SquaredFinancial Review: An In-Depth Look at the Pros and Cons

SquaredFinancial

Seychelles

Seychelles

-

Withdrawal Fee $varies

-

Leverage 500:1

-

Minimum Order 0.01

-

Forex Available

-

Crypto Available

-

Stock Unavailable

-

Indices Available

Licenses

Japan Forex Trading License

Japan Forex Trading License

Cyprus Market Making (MM)

Cyprus Market Making (MM)

Softwares & Platforms

Customer Support

+2484671943

(English)

+2484671943

(English)

Supported language: Chinese (Simplified), English, German, Portuguese, Arabic

Social Media

Summary

SquaredFinancial is a globally regulated forex and CFD broker established in 2005, with headquarters in Cyprus and Seychelles. It offers access to over 10,000 instruments across forex, stocks, indices, commodities, futures, and cryptocurrencies via MT4 and MT5 platforms. Traders can choose between SquaredPro ($0 deposit) and SquaredElite ($500 deposit) accounts, with leverage up to 1:500 and spreads from 0.0 pips. The broker supports EAs, provides negative balance protection, and offers strong educational resources. 24/5 multilingual support is available through live chat, email, and phone.

- Regulated by top-tier authorities CySEC and FSA

- Wide range of over 10,000 tradable instruments

- Competitive spreads starting from 0.0 pips

- Flexible account types for beginners and experienced traders

- Supports popular MetaTrader platforms and proprietary Squared platforms

- Solid educational resources

- Responsive 24/5 customer support

- No deposit or withdrawal fees charged by the broker

- Attractive bonus offers, including a $30 no deposit bonus

- Long operating history and commitment to client protection

- Not available in certain countries, including the United States and Canada

- High minimum deposit of $5,000 for the SquaredElite account

- Educational materials may not be as extensive as some competitors

- No 24/7 customer support available

- Limited range of payment methods compared to some brokers

- Inactivity fees charged on dormant accounts

- Bonuses and promotions subject to terms and conditions

- No guaranteed stop losses or negative balance protection for all account types

- Cryptocurrency deposits and withdrawals can take 2+ days to process

- Swap-free (Islamic) accounts only available on the MT4 platform

Overview

SquaredFinancial is an international forex and CFD broker that has been operating since 2005. With headquarters in Cyprus and Seychelles, SquaredFinancial is authorised and regulated by top-tier regulators CySEC and FSA. The broker offers an extensive range of over 10,000 tradable instruments, including forex, stocks, indices, commodities, futures, and cryptocurrencies, on the popular MetaTrader 4 and MetaTrader 5 platforms.

Throughout its nearly two decades of experience, SquaredFinancial has built a reputation for providing competitive trading conditions, with access to deep liquidity, tight spreads, and leverage up to 1:500. The broker caters to both beginner and experienced traders, offering two account types with different minimum deposits and trading costs. SquaredFinancial also emphasises customer support, security of funds, and educational resources to empower traders.

For more details about SquaredFinancial's offerings, visit their official website at squaredfinancial.com.

Overview Table

| Characteristic | Details |

|---|---|

| Headquarters | Cyprus, Seychelles |

| Regulation | CySEC (Cyprus), FSA (Seychelles) |

| Year Established | 2005 |

| Minimum Deposit | $0 (SquaredPro), $500 (SquaredElite) |

| Instruments | Forex, CFDs, Indices, Commodities, Stocks, Futures, Crypto |

| Platforms | MetaTrader 4, MetaTrader 5 |

| Account Types | SquaredPro, SquaredElite, Demo Account |

| Leverage | Up to 1:500 |

Facts List

- SquaredFinancial is regulated by CySEC (Cyprus) and FSA (Seychelles)

- Offers over 10,000 tradable instruments across multiple asset classes

- Provides MetaTrader 4 and MetaTrader 5 trading platforms

- Minimum deposit of $0 for SquaredPro account and $500 for SquaredElite

- Leverage up to 1:500 available

- Competitive spreads starting from 0.0 pips on SquaredElite account

- Supports automated trading via Expert Advisors (EAs)

- Provides negative balance protection for client accounts

- Educational resources include trading guides, webinars, ebooks and videos

- 24/5 multilingual customer support via live chat, email and phone

SquaredFinancial Licenses and Regulatory

SquaredFinancial operates under two regulated entities:

- SquaredFinancial (Seychelles) Limited is authorised and regulated by the Financial Services Authority (FSA) of Seychelles under license number SD024.

- SquaredFinancial (Cyprus) Limited is authorised and regulated by the Cyprus Securities and Exchange Commission (CySEC) under license number 329/17.

The Seychelles entity provides higher leverage (up to 1:500), flexible trading conditions, and an insurance policy from Lloyd's of London with coverage up to $1,000,000 per client. The CySEC entity offers additional protections like negative balance protection and an investor compensation fund up to €20,000.

Both entities segregate client funds from corporate funds and follow strict regulatory requirements. SquaredFinancial has a clean regulatory track record since its establishment in 2005.

Having multiple regulatory licenses demonstrates SquaredFinancial's commitment to compliance and providing a safe trading environment for clients globally. The broker goes beyond the standard requirements in areas like client fund insurance.

Regulations List

- SquaredFinancial (Seychelles) Limited – Regulated by FSA Seychelles, License No. SD024

- SquaredFinancial (Cyprus) Limited – Regulated by CySEC, License No. 329/17

Trading Instruments

SquaredFinancial offers an extensive selection of over 10,000 tradable instruments across multiple asset classes:

| Asset Class | Details |

|---|---|

| Forex | 42 currency pairs (majors, minors, exotics), spreads from 0.0 pips |

| Share CFDs | 957 global shares (US, UK, Europe, Switzerland) |

| Indices | 12 index CFDs on major global stock indices |

| Commodities | 7 commodity CFDs including metals and energies |

| Futures | 18 futures contracts on commodities and indices |

| Cryptocurrencies | 10 crypto CFDs including Bitcoin and Ethereum, up to 1:5 leverage |

Traders can view the full list of tradable symbols, typical spreads, margin requirements and trading hours on SquaredFinancial's website.

Trading Platforms

SquaredFinancial provides the industry-standard MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms for trading on desktop, web and mobile.

MetaTrader 4

is a user-friendly platform known for its customisable charts, technical analysis tools and algorithmic trading features. It supports automated trading through Expert Advisors (EAs), custom indicators and copy trading.

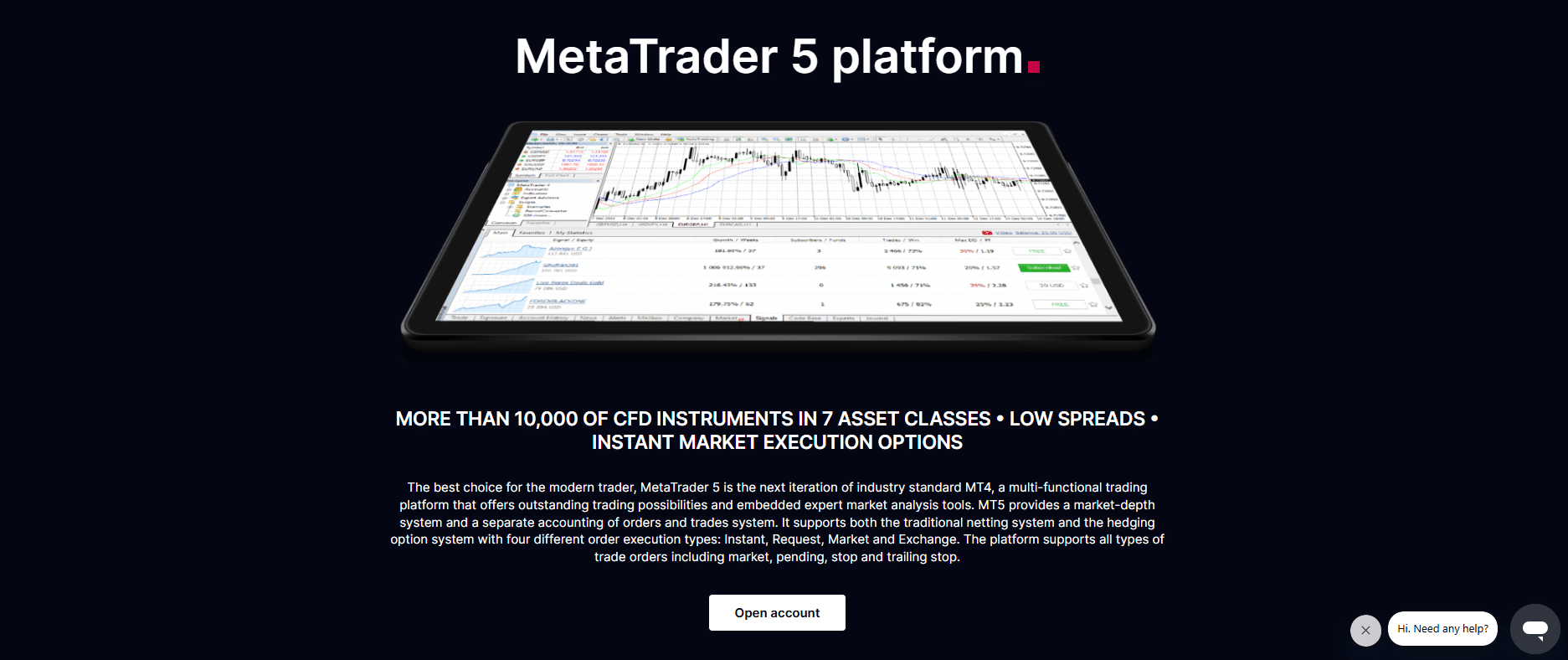

MetaTrader 5

builds upon MT4 with additional features like an integrated economic calendar, fundamental analysis tools, greater timeframes and a built-in chat. MT5 also expands the options for pending orders and supports hedging.

Both platforms are available for Windows and Mac computers and have mobile apps for iOS and Android devices. The web-based WebTrader versions run directly in most modern web browsers without requiring any downloads or installation.

SquaredFinancial allows all trading strategies, including hedging, scalping and algorithmic trading through EAs. The broker provides a Virtual Private Server (VPS) service for clients to run their MT4/MT5 platforms with lower latency and 100% uptime.

While MT4 and MT5 are feature-rich platforms, they may have a learning curve for complete beginners compared to more intuitive web-based platforms. However, SquaredFinancial provides extensive educational resources to help clients get started.

Trading Platforms Comparison Table

| Feature | MT4 | MT5 |

|---|---|---|

| One-click Trading | Yes | Yes |

| Hedging | Yes | Yes |

| Number of Indicators | 30+ | 38+ |

| Timeframes | 9 | 21 |

| Pending Order Types | 4 | 6 |

| Depth of Market | No | Yes |

| Economic Calendar | No | Yes |

SquaredFinancial How to Open an Account: A Step-by-Step Guide

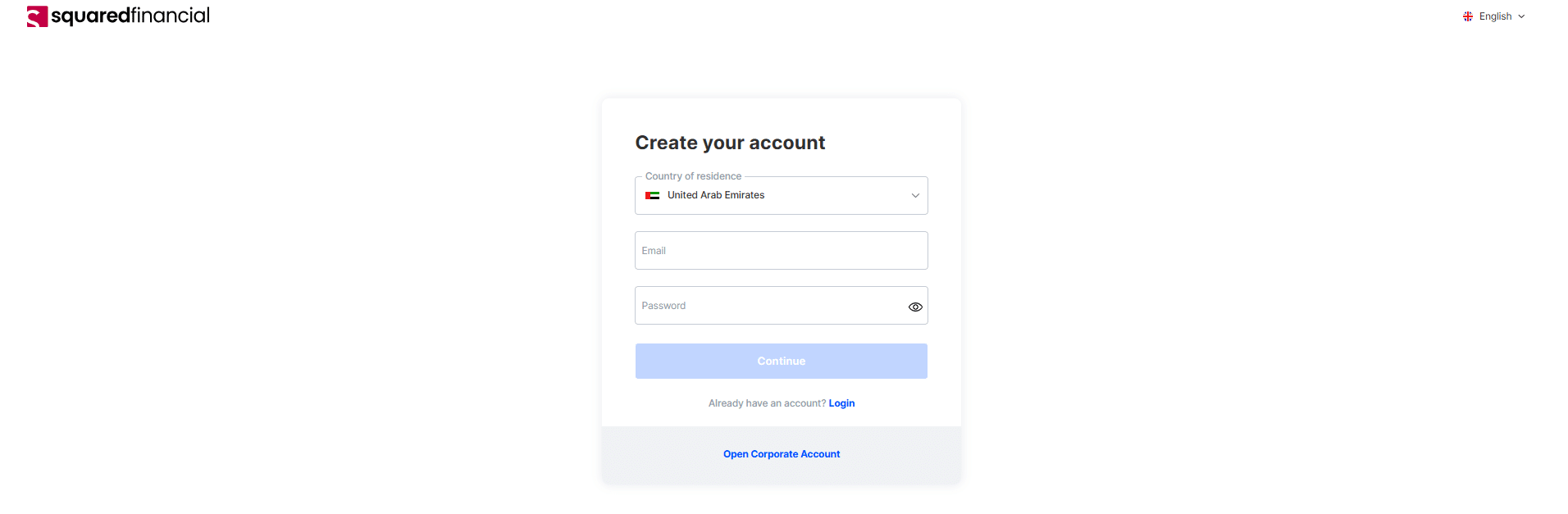

To open a live account with SquaredFinancial:

- Visit the SquaredFinancial website and click 'Open Account.'

- Fill in your personal details, including name, email, phone number and country of residence.

- Provide further information about your financial knowledge, employment status, income and trading experience as part of the onboarding questionnaire.

- Choose your preferred account type, trading platform, base currency and leverage.

- Submit proof of identity (e.g. passport) and proof of address (e.g. utility bill) to verify your account.

- Make a deposit using one of the available payment methods to start trading.

Account verification usually takes under 24 hours. The minimum deposit is $0 for the SquaredPro account and $500 for the SquaredElite account. Supported base currencies include USD, EUR, GBP, ZAR, CHF and HKD.

Clients can also open a Demo account to practice on the MT4/MT5 platforms with virtual funds before going live.

Charts and Analysis

SquaredFinancial provides an extensive suite of tools and resources to help clients make informed trading decisions:

| Feature | Description |

|---|---|

| Live Charts | Customisable price charts for all tradable instruments with timeframes from 1 minute to 1 month. Includes drawing tools and 50+ technical indicators. |

| Technical Analysis | Detailed technical analysis ideas and chart breakdowns from in-house analysts and third-party provider Trading Central. Updated multiple times daily. |

| Economic Calendar | Calendar of upcoming market-moving events and data releases with previous/forecast/actual figures and volatility indicators. |

| Market Insights | Daily blog posts covering market news, asset analysis, and trade ideas. Categories include Forex, Equities, Commodities, Indices, and Cryptocurrencies. |

| SquaredFinancial WebTV | Frequent video updates from market analysts, discussing chart patterns, market sentiment, and potential trade setups. |

| Forex Calculators | Suite of trading calculators, including a margin calculator, pip value calculator, profit calculator, and currency converter. |

Traders can access these resources directly through the SquaredFinancial client portal and mobile app. The analysis is provided for educational purposes only and should not be considered as investment advice.

While the overall research offering is extensive, some of the technical analysis and blog posts lack depth compared to the best providers in the industry. Nonetheless, SquaredFinancial still delivers valuable insights to support clients' trading activities.

SquaredFinancial Account Types

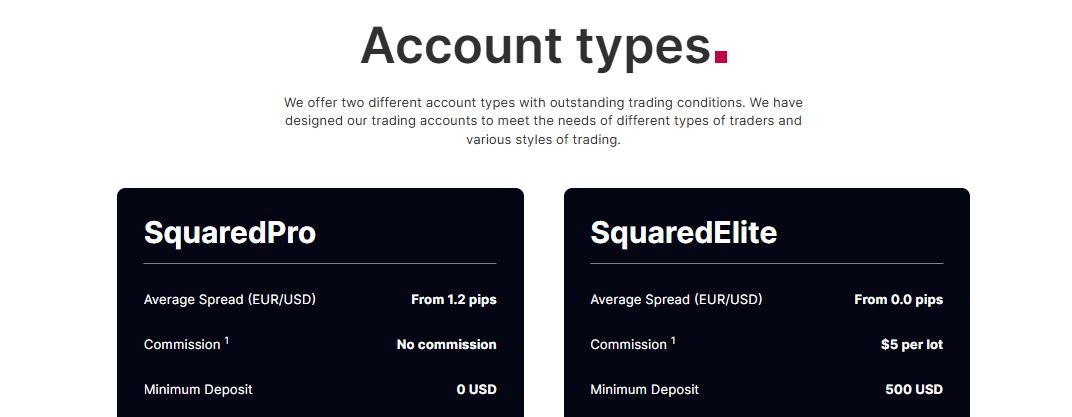

SquaredFinancial offers two main live trading account types:

SquaredPro

- Commission-free account with floating spreads from 1.2 pips on the EUR/USD. Minimum deposit of $0. Suitable for beginner traders.

SquaredElite

- Raw spread account with spreads from 0.0 pips plus a $5 per round lot commission. Minimum deposit of $500. Aimed at experienced traders.

Both account types provide leverage up to 1:500. The spreads and commissions on the SquaredElite account are up to 50% lower than the SquaredPro account, resulting in significant savings for high-volume traders.

SquaredFinancial also offers a free Demo account with $100,000 in virtual funds and the same trading conditions as the live accounts. Demo accounts do not expire and are useful for testing strategies.

Islamic (swap-free) accounts are available on request for clients who cannot pay or receive interest due to religious beliefs. These have the same trading conditions as the regular accounts minus overnight swap fees.

The account selection at SquaredFinancial is more limited than some brokers that offer a wider variety of account tiers and asset classes. However, the low minimum deposit on the SquaredPro still makes it accessible.

Account Types Comparison Table

| Feature | SquaredPro | SquaredElite |

|---|---|---|

| Minimum Deposit | $0 | $500 |

| Spreads From | 1.2 pips | 0.0 pips |

| Commissions | None | $5 per lot |

| Leverage | Up to 1:500 | Up to 1:500 |

| Minimum Deal Size | 0.01 lots | 0.01 lots |

| Stop Out Level | 30% | 30% |

| Negative Balance Protection | Yes | Yes |

| Scalping Allowed | Yes | Yes |

| Hedging Allowed | Yes | Yes |

Negative Balance Protection

SquaredFinancial provides negative balance protection for all retail clients. This means a trader's losses cannot exceed their account balance, even in extreme market volatility that may cause sudden spikes or gaps in asset prices. Negative balance protection acts as a safeguard in situations such as:

- A major news event causing a price shock when markets reopen

- Holding positions over the weekend and prices gap on Monday open

- The account lacks free margin to support the open positions

- A stop loss fails to be executed at the specified level

- The market gaps past the stop loss level without executing it

SquaredFinancial Deposits and Withdrawals

SquaredFinancial offers a range of deposit and withdrawal methods, making it easy for clients to manage their funds. The available options include:

Bank Wire Transfer

Clients can deposit and withdraw funds via bank transfer. The minimum deposit amount is $100, and there are no fees charged by SquaredFinancial. However, banks may charge their own processing fees. Deposits via bank transfer can take 3-5 business days to be credited.Credit/Debit Cards

SquaredFinancial accepts deposits from Visa and Mastercard. The minimum deposit is $20, and funds are credited instantly. Withdrawals to credit/debit cards are processed within 24 hours.E-Wallets

Clients can deposit and withdraw using popular e-wallets such as Skrill and Neteller. The minimum deposit is $5, while the minimum withdrawal is $50. Transactions are processed instantly.Cryptocurrencies

SquaredFinancial supports deposits in various cryptocurrencies, including Bitcoin, Ethereum, and USDT. Deposits are processed within 2+ days, and withdrawals can take a similar amount of time. It is important to note that SquaredFinancial does not charge any fees for deposits or withdrawals. However, a 2% fee is charged if a client deposits funds and withdraws the entire amount without placing any trades. Third-party payment processors may also impose their own fees. To withdraw funds, clients must first verify their trading account by submitting proof of identification and address. Withdrawals are processed back to the original funding source. If that is not possible, clients may be asked to provide additional documentation to comply with anti-money laundering regulations. Overall, SquaredFinancial provides a decent range of payment methods, although the exact options may vary depending on the client's country of residence. The broker's fee-free policy and relatively fast processing times are appealing, but some competitors may offer a wider variety of localised payment solutions.Support Service for Customer

SquaredFinancial provides 24/5 multilingual customer support through various channels:

- Live Chat: Clients can connect with a support representative instantly through the live chat feature on the website.

- Email: For less urgent enquiries, clients can send an email to the support team. Responses are typically provided within 24 hours.

- Phone: SquaredFinancial offers local phone support in multiple countries. The phone numbers are listed on the broker's website.

- Callback Service: Clients can request a callback from the support team by filling out a form with their contact details and preferred callback time.

Customer Support Comparison Table

| Feature | SquaredFinancial | IronFX | AvaTrade |

|---|---|---|---|

| Support Hours | 24/5 | 24/5 | 24/7 |

| Languages | 7 | 30+ | 14 |

| Live Chat | Yes | Yes | Yes |

| Yes | Yes | Yes | |

| Phone | Yes | Yes | Yes |

| Callback | Yes | Yes | No |

Prohibited Countries

SquaredFinancial serves a global client base but does not accept traders from certain countries due to regulatory restrictions or business decisions. The prohibited countries include:

- United States

- Canada

- Israel

- Iran

- North Korea

However, SquaredFinancial does accept clients from most other regions, including:

- European Economic Area (EEA) countries

- Switzerland

- Asia-Pacific

- Latin America

- Africa

- Middle East

Traders from accepted countries can open an account with SquaredFinancial Seychelles, which operates under the Financial Services Authority (FSA) regulation.

It is essential for traders to be aware of and comply with any local laws and regulations related to online trading in their country of residence. SquaredFinancial may request additional documentation from clients in certain jurisdictions to verify compliance.

While SquaredFinancial's country restrictions are not as extensive as some brokers, traders from prohibited countries will need to seek out alternative brokers that can legally service their region.

Special Offers for Customers

SquaredFinancial provides several special offers and promotions for both new and existing clients:

| Promotion | Details |

|---|---|

| 20% Deposit Bonus | For deposits of $500 or more. Bonus is a margin loan; profits are withdrawable. |

| 10% Deposit Bonus | For deposits of $100 or more. Same terms as the 20% bonus. |

| $30 No Deposit Bonus | Available to new clients. Bonus is for trading only and cannot be withdrawn. |

| Refer a Friend | Earn $100 per referral. Referred friend must deposit $500 and trade 5 standard lots. |

| Trading Contests | Periodic competitions with cash prizes and rewards. Details on website and social media. |

The deposit bonuses and no deposit bonus offer an opportunity to increase trading capital, but it's crucial to read the full terms and conditions. Bonuses may have specific trading volume requirements before they can be withdrawn.

The refer-a-friend program incentivises client referrals, and the $100 bonus per referral is competitive with other brokers' offers.

Trading contests add an element of excitement and allow traders to potentially earn prizes for their performance. However, the availability and frequency of these contests may vary.

While the special offers provided by SquaredFinancial can add value, traders should always consider the overall trading costs and conditions when evaluating a broker.

Conclusion

After thoroughly examining SquaredFinancial's offerings, I believe they are a trustworthy and reliable broker that caters to a wide range of traders.

One of SquaredFinancial's key strengths is its regulatory compliance. The broker is regulated by top-tier authorities—CySEC in Cyprus and FSA in Seychelles. This provides clients with a high level of protection and assurance, as the broker must adhere to strict guidelines regarding client funds, financial reporting, and fair business practices.

Another standout aspect of SquaredFinancial is its extensive range of tradable instruments. With over 10,000 assets across forex, shares, indices, commodities, futures, and cryptocurrencies, traders have ample opportunities to diversify their portfolios and implement various strategies. The broker's competitive spreads, starting from 0.0 pips on the SquaredElite account, can help minimise trading costs.

SquaredFinancial's account types cater to both beginner and experienced traders. The SquaredPro account has no minimum deposit and is suitable for those starting out, while the SquaredElite account offers more advanced features and tighter spreads for a $5,000 minimum deposit. The broker's support for the popular MetaTrader 4 and MetaTrader 5 platforms, along with its proprietary Squared Investor and Squared Pro platforms, provides flexibility and choice.

In terms of education and research, SquaredFinancial provides a solid foundation with articles, webinars, e-books, and videos. However, the depth and breadth of these materials may not match some of the industry leaders. The broker's customer support is responsive and available 24/5 through multiple channels, although round-the-clock support would be a welcome addition.

The broker's deposit and withdrawal process is straightforward, with several funding options and no fees charged by SquaredFinancial. The ability to deposit via e-wallets and credit/debit cards is convenient, although some competitors may offer a wider range of localised payment methods.

While SquaredFinancial has some limitations, such as restricted access in certain countries and a relatively high minimum deposit for the SquaredElite account, these are outweighed by the broker's positive attributes.

Overall, I consider SquaredFinancial to be a solid choice for traders seeking a well-regulated, multi-asset broker with competitive trading conditions. The broker's long operating history and commitment to client protection instill confidence, while its range of account types and platforms cater to various trading styles and preferences.

Whether you are a novice trader looking to start your journey or an experienced investor seeking advanced tools and tight spreads, SquaredFinancial is worth considering. As with any broker, it's essential to carefully evaluate your trading goals and risk tolerance before making a decision.

Browse withdrawal speeds in our broker reviews payout matrix.

Rebate hunters read the FXGrow review.