S.A.M. FX Review 2025: Unsafe Choice

S.A.M. Trade

Saint Vincent and the Grenadines

Saint Vincent and the Grenadines

-

Minimum Deposit $10

-

Withdrawal Fee $0

-

Leverage 1000:1

-

Spread From 1.7

-

Minimum Order 0.01

-

Forex Available

-

Crypto Available

-

Stock Unavailable

-

Indices Available

Licenses

Canada Financial Services License

Canada Financial Services License

Softwares & Platforms

Customer Support

Supported language: Arabic, Chinese (Simplified), English, French, Malay, Thai, Vietnamese

Social Media

Summary

Samtrade FX is an unregulated forex broker whose ASIC license was revoked in 2024, now operating as an offshore entity with zero investor protection, making it extremely dangerous for traders' funds. With no regulatory oversight, unverifiable trading conditions, and limited customer support, all traders should avoid Samtrade FX entirely and choose properly regulated alternatives with active ASIC, FCA, or CySEC licenses.S

- Low minimum deposit - $10 entry point

- MT4 platform available - Industry standard trading software

- Multiple account types - Standard, VIP, ECN, Islamic options

- High leverage offered - Up to 1:1000 (though risky without regulation)

- Cryptocurrency trading - Bitcoin and other crypto CFDs available

- Multiple language support - Claims multilingual customer service

- No deposit fees - Broker doesn't charge for deposits

- Swap-free accounts - Islamic account option available

- Demo account - Practice trading available

- USDT deposits - Cryptocurrency funding option

- ASIC license revoked - Lost tier-1 regulation in 2024

- No regulatory protection - Zero investor compensation schemes

- Offshore registration only - SVG FSA is not a financial regulator

- No phone support - Critical for emergency situations

- Limited customer service - Only 24/5, no weekends

- Inactivity fees - $50 after 3 months

- CopySam platform issues - Limited access, functionality questionable

- No fund segregation - Client money not protected

- Unverifiable claims - Spreads, execution, and protection unregulated

- Extensive country restrictions - Banned in major markets including US, Japan

Overview

S.A.M. trade FX, established in 2015, is an online forex and CFD broker that has undergone significant regulatory changes. Most notably, the broker's Australian Securities and Investments Commission (ASIC) license was revoked in 2024, fundamentally altering its regulatory status and risk profile. The company now operates primarily as an offshore entity registered in St. Vincent and the Grenadines, with additional registration as a Money Services Business in Canada.

The broker offers access to forex, CFDs, commodities, and cryptocurrencies through the MetaTrader 4 platform and claims to offer a proprietary CopySam social trading platform, though access to the latter appears limited. While Samtrade FX maintains low minimum deposit requirements and high leverage options, the loss of tier-1 regulation raises serious concerns about fund safety and operational integrity.

Traders can find further details on account specifications, trading instruments, platforms, promotions and FAQs on S.A.M. Trade's official website. As with all online brokers, conducting thorough due diligence on costs and comparing offerings is recommended before signing up.

Overview Table

| Attribute | Details |

|---|---|

| Broker Name | Samtrade FX (S.A.M. Trade) |

| Founded | 2015 |

| Regulatory Status | SVG FSA (registration only), FINTRAC MSB |

| ASIC Status | License REVOKED (2024) |

| Minimum Deposit | $10 USD |

| Maximum Leverage | Up to 1:1000 |

| Spreads | From 1.7 pips (EUR/USD) |

| Trading Platforms | MetaTrader 4, CopySam (limited access) |

| Account Types | Standard, VIP, ECN, Islamic |

| Base Currencies | USD |

| Customer Support | 24/5 (email, contact form) |

| Negative Balance Protection | Claimed (unverified) |

Facts List

- Critical: ASIC license revoked in 2024, removing tier-1 regulatory oversight

- Currently operates under SVG FSA registration (not regulation) and Canadian MSB status

- No meaningful investor protection or compensation schemes available

- Established in 2015, claiming 10 years of operation

- Offers 30+ forex pairs, indices, commodities, futures, and cryptocurrencies

- Minimum deposit of $10 for most account types

- Maximum leverage of 1:1000 available (no regulatory limits)

- Inactivity fee of $50 charged after 3 months

- No phone support available

- Prohibited in multiple countries including USA, Japan, and Israel

S.A.M. Trade Licenses and Regulatory

Current Status: UNREGULATED

SVG FSA Registration: St. Vincent and the Grenadines Financial Services Authority provides business registration only - this is NOT financial regulation and offers zero investor protection.

FINTRAC MSB Registration: Registration Number M19977589 - This Canadian registration only covers anti-money laundering compliance, not trading operations or investor protection.

ASIC License - REVOKED: The Australian Securities and Investments Commission revoked Samtrade FX's license in 2024. This is extremely serious as ASIC only takes such action for significant compliance failures or misconduct.

Trading Instruments

Samtrade FX claims to offer various trading instruments, though without regulatory oversight, these offerings cannot be independently verified:

| Category | Number of Assets | Leverage | Trading Hours | Minimum Trade Size |

|---|---|---|---|---|

| Forex | 30+ pairs | Up to 1:1000 | 24/5 | 0.01 lots |

| Indices | Various | Up to 1:200 | Market hours | 0.01 lots |

| Commodities | 5-10 | Up to 1:500 | 24/5 | 0.01 lots |

| Cryptocurrencies | 4+ | Up to 1:5 | 24/7 | 0.01 lots |

| Futures | Various | Varies | Market hours | 0.01 lots |

Trading Platforms

MetaTrader 4 (MT4): The primary platform offered, available on desktop, web, and mobile. Standard MT4 features include charting tools, indicators, and Expert Advisors.

CopySam Platform: Advertised as proprietary social trading platform but has "limited access" issues. Availability appears restricted and may not function as advertised.

Trading Platform Comparison Table

| Feature | MetaTrader 4 | CopySam |

|---|---|---|

| Availability | Full access | Limited/Restricted |

| Platform Type | Desktop, Web, Mobile | Web (claimed) |

| Automated Trading | Yes (EAs) | Copy trading (if accessible) |

| Technical Indicators | 30+ | Unknown |

| Minimum Investment | $10 | $100 (claimed) |

| Reliability | Industry standard | Questionable |

S.A.M. Trade How to Open an Account: A Step-by-Step Guide

WARNING: Given the revoked ASIC license and lack of regulation, opening an account is NOT recommended.

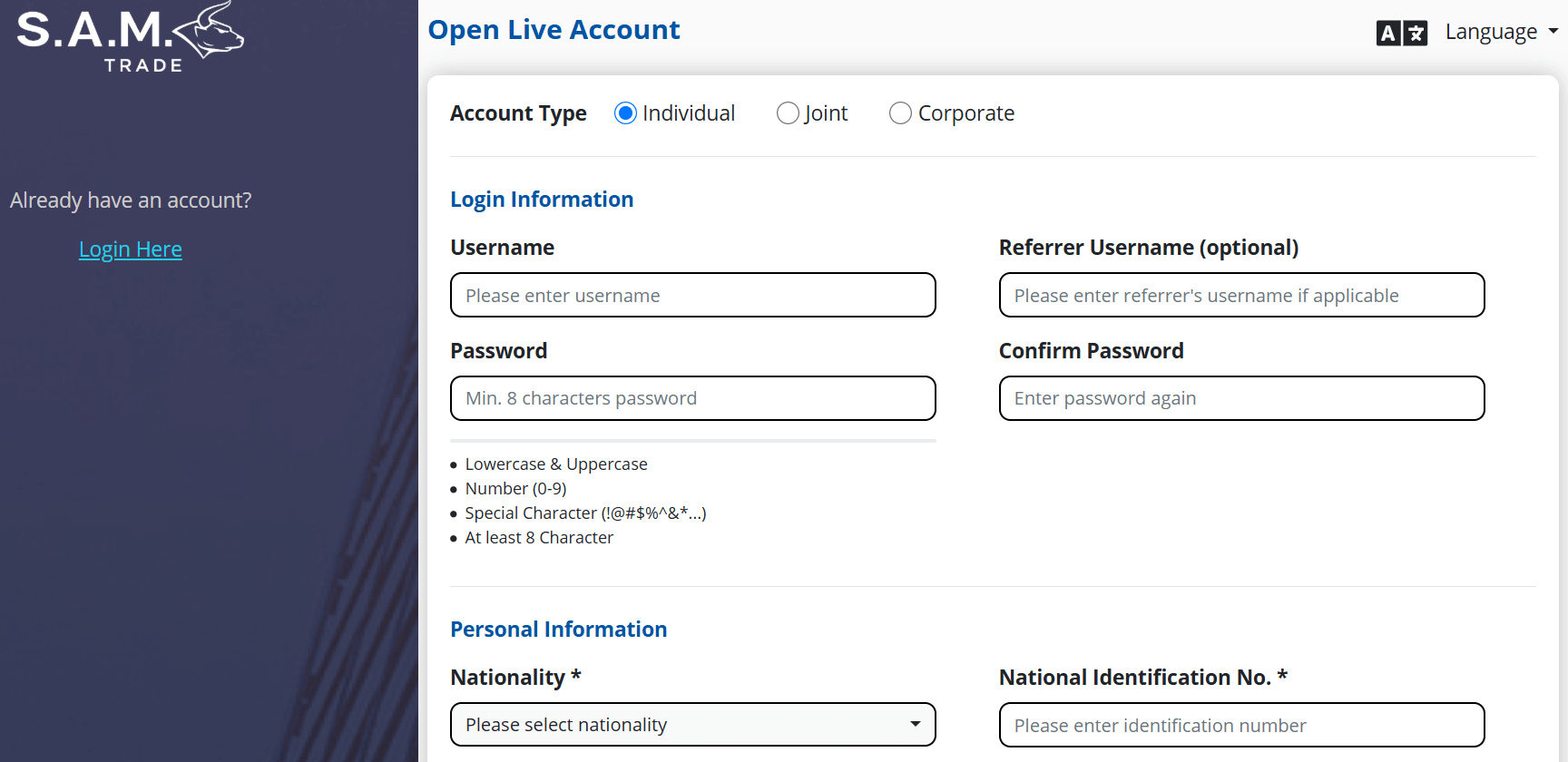

Step 1: Visit the S.A.M. Trade website Go to the official S.A.M. Trade website at samtradefx.com. Click on the "Open Live Account" button on the homepage.

Step 2: Choose your account type Select the type of account you wish to open from the available options - Standard, VIP, ECN, or Islamic. Each account type has different features and minimum deposit requirements, so choose the one that best suits your needs.

Step 3: Fill out the registration form Complete the online registration form with your personal details, including your full name, email address, phone number, country of residence, and date of birth. You'll also need to create a secure password for your account.

Step 4: Verify your identity To comply with anti-money laundering (AML) and know-your-customer (KYC) regulations, you'll need to provide proof of identity and address. This typically involves uploading a copy of your government-issued ID (such as a passport or driver's license) and a recent utility bill or bank statement.

Step 5: Fund your account Once your account is verified, you can make your initial deposit. S.A.M. Trade accepts several payment methods, including:

- Bank Wire Transfer (1-4 business days)

- Credit/Debit Card (instant)

- Tether (USDT) cryptocurrency (up to 1 business day)

The minimum deposit is $10 for Standard, VIP, and Islamic accounts, and $100 for ECN accounts.

Step 6: Download the trading platform After your deposit is processed, you can download the MetaTrader 4 (MT4) trading platform or access the web-based CopySam platform, depending on your preference. Log in using your account credentials and start trading.

Charts and Analysis

S.A.M. Trade provides a range of tools and resources to help clients analyze the markets and make informed trading decisions. The broker's offerings include:

| Feature | Description |

|---|---|

| MetaTrader 4 (MT4) Platform | A robust trading platform for clients at all levels, equipped with powerful charting and analysis tools. It includes: - 30+ built-in technical indicators (e.g., Moving Averages, MACD, RSI, Stochastic)- 24 analytical objects (lines, channels, Fibonacci tools, shapes, etc.)- 9 timeframes (from 1 minute to 1 month)- 3 chart types (bars, candles, line)- Customizable templates and profiles |

| Economic Calendar | A free, real-time economic calendar that keeps clients informed of key market events. It provides: - Date, time, and currency of the event- Event name and level of importance- Previous, forecasted, and actual figures (when applicable)- Color-coded volatility indicators |

| Trader's Club | An exclusive, paid membership program offering in-depth market analysis and insights. Benefits include: - Daily market analysis and trading ideas from professional analysts- Live trading rooms with expert traders- Educational webinars and workshops- One-on-one coaching sessions- Downloadable trading guides and e-books |

The Trader's Club is designed to help clients take their trading knowledge and skills to the next level, with personalized support and guidance from experienced professionals.

S.A.M. Trade Account Types

Four account types are advertised, though terms cannot be independently verified:

- Standard Account: $10 minimum, 1.7 pip spreads

- VIP Account: $10 minimum, tighter spreads claimed

- ECN Account: $100 minimum, raw spreads plus commission

- Islamic Account: $10 minimum, swap-free

Account Types Comparison Table

| Feature | Standard | VIP | ECN | Islamic |

|---|---|---|---|---|

| Minimum Deposit | $10 | $10 | $100 | $10 |

| Maximum Leverage | 1:1000 | 1:1000 | 1:200 | 1:500 |

| Spreads | From 1.7 pips | "Tighter" | From 0 pips | Floating |

| Commission | None | None | $5/lot RT | None |

| Swap-Free | No | No | No | Yes |

| Account Manager | No | Claimed | No | No |

| Minimum Trade | 0.01 lots | 0.01 lots | 0.01 lots | 0.01 lots |

Negative Balance Protection

Samtrade FX claims to offer negative balance protection, but without regulatory oversight, this cannot be verified or enforced. In regulated jurisdictions, this protection is mandatory and guaranteed by the regulator. With Samtrade FX's current status, any such protection is purely at the broker's discretion.

S.A.M. Trade Deposits and Withdrawals

Warning: Without regulation, there's no guarantee of fund return.

Deposit Methods

Traders can fund their S.A.M. Trade accounts using the following methods:| Deposit Method | Minimum Deposit | Processing Time | Fees |

|---|---|---|---|

| Bank Wire Transfer | $20 | 1-4 business days | No fees charged by S.A.M. Trade; banks may charge for outgoing transfers |

| Credit/Debit Card (Visa, Mastercard) | $20 | Instant | No fees charged by S.A.M. Trade; card issuers may charge for transactions |

| Tether (USDT) | USDT 50 | Up to 1 business day | No fees charged by S.A.M. Trade; blockchain network fees may apply |

Withdrawal Methods

S.A.M. Trade supports the following withdrawal methods:| Withdrawal Method | Minimum Withdrawal | Processing Time | Fees |

|---|---|---|---|

| Bank Wire Transfer | $20 | 1-4 business days | No fees by S.A.M. Trade (banks may charge) |

| Credit/Debit Card | $20 | 1-4 business days | No fees by S.A.M. Trade (card issuers may charge) |

| Tether (USDT) | USDT 50 | Up to 1 business day | No fees by S.A.M. Trade (blockchain fees may apply) |

Support Service for Customer

Customer support is limited and inadequate for an unregulated broker:

- Email: support@samtradefx.com

- Contact Form: Website only

- Phone: NOT available

- Live Chat: Limited availability for registered clients

- Languages: Multiple claimed

Customer Support Availability Table

| Day | Hours | Channels Available |

|---|---|---|

| Monday-Friday | 24 hours | Email, Contact Form |

| Saturday | Closed | None |

| Sunday | Closed | None |

| Response Time | 24-48 hours | All channels |

Prohibited Countries

Samtrade FX does not accept clients from:

Afghanistan, Belarus, Botswana, Brazil, Burundi, Colombia, Congo, Cuba, Egypt, Guinea, Guinea-Bissau, Iran, Israel, Iraq, Japan, Lebanon, Liberia, Libya, Mali, Nicaragua, Nigeria, North Korea, Pakistan, Somalia, South Africa, Spain, Sudan, Syria, Togo, Ukraine, United States, Venezuela, Yemen, Zimbabwe

Special Offers for Customers

- SamRewards Program: Points-based system (unverified benefits)

- Traders' Challenge: Competition with prizes (irregular)

- Refer-a-Friend: Referral bonuses (terms unclear)

- Trader's Club: $10,000 membership fee (poor value)

Conclusion

Samtrade FX represents a textbook case of regulatory deterioration in the forex industry, having fallen from ASIC-regulated status to operating as an essentially unregulated offshore entity following license revocation in 2024. This catastrophic regulatory failure eliminates any legitimate reason to trade with this broker, as the absence of tier-1 oversight means zero protection for client funds, no recourse in disputes, and no verification of claimed trading conditions or practices. While the broker maintains operations with SVG registration and Canadian MSB status, these provide no meaningful investor protection or regulatory oversight of trading activities. The combination of revoked ASIC license, limited customer support without phone service, restricted platform access, and unverifiable claims about spreads and execution creates an environment of extreme risk where traders' entire capital is vulnerable. Despite advertising low minimum deposits and high leverage, these apparent benefits are meaningless without the fundamental security that proper regulation provides. Any trader considering Samtrade FX should instead choose properly regulated alternatives with active ASIC, FCA, or CySEC licenses that can be independently verified. The stark reality is that Samtrade FX has transitioned from a regulated broker to an offshore operation that poses unacceptable risks to anyone who values their trading capital and financial security.

Explore raw-spread accounts via our low-cost broker index.

Next stop on your research journey: our BMFN review.