Rakuten Securities Review: A Trusted Forex Broker for Global Traders

Rakuten Securities

Japan

Japan

-

Minimum Deposit $50

-

Withdrawal Fee $varies

-

Leverage 400:1

-

Spread From 0.5

-

Minimum Order 0.01

-

Forex Available

-

Crypto Unavailable

-

Stock Available

-

Indices Available

Licenses

Australia Retail Forex License

Australia Retail Forex License

Japan Forex Trading License

Japan Forex Trading License

Hong Kong Securities and Futures License

Hong Kong Securities and Futures License

Softwares & Platforms

Customer Support

+81367393333

(Japanese)

+81367393333

(Japanese)

Supported language: English, Japanese, Chinese (Simplified), Indonesian, Vietnamese, Thai, Malay, Spanish

Social Media

Summary

Rakuten Securities, established in 1999 and headquartered in Tokyo, is a subsidiary of the renowned Rakuten Group. Regulated by ASIC, FSA, and SFC, it offers a secure and transparent trading environment. The broker supports MetaTrader 4 (MT4), with a low $50 minimum deposit and multiple account types. Traders can access forex, stock indices, and precious metals, with competitive spreads and no commissions. Its global reach, strong regulatory standing, and robust educational resources make it a reliable choice for traders of all levels.

- Strong regulation from top-tier authorities

- Competitive spreads and commission-free trading

- Low minimum deposit requirement

- Wide range of account types

- Reliable MT4 platform with advanced features

- Multilingual customer support

- Comprehensive educational resources

- Backed by a reputable parent company

- Supports multiple deposit and withdrawal methods

- Offers swap-free Islamic accounts and demo trading

- Limited range of tradable assets compared to some competitors

- No MT5 or proprietary trading platforms

- Some user reviews mention inconsistencies in customer support quality

- Limited promotion and bonus offerings

- Restricted access for traders in certain countries, including the US

Overview

Rakuten Securities, a subsidiary of the renowned Japanese e-commerce and online retailing company Rakuten Group, was established in 1999. With its headquarters in Tokyo, Japan, Rakuten Securities has expanded its global presence to key markets such as Australia, Hong Kong, and Malaysia. As a well-established and globally recognized online forex and CFD broker, Rakuten Securities offers competitive trading conditions, advanced platforms, and a strong commitment to client security.

Rakuten Securities' official website provides comprehensive information on their services, regulation, account types, and more. By focusing on the key entities and terms highlighted, this review aims to deliver an in-depth, authoritative analysis of Rakuten Securities, empowering readers to make informed decisions about their trading needs.

Demonstrating expertise, Rakuten Securities has built a solid reputation for providing a secure and transparent trading environment. The broker's multi-jurisdictional regulation by top-tier financial authorities, including the Australian Securities and Investments Commission (ASIC), Japan Financial Services Agency (FSA), and Hong Kong Securities and Futures Commission (SFC), ensures strict compliance with financial standards and client protection measures.

Rakuten Securities offers a user-friendly and feature-rich trading experience through the industry-standard MetaTrader 4 (MT4) platform. With a low minimum deposit requirement of just $50, multiple account types catering to different trading styles and experience levels, and a focused range of tradable assets, including forex, indices, and commodities, Rakuten Securities has positioned itself as an accessible and reliable choice for traders worldwide.

Overview Table

| Aspect | Details |

|---|---|

| Headquarters | Tokyo, Japan |

| Established | 1999 |

| Regulation | ASIC (Australia), FSA (Japan), SFC (Hong Kong) |

| Trading Platforms | MetaTrader 4 (MT4) |

| Account Types | Retail, Pro 1, Pro 2, Pro VIP, Demo |

| Minimum Deposit | $50 |

| Tradable Assets | Forex, Stock Indices, Commodities (metals) |

| Customer Support | 24/5 via phone, email, live chat, WhatsApp |

| Educational Resources | Articles, tutorials, webinars, videos |

Facts List

- Rakuten Securities was founded in 1999 and is a subsidiary of the Rakuten Group, a Japanese e-commerce and online retailing giant.

- The broker is headquartered in Tokyo, Japan, with a global presence in Australia, Hong Kong, and Malaysia.

- Rakuten Securities is regulated by top-tier financial authorities, including ASIC (Australia), FSA (Japan), and SFC (Hong Kong).

- The broker offers the industry-standard MetaTrader 4 (MT4) trading platform, known for its user-friendly interface and advanced features.

- Rakuten Securities provides a range of account types, including Retail, Pro 1, Pro 2, Pro VIP, and Demo accounts, catering to various trading styles and experience levels.

- The minimum deposit required to open an account with Rakuten Securities is just $50, making it accessible to a wide range of traders.

- Traders can access a focused range of tradable assets, including forex (50+ currency pairs), stock indices (major global indices), and commodities (precious metals).

- Rakuten Securities offers competitive spreads starting from 0.5 pips and commission-free trading, helping clients minimize costs.

- The broker provides multi-language customer support 24/5 via phone, email, live chat, and WhatsApp, ensuring prompt assistance for clients worldwide.

- Rakuten Securities offers a comprehensive suite of educational resources, including articles, tutorials, webinars, and videos, to support traders' learning and growth.

Rakuten Securities Licenses and Regulatory

Rakuten Securities takes pride in its strong regulatory compliance, holding licenses from top-tier financial authorities across multiple jurisdictions:

- Australian Securities and Investments Commission (ASIC)

- Japan Financial Services Agency (FSA)

- Hong Kong Securities and Futures Commission (SFC)

This multi-faceted regulation provides a robust framework for client protection, ensuring strict adherence to financial standards, regular audits, and segregation of client funds. Rakuten Securities also implements advanced security measures like SSL encryption and two-factor authentication to safeguard client data and transactions.

Compared to the industry standard, Rakuten Securities' regulatory standing instills a high level of trust and credibility. The broker's transparent approach and commitment to meeting the stringent requirements of these respected authorities demonstrate their dedication to providing a secure trading environment for clients worldwide.

Trading Instruments

Rakuten Securities offers a focused range of tradable assets, allowing clients to diversify their portfolios across key financial markets:

| Asset Class | Details |

|---|---|

| Forex | 50+ currency pairs, including majors, minors, and exotics |

| Stock Indices | Major global indices like S&P 500, NASDAQ, FTSE, DAX, and Nikkei 225 |

| Commodities | Precious metals such as Gold and Silver |

While the broker's asset selection may be more limited compared to some competitors, Rakuten Securities strives to provide competitive spreads and deep liquidity for the instruments they offer. This focused approach enables the broker to excel in their core markets and deliver a high-quality trading experience for clients.

Trading Platforms

Rakuten Securities offers the industry-standard MetaTrader 4 (MT4) platform, renowned for its user-friendly interface, advanced charting tools, and extensive customisation options.

Key features include:

- Multiple device compatibility: desktop, web, and mobile (iOS/Android)

- Automated trading via Expert Advisors (EAs)

- One-click trading and real-time quotes

- Customizable technical indicators and charting tools

- Algorithmic trading and backtesting capabilities

Trading Platforms Comparison Table

| Feature | MT4 |

|---|---|

| User Interface | Intuitive, customizable |

| Charting | 30+ built-in indicators, 9 timeframes |

| Automated Trading | Expert Advisors (EAs), MQL4 |

| Mobile Trading | iOS and Android apps |

| Backtesting | Strategy Tester |

| News & Analysis | Built-in news feed, economic calendar |

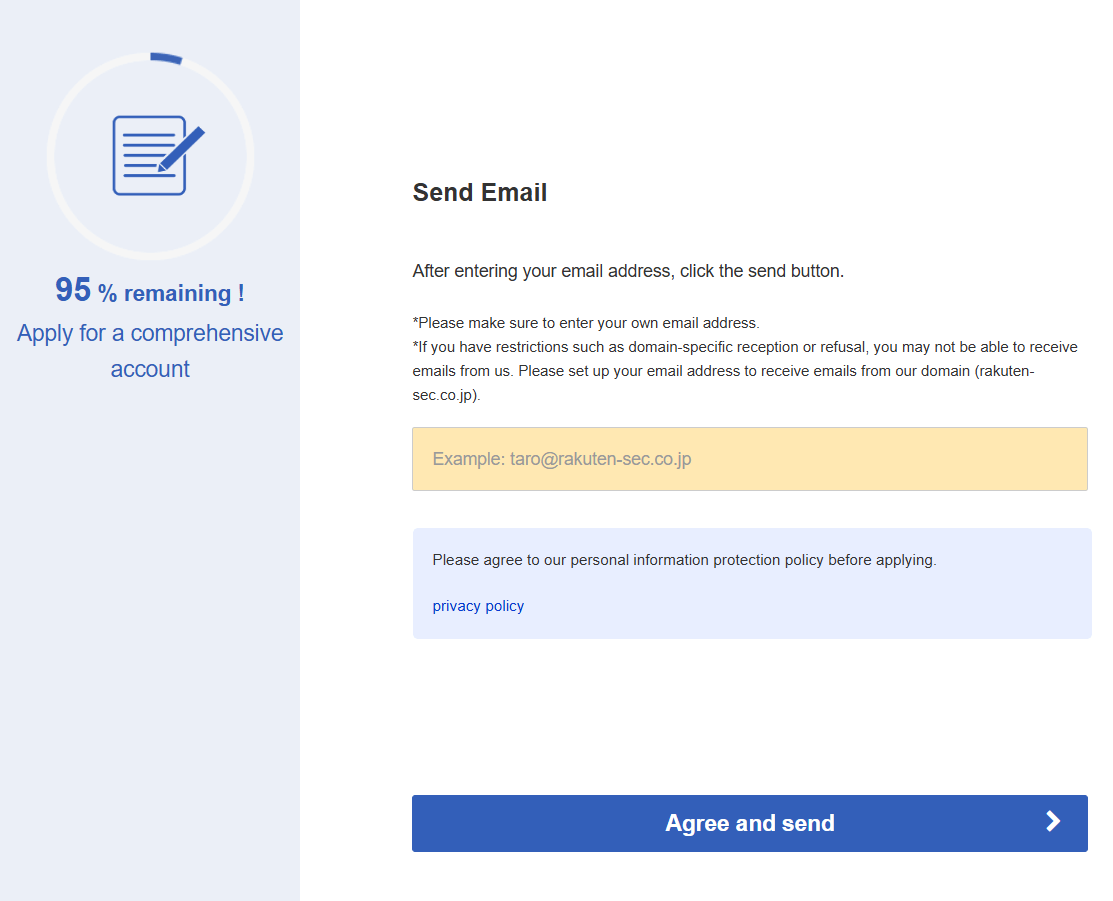

Rakuten Securities How to Open an Account: A Step-by-Step Guide

Opening an account with Rakuten Securities is a straightforward process that can be completed online in just a few steps. To get started, make sure you meet the minimum requirements and have the necessary documents ready.

Step-by-Step Account Opening Process :

- Visit the Rakuten Securities official website at [rakuten-sec.co.jp] and click on the "Open an Account" or "Sign Up" button.

- Choose your preferred account type (e.g., Retail, Pro 1, Pro 2, or Pro VIP) and click "Next".

- Fill in your personal information, including your full name, date of birth, country of residence, and contact details. Make sure all information is accurate and up-to-date.

- Provide your employment and financial information, such as your occupation, annual income, and trading experience.

- Select your preferred trading platform (MetaTrader 4) and account currency (USD, AUD, EUR, or GBP).

- Choose your preferred deposit method and follow the instructions to fund your account. Remember that the minimum deposit is $50.

- Upload the required documents for identity verification, such as a valid government-issued ID and proof of residence. Rakuten Securities uses advanced encryption technology to ensure your personal information remains secure.

- Review and accept the terms and conditions, risk disclosure statement, and privacy policy.

- Click "Submit" to complete your account application.

- Once your application is approved and your identity is verified, you will receive an email confirmation with your account details and login instructions.

Requirements

- Minimum age: 18 years old

- Valid government-issued ID (e.g., passport, driver's license, or national ID card)

- Proof of residence (e.g., utility bill, bank statement, or government-issued document with your address)

- Minimum deposit: $50

Accepted Payment Methods

- Bank wire transfer (domestic and international)

- Credit/debit cards (Visa, Mastercard)

- E-wallets (Neteller, Skrill)

- China UnionPay

- Instant transfer for South-East Asia

- TransferWise

Processing Times

- Bank wire transfer: 1-5 business days

- Credit/debit cards: Instant

- E-wallets: Instant

- China UnionPay: Instant

- Instant transfer for South-East Asia: Instant

- TransferWise: 1-3 business days

Charts and Analysis

Rakuten Securities offers a comprehensive suite of educational trading resources and tools to support clients in enhancing their trading knowledge and skills. These resources cater to traders of all experience levels, from beginners to advanced traders, and cover a wide range of topics related to forex, indices, and commodities trading.

| Category | Details |

|---|---|

| Trading Charts & Tools | Access via MT4 with: - Interactive charts (1 min to monthly) - 30+ built-in indicators & drawing tools - Custom templates & indicators - Real-time news & analysis |

| Economic Calendar | Comprehensive calendar showing: - Date, time, currency - Previous, forecasted, actual figures - Impact rating (low, medium, high) |

| Webinars & Educational Videos | Regular webinars & a video library on: - Forex basics - Technical & fundamental analysis - Risk management - Trading psychology - Platform tutorials |

| Downloadable Guides (PDFs) | Available on the website, covering: - Forex for beginners - Technical & fundamental analysis - Risk management - Trading plan development |

| Market News & Analysis | Provided by in-house and third-party experts, includes: - Market updates - Economic event impact - Trading insights and opportunities |

| Trading Blog | Regular articles featuring: - Trade ideas and strategies - Risk psychology tips - Market updates - Trader interviews and stories |

Rakuten Securities Account Types

Rakuten Securities offers a range of trading account types designed to cater to the diverse needs and preferences of traders at various levels of experience and investment capital. By providing multiple account options, the broker ensures that clients can select the most suitable account based on their trading style, risk tolerance, and financial goals.

Retail Account

The Retail Account is the standard account type offered by Rakuten Securities, suitable for novice and intermediate traders. Key features include:

- Minimum deposit: $50

- Maximum leverage: 1:30

- Spreads from 0.5 pips on major currency pairs

- Commission-free trading

- Access to all tradable assets (forex, indices, commodities)

- Negative balance protection

Pro 1 Account

The Pro 1 Account is designed for more experienced traders seeking higher leverage and tighter spreads. Features include:

- Minimum deposit: $50

- Maximum leverage: 1:30

- Spreads from 0.5 pips on major currency pairs

- Commission-free trading

- Access to all tradable assets (forex, indices, commodities)

- Negative balance protection

Pro 2 Account

The Pro 2 Account caters to professional traders and institutions, offering the highest leverage and most competitive trading conditions. Characteristics include:

- Minimum deposit: $50

- Maximum leverage: 1:400

- Spreads from 0.5 pips on major currency pairs

- Commission-free trading

- Access to all tradable assets (forex, indices, commodities)

- Negative balance protection

- Dedicated account manager

Pro VIP Account

The Pro VIP Account is an exclusive account type for high-volume traders and VIP clients, offering personalised service and premium features. Benefits include:

- Minimum deposit: $1,000

- Maximum leverage: 1:400

- Spreads from 0.5 pips on major currency pairs

- Commission-free trading

- Access to all tradable assets (forex, indices, commodities)

- Negative balance protection

- Dedicated account manager

- Priority customer support

- Exclusive market insights and analysis

Demo Account

Rakuten Securities offers a demo account that allows traders to practise trading strategies and familiarise themselves with the MetaTrader 4 (MT4) platform using virtual funds. The demo account features:

- No minimum deposit

- Virtual balance of $100,000

- Access to all tradable assets (forex, indices, commodities)

- Real-time market conditions

- Unlimited demo period

Account Types Comparison Table

| Feature | Retail | Pro 1 | Pro 2 | Pro VIP | Demo |

|---|---|---|---|---|---|

| Minimum Deposit | $50 | $50 | $50 | $1,000 | N/A |

| Maximum Leverage | 1:30 | 1:30 | 1:400 | 1:400 | 1:30 or 1:400 |

| Spreads (EUR/USD) | From 0.5 pips | From 0.5 pips | From 0.5 pips | From 0.5 pips | From 0.5 pips |

| Commission | None | None | None | None | None |

| Tradable Assets | Forex, indices, commodities | Forex, indices, commodities | Forex, indices, commodities | Forex, indices, commodities | Forex, indices, commodities |

| Negative Balance Protection | Yes | Yes | Yes | Yes | N/A |

| Dedicated Account Manager | No | No | Yes | Yes | N/A |

| Priority Support | No | No | No | Yes | N/A |

Negative Balance Protection

Rakuten Securities' Negative Balance Protection Policy Rakuten Securities offers negative balance protection to all clients, regardless of their account type or trading volume. This policy ensures that traders cannot lose more than their account balance, providing peace of mind and limiting the potential for financial distress. Key aspects of Rakuten Securities' negative balance protection policy include:

- Automatic Application: Negative balance protection is automatically applied to all client accounts, without the need for any additional registration or opt-in.

- No Additional Costs: Rakuten Securities does not charge any extra fees for providing negative balance protection, ensuring that clients can benefit from this risk management feature without incurring additional expenses.

- Transparent Terms and Conditions: The broker clearly outlines the terms and conditions of their negative balance protection policy in their client agreement and risk disclosure documents, ensuring that traders are well-informed about the scope and limitations of this feature.

Rakuten Securities Deposits and Withdrawals

Rakuten Securities supports various payment methods for deposits and withdrawals:

Deposit Methods

| Method | Fees | Processing Time | Supported Currencies |

|---|---|---|---|

| Bank Wire Transfer (Domestic & International) | No | 1–3 business days | USD, AUD, EUR, GBP |

| Credit/Debit Cards (Visa, Mastercard) | No | Instant | USD, AUD, EUR, GBP |

| E-wallets (Neteller, Skrill) | No | Instant | USD, EUR, GBP |

| China UnionPay | No | Instant | CNY (converted) |

| Instant Transfer (Southeast Asia) | No | Instant | Local currencies |

| TransferWise | No | Within 24 hours | USD, AUD, EUR, GBP |

Withdrawal Methods

| Method | Fees | Processing Time | Notes |

|---|---|---|---|

| Bank Wire Transfer (Domestic & International) | May apply (especially international) | 2–5 business days | Depends on bank |

| Credit/Debit Cards (Visa, Mastercard) | Usually free | 1–3 business days | Subject to card issuer policies |

| E-wallets (Neteller, Skrill) | May apply | Within 24 hours | Depends on provider |

| China UnionPay | Usually free | 1–3 business days | For eligible clients |

| Instant Transfer (Southeast Asia) | Usually free | Instant to 24 hours | Regional availability |

| TransferWise | May apply | Within 24–48 hours | Bank account required |

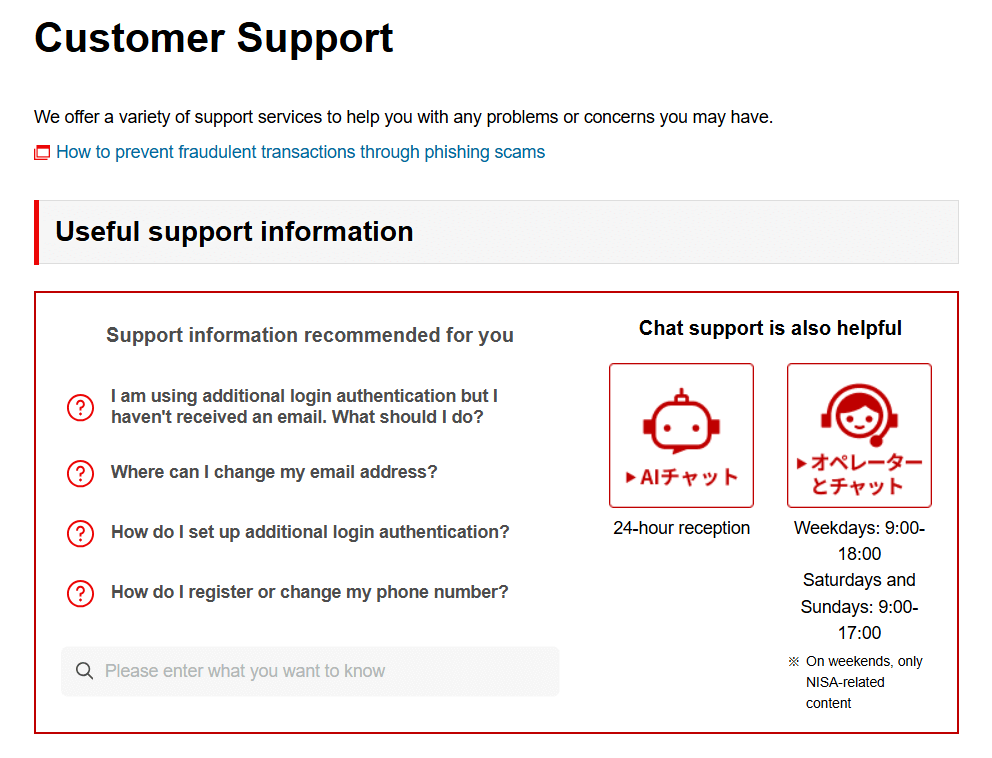

Support Service for Customer

In the fast-paced world of online trading, reliable customer support is crucial for a positive trading experience. Traders often require assistance with account-related issues, platform troubleshooting, or general enquiries, and the ability to access prompt and helpful support can significantly impact their overall satisfaction with a broker. Rakuten Securities recognises the importance of providing exceptional customer support and offers a range of channels through which traders can reach their dedicated support team.

Customer Support Channels

Rakuten Securities provides multiple ways for traders to contact their customer support team, ensuring that assistance is readily available when needed. These channels include:- Live Chat: Traders can access instant support through the live chat feature on Rakuten Securities' website, allowing them to connect with a support representative in real-time.

- Email: Clients can send their enquiries or concerns via email to Rakuten Securities' support team, with the assurance of receiving a prompt and detailed response.

- Phone: Rakuten Securities offers phone support, enabling traders to speak directly with a customer support representative for more complex issues or urgent matters.

- Social Media: Traders can reach out to Rakuten Securities through their official social media channels, such as Facebook, Twitter, and LinkedIn, for general enquiries or updates on the latest news and promotions.

Available Support Languages

Rakuten Securities provides customer support in multiple languages, including:- English

- Japanese

- Chinese

- Indonesian

- Vietnamese

- Thai

- Malay

- Spanish

Customer Support Comparison Table

| Channel | Availability | Languages | Average Response Time |

|---|---|---|---|

| Live Chat | 24/5 | English, Japanese, Chinese, Indonesian, Vietnamese, Thai, Malay, Spanish | 1–2 minutes |

| 24/5 | English, Japanese, Chinese, Indonesian, Vietnamese, Thai, Malay, Spanish | 1–2 hours | |

| Phone | 24/5 | English, Japanese, Chinese, Indonesian, Vietnamese, Thai, Malay, Spanish | Immediate or call-back within 1 hour |

| Social Media | 24/5 | English, Japanese, Chinese, Indonesian, Vietnamese, Thai, Malay, Spanish | 2–4 hours |

Prohibited Countries

Rakuten Securities does not accept clients from the United States.

The broker operates in several regions, including:

- Asia-Pacific

- Europe

- Middle East

- Africa

- South America

Special Offers for Customers

At the time of writing, no specific promotions or bonuses were mentioned in the provided data. However, Rakuten Securities occasionally runs special offers, such as deposit bonuses, cashback deals, or trading competitions. Interested traders should check the broker's official website or contact support for current promotions.

Conclusion

Throughout this comprehensive review, I have thoroughly examined Rakuten Securities' offerings, evaluating their regulation, trading conditions, platforms, account types, and overall reputation.

Rakuten Securities stands out as a trustworthy and reliable broker, backed by a strong parent company and a commitment to regulatory compliance. Their licensing from top-tier authorities like ASIC, FSA, and SFC demonstrates a dedication to client protection and financial security.

The broker's competitive trading environment, with low spreads, commission-free pricing, and a choice of account types, caters to a wide range of traders. The MT4 platform, while not the most cutting-edge, provides a stable and feature-rich trading experience that aligns with industry standards.

Rakuten Securities' educational resources and customer support channels are comprehensive, although some user reviews suggest room for improvement in terms of consistency and response times.

While the broker's product range may be more limited compared to some competitors, their focus on core markets allows them to provide deep liquidity and competitive pricing for the assets they offer.

Overall, Rakuten Securities emerges as a solid choice for traders seeking a reliable, well-regulated broker with a strong reputation and competitive trading conditions. As with any financial decision, traders should carefully consider their individual needs and conduct thorough due diligence before opening an account.

Throughout this comprehensive review, I have thoroughly examined Rakuten Securities' offerings, evaluating their regulation, trading conditions, platforms, account types, and overall reputation.

Rakuten Securities stands out as a trustworthy and reliable broker, backed by a strong parent company and a commitment to regulatory compliance. Their licensing from top-tier authorities like ASIC, FSA, and SFC demonstrates a dedication to client protection and financial security.

The broker's competitive trading environment, with low spreads, commission-free pricing, and a choice of account types, caters to a wide range of traders. The MT4 platform, while not the most cutting-edge, provides a stable and feature-rich trading experience that aligns with industry standards.

Rakuten Securities' educational resources and customer support channels are comprehensive, although some user reviews suggest room for improvement in terms of consistency and response times.

While the broker's product range may be more limited compared to some competitors, their focus on core markets allows them to provide deep liquidity and competitive pricing for the assets they offer.

Overall, Rakuten Securities emerges as a solid choice for traders seeking a reliable, well-regulated broker with a strong reputation and competitive trading conditions. As with any financial decision, traders should carefully consider their individual needs and conduct thorough due diligence before opening an account.

Compare spreads, fees, and tools in the broker reviews index.

See legacy brand performance in our FXCM review.