Skilling Review 2025: User-Friendly Forex Broker with Competitive Offerings and commission

Skilling

Cyprus

Cyprus

-

Minimum Deposit $100

-

Withdrawal Fee $0

-

Leverage 500:1

-

Spread From 0.7

-

Minimum Order 0.01

-

Forex Available

-

Crypto Available

-

Stock Available

-

Indices Available

Licenses

United Kingdom Market Making (MM)

United Kingdom Market Making (MM)

Cyprus Market Making (MM)

Cyprus Market Making (MM)

Japan Forex Trading License

Japan Forex Trading License

Softwares & Platforms

Customer Support

+442036086020

(English)

+442036086020

(English)

Supported language: Chinese (Simplified), English, French, German, Italian, Norwegian, Portuguese, Romanian, Spanish, Swedish, Thai, Vietnamese

Social Media

Summary

Skilling is a regulated online broker offering trading services in forex, CFDs, stocks, and cryptocurrencies. It provides a user-friendly platform with competitive spreads, fast execution, and access to popular trading tools like MT4, cTrader, and its proprietary Skilling Trader. With a strong focus on transparency and education, Skilling caters to both beginners and experienced traders.

- Regulated by CySEC and FSA, providing a level of safety and security for traders

- Offers a wide range of tradable assets, including forex, stocks, indices, commodities, and cryptocurrencies

- User-friendly proprietary platform (Skilling Trader) and popular third-party platforms (MT4 and cTrader)

- Competitive spreads and leverage, with negative balance protection for retail clients

- Multilingual customer support available through various channels

- Comprehensive educational resources and tools for traders of all levels

- Transparency in pricing and fees, with no hidden charges

- Adheres to strict regulatory requirements, ensuring fair trading practices

- Offers a free demo account for practice trading

- Provides a copy trading service for users to follow successful traders' strategies

- Limited geographical availability, with services restricted in several countries (e.g., US, Canada, Japan)

- No 24/7 customer support

- Relatively high minimum deposit for Premium accounts ($5,000)

- Limited research and analysis tools compared to some larger competitors

- No current promotions or bonuses due to regulatory restrictions

- Relatively new broker (founded in 2016) compared to more established competitors

- Seychelles entity may not provide the same level of oversight as CySEC regulation

- Charges commissions on certain account types (Premium)

- Potential fees for inactive accounts or dormant balances

- Limited customization options on the proprietary trading platform

Overview

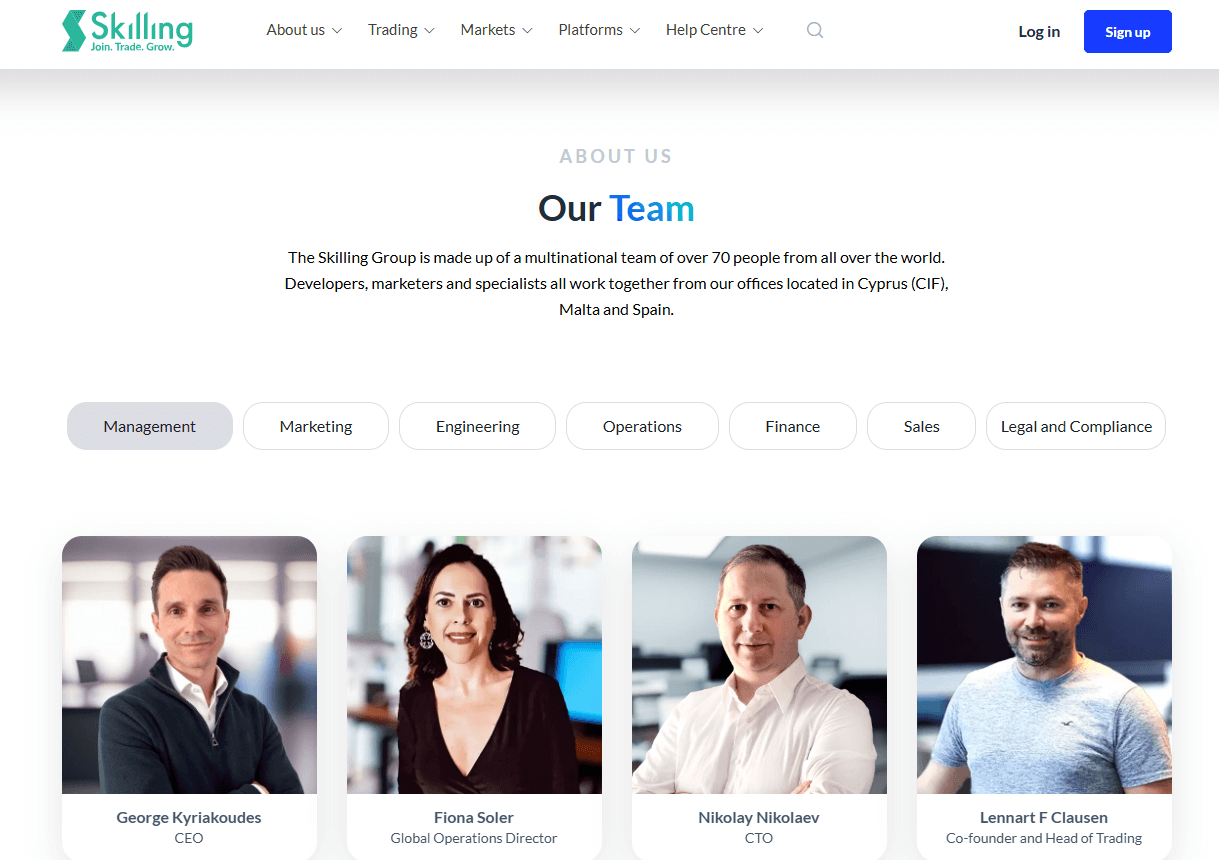

Skilling is an online broker that was established in 2016, offering trading services for forex, CFDs, stocks, indices, commodities, and cryptocurrencies. Headquartered in Cyprus with additional offices in Spain and Malta, Skilling operates globally and is regulated by the Cyprus Securities and Exchange Commission (CySEC) and the Seychelles Financial Services Authority (FSA).

The broker provides access to over 800 trading instruments through its proprietary platform, Skilling Trader, as well as the popular MetaTrader 4 (MT4) and cTrader platforms. Skilling has been recognized for its user-friendly interface and innovative features, receiving the "Best Forex Trading Platform" award at the Global Forex Awards 2022.

With competitive spreads starting from 0.1 pips and a range of account types to suit different trading styles and experience levels, Skilling aims to make trading accessible to everyone. The broker offers extensive educational resources, market analysis tools, and a copy trading service to support both beginner and advanced traders.

While Skilling has gained popularity among traders worldwide, it's essential to note that CFD trading carries a high risk of losing money rapidly due to leverage. As with any financial decision, potential clients should thoroughly research and consider their risk tolerance before investing.

For more information about Skilling's services, regulation, and trading conditions, visit their official website at skilling.com.

Overview Table

| Category | Information |

|---|---|

| Founded | 2016 |

| Headquarters | Cyprus |

| Regulation | Cyprus Securities and Exchange Commission (CySEC), Seychelles Financial Services Authority (FSA) |

| Trading Platforms | Skilling Trader, MetaTrader 4 (MT4), cTrader |

| Markets | Forex, CFDs, Stocks, Indices, Commodities, Cryptocurrencies |

| Minimum Deposit | $100 |

| Account Types | Standard, Premium, MT4 |

| Payment Methods | Credit/Debit Cards, Bank Transfer, E-wallets (Skrill, Neteller) |

| Customer Support | Live Chat, Email, Phone |

| Education | Webinars, Tutorials, Market Analysis |

| Key Features | Competitive Spreads, Copy Trading, Negative Balance Protection |

Fact List

- Skilling was founded in 2016 by a group of experienced traders and technology experts.

- The broker is regulated by CySEC in Cyprus and the FSA in Seychelles.

- Skilling offers over 800 trading instruments across forex, CFDs, stocks, indices, commodities, and cryptocurrencies.

- Clients can choose from three trading platforms: Skilling Trader, MetaTrader 4, and cTrader.

- The minimum deposit to open a live account is $100.

- Skilling provides competitive spreads starting from 0.1 pips on its Premium account.

- The broker offers a copy trading service, allowing users to automatically mirror the trades of successful investors.

- Skilling provides negative balance protection for retail clients, limiting their potential losses.

- Educational resources include webinars, tutorials, and daily market analysis.

- Customer support is available via live chat, email, and phone during weekdays.

Skilling Licenses and Regulatory

Skilling operates under a well-defined regulatory framework, holding licenses from respected financial authorities

| Regulatory Authority | Jurisdiction | License/Reference Number |

|---|---|---|

| Cyprus Securities and Exchange Commission (CySEC) | Cyprus, European Economic Area (EEA) | License No. 357/18 |

| Seychelles Financial Services Authority (FSA) | International Operations | License No. SD042 |

| Financial Conduct Authority (FCA) | United Kingdom (UK) | Temporary Permissions Regime (TPR) Reference No. 810951 |

Skilling's multiple regulatory licenses demonstrate its commitment to operating transparently and adhering to industry best practices. By submitting to the authority of reputable regulators, Skilling offers clients a higher level of security and trust compared to unregulated or loosely regulated brokers.

In conclusion, Skilling's regulation by CySEC and the FSA provides a strong foundation for client protection and trust. However, traders should still exercise caution and thoroughly assess their risk tolerance before engaging in leveraged trading.

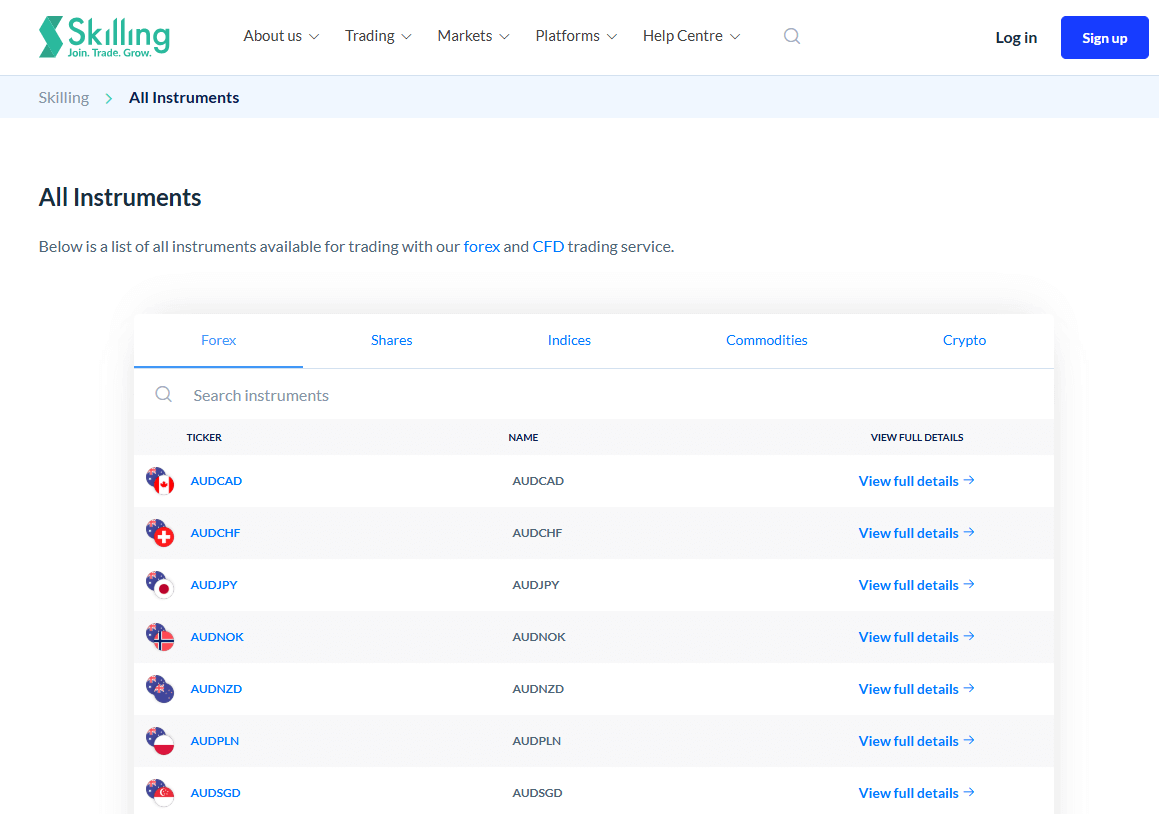

Trading Instruments

Skilling provides a diverse range of tradable assets, enabling traders to access various financial markets through a single platform. The broker offers over 800 instruments across multiple asset classes, ensuring that clients have ample opportunities to diversify their portfolios and capitalize on market movements.

| Asset Class | Details |

|---|---|

| Forex | 70+ currency pairs, including majors, minors, and exotics. Competitive spreads from 0.1 pips on Premium accounts. Popular pairs: EUR/USD, GBP/USD, USD/JPY, USD/CHF. |

| Stocks | CFDs on 700+ global stocks, covering sectors like technology, healthcare, energy, and finance. Includes companies like Apple, Amazon, Facebook, and Tesla. |

| Indices | 23 global indices, including S&P 500, NASDAQ, DAX, FTSE, and Nikkei. Leverage up to 1:20 on major indices. |

| Commodities | 21 commodities, including gold, silver, oil, and natural gas. Competitive spreads with leverage up to 1:20. |

| Cryptocurrencies | 63 cryptocurrency CFDs, including Bitcoin, Ethereum, Litecoin, and Ripple. Leverage up to 1:5 with 24/7 trading. |

Having a diverse range of tradable assets is crucial for traders as it allows them to spread risk across different markets and adapt to changing economic conditions. Skilling's extensive offering demonstrates its commitment to providing clients with a comprehensive trading experience and staying attuned to market trends.

Trading Platforms

Skilling offers a range of trading platforms to cater to the diverse needs and preferences of its clients. Whether you're a beginner or an experienced trader, Skilling's platforms provide user-friendly interfaces, advanced features, and reliable performance to support your trading journey.

| Trading Platform | Description |

|---|---|

| Skilling Trader | Proprietary web-based platform with an intuitive interface, real-time quotes, interactive charts, technical indicators, and a trade assistant for beginners. |

| MetaTrader 4 (MT4) | Popular platform offering advanced charting tools, technical indicators, and automated trading via Expert Advisors (EAs). Known for stability, speed, and customizability. |

| cTrader | Designed for professional traders with fast execution speeds, advanced order types, and depth of market (DOM) functionality. Offers a clean and customizable interface. |

| Mobile Trading | Available on iOS and Android, allowing traders to manage accounts and execute trades on the go. Features include real-time quotes, charts, and trade management. |

| Web-Based Trading | Accessible via web browsers with full functionality for Skilling Trader, MT4, and cTrader. Allows access from any internet-connected device. |

Skilling's diverse range of trading platforms caters to the varying levels of experience and trading styles of its clients. By offering popular platforms like MT4 and cTrader alongside its proprietary Skilling Trader, the broker ensures that clients have access to the tools they need to analyze markets, execute trades, and manage their portfolios effectively.

Trading Platforms Comparison Table

| Feature | Skilling Trader | MetaTrader 4 (MT4) | cTrader |

|---|---|---|---|

| Platform Type | Web-based | Desktop, Web, Mobile | Desktop, Web, Mobile |

| User Level | Beginner-friendly | All levels | Advanced |

| Charting | Basic | Advanced | Advanced |

| Technical Indicators | 30+ | 50+ | 70+ |

| Order Types | Basic | Advanced | Advanced |

| Automated Trading | No | Yes (EAs) | Yes (cBots) |

| Customizability | Limited | High | High |

| Ease of Use | Very Easy | Moderate | Moderate |

| Mobile App | Yes | Yes | Yes |

Skilling How to Open an Account: A Step-by-Step Guide

Opening an account with Skilling is a straightforward process that can be completed entirely online. Follow these steps to get started:

Step 1: Visit the Skilling website and click on the "Open Account" button in the top right corner of the homepage.

Step 2: Choose your account type (Standard, Premium, or MT4) and select your preferred base currency (USD, EUR, GBP, SEK, or NOK).

Step 3: Fill in your personal information, including your full name, date of birth, country of residence, and contact details (email address and phone number).

Step 4: Provide your employment and financial information, such as your occupation, annual income, and trading experience. This information is required to assess your suitability for trading and to comply with regulatory requirements.

Step 5: Complete the brief questionnaire about your trading knowledge and experience. This helps Skilling determine whether leveraged trading is appropriate for you and enables them to provide relevant educational materials.

Step 6: Upload the required verification documents, which typically include:

- Proof of identity: A valid government-issued ID, such as a passport or driver's license.

- Proof of address: A recent utility bill, bank statement, or official document showing your name and address (issued within the last 3 months).

Step 7: Review and accept the terms and conditions, privacy policy, and risk disclosure statement.

Step 8: Submit your application and wait for Skilling to verify your account. This process usually takes less than 24 hours.

Step 9: Once your account is approved, log in to your Skilling account and make your initial deposit using one of the available payment methods, such as credit/debit card, bank transfer, or e-wallets (Skrill, Neteller).

Step 10: Download the trading platform of your choice (Skilling Trader, MT4, or cTrader) or access the web-based platform to start trading.

Charts and Analysis

Skilling provides a range of tools and resources to support traders in their market analysis and decision-making processes. These features are designed to cater to both beginners and experienced traders, helping them navigate the financial markets more effectively.

| Feature | Description |

|---|---|

| Charts & Technical Analysis | Skilling Trader, MT4, and cTrader provide advanced charting tools, including candlestick, bar, and line charts. Supports technical indicators like moving averages, MACD, RSI, and Bollinger Bands, along with drawing tools such as trend lines, Fibonacci levels, and support/resistance levels. |

| Economic Calendar | Provides real-time updates on market-moving events like central bank decisions, GDP releases, and employment reports. Traders can filter events by currency, importance, and time frame. |

| Market News & Analysis | Daily market insights via blog and video updates. Covers forex, stocks, indices, commodities, and cryptocurrencies, helping traders stay informed about key market trends. |

| Educational Resources | Includes trading guides, video tutorials, webinars, and a detailed FAQ section. Covers topics such as forex trading, technical analysis, risk management, and platform tutorials. Suitable for all experience levels. |

| Comparison to Industry Standards | Skilling's charting tools, market analysis, and educational materials are competitive with well-established brokers, providing traders with essential tools for informed decision-making. |

Overall, Skilling's commitment to providing a diverse suite of tools and resources demonstrates its dedication to supporting its clients' trading success. By continually investing in the development and improvement of these resources, Skilling aims to empower traders to navigate the financial markets with confidence.

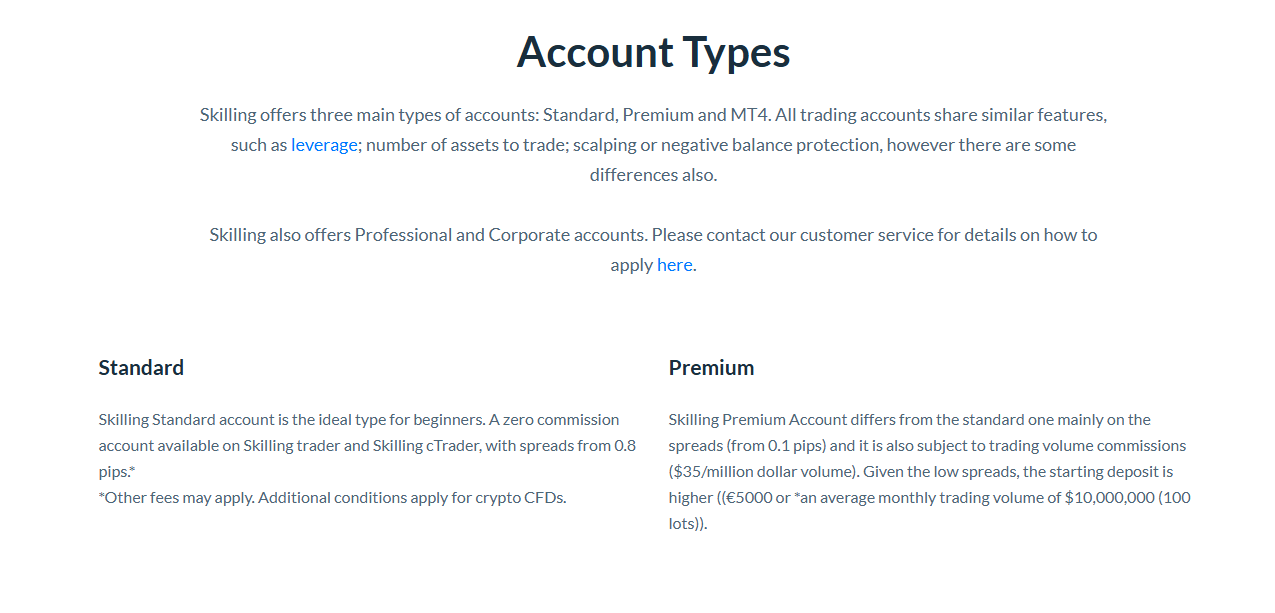

Skilling Account Types

Skilling offers three main account types to cater to the diverse needs and preferences of traders. Each account type comes with unique features, trading conditions, and benefits, allowing traders to choose the most suitable option based on their experience, trading style, and capital.

Standard Account

The Standard Account is ideal for beginner traders who are looking for a cost-effective way to start their trading journey. Key features include:

- Minimum deposit: $100 / €100 / £100 / 1,000 SEK / 1,000 NOK

- Spreads starting from 0.7 pips

- No commissions

- Leverage up to 1:30

- Access to Skilling Trader and cTrader platforms

- Negative balance protection

Premium Account

The Premium Account is designed for more experienced traders who seek tighter spreads and advanced trading features. Characteristics of the Premium Account include:

- Minimum deposit: $5,000 / €5,000 / £5,000 / 50,000 SEK / 50,000 NOK

- Spreads starting from 0.1 pips

- Commission of $35 per million traded on forex and spot metals

- Leverage up to 1:30

- Access to Skilling Trader and cTrader platforms

- Dedicated account manager

- Negative balance protection

MT4 Account

The MT4 Account is tailored for traders who prefer the familiarity and advanced features of the MetaTrader 4 platform. This account type offers:

- Minimum deposit: $100 / €100 / £100 / 1,000 SEK / 1,000 NOK

- Spreads starting from 0.7 pips

- No commissions

- Leverage up to 1:30

- Access to the MT4 platform

- Negative balance protection

Demo Account

In addition to the live trading accounts, Skilling provides a demo account that allows traders to practice trading strategies and familiarize themselves with the platforms in a risk-free environment. The demo account features:

- Virtual balance of $10,000

- Access to all trading platforms (Skilling Trader, cTrader, and MT4)

- Real-time market data and trading conditions

- No expiration date

- Easy transition to a live account

By offering a range of account types, Skilling ensures that traders can select an account that aligns with their trading objectives, experience level, and capital. The variety of options demonstrates Skilling's commitment to providing a flexible and inclusive trading environment for all types of traders.

- Standard Account

- Premium Account

- MT4 Account

- Demo Account

Account Types Comparison Table

| Feature | Standard Account | Premium Account | MT4 Account |

|---|---|---|---|

| Minimum Deposit | $100 / €100 / £100 / 1,000 SEK / 1,000 NOK | $5,000 / €5,000 / £5,000 / 50,000 SEK / 50,000 NOK | $100 / €100 / £100 / 1,000 SEK / 1,000 NOK |

| Spreads | Starting from 0.7 pips | Starting from 0.1 pips | Starting from 0.7 pips |

| Commissions | No | $35 per million traded on forex and spot metals | No |

| Leverage | Up to 1:30 | Up to 1:30 | Up to 1:30 |

| Platforms | Skilling Trader, cTrader | Skilling Trader, cTrader | MetaTrader 4 (MT4) |

| Negative Balance Protection | Yes | Yes | Yes |

Negative Balance Protection

Skilling's Negative Balance Protection Policy: Skilling offers negative balance protection to all retail clients as part of their commitment to responsible trading and client fund protection. Under this policy, if a trader's account balance falls into negative territory, Skilling will absorb the loss and reset the account balance to zero. This means that traders cannot owe money to Skilling as a result of trading losses. It's important to note that negative balance protection does not apply to professional clients or elective professional clients. These clients are assumed to have a higher level of trading experience and knowledge, and they accept the increased risks associated with their professional status. Terms and Conditions: While Skilling's negative balance protection provides a valuable safety net for retail traders, it's crucial to understand the terms and conditions associated with this policy:

- Negative balance protection applies only to trading-related losses. It does not cover losses due to technical issues, platform malfunctions, or other non-trading related events.

- Traders must maintain sufficient margin in their accounts to support their open positions. If a trader's account balance falls below the required margin level, Skilling reserves the right to close out some or all of the open positions to protect the trader's account from further losses.

- Skilling may, at its discretion, waive the negative balance protection in cases where the trader is found to have abused the policy or engaged in fraudulent activity.

Skilling Deposits and Withdrawals

Skilling offers a range of convenient deposit and withdrawal methods to ensure that traders can easily manage their funds. The broker aims to provide a seamless and secure experience for clients when processing transactions.

Deposit Methods

| Method | Processing Time | Fees | Minimum Deposit |

|---|---|---|---|

| Credit/Debit Cards (Visa, Mastercard) | Instant | No fees | Varies by account type |

| Bank Transfer | 2-5 business days | No fees | Varies by account type |

| Skrill | Instant | No fees from Skilling (Skrill fees may apply) | Varies by account type |

| Neteller | Instant | No fees from Skilling (Neteller fees may apply) | Varies by account type |

Minimum Deposit by Account Type

| Account Type | Minimum Deposit |

|---|---|

| Standard Account | $100 / €100 / £100 / 1,000 SEK / 1,000 NOK |

| Premium Account | $5,000 / €5,000 / £5,000 / 50,000 SEK / 50,000 NOK |

| MT4 Account | $100 / €100 / £100 / 1,000 SEK / 1,000 NOK |

Withdrawal Methods

| Method | Processing Time | Fees | Minimum Withdrawal |

|---|---|---|---|

| Credit/Debit Cards (Visa, Mastercard) | 1-3 business days | No fees | $50 / €50 / £50 / 500 SEK / 500 NOK |

| Bank Transfer | 2-5 business days | No fees | $50 / €50 / £50 / 500 SEK / 500 NOK |

| Skrill | 1-3 business days | No fees from Skilling (Skrill fees may apply) | $50 / €50 / £50 / 500 SEK / 500 NOK |

| Neteller | 1-3 business days | No fees from Skilling (Neteller fees may apply) | $50 / €50 / £50 / 500 SEK / 500 NOK |

Deposit and Withdrawal Policies

- Verification Required: Clients must verify their identity and address before processing withdrawals.

- Required Documents: Proof of identity (passport or government-issued ID) and proof of address (utility bill or bank statement).

- Maximum Limits: No maximum deposit or withdrawal limits, but larger deposits may require additional verification checks.

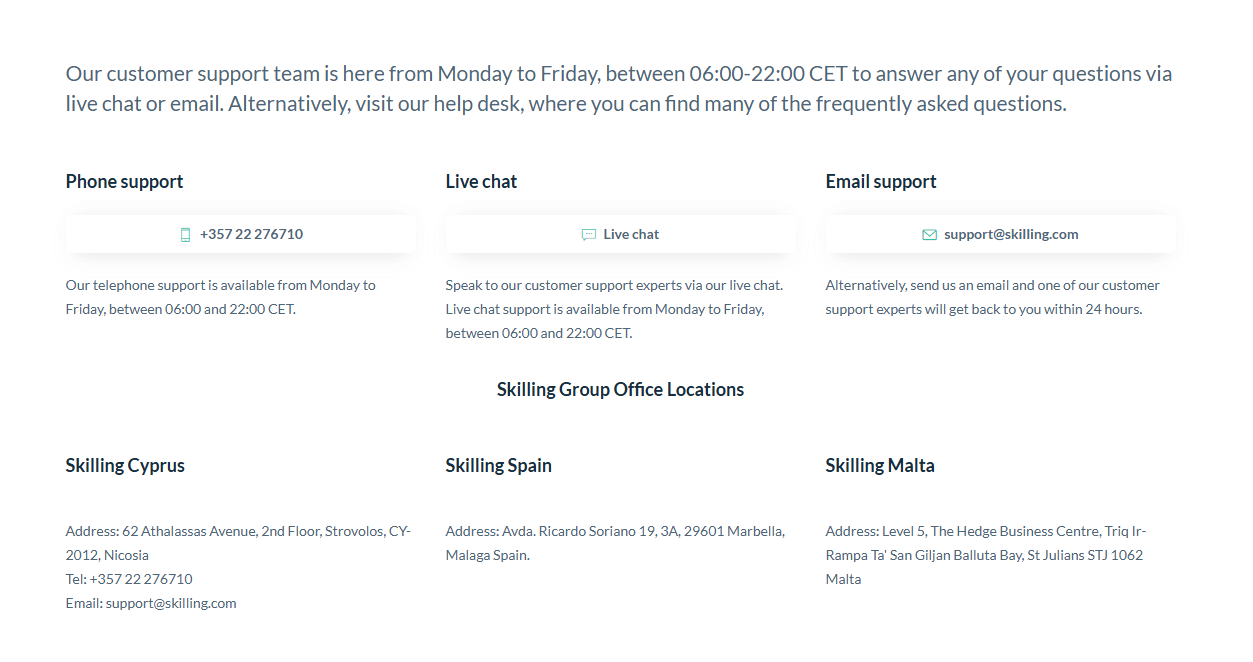

Support Service for Customer

Reliable customer support is a crucial aspect of a positive trading experience. Traders should have access to knowledgeable and responsive support teams to address their queries, concerns, and technical issues promptly. Skilling recognizes the importance of customer support and offers several channels through which traders can reach out for assistance.

Support Channels

Support Languages: Skilling's customer support is available in several languages to cater to their international clientele. These include:- English

- German

- Spanish

- French

- Italian

- Portuguese

- Romanian

- Swedish

- Norwegian

- Thai

- Vietnamese

- Chinese

| Support Channel | Details | Response Time |

|---|---|---|

| Live Chat | Available on the Skilling website for real-time support. | 1-2 minutes |

| Traders can send inquiries to support@skilling.com. | 24 hours | |

| Phone | International: +44 208 080 6555 Cyprus: +357 2227 6710 | 1-2 minutes |

| Social Media | Available on Facebook, Twitter, and Instagram for support. | Varies |

Prohibited Countries

Skilling is prohibited from offering its services in the following countries and regions:

- United States of America

- Canada

- Japan

- Australia

- Belgium

- North Korea

- Iran

- Cuba

- Sudan

- Syria

Consequences of Trading from Prohibited Countries: Attempting to trade with Skilling from a prohibited country can result in several consequences:

- Account Termination: If Skilling discovers that a client is trading from a prohibited country, the broker reserves the right to terminate the client's account immediately.

- Funds Forfeiture: In some cases, clients from prohibited countries may forfeit their account balances if they are found to be in violation of Skilling's terms of service.

- Legal Consequences: Trading with Skilling from a prohibited country may violate local laws and regulations, potentially resulting in legal consequences for the client.

It is crucial for traders to ensure that they are eligible to open an account with Skilling before attempting to do so. By checking the list of prohibited countries and understanding the potential consequences of trading from these regions, traders can avoid any complications or legal issues.

Special Offers for Customers

As Skilling is regulated by the Cyprus Securities and Exchange Commission (CySEC), they are subject to the European Securities and Markets Authority (ESMA) regulations, which prohibit the offering of bonuses or other incentives to retail traders in order to protect consumers. This is a common restriction among European regulated brokers.

While Skilling may have offered promotions in the past (Refer to a Friend) or may offer them in the future, there are no active special offers listed on their website or in other reputable sources at this time.

It's important to note that the absence of special offers does not necessarily detract from the overall quality of a broker. Traders should evaluate brokers based on factors such as regulation, trading conditions, platforms, customer support, and educational resources to determine which broker best suits their needs.

Conclusion

In this comprehensive review, I have thoroughly examined Skilling, a global online broker, to assess its safety, reliability, and overall reputation. By analyzing various aspects of Skilling's operations, including regulatory compliance, geographical jurisdictions, customer support, and more, I have gained valuable insights into their trustworthiness and dependability as a broker.

One of the most crucial factors in determining a broker's safety is their regulatory compliance. Skilling is regulated by the Cyprus Securities and Exchange Commission (CySEC) and the Seychelles Financial Services Authority (FSA). While CySEC is a well-respected regulatory body in Europe, it's important to note that Skilling's Seychelles entity may not provide the same level of oversight and protection as its European counterpart. Nonetheless, Skilling's adherence to regulatory requirements and their commitment to transparency and fair trading practices are commendable.

Skilling's geographical reach is extensive, with clients from over 100 countries able to access their services. However, it's essential to be aware of the restricted countries, such as the United States, Canada, and Japan, where Skilling is prohibited from operating due to regulatory constraints. Traders from these countries will need to seek alternative brokers.

In terms of trading platforms, Skilling offers a range of options, including their proprietary Skilling Trader, MetaTrader 4 (MT4), and cTrader. These platforms cater to traders of all experience levels and provide a user-friendly interface, advanced charting tools, and a wide array of technical indicators. Skilling's commitment to offering reliable and technologically advanced trading platforms is evident.

Customer support is another area where Skilling shines. They offer multiple channels for clients to seek assistance, including live chat, email, and phone support in various languages. While their customer support is not available 24/7, their extended hours and prompt response times ensure that traders can receive the help they need in a timely manner.

One aspect where Skilling falls short compared to some competitors is the lack of current special offers or promotions. As a CySEC-regulated broker, Skilling is subject to ESMA regulations that restrict the offering of bonuses and other incentives to retail clients. While this may be disappointing for some traders, it is ultimately a measure put in place to protect consumers and ensure fair trading practices.

Overall, Skilling presents itself as a reliable and trustworthy broker that prioritizes the needs of its clients. Their strong regulatory compliance, wide range of tradable assets, user-friendly platforms, and excellent customer support make them a compelling choice for traders seeking a safe and transparent trading environment.

However, as with any financial decision, it's crucial for traders to conduct their own research and consider their individual trading needs and risk tolerance before choosing a broker. While Skilling has many positive attributes, traders should be aware of the potential limitations, such as the lack of 24/7 customer support and the absence of current promotional offers.

In conclusion, Skilling is a solid choice for traders seeking a regulated, user-friendly, and reliable broker. Their commitment to providing a safe and transparent trading environment, coupled with their advanced trading platforms and excellent customer support, makes them a strong contender in the competitive world of online brokers.

Look up swap-free accounts in the Islamic broker section.

Looking for high leverage? Read the FXGT review next.