Swissquote Review: An In-Depth Look at This Forex Broker and Stock Trading Platform

Swissquote

Switzerland

Switzerland

-

Minimum Deposit $1000

-

Withdrawal Fee $0

-

Leverage 100:1

-

Spread From 1.1

-

Minimum Order 0.01

-

Forex Available

-

Crypto Available

-

Stock Available

-

Indices Available

Licenses

United Kingdom Market Making (MM)

United Kingdom Market Making (MM)

Switzerland Financial Services License

Switzerland Financial Services License

UAE Financial Services License

UAE Financial Services License

Softwares & Platforms

Customer Support

+41587219393

(English)

+41587219393

(English)

Supported language: English, French, Portuguese, Spanish, Italian

Social Media

Summary

Swissquote is a leading Swiss online bank and forex broker, founded in 1996 and headquartered in Gland, Switzerland. Regulated by top authorities like FINMA and FCA, it offers a wide range of markets, including forex, stocks, indices, commodities, bonds, and crypto. Clients can trade via MetaTrader 4, MetaTrader 5, or Swissquote’s own Advanced Trader platform. With a minimum deposit starting at $1,000, Swissquote combines strong regulation, competitive spreads, innovative tools, and robust educational resources, making it a trusted choice for traders globally.

- Regulated by top-tier authorities FCA, FINMA, DFSA, and MFSA

- Publicly listed company on SIX Swiss Exchange

- Wide selection of 400+ tradable instruments

- MetaTrader 4, MetaTrader 5, and proprietary platform

- Comprehensive educational resources

- Multilingual 24/5 customer support

- High $1,000 minimum deposit requirement

- Spreads slightly wider than some competitors

- No apparent bonuses or loyalty programs

- Not available to US and Canadian traders

- Inactivity fee after 6 months of no trading

Overview

Overview Swissquote is a leading Swiss online bank and forex broker, established in 1996 and headquartered in Gland, Switzerland. The company offers a wide range of financial services, including online trading, banking, and asset management, catering to both retail and institutional clients worldwide. Swissquote is regulated by the Swiss Financial Market Supervisory Authority (FINMA) and is listed on the SIX Swiss Exchange.

As a pioneer in online trading, Swissquote has continuously evolved its platform and services to meet the changing needs of traders and investors. The broker offers access to a diverse range of markets, including forex, stocks, indices, commodities, bonds, and cryptocurrencies, through its advanced trading platforms and mobile apps.

Swissquote's commitment to innovation, transparency, and client satisfaction has earned it numerous awards and recognition within the industry. The company's strong financial standing, coupled with its strict regulatory compliance, provides clients with a secure and reliable trading environment.

For more information about Swissquote's products, services, and account types, please visit their official website at swissquote.com.

Overview Table

| Feature | Details |

|---|---|

| Broker | Swissquote |

| Founded | 1996 |

| Headquarters | Gland, Switzerland |

| Regulation | FINMA (Switzerland), FCA (UK), DFSA (Dubai), SFC (Hong Kong), MFSA (Malta) |

| Publicly Traded | Yes, listed on SIX Swiss Exchange |

| Trading Platforms | MetaTrader 4, MetaTrader 5, Advanced Trader, Mobile apps |

| Markets | Forex, Stocks, Indices, Commodities, Bonds, Cryptocurrencies |

| Minimum Deposit | $1,000 (Standard), $10,000 (Premium), $50,000 (Prime), Custom (Professional) |

| Deposit Methods | Bank transfer, Credit/debit card |

| Withdrawal Methods | Bank transfer |

| Base Currencies | USD, EUR, GBP, CHF, JPY, CAD, AUD, PLN, CZK, HUF, and more |

| Customer Support | Phone, Email, Live chat |

| Education | Webinars, Video tutorials, Ebooks, Market analysis, Trading signals |

| Unique Features | Advanced Trader platform, Robo-advisory service, Themes trading |

Facts List

- Established in 1996, with headquarters in Gland, Switzerland

- Regulated by FCA, FINMA, DFSA, and MFSA

- Offers 400+ forex and CFD instruments across various asset classes

- Provides MetaTrader 4, MetaTrader 5, and a proprietary trading platform

- Minimum deposit of $1,000 to open an account

- Publicly listed on the SIX Swiss Exchange

- Offers competitive spreads starting from 0.6 pips

- Supports automated trading via Expert Advisors (EAs)

- Provides multilingual customer support via phone, email, and live chat

- Educational resources include webinars, tutorials, ebooks, and market analysis

Swissquote Licenses and Regulatory

Swissquote operates under the strict regulatory oversight of top-tier financial authorities in multiple jurisdictions:

- Swissquote Bank Ltd is authorized by the Swiss Financial Market Supervisory Authority (FINMA)

- Swissquote Ltd is regulated by the Financial Conduct Authority (FCA) in the UK

- Swissquote MEA Ltd holds a license from the Dubai Financial Services Authority (DFSA)

- Swissquote Financial Services (Malta) Ltd is regulated by the Malta Financial Services Authority (MFSA)

These licenses ensure that Swissquote adheres to stringent regulatory standards for client fund segregation, capital requirements, and transparency. Swissquote's multi-jurisdictional regulation provides a high level of trust and security for clients.

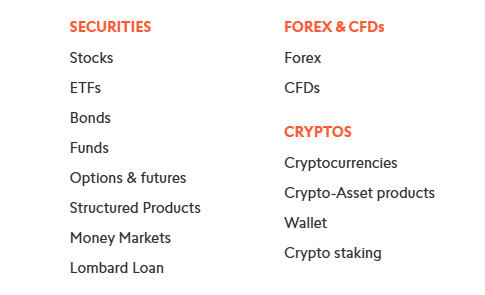

Trading Instruments

Swissquote offers a wide range of tradable instruments, providing clients with access to global financial markets.

The main asset classes available for trading include:

| Asset Class | Details |

|---|---|

| Forex | 130+ currency pairs: Majors (EUR/USD, GBP/USD, USD/JPY), Minors (GBP/JPY, EUR/GBP), Exotics (USD/SEK, USD/NOK, USD/ZAR). Spreads from 0.6 pips. Leverage up to 1:100 (1:30 EU clients). |

| Stock CFDs | 60+ stocks: US (Apple, Amazon, Google), EU (Adidas, BMW, Deutsche Bank), Swiss (Nestlé, Roche, UBS). No commissions. |

| Index CFDs | 30+ indices: US (Dow Jones, S&P 500), EU (DAX 30, CAC 40), UK (FTSE 100), Asia (Nikkei 225, Hang Seng). |

| Commodity CFDs | Metals (Gold, Silver), Energy (Brent Oil, Natural Gas), Agriculture (Corn, Wheat, Coffee). |

| Bond CFDs | Government bonds: US 10-Year Treasury, German Bund, UK Gilt. |

| Cryptocurrency CFDs | Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Ripple (XRP), Bitcoin Cash (BCH) with up to 1:5 leverage. |

| Other Products | Real stocks, ETFs, Options, Futures, Mutual funds, Bonds. |

Swissquote's extensive range of tradable instruments caters to the diverse needs and preferences of traders and investors. Whether you're interested in short-term speculation or long-term investing, you can find opportunities across various markets and asset classes.

Trading Platforms

Swissquote Swissquote offers a range of trading platforms to suit different trading styles, preferences, and experience levels.

MetaTrader 4 (MT4)

MT4 is one of the most popular trading platforms in the world, known for its user-friendly interface, advanced charting tools, and automated trading capabilities. With Swissquote's MT4, traders can:

- Access 130+ forex pairs, 60+ stock CFDs, 30+ index CFDs, and more

- Analyze markets with 30+ built-in indicators and 24 graphical objects

- Customize charts with 9 timeframes and 3 chart types

- Backtest and optimize trading strategies with the Strategy Tester

- Automate trading with Expert Advisors (EAs)

MT4 is available for desktop, web, and mobile, so traders can access their accounts anytime, anywhere.

MetaTrader 5 (MT5)

MT5 is an upgraded version of MT4, offering additional features and tools for advanced trading and analysis. With Swissquote's MT5, traders can:

- Trade on 130+ forex pairs, 60+ stock CFDs, 30+ index CFDs, and more

- Access 38+ technical indicators and 44 graphical objects

- Analyze markets across 21 timeframes

- Develop custom indicators and EAs using the MQL5 programming language

- Enjoy faster processing speeds and advanced order types

Like MT4, MT5 is available for desktop, web, and mobile platforms.

Advanced Trader

Advanced Trader is Swissquote's proprietary trading platform, designed to offer a powerful and intuitive trading experience. Key features include:

- One-click trading for fast order execution

- Real-time market news and analysis

- Advanced charting with 100+ indicators and drawing tools

- Customizable workspace with detachable windows

- Integrated trading signals and market sentiment tools

Trading Platforms Table

| Feature | MT4 | MT5 | Advanced Trader |

|---|---|---|---|

| One-click trading | Yes | Yes | Yes |

| Technical indicators | 30+ | 38+ | 40+ |

| Charting timeframes | 9 | 21 | 11 |

| Drawing tools | 31+ | 44+ | 36+ |

| Automated trading | Yes | Yes | No |

| Web platform | Yes | Yes | Yes |

| Desktop platform | Yes | Yes | Yes |

| Mobile trading app | Yes | Yes | Yes |

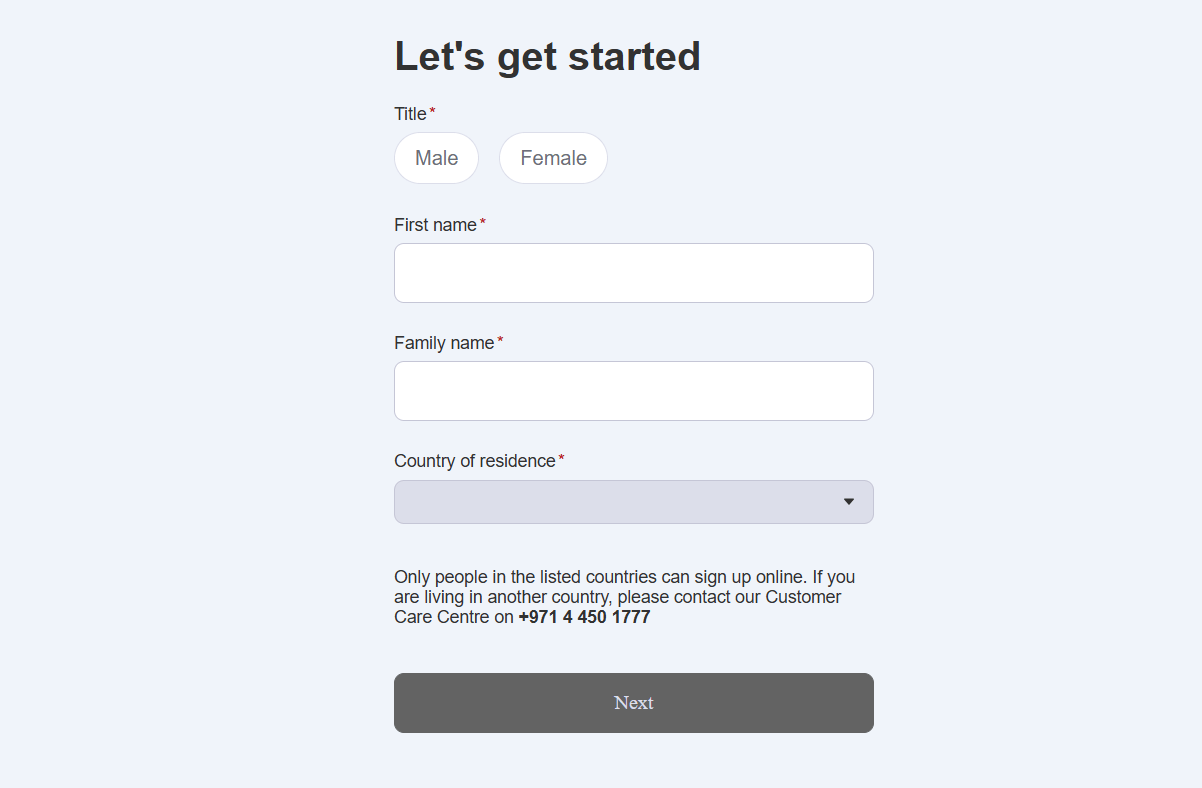

Swissquote How to Open an Account: A Step-by-Step Guide

Opening a trading account with Swissquote is a straightforward process that can be completed online in a few simple steps:

Step 1: Visit the Swissquote website Go to swissquote.com and click on the "Open an account" button.

Step 2: Select your account type Choose the type of account you want to open: Standard, Premium, Prime, or Professional. Each account type has different minimum deposit requirements and features, so select the one that best suits your trading needs and experience level.

Step 3: Fill out the application form Provide your personal details, including your full name, date of birth, nationality, and contact information. You'll also need to answer questions about your financial situation, employment status, and trading experience.

Step 4: Verify your identity and residency To comply with anti-money laundering (AML) and know-your-customer (KYC) regulations, you'll need to upload proof of identity and proof of residency documents. Accepted documents include:

- Passport or national ID card

- Utility bill or bank statement (less than 3 months old)

Step 5: Choose your account base currency and leverage Select your preferred account base currency from the available options, such as USD, EUR, GBP, or CHF. Also, choose your desired leverage level, keeping in mind the maximum leverage restrictions based on your jurisdiction and investor protection rules.

Step 6: Review and accept the terms and conditions Read through Swissquote's terms and conditions, client agreement, and risk disclosure documents. If you agree with the terms, check the relevant boxes and click "Submit" to complete your application.

Step 7: Wait for account approval Swissquote will review your application and verify your documents. This process typically takes 1-2 business days. Once your account is approved, you'll receive a confirmation email with your account details and login credentials.

Step 8: Fund your account To start trading, you'll need to fund your account using one of the available deposit methods, such as bank transfer or credit/debit card. The minimum deposit amount varies depending on your account type:

- Standard: $1,000 or equivalent

- Premium: $10,000 or equivalent

- Prime: $50,000 or equivalent

- Professional: Custom

Step 9: Download and install a trading platform Choose your preferred trading platform (MT4, MT5, or Advanced Trader) and download the appropriate software for your device. You can also access the web-based versions of the platforms through your browser.

Step 10: Log in and start trading Once your account is funded and you've installed your chosen trading platform, log in using your account credentials and start exploring the markets. You can search for instruments, analyse charts, and place trades based on your trading strategy and risk management plan.

Charts and Analysis

Swissquote offers a comprehensive suite of educational trading resources and tools to support clients in their trading journey.

| Feature | Details |

|---|---|

| Charting Tools | - Multiple chart types: Line, bar, candlestick, etc. - Customizable timeframes: From 1 minute to monthly - 50+ technical indicators: Moving averages, MACD, RSI, Bollinger Bands, and more - 30+ drawing tools: Trendlines, Fibonacci retracements, channels, etc. - Chart templates: Save custom chart setups for quick access |

| Market Analysis | - Daily market reports on key economic events and setups - Market news and commentary - Technical and fundamental analysis - Trading signals and strategies - Weekly economic calendar |

| Educational Resources | - Webinars: Live and recorded online sessions - Video tutorials: Platform usage and trading guides - Ebooks: Trading strategies, risk management, etc. - Glossary: Key trading terminologies explained |

More details on Swissquote's charts, analysis tools, and educational resources can be found on the official website. The broker's commitment to client education and providing a supportive trading environment is evident from the depth and quality of these offerings.

Swissquote Account Types

Account Types Swissquote offers a range of account types to cater to the diverse needs of traders, from beginners to professionals.

Standard Account

- Minimum deposit: $1,000 or equivalent

- Spreads from 1.7 pips

- Leverage up to 1:100

- No commissions

- Suitable for new to intermediate traders

Premium Account

- Minimum deposit: $10,000 or equivalent

- Spreads from 1.4 pips

- Leverage up to 1:100 (non-EU) or 1:30 (EU)

- No commissions

- Tier-based pricing and additional benefits

- Ideal for more experienced and active traders

Prime Account

- Minimum deposit: $50,000 or equivalent

- Spreads from 1.1 pips

- Leverage up to 1:100 (non-EU) or 1:30 (EU)

- No commissions

- Dedicated account manager and premium support

- Designed for high-volume traders and institutions

Professional Account

- For eligible clients meeting certain criteria

- Customized spreads, leverage, and service

- Tailored to specific trading needs and strategies

All account types provide access to the full range of tradable instruments and platforms offered by Swissquote. Islamic swap-free accounts are also available upon request for clients who cannot receive or pay interest due to religious beliefs.

Demo Account In addition to the live trading accounts, Swissquote offers a demo account that allows prospective clients to practise trading strategies and familiarise themselves with the trading platforms in a risk-free environment. Demo accounts come with virtual funds and real-time market data, closely simulating live trading conditions.

Account Types Comparison

| Feature | Standard | Premium | Prime | Professional |

|---|---|---|---|---|

| Minimum Deposit | $1,000 | $10,000 | $50,000 | Custom |

| Spreads From | 1.7 pips | 1.4 pips | 1.1 pips | Custom |

| Commissions | None | None | None | Custom |

| Leverage | Up to 1:100 | Up to 1:100 (non-EU) / 1:30 (EU) | Up to 1:100 (non-EU) / 1:30 (EU) | Custom |

| Execution | Instant | Instant | Instant | Custom |

| Platforms | MT4, MT5, Advanced Trader | MT4, MT5, Advanced Trader | MT4, MT5, Advanced Trader | Custom |

| Customer Support | 24/5 | 24/5 | 24/5 + Dedicated Manager | Custom |

| Instruments | 400+ | 400+ | 400+ | Custom |

| Negative Balance Protection | Yes | Yes | Yes | Custom |

Negative Balance Protection

Swissquote provides negative balance protection for all retail client accounts. This means that traders cannot lose more than their account balance, even in extreme market volatility. If a trader's account equity falls below zero due to trading losses, Swissquote will absorb the negative balance and bring the account back to zero. This policy protects traders from additional liabilities beyond their initial deposit. Terms and conditions apply.

Swissquote Deposits and Withdrawals

Deposits and Withdrawals Swissquote offers a range of convenient and secure funding methods for clients to deposit and withdraw funds from their trading accounts.

Deposit Methods

| Deposit Method | Currencies Accepted | Processing Time | Fees |

|---|---|---|---|

| Bank Wire Transfer | USD, EUR, GBP, CHF, JPY, CAD, AUD, and more | 1-2 business days | No Swissquote fees; intermediary bank fees may apply |

| Credit/Debit Card | USD, EUR, GBP, CHF | Instant | No fees charged by Swissquote |

Withdrawal Methods

| Withdrawal Method | Currencies Accepted | Processing Time | Fees |

|---|---|---|---|

| Bank Wire Transfer | USD, EUR, GBP, CHF, JPY, CAD, AUD, and more | 1-2 business days | No Swissquote fees for most currencies; intermediary bank fees may apply |

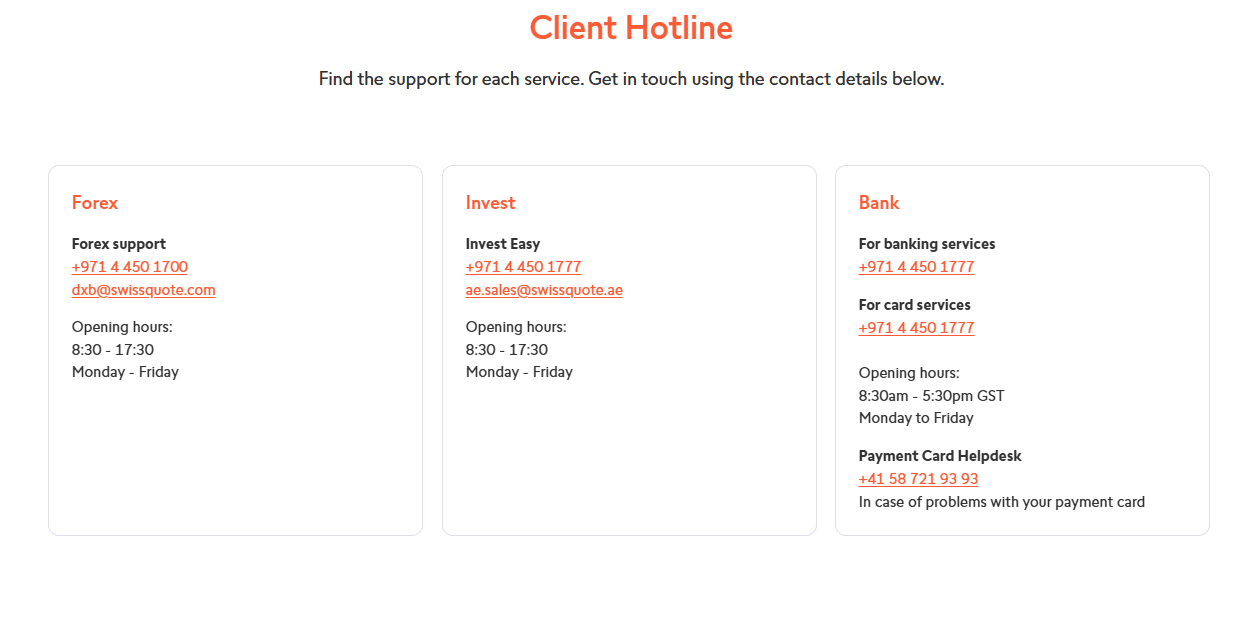

Support Service for Customer

Swissquote provides multilingual customer support via the following channels:

- Live chat: 24/5 availability for instant assistance

- Telephone: Multilingual support during business hours

- Email: 24/5 with typical response time of a few hours

- Knowledge base: Help articles addressing common queries

- Social media: Announcements and general support on Facebook, Twitter, LinkedIn

The customer support team is knowledgeable and responsive, ensuring that clients receive timely and helpful assistance with their enquiries.

The customer support team is knowledgeable and responsive, ensuring that clients receive timely and helpful assistance with their enquiries.

Customer Support Table

| Channel | Availability | Support Languages | Expected Response Time |

|---|---|---|---|

| Live chat | 24/5 | EN, DE, FR, IT, ES, PT | A few minutes |

| Telephone | 09:00–17:30 (CET), Mon–Fri | EN, DE, FR, IT, ES, PT | Immediate |

| 24/5 | EN, DE, FR, IT, ES, PT | A few hours | |

| Knowledge base | 24/7 | EN, DE, FR, IT, ES, PT | Instant |

| Social media | 24/5 | EN, DE, FR, IT, PT | A few hours |

Prohibited Countries

Due to regulatory restrictions, Swissquote cannot accept clients from the following countries:

- United States

- Canada

- Belgium

- France

- Japan

- Singapore

- Hong Kong

Special Offers for Customers

At the time of writing, Swissquote does not appear to offer any special promotions, bonuses, or loyalty programs. Traders are advised to check the broker's website for any updated offers or seasonal promotions.

Conclusion

Throughout this comprehensive review, I have analysed Swissquote's safety, reliability, and overall reputation as an online forex and CFD broker.

Swissquote stands out for its strong regulatory compliance, being authorised by top-tier financial authorities like the FCA, FINMA, DFSA, and MFSA across multiple jurisdictions. This multi-layered regulation provides a high level of client protection and transparency. As a publicly listed company on the SIX Swiss Exchange, Swissquote is also subject to strict financial reporting standards.

In terms of trading offerings, Swissquote excels with its diverse selection of 400+ instruments across forex, stocks, indices, commodities, bonds, and cryptocurrencies. The broker caters to both short-term traders and long-term investors with its range of account types and comprehensive suite of trading platforms, including MT4, MT5, and the Advanced Trader platform.

Swissquote's commitment to client education is evident from its extensive collection of webinars, tutorials, ebooks, and market analysis. The responsive customer support team, available 24/5 via live chat, phone, and email, ensures that clients receive timely assistance.

One potential drawback is the relatively high minimum deposit requirement of $1,000, which may be a barrier for some beginner traders. Additionally, Swissquote's spreads, while competitive, are slightly higher than some of its peers.

Overall, I consider Swissquote to be a trustworthy and reliable choice for traders seeking a well-regulated, multi-asset broker with advanced trading platforms and robust educational resources. The broker's long-standing reputation and transparent operations inspire confidence in its services.

Every spread table lives in the broker review pricing centre.

NYSE-listed? Explore the ColmexPro review.