrates a commitment to transparency and user-focused service through their offerings. They provide a diverse range of account types with competitive spreads and no hidden fees, catering to traders of different skill levels and preferences. The low minimum deposit requirement and wide selection of payment methods make it easy for clients to start trading with Octa.

The broker's range of trading platforms, which includes the popular MT4 and MT5 alongside their proprietary OctaTrader, ensures that clients have access to the tools and features they need to analyze markets, execute trades, and manage their portfolios effectively. The integration of copy trading functionality further enhances the accessibility of trading for beginners.

Octa's educational resources and market analysis are another strong suit, providing clients with the knowledge and insights needed to make informed trading decisions. The broker's commitment to 24/5 customer support across multiple channels and languages ensures that clients can access assistance whenever they need it.

While Octa's product offerings may not be as extensive as some of the larger, multi-asset brokers, their focus on core trading instruments, particularly forex and cryptocurrencies, allows them to provide a more specialized and streamlined experience for their target audience.

Overall, Octa presents itself as a reliable and user-focused broker that prioritizes the needs of its clients. Their competitive trading conditions, advanced platforms, and educational resources make them an attractive choice for both novice and experienced traders. However, as with any broker, it is crucial to carefully consider one's individual trading needs and risk tolerance before opening an account.

For those seeking a well-rounded and accessible trading experience with a focus on forex and cryptocurrencies, Octa is definitely worth considering. As always, conducting thorough due diligence and staying informed about the latest developments in the broker's operations and regulatory standing is essential to making an informed decision.

If you’re still weighing your options, dive into our full lineup of unbiased broker reviews.