Orbex Review 2025: Is This Multi-Regulated Broker Safe?

Orbex

Mauritius

Mauritius

-

Minimum Deposit $100

-

Withdrawal Fee $Varies

-

Leverage 500:1

-

Minimum Order 0.01

-

Forex Available

-

Crypto Available

-

Stock Available

-

Indices Available

Licenses

United Kingdom Market Making (MM)

United Kingdom Market Making (MM)

Japan Forex Trading License

Japan Forex Trading License

Forex & CFD Brokerage License

Forex & CFD Brokerage License

Softwares & Platforms

Customer Support

+2302035198140

(English)

+2302035198140

(English)

Supported language: English

Social Media

Summary

Orbex is a multi-regulated forex and CFD broker established in 2011, headquartered in Mauritius with offices in Kuwait and Jordan. It offers 400+ tradable instruments including forex, stocks, indices, commodities, and crypto, with MT4, MT5, FIX API, and a mobile app. Account types include Starter ($100 min deposit), Premium ($500), and Ultimate ($25,000), with spreads from 0.0 pips and leverage up to 1:500. Educational tools and 24/5 customer support are also provided.

- Wide selection of 400+ tradable instruments

- Competitive spreads from 0 pips and leverage up to 1:500

- Choice of MT4/MT5 plus proprietary add-ons for advanced trading

- Flexible account types for all experience levels from $100 minimum

- Negative balance protection and fund segregation for safety

- Access to Trading Central and Elliott Wave tools for market research

- Extensive educational resources and exclusive 1-on-1 training

- 24/5 customer support via phone, email, and live chat

- Convenient funding via multiple methods with zero fees

- Regular promotions like deposit bonus, refer-a-friend and loyalty rebates

- Questionable regulation status with FCA, BaFin, CySEC warnings

- Reported complaints on withdrawal delays and requotes

- Does not accept clients from US, Canada, Australia, Japan, Belgium, EEA

- No 24/7 customer support

- Limited social/copy trading tools

- No guaranteed stop losses or STP/ECN accounts

- $50 minimum withdrawal amount

- Complex account verification and KYC procedures

- Suspected clone regulations and irregularities in licenses

- Limited credit/debit card funding options

Overview

Orbex is a multi-regulated forex and CFD broker established in 2011. They have a presence in various regions, including the EU and MENA, with offices in Mauritius, Kuwait and Jordan. Orbex offers over 400 tradable instruments, including 60+ forex pairs, 200+ stock CFDs, commodities, indices and cryptocurrencies. They provide the popular MT4 and MT5 trading platforms.

Orbex has three main account types – Starter, Premium and Ultimate – with minimum deposits ranging from $100 to $25,000. Spreads start from 0.0 pips on the Premium and Ultimate accounts, with commissions of $5-8 per lot traded. The Starter account has variable spreads from 1.7 pips with no added commission. Leverage up to 1:500 is available. Educational resources include articles, e-books, webinars and a Trading Academy.

Overview Table

| Aspect | Information |

|---|---|

| Registered Country/Area | Mauritius |

| Founded Year | 2011 |

| Company Name | ORBEX Ltd |

| Regulation | Regulated by FSC Mauritius and FSA Seychelles. Previously under FCA, BaFin, Banque de France, and CySEC (current status unclear). |

| Minimum Deposit | - $100 (Starter) - $500 (Premium) - $25,000 (Ultimate) |

| Maximum Leverage | Up to 1:500 |

| Spreads | - From 1.7 pips (Starter) - From 0.0 pips (Premium & Ultimate) |

| Trading Platforms | MT4, MT5, FIX API, Orbex Mobile App |

| Tradable Assets | Forex, Stocks, Indices, Commodities, Cryptocurrencies |

| Account Types | Starter, Premium, Ultimate |

| Demo Account | Available |

| Islamic Account | Swap-free option provided |

| Customer Support | 24/5 via Phone, Email, Live Chat |

| Payment Methods | Credit/Debit Cards, Skrill, Neteller, Perfect Money, UnionPay, Bank Wire |

| Educational Tools | Articles, eBooks, Webinars, Trading Central, VPS, Calculators, Economic Calendar |

Facts List

- Orbex was founded in 2011 and is based in Mauritius.

- They are licensed by the FSC Mauritius and FSA Seychelles.

- There are concerns about Orbex's regulatory status with FCA, BaFin, Banque de France and CySEC.

- Orbex offers 400+ instruments including 60+ forex pairs and 200+ stock CFDs.

- Minimum deposits are $100, $500 and $25,000 for Starter, Premium and Ultimate accounts respectively.

- Maximum leverage offered is 1:500.

- Spreads start from 0.0 pips with commissions of $5-8 on Premium and Ultimate accounts.

- Trading platforms include MT4, MT5, mobile apps and FIX API.

- Extensive educational resources are available including Trading Academy, webinars and ebooks.

- Customer support is 24/5 via live chat, email and phone.

Orbex Licenses and Regulatory

Orbex is licensed and regulated by the Financial Services Commission (FSC) of Mauritius and the Seychelles Financial Services Authority (FSA). The FSC Mauritius license allows Orbex Global Limited to operate worldwide, except in certain restricted jurisdictions. The FSA license authorises Orbex Limited to provide investment services.

However, there are concerns about Orbex's regulatory status with other authorities they previously claimed regulation from:

- The UK Financial Conduct Authority (FCA) has classified Orbex as "Unsubscribed" indicating an abnormal status.

- Germany's Federal Financial Supervisory Authority (BaFin) states Orbex has exceeded their regulated business scope.

- Banque de France also marks their status as "Exceeded".

- The Cyprus Securities and Exchange Commission (CySEC) regulation is suspected to be a clone.

While multiple licenses can provide greater oversight, the inconsistencies noted about Orbex's regulatory standing in different jurisdictions are a red flag. Caution and further due diligence are advised given these regulatory concerns. A deeper look into their current licensing, operations and compliance would help provide clarity on their safety and reliability as a broker.

Regulation List

- FSC Mauritius

- FSA Seychelles

- Previously FCA UK, BaFin Germany, Banque de France, CySEC Cyprus – but current status is questioned

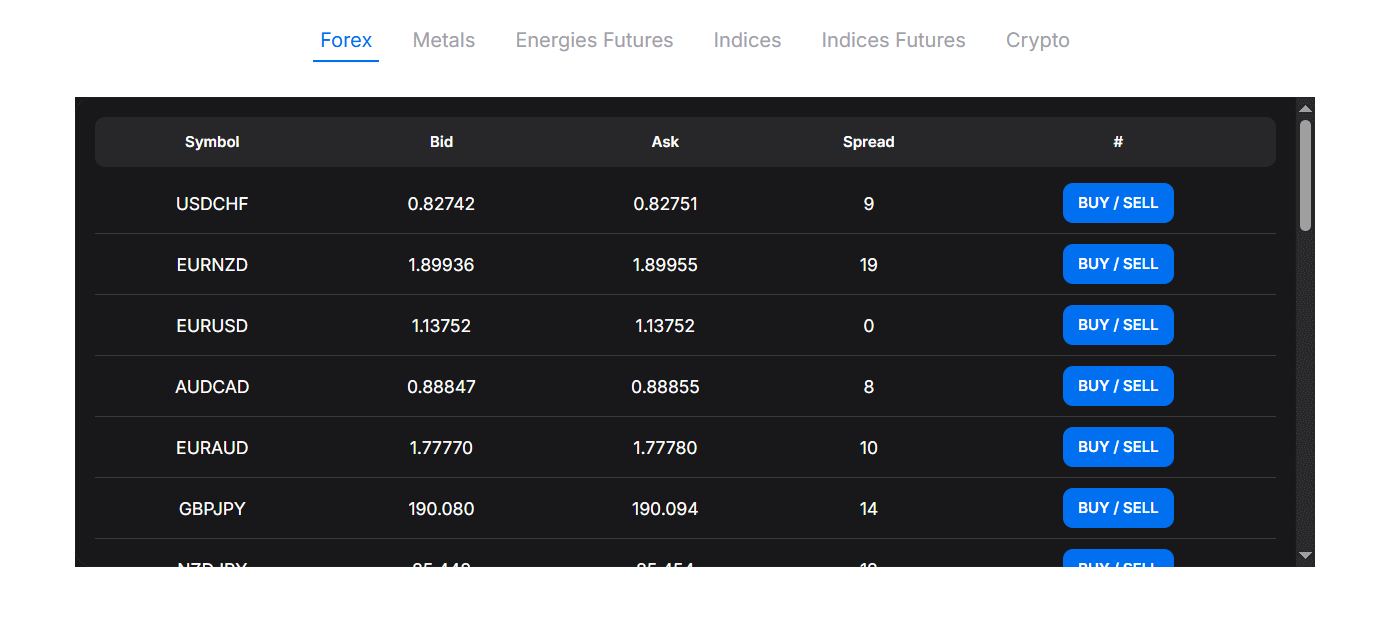

Trading Instruments

Orbex provides access to trade over 400+ instruments across multiple asset classes:

| Asset Class | Details |

|---|---|

| Forex | - 60+ currency pairs (majors, minors, exotics) - Low spreads - Leverage up to 1:500 - Pairs include EUR/USD, GBP/USD, USD/JPY, AUD/USD, etc. |

| Stock CFDs | - 200+ global stock CFDs - 0% commission - Access to US, UK, Germany, and more - Examples: Apple, Amazon, Tesla, Pfizer, Boeing, Barclays |

| Indices | - 10+ major world indices - Leverage up to 1:100 - Includes US30, NAS100, GER30, UK100, FRA40, AUS200, etc. |

| Commodities | - Trade CFDs on metals & energies - Precious metals: Gold, Silver, Platinum, Palladium - Energies: Brent Crude, WTI Crude |

| Cryptocurrencies | - Bitcoin, Ethereum, Litecoin, Ripple, Bitcoin Cash - Leverage up to 1:2 - 0.5% commission |

This wide selection provides traders the opportunity to diversify across markets. The Zero accounts, Orbex uses a virtual dealer plugin that allows for fixed spreads and ultra-fast execution.

Trading Platforms

Orbex offers traders access to the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms for desktop, web, and mobile trading:

MetaTrader 4 (MT4)

- Customizable interface with 30+ preinstalled indicators

- Three execution modes – Instant, Request, and Market

- Nine timeframes for flexible chart analysis

- EA compatibility for automated trading

- Available on Windows, Mac, WebTrader, iOS, and Android

- Integrated with Trading Central and free VPS hosting

MetaTrader 5 (MT5)

- Includes all features of MT4 plus additional tools

- 38 built-in indicators and 44 analytical objects

- 21 timeframes and Depth of Market for precision trading

- Supports hedging, netting and all pending order types

- Available on Windows, Mac, WebTrader, iOS, and Android

- Faster processing and advanced risk management features

Orbex WebTrader

- Browser-based platform for MT4 and MT5

- Work on any OS without download or installation

- Saves charts and preferences on the cloud

- Accessible from any device with internet connection

Orbex Mobile App

- Proprietary multi-asset trading app for iOS and Android

- Real-time quotes and one-tap trading from charts

- Over 30 preinstalled indicators and analytical tools

- Deposit and withdraw funds on the go

- View trading history and manage open positions

FIX API

- Enables traders to develop custom trading apps

- Connect trading algorithms via a FIX gateway

- Provides low-latency connectivity to liquidity providers

- Available for institutional and high volume traders

The diversity of Orbex's platform offering caters to the needs of both beginner and professional traders. The choice of MT4 and MT5 ensures a familiar, feature-rich environment that is the industry standard for retail traders. Meanwhile, the WebTrader provides instant access without setup, and the Mobile App offers seamless trading on the go. The FIX API further expands options for algorithmic traders and institutions.

comparison table trading platform

| Feature | MT4 | MT5 | Web Trader | Mobile App | FIX API |

|---|---|---|---|---|---|

| Customizable Layout | Yes | Yes | Limited | Limited | N/A |

| Technical Indicators | 30+ | 38+ | 30+ | 30+ | N/A |

| Timeframes | 9 | 21 | 9 | 9 | N/A |

| Execution Modes | 3 | 4 | 2 | 2 | N/A |

| EAs Supported | Yes | Yes | Yes | No | N/A |

| VPS Hosting | Free | No | No | No | Available |

| Integrated Tools | Trading Central, Elliott Wave | Trading Central, Elliott Wave, News, Sentiment, Alerts | N/A | N/A | N/A |

| Order Types | 4 | 6 | 2 | 2 | 6 |

| Hedging | No | Yes | No | No | Yes |

| Depth of Market | No | Yes | No | No | Yes |

| Social Trading | Via Signals | Via Signals | No | No | No |

| Chat Support | Yes | Yes | No | Yes | No |

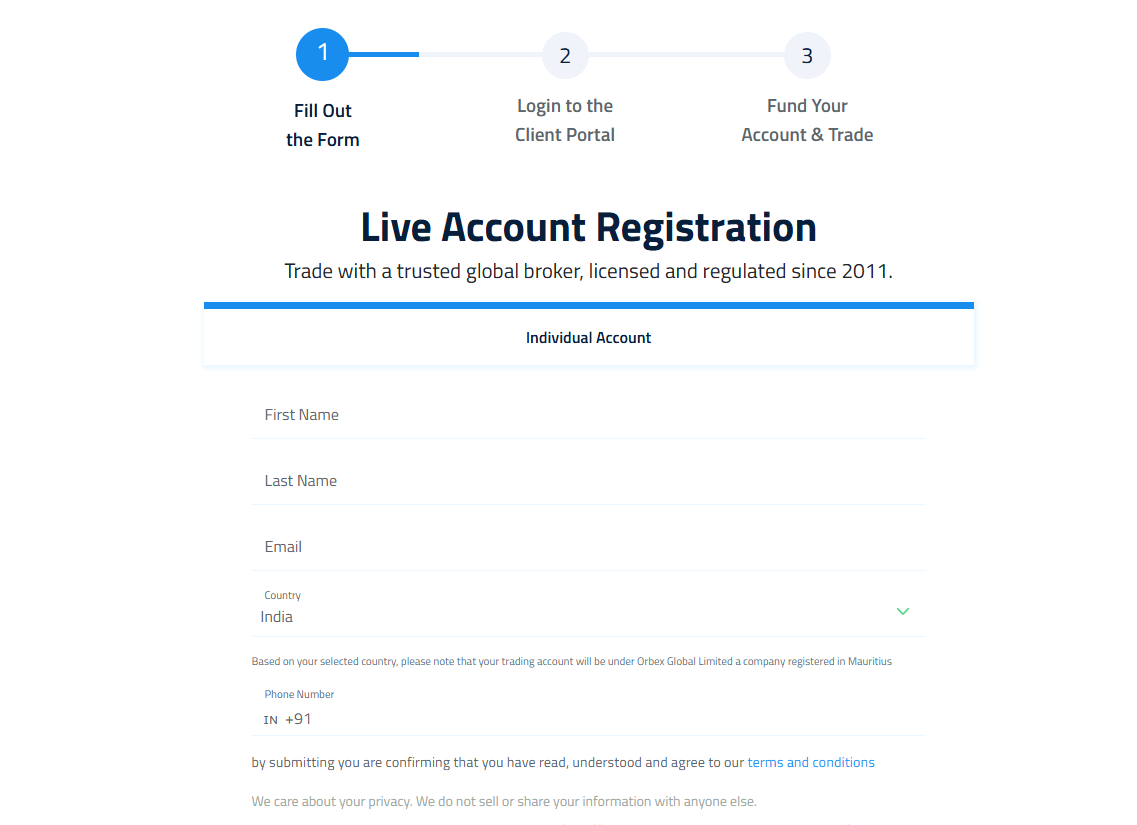

Orbex How to Open an Account: A Step-by-Step Guide

Follow these steps to open a live trading account with Orbex:

- Visit the Orbex website and click "Open Live Account".

- Fill in the registration form with your personal details including full name, email, country of residence, and phone number.

- Choose your account type – Starter, Premium or Ultimate.

- Select your preferred trading platform – MT4 or MT5.

- Choose the base currency for your account – EUR, USD, GBP or PLN.

- Read and agree to the terms & conditions and privacy policy.

- Submit your application. You will receive a verification email with login details to your provided email address.

- Log in to the secure client portal with your credentials.

- Complete your profile and upload supporting documents for identity and residence verification as per regulatory requirements. This includes:

- Proof of ID: Colored copy of passport or government-issued ID

- Proof of Residence: Bank statement or utility bill (not older than 3 months)

- Once your profile is approved, fund your account using the available deposit methods:

- Credit/debit cards: Visa, Mastercard

- E-wallets: Skrill, Neteller, Perfect Money, fasapay

- Wire Transfer

- Download and install your chosen trading platform or access the web terminal.

- For MT4/MT5: Use the provided login and password to access your account

- For other platforms: Follow the setup instructions provided

Start trading the markets. Be sure to familiarise yourself with the platform and adhere to risk management principles.

Charts and Analysis

Orbex provides a comprehensive suite of research and analysis tools to help traders make informed decisions. This includes:

| Feature | Details |

|---|---|

| Real-time Charts | - Integrated with MT4/MT5 - 3 chart types: bar, line, candlestick - Customizable timeframes & zoom - 50+ indicators & tools - Multiple setups (up to 100 charts) - Custom watchlists & detachable charts |

| Trading Central | - Award-winning technical analysis - Real-time trade ideas - Market overviews & investment research - Emerging Pattern Recognition - Analyst consensus & forecasts - Integrated into MT4/MT5 |

| Elliott Wave Analysis | - Advanced wave counting tools - 3 customizable templates - Expert-level Elliott Wave studies |

| Economic Calendar | - Live updates on global economic events - Includes policy decisions, central bank meetings, data releases - Forecasts vs. actuals - Advanced filters & indicators - Historical data for back-testing |

| Market News & Analysis | - Daily reports from Orbex analysts - Technical and fundamental insights - Strategy, risk & psychology coverage |

| Trading Calculators | - Margin Calculator: Required deposit per trade - Pip Calculator: Pip value by pair & lot - Profit/Loss Calculator: Estimate trade outcome |

| Orbex Blog | - In-depth guides on tools & analysis - Articles on psychology, skills, and strategies - Archived webinars & video tutorials |

By leveraging these rich resources, both beginner and advanced traders can enhance their market understanding, get timely trading ideas and fine-tune their strategies more effectively. The tools are designed to be intuitive while providing deep insights for a well-rounded trading experience.

Orbex Account Types

Orbex offers three main live trading account types tailored to different trader needs and experience levels:

Starter Account

- Minimum deposit: $100

- Variable spreads from 1.7 pips with 0 commission

- Up to 1:500 leverage

- Minimum trade size: 0.01 lots

- 20% stop out and 100% margin call levels

- NDD execution

- Access to Trading Central

- Basic educational resources

Best suited for new traders looking for competitive spreads and low capital investment.

Premium Account

- Minimum deposit: $500

- Raw spreads from 0 pips + $8 commission per lot

- Up to 1:500 leverage

- Minimum trade size: 0.01 lots

- 20% stop out and 100% margin call levels

- NDD execution

- Access to Trading Central, VPS, advanced webinars

- 1 exclusive 1-on-1 training session

- Advanced educational resources

Designed for intermediate traders seeking tighter pricing, extra tools and personalised training.

Ultimate Account

- Minimum deposit: $25,000

- Raw spreads from 0 pips + $5 commission per lot

- Up to 1:500 leverage

- Minimum trade size: 0.01 lots

- 20% stop out and 100% margin call levels

- NDD execution

- Access to Trading Central, VPS, exclusive webinars

- 3 exclusive 1-on-1 training sessions

- Advanced educational resources

Premium offering for professional traders and high-net-worth individuals looking for optimal trading conditions, advanced tools and dedicated support.

In addition to these, Orbex also provides:

- Demo Account: Risk-free practice account with virtual funds to test strategies and platforms without capital investment. Mirrors the live trading environment.

- Islamic Account: Swap-free account for Muslim traders adhering to Sharia principles. Overnight positions do not incur interest.

By catering to varied investment objectives, experience levels and needs, Orbex ensures there is an account type suitable for all types of traders. The tiered structure provides a growth path for clients as their skills advance while enabling access to enhanced education and platform features.

Account Types Comparison Table

| Feature | Starter | Premium | Ultimate |

|---|---|---|---|

| Minimum Deposit | $100 | $500 | $25,000 |

| Spreads | Variable from 1.7 pips | From 0 pips | From 0 pips |

| Commission (per lot) | $0 | $8 | $5 |

| Leverage | Up to 1:500 | Up to 1:500 | Up to 1:500 |

| Minimum Trade Size | 0.01 lots | 0.01 lots | 0.01 lots |

| Stop Out Level | 20% | 20% | 20% |

| Margin Call | 100% | 100% | 100% |

| Execution | NDD | NDD | NDD |

| Platform Access | MT4 & MT5 | MT4 & MT5 | MT4 & MT5 |

| Trading Central | ✓ | ✓ | ✓ |

| VPS Hosting | ✗ | ✓ | ✓ |

| Webinars | Monthly | Exclusive Access | Exclusive Access |

| 1-on-1 Training | ✗ | 1 Session | 3 Sessions |

| Education | Basic | Advanced | Advanced |

Negative Balance Protection

Orbex provides negative balance protection for all live trading accounts as a part of their licensing conditions. This means that if a trader's account balance drops to zero due to trading losses or exceptional market volatility, Orbex will bear the negative balance and bring the account back to zero at no additional cost to the trader. For example, let's say a trader has $1000 in their account and opens a large EUR/USD position ahead of a major news event. An unexpected outcome causes the market to sharply move against the trader's position, depleting the account and pushing the balance to -$50 before the trade is closed. With Orbex's negative balance protection, this -$50 will be nullified and the account returns to $0, even though the total loss exceeded the trader's account balance. This policy provides an extra layer of safety, especially for high-risk trading strategies or during periods of extreme market turbulence. It ensures that traders' losses are limited to the funds in their account, preventing them from going into debt due to adverse trading conditions. However, it's important to note that negative balance protection does not negate the importance of proper risk management. Traders should still employ sound strategies, set appropriate stop-losses, and never risk more than they can afford to lose. Negative balance protection is a failsafe, not a substitute for disciplined trading. In summary, Orbex's negative balance protection is a valuable safety net that provides peace of mind and an extra level of security for traders. It demonstrates the broker's commitment to client protection and fair trading practices.

Orbex Deposits and Withdrawals

Orbex provides a variety of convenient funding options for traders to deposit and withdraw funds:

Deposit Methods

| Payment Method | Includes | Deposit Fee | Processing Time |

|---|---|---|---|

| Credit/Debit Cards | Visa, Mastercard | No fees from Orbex (3rd-party fees may apply) | Instant |

| E-wallets | Skrill, Neteller, Perfect Money, UnionPay, ENet | No fees from Orbex (3rd-party fees may apply) | Instant |

| Wire Transfer | International Bank Transfer | No fees from Orbex (bank fees may apply) | 3–5 Business Days |

| Other Methods | Bitcoin, Fasapay, Przelewy24, Poli, Knet, Zotapay | No fees from Orbex (may vary by provider) | Instant to Few Hours |

- Starter: $100

- Premium: $500

- Ultimate: $25,000

Withdrawal Methods

| Method Type | Includes | Withdrawal Fee | Processing Time |

|---|---|---|---|

| Credit/Debit Cards | Visa, Mastercard | No fees from Orbex (bank fees may apply) | Up to 5 Business Days |

| E-wallets | Skrill, Neteller, Perfect Money | No fees from Orbex (provider fees may apply) | Within 24 Hours |

| Wire Transfer | International Bank Transfer | No fees from Orbex (bank fees may apply) | Up to 5 Business Days |

| Other Methods | Bitcoin, Fasapay | No fees from Orbex (provider/network fees may apply) | Within 24 Hours to Few Hours |

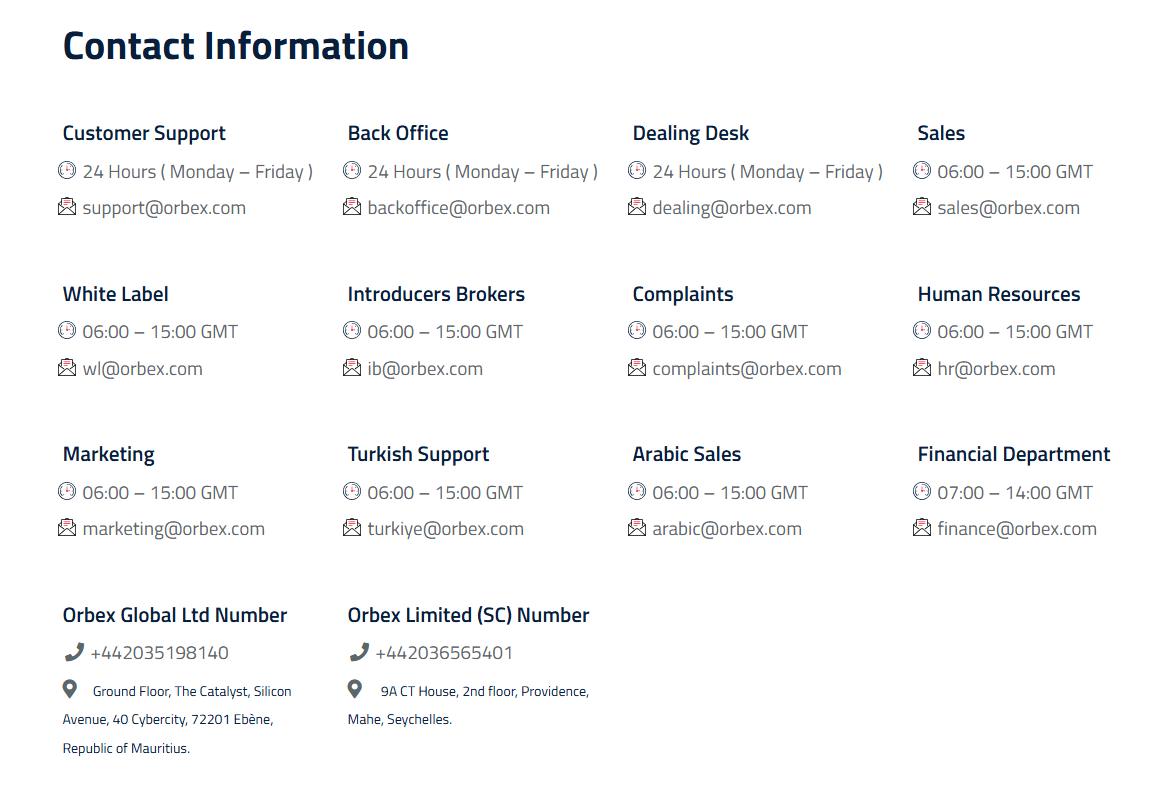

Support Service for Customer

Orbex provides multi-lingual customer support across several channels:

- Live Chat: Available 24/5 directly on the website for instant assistance

- Email: support@orbex.com for general inquiries; backoffice@orbex.com for account queries; dealing@orbex.com for trading issues

- Phone: Local numbers in over 10 countries; International on +44-203-519-8170

- Callback: Request a call from a support agent by filling a web form

- Social Media: @orbexbroker handles on Twitter, Facebook, Instagram, YouTube

Support is available in English, Arabic, Russian, Portuguese, German, Italian, Polish, Indonesian, Malaysian, with limited weekend support.

Support is available in English, Arabic, Russian, Portuguese, German, Italian, Polish, Indonesian, Malaysian, with limited weekend support.

Response Times

- Live Chat: <1 minute

- Emails: 24 hours

- Phone: Instant pick-up may have short queue during peak hours

- Social Media: 4-6 hours

Customer Support Comparison Table

| Channel | Languages Available | Availability | Response Time |

|---|---|---|---|

| Live Chat | English, Arabic | 24/5 | <1 minute |

| English, Arabic, Russian, Portuguese, German, Italian, Polish, Indonesian, Malaysian | 24/5 | 24 hours | |

| Phone | English, Arabic | 24/5 | Instant |

| Callback | English, Arabic | 24/5 | 4 hours |

| Social Media | English, Arabic | 24/5 | 4–6 hours |

| Knowledge Base | English, Arabic | 24/7 | N/A |

Prohibited Countries

Due to regulatory restrictions and compliance policies, Orbex does not provide services to residents of certain countries.

This includes:

- United States

- Canada

- Australia

- Japan

- Belgium

- European Economic Area, Swiss Economic Area, French Territories (FRENCH POMs DROMs COMs)

Residents of these jurisdictions cannot open an account with Orbex or access their trading platforms. Attempting to circumvent these restrictions by providing false residency information is considered a violation of Orbex's terms of service.

If a prohibited country resident's true location is identified after opening an account, Orbex reserves the right to immediately close the account and return the deposited funds. Any profits generated may be forfeited as well.

The restrictions are in place to comply with licensing conditions, international sanctions, anti-money laundering laws, and securities regulations. They may change from time to time based on changes in regulatory frameworks.

It's important for traders to honestly declare their country of residence and not access Orbex's services using VPNs or other means if they are from a restricted jurisdiction. Failure to comply can lead to legal consequences and permanent account bans.

Before signing up, prospective clients should check the updated list of prohibited countries on Orbex's website or contact their support team for clarification.

Prohibited Countries List

- United States, Canada, Australia, Japan, Belgium, European Economic Area, Swiss Economic Area, French Territories (FRENCH POMs DROMs COMs)

Special Offers for Customers

Orbex provides several attractive promotional offers for new and existing clients:

- 20% Deposit Bonus:

- Get 20% bonus on deposits between $500 to $10,000

- Bonus credited automatically to the trading account

- Bonus funds can be used for trading but cannot be withdrawn

- 1 bonus per client with a maximum of $2,000

- Subject to 30x volume requirement on the bonus amount within 60 days

- Refer-a-Friend Program:

- Earn 20% of your referral's net spread on Orbex Zero accounts

- 15% of referral's net deposit on Orbex Standard account

- No limits on the number of friends you can refer

- Commission credited directly to wallet balance monthly

- Referred clients must complete registration and verify account

- Commission earned only on trades that are opened and closed

- Loyalty Cashback Program:

- Automatic enrollment for all live accounts

- Earn up to $15 cashback per lot traded on Zero accounts

- Cashback percentage based on monthly trading volume

- Credited to the wallet balance at the end of each month with no restrictions

- Enables traders to earn rebates on their trading costs

- Demo Trading Competition:

- Monthly competition for demo account holders

- Trade on a $10,000 demo account for 30 days

- Top 3 winners receive real money prizes up to $1000

- Minimum of 10 standard lots must be traded to qualify

- Ranking based on highest gain percentage at the end of the month

- Prizes deposited into live verified accounts only

These offers provide extra value and incentives for Orbex traders. The deposit bonus and cashback program effectively reduce trading costs, while the refer-a-friend plan rewards clients for bringing in new business. The demo competition is a great way for new traders to hone their skills and gain real money with no risk.

It's important to carefully read the terms and conditions for each promotion as they have specific requirements and restrictions. Offers can be subject to change or cancellation at Orbex's discretion.

Conclusion

After a comprehensive review of Orbex's offerings, I conclude that it is a well-rounded broker with some notable strengths but also a few concerning aspects that potential clients should be aware of.

On the positive side, Orbex provides a robust trading environment with access to 400+ instruments across forex, stocks, indices, commodities, and cryptocurrencies. The choice of the MT4/MT5 platform and Orbex's proprietary trading tools ensures that clients have advanced features for analysis, automated trading, and risk management. The multi-tiered account structure starting from just $100 makes Orbex accessible to both novice and professional traders with competitive spreads and flexible leverage.

Orbex's commitment to trader education is commendable with an extensive library of articles, videos, webinars, and tutorials covering market analysis, trading psychology, and platform usage. The broker also goes the extra mile with personal training for Premium and Ultimate account holders.

Client security is well addressed with negative balance protection, segregated funds, and 128-bit SSL encryption for data. The variety of deposit/withdrawal methods with zero fees and 24-hour processing for e-wallets adds a level of convenience and trust.

However, there are some notable concerns regarding Orbex's regulatory status. While the broker is licensed by FSC Mauritius and FSA Seychelles, their claimed regulation with top-tier authorities like FCA, BaFin and CySEC is questionable with warnings of abnormal/exceeded scopes and clone suspicions. This is a red flag that could indicate compliance issues.

There have also been some client complaints online regarding slow withdrawals, requotes, and alleged market manipulation. While not uncommon for brokers, the volume of such reviews is concerning. The lack of 24/7 customer support and limited social trading tools may also be drawbacks for some traders.

Overall, Orbex appears to be a capable broker with full-featured platforms, diverse assets, and flexible terms that cater to a global clientele. The trading conditions are competitive and the educational support is strong. However, the questionable regulatory status and history of complaints cannot be ignored.

Traders should carefully weigh the pros and cons and conduct further due diligence before investing real money. Starting with a small live deposit or demo account may be wise to test the service quality. As with any broker, it is crucial to have realistic expectations and maintain sound risk management.

Compare trading apps inside the broker reviews tech index.

Deep liquidity pools detailed in the FXPrimus review.