Phillip Capital Review 2025: A Comprehensive Guide to the Global Brokerage Powerhouse

phillipcapital

Singapore

Singapore

-

Minimum Deposit $5000

-

Withdrawal Fee $0

-

Minimum Order 0.01

-

Forex Available

-

Crypto Available

-

Stock Available

-

Indices Available

Licenses

United Kingdom Market Making (MM)

United Kingdom Market Making (MM)

US Retail Forex License

US Retail Forex License

US Commodity Trading License

US Commodity Trading License

Singapore Financial Services License

Singapore Financial Services License

US Securities License

US Securities License

Softwares & Platforms

Customer Support

+6565311555

(English)

+6565311555

(English)

Supported language: English, Indonesian, Thai, Vietnamese

Social Media

Summary

PhillipCapital is a global financial services firm headquartered in Singapore, offering a wide range of investment and trading solutions. The company provides access to various asset classes including forex, equities, futures, commodities, and CFDs. With a strong presence in over 15 countries, PhillipCapital caters to both retail and institutional clients. It offers advanced trading platforms like MetaTrader 5 and its proprietary POEMS system. Known for its regulated operations, it emphasizes transparency, research-driven insights, and client education.

- Robust regulatory compliance with top-tier financial authorities

- Wide range of tradable assets across multiple markets

- Advanced trading platforms suitable for all levels of traders

- Competitive spreads and flexible leverage options

- Comprehensive educational resources for continuous learning

- Responsive and knowledgeable customer support team

- Attractive special offers and promotions for added value

- Strong emphasis on transparency, fairness, and integrity

- User-centric approach prioritizing clients' needs and preferences

- Established reputation with over 45 years of industry experience

- High minimum deposit requirement of $5,000 may deter some traders

- Limited cryptocurrency offerings compared to some competitors

- No 24/7 customer support available

- Inactivity fees applied to dormant accounts

- Some advanced trading tools and features require additional subscriptions

- Educational resources may be more geared towards experienced traders

- Withdrawal fees applied for certain payment methods

- Limited social trading and copy trading capabilities

- Some trading platforms may have a steeper learning curve for beginners

- Potentially longer account verification process due to strict compliance measures

Overview

Phillip Capital, a global financial powerhouse founded in Singapore in 1975, has established itself as a trusted partner for traders and investors worldwide. With operations spanning 15 countries, the company has garnered numerous accolades for its commitment to innovation and customer service. Notably, Phillip Capital introduced POEMS, Singapore's first internet-based trading platform, in 1996, demonstrating their dedication to providing cutting-edge tools and technology.

Boasting over $35 billion in assets under management and a customer base exceeding one million, Phillip Capital offers a comprehensive range of financial products, including forex, stocks, futures, ETFs, and CFDs, across 30 global exchanges. The company's success is built upon a solid foundation of expertise, with over five decades of experience in navigating the complexities of financial markets.

Phillip Capital's commitment to regulatory compliance is evident through its oversight by respected organisations such as the Monetary Authority of Singapore (MAS), the Financial Industry Regulatory Authority (FINRA), the Securities and Exchange Commission (SEC), and others. This adherence to strict regulatory standards ensures a safe and secure trading environment for clients.

For more detailed information on Phillip Capital's services, platforms, and offerings, visit their official website at phillipcapital.com. With a focus on innovation, reliability, and customer satisfaction, Phillip Capital continues to empower traders and investors to achieve their financial goals in the dynamic world of global markets.

Overview Table

| Category | Information |

|---|---|

| Established Year | 1975 |

| Geographical Presence | 15 countries |

| Notable Awards | Multiple awards for innovation and service |

| Assets Under Management | Over $35 billion |

| Customer Base | Exceeding 1 million |

| Financial Products | Forex, stocks, futures, ETFs, CFDs |

| Global Exchanges | 30 |

| Regulatory Oversight | MAS, FINRA, SEC, and others |

| Official Website | www.phillipcapital.com |

Facts List

- Phillip Capital was founded in Singapore in 1975 and now operates in 15 countries worldwide.

- The company introduced POEMS, Singapore's first internet-based trading platform, in 1996.

- Phillip Capital manages over $35 billion in assets and serves more than one million customers globally.

- The broker offers a wide range of financial products, including forex, stocks, futures, ETFs, and CFDs, across 30 global exchanges.

- Phillip Capital is regulated by respected organisations such as MAS, FINRA, and SEC, ensuring a safe and secure trading environment.

- The company provides multiple trading platforms, including POEMS 2.0, POEMS Pro, and MetaTrader 5, catering to traders of all levels.

- Phillip Capital offers competitive spreads starting from 0.6 pips on EUR/USD and commissions from $1.88 flat-rate on US shares.

- The broker provides educational resources, including webinars, seminars, and market reports, to support traders in their learning journey.

- Phillip Capital has a strong focus on technology and innovation, continuously investing in R&D to enhance its platforms and services.

- With over five decades of experience, Phillip Capital has established itself as a reliable and trusted partner for traders and investors worldwide.

phillipcapital Licenses and Regulatory

Phillip Capital operates under a robust regulatory framework, holding licenses from multiple respected authorities worldwide. This comprehensive oversight ensures that the broker adheres to strict industry standards, providing clients with a secure and trustworthy trading environment.

One of the key regulators overseeing Phillip Capital is the Monetary Authority of Singapore (MAS), the country's central bank and financial regulatory authority. MAS is known for its stringent regulations and proactive approach to maintaining the integrity of Singapore's financial markets. Phillip Capital's compliance with MAS guidelines demonstrates the broker's commitment to upholding the highest standards of financial conduct and client protection.

In the United States, Phillip Capital is regulated by the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA). These regulatory bodies enforce strict rules and regulations to safeguard investor interests and maintain fair, transparent markets. Phillip Capital's registration with the SEC and FINRA signifies the broker's dedication to operating with integrity and providing clients with a reliable trading platform.

Furthermore, Phillip Capital holds licenses from the Commodity Futures Trading Commission (CFTC), the National Futures Association (NFA), and the Securities Investor Protection Corporation (SIPC). These organisations oversee the derivatives and futures markets, ensuring that brokers like Phillip Capital adhere to rigorous standards of customer protection, financial stability, and market integrity.

Phillip Capital's multiple regulatory licenses across various jurisdictions serve as a testament to the broker's commitment to compliance and client security. By subjecting itself to the oversight of these respected regulatory bodies, Phillip Capital demonstrates its willingness to operate transparently and prioritise the interests of its clients.

In comparison to industry standards, Phillip Capital's regulatory framework is comprehensive and robust. The broker's licenses from top-tier regulators like MAS, SEC, FINRA, CFTC, and others place it among the most well-regulated brokers in the market. This extensive regulatory oversight provides clients with peace of mind, knowing that their funds and trading activities are protected by strict industry standards.

Regulations List

- Monetary Authority of Singapore (MAS)

- Securities and Exchange Commission (SEC)

- Financial Industry Regulatory Authority (FINRA)

- Commodity Futures Trading Commission (CFTC)

- National Futures Association (NFA)

- Securities Investor Protection Corporation (SIPC)

- Financial Conduct Authority (FCA) in the United Kingdom

- Securities and Exchange Board of India (SEBI)

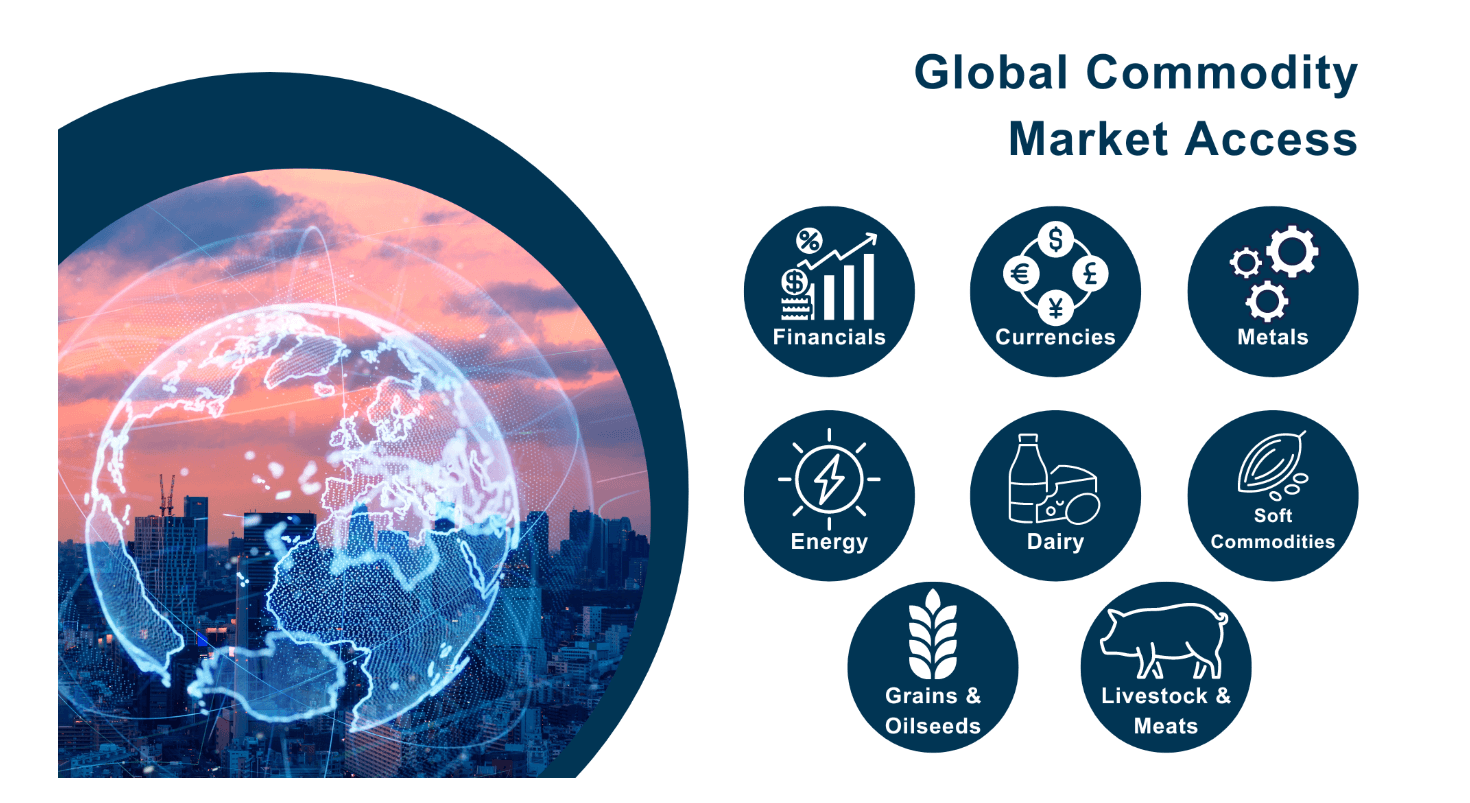

Trading Instruments

Phillip Capital offers a comprehensive range of tradable assets, catering to the diverse needs and preferences of investors and traders worldwide. With a robust portfolio spanning multiple asset classes, the broker provides clients with ample opportunities to diversify their investments and capitalise on various market conditions.

| Asset Class | Details |

|---|---|

| Forex | - Wide selection of currency pairs: majors (EUR/USD, GBP/USD), minors, and exotics - Competitive spreads from 0.6 pips on EUR/USD |

| Stocks | - Access to global stocks (US, UK, EU, Asia) – Includes ETFs and indices - Flexible trading & competitive commissions |

| Futures & Options | - Futures on commodities, indices, currencies, and more - Options trading available for various risk/reward strategies - Access to global exchanges |

| Indices | - Trade top benchmarks: S&P 500, FTSE 100, Nikkei 225, and more - Region-specific index trading - Competitive spreads & flexible lot sizes |

| Cryptocurrencies | - Trade major digital assets: Bitcoin, Ethereum, Litecoin, etc. - Competitive spreads with robust platforms - Exposure to volatile crypto markets |

Phillip Capital's diverse portfolio of tradable assets sets it apart in the industry, providing clients with a comprehensive range of investment opportunities. By offering access to multiple asset classes, the broker empowers traders to diversify their portfolios, manage risk effectively, and seize potential opportunities across various markets.

Trading Platforms

Phillip Capital offers a comprehensive suite of trading platforms, catering to the diverse needs and preferences of traders worldwide. Whether you're a seasoned professional or a novice investor, the broker provides access to industry-leading platforms, ensuring a seamless and efficient trading experience.

MetaTrader 4 (MT4) and MetaTrader 5 (MT5)

Phillip Capital supports the widely popular MetaTrader platforms, MT4 and MT5. These platforms are renowned for their user-friendly interface, advanced charting capabilities, and extensive range of technical indicators. With MT4 and MT5, traders can access a wide array of trading instruments, including forex, stocks, indices, commodities, and more. The platforms offer automated trading functionality through expert advisors (EAs), allowing traders to implement their strategies effortlessly.

Proprietary Trading Platforms

In addition to the MetaTrader suite, Phillip Capital offers its proprietary trading platforms, designed to cater to the specific needs of its clients. These platforms, such as POEMS (Phillip's Online Electronic Mart System), provide a seamless trading experience with advanced features and tools. POEMS offers a user-friendly interface, real-time quotes, interactive charts, and a comprehensive range of trading tools, empowering traders to make informed decisions and execute trades efficiently.

Web-Based Trading

Phillip Capital understands the importance of flexibility and accessibility in today's fast-paced trading environment. The broker offers web-based trading platforms that allow clients to access their accounts and trade directly from their web browsers without the need for software installation. These web-based platforms provide a convenient and secure way to trade, enabling clients to monitor their positions, analyse market trends, and execute trades from anywhere with an internet connection.

Mobile Trading Apps

To cater to the growing demand for mobile trading, Phillip Capital provides mobile trading apps for both iOS and Android devices. These apps offer a seamless and intuitive trading experience, allowing clients to access their accounts, monitor markets, and execute trades on the go. The mobile apps provide real-time quotes, interactive charts, and a range of trading tools, ensuring that traders can stay connected to the markets and make informed decisions even when they are away from their desks.

Advanced Trading Features

Phillip Capital's trading platforms come equipped with a range of advanced features and tools to enhance the trading experience. These include:

- Advanced charting tools with a wide range of technical indicators and drawing tools

- Real-time market news and analysis to keep traders informed about the latest market developments

- Risk management tools, such as stop-loss and take-profit orders, to help traders manage their positions effectively

- Customizable watchlists and alerts to monitor specific instruments and market conditions

- Integration with third-party tools and plugins to extend the functionality of the platforms

Phillip Capital's trading platforms are regularly updated to ensure optimal performance, security, and compatibility with the latest market trends and technologies. The broker's commitment to providing reliable and user-friendly trading platforms sets it apart in the industry, empowering traders to execute their strategies with confidence and precision.

Trading Platforms Comparison Table

| Feature | MT4 | MT5 | POEMS | Web Trading | Mobile Apps |

|---|---|---|---|---|---|

| Forex Trading | ✓ | ✓ | ✓ | ✓ | ✓ |

| Stock Trading | ✓ | ✓ | ✓ | ✓ | ✓ |

| Indices Trading | ✓ | ✓ | ✓ | ✓ | ✓ |

| Commodity Trading | ✓ | ✓ | ✓ | ✓ | ✓ |

| Cryptocurrency Trading | ✗ | ✓ | ✓ | ✓ | ✓ |

| Automated Trading (EAs) | ✓ | ✓ | ✗ | ✗ | ✗ |

| Advanced Charting | ✓ | ✓ | ✓ | ✓ | ✓ |

| Real-Time Quotes | ✓ | ✓ | ✓ | ✓ | ✓ |

| Market News & Analysis | ✓ | ✓ | ✓ | ✓ | ✓ |

| Risk Management Tools | ✓ | ✓ | ✓ | ✓ | ✓ |

| Customizable Watchlists | ✓ | ✓ | ✓ | ✓ | ✓ |

| Mobile Compatibility | ✓ | ✓ | ✓ | ✓ | ✓ |

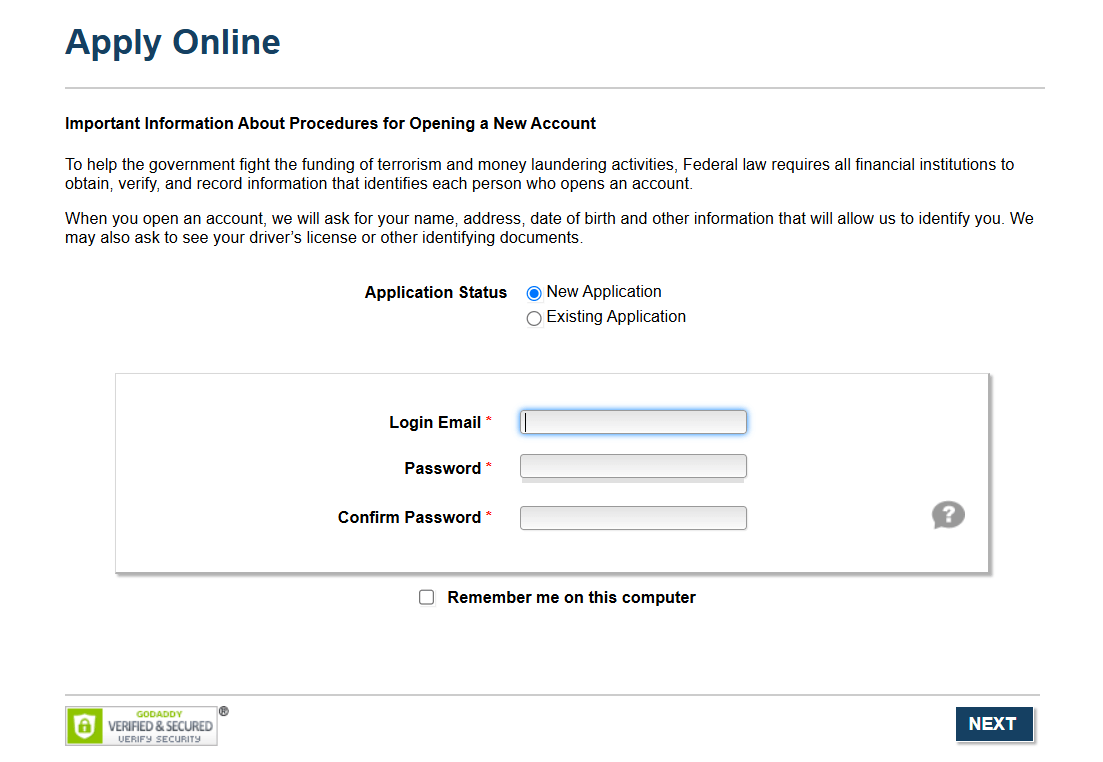

phillipcapital How to Open an Account: A Step-by-Step Guide

Opening an account with Phillip Capital is a straightforward and user-friendly process, designed to accommodate the needs of both novice and experienced traders. To begin your trading journey with Phillip Capital, follow these simple steps:

Step 1: Visit the Phillip Capital website Navigate to the official Phillip Capital website at [insert website link] and click on the "Open an Account" or "Sign Up" button, usually located in the top right corner of the homepage.

Step 2: Choose your account type Select the type of account that best suits your trading needs and objectives. Phillip Capital offers several account types, including Individual, Joint, Corporate, and more. Each account type has its own specific requirements and benefits, so be sure to review the details carefully before making your selection.

Step 3: Complete the online application form Fill out the online application form with your personal information, including your name, address, email, phone number, and other required details. You will also need to provide information about your financial background, trading experience, and risk tolerance to help Phillip Capital assess the suitability of their services for your needs.

Step 4: Upload required documents To comply with regulatory requirements and ensure the security of your account, Phillip Capital will require you to upload certain documents for verification purposes. These may include:

- Government-issued identification, such as a passport or driver's license

- Proof of address, such as a utility bill or bank statement

- Proof of income or financial status, such as a tax return or bank statement

Step 5: Fund your account Once your account is approved, you will need to fund it to start trading. Phillip Capital offers several convenient payment methods, including bank wire transfers, credit/debit cards, and e-wallets. The minimum deposit amount may vary depending on your account type and the specific requirements of your jurisdiction.

Step 6: Download and install the trading platform After your account is funded, you can download and install the trading platform of your choice, such as MetaTrader 4 or 5, or use Phillip Capital's proprietary trading platforms. Log in to your account using the credentials provided by the broker and familiarize yourself with the platform's features and tools.

Step 7: Start trading With your account set up and funded and your trading platform installed, you are now ready to start trading with Phillip Capital. Be sure to familiarise yourself with the broker's trading conditions, including spreads, commissions, and leverage, and always practise responsible risk management when trading.

Phillip Capital's account opening process is designed to be efficient and user-friendly, with most applications approved within 1-2 business days. The broker's dedicated customer support team is available to assist you throughout the process, ensuring a smooth and hassle-free experience.

Charts and Analysis

Phillip Capital understands the importance of providing traders with a comprehensive suite of educational resources and tools to enhance their trading knowledge and skills. The broker offers a wide range of resources designed to cater to the needs of both novice and experienced traders, empowering them to make informed trading decisions and develop effective strategies.

| Category | Details |

|---|---|

| Interactive Charts | - Advanced, customizable charting tools - Multiple chart types, timeframes, drawing tools - Real-time data, technical indicators, overlays for in-depth analysis |

| Market Analysis | - Regular expert commentary - Daily technical & fundamental reports - In-depth coverage across various financial markets |

| Economic Calendar | - Real-time updates on events (e.g., central bank announcements, data releases) - Impact ratings and detailed descriptions - Useful for risk and strategy planning |

| Webinars & Educational Videos | - Regular sessions hosted by industry experts - Topics include strategy, analysis, psychology, platform tutorials - Available live and on-demand |

| Downloadable Resources | - Includes eBooks, guides, trading manuals - Covers technical/fundamental analysis, psychology, risk management - Self-paced learning tools |

| Market News & Insights | - Real-time news across asset classes - Expert commentary, breaking news, and trend analysis – Helps traders stay market-aware and informed |

| Trading Blog | - Regular updates with strategy articles, trader tips, and market insights - Contributions from professionals and experienced traders |

Phillip Capital's extensive range of educational resources and tools sets it apart from many competitors in the industry. The broker's commitment to providing high-quality educational content demonstrates its dedication to empowering traders and helping them succeed in the financial markets.

phillipcapital Account Types

Phillip Capital offers a range of trading account types designed to cater to the diverse needs and preferences of traders at various levels of experience and with different trading objectives. The broker's account types provide flexibility in terms of trading instruments, leverage, and pricing, ensuring that traders can find an account that aligns with their specific requirements.

Cash Plus Account

The Cash Plus Account is ideal for traders seeking cost-effective access to global markets. This account type offers competitive brokerage fees and a standby margin capacity of S$50,000, allowing traders to leverage their funds and investment items. The account provides funding for purchases, defined quantum and margin conditions, and efficient margin call management, making it a versatile option for traders looking to maximise their investment potential.

Cash Management Account

The Cash Management Account is designed for traders who prefer to consolidate their investment funds in a single location. This account type provides access to a wide range of trading instruments, including shares, unit trusts, bonds, and more, with the added convenience of custodial services for Singapore-listed and overseas shares. The account also features an excess funds management tool for higher returns on SGD and USD, as well as multi-currency services for efficient foreign currency asset management.

Margin Account

The Margin Account is suitable for traders who wish to amplify their trading potential across 23 global exchanges. This account type allows traders to use funds or specific investment assets as collateral for margin borrowing, with a basic credit limit of S$50,000 for new accounts. The Margin Account operates within a structure of financing tiers and margin coefficients, regulating funding across different investment instruments and providing a clear framework for margin management.

Share Builders Plan

The Share Builders Plan is an investment account designed for long-term investors who wish to build a diversified portfolio of Singapore-listed shares. This account type allows investors to make regular investments in their chosen stocks, with the flexibility to adjust their investment amounts and frequencies based on their financial goals and risk tolerance. The Share Builders Plan offers a convenient and disciplined approach to investing, making it an attractive option for investors seeking to grow their wealth over time.

Demo Account

Phillip Capital offers demo accounts for traders who wish to practice their trading strategies and familiarise themselves with the broker's trading platforms without risking real funds. The demo accounts provide access to a wide range of trading instruments and features, allowing traders to test their skills and gain confidence before transitioning to live trading. Demo accounts are available for both the MetaTrader 4 and MetaTrader 5 platforms, as well as Phillip Capital's proprietary trading platforms.

Phillip Capital's range of account types caters to the diverse needs of traders, from cost-conscious investors seeking access to global markets to experienced traders looking to maximise their trading potential. The broker's account offerings provide flexibility in terms of trading instruments, leverage, and pricing, ensuring that traders can find an account that aligns with their specific requirements and trading objectives.

Account Types Comparison Table

| Feature | Cash Plus Account | Cash Management Account | Margin Account |

|---|---|---|---|

| Minimum Deposit | S$5,000 | S$5,000 | S$5,000 |

| Margin Capacity | S$50,000 | N/A | Basic credit limit of S$50,000 |

| Tradable Instruments | Shares, ETFs, Bonds, Unit Trusts | Shares, Unit Trusts, Bonds | Shares, ETFs, Bonds, Unit Trusts, Futures, Options |

| Leverage | Up to 2x | N/A | Based on financing tiers and margin coefficients |

| Custodial Services | N/A | Available (SG & overseas shares) | N/A |

| Excess Funds Management | N/A | Available (SGD & USD) | N/A |

| Multi-Currency Services | N/A | Available | N/A |

Additional Plans & Tools

| Feature | Share Builders Plan | Demo Account |

|---|---|---|

| Minimum Deposit | S$100/month | N/A |

| Tradable Instruments | Singapore-listed shares | Wide range depending on the platform |

| Flexibility | Adjustable investment amounts & frequencies | N/A |

| Purpose | Long-term investing, portfolio building | Practice strategies, familiarize with platforms |

| Platforms | N/A | MetaTrader 4, MetaTrader 5, Phillip proprietary platforms |

| Real Funds | Yes | No |

Negative Balance Protection

Phillip Capital understands the importance of protecting its clients' funds and mitigating the risk of negative balances. As such, the broker offers negative balance protection to all its clients, regardless of their account type or trading style.

Under Phillip Capital's negative balance protection policy, if a client's account balance falls below zero due to trading losses, the broker will absorb the negative balance and reset the account balance to zero. This means that clients cannot lose more than the funds they have deposited into their trading account, providing peace of mind and limiting their potential losses.

It is important to note that negative balance protection does not exempt traders from their responsibility to manage risk effectively. Traders should still employ sound risk management strategies, such as setting appropriate stop-loss orders, managing leverage carefully, and diversifying their trading portfolio.

Phillip Capital's commitment to negative balance protection demonstrates the broker's dedication to safeguarding its clients' funds and promoting responsible trading practices. By offering this protection, Phillip Capital ensures that its clients can trade with confidence, knowing that their potential losses are limited to the funds available in their trading account.

phillipcapital Deposits and Withdrawals

Phillip Capital offers a range of convenient and secure deposit and withdrawal options to cater to the diverse needs of its clients. The broker understands the importance of efficient and reliable fund transfers, ensuring that traders can manage their accounts with ease and confidence.

Deposit Options

Phillip Capital accepts the following deposit methods:

Here’s the information on Phillip Capital's Deposit Methods formatted into a clean, structured table for quick reference:| Method | Details | Processing Time | Notes |

|---|---|---|---|

| Bank Wire Transfer | Direct transfer from bank account to trading account | 1–3 business days | Suitable for larger deposits |

| Credit/Debit Cards | Visa and Mastercard supported | Instant | Enables immediate trading |

| E-wallets | Supports services like Skrill and Neteller | Fast (usually within hours) | Secure and convenient |

| Local Bank Transfers | For Singapore-based clients; includes FAST and GIRO options | Usually same day | Fast and easy for local transactions |

Minimum and maximum deposit amounts may vary depending on the chosen payment method and the client's account type. Phillip Capital does not charge any deposit fees, but clients should be aware of any potential fees imposed by their bank or payment service provider.

Withdrawal Options

Phillip Capital offers the following withdrawal methods:

| Method | Details | Processing Time | Notes |

|---|---|---|---|

| Bank Wire Transfer | Withdrawals sent directly to client’s bank account | 1–3 business days | Suitable for larger withdrawals |

| Credit/Debit Cards | Funds returned to the original card used for deposit | Varies (typically 1–5 days) | Only to the same card used |

| E-wallets | Withdrawals available via Skrill and Neteller | Fast (often same day) | Quick and secure |

| Local Bank Transfers | For Singapore clients via FAST and GIRO | Usually same day | Convenient for local withdrawals |

Minimum and maximum withdrawal amounts may vary depending on the chosen payment method and the client's account type. Phillip Capital does not charge any withdrawal fees, but clients should be aware of any potential fees imposed by their bank or payment service provider.

To ensure the security of client funds and comply with regulatory requirements, Phillip Capital may require clients to complete additional verification steps before processing a withdrawal request. This may include providing proof of identity, proof of address, or other relevant documentation.

Phillip Capital processes withdrawal requests promptly, with most requests being completed within 1-3 business days. However, in some cases, additional processing time may be required due to bank or payment service provider procedures.

Support Service for Customer

Phillip Capital offers a comprehensive range of customer support channels, catering to the diverse preferences and needs of its global clientele. Traders can reach out to the broker's support team through the following channels:

- Live Chat: Phillip Capital's website features a live chat option, allowing traders to connect with a support representative in real-time. This channel is ideal for quick queries and general assistance.

- Email Support: Clients can send their enquiries, concerns, or feedback to Phillip Capital's dedicated email support address. The support team strives to provide detailed and helpful responses within 24 hours.

- Phone Support: Phillip Capital offers phone support in multiple countries, with dedicated local numbers for clients in Singapore, Malaysia, Indonesia, Thailand, and Hong Kong. Phone support is available during regular business hours, providing personalised assistance for more complex issues.

- Social Media: Traders can connect with Phillip Capital through popular social media platforms, such as Facebook, Twitter, and LinkedIn. The broker's social media teams actively engage with clients, addressing queries and sharing valuable market insights.

Phillip Capital provides customer support in multiple languages, including English, Mandarin, Bahasa Indonesia, Thai, and Vietnamese, ensuring that clients from diverse linguistic backgrounds can communicate effectively with the support team.

The broker's customer support operates from Monday to Friday, 8:30 AM to 5:30 PM (GMT+8), catering to traders in the Asia-Pacific region. While Phillip Capital does not offer 24/7 support, the broker strives to provide prompt assistance during its operational hours.

Phillip Capital's live chat and phone support channels offer the fastest response times, with most queries being addressed within minutes. Email support typically yields a response within 24 hours, while social media enquiries are handled within 48 hours.

To further enhance its customer support, Phillip Capital maintains a comprehensive FAQ section on its website, addressing common questions related to account opening, trading platforms, fund transfers, and more. The broker also provides a range of educational resources, including video tutorials and user guides, to help traders navigate its platforms and services effectively.

Phillip Capital provides customer support in multiple languages, including English, Mandarin, Bahasa Indonesia, Thai, and Vietnamese, ensuring that clients from diverse linguistic backgrounds can communicate effectively with the support team.

The broker's customer support operates from Monday to Friday, 8:30 AM to 5:30 PM (GMT+8), catering to traders in the Asia-Pacific region. While Phillip Capital does not offer 24/7 support, the broker strives to provide prompt assistance during its operational hours.

Phillip Capital's live chat and phone support channels offer the fastest response times, with most queries being addressed within minutes. Email support typically yields a response within 24 hours, while social media enquiries are handled within 48 hours.

To further enhance its customer support, Phillip Capital maintains a comprehensive FAQ section on its website, addressing common questions related to account opening, trading platforms, fund transfers, and more. The broker also provides a range of educational resources, including video tutorials and user guides, to help traders navigate its platforms and services effectively.

Customer Support Comparison Table

| Support Channel | Availability | Languages | Response Time |

|---|---|---|---|

| Live Chat | Monday to Friday, 8:30 AM to 5:30 PM (GMT+8) | English, Mandarin, Bahasa Indonesia, Thai, Vietnamese | Within minutes |

| Email Support | Monday to Friday, 8:30 AM to 5:30 PM (GMT+8) | English, Mandarin, Bahasa Indonesia, Thai, Vietnamese | Within 24 hours |

| Phone Support | Monday to Friday, 8:30 AM to 5:30 PM (GMT+8) | English, Mandarin, Bahasa Indonesia, Thai, Vietnamese | Within minutes |

| Social Media | Monday to Friday, 8:30 AM to 5:30 PM (GMT+8) | English | Within 48 hours |

Prohibited Countries

In compliance with international regulations and local laws, Phillip Capital is restricted from providing its services in certain countries and regions. These restrictions are put in place to ensure that the broker operates within the legal framework of each jurisdiction and to protect both the company and its clients from potential legal and financial risks.

The primary reasons behind these restrictions include:

- Local Regulations: Some countries have strict regulations governing the provision of financial services, including online trading. These regulations may require brokers to obtain specific licenses, comply with local laws, or adhere to particular operational guidelines.

- Licensing Requirements: Phillip Capital holds licenses from reputable regulatory bodies such as the Monetary Authority of Singapore (MAS) and the Financial Conduct Authority (FCA) in the United Kingdom. However, these licenses may not be recognised or valid in certain jurisdictions, preventing the broker from legally operating in those countries.

- Geopolitical Factors: Political instability, economic sanctions, or international trade restrictions may prohibit Phillip Capital from offering its services in specific regions or to citizens of certain countries.

Phillip Capital is not permitted to open accounts or provide trading services to residents of the following countries:

- United States

- Canada

- European Union (excluding the United Kingdom)

- Japan

- New Zealand

- Australia

- Iran

- Iraq

- Libya

- Sudan

- Syria

- North Korea

- Cuba

Please note that this list is not exhaustive and may be subject to change based on evolving regulations and geopolitical developments. It is essential for potential clients to verify their eligibility to open an account with Phillip Capital based on their country of residence.

Attempting to trade with Phillip Capital from a prohibited country may result in legal consequences, account termination, and potential financial losses. The broker strongly advises clients to comply with their local laws and regulations and to seek professional legal advice if they are unsure about their eligibility to trade with Phillip Capital.

Special Offers for Customers

Phillip Capital provides a range of special promotions and offers designed to attract new clients and reward existing traders for their loyalty. These offers can help traders maximise their potential returns and enhance their overall trading experience with the broker.

Current special offers available at Phillip Capital include:

- Sign-up Bonus: New clients who open a trading account with Phillip Capital and meet the minimum deposit requirement are eligible for a sign-up bonus. The bonus amount varies depending on the account type and initial deposit, ranging from $50 to $1,000. To qualify for the bonus, traders must complete a specified trading volume within the first 30 days of account activation.

- Loyalty Program: Phillip Capital's loyalty program rewards traders based on their trading activity and account balance. Clients can earn points for each lot traded, which can be redeemed for cash rebates, trading credits, or other exclusive benefits. The loyalty program has multiple tiers, with higher levels offering more lucrative rewards and perks.

- Trading Competition: Phillip Capital hosts periodic trading competitions, allowing clients to compete against each other for attractive prizes. These competitions typically focus on specific trading instruments or strategies, with winners determined based on factors such as overall profitability, trading volume, or risk management. Prizes may include cash rewards, trading credits, or sponsored merchandise.

- Educational Workshops: The broker offers complimentary educational workshops and webinars for clients, covering a range of trading topics, strategies, and market analysis techniques. These workshops are conducted by experienced traders and market analysts, providing valuable insights and practical knowledge to help traders improve their skills and performance.

- Third-Party Partnerships: Phillip Capital collaborates with select third-party service providers to offer exclusive discounts and promotions to its clients. These partnerships may include discounted access to trading tools, market research subscriptions, or educational resources. Clients can benefit from these partnerships by accessing premium services at reduced costs, enhancing their trading capabilities and market knowledge.

It is essential for traders to carefully review the specific terms and conditions associated with each special offer, as they may be subject to certain requirements or limitations. For example, sign-up bonuses may have minimum deposit thresholds or trading volume requirements, while loyalty program rewards may be subject to expiration dates or redemption restrictions.

Conclusion

After conducting a thorough review of Phillip Capital, I can confidently say that they have established themselves as a reliable and reputable broker in the online trading industry. With a strong commitment to regulatory compliance, a wide range of trading instruments, and a user-focused approach, Phillip Capital stands out as a trustworthy choice for both novice and experienced traders.

One of the key factors that contribute to Phillip Capital's reliability is their adherence to strict regulatory standards. They are overseen by top-tier financial authorities such as the Monetary Authority of Singapore (MAS), the Financial Conduct Authority (FCA) in the United Kingdom, and the Securities and Exchange Commission (SEC) in the United States. This comprehensive regulatory framework ensures that Phillip Capital operates with transparency, fairness, and integrity, prioritising the safety and security of their clients' funds and personal information.

In terms of trading offerings, Phillip Capital provides a diverse array of tradable assets, including forex, stocks, indices, commodities, and more. This extensive product range allows traders to diversify their portfolios and capitalise on opportunities across multiple markets. The broker's competitive spreads, flexible leverage options, and advanced trading platforms, such as the acclaimed MetaTrader 4 and MetaTrader 5, further enhance the trading experience, catering to the needs and preferences of different types of traders.

Another aspect that sets Phillip Capital apart is their commitment to education and support. They offer a comprehensive suite of educational resources, including webinars, tutorials, market analysis, and trading guides, empowering traders to expand their knowledge and refine their skills. The broker's customer support team is readily available through multiple channels, ensuring that clients receive prompt and professional assistance whenever they need it.

Moreover, Phillip Capital's special offers and promotions provide additional value to traders. From attractive sign-up bonuses to loyalty programs and trading competitions, the broker goes the extra mile to reward and incentivise their clients. These offers not only help traders maximise their potential returns but also foster a sense of community and engagement within the Phillip Capital trading ecosystem.

In conclusion, based on my thorough analysis of Phillip Capital's regulatory compliance, trading offerings, educational resources, customer support, and special promotions, I can confidently recommend them as a reliable and trustworthy broker. Their commitment to providing a safe, transparent, and user-centric trading environment makes them an excellent choice for traders seeking a dependable partner in their online trading journey.

Ready to decide? Start with the broker reviews shortlist for top picks.

Offshore MT4 perks? See the TradersWay review.