Octa Review 2025: Low Fees, Copy Trading, and Comprehensive Education

OctaFx

Saint Vincent and the Grenadines

Saint Vincent and the Grenadines

-

Minimum Deposit $25

-

Withdrawal Fee $0

-

Leverage 1:1000

-

Spread From 0.4

-

Minimum Order 0.01

-

Forex Available

-

Crypto Available

-

Stock Unavailable

-

Indices Available

Licenses

Cyprus Market Making (MM)

Cyprus Market Making (MM)

South Africa Retail Forex License

South Africa Retail Forex License

Softwares & Platforms

Customer Support

+442033221059

(English)

+442033221059

(English)

Supported language: Chinese (Simplified), English, Hindi, Indonesian, Portuguese, Spanish

Social Media

Summary

OctaFX is a global forex and CFD broker founded in 2011, serving over 21 million accounts in 180+ countries. It offers 300+ instruments with spreads from 0.6 pips, zero commissions, and a low $25 minimum deposit. The broker is regulated by CySEC, FSCA, MISA, and FSA, ensuring varying levels of client protection. Traders can use MT4, MT5, or OctaTrader, with added features like copy trading, fast withdrawals, negative balance protection, and 24/7 multilingual support. While it’s cost-effective and beginner-friendly, it has limited commodities, weaker regulation in Comoros, and fewer advanced tools for professional traders.

- Extremely low $25 minimum deposit

- Competitive spreads from 0.6 pips

- No commission or hidden fees

- 100+ industry awards recognition

- 24/7 multilingual customer support

- Multiple regulatory licenses

- Comprehensive copy trading service

- Fast withdrawal processing

- Negative balance protection

- Extensive educational resources

- Primary registration in Comoros (weaker regulation)

- Limited commodity selection (5 instruments)

- Dealing desk execution model

- No direct market access

- Limited advanced research tools

- OctaTrader lacks EA support

- Restricted in major markets (US, Japan, Australia)

- No guaranteed stop-loss orders

- Limited cryptocurrency selection

- Basic platform customization options

Overview

OctaFX stands as a prominent global forex and CFD broker, established in 2011 with registered offices in Comoros and Cyprus. With over 21 million trading accounts spanning 180 countries, this multi-regulated broker has garnered recognition through 100+ international industry awards. The broker operates under multiple regulatory frameworks including CySEC (Cyprus), FSCA (South Africa), and MISA (Comoros), providing diverse oversight for different client segments.

The platform distinguishes itself through competitive trading conditions, offering spreads from 0.6 pips with no commissions, alongside a remarkably low $25 minimum deposit requirement. OctaFX provides access to 300+ trading instruments across forex, cryptocurrencies, stocks, indices, and commodities through industry-standard platforms MT4, MT5, and their proprietary OctaTrader.

For more details on Octa's regulations, accounts, platforms, and offerings, visit their official website at octafx.com.

Overview Table

| Feature | Details |

|---|---|

| Company Name | OctaFX (Octa Markets) |

| Founded | 2011 |

| Headquarters | Comoros (Registered), Cyprus (Business) |

| Regulation | CySEC, FSCA, MISA, FSA |

| Min Deposit | $25 |

| Instruments | 300+ (Forex, Crypto, Stocks, Indices, Commodities) |

| Platforms | MT4, MT5, OctaTrader |

| Max Leverage | 1:1000 (non-EU) |

| Support | 24/7 multilingual |

| Awards | 100+ international recognitions |

Facts List

- OctaFX was founded in 2011 with registered offices in Comoros and operational headquarters in Cyprus, serving over 21 million trading accounts across 180 countries globally

- The broker holds multiple regulatory licenses including CySEC (Cyprus) License 372/18, FSCA (South Africa), MISA (Comoros), and FSA (Saint Vincent), providing varied levels of client protection

- OctaFX offers 300+ tradable instruments including 52 forex pairs, 30+ cryptocurrency CFDs, 150 stock CFDs, 10 indices, and 5 commodities with execution speeds averaging 59ms for EUR/USD

- Minimum deposit requirement is just $25 across all account types with maximum leverage up to 1:1000 for non-EU clients and 1:30 for CySEC-regulated accounts

- Trading spreads start from 0.6 pips on major currency pairs with zero commissions, no swap fees on Islamic accounts, and no deposit or withdrawal fees charged by the broker

- The broker provides MetaTrader 4, MetaTrader 5, and proprietary OctaTrader platforms accessible via desktop, web, and mobile applications for iOS and Android devices

- Copy trading service boasts over 6 million users allowing clients to automatically replicate strategies of successful traders directly through the mobile application

- Customer support operates 24/7 in over 20 languages through live chat, email, phone support, and social media channels with average response times of 1-2 minutes for live chat

- OctaFX has received over 100 international industry awards recognizing service quality, innovation, and customer satisfaction throughout its operational history

- The broker processes withdrawals within 1-3 hours for e-wallets and cryptocurrencies, maintaining segregated client accounts with negative balance protection across all entities

OctaFx Licenses and Regulatory

OctaFX operates under a comprehensive multi-jurisdictional regulatory framework that provides varying levels of client protection. The Cyprus entity, Octa Markets Cyprus Ltd, holds the strongest regulation through CySEC (license 372/18), ensuring adherence to strict EU financial standards including segregated client funds and negative balance protection.

Regulations List

- Cyprus Securities and Exchange Commission (CySEC) - License 372/18

- Financial Sector Conduct Authority (FSCA) - South Africa

- Mwali International Services Authority (MISA) - Comoros

- Financial Services Authority (FSA) - Saint Vincent

Trading Instruments

OctaFX offers traders access to diverse financial markets through 300+ tradable instruments. The broker's asset selection covers major market segments, enabling portfolio diversification and various trading strategies.

Tradable Assets Table

| Asset Class | Number | Key Features |

|---|---|---|

| Forex Pairs | 52 | Majors, minors, exotics |

| Cryptocurrencies | 30+ | Bitcoin, Ethereum, altcoins |

| Stock CFDs | 150 | Global exchanges coverage |

| Indices | 10 | Major global indices |

| Commodities | 5 | Gold, silver, oil, gas |

Trading Platforms

OctaFX provides multiple trading solutions catering to different trader preferences and experience levels. Each platform offers unique features while maintaining the broker's competitive trading conditions.

Trading Platforms Comparison Table

| Feature | MT4 | MT5 | OctaTrader |

|---|---|---|---|

| User Interface | 4.5/5 | 4/5 | 5/5 |

| Technical Indicators | 30+ | 40+ | 30+ |

| Timeframes | 9 | 21 | 9 |

| Automated Trading | Yes | Yes | No |

| Mobile Apps | iOS/Android | iOS/Android | Web-based |

| Copy Trading | Yes | Yes | No |

| One-Click Trading | Yes | Yes | Yes |

OctaFx How to Open an Account: A Step-by-Step Guide

Opening an account with Octa is a straightforward process that can be completed entirely online. The broker has streamlined the registration procedure to ensure a user-friendly experience for new clients.

Registration Process

- Visit the official Octa website.

- Click on the "Open an Account" button at the top right corner of the page

- Select your preferred account type (OctaFX MT4, OctaFX MT5, or OctaTrader)

- Fill in your personal details, including full name, email address, phone number, and country of residence

- Provide your trading experience and employment information

- Choose your preferred account currency and leverage

- Agree to the terms and conditions and privacy policy

- Click on "Register" to submit your application

To verify your account, follow these steps:

- Log in to your Octa account dashboard

- Navigate to the "Verification" section

- Upload a clear copy of your government-issued ID and proof of residence

- Submit the documents for review

- Octa's compliance team will review your documents within 1-2 business days

- Once your account is verified, you can proceed to fund your account and start trading

Charts and Analysis

OctaFX provides comprehensive educational materials and market analysis tools supporting traders at all experience levels. The broker's educational ecosystem includes real-time market insights and structured learning paths.

Educational Resources Table

| Resource Type | Features | Availability |

|---|---|---|

| Market Analysis | Daily technical/fundamental | Free |

| Webinars | Live sessions with Q&A | Weekly |

| Video Tutorials | Platform guides, strategies | On-demand |

| Economic Calendar | Customizable events | Real-time |

| Trading Articles | Beginner to advanced topics | Library access |

OctaFx Account Types

OctaFX offers diversified account structures accommodating various trading styles and capital requirements. Each account maintains competitive conditions while serving specific trader segments.

Account Types Comparison Table

| Feature | Demo | MT4 Standard | MT5 Standard | OctaTrader |

|---|---|---|---|---|

| Minimum Deposit | $0 | $25 | $25 | $25 |

| Spreads (EUR/USD) | 0.6 pips | 0.6 pips | 0.6 pips | 0.6 pips |

| Commission | None | None | None | None |

| Max Leverage | 1:1000 | 1:1000 | 1:1000 | 1:200 |

| Islamic Option | N/A | Yes | Yes | Yes |

| EA Support | Yes | Yes | Yes | No |

Negative Balance Protection

OctaFX implements comprehensive negative balance protection ensuring traders cannot lose more than their deposited funds. This critical safety feature activates during extreme market volatility, price gaps, or unexpected events. When account equity turns negative, OctaFX absorbs the loss and resets the balance to zero, protecting clients from additional liability beyond their investment.

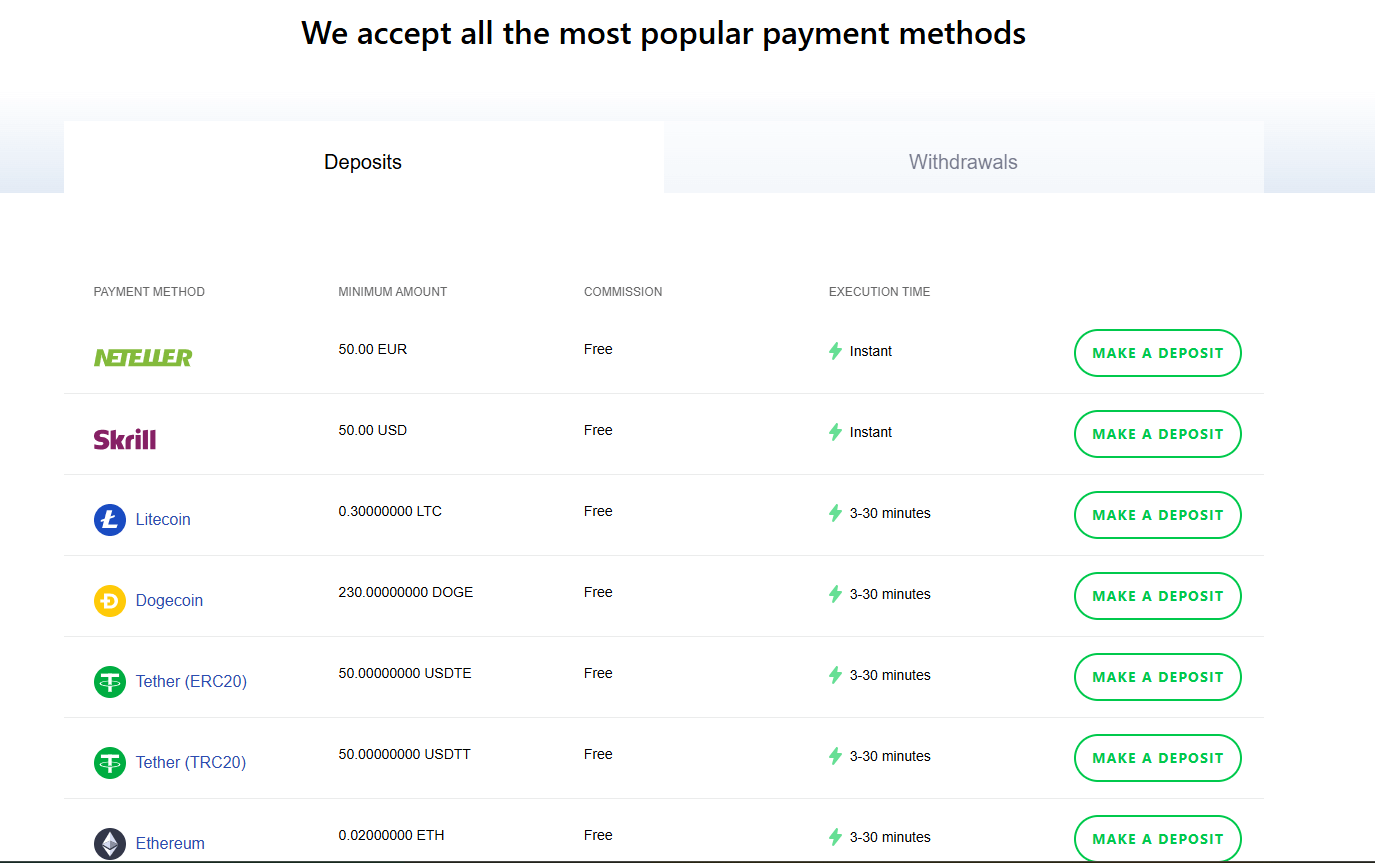

OctaFx Deposits and Withdrawals

OctaFX facilitates convenient fund management through multiple payment channels with no broker-imposed fees. The platform processes transactions efficiently while maintaining security standards.

Payment Methods Table

| Method | Deposit Time | Withdrawal Time | Fees |

|---|---|---|---|

| Cards (Visa/MC) | Instant | 1-5 days | None |

| Bank Wire | 1-5 days | 1-3 days | None |

| E-wallets | Instant | 1-3 hours | None |

| Cryptocurrencies | 1-3 hours | 1-3 hours | None |

Support Service for Customer

OctaFX delivers round-the-clock multilingual support through various communication channels. The support infrastructure serves global clients across different time zones effectively.

Customer Support Comparison Table

| Channel | Availability | Response Time | Languages |

|---|---|---|---|

| Live Chat | 24/7 | 1-2 minutes | 20+ |

| 24/7 | 1-24 hours | 20+ | |

| Phone | 24/7 | 1-5 minutes | Multiple |

| Social Media | 24/7 | 1-6 hours | English+ |

Prohibited Countries

In the global landscape of online trading, brokers must comply with various regulatory requirements and legal restrictions. As a result, Octa is prohibited from providing services to clients in certain countries and regions.

Prohibited Countries List

- North America

- European Union (excluding Estonia)

- Japan

- Australia

- New Zealand

- Iran

- North Korea

- Sudan

- Syria

- Cuba

- Crimea Region

Special Offers for Customers

OctaFX provides various promotional programs enhancing trader value and engagement opportunities.

Special Offers Table

| Program | Requirements | Benefits |

|---|---|---|

| Welcome Bonus | $50 deposit | 50% bonus |

| Loyalty Program | Trading activity | Reduced spreads, VIP perks |

| Copy Trading | Account activation | Follow successful traders |

| Competitions | Registration | Cash prizes |

| Refer-a-Friend | Valid referral | Trading bonuses |

Conclusion

OctaFX has established itself as a credible and accessible broker particularly well-suited for beginner to intermediate traders seeking low-cost entry into forex and cryptocurrency markets. The broker's competitive edge lies in its remarkably low $25 minimum deposit, tight spreads from 0.6 pips, and absence of commissions or hidden fees, making it one of the most affordable options in the industry. Their multi-regulated structure, while not perfect due to the Comoros primary registration, provides reasonable client protection especially for European traders under CySEC oversight. The comprehensive copy trading platform with 6 million users, combined with extensive educational resources and 24/7 multilingual support, creates a supportive environment for trading development. However, limitations including restricted asset diversity with only 5 commodities, dealing desk execution model, and absence of advanced professional features may deter experienced traders. The platform excels in user accessibility and cost-effectiveness but falls short in areas like research tools and market depth compared to tier-one brokers. Overall, OctaFX represents a solid choice for cost-conscious traders prioritizing simplicity and support over advanced functionality, though traders should carefully consider which regulatory entity covers their region.

Compare payout speeds in the broker withdrawal tracker.

See how rivals stack up in our CICC review.