Spreadex Review: A Comprehensive Broker Analysis

Spreadex

United Kingdom

United Kingdom

-

Minimum Deposit $1

-

Withdrawal Fee $0

-

Leverage 100:1

-

Spread From 0.1

-

Minimum Order 0.01

-

Forex Available

-

Crypto Available

-

Stock Unavailable

-

Indices Available

Licenses

United Kingdom Market Making (MM)

United Kingdom Market Making (MM)

Softwares & Platforms

Customer Support

+441727895000

(English)

+441727895000

(English)

Supported language: English

Social Media

Summary

Spreadex is a UK-based broker founded in 1999, regulated by the FCA, and known for its strong reputation in spread betting, CFD trading, and sports betting. It offers over 15,000 instruments across forex, shares, commodities, indices, and more, with spreads starting from 0.1 pips. The broker provides access to proprietary web, mobile platforms, and TradingView integration. Clients enjoy low minimum deposits from $1, flexible funding options, and responsive 7-day customer support.

- FCA-regulated with 20+ year track record

- Extensive 15,000+ tradable instruments across assets

- Innovative platform with smart tools like pattern recognition

- Spreads from just 0.1 pips, low $1 minimum deposit

- Fast same-day funding with no withdrawal fees

- Negative balance protection for added safety

- Wide free educational materials and market analysis

- Prompt, professional customer support team

- Bonuses like $500 welcome match and $25 no-deposit credit

- TradingView integration and AutoChartist signals

- No 24/7 support outside market hours

- Limited product range compared to some brokers

- No VPS hosting for EAs and high-frequency strategies

- Educational webinar and video library could be expanded

- Minor website navigation and interface quirks

- Only 3 base currencies available for accounts

- Islamic swap-free accounts not offered

- Maximum leverage capped at 1:200 for Pro accounts

- Dealing desk model may not suit scalpers

- Limited social trading features and copy trading

Overview

Spreadex is a UK-based broker established in 1999, offering spread betting, CFD trading, and sports betting services. Regulated by the Financial Conduct Authority (FCA) for its financial trading services, Spreadex has built a strong reputation over its 20+ years in the industry. With a headquarters in St. Albans, Spreadex caters to retail and professional clients, providing a wide range of tradable instruments and competitive trading conditions.

More details about their offerings can be found on the official Spreadex website.

Overview table

| Details | |

|---|---|

| Regulation | Financial Conduct Authority (FCA) - No. 190941 |

| Trading Platforms | Proprietary Web, Mobile, TradingView |

| Products | 15,000+ instruments (forex, indices, shares, commodities, bonds, ETFs, options, cryptos) |

| Spread | From 0.1 pips (EUR/USD) |

| Leverage | Up to 1:30 (retail), 1:200 (professional) |

| Min Deposit | $1 |

| Funding | Bank transfer, card, Apple Pay |

| Founded | 1999 |

| Headquarters | St Albans, UK |

Facts

- Established in 1999 with over 20 years of industry experience

- Regulated by the top-tier UK Financial Conduct Authority (FCA)

- Offers 15,000+ tradable instruments across multiple asset classes

- Proprietary web and mobile trading platforms plus TradingView

- Fixed and variable spreads from 0.1 pips on EUR/USD

- Leverage up to 1:30 for retail and 1:200 for professional clients

- No minimum deposit and low $1 minimum to open an account

- Multiple funding options including bank transfer, debit/credit card, Apple Pay

- Prompt customer support via phone, email, live chat 7 days a week

- In-house expert analysis and educational resources for clients

Spreadex Licenses and Regulatory

Spreadex operates as an FCA-regulated broker under its subsidiary Spreadex Ltd, which is authorized and regulated by the Financial Conduct Authority (FCA) in the United Kingdom under registration number 190941.

The FCA is considered a top-tier regulator known for its strict oversight and high standards. Spreadex's long-standing FCA regulation lends strong credibility to its operations.

As an FCA-regulated broker, Spreadex must adhere to strict financial standards, including:

- Segregating client funds from corporate funds in Tier-1 bank accounts

- Maintaining a minimum capital adequacy ratio

- Undergoing regular audits and submitting periodic reports

- Participating in the Financial Services Compensation Scheme (FSCS) which protects clients' funds up to £85,000 in the unlikely event of broker insolvency

- Following guidelines around responsible marketing and advertising practices

Trading Instruments

Spreadex offers an extensive selection of 15,000+ tradable instruments, providing access to diverse markets.

| Category | Details |

|---|---|

| Forex | 80+ major, minor and exotic FX pairs with tight spreads |

| Indices | 30+ global stock indices including Wall Street, UK 100, Germany 30 |

| Commodities | 20+ commodities across metals, energies, softs |

| Equities | 1000+ international share CFDs with low commissions |

| Bonds & Interest Rates | 13 government bonds and rates including Gilts, Treasuries |

| ETFs | 20+ ETF CFDs tracking indices, sectors, commodities |

| Options | 30+ FX and commodity options |

| Cryptocurrencies | 9 crypto CFDs including Bitcoin, Ethereum, Litecoin |

More details about Spreadex's available markets and specific instruments can be found on their website. The range caters well to the needs of both novice and experienced traders.

The extensive asset selection allows traders to diversify across markets and implement strategies in varying conditions. This breadth of offering also indicates Spreadex's strong industry connections.

Trading Platforms

Spreadex provides several options to access the markets, catering to different trading styles and preferences:

Web Trading

Spreadex's proprietary web platform is user-friendly and packed with tools like advanced charts, one-click trading, price alerts. Access via any modern web browser.

Mobile App

Native mobile apps for iOS and Android devices to trade on the go. Includes core features of the web version like live quotes, charts, news.

TradingView

Spreadex offers full integration with the powerful TradingView platform for advanced charting and social trading features. Accessible via web and mobile.

The Spreadex platforms are designed to be intuitive for beginners while offering the functionality demanded by expert traders. Enhanced features like interactive charts and pattern recognition set Spreadex apart.

Alongside manual trading, the platforms also facilitate automated trading solutions via API. This allows algorithmic traders to execute their strategies seamlessly.

Spreadex is committed to providing a stable, cutting-edge trading environment to clients. Regular updates introduce new tools and optimize the user experience.

platforms Comprisan table

| Feature | Web-Based | Mobile Apps | TradingView Integration |

|---|---|---|---|

| Charts | 50+ indicators, 15 time frames | 40+ indicators, 15 time frames | 100+ indicators, 11 time frames |

| Order Types | Buy, Sell, Limit, Stop, Trailing Stop | Buy, Sell, Limit, Stop | Buy, Sell, Limit, Stop, Trailing Stop |

| Pattern Recognition | Yes | No | Yes |

| Alerts | Yes | Yes | Yes |

| News Feed | Yes | Yes | Yes |

| Research | Yes | Limited | Yes |

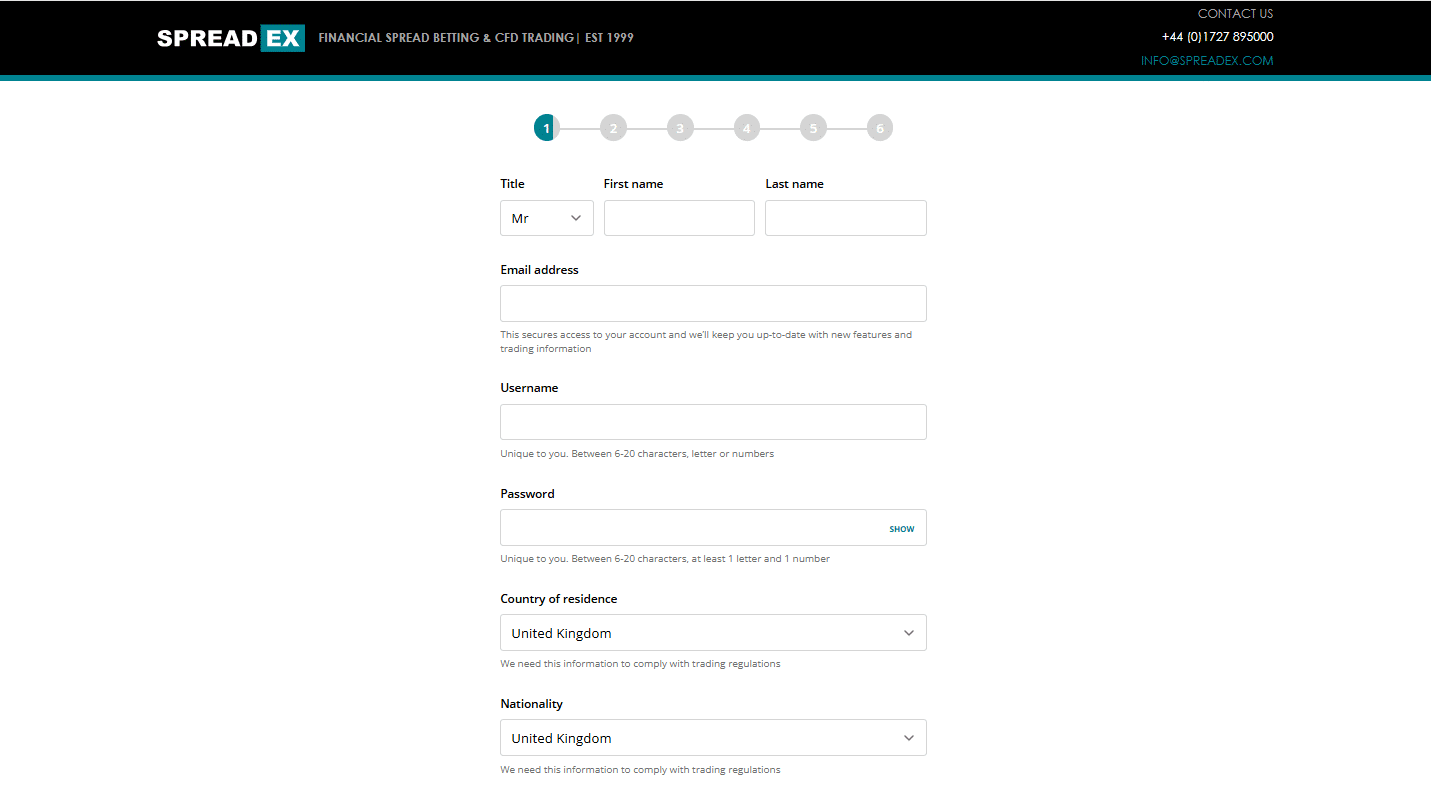

Spreadex How to Open an Account: A Step-by-Step Guide

Opening a live trading account with Spreadex is a quick and straightforward process:

- Visit the Spreadex website and click on 'Open an Account' button.

- Fill out the online application form with your personal details, including full name, date of birth, address, and contact information.

- Verify your identity and residency by uploading supporting documents, such as government-issued ID and proof of address.

- Complete the brief trading experience questionnaire to determine your risk profile and eligibility for different account types (e.g., retail or professional).

- Choose your preferred account base currency (GBP, EUR, USD) and select any welcome bonus or promotion you wish to opt-in to.

- Review and accept the broker's terms and conditions, including the risk disclosure statement.

- Submit your application and wait for email confirmation from Spreadex. Approval usually takes under 24 hours.

- Fund your account using one of the supported payment methods (bank transfer, card, Apple Pay) to begin trading.

Charts and Analysis

Spreadex equips traders with an arsenal of research and analysis tools:

| Feature | Description |

|---|---|

| Interactive Charts | Web platform and TradingView integration with 50+ indicators, 15 timeframes, and graphical objects for detailed analysis. |

| Pro Pattern Scanner | Proprietary Automatic Pattern Recognition tool to identify candlestick patterns for potential trade setups. |

| Trading Signals | Actionable buy/sell signals based on technical indicators like RSI, MACD, and moving averages. |

| Market News and Insights | Real-time updates from Reuters and in-house research providing daily technical and fundamental analysis. |

| Economic Calendar | Tracks scheduled events, forecasts, and historical data that could impact the markets. |

| Sentiment Indicators | Market mood measures, including long/short ratios and trader positioning, for contrarian trading strategies. |

These tools are neatly integrated into the main Spreadex platform, so traders can access them without navigating away. The combination of world-class third-party tools like TradingView and proprietary innovations like pattern recognition demonstrates Spreadex's commitment to delivering value to clients.

The research offer strikes a good balance between empowering self-directed traders and providing expert guidance. The materials are useful for both short-term and long-term traders.

Spreadex Account Types

Spreadex offers three main account types tailored to different trading needs and experience levels:

Standard Account

The default option for retail traders. Minimum deposit of just $1. Spreads from 0.6 pips on FX. Up to 1:30 leverage. Negative balance protection.

Professional Account

For clients meeting certain criteria like trading volume and experience. Tighter spreads. Up to 1:100 leverage. No negative balance protection.

Demo Account

Risk-free practice account loaded with virtual funds. Access to live prices and features. Ideal for testing strategies and platforms.

The low minimum deposit makes it easy for beginners to start trading. Useful educational resources smooth the learning curve.

Experienced traders will appreciate the tighter spreads and added flexibility of the Professional account when eligible. Though leverage is capped at 1:30 and 1:100 respectively per ESMA rules.

The demo environment is ideal for hands-on learning and strategizing without risk. Ample $10k virtual balance. No time restrictions.

One notable downside is the lack of a swap-free Islamic account for Muslim traders. Spreadex should consider adding this.

Overall, Spreadex's account lineup is streamlined but sufficiently varied to accommodate traders of different styles and sizes. Standout elements are the low-cost entry point, professional upgrade path, and unlimited demo.

Account Types comparison table

| Feature | Standard | Professional | Demo |

|---|---|---|---|

| Minimum Deposit | $1 | $1 | $0 |

| Maximum Leverage | 1:30 | 1:100 | 1:30 |

| Spread on EUR/USD | 0.6 pips | 0.1 pips | 0.6 pips |

| Account Base Currencies | GBP, EUR, USD | GBP, EUR, USD | GBP |

| Market Instruments | 8000+ | 15000+ | 8000+ |

| Negative Balance Protection | Yes | No | Yes |

| Islamic Account | No | No | No |

Negative Balance Protection

Negative balance protection is a vital risk management safeguard offered by Spreadex to its retail clients. In essence, it ensures that a trader's losses can never exceed their account balance. Trading with leverage always carries the risk of losses surpassing deposited funds in highly volatile conditions or with sudden price gaps. Negative balance protection prevents accounts from falling into a negative equity state. For example, say a trader with a $1,000 account takes a $20,000 leveraged position in GBP/USD ahead of a major news event like the Brexit referendum. If the trade moves sharply against them, negative balance protection will automatically close out the position once the account equity reaches zero. The trader cannot lose more than their $1,000 deposit. This contrasts with the alternative where, if the GBP/USD position dropped $1,500 in value, the account balance would show as -$500 and the broker may request the additional funds from the trader. As an FCA-regulated broker, Spreadex is required to provide negative balance protection to retail clients as part of fair and transparent market practices. It's a default safeguard applied to all standard retail accounts. Professional clients who meet certain criteria for trading experience, frequency, and portfolio size can waive their right to negative balance protection. This allows them to access higher leverage caps. However, even professionals are always aware of their maximum risk on any given trade. Spreadex's negative balance protection instills peace of mind for novice and casual traders, creating a safer environment to learn and trade the markets without fear of falling into unsustainable levels of debt. It's a sign of the broker's commitment to responsible trading.

Spreadex Deposits and Withdrawals

Spreadex supports several convenient funding methods for deposits and withdrawals:

Deposit Method

| Deposit Method | Processing Time | Fees | Additional Info |

|---|---|---|---|

| Bank Transfer | UK: Instant (Faster Payments) / International: 1 business day | Free (Bank charges may apply) | Available for GBP, EUR, USD. |

| Debit/Credit Card | Instant | 1.5% fee on credit card deposits, no fee for debit cards | Available for Visa, Mastercard. |

| Apple Pay | Instant | No fees | Available for Apple device users. |

| PayPal | Not directly supported | N/A | Use bank or card instead. |

Withdrawals Method

| Withdrawal Method | Processing Time | Fees | Additional Info |

|---|---|---|---|

| Bank Transfer | Same day (if before 2pm GMT) | Free (Bank charges may apply) | Available for GBP, EUR, USD. |

| Debit/Credit Card | Same day (if before 2pm GMT) | Free (Bank charges may apply) | Available for Visa, Mastercard. |

| Apple Pay | Not applicable | N/A | Not available for withdrawals. |

| PayPal | Not directly supported | N/A | Use bank or card for withdrawal. |

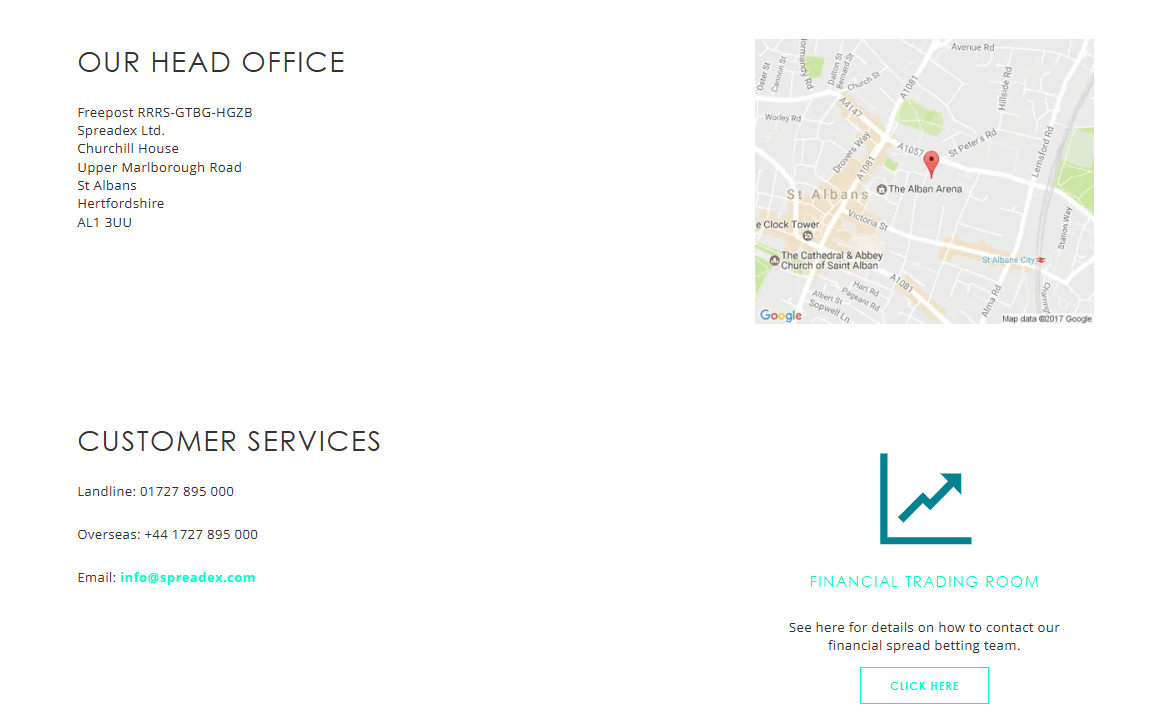

Support Service for Customer

Spreadex prides itself on delivering top-notch customer service to clients. The support desk can be reached through several channels:

- Phone: Call +44 1727 895 191 to speak with a live agent

- Email: Send queries to info@spreadex.com for email assistance

- Live Chat: Instantly connect with the support team directly through the website

Customer Support table

| Support Channel | Availability |

|---|---|

| Phone | Mon-Sun 8am-6pm |

| Mon-Sun 8am-6pm | |

| Live Chat | Mon-Sun 8am-6pm |

| FAQ | 24/7 |

| Contact Form | Response within 4 hours |

Prohibited Countries

Due to regulatory restrictions and business decisions, Spreadex does not accept clients from the following countries:

- United States

- Canada

- Australia

- New Zealand

- Belgium

- Brazil

- India

- Japan

- Malaysia

- Russia

- Taiwan

Reasons for restrictions include strict local laws, failure to obtain required licenses, and lack of business infrastructure in the region.

Residents of restricted countries who attempt to open a Spreadex account may have their application rejected and any deposited funds returned.

Using a VPN to circumvent geo-blocks and falsely representing your location is grounds for immediate account termination and may be illegal.

If you reside in a non-restricted country but travel to a restricted jurisdiction, notify Spreadex to avoid account access issues. Temporary logins from restricted areas may require additional checks.

As regulations evolve, Spreadex periodically reviews its list of restricted countries. Some regions may become eligible for service, while others are added to the restricted list.

Before registering, always check if your country of residence is permitted and contact Spreadex support for any clarification of eligibility requirements in your specific scenario.

Special Offers for Customers

Spreadex provides several attractive promotions and bonuses for both new and existing clients:

| Promotion | Details |

|---|---|

| Welcome Bonus | 100% match on first deposit up to $500. 10x volume requirement before withdrawal. |

| Refer-a-Friend | Earn $50 cash per referral. Your friend gets $20 trading credit. No limits on rewards. |

| Loyalty Scheme | Earn points for cash rebates, bonus funds, or merchandise. Tiered benefits based on volume. |

| Trading Competitions | Monthly contests with prizes up to $10,000. Categories include highest gain, most volume, best trade. |

| No-Deposit Bonus | $20 free credit to start trading. 5x volume requirement to withdraw profits. Ideal for testing. |

Most promotions carry certain terms and conditions like time limits, valid instrument restrictions, and minimum volume rules. Be sure to read the fine print before opting in.

The range of offers is wider than most brokers which are usually limited to a single welcome bonus. The referral program and loyalty scheme are great ways for active traders to boost returns.

Spreadex could enhance its offer by adding more bonus variety like gadget giveaways, education reimbursements, and VIP experiences seen at other brokers.

Overall, Spreadex provides solid incentives for both new account signups and consistent trading. The bonus structures are straightforward with transparent terms. Always consider strategy and risk first, but these offers can be valuable complements.

Conclusion

After an in-depth evaluation, I believe Spreadex is a reliable and customer-centric broker well-suited for most trading styles and experience levels.

Their credentials as an FCA-regulated company with over 20 years in business immediately signal trustworthiness and stability. The fact that client funds are segregated at tier-1 banks and protected under the FSCS compensation scheme provides extra peace of mind.

I was impressed by Spreadex's broad asset selection, spanning over 15,000 instruments across forex, shares, indices, commodities, options, ETFs, and more. This enables significant diversification. Though the crypto offering could be expanded, the overall range surpasses most multi-asset brokers.

Spreadex's proprietary platform is feature-rich with advanced charting, automated pattern recognition, and integrated research. It strikes a good balance of power and usability for both novice and seasoned traders. The TradingView offers further flexibility for chartists and API access accommodates algorithmic strategies.

Spreads are highly competitive from just 0.1 pips on EUR/USD. The range of account types is limited, but the low $1 minimum deposit and high max leverage up to 1:200 for pros ensure clients can find a suitable fit. I appreciate the negative balance protection on retail accounts but would like to see an Islamic swap-free option added.

The variety of funding methods with same-day processing is another plus. I received very professional and prompt support via live chat. The comprehensive educational resources are perfect for beginner traders still learning the ropes.

While Spreadex is not ideal for high-volume trading due to the lack of VPS hosting and variable spreads, most individual retail traders will find the conditions and platform more than satisfactory. Room for improvement in areas like 24/7 support, more social trading tools, and a loyalty program.

Overall, Spreadex scores highly for its blend of regulatory safety, expansive markets, unique platform, helpful support, and low-cost entry point. Definitely on my shortlist of recommended brokers for 2023.

Filter platforms by asset class via the broker reviews asset hub.

Fast STP execution noted in our Eightcap review.