SuperForex Review 2025: Comprehensive Look at the Global Forex Broker

SuperForex

Belize

Belize

-

Minimum Deposit $1

-

Withdrawal Fee $varies

-

Leverage 3000:1

-

Minimum Order 0.01

-

Forex Available

-

Crypto Available

-

Stock Available

-

Indices Available

Licenses

Belize Financial Services License

Belize Financial Services License

Softwares & Platforms

Customer Support

+442045771579

(English)

+442045771579

(English)

Supported language: Chinese (Simplified), English, Portuguese, Arabic, Spanish

Social Media

Summary

SuperForex is a global forex broker established in 2013, serving clients in over 150 countries with headquarters in Belize and an office in Bulgaria. Regulated by the IFSC of Belize, it offers a wide range of trading instruments including forex, cryptocurrencies, indices, metals, and stocks. The broker provides various STP and ECN account types with flexible leverage up to 1:3000 and minimum deposits starting at just $1. SuperForex supports MetaTrader 4 and offers strong customer support across multiple communication channels. It also provides educational resources and tools for traders at all levels.

- Wide range of tradable assets

- Competitive trading conditions

- Low minimum deposit requirements

- MetaTrader 4 platform available for desktop, web, and mobile

- Variety of account types to suit different trading styles

- Negative balance protection for all clients

- Multiple deposit and withdrawal options

- Responsive and multilingual customer support

- Extensive educational resources and tools

- Regular promotions and bonus offers

- Regulated by an offshore authority (IFSC) rather than a major financial regulator

- Limited choice of trading platforms (only MT4)

- Some withdrawal methods may incur fees

- High leverage can increase risk exposure

- Not available to residents of certain countries due to regulatory restrictions

- Bonuses and promotions may have specific terms and conditions

- No direct telephone support for some countries

- Educational content may not be suitable for all skill levels

- Limited range of crypto markets compared to some larger exchanges

- No guaranteed stop-loss orders

Overview

SuperForex is a well-established, global forex broker that has been providing trading services to clients in over 150 countries since its founding in 2013. With its headquarters located in Belize City, Belize, and an additional office in Sofia, Bulgaria, SuperForex has built a solid reputation for offering a wide range of financial instruments, competitive trading conditions, and a user-friendly platform.

One of the key strengths of SuperForex is its regulatory status. The broker is regulated by the International Financial Services Commission (IFSC) of Belize, which provides a level of oversight and protection for its clients. While Belize is considered an offshore jurisdiction, the IFSC still requires regulated brokers to adhere to certain standards, such as maintaining segregated client funds and following anti-money laundering procedures. Additionally, SuperForex is a member of the Investor Compensation Fund, which offers further protection to clients in the event of the broker's insolvency.

SuperForex offers a diverse range of tradable assets, including over 100 currency pairs, 9 cryptocurrency pairs, 15 index futures, various metals, energies, soft commodities, and 90+ stock CFDs. This extensive product offering allows traders to diversify their portfolios and take advantage of opportunities across multiple markets.

The broker provides two main account categories: STP and ECN accounts, each with several variations designed to cater to different trading styles and preferences. These account types offer competitive spreads, flexible leverage options (up to 1:3000 on some accounts), and low minimum deposit requirements (starting from just $1). SuperForex also supports Islamic trading with its swap-free account options.

Overview Table

| Characteristic | Details |

|---|---|

| Year of Establishment | 2013 |

| Headquarters | Belize City, Belize |

| Additional Offices | Sofia, Bulgaria |

| Regulation | International Financial Services Commission (IFSC) of Belize |

| Countries of Operation | Over 150 countries worldwide |

| Trading Instruments | Forex, Cryptocurrencies, Indices, Metals, Energies, Softs, Stocks |

| Account Types | STP: Standard, Swap-Free, No Spread, Micro Cent, Profi STP, Crypto ECN: Standard, Standard Mini, Swap-Free, Swap-Free Mini, Crypto |

| Trading Platforms | MetaTrader 4 (MT4) |

| Minimum Deposit | $1 (varies by account type) |

| Customer Support | Phone, Email, Live Chat, WhatsApp, Skype, WeChat, Telegram |

Facts List

- SuperForex was established in 2013 and has its headquarters in Belize City, Belize.

- The broker is regulated by the International Financial Services Commission (IFSC) of Belize.

- SuperForex operates in over 150 countries worldwide and has an additional office in Sofia, Bulgaria.

- The company offers a wide range of trading instruments, including forex, cryptocurrencies, indices, metals, energies, softs, and stocks.

- SuperForex provides both STP and ECN account types, catering to different trader preferences and needs.

- The minimum deposit required to open an account varies by account type, with some starting as low as $1.

- The primary trading platform offered by SuperForex is MetaTrader 4 (MT4).

- Clients can reach SuperForex's customer support through various channels, including phone, email, live chat, and popular messaging apps like WhatsApp, Skype, WeChat, and Telegram.

- SuperForex has received numerous industry awards over the years, recognising its growth, innovation, and service quality.

- The broker offers a range of educational resources and tools to support traders, such as webinars, tutorials, and market analysis.

SuperForex Licenses and Regulatory

SuperForex is regulated by the International Financial Services Commission (IFSC) of Belize, a financial regulator established in 1999 to oversee the country's offshore financial services industry. The IFSC is responsible for licensing, regulating, and supervising international financial services providers, including forex brokers like SuperForex.

While the IFSC provides a level of oversight and protection for SuperForex's clients, it is important to note that Belize is considered an offshore jurisdiction, and its regulatory standards may not be as stringent as those in more established financial hubs like the United States, United Kingdom, or Australia.

However, SuperForex's regulation by the IFSC demonstrates the broker's commitment to operating within a legal framework and adhering to certain standards of transparency and client protection. The IFSC requires regulated entities to maintain segregated client funds, submit regular financial reports, and follow anti-money laundering (AML) and know-your-customer (KYC) procedures.

Additionally, SuperForex is a member of the Investor Compensation Fund (ICF), an organisation that provides additional protection for clients in the event of a broker's insolvency. The ICF offers compensation of up to €20,000 per client if the broker becomes insolvent and is unable to meet its financial obligations.

Regulations List

- SuperForex is regulated by the International Financial Services Commission (IFSC) of Belize.

Trading Instruments

SuperForex offers a comprehensive range of tradable assets, allowing clients to diversify their portfolios and take advantage of various market opportunities. The broker provides access to over 100 trading instruments across multiple asset classes, including:

| Asset Class | Details |

|---|---|

| Forex | 100+ currency pairs including majors, minors, and exotics |

| Cryptocurrencies | 9 crypto pairs (e.g., BTC/USD, ETH/USD, LTC/USD, XRP/USD, etc.) |

| Indices | 15 index futures (S&P 500, NASDAQ, Dow Jones, FTSE 100, DAX, and more) |

| Metals | 5 spot metal CFDs (gold, silver) and 5 metal futures (gold, silver, platinum, palladium, copper) |

| Energies | 7 energy futures (crude oil WTI/Brent, heating oil, gasoline, natural gas) |

| Softs/Commodities | 20+ soft futures (coffee, cocoa, cotton, sugar, soybeans, corn, wheat, etc.) |

| Stocks | 90+ stock CFDs focusing on major US companies |

By offering a wide array of tradable assets, SuperForex enables traders to pursue their preferred strategies and capitalise on market trends across various sectors. The broker's extensive product offerings cater to both novice and experienced traders, providing ample opportunities for portfolio diversification and risk management.

Trading Platforms

SuperForex offers its clients access to the popular and versatile MetaTrader 4 (MT4) platform for trading. MT4 is a widely used, user-friendly platform that provides a comprehensive suite of tools and features for traders of all experience levels. The platform is available in several versions, ensuring accessibility and convenience for all traders:

MT4 for Desktop

The desktop version of MT4 is available for both Windows and Mac operating systems. This version offers the most comprehensive set of features and tools, including:

- Intuitive, customizable interface

- Advanced charting tools with 9 timeframes and 30+ built-in indicators

- Multiple order types, including market and pending orders

- One-click trading functionality

- Extensive backtesting capabilities

- Support for automated trading through Expert Advisors (EAs)

- Multilingual support

MT4 WebTrader

For traders who prefer not to download and install software, SuperForex offers the MT4 WebTrader. This web-based version of the platform can be accessed directly through a web browser, providing traders with the flexibility to trade from any device with an internet connection. The WebTrader offers a similar set of features to the desktop version, including charting tools, technical indicators, and one-click trading.

MT4 for Mobile

SuperForex also provides a mobile version of the MT4 platform for both iOS and Android devices. The mobile app allows traders to manage their accounts, execute trades, and monitor the markets on the go. Key features of the mobile app include:

- Real-time quotes and charts

- Multiple order types and one-click trading

- Account management tools

- Push notifications for important events and price alerts

In addition to the standard MT4 features, SuperForex provides clients with access to a range of trading tools and resources, such as real-time market news, an economic calendar, trading calculators, and educational materials like webinars and video tutorials.

By offering the MT4 platform across multiple devices and operating systems, SuperForex ensures that traders can access their accounts and take advantage of trading opportunities whenever and wherever they choose. The platform's user-friendly interface, advanced features, and extensive customisation options make it an ideal choice for both novice and experienced traders alike.

Trading Platforms Comparison Table

| Feature | MT4 |

|---|---|

| Available For | Desktop (Windows, Mac), Web, Mobile (iOS, Android) |

| User Interface | Intuitive, customizable |

| Charting Tools | 30+ built-in indicators, 9 timeframes, 3 chart types |

| Automated Trading | Supported via Expert Advisors (EAs) |

| Order Types | Market, Pending (Buy Limit, Buy Stop, Sell Limit, Sell Stop) |

| One-Click Trading | Yes |

| Multilingual Support | Yes, supports 20+ languages |

| Community Resources | Large user base, extensive EA & custom indicator library |

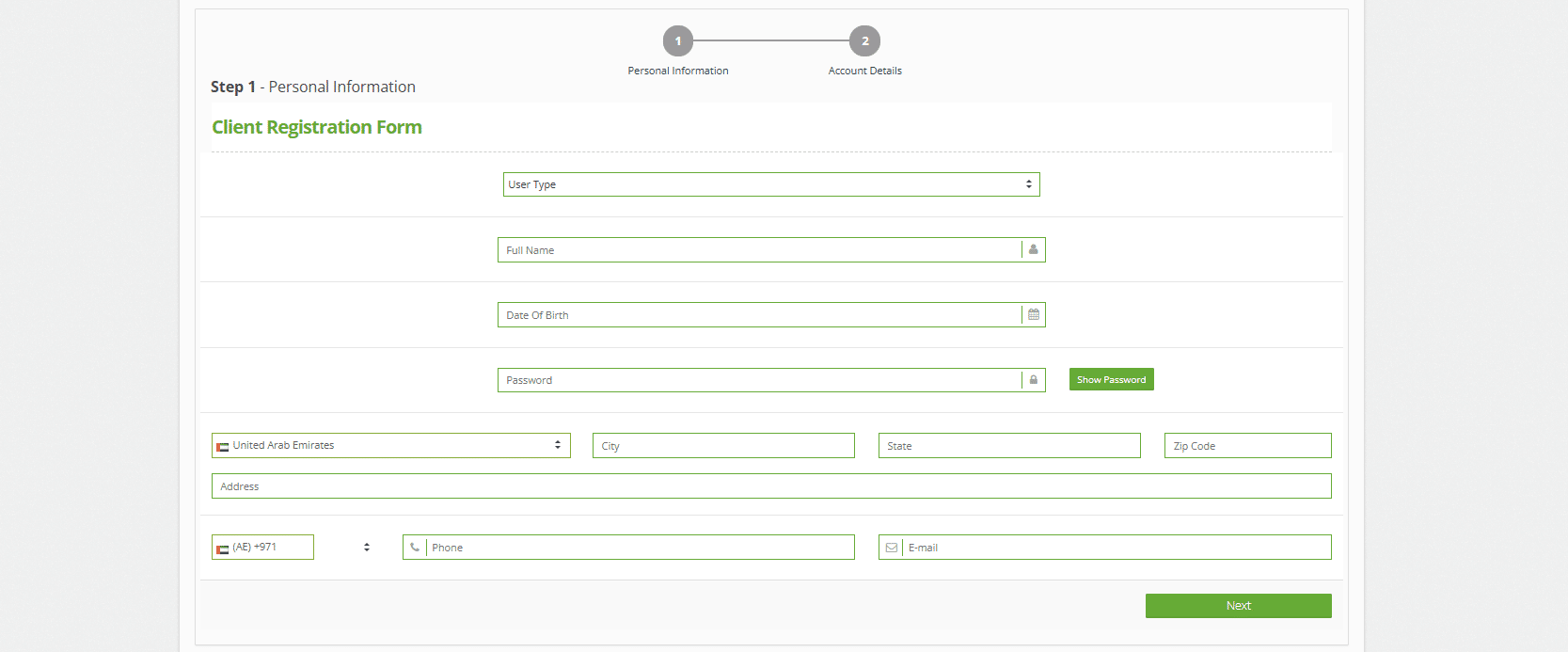

SuperForex How to Open an Account: A Step-by-Step Guide

Opening an account with SuperForex is a straightforward process that can be completed online in a few simple steps:

- Visit the SuperForex website (superforex.com) and click on the "Open Account" button.

- Fill out the registration form with your personal information, including your full name, email address, phone number, and country of residence.

- Choose your preferred account type (e.g., STP Standard, ECN Standard) and base currency.

- Review and accept the broker's terms and conditions.

- Verify your email address and phone number by entering the confirmation codes sent to you.

- Submit the required identification documents (e.g., government-issued ID, proof of address) to complete the account verification process.

- Fund your account using one of the available deposit methods, such as bank wire transfer, credit/debit card, or e-wallet.

- Download and install the MetaTrader 4 (MT4) platform on your device, or access the WebTrader version through your web browser.

- Log in to your trading account using the provided credentials and start trading.

SuperForex offers a variety of account funding options, with most deposits processed instantly and without additional fees. The minimum deposit requirement varies depending on the account type, with some accounts allowing traders to start with as little as $1.

Charts and Analysis

SuperForex provides its clients with access to a range of tools and resources to support their market analysis and trading decisions. These include:

| Feature | Description |

|---|---|

| Real-Time Charts | Customizable charts with 9 timeframes and 3 chart types (line, bar, candlestick) via MT4 |

| Technical Analysis Tools | 30+ built-in indicators and drawing tools for price analysis and trading strategies |

| Economic Calendar | Tracks important economic events and data releases impacting the financial markets |

| Market News & Analysis | Regular updates, articles, and expert analysis to support informed trading decisions |

| Webinars & Education | Includes webinars, video tutorials, guides, and e-books for trader development |

| Trading Calculators | Tools for calculating margin, profit/loss, pip values, and managing trading risk |

By leveraging these tools and resources, traders can gain valuable insights into market dynamics, refine their strategies, and make more informed trading decisions. SuperForex's commitment to providing a comprehensive suite of analysis tools demonstrates the broker's focus on supporting its clients' trading success.

SuperForex Account Types

SuperForex offers a range of account types to cater to the diverse needs and preferences of traders. The two main categories are STP accounts and ECN accounts, each with several variations:

STP Accounts

- Standard: Minimum deposit of $5, leverage up to 1:1000, fixed spreads

- Swap-Free: Designed for Islamic traders, with no overnight swap charges

- No Spread: Tight spreads starting from 0 pips, $50 minimum deposit

- Micro Cent: Ideal for beginners, with a minimum deposit of just $1

- Profi STP: For experienced traders, with a minimum deposit of $500 and leverage up to 1:3000

- Crypto: Designed for cryptocurrency trading, with a minimum deposit of $50 and leverage up to 1:10

ECN Accounts

- ECN Standard: Minimum deposit of $100, leverage up to 1:1000, floating spreads

- ECN Standard Mini: Same as ECN Standard, but with a lower minimum deposit of $5

- ECN Swap-Free: Designed for Islamic traders, with no overnight swap charges

- ECN Swap-Free Mini: Same as ECN Swap-Free, but with a lower minimum deposit of $5

- ECN Crypto: Designed for cryptocurrency trading, with a minimum deposit of $50 and leverage up to 1:10

All account types offer access to the MT4 trading platform, a wide range of trading instruments, and competitive trading conditions. SuperForex also provides demo accounts for traders to practise their strategies and familiarise themselves with the platform in a risk-free environment.

Account Types Comparison Table

STP

| Feature | STP Standard | STP Swap-Free | STP No Spread | STP Micro Cent | STP Profi | STP Crypto |

|---|---|---|---|---|---|---|

| Minimum Deposit | $5 | $5 | $50 | $1 | $500 | $50 |

| Leverage | Up to 1:1000 | Up to 1:1000 | Up to 1:1000 | Up to 1:1000 | Up to 1:3000 | Up to 1:10 |

| Spreads | Fixed | Fixed | From 0 pips | Fixed | From 0.01 pips | Fixed |

| Commission | No | No | No | No | No | No |

| Swap-Free | No | Yes | Yes | No | Yes | Yes |

| Minimum Lot Size | 0.01 | 0.01 | 0.1 | 0.0001 | 0.1 | 0.1 |

ECN

| Feature | ECN Standard | ECN Standard Mini | ECN Swap-Free | ECN Swap-Free Mini | ECN Crypto |

|---|---|---|---|---|---|

| Minimum Deposit | $100 | $5 | $100 | $5 | $50 |

| Leverage | Up to 1:1000 | Up to 1:1000 | Up to 1:1000 | Up to 1:1000 | Up to 1:10 |

| Spreads | Floating | Floating | Floating | Floating | Floating |

| Commission | Yes | Yes | Yes | Yes | Yes |

| Swap-Free | No | No | Yes | Yes | Yes |

| Minimum Lot Size | 0.1 | 0.01 | 0.1 | 0.01 | 0.1 |

Negative Balance Protection

SuperForex offers negative balance protection to all its clients, ensuring that traders cannot lose more than their account balance. This feature is crucial for managing risk and protecting traders from potentially devastating losses in volatile market conditions. Negative balance protection works by automatically closing a trader's positions when their account equity reaches zero, preventing the account from going into a negative balance. This means that even if a trader experiences significant losses due to unexpected market movements or gaps, their maximum loss is limited to the funds in their account. SuperForex's commitment to negative balance protection demonstrates the broker's focus on client safety and risk management. By offering this protection, SuperForex enables traders to manage their risk more effectively and trade with greater peace of mind, knowing that they cannot lose more than their initial investment. It is essential for traders to understand that while negative balance protection is an important safety net, it does not eliminate the risk of trading altogether. Traders should still employ sound risk management strategies, such as setting appropriate stop-loss orders and managing their position sizes, to minimise potential losses and preserve their capital.

SuperForex Deposits and Withdrawals

SuperForex offers a wide range of deposit and withdrawal options to cater to the needs of its global client base. The available methods include:

Deposit Methods

| Method Type | Examples |

|---|---|

| Bank Wire Transfer | Global bank transfers |

| Credit/Debit Cards | Visa, Mastercard |

| Electronic Payment Systems | Skrill, Neteller, FasaPay, Perfect Money, AdvCash |

| Cryptocurrencies | Bitcoin, Ethereum, Litecoin, Ripple, Tether |

| Local Payment Methods | Country-specific options (varies by region) |

Withdrawal Methods

| Method Type | Examples |

|---|---|

| Bank Wire Transfer | Global bank transfers |

| Credit/Debit Cards | Visa, Mastercard |

| Electronic Payment Systems | Skrill, Neteller, FasaPay, Perfect Money, AdvCash |

| Cryptocurrencies | Bitcoin, Ethereum, Litecoin, Ripple, Tether |

| Local Payment Methods | Country-specific options (varies by region) |

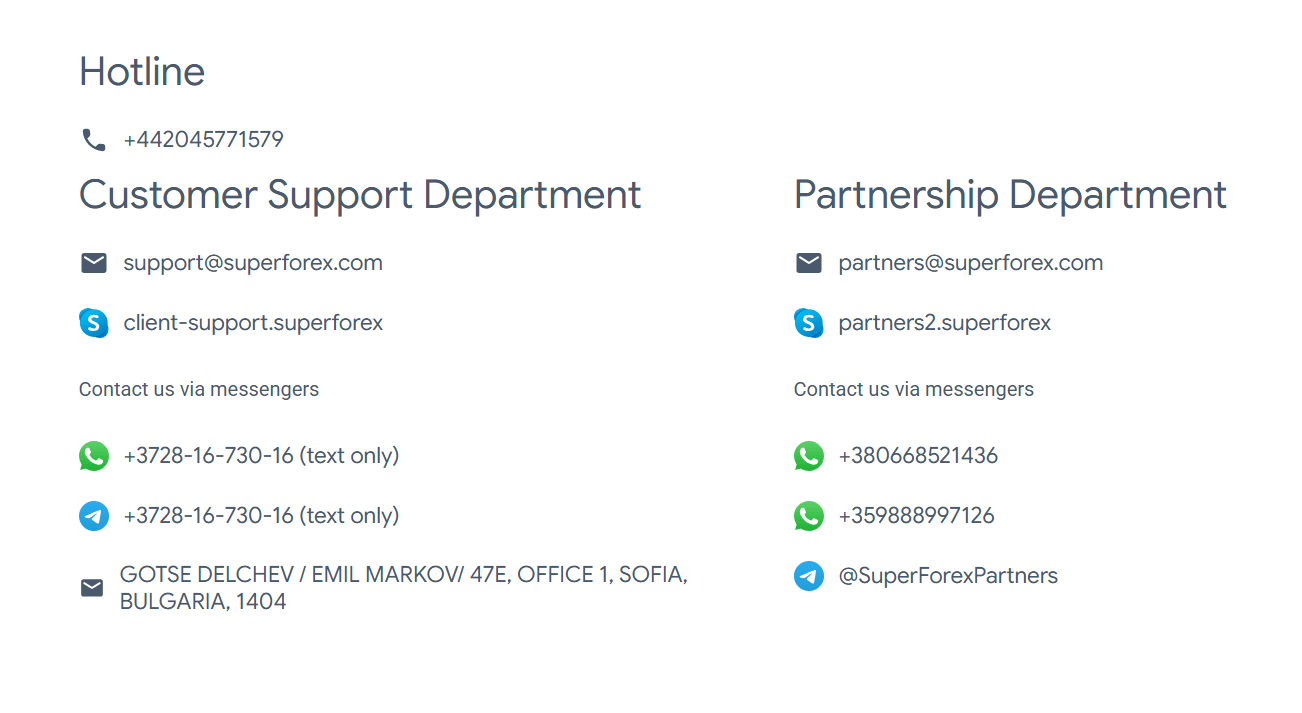

Support Service for Customer

The broker offers several channels through which traders can contact the support team:

The broker offers several channels through which traders can contact the support team:

- Phone: +44 20 3289 7341

- Email: support@superforex.com

- Live chat: Available 24/5 on the SuperForex website

- WhatsApp: +1 (506) 302-5341

- Skype: superforex_support

- WeChat: SUPERFOREX_SUPPORT

- Telegram: @SuperForexSupport

Customer Support Comparison Table

| Channel | Availability |

|---|---|

| Phone | 24/5 |

| 24/5 | |

| Live chat | 24/5 |

| 24/5 | |

| Skype | 24/5 |

| 24/5 | |

| Telegram | 24/5 |

Prohibited Countries

SuperForex accepts clients from most countries worldwide, with a few exceptions due to regulatory restrictions or other factors. The broker does not provide services to residents of the following countries:

- Algeria

- American Samoa

- Antigua and Barbuda

- Azerbaijan

- Barbados

- Crimea and Sevastopol

- Curaçao

- Dominica

- Grenada

- Guam

- Democratic People's Republic of Korea (DPRK)

- Puerto Rico

- Saint Kitts and Nevis

- Saint Lucia

- Saint Vincent and the Grenadines

- Syria

- Trinidad and Tobago

- Ukraine

- US Virgin Islands

- USA

It is essential for traders to check their country's eligibility before attempting to open an account with SuperForex. Registering from a prohibited country may result in the termination of the trading account and the forfeiture of any funds.

Special Offers for Customers

SuperForex provides a range of special offers and promotions to both new and existing clients, enhancing their trading experience and potential rewards. Some of the notable offers include:

- Welcome Bonus: New clients can receive a 100% bonus on their first deposit, up to a maximum of $10,000. This bonus can be used to increase trading capital and potentially generate more profits.

- Refer-a-Friend Program: Clients can earn up to $500 by referring friends to trade with SuperForex. The broker pays a commission based on the trading volume generated by the referred friend.

- Loyalty Program: SuperForex rewards its loyal clients with cashback, deposit bonuses, and other exclusive offers based on their trading activity and account balance.

- Trading Contests: The broker regularly hosts trading contests where participants can compete for real money prizes. These contests are designed to test traders' skills and strategies in a competitive environment.

- Seasonal Promotions: SuperForex occasionally offers special promotions tied to specific events or holidays, such as increased deposit bonuses, reduced spreads, or cashback offers.

It is important for traders to carefully review the terms and conditions associated with each special offer, as they may have specific requirements, such as minimum deposit amounts, trading volume thresholds, or time limitations. Some bonuses may also be subject to trading restrictions or withdrawal limitations.

Conclusion

Throughout this comprehensive review, I have thoroughly examined various aspects of SuperForex's offerings and services. Based on the information gathered and analysed, I can confidently conclude that SuperForex is a reliable and trustworthy broker that prioritises the needs of its clients.

One of the key factors contributing to SuperForex's credibility is its regulation by the International Financial Services Commission (IFSC) of Belize. While Belize is considered an offshore jurisdiction, the IFSC still provides a level of oversight and protection for the broker's clients. Additionally, SuperForex's membership in the Investor Compensation Fund offers an extra layer of security for traders.

SuperForex's wide range of tradable assets, which includes forex pairs, cryptocurrencies, indices, commodities, and stocks, allows traders to diversify their portfolios and explore various market opportunities. The broker's competitive trading conditions, such as low spreads, high leverage, and minimal deposit requirements, cater to traders of all experience levels and financial capabilities.

The MetaTrader 4 platform offered by SuperForex is a reliable and user-friendly trading solution, providing traders with advanced charting tools, automated trading capabilities, and mobile accessibility. The broker's range of account types, including STP and ECN accounts, accommodates different trading styles and preferences.

SuperForex's commitment to education and support is evident in its extensive collection of educational resources, including webinars, tutorials, and market analysis. The broker's multilingual customer support team is readily available through various channels, ensuring that clients receive prompt assistance whenever needed.

While SuperForex has many positive aspects, it is essential to acknowledge that no broker is perfect. Some potential drawbacks include the lack of regulation by a major financial authority and the limited number of trading platforms offered.

In conclusion, SuperForex is a well-rounded broker that offers a solid trading environment for both novice and experienced traders. Its regulatory status, wide range of financial instruments, competitive trading conditions, and commitment to client support make it a strong contender in the online trading industry. However, as with any financial decision, traders should conduct their own research and consider their individual trading goals and risk tolerance before opening an account with SuperForex or any other broker.