Plus500 Review 2025: Pros, Cons & Key Features

Plus500

Israel

Israel

-

Minimum Deposit $100

-

Withdrawal Fee $0

-

Leverage 1:300

-

Spread From 0.8

-

Minimum Order 0.01

-

Forex Available

-

Crypto Available

-

Stock Available

-

Indices Available

Licenses

United Kingdom Market Making (MM)

United Kingdom Market Making (MM)

Cyprus Market Making (MM)

Cyprus Market Making (MM)

South Africa Retail Forex License

South Africa Retail Forex License

Australia Retail Forex License

Australia Retail Forex License

Singapore Financial Services License

Singapore Financial Services License

Financial Services Authority Seychelles

Financial Services Authority Seychelles

New Zealand Financial Markets Authority

New Zealand Financial Markets Authority

Softwares & Platforms

Customer Support

Supported language: Arabic, English, French, German, Italian, Russian, Spanish

Social Media

Summary

Plus500, founded in 2008 and LSE-listed, is regulated by 11 top-tier authorities and offers 2,800+ CFDs across multiple asset classes. Its proprietary platform is simple and mobile-friendly, with a $100 minimum deposit, fee-free transactions, and negative balance protection. Best suited for beginners and retail traders, it lacks MetaTrader, advanced tools, and phone support, which may limit appeal for professionals.

- 11 regulatory licenses

- LSE-listed for transparency

- 2,800+ tradable instruments

- User-friendly platform

- $100 minimum deposit

- No deposit/withdrawal fees

- 24/7 multilingual support

- Negative balance protection (retail)

- Competitive spreads

- Free unlimited demo

- No MetaTrader platforms

- No automated trading

- No phone support

- 0.7% currency conversion fee

- Inactivity fees after 3 months

- Limited educational resources

- No deposit bonuses

- USA clients prohibited (Only Futures Allowed)

- Higher spreads than some competitors (0.8 vs 0.6 pips)

Overview

Established in 2008, Plus500 has evolved into a global CFD powerhouse operating across more than 50 countries worldwide. This Israeli-founded broker has achieved remarkable growth, becoming publicly traded on the London Stock Exchange (LSE) under ticker PLUS, adding an exceptional layer of transparency rarely seen in the CFD industry. With regulatory approval from 11 top-tier authorities including the FCA, ASIC, and the newly added CIRO (Canada), Plus500 demonstrates an unwavering commitment to regulatory compliance and client protection.

The broker has garnered numerous industry accolades for its innovative proprietary platform and exceptional customer service, consistently ranking among the most user-friendly CFD platforms globally. Offering over 2,800 tradable instruments across forex, stocks, indices, commodities, and cryptocurrencies, Plus500 caters to both novice and experienced traders seeking a streamlined trading experience without the complexity of traditional platforms like MetaTrader.

Visit plus500.com for more details.

Overview Table

| Category | Details |

|---|---|

| Headquarters | Haifa, Israel |

| Year Established | 2008 |

| Regulation | FCA, CySEC, ASIC, FMA, FSCA, MAS, FSA, CIRO, DFSA, ISA, EFSA |

| Public Listing | London Stock Exchange (PLUS) |

| Instruments | 2,800+ CFDs (Forex, Stocks, Indices, Commodities, Crypto, Options, ETFs) |

| Platforms | Proprietary WebTrader, iOS/Android Apps |

| Min. Deposit | $100 (cards/e-wallets), $500 (bank transfer) |

| Spreads | From 0.8 pips (EUR/USD) |

| Leverage | Up to 1:300 (retail) |

| Demo Account | Unlimited, Free |

| Customer Support | 24/7 Live Chat, Email, WhatsApp |

Facts List

- 11 regulatory licenses across major global jurisdictions ensuring maximum client protection

- LSE-listed company providing unparalleled transparency and financial reporting

- 2,800+ CFD instruments spanning seven asset classes for diversified trading

- Proprietary platform optimized for simplicity and mobile-first trading

- Competitive spreads starting from 0.8 pips on major forex pairs

- No commission trading on all CFD instruments

- Negative balance protection for retail clients preventing debt to broker

- 24/7 multilingual support available in 16 languages

- Low entry barrier with $100 minimum deposit

- Instant deposits via cards and e-wallets with no fees

Plus500 Licenses and Regulatory

Plus500's regulatory credentials stand as one of its strongest competitive advantages. The broker maintains licenses from 11 prestigious financial authorities worldwide, surpassing many competitors in regulatory coverage. This extensive oversight ensures client funds are segregated, operations are transparent, and trading conditions remain fair.

Regulatory Licenses Table

| Regulatory Authority | Jurisdiction | License Number |

|---|---|---|

| Financial Conduct Authority (FCA) | United Kingdom | 509909 |

| Cyprus Securities and Exchange Commission (CySEC) | Cyprus | 250/14 |

| Australian Securities and Investments Commission (ASIC) | Australia | 417727 |

| Canadian Investment Regulatory Organization (CIRO) | Canada | Active |

| Dubai Financial Services Authority (DFSA) | UAE | F005651 |

| Israel Securities Authority (ISA) | Israel | 514666577 |

| Estonian Financial Supervision Authority (EFSA) | Estonia | Active |

| Financial Markets Authority (FMA) | New Zealand | 486026 |

| Financial Sector Conduct Authority (FSCA) | South Africa | 47546 |

| Monetary Authority of Singapore (MAS) | Singapore | CMS100648-1 |

| Seychelles Financial Services Authority (FSA) | Seychelles | SD039 |

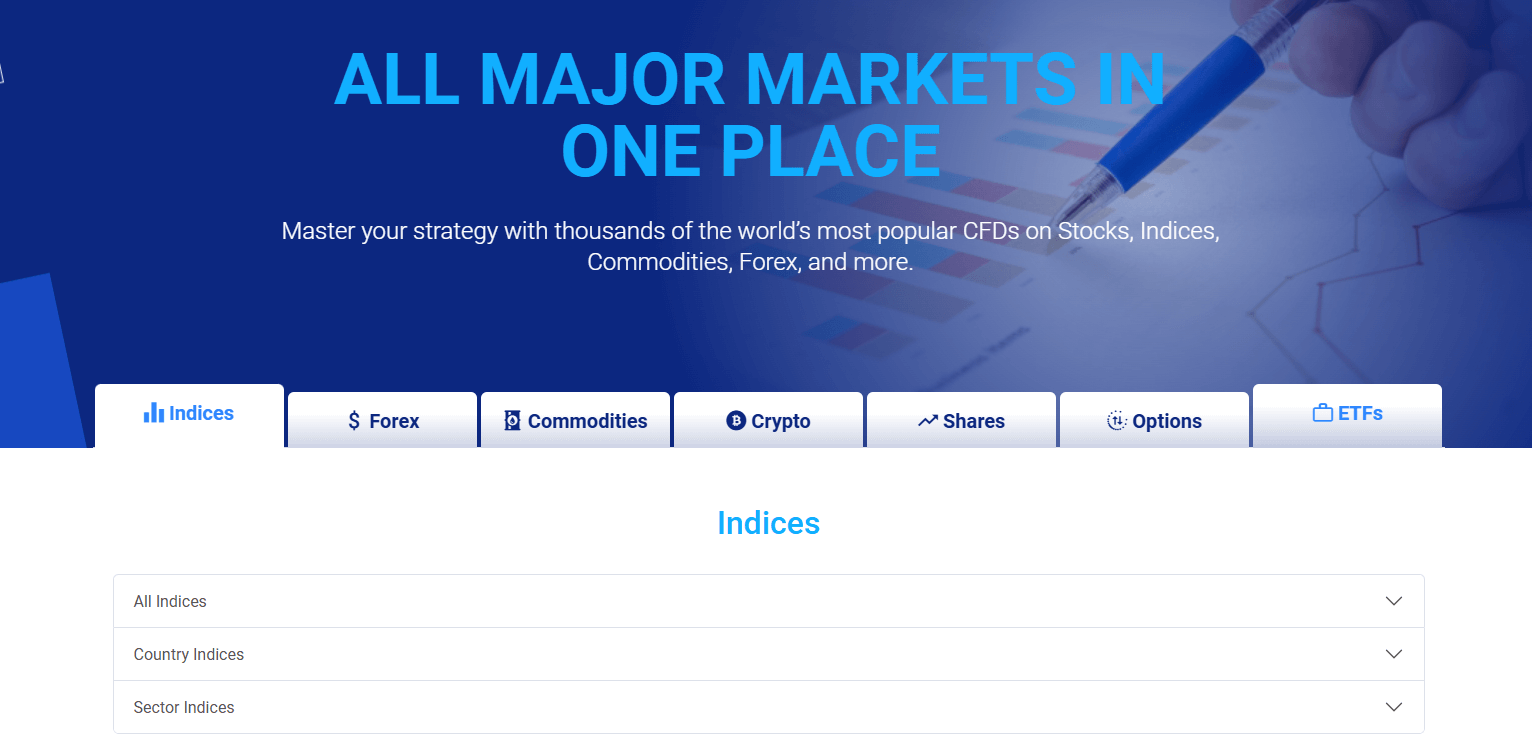

Trading Instruments

Plus500 offers an impressive array of over 2,800 CFD instruments, providing traders with extensive market exposure across multiple asset classes. This diversity enables portfolio diversification and adaptation to various market conditions.

| Asset Class | Number of Instruments | Key Features |

|---|---|---|

| Forex | 60+ pairs | Majors, minors, exotics; spreads from 0.8 pips |

| Stocks | 1,900+ CFDs | Global exchanges coverage, zero commissions |

| Indices | 29 indices | Major global markets, tight spreads |

| Commodities | 24 instruments | Metals, energy, agriculture |

| Cryptocurrencies | Up to 19 coins | Bitcoin, Ethereum, regional variations |

| Options | Various | CFDs on options for stocks/indices |

| ETFs | 96 CFDs | Sector and thematic exposure |

Trading Platforms

Plus500's proprietary platform ecosystem prioritizes accessibility and user experience over complex functionality. While lacking MetaTrader support, the platform excels in delivering a streamlined trading experience.

Platform Comparison Table

| Feature | WebTrader | Mobile Apps | MT4/MT5 |

|---|---|---|---|

| Availability | ✓ Browser-based | ✓ iOS/Android | ✗ Not offered |

| Charts | 100+ indicators | 100+ indicators | N/A |

| Order Types | Market, Limit, Stop, Guaranteed Stop | Full range | N/A |

| Automated Trading | ✗ | ✗ | N/A |

| Price Alerts | ✓ | ✓ | N/A |

| Sentiment Data | ✓ | ✓ | N/A |

| +Insights Tool | ✓ | ✓ | N/A |

Plus500 How to Open an Account: A Step-by-Step Guide

Opening a live trading account at Plus500 is a quick and fully digital process. Here's a step-by-step guide:

Plus500 Account Opening Process List

- Visit Plus500.com and click "Start Trading Now."

- Enter your email and choose a strong password.

- Fill in the registration form with your personal details.

- Select your preferred trading platform: WebTrader or mobile

- Choose your account currency from 16 base currencies.

- Upload proof of identity and proof of residence documents.

- Answer a short trading experience questionnaire.

- Make a deposit using a credit card, PayPal, Skrill, or bank transfer.

- Start trading on your live account or practice on a demo.

Requirements

- Personal details like name, address, date of birth

- Proof of identity (passport, national ID card, driver's license)

- Proof of residence (bank statement, utility bill, credit card statement)

- Minimum deposit of $100 ($500 for wire transfer)

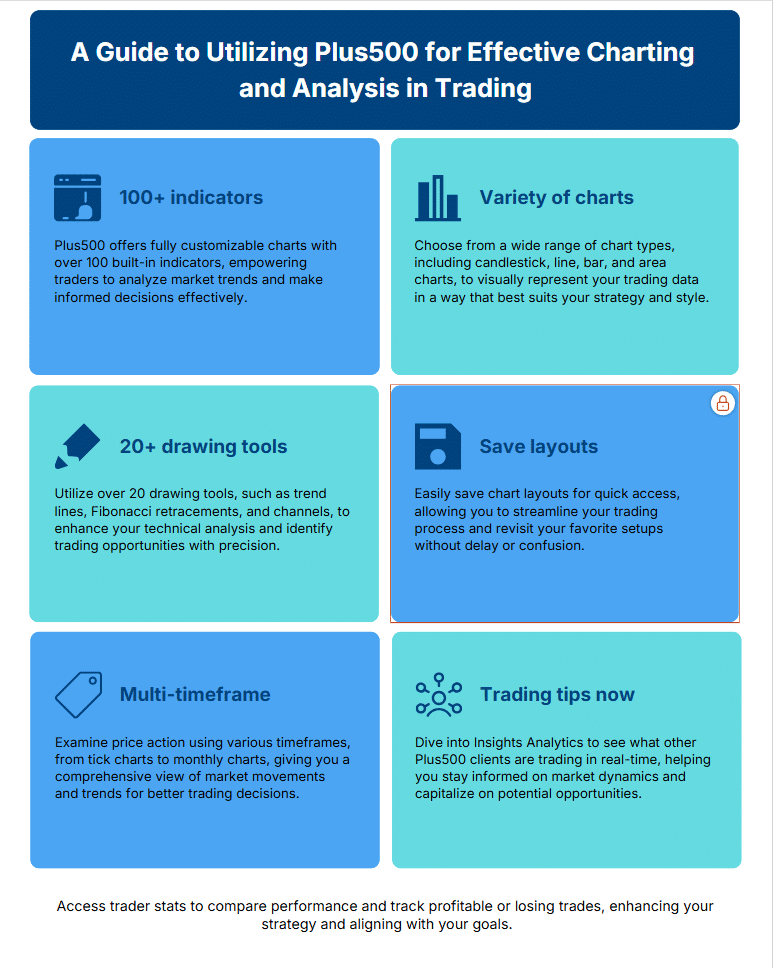

Charts and Analysis

Plus500 provides essential educational resources and market analysis tools, though the offering remains more limited compared to education-focused brokers.

| Resource | Description |

|---|---|

| Market Insights | Daily analysis articles covering major market events |

| Traders' Talk | Weekly video market analysis and trade ideas |

| Economic Calendar | Comprehensive schedule of economic releases |

| Trader's Guide | Basic strategy articles and platform tutorials |

| Video Tutorials | Platform navigation and feature explanations |

| +Insights Analytics | Real-time trader sentiment and positioning data |

Insights Analytics

- Explore what other Plus500 clients are trading in real-time.

- Discover the most popular or top-moving instruments.

- Gauge crowd sentiment with long/short positioning data.

- Track the most profitable and loss-making trades.

- Filter data by asset class, region, and time period.

- Access individual trader statistics to compare performance.

Plus500 Account Types

Plus500 maintains a simplified account structure, offering standard retail accounts for traders.

Account Types Comparison

| Feature | Retail Account | Demo Account |

| Minimum Deposit | $100 | Free |

| Leverage | Up to 1:300 | 1:300 |

| Negative Balance Protection | Yes | N/A |

| Spreads | Standard | Real market |

| Virtual Funds | N/A | Unlimited |

Negative Balance Protection

Plus500 provides comprehensive negative balance protection for retail clients, ensuring traders cannot lose more than their account balance. This crucial safety feature protects against extreme market volatility and price gaps, particularly important during major economic events or market crashes. The protection applies automatically to all retail accounts without additional terms or conditions, demonstrating Plus500's commitment to responsible trading practices.

Plus500 Deposits and Withdrawals

Plus500 offers flexible payment options with no fees charged by the broker for deposits or withdrawals.

Complete Payment Methods

| Method | Deposit Min/Max | Withdrawal Min/Max | Deposit Time | Withdrawal Time | Fees |

|---|---|---|---|---|---|

| Visa/Mastercard | $100 / $40,000 | $50 / Unlimited | Instant | 1-3 days | Free |

| PayPal | $100 / $40,000 | $50 / Unlimited | Instant | 1 day | Free |

| Skrill | $100 / $40,000 | $50 / Unlimited | Instant | 1 day | Free |

| Bank Transfer | $500 / Unlimited | $50 / Unlimited | 3-5 days | 3-5 days | Free |

| Klarna | $100 / Varies | Not available | Instant | N/A | Free |

| iDEAL | $100 / Varies | Check availability | Instant | 1-3 days | Free |

| GiroPay | $100 / Varies | Check availability | Instant | 1-3 days | Free |

| Blik | $100 / Varies | Check availability | Instant | 1-3 days | Free |

| POLi | $100 / Varies | Not available | Instant | N/A | Free |

| PayNow | $100 / Varies | Check availability | Instant | 1-3 days | Free |

| BPay | $100 / Varies | Not available | 1-2 days | N/A | Free |

Support Service for Customer

Plus500 provides round-the-clock multilingual support through multiple channels, though notably lacks phone support.

Support Channels

| Channel | Availability | Languages | Response Time |

|---|---|---|---|

| Live Chat | 24/7 | 16 languages | Minutes |

| 24/7 | 16 languages | Within 24 hours | |

| Business hours | Multiple | Quick response | |

| Phone | Not available | N/A | N/A |

Prohibited Countries

Plus500 does not accept clients from certain jurisdictions due to regulatory restrictions or company policy. These include:

- USA

- North Korea

- Iran

- Syria

- Sudan

- Cuba

- Belgium

- Japan

The reasons vary but often relate to local licensing requirements, economic sanctions, or anti-money laundering rules.

Please note that US traders can only trade Futures with Plus500.

Attempting to trade from a prohibited country violates Plus500's terms of service. Accounts may be blocked or funds withheld. Always check your eligibility before signing up.

Special Offers for Customers

Plus500 occasionally offers bonuses. At the time of this writing, they provide a 150$ bonus on a 500$ deposit if you meet their Terms and Conditions. The bonuses mentioned are for Bronze T&Cs.

Conclusion

After a comprehensive analysis, Plus500 emerges as a highly credible and well-regulated CFD broker, particularly suited for retail traders prioritizing simplicity, security, and regulatory protection. The broker's 11 regulatory licenses, including recent additions of CIRO (Canada) and DFSA (UAE), position it among the most comprehensively regulated brokers globally.

The proprietary platform, while lacking advanced features like automated trading and MetaTrader support, excels in delivering an intuitive trading experience ideal for beginners and intermediate traders. The breadth of 2,800+ CFD instruments provides ample trading opportunities, though the 0.8 pip minimum spread on EUR/USD positions Plus500 as competitive but not market-leading on pricing.

Plus500's strengths clearly lie in its regulatory framework, user-friendly technology, and accessible entry requirements. The $100 minimum deposit, fee-free transactions, and 24/7 support create an environment conducive to retail trading success. Being publicly traded on the LSE adds unprecedented transparency rarely found among CFD brokers.

However, limitations exist. Traders requiring advanced analytical tools, automated trading capabilities, or MetaTrader platforms should consider alternatives. The absence of phone support may frustrate some clients, while the 0.7% currency conversion fee and inactivity charges after three months represent ongoing cost considerations.

For traders seeking a straightforward, highly regulated CFD trading environment without the complexity of traditional platforms, Plus500 represents an excellent choice. The broker particularly suits those valuing regulatory security over advanced features, making it ideal for risk-conscious retail traders entering the CFD market.