Pepperstone Review 2025: Exploring Broker Regulations, Pros and Cons, Platforms, and Trading Conditions

Pepperstone

Australia

Australia

-

Withdrawal Fee $0

-

Leverage 500:1

-

Minimum Order 0.01

-

Forex Available

-

Crypto Available

-

Stock Available

-

Indices Available

Licenses

United Kingdom Market Making (MM)

United Kingdom Market Making (MM)

Cyprus Market Making (MM)

Cyprus Market Making (MM)

Australia Retail Forex License

Australia Retail Forex License

UAE Financial Services License

UAE Financial Services License

Softwares & Platforms

Customer Support

+61390200155

(English)

+61390200155

(English)

Supported language: Arabic, Chinese (Simplified), English, French, German, Italian, Spanish

Social Media

Summary

Pepperstone, founded in 2010 in Melbourne, has grown into a global forex and CFD broker serving over 750,000 traders with a monthly trading volume exceeding $400 billion. It holds seven top-tier regulatory licenses across key jurisdictions, offering both strict oversight (e.g., FCA, ASIC) and high-leverage options (e.g., SCB, CMA). Traders can access over 1,200 instruments across major platforms like MT4, MT5, cTrader, and TradingView. With institutional-grade Razor accounts, zero non-trading fees, and premium partnerships like the ATP Tour and Aston Martin F1, Pepperstone positions itself as a technologically advanced, client-focused broker for serious traders.

- Institutional-grade Razor pricing with spreads from 0.0 pips plus transparent low commission

- Exceptional Share CFD selection offering 1,000+ global stocks for leveraged equity trading

- All major platforms are supported, including exclusive TradingView integration for Razor accounts

- Zero deposit and inactivity fees demonstrate a genuine client-centric fee structure

- Seven global regulatory licenses providing credibility and operational flexibility

- Free premium tools including Autochartist and Smart Trader Tools package

- Multiple funding methods including modern USDT cryptocurrency option

- Comprehensive educational ecosystem with daily analysis and integrated learning tools

- Active Trader rebate program rewarding high-volume clients with cash returns

- Variable protection levels depending on the chosen entity—no compensation scheme for ASIC clients

- Professional account danger removes negative balance protection, creating unlimited loss potential

- Major markets prohibited include United States, Canada, and Japan

- TradingView platform restricted to Razor account holders only

- Limited MT4 functionality with only 45 Share CFDs available versus 1,160+ on other platforms

- Swap fees accumulate on positions held overnight, impacting longer-term strategies

- Phone support limitations not matching 24/5 live chat availability

- Cryptocurrency selection modest compared to dedicated crypto platforms

- Complex entity selection requires understanding jurisdiction-specific protections

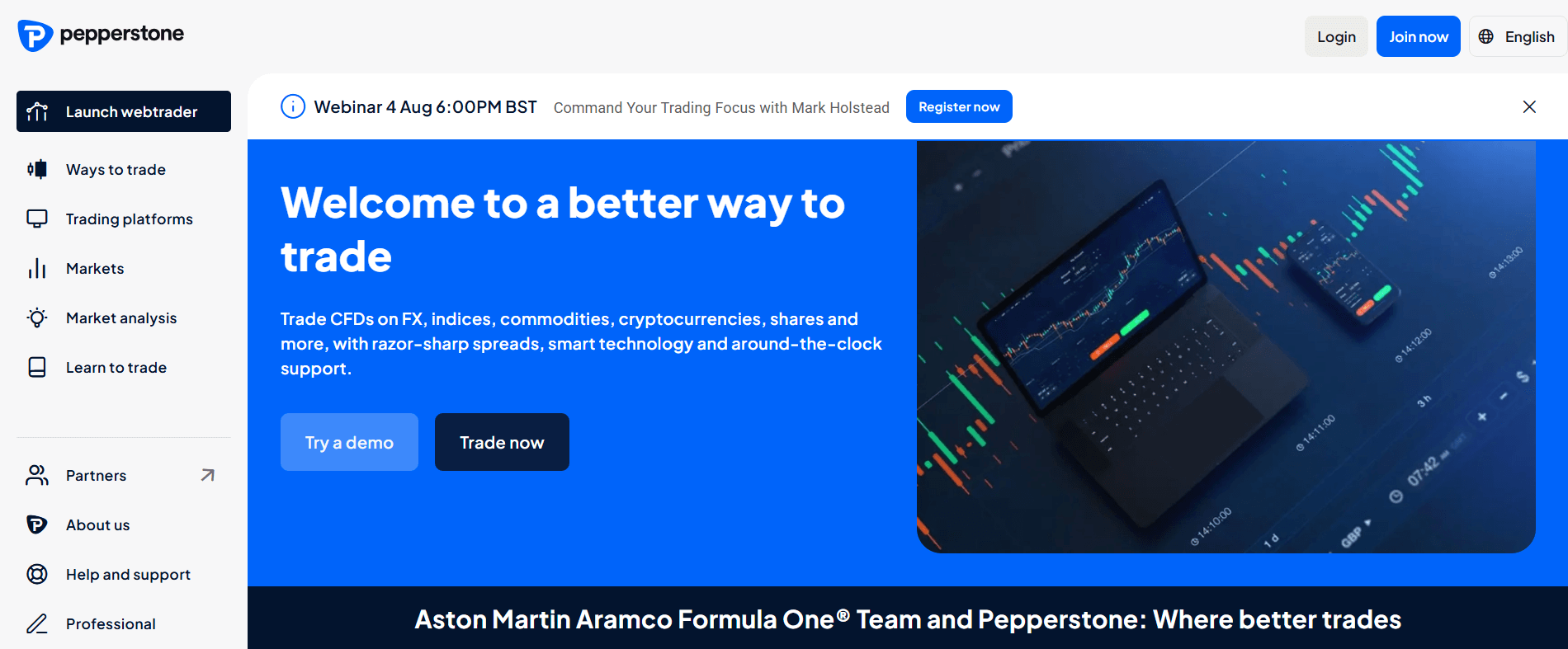

Overview

Pepperstone has transformed from its 2010 Melbourne startup origins into a global forex and CFD powerhouse serving over 750,000 traders with monthly trading volumes exceeding $400 billion. Operating through seven regulatory licenses across major jurisdictions, the broker offers institutional-grade trading conditions while maintaining retail accessibility. Their strategic partnerships with Aston Martin F1 and the ATP Tour, combined with support for all major trading platforms (MT4, MT5, cTrader, TradingView) and over 1,200 tradable instruments, position them as a premium choice for serious traders seeking competitive pricing and technological excellence.

Explore more on the official website at pepperstone.com.

Overview Table

| Feature | Details |

|---|---|

| Company Name | Pepperstone Group Limited |

| Founded | 2010 |

| Headquarters | Melbourne, Australia |

| CEO | Tamas Szabo (since 2017) |

| Global Presence | 7 offices worldwide, serving 160+ countries |

| Active Traders | 750,000+ clients |

| Monthly Trading Volume | $400+ billion |

| Regulatory Licenses | 7 licenses: FCA (UK), ASIC (Australia), CySEC (Cyprus), BaFin (Germany), DFSA (Dubai), SCB (Bahamas), CMA (Kenya) |

| Trading Platforms | MT4, MT5, cTrader, TradingView, Proprietary Platform |

| Total Instruments | 1,200+ tradable instruments |

| Minimum Deposit | $0 (deposit of at least $200 is recommended for responsible trading and risk management) |

| Account Types | Standard, Razor, Professional |

| Key Partnerships | Aston Martin F1 Team, ATP Tour |

| Customer Support | 24/5 Live Chat, Email, Phone, Social Media |

Facts List

- Seven global licenses: FCA, ASIC, CySEC, BaFin, DFSA, SCB, CMA regulatory coverage

- 750,000+ active traders: Processing $400+ billion monthly volume

- 1,000+ Share CFDs: Leading equity CFD selection across global exchanges

- 0.0 pip Razor spreads: Raw institutional pricing with $7 round-trip commission

- All major platforms: MT4, MT5, cTrader, TradingView, proprietary options

- Zero non-trading fees: No deposit, withdrawal, or inactivity charges

- 500:1 leverage available: Professional accounts with unlimited loss risk

- Variable compensation protection: £85,000 UK, €20,000 EU, none for Australia

- Aston Martin F1 partnership: Premium brand associations with ATP Tour

- Free trading tools: Smart Trader Tools, Autochartist, VPS hosting included

Pepperstone Licenses and Regulatory

Pepperstone's regulatory architecture represents one of the industry's most sophisticated multi-jurisdictional frameworks, demonstrating both global ambitions and strategic market segmentation. This complex structure serves multiple purposes: building credibility through prestigious licenses, enabling regulatory arbitrage for competitive advantage, and providing clients with choices based on their risk appetite and protection preferences.

The foundation of Pepperstone's regulatory credibility rests on licenses from top-tier financial authorities. The Financial Conduct Authority (FCA) authorization in the United Kingdom provides access to one of the world's most trusted regulatory frameworks, complete with stringent capital requirements, mandatory segregation of client funds, and access to the Financial Services Compensation Scheme (FSCS) protecting eligible clients up to £85,000.

Regulatory Licenses List

| Jurisdiction | Regulator | License Number | Key Benefits |

|---|---|---|---|

| United Kingdom | Financial Conduct Authority (FCA) | #684312 | £85,000 FSCS compensation protection |

| Australia | Australian Securities and Investments Commission (ASIC) | AFSL #414530 | Strong oversight but no compensation scheme |

| Cyprus | Cyprus Securities and Exchange Commission (CySEC) | #388/20 | EU passporting rights with €20,000 ICF protection |

| Germany | Federal Financial Supervisory Authority (BaFin) | #154148 | €20,000 EdW compensation coverage |

| Dubai | Dubai Financial Services Authority (DFSA) | #F004356 | Access to Middle East markets |

| Bahamas | Securities Commission of The Bahamas (SCB) | #SIA-F217 | Up to 500:1 leverage offerings |

| Kenya | Capital Markets Authority (CMA) | #155 | Maximum 400:1 leverage for qualifying traders |

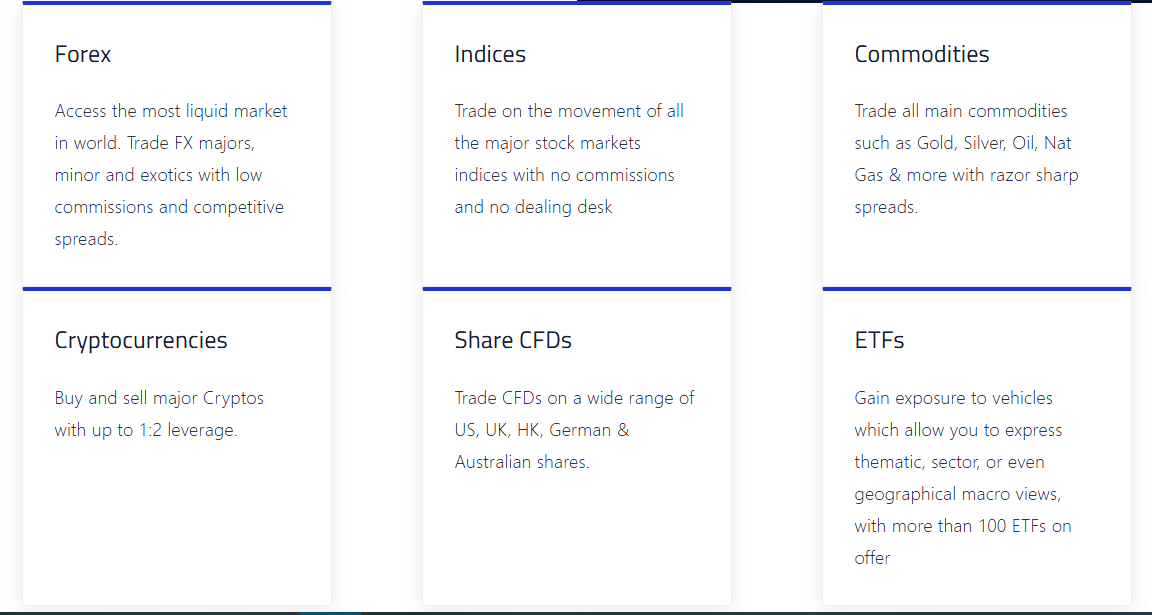

Trading Instruments

Pepperstone's instrument portfolio represents a carefully curated selection of over 1,200 tradable assets, strategically weighted to serve both traditional forex traders and those seeking diversified market exposure through CFDs. The composition reveals clear strategic priorities while maintaining sufficient breadth to satisfy varied trading strategies and market interests.

| Asset Class | Coverage | Key Highlights |

|---|---|---|

| Share CFDs | 1,000+ stocks across US, UK, EU, AU, DE, FR, ES, NL, CH | 80% of total offering; supports short selling, sector/geographic strategies |

| Forex | 60+ pairs: majors, minors, exotics | Raw spreads from 0.0 pips (Razor); supports carry trades and regional diversification |

| Indices | 26 global indices including S&P 500, NASDAQ, DAX, FTSE, Nikkei, ASX 200 | Ideal for macro strategies and market sentiment plays |

| Commodities | 30+ instruments: metals, energy, agriculture | Spot & futures pricing; includes Gold, Oil, Natural Gas, Wheat, Coffee |

| ETFs | 100+ ETF CFDs | Thematic exposure to sectors, strategies, and global regions |

| Cryptocurrencies | 31+ crypto pairs: BTC, ETH, LTC, XRP against USD, EUR, etc. | CFD trading without wallets offers crypto-fiat flexibility |

Trading Platforms

Pepperstone's technology infrastructure represents a masterful balance between supporting established platforms and providing cutting-edge alternatives. This platform-agnostic approach acknowledges that many traders have invested years learning specific platforms and developing custom indicators or automated strategies.

Trading Platforms Comparison Table

| Feature | MT4 | MT5 | cTrader | TradingView | Proprietary |

|---|---|---|---|---|---|

| Best For | Forex EAs | Multi-Asset Trading | Advanced Execution | Technical Analysis | Simplicity |

| Programming Language | MQL4 | MQL5 | C# | Pine Script | API Only |

| Share CFDs | 45 only | 1,000+ | Full range | 930+ | Full range |

| Charting Package | Good (enhanced with STT) | Better | Excellent | Best-in-Class | Basic |

| Order Types | Standard | Standard+ | Advanced | Standard | Standard |

| Market Depth | No | Yes | Yes (Level II) | No | No |

| Copy Trading | MT Signals | MT Signals | cTrader Copy | Social Features | No |

| Mobile Apps | Yes | Yes | Yes | Yes | Yes |

| One-Click Trading | Yes | Yes | Yes | Yes | Yes |

| Backtesting | Strategy Tester | Enhanced Tester | Yes | Limited | No |

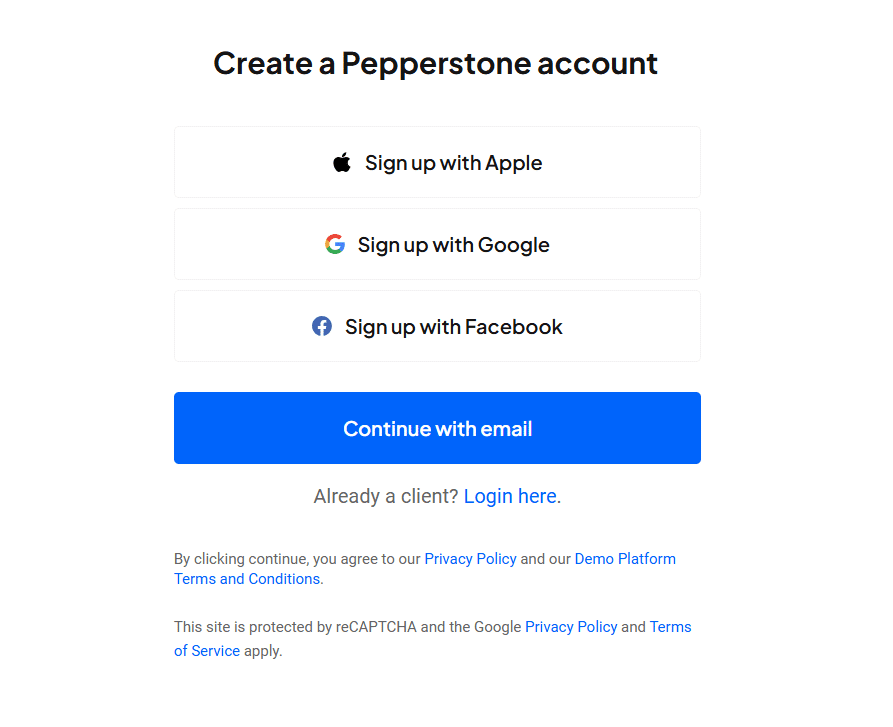

Pepperstone How to Open an Account: A Step-by-Step Guide

Opening a trading account with Pepperstone follows a streamlined digital process designed to balance regulatory compliance with user convenience. The broker has optimised each step to minimise friction while ensuring adherence to anti-money laundering (AML) and know-your-customer (KYC) requirements across all jurisdictions.

- Select Account Type: Choose between Standard (simplified pricing) or Razor (raw spreads plus commission) based on your trading style and volume expectations

- Choose Regulatory Entity: International traders select their preferred entity considering leverage needs versus protection levels

- Complete Online Application: Provide personal information, employment details, trading experience, and financial situation as required by regulations

- Upload Verification Documents: Submit clear photos or scans of government ID and proof of residence through the secure portal

- Await Verification: Typically completed within hours; you'll receive email confirmation once approved

- Fund Your Account: Select from multiple payment methods including cards, e-wallets, bank transfer, or USDT cryptocurrency

- Download Trading Platform: Choose your preferred platform from MT4, MT5, cTrader, or access web-based options

- Configure Account Settings: Set leverage levels, base currency preferences, and enable any additional features

- Access Demo Account: Practice with virtual funds to familiarise yourself with platforms and test strategies risk-free

- Begin Live Trading: Access full instrument range and execute your first trades with real capital

Charts and Analysis

Pepperstone's commitment to trader education extends far beyond basic platform tutorials, encompassing a comprehensive ecosystem designed to develop trading skills from foundational concepts to advanced strategy implementation. This educational infrastructure serves dual purposes: empowering traders with knowledge while encouraging platform engagement and informed trading decisions.

| Category | Key Features | Description |

|---|---|---|

| Learning Pathways | Beginner to advanced content | Covers leverage, risk management, technical analysis, algorithmic trading, and portfolio strategies |

| Market Insights | The Daily Fix, Autochartist | Real-time macro analysis and live pattern recognition for hands-on learning |

| Interactive Education | Live webinars, recorded sessions | Platform tutorials, strategy workshops, and advanced trading techniques |

| Practical Tools | Economic calendar, calculators, sentiment indicators | Support tools for event tracking, risk calculation, and understanding trader sentiment |

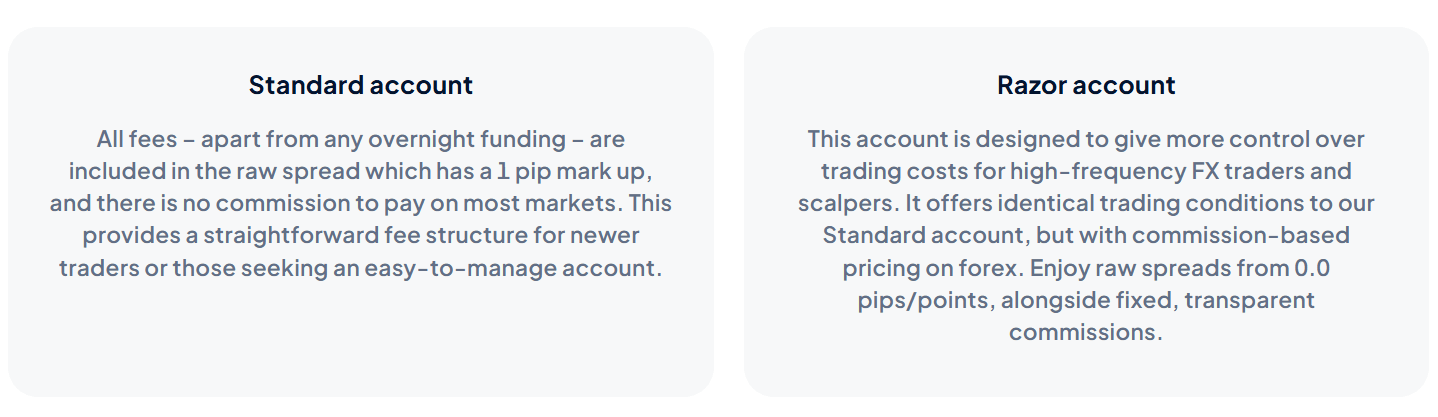

Pepperstone Account Types

Pepperstone's account structure reflects sophisticated market segmentation, offering distinct options tailored to different trader profiles while maintaining flexibility for evolution as skills and capital grow.

Leverage

Leverage at Pepperstone is determined by client residence and governing regulator, following global best practices for investor protection.

Retail Clients (ASIC, FCA, CySEC/BaFin)

- Major Forex Pairs: Up to 30:1

- Minor/Exotic Pairs, Gold, Major Indices: Up to 20:1

- Commodities (ex-Gold) & Minor Indices: Up to 10:1

- Share CFDs: Up to 5:1

International Clients (SCB/Other)

- Forex Pairs: Up to 500:1 potential

- Professional Status: Higher leverage available meeting specific criteria

Account Types Comparison Table

| Feature | Professional Account | Demo Account | Standard Account | Razor Account |

|---|---|---|---|---|

| Target Trader | Experienced/High-volume | All traders (practice) | Beginners, position traders | Active traders, scalpers |

| Requirements | Wealth/experience criteria | None | None | None |

| Leverage | Up to 500:1 | Same as live | 30:1 (FCA/ASIC), up to 400:1 (CMA) | 30:1 (FCA/ASIC), up to 400:1 (CMA) |

| Negative Balance Protection | No – unlimited liability | N/A | Yes | Yes |

| Margin Close-Out | No mandatory 50% rule | N/A | FCA/ASIC standard applies | FCA/ASIC standard applies |

| Spread Type | Same as Razor | Real market spreads | Fixed markup included | Raw interbank spreads |

| EUR/USD Typical Spread | From 0.0 pips (avg 0.13) | Real market-based | From 1 pip | From 0.0 pips (avg 0.13) |

| Commission | ~$3.50 per side per lot | None | None | ~$3.50 per side per lot |

| Minimum Deposit | Real money required | $50,000 virtual | $0 | $0 |

| Platforms Available | All including TradingView | All platforms | All except TradingView | All including TradingView |

| Execution Type | Market execution | Simulated execution | Market execution | Market execution |

| Minimum Trade Size | 0.01 lots | 0.01 lots | 0.01 lots | 0.01 lots |

| Duration | Permanent | Unlimited | Permanent | Permanent |

| Asset Access | Full range | Full range | Full range | Full range |

Negative Balance Protection

Negative balance protection (NBP) caps potential losses at your account balance, ensuring you cannot lose more than deposited funds. Pepperstone provides automatic NBP for all retail clients across every regulatory entity, from strictly regulated FCA/ASIC operations to flexible Bahamas/Kenya licenses. However, Professional account holders explicitly waive this protection when accepting higher leverage up to 500:1, assuming unlimited liability where market gaps could result in owing Pepperstone far more than your deposit—a risk that has financially ruined traders during black swan events like the 2015 Swiss Franc crisis.

Pepperstone Deposits and Withdrawals

Pepperstone's payment infrastructure reflects modern expectations for financial flexibility while maintaining security and regulatory compliance. The broker's commitment to fee-free deposits across all methods demonstrates a client-centric approach.

Payment Methods Comparison

| Method | Deposit Time | Withdrawal Time | Fees | Notes |

|---|---|---|---|---|

| Bank Transfer (Domestic) | Same Day | 1-2 Business Days | None | Reliable for large amounts |

| Bank Transfer (International) | 3-5 Business Days | 3-5 Business Days | ~$20 (bank fees) | Global accessibility |

| Visa/Mastercard | Instant | 1-2 Business Days | None | Fast funding option |

| PayPal | Instant | Within 24 Hours | None | Private and convenient |

| Neteller | Instant | Within 24 Hours | None | Popular with traders |

| Skrill | Instant | Within 24 Hours | None | Instant liquidity |

| USDT (Tether) | Near-Instant | Within 24 Hours | None | Crypto-based stability |

Support Service for Customer

Pepperstone's customer support infrastructure reflects the demands of a global trading audience operating across all time zones, with market events requiring assistance at any hour.

Customer Support Comparison Table

| Channel | Availability | Response Time | Languages | Best Used For |

|---|---|---|---|---|

| Live Chat | 24/5 Market Hours | 1-2 minutes | 10+ languages | Quick questions, platform issues |

| 24/7 Submission | Within 24 hours | Multiple | Complex issues, documentation | |

| Phone | Business Hours | Immediate | English + Regional | Urgent matters |

| Help Center | 24/7 | Instant | Primarily English | Self-service |

| Social Media | Daily Monitoring | 2-4 hours | English | General inquiries |

| Account Manager | Business Hours | Priority | Various | High-value client needs |

Prohibited Countries

Pepperstone excludes several major markets from its services due to regulatory complexity and compliance costs. The United States, Canada, and Japan top the prohibited list due to stringent local requirements incompatible with Pepperstone's global model. Additional restrictions apply to sanctioned countries (Iran, North Korea, Syria), regions with unclear regulatory frameworks (Afghanistan, Yemen), and jurisdictions explicitly prohibiting CFDs (Belgium). New Zealand recently restricted retail CFD trading, though professional clients may still qualify.

Regions Where Pepperstone Operates

United Kingdom, European Union, Australia, Singapore, Hong Kong, Southeast Asia, India, Middle East, South Africa, Kenya, Latin America, Russia, Turkey, and most countries not specifically restricted by sanctions or local regulations.

Special Offers for Customers

Pepperstone's promotional strategy reflects regulatory constraints and a philosophy favoring sustainable value over flashy bonuses. Unlike brokers relying heavily on deposit bonuses that often include restrictive withdrawal conditions, Pepperstone focuses on tangible benefits that enhance the trading experience without creating hidden obligations.

| Category | Key Benefits | Notes |

|---|---|---|

| Cash Rebates | The Active Trader Program's tiers are based on standard lots traded per month, not notional volume. | The rebate is then paid as cash per lot traded |

| VPS Hosting | Free low-latency VPS for qualifying high-volume traders | Typically requires 15–20 standard lots/month |

| Smart Trader Tools | 28 premium MetaTrader plugins including Correlation Matrix and Advanced Trade Terminal | Free for MT4/MT5 users |

| Education Access | Exclusive webinars, strategy sessions, and early access to market research | Ongoing support for all levels of traders |

| Autochartist Tool | Real-time chart pattern recognition and technical signals | Institutional-grade tool included free |

| Client Rewards | Invitations to Formula 1, ATP events, and other VIP experiences | Offered to top-tier or high-value clients |

Conclusion

Pepperstone has successfully positioned itself as a premium broker that bridges institutional-grade conditions with retail accessibility—a challenging balance that many competitors fail to achieve. Their multi-jurisdictional regulatory framework, while complex, offers strategic brilliance by creating options for traders with different risk appetites and protection preferences.

The true differentiation lies in their technology and pricing strategy. The platform-agnostic approach demonstrates genuine understanding of trader needs, recognizing that many have invested years mastering specific platforms. The Razor account's 0.0 pip spreads with transparent commission offers genuinely competitive all-in costs for active traders.

Their Share CFD depth with 1,000+ individual stocks positions them as a serious alternative to traditional stockbrokers for traders seeking leveraged equity exposure. Combined with comprehensive forex coverage and solid commodities selection, they offer true multi-asset capabilities through a single account structure.

However, concerns exist around the Professional account option's removal of negative balance protection, creating unlimited liability that has bankrupted even experienced traders during black swan events. The advertised $0 minimum deposit also troubles me, as it's inadequate for responsible leveraged trading.

For experienced, cost-conscious traders prioritizing execution quality and platform choice, Pepperstone emerges as an excellent option. The Razor account particularly suits scalpers, day traders, and algorithmic strategies, while beginners should proceed with extreme caution, utilizing extensive demo trading and resisting the dangerous allure of excessive leverage.